What is Electric Mobility Market Size?

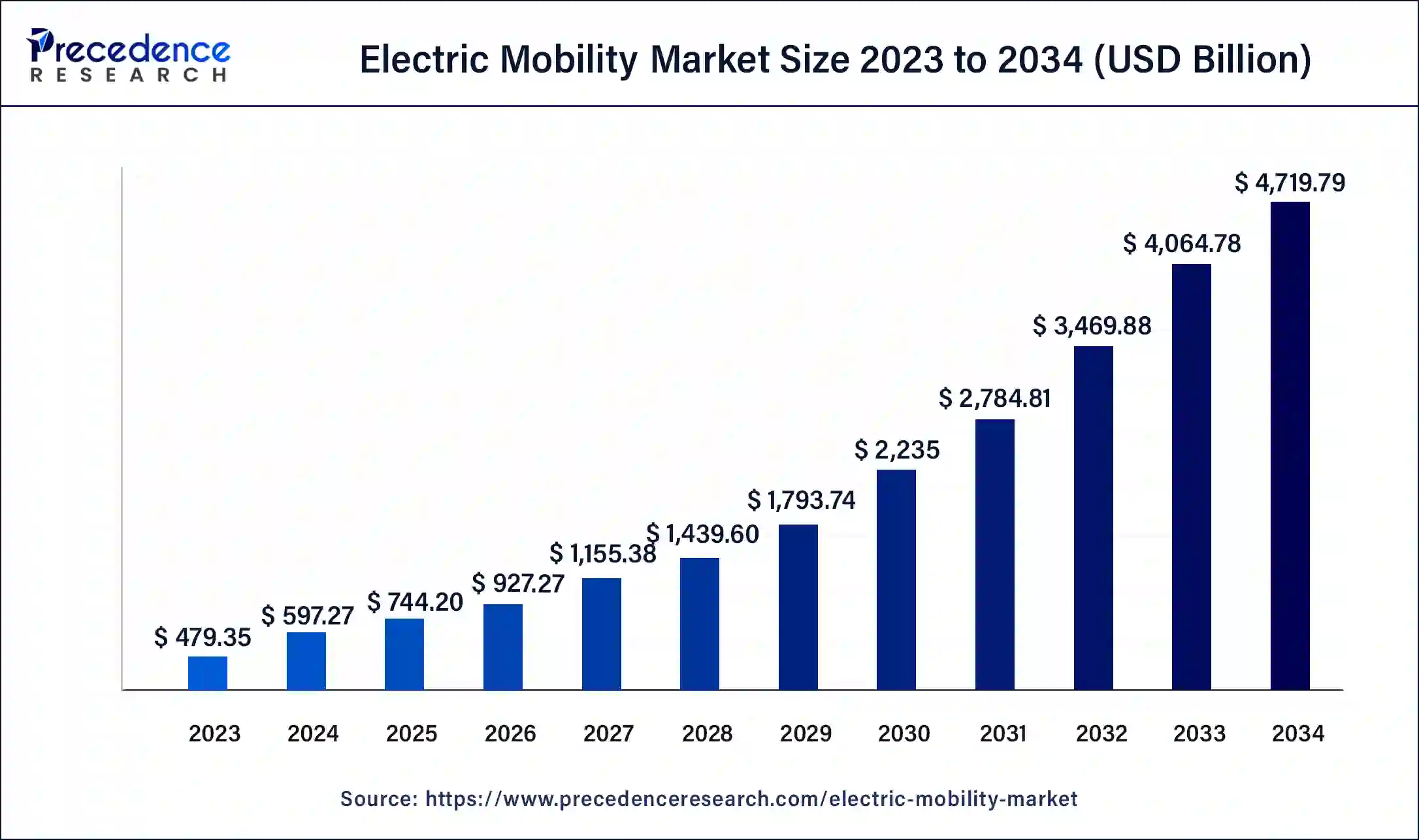

The global electric mobility market size is estimated at USD 744.20 billion in 2025 and is predicted to increase from USD 927.27 billion in 2026 to approximately USD 4,719.79 billion by 2034, expanding at a CAGR of 22.96% from 2025 to 2034.

Market Highlights

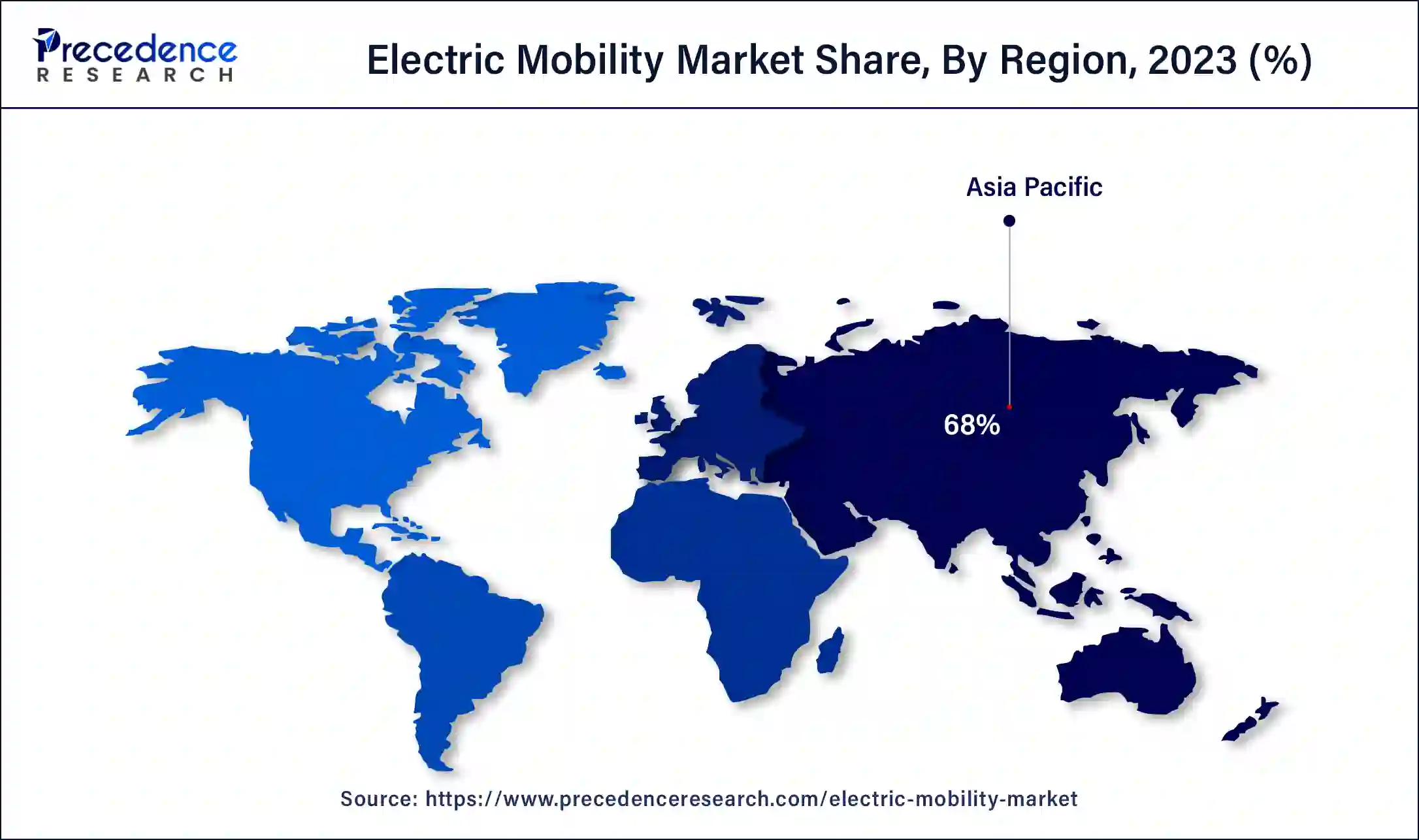

- Asia Pacific region accounted highest revenue share of 68% in 2024.

- By Product, the electric cars segment has generated a revenue share of around 39% in 2024.

- The electric motorcycles segment is expected to reach a CAGR of 19.3% during the forecast period.

- By Battery, the lithium-ion battery segment captured a revenue share of 83% in 2024.

- By end-use, the personal segment has generated a revenue share of around 77% in 2024.

- The commercial segment is poised to grow at a CAGR of 18.9% over the forecast period.

- By drive, the chain drive segment has accounted revenue share of around 46.5% in 2024.

- The belt drive segment is poised to reach a CAGR of 15.5% during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 744.20 Billion

- Market Size in 2026: USD 927.27 Billion

- Forecasted Market Size by 2034: USD 4,719.79 Billion

- CAGR (2025-2034): 22.96%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

What are the Diverse Advantages of Various AI Factors?

Artificial intelligence is revolutionizing electric mobility by optimizing the management of energy, safety, and efficiency. It supports battery optimization, adaptive energy management, route optimization, safety improvements, manufacturing robots, predictive analytics, infrastructure, and user experience. On the manufacturing side, robotics and predictive analytics ensure a streamlined production process, minimize defects, and maximize supply chain efficiency. On the infrastructure side, there is intelligent charger location, load balancing, and integration of renewable energy. At the user side of the equation, personalized driving experiences, connected services, and easy charging interactions all rely on AI. In essence, all these capabilities bind an AI role as an enabler in advancing an intelligent, safe, and sustainable electric-mobility ecosystem.

Electric Mobility Market Growth Factors

- Emission of greenhouse gases and increased carbon footprints are being regulated strictly, which is in favor of energy-efficient mobility solutions.

- With the declining costs of advanced batteries, electric vehicles are now more affordable and accessible to consumers.

- Rising awareness regarding the lower operational and maintenance costs of electric vehicles is spurring the acceptance of them in the zone, region-wise.

- Increased mobility-as-a-service models are propelling the transition from conventional ownership to shared sustainable transport.

- With technological development and strong commercial investments, rapid innovations are occurring in electric mobility infrastructure and vehicle performance.

Electric Mobility Market Outlook

- Global Expansion: The players are imposing infrastructure, manufacturing, and EV sales, especially in China, the US, and developing markets.

- Major Investor:In August 2025, Suzuki Motor made $8 billion investment plan in India, for the production of its first EV in Gujarat.

- Startup Ecosystem: Telo Trucks (USA), a startup is establishing a compact electric pickup truck.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 744.20 Billion |

| Market Size in 2026 | USD 927.27 Billion |

| Market Size by 2034 | USD 4,719.79 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 22.96% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Battery, Voltage, End-use, Drive, and Region |

| Regional Scope | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

Rising demand for environmentally friendly transportation options

According to multiple research studies, electric vehicles are more environmentally friendly. Compared to petrol or diesel automobiles, they release minimal or even zero air pollutants and greenhouse gases. Additionally, this accounts for the power needed to maintain them during manufacturing. According to studies conducted by the European Energy Agency, driving an electric car creates 17-30% less carbon emissions than driving a petrol or diesel vehicle. Utilizing low-carbon power also significantly reduces emissions from the production of electricity. Additionally, rising environmental concerns increase demand for sustainable transportation or mobility solutions. Considering all these elements, the rising demand for environmentally friendly transportation options across the globe will fuel the market's growth.

Energy independence offered by electric mobility solutions

The energy independence offered by electric vehicles is observed as a significant driver for the market's growth. Electric mobility solutions often provide an alternative to traditional internal combustion engine vehicles, which rely on fossil fuels. Multiple countries are dependent on other regions or countries for their fossil fuel resources. The adoption of electric mobility brings a solution for such countries to become energy independent. The adoption of electric vehicles even offers a solution for multiple geopolitical disputes, economic crises, and fluctuating oil prices. Electric mobility also enables the utilization of domestic energy resources along with energy security.

Market Restraint

High initial cost

The complexity of lithium-ion battery technology is the main barrier preventing manufacturers from achieving price parity between electric vehicles and conventional automobiles. Several additional variables also considerably raise the price of electric vehicles. The research and development process of electric vehicles requires a high-cost initial investment, which is time-consuming. The battery pack, wheels, and all other components must be uniquely created for a specific electric vehicle. Therefore, the automakers are compelled to raise the price to cover production expenses. An electric vehicle's operating system may be simpler compared to a regular car. But then, sophisticated and intricate technologies are required to produce an electric vehicle. Batteries with high-capacity and electric motors need to be managed by proper electronic systems. Advanced driver assistance technologies are also available in certain battery-electric cars. As a result, BEVs are far more expensive than conventional vehicles. Such factors associated with the investment cost hinder the growth of the market.

Lack of charging infrastructure

Every year, electric vehicle sales increase globally, and all nations are working to meet their environmental goals. Before switching significantly from conventional to electric vehicles, the automobile industry still has a long way to go. The initial cost, range anxiety, lack of charging infrastructure, and lengthy charging times are the reasons limiting the growth of the electric vehicle market.

Among them all, the lack of charging infrastructure acts as a major hindering factor for the market. The lack of charging infrastructure for electric mobility solutions limits the adoption of such mobility solutions by creating concerns about the operation of electric vehicles for long routes. If enough private and public charging facilities are designed for electric vehicle charging, the problem of range anxiety can be solved. Considering the current situation, in 2021, only 1800 stations for charging existed in India. To address this restraint, the Indian government set up a goal to install approximately four lakh charging stations by 2032.

Market Opportunity

Development of autonomous electric vehicles

Over the past ten years, battery technology has made some of the most significant strides in electric vehicles. Electric vehicles now have greater driving ranges because of cheaper and more effective lithium-ion batteries. Long-distance driving has become simpler for owners of electric cars because of the increasing availability of charging stations. The development of autonomous driving is another field. Electric vehicles are more suitable for autonomous driving than gasoline-powered vehicles since they are simpler to handle and need less upkeep. Fully autonomous electric cars are currently being developed by businesses like Tesla and might be accessible to consumers within a few years. The development of autonomous vehicles is observed as a technological advancement for the market which is considered to offer a plethora of growth opportunities for the market.

Government Incentives

To encourage the policy-driven acceptance of plug-in electric cars, governments in several countries have started offering incentives. These incentives mostly come in the form of refunds on purchases, tax exemptions and credits, and other benefits like access to bus lanes and exemptions from paying fees (such as charges, parking, tolls, etc.). The size of a car's battery or the range of an all-electric vehicle may affect the number of financial incentives. Hybrid electric cars are frequently mentioned. The advantages are also extended in some nations to fuel cells and the conversion of electric vehicles. For instance, the Indian government has implemented FAME-II, PLI SCHEME, Special Electric Mobility Zone, Battery Swapping Policy, and Tax Reduction on electric vehicles. Such offers and incentives by the government promote the adoption and production of electric mobility solutions which are observed to act as a growth opportunity for the market in the upcoming period.

Market Challenge

Lack of information and awareness in underdeveloped areas

Underdeveloped areas or regions are still unaware of the benefits of electric mobility. Such communities have limited exposure to information on electric mobility options. Lack of information about the benefits, function, and availability limits the potential buyers from choosing electric mobility solutions. In such areas, inadequate charging infrastructure also limits the sales of electric vehicles. Such factors create concerns about the market's growth in underdeveloped areas. In addition, affordability, anxiety, lack of government support, and absence of potential manufacturers also create a significant challenge for the market to grow in such areas.

Segment Insights

Product Insights

Based on product, the electric mobility market is dominated by the electric cars segment accounting for nearly 39% revenue share in the year 2024 and is predicted to continue the same trend during the forthcoming period. This is primarily attributed to the high cost of battery-powered electric vehicles in comparison to the cost of e-scooters, motorcycles, wheelchairs, skateboards, and bicycles.

However, the electric motorcycle segment exhibits significant growth of approximately 35% during the analysis timeframe because of favorable government policies promoting the adoption of electric two-wheelers such as tax concession and many others.

Battery Insights

Li-ion battery led the global electric mobility market in the year 2024 with more than half of the total market share and exhibits considerable growth during the forecast period. This is mainly because of reducing the cost of Li-ion battery packs used in electric vehicles. The cost of Li-ion batteries for EVs has decreased by 70% within the past seven years and is estimated to further reduce by nearly 50% by 2034 because of technological developments and production scale economies.

On the other hand, nickel-metal hydride (NiMH) battery estimated to rise by a considerable rate during the upcoming years owing to increasing demand for more environmentally conducive along with high-performance batteries. This in turn has made NiMH one of the most demanded battery types for hybrid electric vehicles (HEVs) and this is anticipated to increase its share in the global electric mobility market during the forthcoming years.

Voltage Insights

The 24V segment accounted for approximately 25% of the market revenue share in the year 2024 and is estimated to further capture a significant share during the analysis period. This is major because of superior power output and higher compatibility with electric vehicles.

Moreover, the greater than 48V segment is predicted to witness prominent growth over the forthcoming years with a CAGR of nearly 25%. This is primarily due to increasing demand for greater than 48V batteries in electric vehicles because of increasing research & development activities for improving the speed and distance coverage of EVs.

Regional Insights

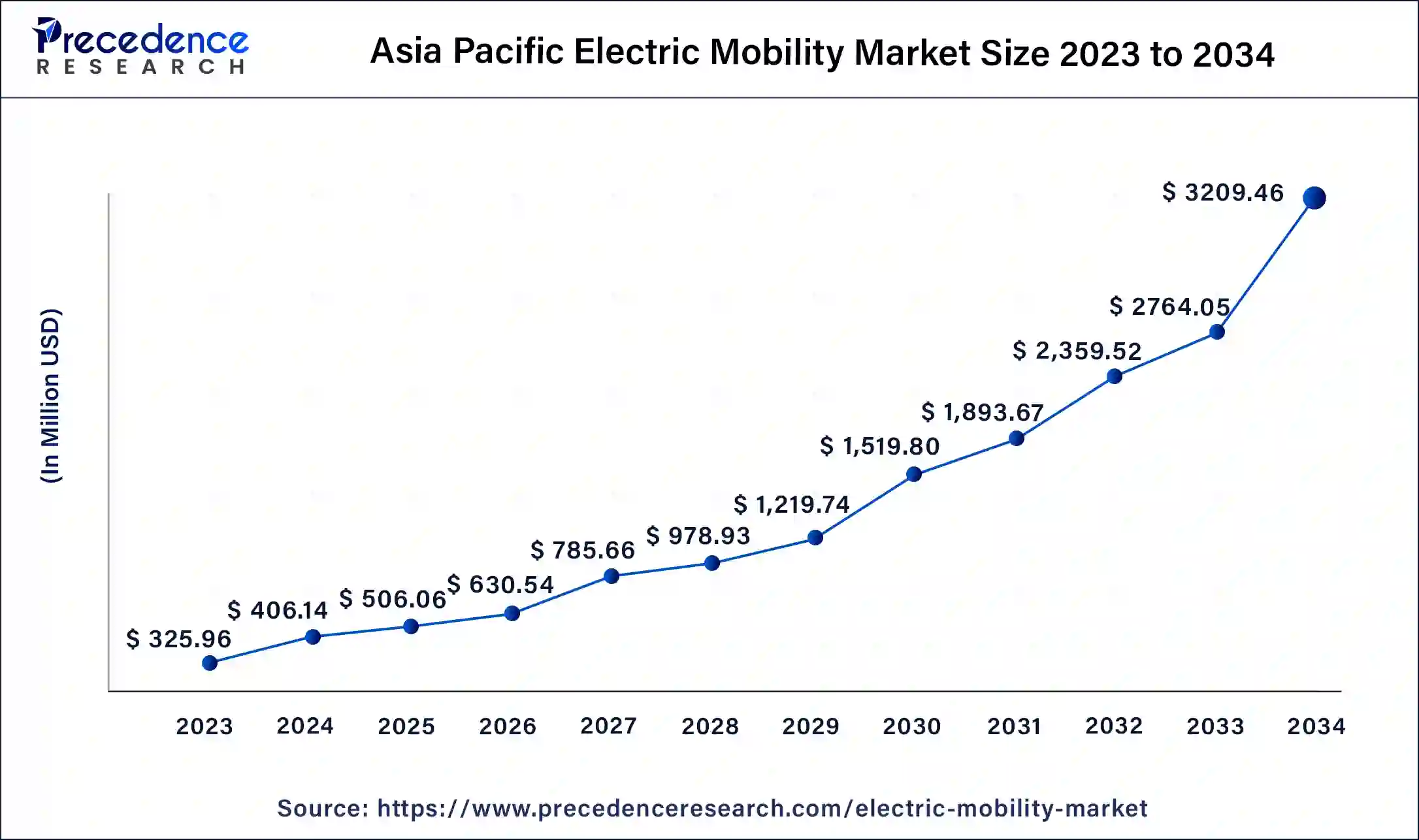

Asia PacificElectric Mobility Market Size 2025 to 2034

The Asia Pacific electric mobility (e-mobility) market size is valued at USD 506.06 billion in 2025 and is expected to be worth USD 3,209.46 billion by 2034, at a CAGR of 23% from 2025 to 2034.

The Asia Pacific region is the front-runner in the global electric mobility market in the year 2024 and is poised to grow at a rapid rate during the upcoming years. The significant growth of the region is mainly because of the rising adoption of electric vehicles mostly electric scooters and electric bicycles in countries such as Japan, India, and China. This is mainly because of rising prices of fuel along with an alarming rise in pollution prominently in developing nations in the region.

India E-vehicle market sales in Q1 of 2025

- In April 2025, Electric passenger vehicle manufacturers in India sold 12,330 units. A strong year-on-year increase of 58 %, which translates into an additional 4,547 EVs sold in April.

- Market leader Tata Motors's sales declined to 4,461 units, down 14% YoY(April 2024-April 2025). The company's monthly market share has plunged to a new low of 36 percent, versus the 6% it had a year ago.

- The MG Windsor EV five-seater has put tailwinds into JSW MG Motor India's sales. The company has eaten into Tata Motors' market share, with the company's third electric vehicle, after the ZS EV and Comet, has sold over 20,000 units since its September 2024 launch.

- In April 2025, JSW MG Motor sold 30,153 units, an additional 18,472 units, and in the process doubled its e-PV share to 28% from 13% in FY2024.

On the contrary, European countries in the global electric mobility market are poised to register a significant growth of nearly 21% over the upcoming period owing to rapid development in battery charging technology particularly for electric vehicles. For instance, European countries such as France, Demark, Netherlands, and Ireland have taken the initiative to prohibit the sale of petrol and diesel-powered vehicles by the year 2034.

- The EV sales in Western Europe, including the UK, will rise 40% to 2.7 million vehicles in 2025, with the share of battery-electric vehicles (BEVs) expected to reach 22% of the total market, according to independent car analyst Matthias Schmidt. The forecasted trend is expected to continue in 2026, with 3 million EVs projected to be sold across the European region.

Upcoming Battery Technology & Facilities are Driving North America

A major expansion of the electric mobility market in North America has been promoted by the ongoing technological advances in battery technology, including the development of solid-state batteries, which are resulting in increased energy density, enhanced safety, and longer lifespans. Whereas, emerging novel facilities, like where Honda is spending $15 billion to establish an EV and battery factory complex in Alliston, Ontario, and a $4.4 billion hub in Ohio.

Innovative Government Incentives & Charging Approaches: Leveraging the U.S. market Growth

The US market is surging in government incentives, such as tax credits, rebates, and subsidies for consumers, as well as novelty in charging solutions; meanwhile, Tesla has started testing wireless charging pads for urban EV parking lots in collaboration with a California-based energy startup in January 2025.

Exploring Public Transportation Electrification is Propelling South America

The electric mobility market in South America has been forging major explorations in public transportation electrification, whereas Santiago planned to acquire 1,800 e-buses in operation in 2024, emphasizing a 68% zero-emission bus fleet. Alongside, Brazilian automaker Marcopolo developed electric buses customized to local essentials, and Volkswagen Truck & Bus started the production of its e-Volksbus model in Brazil in the second half of 2024.

Emergence of Key Program & Import Tax Changes: Bolstering the Brazilian Market

The latest efforts, such as the MOVER program introduced by law in June 2024, encompass the Green Mobility and Innovation Program (MOVER) that facilitates incentives for the production of low-emission vehicles. However, they have also restated import tariffs on electric and hybrid vehicles in January 2024 (starting at 10-15%) to support domestic production. These tariffs are set to rise gradually, reaching 35% by mid-2026.

Major Players Imposing Production & Infrastructure are Transforming the MEA Market

Exceptional developments in the electric mobility market in MEA are assisting notable expansion. The major contribution of key companies in manufacturing & infrastructure, such as Hyundai, stated the construction of an additional EV assembly line in May 2025, complementing the existing Lucid Motors plant in Jeddah. Along with this, EVIQ, launching over 5,000 fast chargers across 10,000 locations by 2030.

Production Unit of Battery: Revolutionising the African Market

Continuous improvement in the manufacturing unit, mainly for EV battery materials, is leveraging the comprehensive developments in the African Market. For example, in June 2025, Sino-Moroccan COBCO initiated local production of EV battery materials. Morocco has a goal to produce 100,000 EV units and install 2,500 public chargers by 2026.

Value Chain Analysis

- Component Manufacturing (Engines, Transmissions, etc.)

Electric mobility component manufacturing involves designing electric motors, battery packs, and power electronics. Companies like Bosch, Siemens, LG Energy Solution, and BYD lead advancements in efficient EV component production globally.

- Vehicle Assembly and Integration

Vehicle assembly integrates batteries, powertrains, and digital systems into finished EVs. Key players such as Tesla, Rivian, Tata Motors, and Hyundai focus on precision assembly and intelligent automation for performance optimization.

- Aftermarket Services and Spare Parts

Aftermarket services include battery replacement, software updates, and EV component servicing. Companies like Mahindra Electric, NIO, Tesla, and ABB provide reliable maintenance networks and spare parts support for extended EV life.

Electric Mobility Market Companies

- Gogoro Inc.

- BMW Motorrad International

- Honda Motor Co. Ltd.

- Mahindra Group

- KTM AG

- Ninebot Ltd.

- Terra Motors Corporation

- Suzuki Motor Corporation

- Vmoto Limited

- Zero Motorcycles

- Yamaha Motor Company Limited

- ALTA Motors

- NYCeWheels

- Lightning Motorcycles

- Accell Group

- Tesla

Recent Developments

- In September 2025, Ampere, Greaves Electric Mobility's electric two-wheeler brand, introduces the Magnus Grand, a family scooter featuring advanced LFP battery technology, aiming to set new standards in style, comfort, and safety. (Source: https://energetica-india.net)

- In August 2025, Jupiter Electric Mobility opened its first showroom in Hyderabad, introducing its JEM TEZ, a 1.05-ton eLCV, to Telangana's logistics market, aiming to accelerate electrification. (Source: https://www.motorindiaonline.in)

Segments Covered in the Report

By Product

- Electric Bicycle

- Electric Skateboard

- Electric Car

- Electric Motorcycle

- Electric Wheelchair

- Electric Scooter

- Standing/Self-Balancing

- Retro

- Folding

By Battery

- NiMH

- Sealed Lead Acid

- Li-ion

By Voltage

- Less than 24V

- 24V

- 36V

- 48V

- Greater than 48V

ByEnd-use

- Personal

- Commercial

ByDrive

- Belt Drive

- Chain Drive

- Hub Drive

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content