What is the Wheat Starch Market Volume?

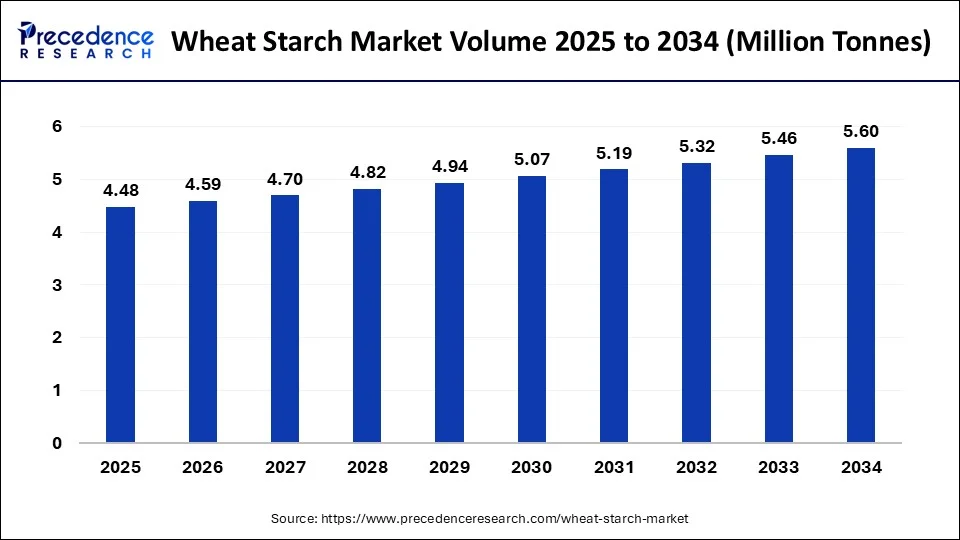

The global wheat starch market size is calculated at USD 4.48 million tonnes in 2025 and is predicted to increase from USD 4.59 million tonnes in 2026 to approximately USD 5.74 million tonnes by 2035, expanding at a CAGR of 2.51% from 2026 to 2035.

Wheat Starch Market Key Takeaways

- The global wheat starch market was valued at USD 4.48 million in 2025.

- It is projected to reach USD 5.74 million by 2035.

- The market is expected to grow at a CAGR of 2.51% from 2025 to 2035.

- In terms of revenue, the market is valued at USD 2.51 million in 2025.

- It is projected to reach USD 5.6 billion by 2035.

- The market is expected to grow at a CAGR of 2.51% from 2025 to 2035.

- Asia Pacific dominated the wheat starch market in 2025.

- By region, Europe is expected to grow rapidly in the market during the forecast period.

- By type, the native starch segment dominated the market in 2025.

- By type, the modified starch segment is estimated to grow at the fastest rate in the market during the forecast period.

- By end use, the food processing industry segment dominated the market in 2025.

- By end use, the pharmaceuticals segment is estimated to grow fastest in the market over the studied period.

How Can AI Help the Wheat Starch Market?

Wheat starch is produced using the wheat wet milling process, which includes steeping, grinding, and separation of grain components. Artificial Intelligence (AI) has the potential to revolutionize wheat milling by providing unparalleled options for optimization, efficiency, and quality enhancement. The adoption of AI, like machine learning, deep learning, and computer vision, can overcome the limitations of wheat milling. Machine learning (ML) algorithms assist in predictive modeling, process optimization, and quality control. ML can optimize milling settings and predict outcomes by analyzing the grain properties, milling parameters, and product characteristics. Deep learning algorithms help in image analysis by automated inspection and classification of wheat grains. In addition, computer vision technology maintains product quality and safety by detecting defects and impurities in real-time.

Technological Advancement

Technological advancements in the wheat starch market feature extraction, refining, functionality through modification, and clean label options. The advancement features the modification of wheat starch at chemical, enzymatic, and physical levels, to further implement in applications. This modified starch is mainly used as a gluten-free binder, thickening product. The sustainable clean label option is an updated innovation meeting the demands of the consumers. Extraction and refining introduce methods to extract starch from wheat. Methods such as hydrothermal treatment and enzyme-assisted extraction are used for efficient and effective production. The advancement and innovation contribute to the health and safety of individuals.

Major Breakthroughs in the Wheat Starch Market

| Company Name | Roquette |

| Headquarters | Lestrem, France |

| Recent Development | In March 2022, Roquette announced an investment plan of 25m for liquid and powder polyols between 2022 and 2024. Polyols are produced from plant-based raw materials like maize and wheat; and widely used as sugar alternatives in food products. The investment was made to improve equipment efficiency, increase safety standards, standardize some industrial operations, and ensure sustainable supply in the market. |

| Company Name | Crespel & Deiters Group |

| Headquarters | Ibbenburen, Germany |

| Recent Development | In July 2024, Loyma, a part of the Crespel & Deiters Group, developed three wheat-based specific solutions for fat reproduction, providing both processing and nutritional benefits, including reduced fat content in meat analogs while mimicking texture. |

Wheat Starch Market: From Food to Pharmaceuticals

The wheat starch market involves production and commercial utilization in various sectors. Wheat starch is a carbohydrate found as discrete granules within the wheat endosperm. More than 808.4 million metric tonnes of wheat was produced globally in 2022. China, India, Russia, the U.S., and Australia are the top five countries with the highest wheat production globally. Wheat starch is widely used in food, pharmaceutical, paper, textile, and construction industries. In the food industry, wheat starch is used as a thickening agent, emulsifier, stabilizer, glazing agent, and fat substitute.

Due to its ability to increase the strength and surface sizing of paper, wheat starch is used in the manufacture of corrugated paperboard, paper bags and boxes, and gummed paper and tape in the paper industry. In the textile industry, wheat starch is used as warp sizing, which increases the strength of the thread during weaving. In the construction industry, wheat starch is used in gypsum wallboard manufacturing, providing rigidity to the board. In the pharmaceutical industry, wheat starch is widely used as an excipient and in drug delivery systems to provide targeted delivery, sustained drug release, and precise dosing for the treatment of several disorders.

Wheat Starch Market Outlook

The wheat starch market is expected to grow significantly from 2025 to 2034 due to increasing global demand for processed foods, baked goods, and confectionery products. The demand for wheat starch is driven by the rising popularity of convenience foods, ready-to-eat meals, and functional ingredients in both developed and emerging economies. Additionally, its expanding use in adhesives, paper, textiles, and personal care products further boosts the market.

Leading wheat starch manufacturers are expanding geographically to seize emerging market opportunities and enhance supply chain resilience. Companies are investing in manufacturing plants and distribution channels in Asia-Pacific, Latin America, and Eastern Europe, where the industrial and food processing sectors are rapidly growing. Roquette and Meelunie have increased their production capacity in China and Southeast Asia to meet rising regional demand and to create new market opportunities.

Major investors in the market include global food manufacturers, ingredient suppliers, and agro-processing companies that fund large-scale production facilities and innovation in clean-label, high-performance starch solutions. Their investments support advanced processing technologies, capacity expansion, and the development of specialized wheat-based ingredients that enhance the market's growth and industrial applicability.

Market Scope

| Report Coverage | Details |

| Market Volume by 2035 | USD 5.74 Million Tonnes |

| Market Volume in 2025 | USD 4.48 Million Tonnes |

| Market Volume in 2026 | USD 4.59 Million Tonnes |

| Market Growth Rate from 2025 to 2035 | CAGR of 2.51% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising global food demand

The rising population worldwide leads to an increase in the demand and consumption of food. Additionally, the rising awareness of nutrient-rich food poses a high demand for starch or starchy foods. Starchy foods are rich in carbohydrates and fibers and are a major source of energy in the body. Starch metabolizes in the body into glucose and circulates within the body through the bloodstream. Fiber is also essential for humans as it aids digestion. Wheat starch is a type of insoluble fiber that facilitates bowel movements and prevents constipation. Commercially, wheat starch is widely used as a thickening agent to thicken desserts, sauces, and instant foods. Also, the glucose produced from starch can be further fermented to biofuel corn ethanol using the wet milling or dry milling process. In addition, the rising demand for plant-based meat increases the use of wheat starch.

Restraint

Cost related issues

The funding for wheat production can be hampered due to several factors, like population growth, weather, supply chain disruptions, and currency fluctuations. Natural calamities like floods and droughts greatly affect wheat production, resulting in rising prices. Another challenge for the wheat starch market is the inappropriate ratio of A and B-type granules, which affects the quality of wheat-based foods like bread and pasta. Wheat starch contains two different types of granules: larger A-type granules and smaller B-type granules. The quality of wheat-based foods is affected by different physicochemical properties and size distribution of both the granules. Additionally, the different sizes of both granules negatively influence the starch manufacturing industry due to the loss of smaller B-type granules, thereby increasing wastage during the milling process.

Opportunity

Environmental wastewater treatment

Industrial wastewater management is a major concern due to the presence of several harmful chemicals like heavy metals, aromatic compounds, and dyes. Since starch is a natural polysaccharide, it is non-toxic and biodegradable. However, the adsorption capability of native starch is limited due to its low molecular weight, low water solubility, limited surface area, and rapid degradability in water. Hence, native starch is chemically modified to increase its adsorption capability by around 90%. Modified starch has the ability to remove various pollutants like oil, organic solvents, pesticides, heavy metals, dyes, pharmaceutical impurities, etc.

Wheat Starch Market Segment Insights

Type Insights

The native starch segment dominated the wheat starch market in 2025. Native starch is the starch that is obtained directly from plants. Native starch is a long-chain carbohydrate that is insoluble in cold water and swells to different degrees, depending on type and temperature. Native starch has immense potential in food applications due to its gelatinization, biodegradability, and retrogradation. It is used as a thickening, gelling, and stabilizing agent in bakery products. Cargill, Inc., an American multinational food corporation, uses native starch along with other label-friendly ingredients to overcome the limitations of native starch and replace modified starch in bakery foods.

The modified starch segment is estimated to grow at the fastest rate in the wheat starch market during the forecast period. Modified starch is derived from physically, chemically, or enzymatically modifying the native starch to enhance its potential. The modification can be done through wet and dry chemical processes, drum drying, and extrusion methods. Modified starch can have improved freeze-thaw stability, acid or alkali resistance, and better shear stability. Hence, modified starches transform foods to make them suitable for microwaveable foods, instant preparations, and ultrahigh temperatures.

End-use Insights

The food processing industry segment dominated the wheat starch market in 2025. Wheat starch has widespread use in the food processing industry due to its physicochemical properties like heat stability, solubility, transmittance, color, and texture. It is used for adhesion and binder in bread, as dustings in chewing gums and bakery products, as a fat replacer and juiciness enhancer in ice cream and salad dressings, as a stabilizer in beverages, as a gelling agent in jellies, and as a foam stabilizer in marshmallows. The increasing consumer preferences for safe and hygienic foods increase the demand for the food processing industry.

According to the U.S. Department of Agriculture, the agriculture, food, and related industries contributed 5.6%, i.e., 1.5 trillion USD, to the U.S. GDP in 2024.

In March 2024, MGP Ingredients, a leading plant-based food producer, announced its new state-of-the-art manufacturing facility in Atchison, U.S. The new plant facilitated more control over the production of the ProTerra line of textured wheat and pea proteins for making plant-based meats. Apart from the manufacturing facility, it also provided an R&D facility and enhanced the ability to commercialize products.

The pharmaceuticals segment is estimated to grow fastest in the wheat starch market over the studied period. Wheat starch is widely used in the pharmaceutical sector due to its nontoxic, intrinsic, and nonirritant properties, low cost, ease of modification, and versatility. Starch is majorly used as the diluent, disintegrant, binder, and lubricant in conventional dosage forms like tablets and capsules. It is also used in drug delivery systems to the targeted site.

In September 2022, researchers at the UPV/EHU University of the Basque Country successfully produced starch-based personalized medicine using 3D printing. The tablet was developed using different types of starch to tailor the drug release by optimizing the right starch type and tablet shape.

Wheat Starch Market Regional Insights

Asia Pacific dominated the wheat starch market in 2025. The rising population, increasing food consumption demand, rapid expansion of the pharmaceutical sector, and highest wheat production drive the market growth. Countries like China and India have the largest populations in the world, which results in changing food demands. Also, the agricultural production of wheat is highest in the Asia-Pacific region. China, India, Australia, and Pakistan are among the top ten countries with the highest wheat production. The Ministry of Food Processing Industries, Government of India, formed a policy, "National Food Processing Policy 2019," with a vision to achieve a minimum of six-fold increase in investment over fifteen years up to 2034-35 for a significant increase in output.

China Wheat Starch Market Trends

China is a significant contributor to the market in Asia Pacific, driven by rapid urbanization, rising disposable incomes, and increasing demand for processed foods. Wheat starch is widely used in bakery, confectionery, sauces, and convenience foods as a texturizer, stabilizer, and shelf life extender. Additionally, rising demand for biodegradable packaging, adhesives, and paper products is boosting industrial use of wheat starch, supported by China's strong manufacturing base and sustainability-driven policies.

Europe is expected to grow rapidly in the wheat starch market during the forecast period. The presence of key players, rising food demands, increased collaborations and investments, research and innovation, and rising demand for paper packaging potentiate market growth. European countries like Russia, France, Germany, and Argentina reported the highest production of wheat in 2022. The European Government's policy "Starch Europe 2019-2024" was formed to strengthen the EU starch market and to create a more sustainable future for Europe and a stronger EU economy. Germany is the biggest food and beverage market in the European Union. Crespel & Deiters is the leading producer of wheat starch globally. In 2024, it processed 368,000 tonnes of wheat and produced 140,000 tonnes of wheat starch.

- In April 2024, Tereos, a French company active in the processed agricultural raw materials like sugar, alcohol, and starch markets, announced a collaboration with Futerro, a Belgian leader in the production of lactic acid, lactide, and polylactic acid. The collaboration was made to develop a circular and sustainable bio-manufacturing platform by extracting dextrose from French wheat and convert into industrially compostable and recyclable bioplastics.

New Advancement in the Wheat Starch Market

- In June 2024, Hero Bread, a Californian startup, raises 21 million USD to drive their product innovation and retail expansion. Hero Bread produces an artisanal line of low-carb and high-nutrition baked goods. Hero Bread uses resistant wheat starch to achieve minimal to zero net carbs instead of regular wheat starch.

Germany Wheat Starch Market Trends

Germany is a major player in the market in Europe, supported by the well-established food, paper, and pharmaceutical industries, which rely on high-purity starches for diverse applications. Consumer preference for organic and sustainable ingredients is expected to accelerate the use of wheat starch in clean-label foods. Moreover, rising consumption of processed and convenience foods is driving the market.

North America is expected to grow at a notable rate in the wheat starch market, supported by its mature food processing industry. There is high consumption of bakery products, convenience foods, sauces, and soups, where wheat starch serves as a key thickener, stabilizer, and binder. The region's focus on sustainable materials, coupled with investments in biotechnology and specialty starch applications for packaging, personal care, and industrial use, positions it at the forefront of next-generation wheat starch development.

U.S. Wheat Starch Market Trends

In the U.S., the market is driven by a well-developed food processing industry and strong demand for functional ingredients. Bakery products, sauces, soups, and convenience foods commonly use wheat starch as a stabilizer, thickener, and binder. Additionally, growing applications in adhesives, pharmaceuticals, and sustainable packaging are further supporting market expansion in the country.

Latin America is expected to see robust growth in the market, driven by the expanding food processing sector. Increased use of wheat starch in bakery, confectionery, sauces, and processed foods is expected to drive market expansion. Additionally, the rising awareness of natural and clean-label ingredients is likely to create more opportunities in the region. Brazil leads the market, supported by its high wheat production capacity and the expansion of the food processing business.

Wheat Starch Market Value Chain Analysis

The foundation of wheat starch production lies in the cultivation and supply of high-quality wheat varieties, chosen for their starch content and suitability for processing. Wheat is sourced from major producing regions such as the EU, North America, Russia, and China.

Key Players / Sources: Large-scale wheat producers in France, U.S., Russia, and Ukraine; agricultural cooperatives supplying industrial wheat.

Raw wheat is processed to separate starch from gluten, proteins, and fibers. This involves milling, washing, and refining to obtain high-purity wheat starch suitable for food, pharmaceutical, or industrial applications.

Key Players: Roquette, Tereos, Crespel & Deiters Group, AGRANA.

Processed starches are packaged in bulk bags, drums, or powder form under controlled humidity and temperature to maintain quality. Proper storage and transport are crucial to prevent degradation.

Key Players / Service Providers: Packaging solution providers, logistics and warehousing companies specialized in food-grade powders.

Wheat starch is supplied to multiple industries, including food & beverage (bakery, confectionery, sauces), paper & packaging, adhesives, pharmaceuticals, and personal care products. Distribution channels include direct sales, wholesalers, and industrial distributors.

Key Players / End Users: Food manufacturers, paper mills, adhesive producers, cosmetic companies.

Wheat Starch Market Top Companies

A global leader in plant-based ingredients, Roquette produces wheat-derived starches among many other starches and provides high-performance ingredients for food, nutrition, pharmaceutical, and industrial markets.

A major cooperative active in starch, sugar, and bio ethanol, Tereos supplies wheat starch and related starch products as part of its broad agricultural raw material processing business.

Long-established specialist in wheat-based raw materials, producing wheat starch, wheat proteins, and wheat-based ingredients for food, feed, industrial, and adhesive applications, with dedicated brands for different use cases.

A global ingredients supplier offering a broad portfolio including wheat starch, proteins, fibres, sweeteners and more, for food, feed and industrial markets across many geographies.

Provides high-quality native wheat starch, used as an emulsifier, stabilizer, thickener, or viscosity modifier in food and animal feed applications.

Offers a range of specialty wheat starches (native and modified) and wheat-derived proteins; its starch products serve bakery, sauces, snacks, and other food segments.

Established supplier of starches (wheat, potato, corn, pea, tapioca) as well as sweeteners and proteins, with global distribution and supply chain services.

Recent Developments

- In December 2024, the Punjab Agricultural University (PAU) launched a wheat variety for nutritious 'atta' biscuits. The new launch has boosted the agricultural industries. The PBW Biscuit 1 variety has been inspired by Punjab's love for 'atta' biscuits. (Source - https://www.tribuneindia.com)

- In November 2023, Amber Wave launched production at the wheat protein facility set to become the largest in North America. The latest technology and vast scope for innovation in the food industry encourage development in the health sector. (Source - https://vegconomist.com)

- In January 2023, Puratos launched wheat bran fibre ferment in light of new gut health insights. The fibre content of foods contributes to wellness and good health for individuals. The beneficial nutrients will add a new approach to the wheat starch market. (Source- https://www.nutraingredients.com)

Segments Covered in the Report

By Type

- Native

- Modified

- Clean Label

By End-use

- Food Processing Industry

- Pharmaceuticals

- Textile & Paper

- Cosmetics

- Animal Feed

- Other

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting