What is the Aesthetic Lasers Market Size?

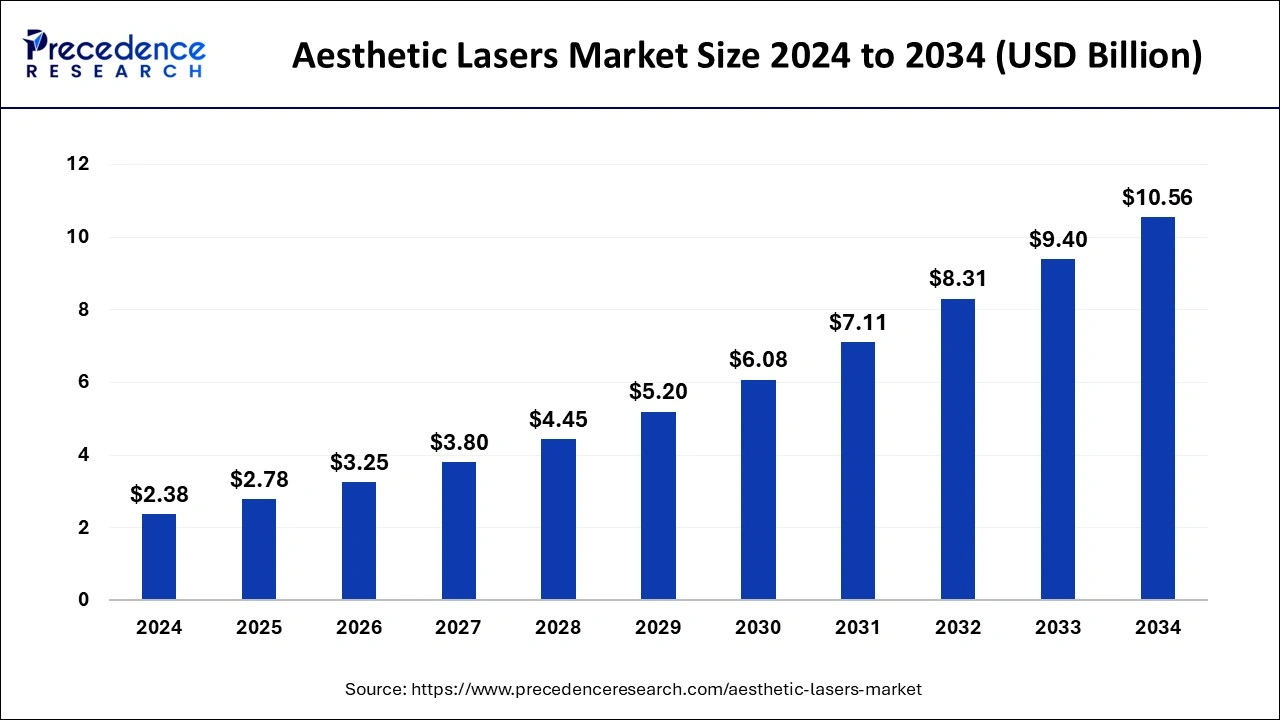

The global aesthetic lasers market size was accounted at USD 2.78 billion in 2025 and predicted to increase from USD 3.25 billion in 2026 to approximately USD 11.67 billion by 2035, representing a CAGR of 15.43% from 2026 to 2035.

Aesthetic Lasers MarketKey Takeaways

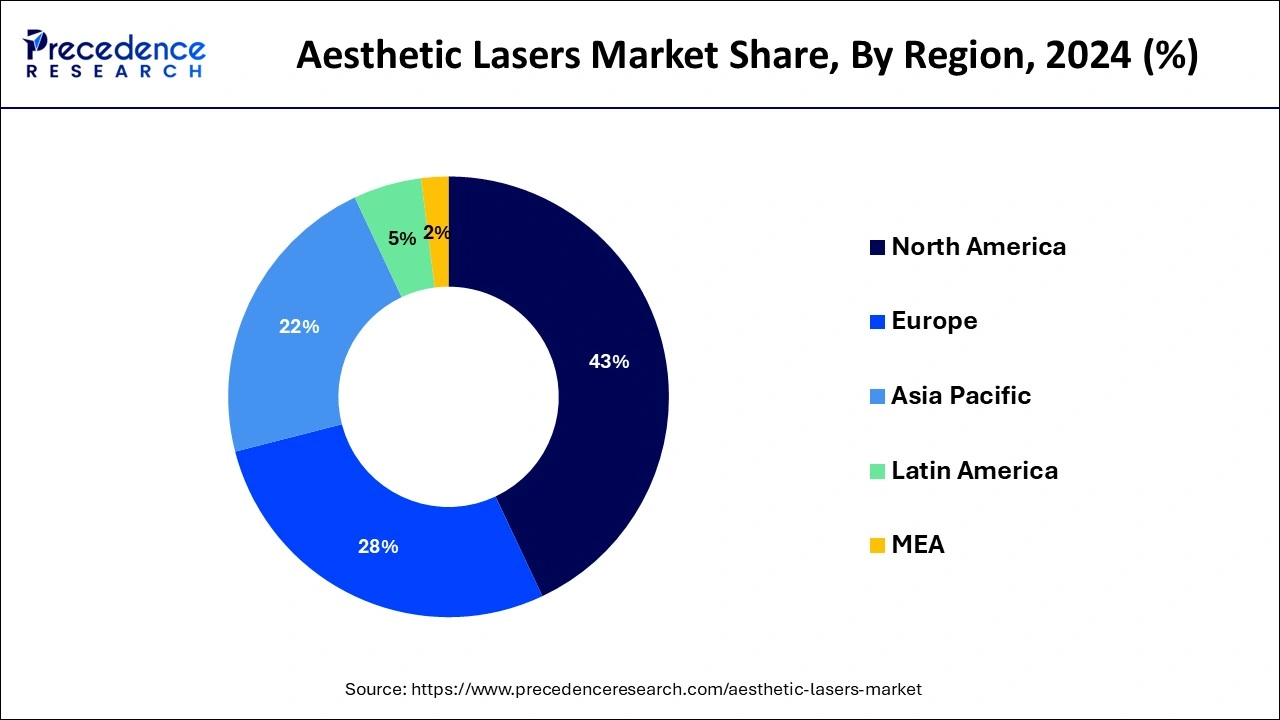

- North America dominated the market and generated more than 36.80% of revenue share in 2025.

- By technology / Laser Type, the non-ablative lasers segment contributed the highest revenue share of 28.60% in 2025.

- By application, the hair removal segment held the biggest market share of 32.90% in 2025.

- By form factor, the fixed (stationary) systems segment captured the highest market share of 71.40% in 2025

- By end user, the dermatology clinics segment contributed the biggest market share of 41.20% in 2025.

- By distribution channel, the direct sales segment held the largest share of 46.70% in 2025.

Market Overview

The most widely used medical technique for changing a person's physical appearance is aesthetic lasers. Aesthetic lasers use heat and light to support the skin's natural production of new collagen. People's bodies eventually lose the ability to produce collagen as they get older. These treatments are meant to improve, beautify, and correct the body. Cosmetic lasers, radiofrequency (RF), light-based, and ultrasound aesthetic devices are among the energy-based aesthetic devices.

Due to numerous advantages over other devices, such as ease of use, minimally invasiveness, and quicker operations, aesthetic laser technologies are favored. The increasing acceptance of radiofrequency-based treatments is also boosting sales of aesthetic lasers. In addition to being fully non-invasive, radiofrequency-based devices like Picoway, LaseMD, FraxPro, and Pixel CO2 are useful in treating a variety of skin disorders. Candela Medical's PicoWay is a picosecond laser platform that produces extremely brief pulses with high peak power for a photoacoustic effect. Tattoo removal, skin rejuvenation, toning, and pigmented lesions are all treated with the platform. Greater treatment outcomes and high patient satisfaction have been produced as a result of technological improvement in the field of laser technology.

How is AI Influencing the Aesthetic Lasers Market?

AI is drastically reshaping the landscape of the market. AI has been integrated into aesthetic laser systems for gathering real-time information about human skin, improving precision treatment, and streamlining patient management. It also enhances clinic efficiency by streamlining treatment planning, patient management, and device maintenance, reducing downtime and operational costs. Additionally, AI improves the patient's experience through virtual consultations, outcome simulations, and data-driven recommendations, boosting satisfaction and driving broader adoption of laser-based aesthetic procedures.

- In July 2025, eMI Aesthetics launched an AI-enabled cosmetic imaging solution. This AI-based solution is designed to enhance the capabilities of cosmetic treatment across the globe.

(Source: finance.yahoo.com)

Aesthetic Lasers Market Growth Factors

One of the factors driving the demand for laser-based treatments and, consequently, the growth of the cosmetic laser market in 2024 is an increase in the number of clients seeking anti-aging therapies.

Another key factor propelling the growth of the cosmetic laser market is the rise in the prevalence of skin issues. The need for procedure-specific cosmetic lasers is expected to increase as the cosmetic business expands and people's awareness of their physical appearance increases. As a result, more people are anticipated to undergo minimally invasive cosmetic operations. This is one of the main factors influencing the demand for aesthetic lasers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.78 Billion |

| Market Size in 2026 | USD 3.25 Billion |

| Market Size by 2035 | USD 11.67 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 15.43% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product Type, By Application, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rises the population of obese and the prevalence of skin condition

People are being impacted by the growing obesity epidemic caused by sedentary lifestyles in industrialized and developing nations. The rapid and less-invasive action of lasers is enticing patients to undergo various cosmetic operations. This is among the key factors that will probably increase demand for aesthetic lasers. The Centers for Disease Control and Prevention predict that over the years 2015–2016, 38.9% of American adults (or approximately 93.3 million people) were obese. One of the factors contributing to the increased use of cosmetic lasers for therapy is the rising prevalence of skin illnesses or ailments like rosacea and others. Consequently, it is driving up demand for energy-based aesthetic lasers with minimally invasive procedures. For instance, according to a study by the British Journal of Dermatology, 2.39% of dermatology patients worldwide and 5.46% of the general population were estimated to have rosacea, respectively.

Restraints

High cost

Aesthetic lasers are technologically advanced and have substantial manufacturing expenses. Regulatory requirements for medical devices might also slow down the licensing procedure and cause delays in product launch activities, which would impede the market's expansion. The maintenance of these facilities raises the cost of the service. The cost increase is a challenge, preventing some people from using these services and limiting the market's overall growth. This poses a challenge for low- and middle-income people in particular. For instance, according to the statement of American Society of Plastic Surgeons, the average cost of laser hair removal is $285 approximately.

Opportunities

Technology advancements

The market has grown due to technological developments in laser treatments and will keep expanding. In laser procedures, focused light is used to treat a range of skin conditions, remove unwanted hair, improve vision, and achieve other medical or aesthetic goals. Based on the type of laser being utilized, there are several types of laser treatments, including ablative, nonablative, pulsed dye, diode, and neodymium lasers. Depending on the desired outcome and potential hazards, every type of laser offers advantages as well as disadvantages. Laser therapies are expected to grow in popularity and demand due to their benefits, which include precision, speed, and minimal invasiveness. This has caused processes to switch to more modern, quick, and painless methods. The market has significantly more advanced tools and methods than earlier processes.

- In September 2021, Asclepion introduced Dermablate, the most adaptable erbium laser with exceptional performance.

Additionally, manufacturers are investing more in R&D to bring forth more cutting-edge and affordable technology. The increased R&D efforts of market participants will soon lead to the introduction of more cutting-edge and inventive technologies. These factors are expected to increase the use and acceptance of aesthetic lasers, driving the market to expand rapidly over the forecast period.

Segment Insights

Technology / Laser Type Insights

The non-ablative lasers segment contributed the highest revenue share of 28.60% in 2025. The growth of the segment is majorly driven by growing consumer demand for non-invasive and minimal-downtime procedures. Consumers are increasingly opting for non-surgical treatments that offer shorter recovery times and minimal risk. Moreover, technological innovations are making non-ablative lasers safer, more efficent, and well-suited for a wider range of skin types. The segment is also heavily influenced by rising disposable incomes and growing public acceptance of cosmetic treatments.

Application Insights

The hair removal segment held a dominant presence in the aesthetic lasers market in 2025, with 32.90%, owing to the increasing global demand for aesthetic and personal grooming services light to improve skin appearance. Social media influence and a surge in disposable income of individuals have led to a rising interest in personal aesthetics services. Moreover, the increasing prevalence of unwanted hair and increasing consumer preference for long-lasting hair removal results over conventional methods have significantly increased the adoption of aesthetic lasers during the forecast period.

Form Factor Insights

The fixed (stationary) systems segment held the 71.40% market share in 2025. Fixed (stationary) aesthetic laser systems are generally large and high-powered devices that are designed for clinical use in dermatology clinics and medical spas. These often feature multiple handpieces and are widely used for various applications, such as hair removal, tattoo removal, and advanced skin resurfacing. The fixed aesthetic laser systems typically deliver higher peak power levels which resulting in more effective treatments and better treatment outcomes.

End User Insights

The dermatology clinics segment contributed the biggest market share of 41.20% in 2025. Dermatology clinics are increasingly adopting aesthetic lasers to treat various skin issues such as scars, wrinkles, unwanted hair, and tattoo removal. Advanced aesthetic lasers in dermatology clinics offer transformative solutions for a wide range of skin concerns and offer various benefits in the field of skincare, which mainly include reduction in fine lines and wrinkles, enhanced collagen production, improved skin elasticity & skin texture, reduced pore size, and others. The rising aging population and increasing preference for non-invasive procedures like wrinkle reduction and skin rejuvenation have increased the demand for laser treatments that offer powerful solutions for maintaining youthful and vibrant skin. Some clinical studies have shown that laser treatments can stimulate nearly 43 percent more collagen production in treated areas, which leads to improvements in skin texture and firmness.

Distribution Channel

The direct sales segment held the largest share of 46.70% in 2025. Direct sales is a significant distribution channel in the aesthetic laser market industry, which includes manufacturers selling directly to clinics and aesthetic practices. Several aesthetic laser companies are handling their own sales, allowing for building direct relationships with customers. Direct sales channels provide access to attractive pricing and financing options that may not be available through third-party distributors sales.

Regional Insights

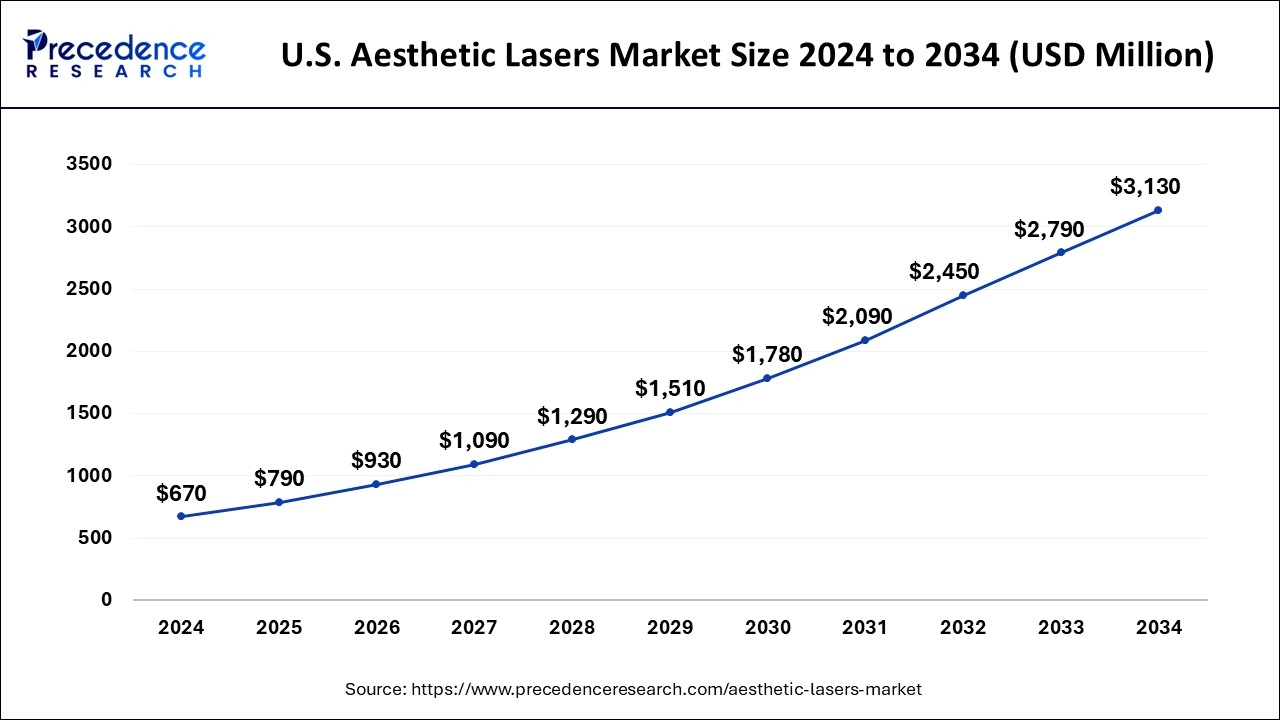

U.S. Aesthetic Lasers Market Size and Growth 2026 To 2035

The U.S. aesthetic lasers market size reached USD 712.49 million in 2024 and is anticipated to reach around USD 3,103.12 million by 2034, poised to grow at a CAGR of 15.85% from 2026 to 2035.

North America held the largest share of the aesthetic laser market in 2025, and it is expected to expand significantly during the projection period. The presence of major market participants, the rise in aesthetic laser operations, and the widespread use of minimally invasive equipment in the area are all factors contributing to growth. One of the major countries in the North American region, the United States has a sizeable market share. A recent study published by the American Society of Plastic Surgeons stated that there were 15.6 million cosmetic procedures carried out in the United States as of 2021.

Considering the growing demand for cosmetic procedures, the market players in North America are focused on product advancements and launches in order to sustain in the market.

The U.S. is the largest driver of the aesthetic laser market, with increasing demand for non-invasive cosmetic procedures. The U.S. performed over 3.1 million laser treatments in 2023, including over 900,000 laser hair removal procedures. The U.S. saw a 7% year-over-year increase in non-surgical skin tightening. Higher awareness of aesthetic treatments, a more resilient infrastructure for cosmetic dermatology, and quicker adoption of advanced laser technologies are some of the factors contributing to the nation's dominance in the aesthetic laser market.

On the other hand, Asia Pacific is expected to witness significant growth in the market.An increasing number of opportunities inmedical tourism are expected to cause the Asia-Pacific area to develop at the fastest rate during the projection period. Throughout the projection period, individuals with significant awareness of aesthetic procedures are also anticipated to contribute to the high growth of this geographical segment. There is a significant propensity and desire among the populace to undergo aesthetic procedures in developing economies like India. According to the International Society of Aesthetic Plastic Surgery, around 70,416 face rejuvenation treatments were performed in India in 2020. Additionally, it is anticipated that growing medical tourism in emerging nations will stimulate the market in the region.

India appears to be emerging as a major market for aesthetic lasers, reporting over 86,000 facial rejuvenation procedures in 2022. This is due to an emergent middle-class sector and more access to aesthetic clinics in urban areas that are observing rising patient footfalls from abroad. Some of India's leading aesthetic centers observe that as much as 15% of their clients are medical tourists. The popularity of laser skin resurfacing and pigmentation correction procedures lures more consumers into clinics.

What Drives the European Aesthetic Laser Market?

The European aesthetics laser market is primarily driven by the rise in the number of dermatology clinics, as well as the increasing cases of psoriasis in different countries, such as Germany, France, the UK, and Sweden. Numerous government initiatives aimed at developing the healthcare sector, along with increasing the adoption of tattoo removal services by the youth, are playing a crucial role in shaping the market's landscape. Moreover, the growing adoption of portable and handheld laser systems by ambulatory surgical centers is expected to accelerate the growth of the market in this region.

Why is Latin America Considered a Significant Region in the Aesthetic Lasers Market?

Latin America is considered a significant region in the market. The rise in the number of government hospitals across various nations, including Argentina, Brazil, and Venezuela, is contributing to the market expansion. Also, the rapid investment by hospital chains to construct new dermatology hospitals, coupled with the surging popularity of skin rejuvenation, is contributing positively to the market. Moreover, the growing prevalence of rosacea, along with technological advancements in the healthcare sector, is expected to drive the growth of the market in this region.

How is the Opportunistic Rise of the Middle East & Africa in the Aesthetic Lasers Market?

The Middle East & Africa (MEA) is emerging as a major player in the market. This is mainly due to the surging adoption of ultrafast lasers and picosecond lasers by healthcare professionals in various countries, such as the UAE, Saudi Arabia, and South Africa. Additionally, the surging investment by the governments for deploying advanced laser machines in public hospitals for the removal of pigmented lesions, coupled with the rising cases of hair removal surgeries, is playing a vital role in shaping the industrial landscape. Moreover, the rising availability of aesthetic laser systems on online platforms is expected to foster the growth of the market in this region.

Aesthetic Lasers MarketCompanies

- Solta Medical Inc.

- Lumenis

- Cynosure, Inc.

- STRATA Skin Sciences (formally Mela Science)

- Syneron Medical Ltd.

- Lutronic

- Cutera

- Viora

- Lynton Lasers

- Sciton, Inc

Recent Developments

- In April 2025, Candela Corporation, a global leader in energy-based medical aesthetics, proudly announced the launch of the Vbeam Pro. The Vbeam Pro device is the only vascular laser FDA-cleared for use in pediatric patients, combining an advanced 595 nm pulsed dye laser with a 1064 nm Nd: YAG wavelength to offer unmatched precision, accuracy, and treatment versatility.

- In June 2024, Lumenis introduced FoLix™, the first FDA-cleared proprietary fractional laser for hair loss treatment. Affecting more than 85% of men and 50% of women, hair loss remains a persistent, widespread challenge. FoLix's groundbreaking approach utilizes fractional laser and Lumenis' proprietary technology tailored for hair.

- In April 2024, CUTERA, INC., a leading provider of aesthetic and dermatology solutions, today announces the launch of xeo+, a pioneering laser and light-based multi-application platform built on a rich history of excellence in performance and innovation.

- In May 2024, UltraClear fiber laser earned FDA clearance in two expanded indications. The FDA has approved the expanded use of the UltraClear cold ablative fractional 2,910 nm fiber laser for the treatment of benign pigmented lesions and vascular dyschromia.

- In March 2023, the pioneers in laser treatments and skincare procedures in India, Doctor Aesthetics Center announced the launch of Picocare 250 Majesty in South India. Picocare 250 Majesty is world's first nd: YAG laser approved by USA-FDA.

- In June 2022, Cynosure announced the launch of a new device to its PicoSure platform, PicoSure Pro. The new device by Cynosure is designed for advanced laser treatment to address unwanted pigmentation and skin revitalization. The PicoSure Pro is manufactured with platinum focus lens array which increases the secretion of collagen and reduces wrinkles.

Segments Covered in the Report

By Technology / Laser Type

- Ablative Lasers

- CO?

- Er:YAG

- Non-Ablative Lasers

- Nd:YAG

- Diode

- Pulsed Dye

- Alexandrite

- Fractional Lasers

- Fractional CO?

- Fractional Er:YAG

- Q-switched Lasers

- Picosecond Lasers

- Ultrafast Lasers (Femtosecond)

- Intense Pulsed Light (IPL)

- Fiber Lasers (Yb, Er, Tm)

- CW / QCW

- NanosecondPulsed

- Hybrid Fiber-Solid-State Lasers (Green / UV)

By Form Factor:

- Fixed (Stationary) Systems

- Portable/Handheld Devices

By Application:

- Hair Removal

- Skin Rejuvenation

- Acne & Scar Treatment

- Tattoo Removal

- Vascular Lesion Removal

- Pigmented Lesion Removal

- Wrinkle Reduction

- Body Contouring & Fat Reduction

- Skin Tightening

- Psoriasis & Rosacea Treatment

- Others (Stretch Marks, Cellulite, etc.)

By End User:

- Hospitals

- Dermatology Clinics

- Medical Spas & Aesthetic Clinics

- Ambulatory Surgical Centers

- Home Users?

By Distribution Channel:

- Direct Sales

- Distributors/Wholesalers

- Online Retail

- Specialty Stores

- Medical Device Companies

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting