What is the Cell and Gene Supply Chain Services Market Size?

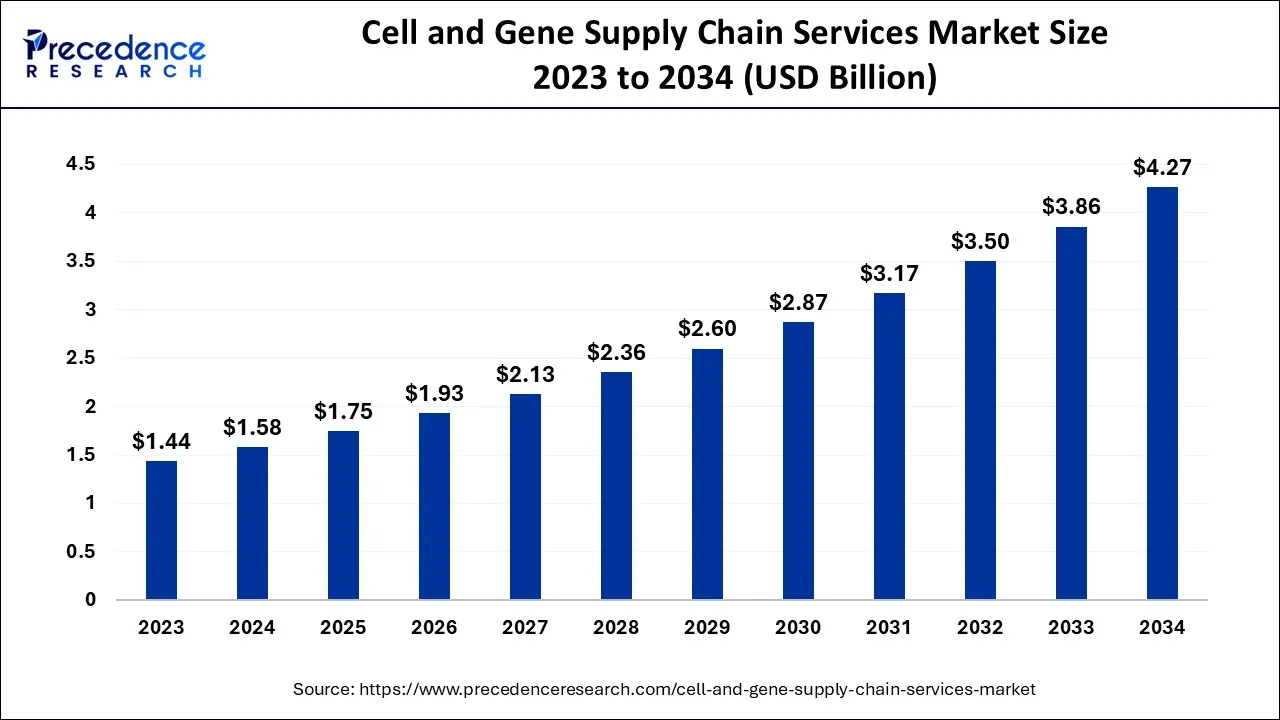

The global cell and gene supply chain services market size is valued at USD 1.75 billion in 2025 and is predicted to increase from USD 1.93 billion in 2026 to approximately USD 4.65 billion by 2035, expanding at a CAGR of 10.27% from 2026 to 2035.

Cell and Gene Supply Chain Services Market Key Takeaways

- North America led the global market with the highest market share in 2025.

- By application, the logistics application segment residential the biggest market share in 2025.

- By end user, the hospital segment has held the highest market share in 2025.

What are Cell and Gene Supply Chain Services?

All living things are composed of fundamental units called cells, and genes are the small fragments of DNA that are present inside cells and convey genetic information. Targeting DNA or RNA in the organism, cell and gene therapy are overlapping disciplines of biomedical study with comparable therapeutic objectives. Both strategies try to alter the genetic material already existing to enhance its functionality or to immunize or combat a specific disease or disorder.

To be more specific, gene therapy modifies the patient's cells using genetic material to address an inherited or acquired condition. Cell therapy, on the other hand, involves implanting a patient with a collection of completely novel cells to treat their disease. This technique is used in the creation of regenerative medications. Additionally, the effort is being made in developing cell treatments from stem cells that may one day be used to treat conditions like autoimmune disorders, Alzheimer's, and Parkinson's.

The ability of cell and gene therapies to provide the desired therapeutic benefits is only one factor contributing to their success. Another is the efficient use of supply chain requirements, underscoring the importance of the supply chain to the growth and development of cell and gene therapies as well as their distribution. The growth in the market is attributed to the growing prevalence of chronic disease, the significant investment by the key players, increasing novel product launches and the growing initiatives by the governments.

As per Centers for Disease Control and Prevention, around 523 million population worldwide had some kind of cardiovascular disease in 2020 and 19 million fatalities were directly related to CVD; this amounts to almost 32% of all deaths globally and is an absolute increase of 18.7% from 2010.

According to the World Cancer Research Fund International, in 2020, there will be 18.1 million new cases of cancer worldwide. 9.3 million of these instances involved men, while 8.8 million involved women.

How is AI contributing to the Cell and Gene Supply Chain Services Industry?

Artificial intelligence is the main driver in personalized logistics optimization, manufacturing coordination, and traceability throughout the supply chains of cell and gene therapies. It makes sure that the production is consistent, there are no disruptions, the Identity and Custody of the product are safe, the documentation for regulatory compliance is done faster, quality detection is improved, and demand forecasting is supported, which in turn guarantees delivery of personalized therapies that are reliable, timely, and compliant.

Market Outlook

- Industry Growth Overview: The market is continuously expanding, like the personalized medicines, which are increasing, thus the need for very precise logistics, full traceability, and the support of well-coordinated manufacturing.

- Sustainability Trends: The focus on energy saving, waste minimizing, routing, and cold-chain technologies that are environmentally friendly grows.

- Global Expansion: The U.S. keeps its leading position while Europe and Asia-Pacific are growing through partnerships, infrastructure development, and digital logistics adoption.

- Major Investors: Top players are Azenta Life Sciences, Cryoport, Lonza, Marken, and Thermo Fisher Scientific.

Startup Ecosystem: Startups are using AI and machine learning to enhance the reliability of delivery, the precision of tracking, and the efficiency of the gene therapy supply chain.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.75 Billion |

| Market Size by 2035 | USD 4.65 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.27% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Technology, By Application, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing investment in cell therapy

Over the forecast period, the market growth is anticipated to be driven by the increasing investment in cell treatment. For instance, LFB is funding a sizable cell therapy medicine production endeavor as part of an agreement with two biotechnology companies and seven public hospitals. This initiative, called C4C, is funded by OSEO, a French organization that supports creative endeavors, and it attempts to market cell treatment products.

The objective of this initiative is to establish a French cell treatment business in which LFB subsidiary CELLforCURE will play a prominent role. Under regulations governing advanced therapeutic drugs, the C4C project aims to construct the first technical support unit for industrial cell therapy in France. This unit will be dedicated to the mass manufacturing of allogeneic and autologous cell therapy products.

Restraints

Quality sensitivity

The use of cell and gene therapies is quite delicate. Due to the limited half-life of very small batches of cells, before the quality degrades, it is crucial to apply efficient preservation techniques and a cold chain along the whole supply chain. The ideal cryopreservation shipping temperatures for cell and gene treatments are extremely low, about -120°C (-184°F), and at comparable low temperatures for dry ice, liquid nitrogen, and refrigeration preservation techniques.

Additionally, authorized treatment facilities must be able to hold, manage, and defrost the drug products. The majority of present pharmaceutical supply networks are unprepared to meet these escalating demands. Logistics partners must have complete visibility into the supply chain to prepare for emergencies and streamline processes. Thus, the lack of visibility in the process might be a hurdle to the market expansion during the forecast period.

Opportunities

Growing cell and gene therapy manufacturing capacity by CDMOs

The fast growth in demand for cell and gene therapies has caused a rapid evolution in the manufacture of these therapies. Higher yields and reduced product prices are necessary since these medicines are being used more widely. Large contract development and manufacturing companies have invested heavily in this area recently, making many sizable acquisitions and expanding geographically by setting up production facilities. These additions will facilitate the production of cell and gene treatments and present expanding prospects for CDMOs offering these services.

Technology Insights

Based on the technology, the global cell and gene supply chain services market is segmented into presence on the cloud and presence on-premises. The presence of the cloud segment is expected to grow at the highest CAGR over the forecast period. The growth in the segment is attributed to various factors such as ensuring supplier and raw material quality, improving manufacturing cycle times and others. Customer satisfaction rises and costs are decreased when every quality measurement is seen from beginning to end from every angle. Quality levels can be tracked and reported by production center, product, and customer levels using cloud SCM software.

The Bill of Materials (BOM) is always guaranteed to define the best quality components and raw materials since it provides real-time information on shipment inspections and quality levels. A cloud-based SCM system also allows for real-time monitoring and tracking of any assembly, component, or subassembly across the supply chain. Quality becomes a more integral aspect of the system of record in any business with cloud SCM apps and platforms. Thus, this is expected to drive segment growth during the forecast period.

Application Insights

Based on the application, the global cell and gene supply chain services market is divided into ordering and scheduling, sample collection, logistics and post treatment follow-up. The logistics application segment is expected to capture the largest market share over the forecast period. Maintaining the drug integrity while it is being transported for cell and gene therapies is of the utmost importance, as is making sure it reaches its destination on schedule and at the right temperature. With these medications, maintaining speed, temperature, and integrity becomes considerably more difficult.

The companies are investing heavily to secure the logistics operation cell and gene is expected to drive the segment growth over the forecast period. For instance, in February 2022, DHL Supply Chain, the top contract logistics company in the world and North America, announced that it's Life Sciences and Healthcare (LSHC) division will invest more than USD 400 million to increase the size of its pharmaceutical and medical devices distribution network by 27%. Thus, this kind of investment is expected to drive the segment growth during the forecast period.

End User Insights

Based on the end user, the global cell and gene supply chain services market is divided into biobanks/ cell-bank, hospitals, research institutes, cell therapy labs and others. The hospital segment is expected to dominate the market during the forecast period. The growth in this segment is owing to the rising prevalence of various diseases across the globe including cancer, cardiovascular, autoimmune and others, this disease required treatment in hospitals. Thereby driving the market growth over the forecast period.

On the other hand, the research institutes are expected to hold the largest market share during the forecast period. A lot of research is being done on ACT, which is attracting growing interest globally. Utilizing live cells to cure and prevent disease is a new scientific area. The research is primarily done on mesenchymal stem cells, chondrocytes, bone marrow and others. Thus, this is expected to drive market growth over the forecast period.

Regional Insights

North America is expected to dominate the market over the forecast period. A favorable regulatory framework, particularly in the US, is attributed to this. In addition to early and consistent involvement with the sponsor and unique regulatory designations helpful for many CGTs, the US FDA has established a collaborative regulatory method for CGTs. Additionally, the US regulatory approval procedure is expanding and becoming more advantageous for vendors creating CGT products. To speed up the approval procedure, the US FDA has given CGTs the orphan drug category, breakthrough designation, accelerated approvals, and RMAT designations.

Moreover, the growing number of patients with chronic diseases including cancer, cardiovascular and others is expected to drive the cell and gene supply chain services market in the region. For instance, as per the American Cancer Society, in the US, there will be 609,360 cancer-related deaths and an estimated 1.9 million newly diagnosed cancer cases in 2022. Furthermore, the major investment by the key players is expected to flourish the market in the region. For instance, in June 2022, to address the intricate demands of the rapidly growing cell and gene therapy sector, Biocair made a significant investment in the formation of a specialized logistics team.

A team of over 30 devoted specialists is being built by pharmaceutical, biotech, and life science logistic experts to provide users of cell and gene therapy services with around-the-clock support globally. Thus, this kind of investment by the prominent players is expected to propel the market growth over the forecast period.

The Asia Pacific is expected to grow at the highest CAGR during the forecast period. Regenerative medicine-focused biotechnology companies are becoming more prevalent in the Asia Pacific region. Furthermore, the region is expected to continue to hold its position as the hub of cell research and therapy due to the steady expansion of destinations for medical tourists including Thailand, Singapore, and India. Additionally, compared to North America and Europe, Asia is seeing a rise in the number of participants in CGT clinical studies. This benefits the Asia Pacific market because there is a vast patient pool and low trial cost, in turn, driving the growth of the market.

U.S. Cell and Gene Supply Chain Services Market Trends:

The U.S. market takes advantage of highly developed biotech ecosystems and fast automation acceptance. AI-powered logistics, predictive analytics, and smart manufacturing are the backbone of personalized therapies. Locations that are properly established help to develop and manage the supply deficiency of autologous and allogeneic therapy nationwide.

China Cell and Gene Supply Chain Services Market Trends:

China has a big market opportunity backed up by government funding and quick technology adoption. The high degree of clinical activity in the country naturally causes a demand for efficient distribution.

What Are the Driving Factors of The Cell and Gene Supply Chain Services Market in Europe?

Europe is gradually advancing its position with steady growth due to the support of strong research institutions, sustainability priorities, and public-private cooperation. The government funding makes it possible to have oncology and rare disease programs. On the other hand, the diversity of reimbursement systems leads to uneven market penetration, thus forcing companies to come up with adaptive supply chain strategies, localized logistics models, and advanced tracking solutions.

Germany Cell and Gene Supply Chain Services Market Trends:

Germany is at the forefront of Industry adoption with the use of automation, robotics, and precision cold-chain systems. Cooperation between academia and industry is already creating a manufacturing environment that is both accurate and compliant. Targeting the existing biotechnology infrastructure for optimization, digital traceability, and reliable cross-network distribution of complex therapies are the main areas where the market will be developed.

Cell and Gene Supply Chain Services Market-Value Chain Analysis

- R&D (Research and Development): The whole process of discovering and developing therapeutic candidates, the more the process and biological understanding supporting the scaling-up of the cell and gene therapy production, the better.

Key players: Novartis, Gilead Sciences (Kite Pharma), Bristol Myers Squibb - Clinical Trials and Regulatory Approvals: Human studies are performed to collect safety and efficacy data, which in turn enable regulatory approvals and controlled commercialization of the therapy.

Key players: Charles River Laboratories, Thermo Fisher Scientific, WuXi AppTec - Formulation and Final Dosage Preparation: Physically combining different elements into patient-ready formulations while controlling stability, accuracy, and suitability for therapeutic administration to the intended population.

Key players: Lonza, Catalent Biologics, AGC Biologics - Packaging and Serialization: Finished products are first packed in protective material and then attached with specific identifiers to secure, traceable, compliant, and safe handling.

Key Players: West Pharmaceutical Services, Almac, Sharp - Distribution to Hospitals, Pharmacies of Cell and Gene Supply Chain Services: Safeguarding safe temperature-controlled logistics from manufacturing sites to authorized care facilities, managing the distribution of therapies, and delivering them safely.

Key Players: Cryoport, BioLife Solutions, Marken

Top Companies in the Cell and Gene Supply Chain Services Market & Their Offerings:

- Biocair: Offers logistics specializing in temperature-sensitive handling, cryogenic transport, packaging that complies with regulations, and expertise in the regulatory process, all helping the movements of cell and gene therapy that are sensitive.

- Arvato Supply Chain Solutions SE: Providing cold-chain transport customized according to the client's needs, sophisticated tracking, legal handling, and customs support for therapeutic products of the highest sensitivity.

- Life Couriers: Concentrates mainly on the transport of medical specimens in a very secure manner, using fleets that are climate-controlled, with strict compliance standards, and reliable nationwide delivery services.

Cell and Gene Supply Chain Services Market Companies

- Biocair

- Arvato Supply Chain Solutions SE

- Associated Couriers, LLC.

- TrakCel

- ParkourSC

- DHL

- McKesson

- Almac

- Catalent

- Biostor Ltd.

Recent Developments

- In January 2023, a new strategic alliance between Cryoport and Syneos Health was created to advance cell and gene therapies. The collaboration will advance cell and gene therapies globally and provide the industry with its first fully integrated biopharmaceutical and supply chain solution. Giving more individuals worldwide access to these life-changing therapies owing to this agreement will hasten the healing process and enhance the outcomes.

- In January 2023, Catalent, a global leader in facilitating the creation and distribution of better treatments for patients, recently announced the launch of its new case management service. This service has been created with the express purpose of addressing the specific difficulties involved in the timely and safe delivery of cutting-edge therapies to patients by offering qualified supply chain oversight from program inception to completion.

- In October 2022, a new partnership has been established between CSafe, a US-based supplier of active and passive temperature-controlled shipping solutions, and BioLife Solutions, a US-based provider of bioproduction tools and services for cell and gene therapy and larger biopharma markets. The goal of the partnership is to offer a combined global service network to support CGT products. Reliability, security, and quality will all be prioritized in the cooperation.

- In August 2025, Celcius Logistics launched Celcius+, a dedicated logistics vertical for pharmaceuticals. The service focuses on temperature control, compliance, and real-time visibility for sensitive products. (https://www.expresspharma.in)

- In August 2025, Bionova Scientific, a CDMO under Asahi Kasei, opened a 10,000 sq. ft. plasmid DNA facility in The Woodlands, Texas, to support cell and gene therapy. The site will manufacture research-grade pDNA and aims to provide CGMP production services by Q4 2025. It is located within 30 miles of Houston. (https://www.expresspharma.in)

Segments Covered in the Report

By Technology

- Presence on cloud

- Presence on-premises

By Application

- Ordering and Scheduling

- Sample Collection

- Logistics

- Post Treatment Follow-up

By End User

- Biobank/ Cell-bank

- Hospitals

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting