What is the Gene Identification Market Size?

The global gene identification market is witnessing rapid growth as next-generation sequencing and computational biology accelerate discovery of disease-causing genes.The growth of the market is driven by rising demand for precision medicine, advances in sequencing technologies, and expanding applications across healthcare and research.

Gene Identification Market Key Takeaways

- North America dominated the gene identification market with the largest market share of 40% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By technology, the next-generation sequencing (NGS) segment held the biggest market share of 45% in 2024.

- By technology, the CRISPR/Cas-based tools segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By offering, the reagents & consumables segment captured the highest market share of 40% in 2024.

- By offering, the software & bioinformatics tools segment is expected to expand at a notable CAGR over the projected period.

- By application, the clinical diagnostics segment contributed the maximum market share of 35% in 2024.

- By application, the drug discovery & development segment is expected to expand at a notable CAGR over the forecast period.

- By end user, the academic & research institutes segment generated the major market share of 30% in 2024.

- By end user, the pharmaceutical & biotechnology companies segment is expected to expand at the highest CAGR over the projected period.

How is the Gene Identification Industry Developing?

The gene identification industry continues to develop due to strong backing from the government and increased demand for gene identification technologies in personalized medicine and genomic studies. The gene identification market refers to technologies, platforms, and services used to identify, map, and analyze genes responsible for specific traits, biological functions, or diseases. It involves sequencing, bioinformatics, genome-wide association studies (GWAS), and molecular diagnostic tools that help pinpoint genetic variations and mutations. These solutions are vital for advancing precision medicine, drug discovery, agricultural biotechnology, and evolutionary research.

The increasing incidence of hereditary diseases and cancers is creating the need for precise gene mapping methods. Emerging technologies, such as next-generation sequencing and AI-based bioinformatics, are lending themselves to enhanced accuracy and efficiency in genetic analysis. Overall, the emerging developments in gene identification underpin the exploitation of advanced technologies to drive innovation in diagnostics, drug discovery, and targeted treatment methods.

Gene Identification Market Outlook

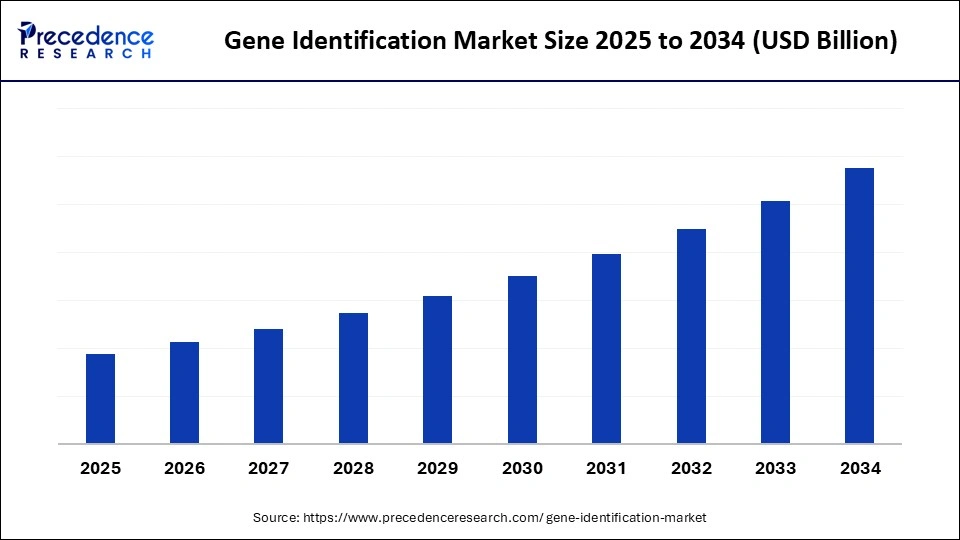

- Market Growth Overview: The gene identification market is expected to experience significant growth between 2025 and 2034, driven by advancements in genomics and biotechnology. With the increasing adoption of public health initiatives and clinical applications, the demand for genomic surveillance and diagnostics is growing. As technological advances in genetic sequencing occur, there is also a broad acceptance of genomic information in health decisions.

- Opportunity: Public Health Integration: Governments around the world are beginning to incorporate genomic surveillance into public health genetic strategies. According to the WHO, in its 2022-2032 Strategy, the organization aims for each of the 194 Member States to have timely access to genomic sequencing for pathogens capable of causing pandemics and epidemics. The initiative will encourage collaboration and sharing of information across borders, creating avenues for businesses in diagnostics and bioinformatics.(Source: https://www.who.int)

- Challenge: Regulatory Uncertainties: The gene identification market is subject to regulatory uncertainties, exemplified by the patent disputes and antitrust issues that can arise. For example, in September 2025, Element Biosciences filed lawsuits against Illumina, accusing them of antitrust violations and patent infringement in the field of gene-sequencing technology, which could affect competition and innovation.(Source: https://www.elementbiosciences.com)

- Global Expansion: Adoption of gene identification technologies is marking a more global reach as there is a push from the WHO's International Pathogen Surveillance Network (IPSN) to consider genomics in the public health sector. This would also aid in global health security through pathogen detection and responses.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Offering, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Key Technological Shifts in Gene Identification Market

New technologies for identifying genes are emerging rapidly. Artificial intelligence, next-generation sequencing, and sophisticated gene-editing technologies are gaining traction. These technologies enable accurate mapping of genetic identifiers associated with diseases.

- In July 2025, DeepMind released AlphaGenome, an artificial intelligence system capable of analyzing up to one million DNA base pairs to help determine the behavior of genes.(Source: https://www.scientificamerican.com)

Additionally, researchers at Yale University developed a CRISPR-Cas12a mouse model for the specific study of complex gene interactions, and now, in the case of Stanford University, the CRISPR-GPT is facilitating the development of experimental protocols within months, as opposed to years.

Segments Insights

Technology Insight

Why Did the NGS Segment Lead the Gene Identification Market?

The next-generation sequencing (NGS) segment led the market while holding about 45% share in 2024. This segment holds the leadership position due to its high-throughput capabilities, cost-effectiveness, and accuracy in identifying complex genetic variants, making it the preferred tool for clinical diagnostics, oncology-based studies, and large-scale genomic studies. NGS allows simultaneous analysis of thousands of genes or entire genomes, making it an ideal choice for large-scale gene identification projects across research, clinical diagnostics, and personalized medicine.

The CRISPR/Cas-based tools segment is expected to grow at the fastest rate during the forecast period. The segment's growth is attributed to its high performance in gene editing, functional genomics, and the potential for biologic (therapeutic) drug discovery. The increasing use of this technology in precision medicine and drug discovery on a global scale also contributes to segmental growth.

Offering Insights

What Made Reagents & Consumables the Dominant Segment in the Market?

The reagents & consumables segment dominated the gene identification market with a 40% share in 2024. This is primarily due to their recurring demand, their essential role in every stage of gene analysis, and the increasing adoption of advanced genomic techniques, such as NGS and PCR. These tools are essential in sequencing workflows, enabling frequent testing of specific genetic variants. Moreover, a significant rise in research activities contributed to segmental dominance.

The software & bioinformatics tools segment is projected to grow at the fastest rate during the forecast period. This is primarily due to the increasing demand for sophisticated computational platforms that can analyze diverse genomic datasets, utilize AI, and support personalized medicine initiatives. Moreover, the rise in personalized medicine and genomics-based drug discovery has fueled the need for robust data analysis platforms, contributing to the segment's growth.

Application Technology Insights

How Does the Clinical Diagnostics Segment Dominate the Market in 2024?

The clinical diagnostics segment dominated the gene identification market with approximately 35% share in 2024. This is due to the increasing patient demand for early disease detection, genetic testing for genetic diseases, and precision applications in relation to personalized healthcare, making it a core component of patient care. The rising prevalence of genetic disorders, cancer, and other chronic diseases that require accurate and early detection also supported segmental dominance.

The drug discovery & development segment is expected to expand at the highest CAGR over the projection period. The increased integration of gene identification in target validation, biomarker discovery, and investments in personalized therapeutics drive the growth of the segment, as drug companies focus on streamlining R&D pipelines while improving patient treatment outcomes. Additionally, advancements in genomic technologies and bioinformatics tools have streamlined the integration of gene identification in early-stage drug development, reducing time and costs.

End-User Insights

Why Did Academic & Research Institutes Contribute the Largest Market Share in 2024?

The academic & research institutes segment held a leading position in the market by holding nearly 30% share in 2024. This is primarily due to the increased volume of genetic studies performed by these institutes. Increased government-supported research projects and collaborative efforts with biotechnology companies make the academic & research institutes segment an integral contributor to the innovation of gene mapping and the understanding of disease.

The pharmaceutical & biotechnology companies segment is poised to expand at the highest rate in the coming years. The resurgence of interest in personalized medicine, extensive genomic research for drug development, and substantial investments in advanced genetic research tools are driving the growth of this segment. Additionally, regulatory support for genomic-based drug development, along with rising investment in biopharmaceutical innovation, drives the growth of the segment.

Regional Insights

What Made North America the Dominant Region in the Gene Identification Market?

North America dominated the gene identification market by capturing about 40% share in 2024. The region's dominance stems from its well-developed clinical research ecosystems, robust payer reimbursement environments, and institutionalized private-sector research and development. Large national programs and large hospital systems promote rapid access to high-quality clinical samples and ample real-world datasets, providing evidence that facilitates the validation and commercialization of diagnostic tests.

The regional value-chain of instrument manufacturers, bioinformatics companies, and high-throughput service laboratories fosters a rapid scale-up capability for sequencing and interpretation workflows. Cumulatively, the U.S. is the major contributor to the market due to its large federal research programs, a dozen clinical trial activities, and the high adoption of sophisticated and rapid diagnostic tools. Programs that integrate genomics with clinical outcomes, as well as venture and strategic mergers and acquisitions, reduce the time-to-market for new tests and related genotyping and interpretation platforms. These trends have catalysed the U.S. toward the primary commercialization activity of gene-identification products.

What Makes Asia Pacific the Fastest-Growing Area for Gene Identification?

Asia Pacific is expected to experience the fastest growth in the market, driven by expanding national genomics initiatives, improved access to healthcare, and the rapid adoption of lower-cost sequencing technologies. Governments and large private sector players are investing in population-scale projects and domestic manufacturing to reduce dependence on imports and lower the price per sample. There is also a large number of patients in this region, which is increasing the number of precision-medicine pilots. The rapid adoption of digital health is reducing timelines for validation and expanding the classes of clinical use, creating attractive conditions for scale economies for new entrants into the market and service provision.

China is a significant contributor to the market in the Asia Pacific. The country is home to major domestic suppliers of sequencing tools and has policymakers who are aggressive in their approach, directly impacting supply chains and market dynamics. The structural shifts, combined with national aspirations for large genomic databases and public–private partnerships, are creating a high-volume market and strong incentives for localization among both global and domestic suppliers.

Gene Identification market Companies

- Illumina, Inc.

- Thermo Fisher Scientific

- Agilent Technologies

- Bio-Rad Laboratories, Inc.

- Hoffmann-La Roche Ltd.

- Pacific Biosciences (PacBio)

- QIAGEN

List of Some Gene Identification Kits/Products

| Product Name | Manufacturer | Product Description |

| AncestryDNA | Ancestry | AncestryDNA provides insights into ancestral origins, including über 3.000 geographical ancestral regions and journeys |

| 23andMe | 23andMe | 23andMe provides DNA testing with the ancestry breakdown, personalized health understandings and more. |

| MyHeritage DNA | MyHeritage | MyHeritage DNA offers genetic testing for ancestry and ethnicity |

| Nebula Genomics | Nebula Genomics | Personal genomics company that offers direct-to-consumer whole-genome sequencing (WGS) and analysis. |

| QIAprep Spin Miniprep Kit | QIAGEN | Designed for isolating high-purity plasmid or cosmid DNA, offering up to 20 µg yields for various molecular biology applications like sequencing and cloning. |

| Sequencing Systems (e.g., NovaSeq) | Illumina, Inc | A system of high-throughput genetic sequencing instruments utilizes Illumina's established sequencing-by-synthesis (SBS) chemistry |

| PrimeTime qPCR Assays | Integrated DNA Technologies (IDT) | PrimeTime qPCR Probe Assays consist of a primer pair and fluorescently labeled 5′ nuclease probe. |

| TaqMan real-time PCR | Thermo Fisher Scientific | Method for quantifying DNA or RNA during a polymerase chain reaction (PCR) |

| Oncomine Dx Target Test | Thermo Fisher Scientific | Uses next-generation sequencing (NGS) to identify multiple cancer-related genetic mutations in a single tissue sample |

| EasySeq™ Human DNA Sample Identification Kit | NimaGen |

Targeted next-generation sequencing (NGS) assay for tracking and verifying human DNA samples |

Recent Developments

- In October 2024, CAMP4 Therapeutics entered into a research collaboration with BioMarin Pharmaceutical Inc. to develop innovative therapeutics that enhance protein levels by targeting regulatory RNA (regRNA) sequences, crucial in controlling gene expression.(Source: https://cm.asiae.co.kr)

- In December 2023, Reproductive technology startup Orchid launched a comprehensive new genetic test aimed at supporting prospective parents across the U.S., offering broader insights into inherited health risks.(Source: https://investors.camp4tx.com)

Exclusive Insights

Our experts observe that the gene identification market is well-positioned for consistent growth in a setting where high-throughput sequencing costs decrease and machine learning of the data advances. The primary drivers of growth include expansion in precision medicine, population screening, and increased spending on biotech R&D. However, concerns include the complexity of regulatory frameworks, prolonged delays in reimbursement, cybersecurity and patient data governance, and, of course, the ongoing challenge of clinically interpreting variants of uncertain significance.

Commercial opportunities exist for scalable NGS platforms, cloud-native bioinformatics platforms, sample-to-answer automated workflows, and partnerships for companion diagnostics. Market leaders and participants who deliver proven, affordable healthcare solutions and prioritize interoperability and real-world evidence generation will capture a larger market share. Ultimately, harmonized standards, clear payer pathways, evidence of clinical utility, and tactical M&A activity could lead to consolidation.

Segments Covered in the Report

By Technology

- Next-Generation Sequencing (NGS)

- Whole Genome Sequencing

- Whole Exome Sequencing

- Targeted Sequencing

- Polymerase Chain Reaction (PCR)

- Real-Time PCR (qPCR)

- Digital PCR

- Microarrays

- Fluorescence In-Situ Hybridization (FISH)

- CRISPR/Cas-Based Tools

- Others

By Offering

- Instruments & Platforms

- Sequencers

- PCR Systems

- Microarray Systems

- Reagents & Consumables

- DNA Extraction Kits

- Sequencing Reagents

- PCR Consumables

- Software & Bioinformatics Tools

- Data Analysis Platforms

- Genomic Databases

- Services

- Gene Sequencing Services

- Bioinformatics & Data Interpretation

By Application

- Clinical Diagnostics

- Oncology

- Rare & Genetic Disorders

- Infectious Diseases

- Drug Discovery & Development

- Agricultural Biotechnology

- Forensic Research

- Evolutionary & Population Genetics

- Others

By End User

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Hospitals & Clinics

- Forensic Laboratories

- Agriculture & Animal Research Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting