What is Water Treatment Systems Market Size?

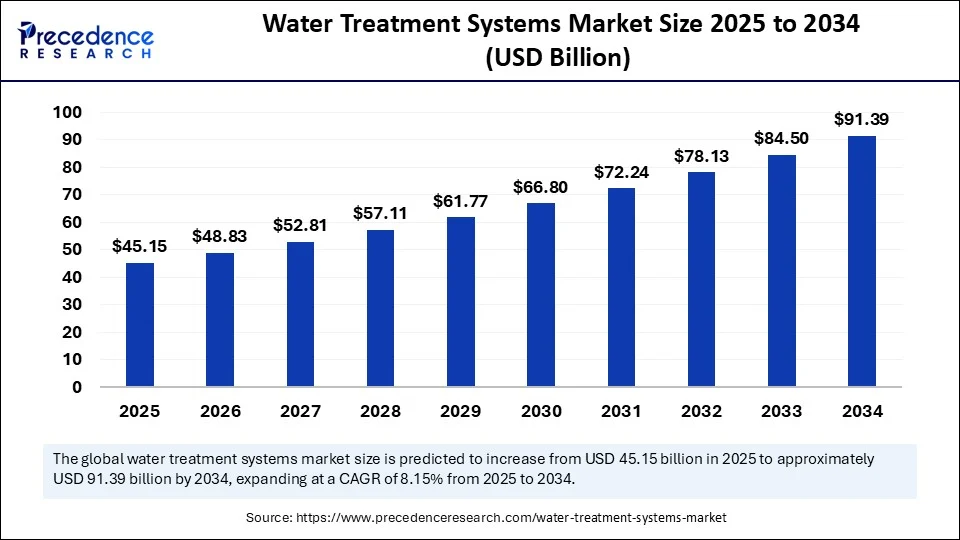

The global water treatment systems market size accounted for USD 45.15 billion in 2025 and is predicted to increase from USD 48.83 billion in 2026 to approximately USD 91.39 billion by 2034, expanding at a CAGR of 8.15% from 2025 to 2034. The growth of the market is attributed to the increasing scarcity of clean water and stringent environmental regulations. Moreover, the rising focus of municipalities on wastewater management and demand for clean water supports market expansion.

Market Highlights

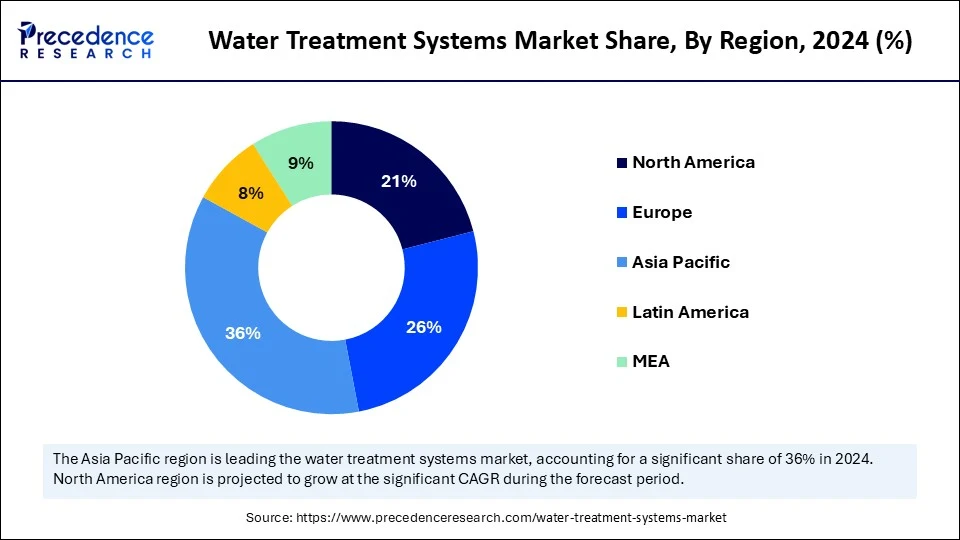

- Asia Pacific dominated the water treatment systems market with the largest market share of 36% in 2024.

- North America is expected to expand at the fastest CAGR between 2025 and 2034.

- By technology type, the reverse osmosis systems segment held the biggest market share of 29% in 2024.

- By technology type, the distillation systems segment is expected to grow at a significant CAGR between 2025 and 2034.

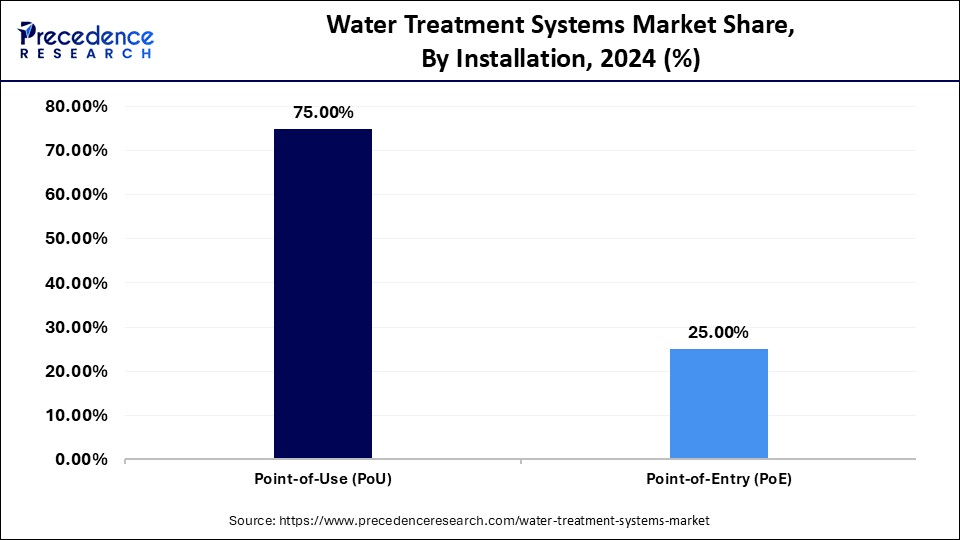

- By installation, the point-of-use (PoU) segment captured the highest market share of 75% in 2024.

- By installation, the point-of-entry (PoE) segment is expected to grow at the highest CAGR between 2025 and 2034.

- By application, the residential segment generated the major market share in 2024.

- By application, the commercial segment is expected to grow at the fastest CAGR between 2025 and 2034.

What are the Factors Strengthening the Water Treatment Systems?

Water treatment systems are essential for purifying, recycling, and managing water across residential, industrial, and municipal sectors to ensure public health and sustainable resource management. The global water treatment systems market is expanding at a robust pace, driven by a complex blend of urbanization, industrial expansion, environmental regulations, and growing water stress. Clean water is no longer a luxury but a necessity, and this urgency is pushing the public and private sectors to invest heavily in innovative water purification and recycling technologies. There is high adoption of point-of-use and point-of-entry filtration systems in the residential sector as consumers become more aware of contaminants like lead, microplastics, and chlorine in tap water. Meanwhile, the industrial sector is demanding closed-loop systems to treat and reuse water, reducing dependency on freshwater sources.

Governments worldwide are enforcing stringent regulations on wastewater discharge and industrial effluents, compelling organizations to install high-efficiency treatment systems. Moreover, global sustainability movements and ESG goals are prompting corporations to prioritize water stewardship. Technological advancements such as membrane filtration, UV disinfection, and AI-driven monitoring are enhancing system performance, lowering operational costs, and making treatment solutions scalable for all geographies. Decentralized treatment systems are also gaining popularity in rural and remote areas. As climate change continues to strain global water supplies and populations rise, the need for water treatment systems becomes a critical pillar of infrastructure, environmental strategy, and public health.

How is Artificial Intelligence Impacting the Water Treatment Systems Market?

Artificial Intelligence (AI) is revolutionizing water treatment systems by making them smarter, more efficient, and highly predictive. Traditional water treatment relied on static infrastructure and reactive decision-making. However, AI enables real-time monitoring, predictive maintenance, and optimized filtration cycles, revolutionizing how water quality is managed. By integrating AI with sensors, SCADA systems, and cloud platforms, operators can now detect contaminant levels, leakages, and equipment anomalies with precision. Machine learning algorithms analyze vast amounts of data to optimize chemical dosing, reduce energy consumption, and predict equipment failure before it occurs. This not only ensures water safety but also significantly lowers operational costs.

AI-driven decision support systems can also adjust processes dynamically based on fluctuating water quality, weather patterns, or demand. For instance, smart wastewater treatment plants are already using AI to manage sludge processing and nutrient removal efficiently, without manual intervention. Furthermore, AI enables remote operations, which is vital for decentralized and rural systems, improving accessibility to clean water. As water utilities and industries increasingly embrace digitalization, AI is positioned to be a cornerstone of next-generation water treatment, optimizing efficiency, safety, and sustainability at scale.

Water Treatment Systems Market Trends

- Rise in Smart Water Systems: AI, IoT, and automation are enhancing monitoring, fault detection, and energy efficiency.

- Sustainability-Driven Innovation: Eco-friendly filtration materials, zero-liquid discharge systems, and water reuse models are gaining popularity.

- Shift Towards Decentralized Treatment: Mobile, modular, and off-grid systems are expanding access in underdeveloped regions.

- Stricter Regulatory Frameworks: Global tightening of water quality and discharge standards is driving mandatory system adoption.

Water Treatment Systems Market Outlook:

- Global Expansion: Increasing issues regarding water pollution and scarcity, expanding industrialization, and government initiatives assisting advanced treatment technologies are fostering the global progression.

- Major Investors: Including Veolia Environment S.A., Ion Exchange (India) Ltd., and other giant companies are actively investing in boosting access to clean water, encouraging sustainability, and capitalizing on the rising market demand.

- Startup Ecosystem: DigitalPaani (India), a startup, provides an IoT and AI-driven platform to improve the operations of water and wastewater treatment plants.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 45.15 Billion |

| Market Size in 2026 | USD 48.83 Billion |

| Market Size by 2034 | USD 91.39 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.15% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Installation, Technology, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Water Scarcity and the Need for Clean Water

The most significant driver behind the growth of the water treatment systems market is the rising global water scarcity and the urgent need for clean and safe water access. With population growth, urban expansion, and industrial development occurring at unprecedented rates, the demand for freshwater is outpacing supply in many parts of the world. Climate change further exacerbates the situation, reducing the reliability of traditional water sources like rivers and lakes while increasing pollution risks through flooding and runoff. In response, governments are enforcing stricter environmental regulations for wastewater discharge, industrial effluents, and agricultural contaminants. This has made water treatment no longer optional but regulatory and social responsibility.

Public awareness around water quality contaminants such as lead, PFAS, nitrates, and microplastics has also surged. As a result, both residential and commercial sectors are investing in advanced water purification systems, whether point-of-use, point-of-entry, or community-scale solutions. Industries, too, especially pharmaceuticals, chemicals, food processing, and energy, are integrating water recycling systems to reduce freshwater dependency and enhance operational efficiency. These changes are deeply aligned with broader global goals like SDG 6: Clean Water and Sanitation. Ultimately, the growing convergence of public pressure, policy mandates, and environmental risks is pushing the water treatment systems market forward, making it a core infrastructure element of sustainable development.

Restraint

High Costs and Environmental Concerns

While the global water treatment systems market is expanding due to rising environmental concerns and water scarcity, it faces significant restraints that hinder consistent growth. The most pressing challenge lies in the high capital cost and maintenance complexity associated with advanced water treatment technologies. Many residential and small-scale commercial consumers hesitate to invest in systems that demand recurring costs, regular servicing, and technical knowledge. Another restraint is the lack of awareness and infrastructure in rural and underdeveloped areas. Despite growing global concern over clean water access, a substantial population still lacks an understanding of waterborne diseases or the long-term benefits of water purification systems. This slows down adoption, particularly in low-income or education-deficient regions.

Stringent government regulations and slow-moving public sector projects can create delays in the installation and procurement of municipal water treatment plants. In addition, disposal of waste generated during filtration, such as brine from reverse osmosis or sludge from industrial setups, raises environmental and compliance issues, adding to operational burdens. Technological complexity also creates a barrier; many users prefer simpler, familiar alternatives like boiling water or using basic filters instead of engaging with complex systems that involve UV, UF, RO, or nanotech components.

Opportunity

Emerging Markets and Technological Advancements

The water treatment systems market is bursting with untapped potential, particularly in emerging economies, technological innovation, and rural infrastructure development. The opportunity lies not just in expanding access but in transforming water treatment from a utility into a sustainability solution. A major growth area is decentralized water treatment systems, especially for remote, peri-urban, or disaster-prone regions where central water infrastructure is lacking or underperforming. Compact, solar-powered filtration units, mobile treatment containers, and point-of-use purifiers offer scalable, cost-effective solutions tailored for such areas.

Another vast opportunity is the integration of AI, IoT, and automation, which transforms traditional treatment systems into smart infrastructure. AI-enhanced filtration, predictive maintenance, and real-time water quality analytics are in demand across municipal utilities and large-scale industries alike. The residential segment is also evolving beyond basic filtration. Health-conscious consumers now seek multi-stage purifiers, alkaline water systems, and aesthetically designed dispensers that align with wellness trends. Moreover, with ESG frameworks gaining traction, corporations are increasingly willing to invest in water neutrality and advanced recycling systems to meet sustainability benchmarks. The market also holds promise in zero-liquid discharge (ZLD) technologies, particularly in regions with stringent compliance norms.

Segment Insights

Technology Insights

Why is the Reverse Osmosis Segment Leading the Market?

The reverse osmosis (RO) segment led the water treatment systems market with the largest share of 29% in 2024. This is mainly due to its exceptional filtration capability, versatile applications, and consumer trust. RO systems work by pushing water through a semi-permeable membrane, removing up to 99% of contaminants, including bacteria, viruses, dissolved salts, heavy metals, and microplastics, making it one of the most effective purification technologies available. What makes RO highly appealing is its multi-industry applicability. It is used in residential settings to deliver clean, odorless, and safe drinking water and is equally critical in industries such as pharmaceuticals, food & beverage, and power generation, where water purity standards are extremely stringent.

Technological improvements have addressed early drawbacks like wastewater generation and energy usage. Modern RO systems are now equipped with energy recovery devices, smart sensors, and custom filtration stages to improve efficiency and reduce environmental impact. Compact models have made household adoption easier, while industrial units are now scalable and modular. Another strength is consumer perception. RO has become a household term associated with "safe drinking water," which gives it a branding advantage over lesser-known technologies. Many consumers trust RO because they can “taste the difference,” which reinforces loyalty and repeat purchases. With increasing concerns around pollutants like arsenic, fluoride, and pharmaceutical traces in water supplies, RO systems offer a comprehensive solution rather than a selective one. The technology's adaptability to local water conditions also boosts its relevance in urban, rural, and disaster-struck regions.

On the other hand, the distillation systems segment is expected to grow at a significant CAGR in the coming years due to rising interest in ultra-pure water and low-maintenance, chemical-free purification methods. Distillation mimics nature's hydrological cycle by boiling water and then condensing the steam, effectively removing inorganic minerals, heavy metals, and biological contaminants. One of the key factors driving the growth of the segment is the increasing demand from health-conscious consumers who seek pure, mineral-free water for specialized uses, like baby formula preparation, detox routines, or CPAP machines. In industrial settings, especially in laboratories and electronics manufacturing, the need for zero-contaminant water makes distillation a highly viable option.

Recent innovations have made modern distillers more compact, energy-efficient, and user-friendly, challenging the perception that they are bulky and slow. Countertop distillers for home use now feature stainless steel chambers, automatic shut-off, and carbon post-filters, making them both practical and safe for daily use. The segment is also benefiting from the growing distrust in municipal water supplies and the desire for complete purification without relying on synthetic chemicals or disposable filter cartridges. As climate change leads to increasingly unpredictable water quality, distillation offers a fail-safe solution capable of handling high turbidity, dissolved salts, and even biological contamination with ease.

Installation Insights

Why Did the Point-of-Use Segment Dominate the Water Treatment Systems Market in 2024?

The point-of-use (POU) segment dominated the market with a major revenue share of 75% in 2024. This is mainly due to its affordability, convenience, and immediate impact. PoU systems are installed right at the water dispensing point, like kitchen taps, water dispensers, or under-the-sink purifiers, delivering treated water exactly where it is consumed. Their popularity in residential settings is primarily driven by urban lifestyles and health-conscious behavior. Consumers prefer solutions that are easy to install, require minimal plumbing modifications, and provide visibly clean, good-tasting water. From compact UV purifiers to multi-stage RO filters, POU systems offer a wide range of designs to suit different household needs and water qualities.

Another strength lies in their cost-effectiveness. POU systems are generally more affordable than whole-house setups and allow users to invest only where water is consumed for drinking or cooking, making them ideal for apartments, small families, or rental homes. Maintenance is straightforward, with cartridge replacements being the only recurring task. In commercial spaces such as cafés, hospitals, or offices, POU systems provide hygienic water without altering the building's infrastructure. Their modular nature also makes them adaptable to both urban and rural areas, including low-income segments, thereby expanding market reach. With rising concerns over contaminants like lead, chlorine, and microplastics, point-of-use systems have become the first line of defense for millions of households. Paired with sleek aesthetics and easy operation, they not only fulfill a functional need but also fit seamlessly into modern home environments.

Meanwhile, the point-of-entry (POE) segment is expected to grow at the fastest CAGR during the forecast period. PoE systems offer comprehensive, house-wide water protection from a single system. Installed at the water line entering a building, POE units treat all incoming water, providing clean water not just for drinking but also for bathing, laundry, dishwashing, and more. This category is especially gaining popularity among affluent homeowners, health-conscious families, and those living in areas with hard water or high contaminant levels.

POE systems typically include sediment filters, activated carbon, and water softeners, sometimes combined with UV sterilization or iron removal units, depending on local water conditions. The appeal lies in holistic protection. Households want to protect not just their health but also their appliances and plumbing systems from limescale, chlorine damage, and mineral buildup. Cleaner water extends the lifespan of water heaters, washing machines, and dishwashers and improves skin and hair quality, making POE systems a lifestyle upgrade, not just a utility. As residential architecture trends toward larger homes and multi-bathroom layouts, the demand for centralized water treatment is increasing. Builders and architects are now incorporating POE units into new constructions, especially in gated communities and luxury apartments. Though POE systems require higher upfront investment and professional installation, consumers view them as a long-term solution for complete peace of mind. Their growth is further acceleated by rising awareness of waterborne diseases, chlorine sensitivities, and property value enhancement.

Application Insights

How Does the Residential Segment Dominate the Water Treatment Systems Market in 2024?

The residential segment dominated the market with the biggest share in 2024, driven by increased awareness of waterborne diseases, health-conscious behavior, and increased distrust in municipal water supplies. Households across both developed and developing regions are turning to water purification systems not just as an add-on, but as an essential part of daily living. Urbanization is pushing more people into compact housing with aging pipelines, which may contain lead, rust, and microbial contaminants, boosting the demand for water treatment systems.

Residents are increasingly investing in point-of-use systems like RO, UV, or carbon-based purifiers to ensure safe drinking and cooking water. For those living in suburban or rural areas with hard or untreated water sources, point-of-entry systems like whole-house filters or softeners are becoming the norm. In today's wellness-driven society, clean water is associated not just with safety but also with taste, skin quality, hair health, and overall wellness. Consumers are investing in alkaline systems, mineral-enhancing filters, and aesthetic purifier designs that blend with modern interiors, ensuring the long-term growth of the segment.

On the other hand, the commercial segment is emerging as the fastest-growing application in the water treatment systems market, fueled by a combination of regulatory compliance, customer expectations, and operational necessity. From hospitality and healthcare to offices, education and retail businesses are under pressure to offer clean, safe, and high-quality water as part of their service environment. In sectors such as hotels, restaurants, and cafes (HoReCa), water quality directly impacts customer experience, affecting everything from the taste of beverages to the cleanliness of cutlery and linens.

Water filtration has become an unspoken standard, and many establishments are integrating multi-stage purification systems that serve both guests and kitchen operations. Healthcare facilities, including hospitals and clinics, are also investing in advanced water treatment solutions, where water quality is critical for sterilization, patient safety, and hygiene. Similarly, in educational institutions, providing clean drinking water is now a baseline responsibility, driving demand for centralized filtration systems in schools and colleges. A growing trend is the rise of smart building management in corporate offices, co-working spaces, and commercial complexes. Here, water treatment systems are integrated with IoT platforms that optimize water usage, track quality, and align with sustainability goals. Businesses are leveraging these solutions to reduce operational costs, meet green building standards, and earn ESG (Environmental, Social, and Governance) credibility.

Regional insights

Asia Pacific Water Treatment Systems Market Size and Growth 2025 to 2034

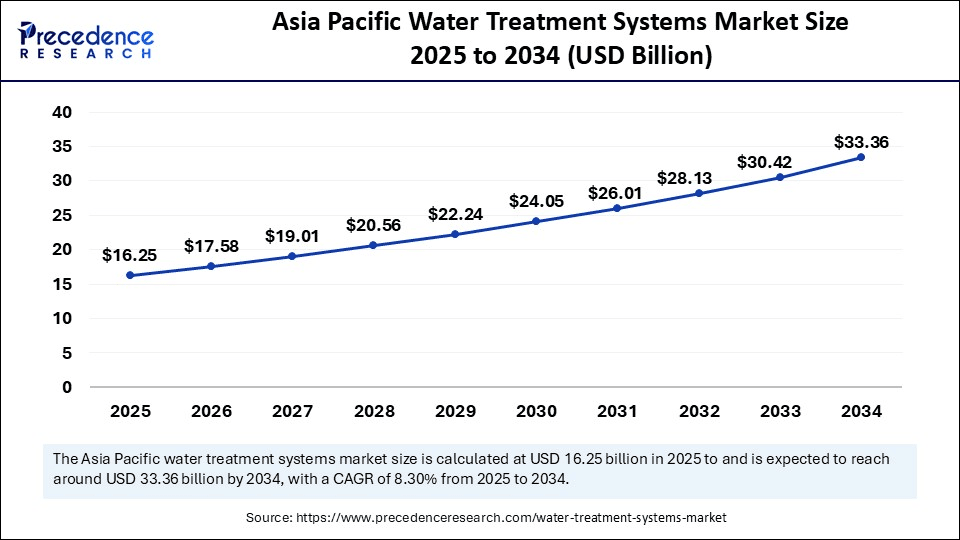

The Asia Pacific water treatment systems market size is exhibited at USD 16.25 billion in 2025 and is projected to be worth around USD 33.36 billion by 2034, growing at a CAGR of 8.30% from 2025 to 2034.

What Made Asia-Pacific the Dominant Region in the Water Treatment Systems Market?

Asia Pacific dominated the market with the highest market share of 36% in 2024, primarily due to its sheer population density, industrialization, and water scarcity challenges. Rapid urbanization across countries like India, China, Indonesia, and Vietnam has outpaced infrastructure development, resulting in significant pressure on existing water resources. This has made water purification and wastewater treatment systems not just an environmental imperative but a national priority for several governments. In countries such as China, the government's strict environmental laws have mandated effluent treatment in both municipal and industrial sectors.

Exploration of Flagship Programs: Impacts on the Indian Market

Meanwhile, India's flagship programs like Jal Jeevan Mission and Namami Gange are heavily investing in both household and urban water treatment solutions, creating robust demand for decentralized, smart, and affordable technologies. Moreover, the region's large base of manufacturing and chemical industries necessitates the use of advanced treatment systems to comply with environmental standards and maintain operational sustainability. The rising middle class is also becoming more health-aware, driving the adoption of residential water purifiers and point-of-use filtration systems in urban households.

Asia-Pacific's strength lies in its ability to combine governmental urgency, private investment, and technological innovation. Companies are increasingly introducing cost-efficient and locally adapted systems, often powered by solar energy or equipped with mobile connectivity for rural deployment. Given the convergence of economic growth, environmental pressure, and technological readiness, Asia-Pacific is leading the shift toward affordable, scalable, and decentralized water treatment for a sustainable future.

What Opportunities Exist in the North America Water Treatment Systems Market?

North America is expected to witness the fastest growth during the forecast period. This momentum is driven by a unique mix of aging infrastructure, stringent environmental regulations, and a growing awareness of contaminants such as PFAS, lead, microplastics, and pharmaceutical residues in public water systems. In the U.S., federal and state-level agencies are pushing for major water infrastructure upgrades, with billions allocated through acts like the Bipartisan Infrastructure Law. Cities across the country are investing in modernizing aging wastewater treatment plants, integrating AI and internet of things (IoT) for real-time monitoring, and embracing decentralized systems for underserved communities. The region also boasts a tech-savvy, health-conscious consumer base, particularly in urban areas, where residential demand for smart purifiers, alkaline systems, and whole-home filtration units is rising.

Consumers in the region are no longer satisfied with basic filtration; they seek products that align with wellness, sustainability, and design preferences. On the industrial front, zero-liquid discharge systems, water recycling units, and energy-efficient membrane technologies are being widely adopted across sectors like oil & gas, food processing, and pharmaceuticals. North American corporations are also under increasing pressure to meet ESG goals, which often include water neutrality and sustainable water sourcing. Furthermore, North America is a hub for technological innovation, with startups and established players developing AI-driven analytics, sensor-based diagnostics, and machine-learning-powered efficiency models. These innovations are reshaping how water is treated, reused, and monitored. In essence, North America's rapid growth is propelled by technological leadership, regulatory enforcement, and a cultural shift towards responsible water consumption, placing the region at the forefront of modern ater stewardship.

Innovations in Materials & Methods: Encourages the U.S. Market

A major growth of the water treatment systems market in the U.S. is propelled by the ongoing groundbreakings in materials & methods. Specifically, the MIT researchers have established a high-efficiency, solar-powered desalination system using hydrophobic membranes and a submerged design to prevent salt buildup. Alongside, certain firms are promoting novel filtration materials that are based on natural silk and cellulose used for removing contaminants like "forever chemicals" and heavy metals.

Strategies on Nature-based Solutions (NBS) are Driving Europe

Europe, with a notable growth in the market, is pushing developments in nature-based solutions, particularly Greywater treatment projects that are testing as green walls and constructed wetlands, to treat greywater from public buildings, parking areas, and refugee camps for reuse. Whereas the urban water management systems are employed to track and collect water condition information for pilots for greywater treatment and reuse in multi-level green façades.

Emergence of Treatment Plants into Resource Centers: Promotes the UK Market

The recent RoKKa project by Fraunhofer IGB focused on the conversion of wastewater treatment plants into "biorefineries" by extracting useful resources from sewage sludge, like nitrogen for fertilizers, which lowers energy use and harmful emissions.

Key Players in Water Treatment Systems Market and Their Offerings

- 3M- This company mainly offers diverse whole-house filtration systems, scale prevention systems, and fully automatic water softeners.

- Honeywell International Inc.- A major leader specialising in industrial automation, control, and smart metering solutions for water and wastewater treatment.

- DuPont- They are increasingly facilitating membranes, including reverse osmosis (RO), ultrafiltration (UF), nanofiltration (NF), ion exchange (IEX) resins, electrodeionization (EDI), and membrane bioreactor (MBR) systems.

- Panasonic- It is focusing on faucet and countertop purifiers with advanced filtration, and central whole-house systems.

- Pentair plc- A company that mainly offers a variety of filtration systems, water softeners, and reverse osmosis systems.

Water Treatment Systems Market Companies

- 3M

- Honeywell International Inc.

- DuPont

- Panasonic

- Pentair plc

- BWT Aktiengesellschaft

- Culligan

- Watts Water Technologies Inc.

- Aquasana, Inc.

- Calgon Carbon Corp.

- Pure Aqua, Inc.

- EcoWater Systems LLC

- Aquaphor

- FilterSmart

- WCC (Water Control Corp.)

Recent Developments

- In June 2025, The State Government owned Kerala Water Authority (KWA), responsible for the development and regulation of water supply and wastewater management in the southern Indian state of Kerala, awarded SUEZ the contract for Kochi City water supply system upgrade, operations and maintenance, under its Kerala Urban Water Services Improvement Program (KUWSIP). This performance-based contract is jointly financed by the Asian Development Bank and the Government of Kerala for the water distribution network.(source: https://economictimes.indiatimes.com)

- In April 2024, Thermax announced the opening of its state-of-the-art manufacturing facility in Pune for water and wastewater treatment solutions. This marks a significant step aligned with Thermax's broader mission of conserving resources and preserving the future.

(Source: https://www.indianchemicalnews.com)

Segments Covered in the Report

By Installation

- Point-of-Use (PoU)

- Point-of-Entry (PoE)

By Technology

- Reverse Osmosis Systems

- Distillation Systems

- Disinfection Methods

- Filtration Methods

- Water Softeners

- Others

By Application

- Residential

- Commercial

- Industrial

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting