What is the Advanced Metering Infrastructure (AMI) Market Size?

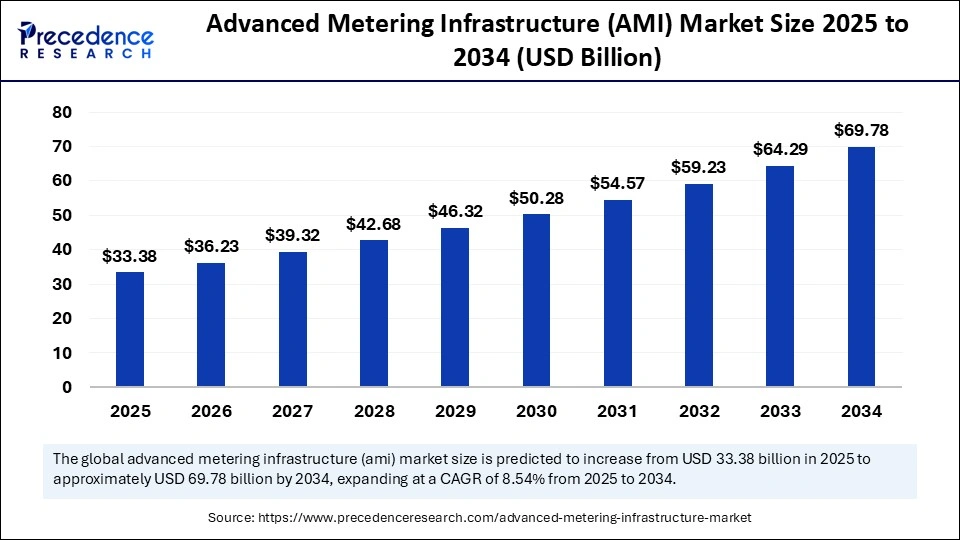

The global advanced metering infrastructure (AMI) market size was calculated at USD 33.38 billion in 2025 and is predicted to increase from USD 36.23 billion in 2026 to approximately USD 69.78 billion by 2034, expanding at a CAGR of 8.54% from 2025 to 2034. The market growth is attributed to increasing government initiatives and technological advancements, driving the adoption of smart grids and real-time energy management systems.

Market Highlights

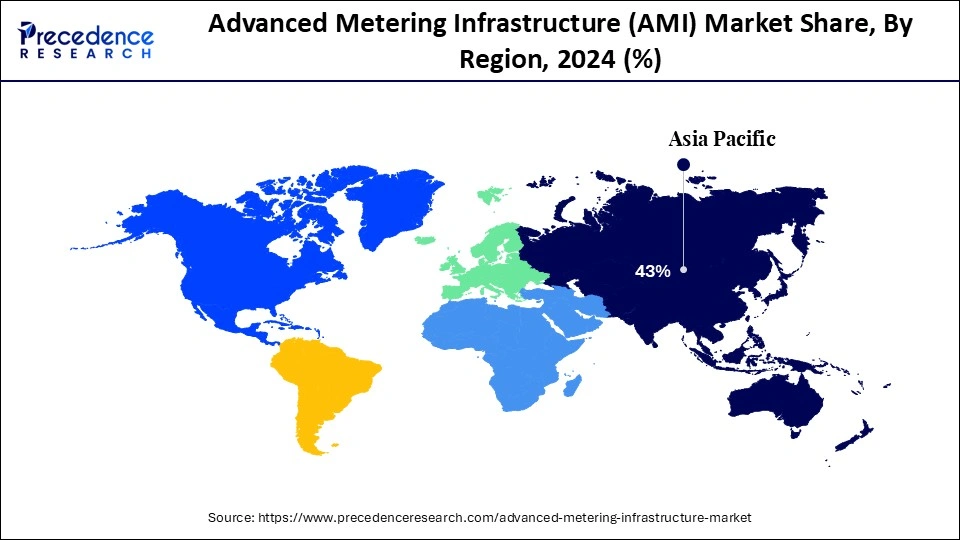

- By region, the Asia Pacific segment held a dominant presence in the advanced metering infrastructure (AMI) market in 2024, accounting for an estimated 43% market share, and is expected to sustain the position during the forecast period.

- By product type, the smart meters segment accounted for a considerable share of the market in 2024 that holding a market share of about 40.4%.

- By product type, the meter data management systems (MDMS) segment is projected to experience the highest growth rate of 10.5% in the market between 2025 and 2034.

- By end-user, the electric utilities segment led the advanced metering infrastructure (AMI) market, accounting for an estimated 50.4% market share.

- By end-user, the gas utilities segment is set to experience the fastest rate of advanced metering infrastructure (AMI) market growth from 2025 to 2034, accounting for 10.8% of market share.

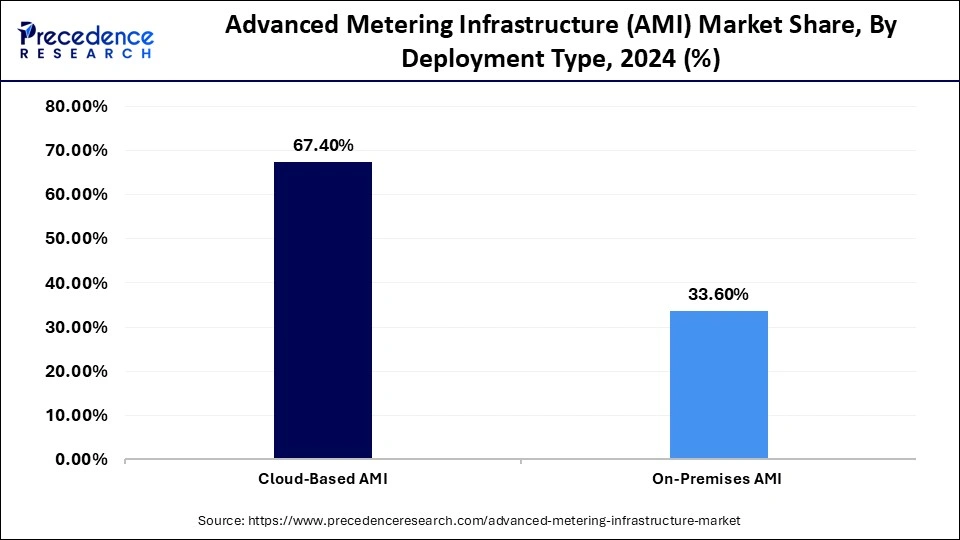

- By deployment type, the on-premises AMI segment registered its dominance over the market in 2024, which held a market share of about 67.4%.

- By deployment type, the cloud-based AMI segment is anticipated to grow with the highest CAGR in the market during the studied years, accounting for 10.2% market share.

- By application, the industrial segment dominated the market, accounting for an estimated 54.4% market share.

- By application, the residential segment is projected to expand rapidly in the market in the coming years, accounting for 10.8% of market share.

- By communication technology, the radio frequency (RF) mesh segment maintained a leading position in the advanced metering infrastructure (AMI) market in 2024 that holding a market share of about 42.4%.

- By communication technology, the cellular network segment is predicted to witness significant growth in the market over the forecast period, accounting for 10% market share.

Market Size and Forecast

- Market Size in 2025: USD 33.38 Billion

- Market Size in 2026: USD 36.23 Billion

- Forecasted Market Size by 2034: USD 69.78 Billion

- CAGR (2025-2034): 8.54%

- Largest Market in 2024: Asia Pacific

Market Overview

What Is the Advanced Metering Infrastructure (AMI) Market?

The advanced metering infrastructure (AMI) market is experiencing high growth rates, which are mainly due to the high government regulation and favourable policies towards the modernisation of energy infrastructure. The 2024 report of the Federal Energy Regulatory Commission states that 119.3 million advanced meters out of 165 million meters had been installed and operated in the United States, which is an advanced meter penetration rate of 72.3%.

The necessity of having a decarbonised and resilient grid that can manage the growth of power demand and incorporate various sources of energy. The AMI technology is a combination of a network of smart meters, communication networks, and data management systems. They allow two-way communication between the utilities and the consumers. Furthermore, the further focus on grid modernisation and the use of smart grid technologies is likely to stimulate the system of AMI deployment in the coming years.

Impact of Artificial Intelligence on the Advanced Metering Infrastructure (AMI) Market

The market of the advanced metering infrastructure (AMI) is being changed by artificial intelligence (AI) to improve both data intelligibility and real-time decision-making. Suppliers of power equipment include Artificial Intelligencealgorithms in AMI to process large volumes of data collected by millions of connected meters to predict demand correctly and distribute energy more reliably. Furthermore, the AI enables faster digitalisation of the utility industry by automating data management, contributing to grid-edge intelligence, and enhancing cybersecurity measures.

Advanced Metering Infrastructure (AMI) MarketGrowth Factors

- Driving Demand for Grid Resilience: The growing frequency of climate-driven power disruptions is boosting investment in AMI systems to strengthen grid reliability.

- Rising Adoption of IoT and Edge Computing: Integration of IoT and edge analytics is propelling advanced meter capabilities, enabling faster and more precise energy management.

- Boosting Demand for Energy Efficiency Programs: Growing energy efficiency targets by governments and utilities are driving large-scale deployment of smart meters and AMI networks.

- Fueling Development of Automated Demand Response: Rising need for dynamic load management is spurring utilities to deploy AMI-enabled demand response programs.

- Growing Integration of Electric Vehicles (EVs): Expanding Electric Vehicles adoption is driving the need for intelligent grid management, propelling AMI investments to handle variable loads.

Comprehensive Global Insights and Data Trends Driving the Advanced Metering Infrastructure (AMI) Market Landscape

- Around 63% of consumers are aware that they have access to home energy reports or other formats of usage data. Among these, 94% engage with their data regularly, indicating a strong interest in monitoring and managing energy consumption.

- Smart meters have been found to reduce energy consumption by up to 10% by providing real-time feedback to consumers. This leads to more energy-efficient behaviour and supports demand response programs that balance energy use during peak times.

- In Varanasi, India, a large-scale awareness and verification drive was launched to address consumer concerns about smart meters. The initiative involved testing smart meters alongside check meters, resulting in a 100% satisfaction rate and increased public trust.

- The UK government reported that the installation of smart meters led to electricity consumption savings ranging from 1.0% to 3.4%, with a median saving estimate of 2.5%. Gas consumption savings ranged from 1.0% to 2.8%, with a median saving estimate of 2.0%. These savings were observed in the first year following installation.

- Efficiency Vermont reported operational savings of USD 27 million as of early 2016, attributed to the high-resolution data provided by AMI systems. The transition from monthly to hourly or even 15-minute interval data allows for better detection of equipment usage patterns and peak events, leading to more efficient energy management.

- The City of Fredericksburg invested approximately USD 4.5 million to replace all traditional water meters with advanced smart meters. This initiative aims to improve accuracy, billing efficiency, and water conservation. The project also enhances real-time monitoring, enabling quicker issue detection and better customer service.

- The AEMC published the “Accelerating Smart Meter Deployment Rule” to streamline and speed up AMI rollouts nationwide. This reform focuses on reducing deployment timelines, lowering installation costs, and increasing meter accessibility. It is a strategic step toward building a more flexible and intelligent energy grid.

(Source:https://virtual-peaker.com)

(Source: https://bermex.acrt.com)

(Source: https://timesofindia.indiatimes.com)

(Source: https://www.bi.team)

(Source: https://www.efficiencyvermont.com)

(Source: https://www.fredericksburgva.gov)

(Source: https://www.aemc.gov.au)

Advanced Metering Infrastructure (AMI) Market – Value Chain Analysis

- Component Fabrication and Machining – Manufacturing of smart meters, communication modules, and data concentrators with compliance to interoperability and grid standards.

- Key players include Landis+Gyr, Itron Inc., and Honeywell International Inc.

- Testing and Certification – Rigorous performance, interoperability, and cybersecurity testing to ensure regulatory compliance and operational reliability.

- Key players include TÜV Rheinland, UL LLC, and SGS SA.

- Installation and Commissioning – Deployment of AMI hardware, integration with utility networks, and calibration for accurate data collection.

- Key players include Schneider Electric SE, Siemens AG, and ABB Ltd.

- Distribution and Sales – Supply of AMI systems through direct sales and partnerships, often linked to government smart grid projects.

- Key players include Oracle Corporation, Kamstrup A/S, and Landis+Gyr.

- Maintenance and After-Sales Service – Hardware servicing, software updates, network diagnostics, and predictive maintenance for system longevity.

- Key players include Trilliant Holdings, Siemens Smart Infrastructure, and Honeywell Forge.

- Product Lifecycle Management – Planning, upgrades, and responsible disposal of AMI assets to ensure adaptability and environmental compliance.Key players include IBM Corporation, Oracle Utilities, and Siemens MindSphere.

Analyst Commentary: Advanced Metering Infrastructure (AMI) Market Outlook

The advanced metering infrastructure (AMI) market is entering a phase of accelerated structural realignment, underpinned by regulatory modernization, decarbonization imperatives, and the progressive digitization of utility asset bases. Functionally positioned at the confluence of smart grid transformation and data-driven energy management, AMI represents not merely a metering upgrade but a strategic inflection toward bidirectional, real-time utility intelligence.

From a macro-thematic lens, the market's evolution can be conceptualized as a transition from hardware-centric metering deployments to integrated, analytics-oriented network architectures. This paradigm shift is reshaping value capture dynamics across the utility value chain — migrating profit pools away from discrete device vendors toward platform integrators, data analytics providers, and grid orchestration software players.

Analysts interpret the AMI sector through a four-dimensional competitiveness framework:

- Technological Convergence: The ongoing fusion of IoT, edge computing, and low-power wide-area networks (LPWAN) is enhancing data granularity, enabling sub-second telemetry, and facilitating adaptive load balancing. This integration elevates AMI from a passive measurement system to an active grid management layer. Vendors that can transition from device-centric to software-defined architectures are expected to capture disproportionate market share.

- Regulatory Catalysts:Policy-driven imperatives — notably energy transition targets, dynamic pricing frameworks, and emissions accountability mandates — are catalyzing AMI adoption. Jurisdictions in North America, the EU, and parts of Asia-Pacific are embedding AMI deployment within their national grid modernization blueprints, effectively transforming regulatory compliance into a long-cycle revenue visibility mechanism for utilities and technology suppliers.

- Economic Model Evolution:The shift toward “metering-as-a-service” and performance-based contracting introduces recurring revenue visibility but compresses upfront cash flows. This dynamic is attracting private capital and infrastructure funds seeking yield in long-duration digital utility assets while simultaneously disintermediating traditional EPC-led deployment models. The result is a bifurcation between capital-light software firms and capital-intensive infrastructure integrators, with valuation differentials increasingly reflecting recurring software revenue multiples.

- Data Monetization and Cyber Resilience:: As AMI networks generate exponential data volumes, utilities are seeking to monetize insights through demand forecasting, distributed energy resource (DER) orchestration, and prosumer engagement models. However, this data-centric shift amplifies cyberattack vectors, compelling heightened investment in zero-trust network architectures and quantum-resilient encryption frameworks. The tension between data liquidity and grid security will define the next competitive frontier.

From a market maturity perspective, global AMI penetration remains sub-optimal relative to policy ambitions. Mature markets (e.g., the U.S., Western Europe, Japan) are entering the AMI 2.0 refresh cycle, focusing on enhanced interoperability and edge analytics, while emerging economies are engaging in first-wave rollouts driven by loss reduction mandates and electrification programs. This staggered maturity landscape creates a multi-speed global market characterized by regional policy asymmetries and varied investment intensity.

From an investment and valuation standpoint, analysts view AMI as a hybrid infrastructure–software asset class, straddling the defensive characteristics of regulated utility technology and the growth optionality of digital platforms. Market consensus projects a mid-teens CAGR through 2030, with incremental value creation contingent on the industry's ability to transition from device revenue to recurring data and analytics monetization.Strategically, the sector's future trajectory will likely be defined by vertical consolidation and cross-domain integration:

- Vertical consolidation as meter OEMs, network providers, and software vendors pursue end-to-end stack control to safeguard margin capture.

- Cross-domain integration as AMI platforms converge with demand response systems, EV charging networks, and distributed generation management tools, embedding AMI as the digital nervous system of the decarbonized grid.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 33.38 Billion |

| Market Size in 2026 | USD 36.23 Billion |

| Market Size by 2034 | USD 69.78 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.54% |

| Dominating Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End-User, Deployment Type, Application, Communication Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Advanced Metering Infrastructure (AMI) Market Regulatory Landscape

| Country/Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | Federal Energy Regulatory Commission (FERC), National Institute of Standards and Technology (NIST) | Smart Grid Investment Grant (SGIG) Program- NIST Cybersecurity Framework- Federal Energy Regulatory Commission (FERC) Orders | Smart grid modernization- Cybersecurity standards- Grid resilience | SGIG program provided funding for AMI deployments.- NIST's role in developing cybersecurity standards for AMI systems. |

| European Union | European Commission (EC), European Network of Transmission System Operators for Electricity (ENTSO-E) | Electricity Regulation (EU) 944/2019- Directive (EU) 2019/944 on common rules for the internal market for electricity | Electricity market integration- Consumer empowerment- Smart grid development | EU mandates the deployment of smart meters under certain conditions.- Emphasis on consumer rights and data privacy. |

| India | Central Electricity Authority (CEA), Bureau of Indian Standards (BIS) | Functional Requirements for Advanced Metering Infrastructure (AMI) Systems (CEA)- IS 16444:2015 (BIS) | AMI system architecture- Metering standards- Communication protocols | CEA's guidelines focus on the technical aspects of AMI deployment.- BIS standardizes communication protocols for smart meters. |

| China | National Energy Administration (NEA), State Grid Corporation of China (SGCC) | Smart Grid Development Plan (2016-2020)- Technical Specifications for Smart Metering Systems (SGCC) | Smart grid infrastructure- Metering system standards- Data management | SGCC's specifications provide detailed requirements for smart metering systems.- NEA's plan outlines the national strategy for smart grid development. |

| Australia | Australian Energy Regulator (AER), Standards Australia | National Electricity Rules (NER)- AS 4750:2010 (Standards Australia) | Electricity market operation- Smart meter installation- Consumer protection | AER regulates the economic aspects of AMI deployment.- Standards Australia provides technical specifications for smart meters. |

| Japan | Ministry of Economy, Trade and Industry (METI), Japan Smart Community Alliance (JSCA) | Smart Grid Roadmap (METI)- Smart Metering Guidelines (JSCA) | Smart grid development- Metering system standards- Consumer engagement | METI's roadmap outlines the government's strategy for smart grid implementation.- JSCA's guidelines focus on promoting smart metering technologies. |

| South Korea | Ministry of Trade, Industry and Energy (MOTIE), Korea Electric Power Corporation (KEPCO) | Smart Grid Master Plan (MOTIE)- KEPCO's AMI Deployment Guidelines | Smart grid infrastructure- Advanced metering systems- Data management | MOTIE's plan sets the direction for smart grid development.- KEPCO provides detailed guidelines for AMI deployment. |

Market Dynamics

Drivers

How Is the Rising Deployment of Smart Grids Transforming the Advanced Metering Infrastructure Market?

Increasing deployment of smart grids is projected to drive growth in the advanced metering infrastructure (AMI) market. These grids are based on AMI systems that allow real-time monitoring and automatic exchange of data to enhance energy management and stability of the grid. Countries, including the United States, China, and the European Union members, are still willing to invest heavily in digital grid infrastructure, and this is speeding up the AMI installations on a large scale.

The governments are encouraging the modernisation of smart grids via funding schemes and policies facilitating AMI adoption in the world. The Department of Energy (DOE) in the United States announced almost 38 projects of 2 billion dollars to help protect the power grid against extreme weather and augment grid capacity. The European Commission Directorate-General for Energy has been proactive in Europe in advancing smart grid technology, such as AMI, by way of numerous initiatives and funds. Furthermore, the growing need for efficient power utilisation creates sustained demand for AMI deployments across residential, commercial, and industrial sectors.

Restraint

Hampered by High Implementation Costs

High implementation costs are expected to restrain the rapid adoption of advanced metering infrastructure, thus hindering growth in the advanced metering infrastructure (AMI) market. The installation of smart meters and the adaptation of communication networks and more sophisticated analytics systems require significant capital investments for utilities. Additionally, the Lack of standardisation and interoperability is likely to impede the smooth integration of AMI systems across diverse grid environments.

Opportunity

How Are Stringent Government Regulations and Policies Driving the Expansion of the AMI Market?

Rising government regulations and policies are anticipated to create immense opportunities for the players competing in the advanced metering infrastructure (AMI) industry in the coming years. The governments across the globe are enacting powerful laws and policies to hasten the rate at which smart meters are smartened and the integration of AMI. The Revamped Distribution Sector Scheme (RDSS) (India) aims to have 250 million smart meters installed by 2027, which is an impressive 25% growth rate per year (CEA).

The Clean Energy for All Europeans package requires any member state in the European Union to have at least 80% rollout of smart meters by 2024. These trends underscore the fertile grounds that government regulation is establishing concerning AMI implementation, innovation, and sustainable energy revolution in the world through targeted funding. Additionally, the shift toward analytics-driven grid operations drives sustained innovation and competitive growth across the AMI industry.(Source: https://energy.economictimes.indiatimes.com)

Segment Insights

Product Type Insights

Why Did Smart Meters Dominate the Advanced Metering Infrastructure (AMI) Market in the Past Year?

The smart meters segment dominated the advanced metering infrastructure (AMI) space in 2024 that holding a market share of about 40.4%, as they enhance billing precision and minimise technical losses. Deployments were facilitated by regulators and funding agencies to standardised smart meters that reduce the length of project timelines.

- In 2024, the federal and national programs emphasised grid upgrade priorities, agencies announced significant grid resilience investments and deployment assistance, which utilities used as the basis of planning meter replacement waves. Furthermore, both in urban and rural areas, it renders economically feasible and operationally appealing, which further facilitates the segment in the coming years.(Source: https://www.energy.gov)

The meter data management systems (MDMS) segment is expected to grow at the fastest rate in the coming years, accounting for 10.5% market share, as smart-meter fleets create datasets exponentially larger than needed. The application of validated, consolidated, and auditable processing to support billing, settlement, and analytics. Furthermore, the vendors improved integration into MDMS platforms with API-first, further boosting the segment demand.

End-User Insights

What Made Electric Utilities the Leading End-User Segment in the Advanced Metering Infrastructure (AMI) Market?

The electric utilities segment held the largest revenue share in the advanced metering infrastructure (AMI) sector in 2024, accounting for an estimated 50.4% market share. Utility-scale companies anticipated taking advantage of smart meters to provide outage management, time-of-use tariffs, and automated demand response. Moreover, the regulators-imposed deployment or performance goals strengthened the schedules of utility investment and consolidated the hegemony of electric utilities.

The gas utilities segment is expected to grow at the fastest CAGR in the coming years, accounting for 10.8% of market share, owing to the increasing use of smart gas meters to enhance billing accuracy, loss detection, and leakage. This permits consumption-level data to support new tariff designs and energy-efficiency initiatives. Additionally, the European Commission and the associated technical updates considered gas meter modernisation and compliance with measurements, thus further propelling the segment.

Deployment Type Insights

Why Did On-Premises AMI Capture the Largest Share in the Advanced Metering Infrastructure (AMI) Market?

On-premises AMI segment dominated the advanced metering infrastructure (AMI) market in 2024, which held a market share of about 67.4%, due to the desire by utility companies to have complete control of their data, infrastructure, and system customisation. Furthermore, the vendors, including Itron, Siemens, and Landis+Gyr, who enhanced their on-premises solutions with specific support contracts, further fuel the demand for on-premises AMI.

Cloud-based AMI segment is expected to grow at the fastest rate in the coming years, accounting for 10.2% market share, as it manages large volumes of data in a more flexible and less expensive way. The movement toward Software-as-a-Service (SaaS) and cloud-hosted analytics platforms is also likely to transform the AMI ecosystem.

- In 2025, Netmore Group, a leading global operator of Internet of Things (IoT) networks, launched Metering-as-a-Service (MaaS) tailored for water and gas utilities. This innovative service provides a cost-efficient alternative to traditional, capital-intensive Advanced Metering Infrastructure (AMI) projects by removing upfront expenses and enhancing cash flow. It enables utilities to accelerate their modernization efforts more quickly and affordably while leveraging cutting-edge metering technology.

Furthermore, the higher deployment speed, centralised monitoring, and enhanced customer engagement features further boost the cloud-based AMI technology market.

Application Insights

What Factors Led Industrial Applications to Dominate the Advanced Metering Infrastructure (AMI) Market?

The industrial segment held the largest revenue share in the advanced metering infrastructure (AMI) market in 2024, accounting for an estimated 54.4% market share, led by large-scale manufacturing plants, refineries, and processing plants that focused on operational efficiency and managerial precision of energy. Electricity companies in the U.S., Germany, Japan, and China worked on the implementation of advanced metering to enhance load forecasting.

As it is stated in the International Energy Agency 2024 report, the energy demand in the industry constituted more than a third of the aggregate world energy demand, highlighting the importance of this sector in AMI integration. Additionally, the integration of renewable sources of power and distributed energy resources (DERs) is expected to propel the market in the coming years.

The residential segment is expected to grow at the fastest CAGR in the coming years, accounting for 10.8% of market share, as smart grid modernisation initiatives led by governments will bring uptake by households around the world. Furthermore, the change of direction to smart energy ecosystems makes residential AMI one of the key facilitators to transition to a more sustainable and digitally interconnected power infrastructure.

Communication Technology Insights

Why Has Radio Frequency (RF) Mesh Emerged As the Dominant Communication Technology in the Advanced Metering Infrastructure (AMI) Market?

Radio frequency (RF) mesh segment dominated the advanced metering infrastructure (AMI) market in 2024 that holding a market share of about 42.4%, due to its reliability, scalability, and economic efficiency in large-scale AMI applications. They offer a self-healing network and the capability of high data throughput in both dense urban and suburban environments, thus further fuelling the segment growth.

The meter data management systems (MDMS) segment is expected to grow at the fastest rate in the coming years, accounting for 10% market share, owing to the use of 4G LTE and the new 5G networks by utilities to enhance coverage, network speed, and security.

In mid-2024, the International Telecommunication Union 2024 estimated that the 5G penetration in the globe was over 30%. They implemented AMI over as wide an area as possible, without specialised network infrastructure. Moreover, the real-time diagnostics and scalable data management over distributed customer bases help the cellular technology become a foundation for next-generation smart metering and distributed grid automation strategies.

Regional Insights

Asia Pacific Advanced Metering Infrastructure (AMI) Market Size and Growth 2025 to 2034

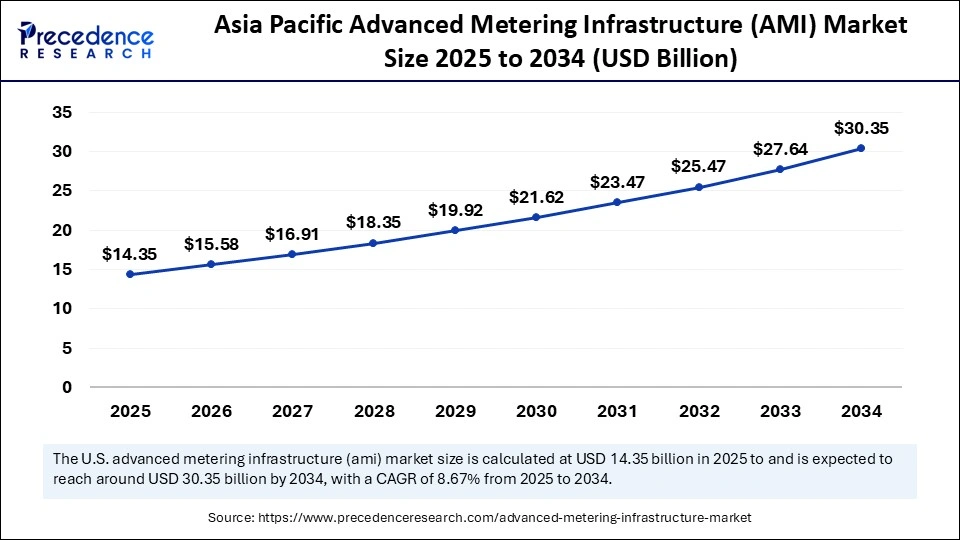

The Asia Pacific advanced metering infrastructure (AMI) market size was exhibited at USD 14.35 billion in 2025 and is projected to be worth around USD 30.35 billion by 2034, growing at a CAGR of 8.67% from 2025 to 2034.

What Drove Asia Pacific to Become the Leading Region in the Advanced Metering Infrastructure (AMI) Market?

Asia Pacific led the advanced metering infrastructure (AMI) market, capturing the largest revenue share in 2024, accounting for an estimated 43% market share, and is expected to sustain this position during the forecast period, due to extensive government-led smart grid modernisation initiatives and accelerated infrastructure digitisation. Key economies of

China, Japan, South Korea, and India are factors that motivated the leadership of the region.

The Central Electricity Authority (CEA) of India released a large-scale tender under the Revamped Distribution Sector Scheme (RDSS), where more than 250 million smart meters were to be installed to improve grid stability and transparency. The adoption has been boosted by cost cuts due to domestic manufacturing, improvement of communication technologies, such as narrowband IoT (NB-IoT) and RF mesh networks.

China has become the world leader in advanced metering infrastructure (AMI) implementation. The aggressive digital transformation strategy by the State Grid Corporation of China is focused on the modernisation of the grid and grid resilience. The Chinese government has included AMI implementation, which is in line with the 14th Five-Year Plan to enhance energy efficiency and lower carbon emissions. Additionally, Trilliant Holdings and Landis+Gyr increased manufacturing and research and development activities in the region, which strengthens the market growth

Top Vendors in the Advanced Metering Infrastructure (AMI) Market & Their Offerings

- Itron Inc. (USA): A global leader in smart metering solutions, Itron offers advanced electric, gas, and water meters, along with communication networks and data analytics platforms.

- Landis+Gyr AG (Switzerland): Specialising in smart metering systems, Landis+Gyr provides comprehensive solutions for electricity, gas, and water metering.

- Sensus USA Inc. (Xylem Inc., USA): Sensus delivers smart metering solutions for water, gas, and electric utilities.

- Honeywell International Inc. (USA): Honeywell offers a range of smart metering products, including electric, gas, and water meters, along with communication networks and data analytics platforms.

- Schneider Electric SE (France): Schneider Electric provides integrated smart metering solutions, combining hardware, software, and services to optimise energy management for utilities and consumers alike.

- Aclara Technologies LLC (USA): Aclara specialises in smart metering solutions for water, gas, and electric utilities.

- Cisco Systems Inc. (USA): Cisco provides networking solutions that support advanced metering infrastructure, offering secure and scalable communication networks for smart grid applications.

- Trilliant Holdings Inc. (USA): Trilliant offers secure and scalable communication platforms for smart grid applications, facilitating real-time data exchange between utilities and consumers.

Top Advanced Metering Infrastructure (AMI) Market Companies

- Aclara Technologies LLC: Provides advanced metering and smart infrastructure solutions for electric, water, and gas utilities, focusing on data analytics and network communication integration.

- Badger Meter Inc.: Specializes in flow measurement and control solutions, offering smart water metering systems and cloud-based data management for utilities and municipalities.

- Cisco Systems Inc.: Delivers secure, scalable communication networks and IoT connectivity infrastructure essential for AMI data transmission and real-time monitoring.

- Eaton Corporation plc: Offers smart grid and power management technologies that integrate AMI systems with advanced control, distribution automation, and grid optimization tools.

- General Electric (GE): Provides grid modernization and metering solutions through its Grid Solutions division, enabling efficient energy distribution and smart data integration.

- Honeywell International Inc.: Develops smart meters and energy management platforms that combine IoT, sensors, and analytics for real-time grid performance and consumer insights.

- IBM Corporation: Offers AI-driven data analytics and cloud platforms that enhance AMI performance, predictive maintenance, and smart grid security.

- tron Inc.: A global leader in smart metering, grid, and water management solutions, Itron's AMI systems enable utilities to optimize energy and resource consumption.

- Kamstrup A/S: Designs advanced metering and data analytics systems for water and energy management, focusing on precision, sustainability, and digital transformation.

- Landis+Gyr AG: A pioneer in smart metering and grid management, offering AMI platforms that support real-time data, energy efficiency, and demand-response solutions.

- Mueller Systems LLC: Provides smart water metering solutions integrating wireless data collection and analytics to improve distribution network efficiency and sustainability.

- Schneider Electric SE: Delivers end-to-end energy management and automation systems, integrating AMI with IoT-based smart grid and building energy optimization solutions.

- Sensus (A Xylem Brand): Offers smart metering, communication, and data analytics technologies for water, gas, and electric utilities, supporting advanced billing and network optimization.

- Siemens AG: Develops digital grid technologies and smart metering systems that integrate AMI with predictive analytics and energy automation infrastructure.

- Trilliant Holdings Inc.: Provides a secure IoT communications platform that supports advanced metering, smart grid modernization, and distributed energy management.

Recent Developments

- In August 2025, the Portland Water District (PWD) announced a landmark infrastructure upgrade, aiming to replace nearly all 55,000 water meters with cutting-edge AMI technology. This $30 million initiative, scheduled to begin in October and extend over the next three years, is expected to improve customer service, streamline operations, enhance leak detection, and bolster emergency response capabilities.

- In September 2025, the City of Fredericksburg celebrated a major milestone in its water utility modernisation with the completion of Phase I of its Advanced Metering Infrastructure (AMI) Project. Marked by a ribbon-cutting ceremony at the City Shop on September 23, this initiative replaced or upgraded all water meters with state-of-the-art smart meter technology. The upgrade is designed to enhance efficiency, accuracy, and customer service, and Phase I was completed ahead of schedule.

- In September 2025, Itron, Inc., a pioneer in utility technology innovation, announced its partnership with the American Samoa Power Authority (ASPA) to modernise its electricity distribution system. ASPA will deploy Itron's advanced metering infrastructure solutions, including smart electric meters, the UtilityIQ headend application suite, and iPay prepayment software, aiming to improve operational efficiency, billing accuracy, and customer satisfaction as part of ASPA's digital transformation strategy.

(Source: https://www.fredericksburgva.gov)

(Source: https://ir.ameresco.com)

(Source: https://investors.itron.com)

Segments Covered in the Report

By Product Type

- Smart Meters

- Communication Modules

- Meter Data Management Systems (MDMS)

- Head-End Systems

- Meter Data Collectors

- Home Area Network (HAN) Devices

By End-User

- Electric Utilities

- Water Utilities

- Gas Utilities

By Deployment Type

- Cloud-Based AMI

- On-Premises AMI

By Application

- Residential

- Commercial

- Industrial

By Communication Technology

- Radio Frequency (RF) Mesh

- Power Line Communication (PLC)

- Cellular Networks

- Wi-Fi

- Low Power Wide Area Networks (LPWAN)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content