What is the 3D Protein Structures Analysis Market Size?

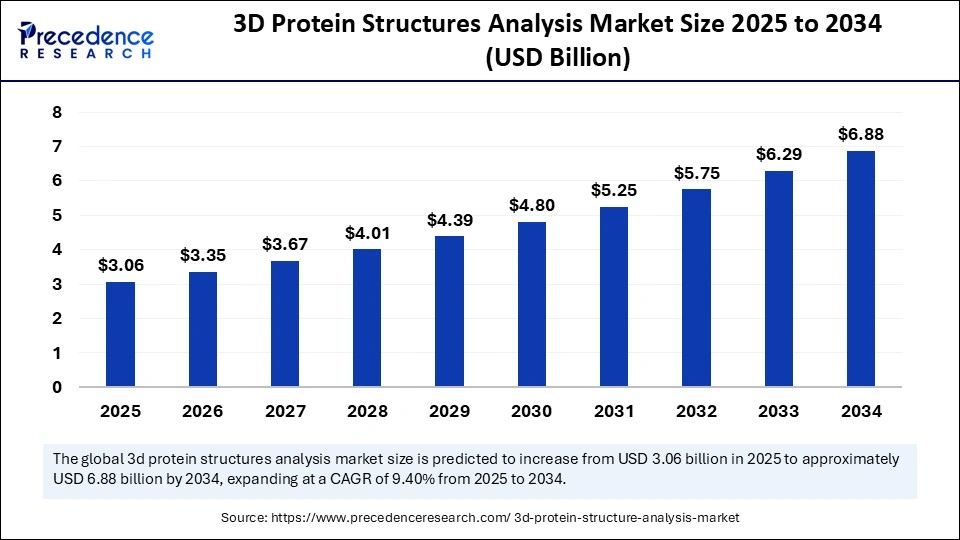

The global 3D protein structures analysis market size accounted for USD 2.80 billion in 2024 and is predicted to increase from USD 3.06 billion in 2025 to approximately USD 6.88 billion by 2034, expanding at a CAGR of 9.40% from 2025 to 2034. The growth of the market is driven by rising demand for structure-based drug design, advancements in imaging technologies, and growing focus on precision medicine.

Market Highlights

- North America dominated the global 3D protein structures analysis market with the largest share of 42% in 2024.

- By region, Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By technology, the X-ray crystallography segment captured the biggest market share of 35% in 2024.

- By technology, the cryo-electron microscopy segment is anticipated to show considerable growth over the forecast period.

- By component, the instruments & imaging systems segment contributed the highest market share of 40% in 2024.

- By component, the software & computational tools segment is anticipated to show considerable growth over the forecast period.

- By application, the drug discovery & development segment held the maximum market share of 45% in 2024.

- By application, the biomarker identification segment is anticipated to grow at the fastest CAGR over the forecast period.

- By end-use industry, the pharmaceutical & biotechnology companies segment generated the major market share of 50% in 2024.

- By end-use industry, the contract research organizations (CROs) segment is anticipated to expand at the fastest CAGR over the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 2.80 Billion

- Market Size in 2025: USD 3.06 Billion

- Forecasted Market Size by 2034: USD6.88 Billion

- CAGR (2025-2034): 9.40%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is 3D Protein Structure Analysis?

3D protein structure analysis is the process of studying the three-dimensional (3D) shape of a protein to understand its function, interactions, and role in biological processes. The market growth is largely driven by the increasing demand for precision medicine, which focuses on patient-specific treatments, as well as the rapid advancement in structural biology methods and the growing use of artificial intelligence and machine learning in protein modeling. The 3D protein structures analysis market revolves around the technologies, tools, and services that identify, model, and analyze the three-dimensional structure of proteins. The study of protein structures is essential for exploring biological processes, discovering new drugs, and identifying and determining usable biomarkers.

The experimental methods, such as X-ray crystallography, cryo-electron microscopy, and nuclear magnetic resonance, are backed by advanced techniques of computational modeling and AI-based predictive systems. The process of drug discovery is accelerating, and pharmaceutical and biotechnology companies are relying on the 3D protein analysis technique to discover drugs that treat complex diseases, such as cancer, neurodegenerative diseases, and infectious diseases.

AI Shifts in the 3D Protein Structures Analysis Market

The integration of artificial intelligence is transforming the 3D protein structures analysis market by advancing the accuracy of predictions, decreasing costs, and improving the timeframe involved in drug discovery and structural biology studies. Using AI-based systems, including AlphaFold developed by DeepMind, has significantly enhanced the capacity to predict protein folding and protein-protein interactions, providing a faster and more accurate understanding in a short period of time. The combination of AI and cloud-based systems makes structural data more accessible to everyone, facilitates international partnerships, and minimizes issues related to reproducibility.

3D Protein Structures Analysis Market Outlook

- Market Growth Overview: The 3D protein structures analysis market is experiencing rapid growth due to the rising demand for precision medicine, biomarker discovery, and advanced drug development. Research is advancing rapidly due to the development of technologies in X-ray crystallography, cryo-EM, NMR spectroscopy, and AI-driven modeling platforms, which enhance the accuracy of the results.

- Global Expansion: Emerging markets present significant opportunities for market expansion. Global expansion increases access to advanced technologies and research collaborations across borders, accelerating the development and application of 3D protein structure analysis worldwide. It also drives market growth by enabling pharmaceutical, biotech, and academic institutions in emerging regions to adopt structure-based drug discovery and protein engineering tools.

- Major Investors: Key players in the market include DeepMind, Thermo Fisher Scientific, and Danaher, among other biotech-oriented investors, who are investing in AI-enabled protein modeling systems and laboratory equipment. These investments accelerate the adoption of technology, enhance R&D capacity, and promote drug discovery and biomarker identification.

- Startup Ecosystem: Basecamp Research, Latent Labs, and others are startups that specialize in predictive modeling, protein engineering, and systems in drug discovery. These entrepreneurial businesses collaborate with schools and pharmaceutical firms to accelerate research pipelines.

What Factors are Fueling the Rapid Growth of the 3D Protein Structures Analysis Market?

- Advanced Structural Biology Techniques: Advanced structural biology techniques, including cryo-electron microscopy, X-ray crystallography, and nuclear magnetic resonance, have significantly enhanced the resolution, accuracy, and efficiency of protein structure analysis.

- Greater Demand for Precision Medicine: Precision medicine is founded on the specificity of drug targets for individual patients, and it is essential to determine the proper structure of proteins. The analysis of proteins in three dimensions can be used to design therapies tailored to a specific genetic and biological profile.

- Growth of Cloud-Based and Collaborative Platforms: Access to structural data and analysis tools is enhanced through cloud-based computational tools and international collaborations of academia, research centers, and industry.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 2.80 Billion |

| Market Size in 2025 | USD 3.06 Billion |

| Market Size by 2034 | USD 6.88 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.40% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Component, Application, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Focus on Automation and Miniaturization in X-Ray Crystallography Workflow

X-ray crystallography is considered one of the most popular and effective methods for studying the three-dimensional (3D) structure of a protein, providing a profound understanding of how a biomolecule functions and participates in biological processes. Conventionally, such a technique is resource-demanding, requiring large volumes of samples, extensive preparation, and specialized technical skills. Automation simplifies processes of crystallization, data collection, and data analysis, resulting in faster, more reproducible, and less error-prone procedures. The miniaturization maximizes efficiency by reducing the sample size and reagent consumption. With automated and miniaturized crystallography systems adopted by laboratories and pharmaceutical companies, these systems can streamline drug discovery pipelines, enhance protein function studies, and increase the number of structural datasets.

Restraint

High Cost and Complexity

One of the most significant limitations to the 3D protein structures analysis market is the cost of advanced equipment and technologies. More sophisticated instruments, such as crystal-electron microscopy, nuclear magnetic resonance, and high-resolution X-ray crystallography, have substantial capital requirements, which in most instances are beyond the capability of smaller research facilities and new biotechnology firms. In addition to the initial expenditure, maintenance, consumable costs, and professional operators are other expenses that increase financial burdens. Strict regulatory obstacles are also a limiting factor, as any rigorous process of structural validation and drug approval may slow the process of translating discoveries into therapy.

Opportunity

Personalized Medicine and Biomarker Discovery

Protein structural differences, which are often due to genetic polymorphism, play a significant role in an individual's response to drugs and susceptibility to diseases. With the aid of high-resolution structural knowledge, scientists will be able to comprehend these variations better and develop therapies tailored to the specific needs of individual patients. Additionally, 3D structural analysis enables the detection of novel biomarkers of disease proteins or interactions, which can serve as useful evidence for early diagnosis, prognosis, and monitoring of therapy. Such insights are especially important in oncology, neurology, and the treatment of rare genetic diseases, as they enable the creation of precision therapies. The availability of structural analysis platforms capable of delivering patient-specific information on proteins will be crucial for the development of personalized healthcare.

Investment Overview

| Company | Investment Amount | Key Investors | Strategic Focus |

| Latent Labs | $50 million | Radical Ventures, Sofinnova Partners, Jeff Dean (Google), Aidan Gomez (Cohere) | AI-driven generative models for designing novel therapeutic proteins; aims to revolutionize drug discovery with programmable biology |

| CHARM Therapeutics | $80 million | New Enterprise Associates (NEA), SR One, NVIDIA, OrbiMed, F-Prime, Khosla Ventures | AI-designed menin inhibitors for acute myeloid leukemia (AML); advancing clinical trials to address resistance mutations |

Segment Insights

Technology Insights

Why Did the X-Ray Crystallography Segment Lead the Market in 2024?

The x-ray crystallography segment led the 3D protein structures analysis market while holding a 35% share in 2024. This technique has been regarded as the gold standard in analyzing protein structures at the atomic resolution. Pharmaceutical and biotechnology firms are utilizing crystallography to validate drug targets and optimize molecular designs, particularly for small molecules and complex proteins. Moreover, progress in the automation and miniaturization of crystallography processes has improved throughput, reduced the amount of sample required, and increased reproducibility, which is another spur to adoption. However, regardless of the new technologies, crystallography remains a viable field and has a large number of databases, including the Protein Data Bank (PDB), which contributes to its continued relevance.

The cryo-electron microscopy (cryo-EM) segment is expected to grow at a significant CAGR over the forecast period because it is capable of analyzing both proteins and macromolecular complexes, without the need to crystallize the complex under study. Cryo-EM can be used to study proteins in their natural, dynamic forms, with the potential to provide more useful structural information in the context of the real biological environment. Recent technological advancements, including enhanced detectors, automation, and increased resolution, have enabled the cryo-EM method to compete with crystallography in accuracy. Cryo-EM is especially useful in fields of research such as oncology, neurodegenerative diseases, and viral infections, where the complex interactions between proteins are crucial factors.

Component Insights

What Made Instruments & Imaging Systems the Dominant Segment in 2024?

The instruments & imaging systems segment dominated the 3D protein structures analysis market with a 40% share in 2024. This segment includes advanced technologies, such as X-ray crystallography instruments, cryo-electron microscopes, and NMR spectrometers, among others, which are required to determine high-resolution protein structures. These are high-accuracy and high-precision instruments that can be used to explore protein structure in detail, facilitating drug discovery and biomarker discovery. The growing popularity of studies in structural biology across the pharmaceutical, biotechnology, and academic industries has confirmed the need to apply these tools.

The software & computational tools segment is expected to grow at the fastest rate in the upcoming period. The advanced software platforms enable researchers to forecast protein folding, model molecular dynamics, and study interactions with ligands or other biomolecules, without being limited to time-consuming experimentation methods. Structural prediction is more predictable and cost-effective due to the use of tools like AlphaFold and BaseFold, as well as other computer-based systems that utilize AI. Additionally, smaller labs and biotech companies are accessing high-performance computing remotely, as cloud-based computational solutions are democratizing these services. Combining experimental data with imaging systems also improves predictive quality and accelerates drug discovery pipelines.

Application Insights

Why Did the Drug Discovery & Development Segment Lead the 3D Protein Structures Analysis Market?

The drug discovery & development segment led the market while holding a 45% share in 2024. With the 3D structure of proteins, scientists can create small molecules, bioactives, or inhibitors that are highly specific and effective, thereby minimizing off-target effects and maximizing therapeutic effects. Pharmaceutical and biotechnology firms are placing more emphasis on structural insights to hasten early drug discovery, optimize lead compounds, and reduce the development cycle. Molecular docking and analysis of interactions can be accurately measured using advanced methods such as X-ray crystallography, cryo-EM, and NMR, when applied in conjunction with computational methods and AI-assisted prediction tools.

The biomarker identification segment is expected to grow at a significant CAGR over the forecast period. The 3D protein structures analysis of the proteins that determine the disease can be measured with a high degree of resolution, which allows the researcher to determine the structural changes as well as the interaction of the disease-related proteins that are used to identify biomarkers, which are used in the diagnosis, prognosis, and monitoring of the therapy. The rapid prediction and validation of potential biomarkers, even in complex or rare diseases, are now possible due to advances in AI-driven modeling and computational tools. Also, academia, clinical research organizations, and pharmaceutical companies are developing collaborations, which are increasing the use of structural analysis in the discovery of biomarkers.

End-user Insights

Why Did Pharmaceutical & Biotechnology Companies Hold the Largest Market Share in 2024?

The pharmaceutical & biotechnology companies segment held a 50% share of the 3D protein structures analysis market in 2024. These companies depend greatly on the high-resolution protein structural examination to find and confirm drug targets, design therapeutic, and optimize molecular interactions to be effective and safe. These organizations can utilize advanced technologies, such as X-ray crystallography, cryo-electron microscopy, and nuclear magnetic resonance, to facilitate drug development pipelines and eliminate costly trial-and-error approaches by leveraging AI-based computational tools. In addition, the increasing focus on complex diseases, such as cancer, neurodegenerative diseases, and infectious diseases, has heightened the need to obtain rich information on their structure.

The contract research organizations segment is expected to expand at the highest CAGR over the forecast period. CROs offer high-end expertise in structural biology, protein expression, and computational modeling, enabling pharmaceutical and biotech companies to leverage this advanced technology and equipment without incurring capital investment. CROs are increasingly being sought as partners to early-stage drug discovery, biomarker discovery, and personalized medicine programs due to an increase in the need to have cost-effective, flexible, and scalable solutions. Also, partnerships with academic or industrial research institutes are enabling CROs to more rapidly adopt new technology (like cryo-EM, AI-driven models, and cloud-based technology).

Region Insights

U.S. 3D Protein Structures Analysis Market Size and Growth 2025 to 2034

The U.S. 3D protein structures analysis market size was evaluated at USD 823.20 million in 2024 and is projected to be worth around USD 2,061.42 million by 2034, growing at a CAGR of 9.61% from 2025 to 2034.

What Made North America a Global Leader in the 3D Protein Structures Analysis Market?

North America led the global market by capturing the highest market share of 42% in 2024. The existence of a well-developed pharmaceutical and biotechnology sector, along with significant investment in research and development, is the major driving force behind the region's leadership. In the U.S., in particular, there are numerous major educational centers, research institutions, and biotechnological firms that utilize high-quality structural biology methods, including X-ray crystallography, cryo-electron microscopy, and nuclear magnetic resonance. The market ecosystem is further supported by government assistance in the form of grants, funding projects, and partnerships between research organizations in the public and private sectors.

The U.S. is a major contributor to the North American 3D protein structures analysis market due to its strong structural biology research and pharmaceutical development infrastructure. Advanced protein structure determination is becoming readily available and efficient, thanks to the large-scale development of automation, high-throughput workflows, and cloud-based analysis platforms, which are being invested in by leading companies and research institutions in the U.S. Additionally, regulatory systems in the U.S. are strict, promoting high research standards, validation procedures, and enhancing the reliability and usability of structural analysis tools.

Why is Asia Pacific Witnessing the Fastest Growth in the 3D Protein Structures Analysis Market?

Asia Pacific is experiencing the fastest growth in the market due to a boom in the biotechnology and pharmaceutical industries on the continent. The discovery of drugs, personalized medicine, and biomarker discovery is gaining popularity, placing a significant burden on high-resolution structural biology techniques such as X-ray crystallography, cryo-electron microscopy, and NMR spectroscopy. Moreover, expanding government subsidies, implementing good policies, and fostering business in relation to research are driving higher research activities in the fields of molecular biology and structural proteomics.

China is a significant contributor to the rapid growth of the Asia Pacific market. Biotech hubs, research centers, and contract research organizations specializing in protein structure analysis have been majorly experienced in the country. Pharmaceutical firms in China are increasingly utilizing 3D protein structure analysis to accelerate their drug development pipelines and support clinical research, particularly in oncology, neurodegenerative disorders, and infectious diseases. Moreover, it is also facilitated by partnerships with foreign research centers, enabling the transfer of technology and innovation in the field of structural biology.

Country-level Investments & Funding Trends in the 3D Protein Structures Analysis Market

U.S.

The U.S. biotechnology industry, which focuses on 3D protein structure analysis, is leading the market with the support of strong government funding through agencies such as the National Institutes of Health. The prominent key players include Thermo Fisher Scientific, computational software leader Schrodinger, and instrumentation provider Bruker Corporation, whose collaborative efforts drive innovation in protein analysis tools and applications.

China

The bioeconomic sector in China is growing at a very high rate, and both private and governmental entities highly fund research in proteomics. Some of the key players include WuXi AppTec, an international company that offers R&D and manufacturing services, and MGI, a company that provides genetic solutions and multi-omics services based on advanced technologies such as X-ray crystallography and cryo-EM.

Germany

Germany is equipped with a robust biopharmaceutical and academic research base, backed by substantial public funding. Innovative companies, such as Merck KGaA, invest a significant amount in life science research and development, while state agencies fund projects aimed at enhancing innovation in areas like computational and structural biology. Specialized biotech companies, like Jena Bioscience, which provides protein crystallization reagents, are also located in the country.

3D Protein Structures Analysis Market Companies

- Thermo Fisher Scientific Inc

- Bruker Corporation

- Oxford Instruments plc

- Bio-Rad Laboratories, Inc.

- Rigaku Corporation

- Waters Corporation

- Agilent Technologies, Inc.

- Merck KGaA

- Creative Biostructure

- Schrodinger, Inc.

- Dassault Systèmes

- Lonza Group AG

- WuXi AppTec

- GenScript Biotech Corporation

- Cambridge Crystallographic Data Centre

Recent Developments

- In July 2025, Latent Labs presented Latent-X, the newest revolutionary frontier AI model for creating lab-functional protein binders at the all-atom scale. The design model produces designs of individual therapeutic modalities: macrocycles and mini-binders, which have demonstrated breakthrough performance in the laboratory. (Source:https://www.latentlabs.com)

- In June 2025, Singapore Gero launched ProtoBind-Diff, a Sequence-Only AI model generating drug-like molecules with no 3D Structure. ProtoBind-Diff is a system that creates drug-like molecules based on the amino acid sequences of the protein targets; no 3D structures are necessary.(Source: https://www.biopharmaboardroom.com)

- In April 2024, Bruker Corporation, the leader in nuclear magnetic resonance spectroscopy solutions, announced the availability of new high-resolution solid-state NMR scientific applications. These skills can lead to groundbreaking structural biology discoveries in complex proteins, membrane proteins, and protein aggregates.(Source: https://ir.bruker.com)

Segments Covered in the Report

By Technology

- X-Ray Crystallography

- Cryo-Electron Microscopy (Cryo-EM)

- Nuclear Magnetic Resonance (NMR) Spectroscopy

- Small Angle X-Ray Scattering (SAXS)

- Computational Modeling & AI-Based Prediction

- Mass Spectrometry-Based Methods

By Component

- Instruments & Imaging Systems

- Software & Computational Tools

- Reagents & Consumables

- Services (CROs & Research Support)

By Application

- Drug Discovery & Development

- Structural Genomics

- Biomarker Identification

- Protein-Protein Interaction Studies

- Enzyme Engineering & Industrial Biotech

- Academic Research & Education

By End-Use Industry

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations (CROs)

- Healthcare & Diagnostics Companies

- Agricultural & Industrial Biotech Firms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting