What is the Green Hydrogen Market Size?

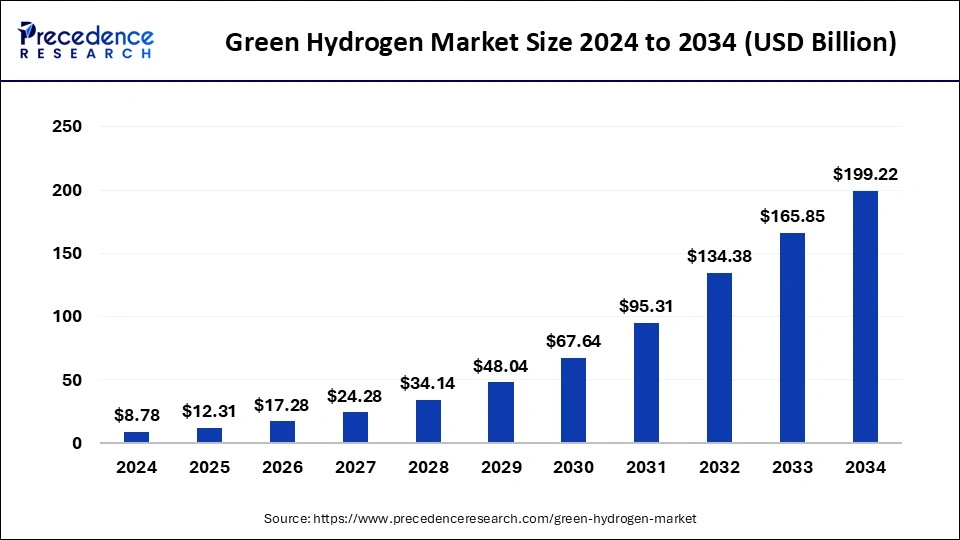

The global green hydrogen market size is calculated at USD 12.31 billion in 2025 and is predicted to increase from USD 17.28 billion in 2026 to approximately USD 231.32 billion by 2035, expanding at a CAGR of 34.09% from 2026 to 2035.

Green Hydrogen Market Key Takeaways

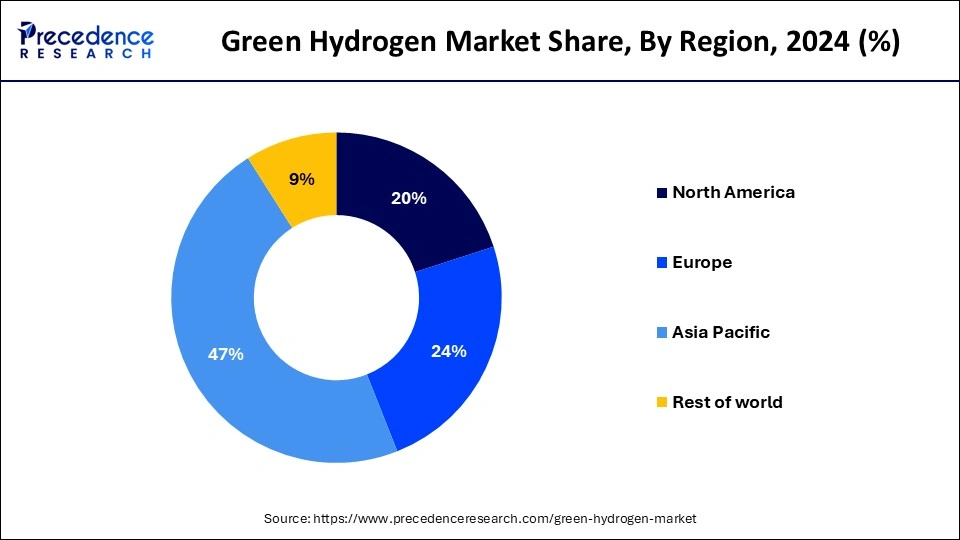

- Asia Pacific region has contributed highest revenue share of over 47.22% in 2025.

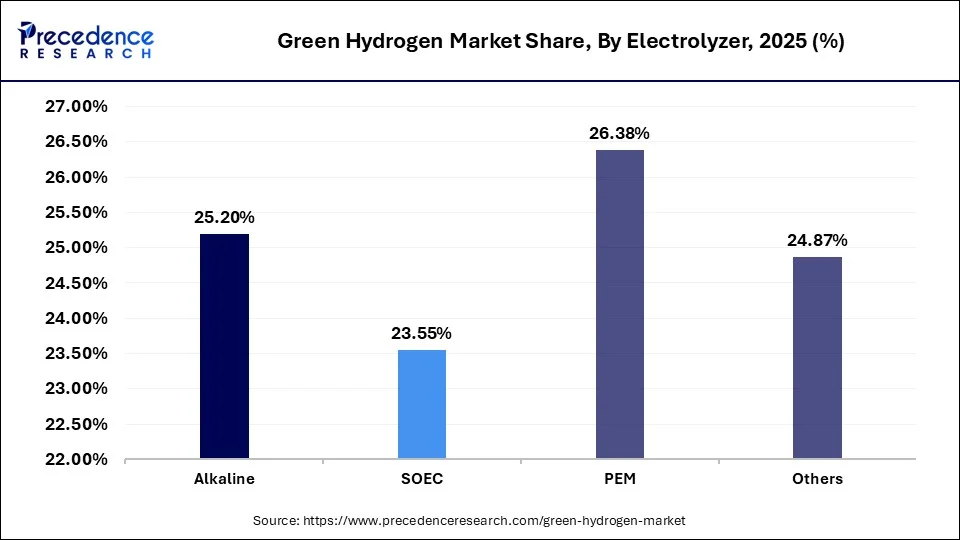

- By electrolyzer, the PEM electrolyzer segment has generated revenue share of over 34.09% in 2025. PEM electrolyzers segment is growing at a higher CAGR of 41.72% over the forecast period.

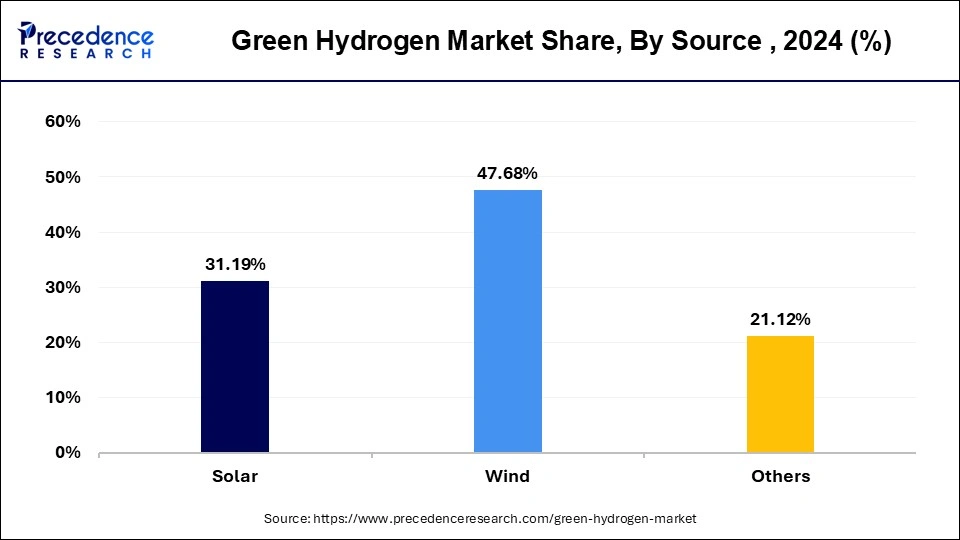

- By source, the wind segment has captured revenue share of over 47.68% in 2025.

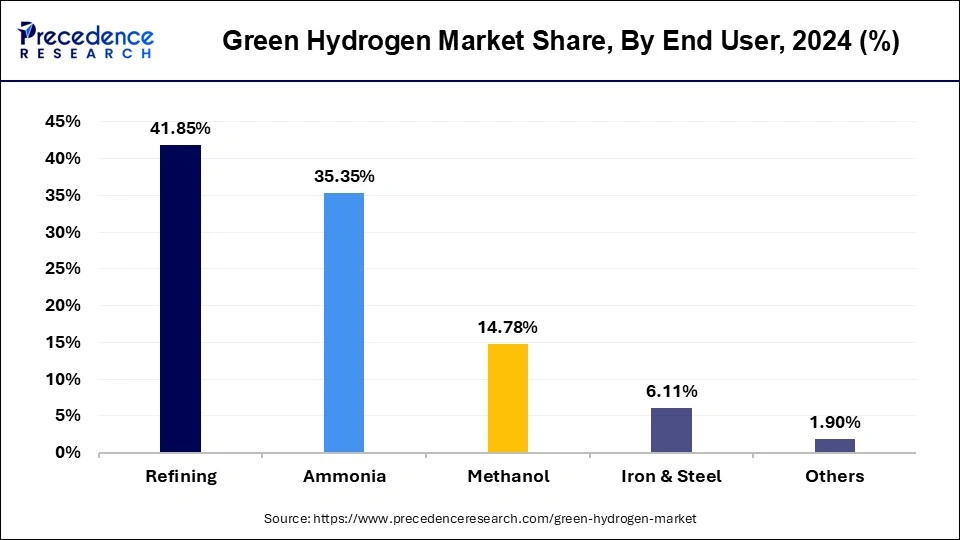

- By End User, refining segment has generated the revenue 41.85% in 2025.

How has AI benefited the green hydrogen market?

Artificial Intelligence (AI) serves as a prominent tool in the green hydrogen market by assisting firms in the green hydrogen value chain to make better decisions, reduce waste, and increase energy savings. AI can monitor hydrogen production in real-time, especially for electrolysis. Through the use of smart sensors and AI models, companies can monitor hydrogen production in real-time, which allows them to identify issues fast and fix them early before they become more serious problems. Additionally, AI can be used to predict energy demand and control the timing of when to produce hydrogen based on electricity prices and, if there is any excess capacity, primarily based on renewable energy. In Germany and Japan, for example, various firms are deploying AI to manage large hydrogen plants more effectively and efficiently than before. AI will also be able to assist with transporting and storing hydrogen through possible routes that are evaluated by the cost and safety of each route before even starting the journey. Altogether, the use of AI in the green hydrogen value chain will provide companies with a faster, cheaper, and cleaner process.

- For instance, Siemens Energy has been using AI in the management of hydrogen production and has optimized what improved energy and reduced operating costs of the plant.

Green Hydrogen Market: What You Need to Know

The global green hydrogen market is a growing industry focused on producing hydrogen fuel with zero emissions through the electrolysis of water, using only renewable energy sources like solar and wind. This clean alternative to fossil-fuel-based grey or blue hydrogen is a vital, flexible energy carrier aimed at reaching net-zero goals and reducing emissions in difficult sectors such as heavy industry, including steel, chemicals, and transportation. Driven by worldwide climate objectives, falling costs for renewable energy, supportive government policies, and technological progress, it is expanding rapidly, positioning itself as a crucial part of a sustainable global energy future with various uses in industry, transportation, and long-term energy storage.

Green Hydrogen Market Growth Factors

Green hydrogen is produced entirely from renewable sources and releases significantly less CO2 than grey hydrogen, which mainly comes from natural gas. It provides a sustainable connection between renewable energy and various applications, including transportation fuels and industrial processes. By combining wind energy with hydrogen production, green hydrogen can boost the efforts to reduce carbon emissions from renewable sources.

Currently, fossil fuels account for 96% of hydrogen production, leading to high carbon emissions. The power-to-gas method, which electrolyzes water into hydrogen and oxygen, offers a cleaner alternative. Green hydrogen is abundant and has a wide range of uses, from powering vehicles to serving as a raw material in manufacturing. As the most plentiful element on Earth, hydrogen holds great potential for innovation. It can be used as a fuel or energy source, as well as a raw material in industry, becoming profitable, and fuel-cell systems are already in operation.

The demand for green hydrogen is increasing due to environmental concerns and the need for sustainable energy options. However, high initial investment and maintenance costs challenge market growth. Still, supportive government policies and more hydrogen integration projects are expected to broaden its market. As regulations favor green hydrogen in the energy sector, the market's revenue is likely to rise. This also aligns with growing environmental worries over increased carbon emissions from fossil fuel use.

Wind farms, both onshore and offshore, are essential for green hydrogen production, benefiting from lower costs in wind energy. Wind energy costs have decreased by 50% over the past few decades. This has increased acceptance of wind power as a source of green hydrogen. The transportation sector dominates the green hydrogen market because it offers a viable alternative to fossil fuels through fuel cell electric vehicles. Overall, green hydrogen is a sustainable fuel choice, supported by technological advances and investor confidence in hydrogen infrastructure development.

Green Hydrogen Market Outlook

- Industry Growth Overview: The green hydrogen market is projected to experience exponential growth from 2025 to 2034. Global decarbonization efforts, decreasing costs of renewable energy, and technological advancements in electrolysis are driving this growth. High-growth sectors include hard-to-decarbonize industries like steel, chemicals such as ammonia and methanol production, and heavy-duty transportation like trucks, ships, and aviation.

- Sustainability Trends: Sustainability remains the main driver of the market. The main focus is on producing hydrogen through zero-emission methods using renewable energy sources like solar, wind, and hydro to replace fossil fuels in industrial and energy uses. Key trends include developing energy-efficient processes, such as Solid Oxide Electrolysis Cells utilizing waste heat, and establishing strong international certification standards and data privacy measures.

- Global Expansion: There is significant potential for global expansion, with significant investments and projects announced in Europe, Asia-Pacific, North America, the Middle East, Africa, and Latin America. The Asia-Pacific region (China, India) leads in production capacity and is experiencing a rapidly growing demand. Europe, particularly Germany, France, and the UK, takes the lead in policy support and infrastructure development. Countries like Chile and Saudi Arabia are tapping into their rich solar and wind resources to become major export centers.

- Major Investors: A significant amount of investment is coming from a diverse group of industrial giants, energy multinationals, and venture capital firms, drawn by strong government incentives such as the U.S. Inflation Reduction Act tax credits and India's National Green Hydrogen Mission funding. Leading corporate investors and players include Air Liquide, Linde plc, Siemens Energy, Plug Power, Cummins Inc., Adani Group, and BP.

- Startup Ecosystem: The startup ecosystem is maturing, focusing on innovative, cost-effective technologies and scalable business models, especially in advanced electrolyzer design (PEM, SOEC, AEM), integration with renewable energy sources, and the development of Robotics-as-a-Service (RaaS) models for infrastructure management. Emerging companies are attracting significant VC funding by providing solutions for the efficient production, storage, and transportation of green hydrogen.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 231.32 Billion |

| Market Size in 2025 | USD 12.31 Billion |

| Market Size in 2026 | USD 17.28 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 34.09% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Electrolyzer, Source, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing government support

Governments play a crucial role in creating supportive policy frameworks and regulations that provide long-term stability and predictability for the green hydrogen market. Governments across the globe are focused on setting up renewable energy targets, establishing emission reduction goals, and implementing carbon pricing mechanisms, all of which incentivize the demand for green hydrogen. Additionally, regulations that promote the integration of green hydrogen into existing energy systems, such as blending it with natural gas in pipelines or supporting fuel cell technology, this element drives market growth.

- In September 2025, Union Minister Pralhad Joshi launched a Rs 100-crore scheme supporting green hydrogen startups, offering up to Rs 5 crore per project. At the Green Hydrogen R&D Conference, 25 startups showcased innovations.

- In July 2024, the Ship Financing Portal was launched to improve access to funding for the shipping sector and the broader maritime industry. The platform, created by the European Commission's Directorate-General for Mobility and Transport, offers businesses and organizations a collection of financial tools needed to support fleet renewal and retrofitting, boost efficiency, and lessen environmental impact.

Rising demand for renewable energy solutions

Renewable energy sources are intermittent in nature, their generation is all dependent on weather conditions. Energy storage becomes crucial for balancing the intermittent supply and demand. Green hydrogen can be produced during periods of excess renewable energy generation and stored for later use. It can be converted back to electricity through fuel cells or used as a feedstock in industrial processes, providing a reliable energy storage solution and contributing to grid stability. Many governments, private organizations and regions have set targets along with a few regulatory policies for transitioning to renewable energy and reducing carbon emissions. These goals often include a focus on the production of green hydrogen as a key component of energy transition strategies. The increasing demand for renewable energy to achieve these targets naturally drives the demand for green hydrogen as a clean energy carrier.

For instance, the European Union has aimed to produce approximately 10 million tons of renewable hydrogen, ammonia and other clean fuel components by 2030. The commission aims to improve the hydrogen infrastructure with this strategy.

Restraint

Lack of Awareness in Underdeveloped Areas

Underdeveloped areas often lack essential infrastructure, such as energy grids and transportation networks. This deficiency hinders the effective establishment and distribution of green hydrogen projects. Without the necessary infrastructure, creating local production and consumption centers for green hydrogen becomes difficult. Many of these regions also face economic challenges, including poverty and limited financial resources. Investing in green hydrogen projects typically requires substantial capital and specialized technical knowledge, which are often hard to access in these areas. The shortage of financial resources and expertise makes it hard to start and maintain green hydrogen initiatives. Therefore, limited awareness in underdeveloped areas emerges as a significant barrier to the growth of the green hydrogen market.

Limitations with infrastructure

Hydrogen has low energy density, and it is challenging to transport and store it efficiently. Dedicated pipelines for hydrogen are limited, and retrofitting existing natural gas pipelines can be costly and complex. Lack of infrastructure for bulk transportation, such as shipping and trucking, adds to the challenges of distributing green hydrogen to end-users. Green hydrogen requires specialized storage facilities to prevent leaks and ensure safety. Existing storage infrastructure for hydrogen is limited, and developing adequate storage solutions for large-scale green hydrogen production and utilization remains a challenge. Moreover, refueling hydrogen stations, building the overall planned infrastructure and transportation limitations hamper the market's expansion by acting as a restraint for the market's growth.

Opportunity

Rising investments in research and development activities

Research and development efforts aim to focus on boosting the performance and durability of green hydrogen technologies. Improving the efficiency and lifespan of electrolyzers can contribute to higher hydrogen production rates and reduced maintenance costs. Similarly, advancements in fuel cell technology can enhance the efficiency and reliability of hydrogen-powered vehicles and other applications. While addressing the major cost constraint of the market, such investments can drive down the costs associated with green hydrogen production. As research progresses, scientists and engineers can identify ways to optimize processes, improve efficiency, and reduce the need for expensive materials. Lower production costs make green hydrogen more competitive with fossil fuels, attracting investment and increasing market adoption.

Technological advancements

Specific technological advancements in electrolyzers, renewable energy production and decarbonization processes are observed to open a plethora of growth opportunities for the global green hydrogen market. Technological advancements contribute to the development of infrastructure required for the green hydrogen market. This includes advancements in hydrogen storage and transportation methods, such as high-pressure or cryogenic storage, as well as the establishment of hydrogen refueling stations and pipelines. As the infrastructure expands, it creates more opportunities for the widespread adoption of green hydrogen.

Challenge

Lack of awareness in underdeveloped areas

Underdeveloped areas often have limited infrastructure, including energy grids and transportation networks. This lack of infrastructure makes it difficult to establish and distribute green hydrogen projects effectively. Without the necessary infrastructure, it becomes challenging to create local production and consumption centers for green hydrogen. Many underdeveloped areas face economic challenges, including poverty and limited financial resources. Investing in green hydrogen projects often requires significant capital and technical expertise, which may be difficult to obtain in these regions. The lack of financial resources and expertise makes it challenging to initiate and sustain green hydrogen initiatives. Thus, the lack of awareness in underdeveloped areas is observed to pose a challenge for the growth of green hydrogen market.

Value Chain Analysis

- Resource Extraction: Extraction of raw materials essential for green hydrogen production, chiefly water, depending on the region's availability.

- Power Generation: Electricity generation through renewables, which is the very first step in which solar, wind, or hydropower systems power electrolysis processes to produce green hydrogen.

Key Players: ACME Group, Avaada - Distribution Network Management: Establishing and maintaining infrastructure to transport and deliver green hydrogen from production plants to end users and other applications.

Key Players: Indian Oil Corporation Limited (IOCL), Power Grid Corporation of India - Energy Storage Systems: In essence, the development and application of all types of means for green hydrogen storage in a way that is effective and safe, i.e., storage in tanks or underground caverns to provide an uninterrupted supply and respond to demand fluctuations.

Key Players: H2e Power, - Grid Maintenance and Monitoring: Maintenance of the grid that supplies renewable energy for green hydrogen production and ensures its efficient and stable operation, as well as monitoring the performance of the entire system.

Key Players: Central Transmission Utility of India - Regulatory Compliance and Energy Trading: Assisting through the evolving policy frameworks and environmental regulations.

Key Players: Ministry of New and Renewable Energy

Segment Insights

Electrolyzer Insights

The wind segment captured revenue share of over 47.68% in 2025. This is primarily due to its cost-effectiveness, abundance, and ability to mitigate the intermittency issues inherent to wind power. Wind is one of the most mature and affordable renewable energy sources, with costs having fallen significantly over the past decade. The global proliferation of wind farms, both onshore and offshore, provides a massive, readily available power source for electrolysis, allowing excess electricity to be stored as hydrogen, stabilizing the grid, and preventing energy waste.

The solar segment is expected to grow at the fastest rate in the coming years because it is an abundant resource in many parts of the world and is very beneficial when there is plenty of sunlight. Countries such as India, Australia, and some regions of Africa have established solar PV and solar thermal energy systems that can power electrolyzers used to produce hydrogen. Since hydrogen is generated from solar energy, solar also provides continuous and intermittent renewable power throughout the day, which is an excellent way to reduce carbon emissions and related costs. The large-scale projects being deployed in deserts worldwide, along with components for hydrogen, also make extensive hydrogen solar power projects more appealing in terms of overall feasibility.

Global Green Hydrogen Market, By Electrolyzer Type, 2022-2024 (USD Million)

| By Electrolyzer Type | 2022 | 2023 | 2024 |

| Alkaline | 1,126.9 | 1,578.5 | 2,212.5 |

| SOEC | 1,052.3 | 1,474.5 | 2,067.5 |

| PEM | 1,176.7 | 1,650.5 | 2,316.6 |

| Others | 1,120.8 | 1,564.1 | 2,184.1 |

Source Insights

The solar renewable energy sector dominates the green hydrogen space because it is an abundant resource in many parts of the world and is very beneficial when there is an abundance of sunlight. Countries such as India, Australia, and a few regions of Africa have established solar PV and solar thermal energy that can be used to run the electrolyzers that make hydrogen. Since hydrogen is converted from solar energy, solar also represents continuous and intermittent renewable power throughout the day hours which is an excellent way to reduce carbon emissions and associated costs. The large-scale projects being deployed in deserts around the world, components for hydrogen, also make intensive hydrogen solar power projects far more attractive in terms of the project.

Wind energy plays a prominent role and is the fastest growing segment in the green hydrogen market due to the alignment of producing wind resources in windy places such as Europe and the coastal regions of water bodies. The wind turbines are also always working night and day, unlike solar. This represents a more stable hydrogen electrolyzer production. The Germany and UK governments have also advocated for wind-to-hydrogen projects to help reduce burdensome emissions developed from heavy industries.

Global Green Hydrogen Market, By Source, 2022-2024 (USD Million)

| By Source | 2022 | 2023 | 2024 |

| Solar | 1,394.6 | 1,953.8 | 2,739.1 |

| Wind |

2,128.7 | 2,984.4 | 4,186.9 |

| Others |

953.4 | 1,329.3 | 1,854.7 |

End User Insights

The refining segment dominated the green hydrogen market with a revenue share of 41.85% in 2024. This is primarily because it is the world's largest consumer of hydrogen, using millions of tons annually for essential processes such as hydrocracking and hydrotreating to produce cleaner fuels. This massive, established demand provides an immediate, ready-made market for green hydrogen that other industrial or mobility applications currently lack. The existing infrastructure for hydrogen storage and pipelines makes integrating new, green hydrogen production facilities a more direct and feasible technical challenge than building new end-user supply chains from scratch, thereby solidifying its initial market dominance.

The ammonia segment is expected to grow at the fastest rate over the projection period because it can be chemically converted into fertilizers and is easy to store and transport. It is also a clean-burning fuel, making it useful as a shipping fuel and a low-carbon option for power plants. Since many countries already have infrastructure for ammonia use, switching to ammonia made from green hydrogen is much simpler and faster.

The iron & steel segment is expected to experience notable growth in the green hydrogen market, as this industry seeks to reduce carbon emissions. In the steel production process, hydrogen can replace steel, making it more environmentally friendly. In Europe, demand for cleaner steel to meet climate targets is driving the growth of new green hydrogen-based steel plants.

Global Green Hydrogen Market, By End User, 2022-2024 (USD Million)

| By End User | 2022 | 2023 | 2024 |

| Refining | 1,869.9 | 2,620.5 | 3,675.1 |

| Ammonia |

1,579.1 | 2,213.2 | 3,104.2 |

| Methanol |

658.7 | 924.3 | 1,298.0 |

| Iron & Steel |

271.4 | 381.6 | 536.7 |

| Others | 97.7 | 127.9 | 166.8 |

Regional Insights

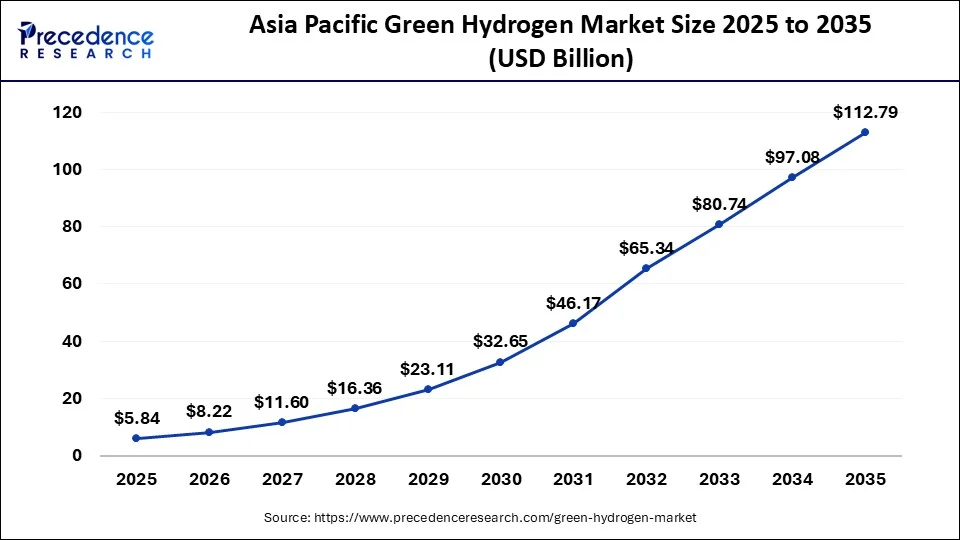

Asia Pacific Green Hydrogen Market Size and Growth 2026 to 2035

The Asia Pacific green hydrogen market size is evaluated at USD 5.84 billion in 2025 and is projected to be worth around USD 112.79 billion by 2035, growing at a CAGR of 34.46% from 2026 to 2035.

Based on the region, the Asia-Pacific segment dominated the global green hydrogen market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. China accounts for the largest market share in the Asia-Pacific green hydrogen market. With a 20-million-ton output, China leads the global green hydrogen market, accounting one third of global production.

Asia Pacific dominated the global green hydrogen market with the largest share in 2024. Favourable policies and initiatives by governments in the region are promoting the adoption of clean energy solutions like green hydrogen. Abundance of renewable energy resources such as solar, hydro ad wind is contributing to cost-effective production of green hydrogen through electrolysis. Additionally, growing focus on reducing carbon emissions, advancements in electrolyzer technology, rising investments in renewable energy infrastructure for energy security as well as increased collaborations between local and international companies for deploying large-scale green hydrogen projects is bolstering the region's market growth. Regional players, like Australia, Japan and South Korea are highly focused on adoption of green hydrogen.

- For instance, in May 2025, India's Ministry of New and Renewable Energy launched the Green Hydrogen Certification Scheme (GHCI) for certifying green hydrogen production through a transparent and credible framework. The scheme focuses on encouraging domestic production and export of green hydrogen to meet India's climate and sustainability goals.

China

China is ahead of all countries in the Asia-Pacific green hydrogen market due to significant government encouragement, large companies, and substantial amounts of solar and wind generation. The government of China also has specific aims in place, establishing targets to reduce emissions, and has started to build many green hydrogen plants. China manufactures electrolyzers, which are machines in green hydrogen, are now manufactured cheaper price than any other nation in the world. China intends to explore green hydrogen for transportation, power, and potentially the steel industry. With a significant population and anticipated growth in energy, China has many opportunities to grow and take the lead in using and developing green hydrogen technology and infrastructure worldwide.

- Europe green hydrogen market size was accounted for USD 2,065.24 million in 2024 and it is growing at a CAGR of 38.30%.

- U.S. green hydrogen market size was reached at USD 1,311.90 million in 2024 and it is growing at a CAGR of 39.34%.

- France green hydrogen market was valued at USD 584.05 million in 2024 and it is growing at a CAGR of 38.44%.

- Germany green hydrogen market size was estimated at USD 629.90 million in 2024 and it is growing at a CAGR of 38.56%.

- China green hydrogen market size was valued at USD 1,352.46 million in 2024 and it is growing at a CAGR of 42.34%.

How the IRA and H2Hubs are Igniting North America's Green Hydrogen Boom?

The market in North America is expected to grow significantly in the coming years, mainly driven by strong government incentives and considerable private sector investment aimed at reaching ambitious decarbonization targets. Landmark U.S. legislation, such as the Inflation Reduction Act (IRA), provides substantial production tax credits, while the Bipartisan Infrastructure Law allocates billions for regional Clean Hydrogen Hubs (H2Hubs). These initiatives have made green hydrogen financially feasible and triggered a surge in large-scale projects and technological innovations. With a focus on using renewable energy to produce clean hydrogen for hard-to-decarbonize sectors like heavy transportation and industry, both the U.S. and Canada are positioning themselves as key hubs for the production and use of green hydrogen, establishing a leadership role in the global hydrogen economy.

U.S. Green Hydrogen Market Trends

The U.S. is experiencing a transformation in the global green hydrogen industry, driven by a bold mix of decarbonization goals and record-breaking financial incentives aimed at speeding up the shift from fossil fuels. At the heart of this effort is the IRA, which offers a production tax credit of up to $3 per kilogram for clean hydrogen, making it competitive with traditional, carbon-heavy methods and encouraging significant private investment. This effort is further bolstered by the Bipartisan Infrastructure Law (BIL), which plans to build integrated networks of producers, infrastructure, and end-users through the creation of H2Hubs.

Europe

Europe is the region experiencing the fastest growth in the green hydrogen market. This is due to strict climate laws and frustration with oil and gas producers from abroad, as well as green energy goals. The European Union would like to be climate-neutral by 2050, and green hydrogen is a big part of that. There are so many countries across Europe building hydrogen plants, and some are going to use wind and solar energy to build clean fuels. The European government is also providing funding to support companies that will proceed with developing the future of hydrogen technology. Clean fuels are being demanded in sectors like steel, transport, and chemicals, creating upticks in demand for hydrogen. There is a demand for green hydrogen, converting it from an idea to a commodity. Europe sees green hydrogen as its ticket to a clean energy future and regional independence from oil and gas producers abroad.

The regional market growth is also driven by increased environmental concerns caused by carbon emissions and the rising demand for cleaner energy. Europe has always aimed to decarbonize, and green hydrogen plays a key role in this, fueling the market. The demand for green hydrogen is likely to increase in the region due to its use in major applications such as fuel and chemical feedstock, as well as the growing demand from the refining and iron and steel industries.

Germany

Germany is the leader in the European green hydrogen market due to successfully combining realistic energy targets, government investment, and leading technology. Germany has focused on developing large-scale hydrogen projects using wind and solar generation. Germany is also globally connected through imports of green hydrogen through cooperative development partners. The German government invests heavily to fund the development of hydrogen plants and the innovation of new uses for clean fuel. Germany has developed large-scale users of hydrogen in the transportation and steel industry to decrease emissions, and the region's level of investment in research and development, and diversification of construction partnerships have successfully escalated their capabilities into high levels of success.

How Latin America's Renewable Riches Will Power the World?

Latin America has become a significant player in the global green hydrogen market because of its abundant and inexpensive renewable energy resources, especially solar, wind, and hydropower. Countries like Chile and Argentina are actively working to become major net exporters, utilizing their exceptional wind and solar potential to produce some of the world's most affordable green hydrogen. Meanwhile, Brazil, Colombia, and Mexico are focusing on using green hydrogen to decarbonize their heavy domestic industries, such as mining, refining, and chemical production, by developing national hydrogen strategies and attracting significant private and multilateral investments to position Latin America as an essential supplier.

The market in Latin America is also driven by favorable government incentives, decarbonization targets, industrial demand for clean energy, supportive regulatory frameworks, and rising corporate sustainability commitments. Additionally, many government agencies in the region are focusing on providing incentives and regulatory support for green hydrogen projects. Several countries are making significant efforts to reduce their carbon emissions and promote renewable energy through green hydrogen development. These factors position Latin America as a significant region in the global market.

Brazil Green Hydrogen Market Trends

Brazil is leveraging its diverse renewable energy mix, which includes substantial hydro, solar, wind, and biomass resources, to become a leading producer of affordable green hydrogen for both domestic consumption and export. Backed by national programs and a new regulatory framework, Brazil is attracting significant private investment into regional production hubs, especially at major ports, to support a strong domestic hydrogen economy and supply clean energy to international markets like Germany and the Netherlands.

Beyond Oil: How the MEA Region is Diversifying its Future with Green Hydrogen

The Middle East and Africa are rapidly becoming key players in the global green hydrogen market, fueled by their large, low-cost renewable energy potential from abundant solar and wind resources. The region primarily aims to serve as a major export hub for green hydrogen and its derivatives to energy-hungry markets. Major projects such as the NEOM Green Hydrogen project in Saudi Arabia and the Hyphen project in Namibia are leading this change. Countries like the UAE, Oman, Egypt, Morocco, and South Africa are developing national strategies and regulatory frameworks to attract international investment.

National decarbonization strategies are also gaining momentum in the region, helping to speed up investments in production hubs, port infrastructure, and hydrogen-ready industrial clusters. Countries like Egypt and Morocco are utilizing their abundant solar and wind resources, positioning themselves as leading players in the region.

Saudi Arabia Green Hydrogen Market Trends

Saudi Arabia is utilizing its vast solar and wind resources to shift from a traditional oil exporter to a leading global supplier of low-carbon hydrogen and related products, such as green ammonia. Central to this shift is the NEOM Green Hydrogen Company project, which aims to be one of the world's largest, cost-competitive green hydrogen production facilities for international export. The country is also considering blue hydrogen options that leverage its existing natural gas infrastructure combined with carbon capture technology to meet the needs of energy-demanding markets.

| Country | Key Regulation/Policy | Definition Standard (CO?e/kg H?) | Primary Incentive Mechanism |

| EU | Renewable Energy Directive (RED III), Delegated Acts, REPowerEU | < 3.38 kg (70% GHG reduction vs. fossil fuel baseline) | Mandates, binding targets for industrial use, ETS/CBAM, subsidies |

| India | National Green Hydrogen Mission (NGHM) | < 2 kg | Production-linked incentives (PLI) for production & manufacturing, transmission fee waivers |

| U.S. | Inflation Reduction Act (IRA) | Varies by tier, lowest tier < 0.45 kg | Production Tax Credits (PTC) up to $3/kg |

| Chile | National Green H? Strategy | Focused on low-carbon certification standards for export | Government financing, strategic partnerships, and conducive export regulations |

Key Companies & Market Share Insights

In the green hydrogen market, there is fierce rivalry to reduce manufacturing costs, develop innovative process technology, expand, and enhance the usage of green hydrogen in end use sectors. The key market players are attempting to grow their market shares by employing various techniques in response to such possibilities in the sector.

Green Hydrogen Market Companies

- NEL ASA: Develops and supplies electrolysis solutions for green hydrogen production, enabling scalable hydrogen generation from renewable energy sources.

- ITM Power: Designs and manufactures PEM electrolyzers, providing integrated solutions for producing green hydrogen for industrial and mobility applications.

- ENGIE: Invests in renewable energy projects and hydrogen infrastructure, promoting large-scale green hydrogen production and distribution for industrial and power sectors.

- Siemens Energy: Offers electrolyzer technology and hydrogen-ready power solutions, supporting industrial decarbonization and renewable energy integration.

- Air Products Inc.: Produces, distributes, and supplies hydrogen for industrial applications while investing in green hydrogen projects for mobility and energy transition.

- Messer Group GMBH: Develops hydrogen production, storage, and distribution solutions, focusing on green hydrogen supply for industrial and energy applications.

- Plug Power Inc.: Designs fuel cell systems and builds green hydrogen generation and distribution infrastructure to support transportation and industrial sectors.

- Cummins Inc.: Manufactures electrolyzers and hydrogen fuel cell systems, contributing to green hydrogen production and adoption in mobility and industrial applications.

- Air Liquide: Supplies hydrogen production and distribution technologies, including electrolyzers, to accelerate the deployment of green hydrogen in industrial and energy sectors.

- Linde: Provides hydrogen production, liquefaction, and distribution solutions, supporting large-scale green hydrogen projects and industrial decarbonization efforts

Recent Developments

- In October 2025, Mangalore-based deep-tech startup Hydgen secured USD 5 million in a mix of equity and debt funding to accelerate its push toward decentralized, on-demand green hydrogen generation. This funding round was led by Transition VC, with participation from Cloudberry Pioneer Investments (Europe), Moringa Ventures (Singapore), and family offices from India and Singapore. The investment will be used to upgrade Hydgen's Mangaluru production facility to a semi-automated manufacturing line and increase its single-stack electrolyser capacity to 250 kW. The company also plans to expand operations in Japan, Europe, and the Middle East.

(Source: https://www.businessworld.in/ ) - In August 2025, Statkraft secured a lease for a piece of land in Shetland next to the abandoned Scatsta Airport to build its 400 MW green hydrogen-to-ammonia plant, Shetland Hydrogen Project 2. The project was going to use excess wind energy from local wind farms that are yet to be built and convert it into ammonia for use as marine fuel and fertiliser.

[Source: https://www.hydrogeninsight.com] - In August 2025, OQ Gas Networks signed a term sheet with Belgium's Fluxys to co-develop hydrogen transportation at agreed sites across Oman. They planned to repurpose natural gas pipelines and build 300 – 400 km of new hydrogen lines by 2030 through OQ Gas Networks, with Fluxys holding a minority operational stake. This was intended to support Oman's green hydrogen development and Net Zero goals.

[Source: https://www.pipeline-journal.net] - In August 2025, India inaugurated its first Make-in-India 1 MW green hydrogen plant at Deendayal Port, Kandla. This facility was established in four months, with a locally manufactured electrolyser, and was also entirely designed and built by locally sourced engineering teams. The facility was built for initial use to power port bus fleets and port street lighting systems, but the state planned and started to develop the project to 10 MW and facilitate the powering of full port operations.

[Source: https://www.newsonair.gov.in] - In August 2025, Copenhagen Infrastructure Partners bought a 70% share in the first 100 MW phase of H2Apex's green hydrogen facility in Lubmin, Germany. CIP had committed €15 million pre-final investment decision, and total EU IPCEI funding amounted to €167 million. Construction was planned to begin in 2026 and commissioning by 2028, and would aim to supply up to 10,000 tonnes per annum.

[Source: https://www.h2-view.com] - In August 2025, Four Zeros Energy partnered with Vergia AS to develop and finance a portfolio of green hydrogen projects throughout the UK. The first of its initiatives, the 20 MW St Austell project in Cornwall, had been selected as a shortlist product under the UK HAR2 allocation round, with production to supply the regional mining operations and carbon reductions by 2028.

[Source: https://www.renews.biz]

Segments Covered in the Report

By Electrolyzer

- Proton Exchange Membrane Electrolyzer

- Alkaline Electrolyzer

- Solid Oxide Electrolyzer

- Others

By Source

- Solar Energy

- Wind Energy

- Others (hydropower, geothermal, and hybrid of solar & wind)

By End User

- Refining

- Ammonia

- Methanol

- Iron & Steel

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting