What is the Agricultural Micronutrients Market Size in 2026?

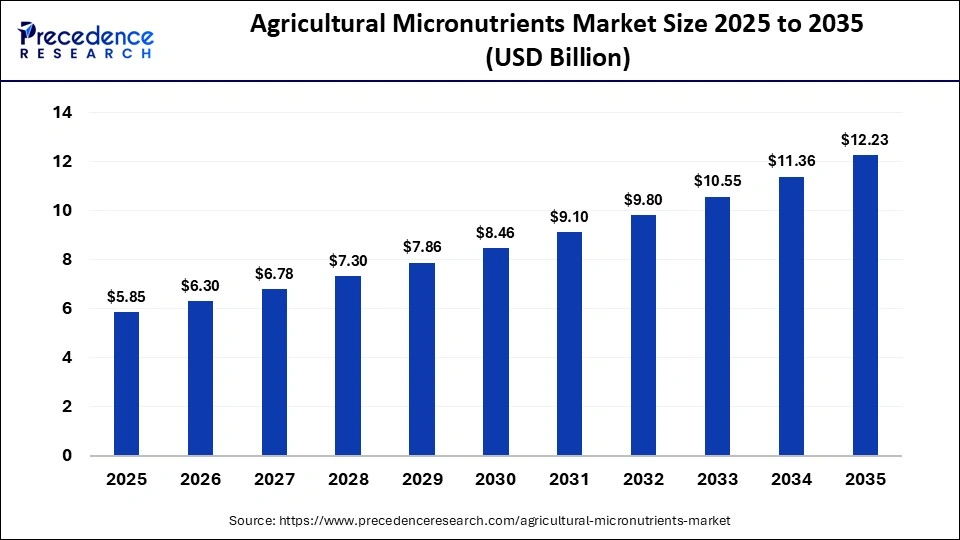

The global agricultural micronutrients market size was calculated at USD 5.85 billion in 2025 and is predicted to increase from USD 6.30 billion in 2026 to approximately USD 12.23 billion by 2035, expanding at a CAGR of 7.65% from 2026 to 2035.The agricultural micronutrients market is experiencing unprecedented growth, driven by an increasing focus on improving soil health and growing adoption of precision agriculture technologies.

Key Takeaways

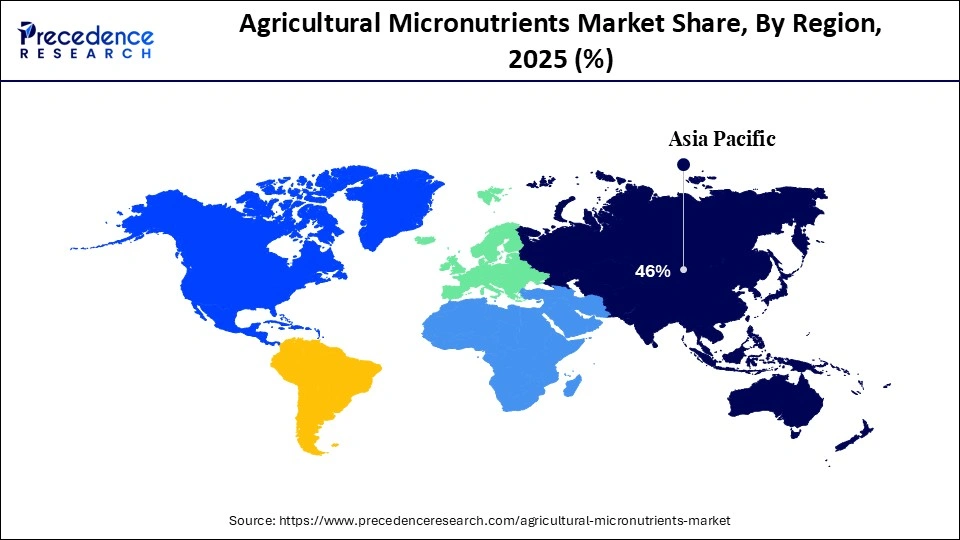

- Asia Pacific held the largest revenue share in the agricultural micronutrients market of 46% in 2025.

- North America is expected to expand at the fastest CAGR in the market.

- By mode of application, the soil application segment held a dominant share of 43.3% in 2025.

- By mode of application, the foliar application segment is expected to grow at the highest CAGR from 2026 to 2035.

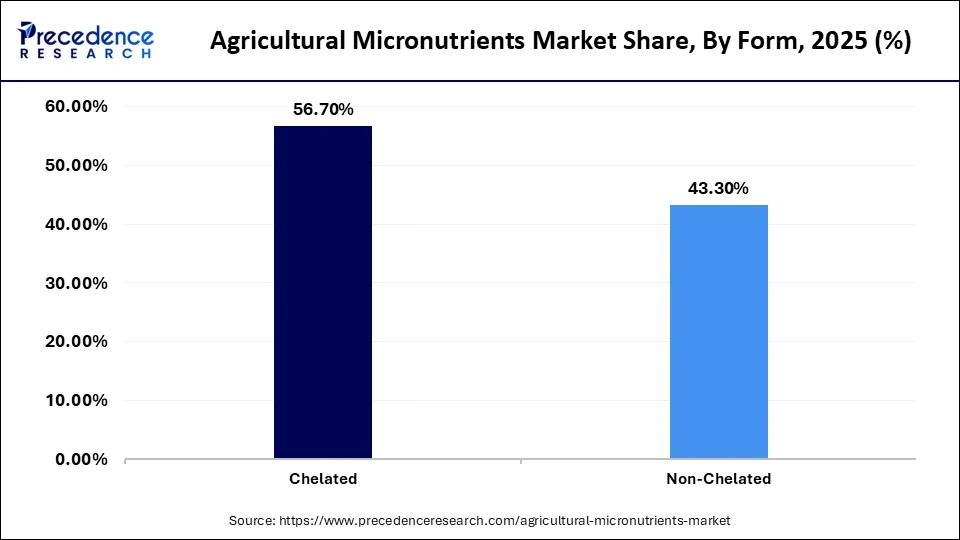

- By form, the chelated micronutrients segment contributed the biggest revenue share of 56.7% in the market in 2025.

- By form, the non-chelated micronutrients segment is expected to expand at the fastest growth rate between 2026 and 2035.

- By crop type, the cereals segment registered its dominance with the highest revenue of 47.1% share during 2025.

- By crop type, the fruit and vegetables segment is expected to grow at the highest CAGR during the forecast period.

- By product, the zinc segment held the largest agricultural micronutrients market of 42.6% share in 2025.

- By product, the manganese segment is expected to grow at the fastest CAGR between 2026 and 2035.

Market Overview

The agricultural sector is increasingly recognizing the significance of essential trace elements. Micronutrients assist in elevating soil nutrient levels, where plant roots can efficiently absorb them for enhancing crop yields and promoting soil health. Agricultural micronutrients play a crucial role in the plant life cycle, specifically in photosynthesis, chlorophyll synthesis, and enzyme function. Micronutrients are generally required in small amounts but are vital for maintaining soil fertility and ensuring robust plant growth. There are various essential micronutrients such as boron, zinc, iron, manganese, molybdenum, and chlorine. Micronutrients are integral to the plant's defense system against diseases, pests, and environmental stresses.

How are AI-driven innovations impacting the growth of the Agricultural Micronutrients Market?

In the rapidly evolving technological landscape, the integration of Artificial Intelligence (AI) is significantly accelerating the growth of the market. Artificial intelligence (AI) is significantly transforming traditional farming techniques into nutrition-focused farming to meet the ongoing global demands. AI algorithms efficiently analyze data from drones, IoT sensors, and satellite imagery to detect real-time nutrient deficiencies in soil, allowing for precise and efficient application of micronutrients. AI and IoT integration in automation, intelligent sensors, and data-driven tools to optimise resource utilisation and foster sustainable farming. AI can collect and analyze diverse datasets, such as soil conditions, crop performance, and historical weather, to offer precise recommendations for micronutrients. Therefore, AI-driven advancements optimize crop health, improve yield, and promote sustainable farming.

What are the emerging trends in the market?

- The increasing global population and the growing need for nutrient-rich food are expected to drive the market's growth in the coming years. A surge in global population necessitates increased agricultural activity for higher-quality and nutrient-dense crops, driving the increasing use of micronutrients.

- The supportive government policies and initiatives are anticipated to create lucrative opportunities for the rapid growth of the market. Several governments worldwide are offering attractive subsidies for micronutrient application to strengthen soil health and boost crop yields. These government policies support integrated nutrient management while reducing environmental impacts, optimizing nutrient use, and promoting sustainable practices.

- The rising emphasis on improved crop production and quality is expected to accelerate the growth of the agricultural micronutrient market during the forecast period. Agricultural micronutrients are indispensable for increasing crop resistance to pests, diseases, and environmental stress, while enhancing the nutritional value and shelf life.

- The rising awareness of soil nutrient deficiencies is expected to contribute to the overall growth of the agricultural micronutrients market. The intensive farming often degrades soil, which increases the need to address deficiencies in zinc, iron, manganese, molybdenum, and boron. The increasing awareness is encouraging farmers to adopt fertilizers as a supplement to improve crop yields and quality.

- The growing demand for sustainable agriculture is anticipated to fuel the expansion of the market. The rise in eco-friendly practices among farmers is driving the demand for biodegradable chelates and specialized products that improve nutrient uptake and reduce environmental adverse impact.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.85 Billion |

| Market Size in 2026 | USD 6.30 Billion |

| Market Size by 2035 | USD 12.23Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.65% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Mode of Application, Form, Crop Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Insights

What caused the Zinc segment to dominate the Agricultural Micronutrients Market?

The zinc segment held the largest market share in 2025, owing to the widespread soil deficiency. Zinc (Zn) is one of the crucial micronutrients recognized as essential for plants. Zinc is required in small amounts but is integral for high-yield crops. Zinc fertilizers are most widely used in cereals and staple crops to improve overall grain quality.

The manganese segment is expected to grow at a remarkable CAGR between 2026 and 2035. Manganese functions as part of enzyme systems in plants. Manganese activates various metabolic reactions and plays a crucial role in photosynthesis, chlorophyll formation, and disease resistance in crops. Manganese-enriched fertilizers are commonly used to increase the cultivation of high-value fruits, vegetables, and horticultural crops.

Mode of Application Insights

Which Mode of Application Dominated the Agricultural Micronutrients Market in 2025?

The soil application segment held the largest market share in the market with approximately 2025. Soil application provides the uniform supply of nutrients directly to the plant root zone. Soil application efficiently addresses long-term soil degradation and widespread nutrient deficiencies. Soil-applied micronutrients ensure the proper utilization of macronutrients by plants that directly promote better root development and optimal plant health.

The foliar application segment is expected to witness the fastest growth in the market with a remarkable CAGR over the forecast period. Foliar application offers rapid and highly efficient nutrient absorption directly to plant leaves. Foliar application assists nutrients for easy mixing with pesticides or fungicides, which both saves time and labor effort. Several studies have shown that foliar application significantly increases crop yields while improving the quality of fruits and vegetables. Farmers widely use foliar sprays in fruits, vegetables, and horticultural crops for high-quality and appearance.

Crop Type Insights

What has led the Cereals segment to dominate the Agricultural Micronutrients Market?

The cereals segment contributed the highest market share in the market in 2025. Cereals occupy the largest agricultural land area globally, owing to the high-volume production of wheat, rice, oats, barley, millet, and maize. Cereals are the primary source of calories and food energy. Farmers are increasingly using micronutrient fertilizers to maintain yield, quality, and food security. These staple crops require micronutrient supplementation to ensure optimal growth and enhance grain quality.

The fruit and vegetables segment is expected to expand at a remarkable growth rate from 2026 to 2035, owing to increasing consumer demand for nutrient-dense food. Micronutrients assist in chlorophyll production, reproductive growth, seed development, and enzyme activation. The essential micronutrients required for the healthy growth and development of fruit and vegetables include zinc, iron, boron, molybdenum, copper, manganese, and chlorine. Fruits and vegetables are highly sensitive to micronutrient deficiencies. Deficiencies of these nutrients often lead to stunted growth, yellowing leaves, lower-quality produce, and reduced crop yield.

Form Insights

What factors are contributing to the dominance of the Chelated Micronutrients segment in the Market?

The chelated micronutrients segment accounted for the largest market share in the agricultural micronutrients market. Chelated micronutrients assist in preventing and correcting micronutrient deficiencies in plants. They are highly beneficial for crops growing in high-pH or alkaline soils, where micronutrients are unavailable due to the formation of insoluble compounds. They significantly increase stability, solubility, and absorption efficiency, ensuring higher crop yields and improved overall plant health. The application of chelated micronutrient fertilizers provides benefits to various crops such as fruits, oilseeds, cereal crops, ornamentals, soybeans, tree nut crops, hydroponic crops, and others.

The non-chelated micronutrients segment is expected to grow with the highest CAGR in the automation and protection system market during the studied year, owing to its cost-effectiveness for large-scale and conventional farming. Non-chelated micronutrients are generally cheaper, which often leads to higher consumption rates among farmers seeking cost-efficient fertilization programs. These products are extensively utilised in price-sensitive agricultural regions. In addition, the rapid technological advancements in non-chelated products, including improved solubility and granular formulations, have significantly increased their nutrient delivery efficiency.

Regional Insights

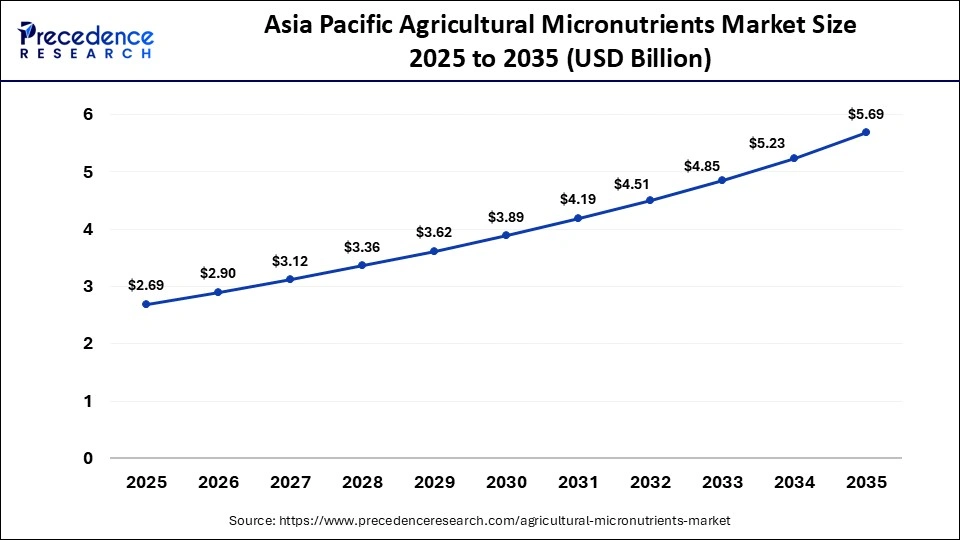

Asia Pacific Agricultural Micronutrients Market Size and Growth 2026 to 2035

The Asia Pacific agricultural micronutrients market size is expected to be worth USD 5.69 billion by 2035, increasing from USD 2.69 billion by 2025, growing at a CAGR of 7.78% from 2026 to 2035.

Asia Pacific Agricultural Micronutrients Market Analysis

Asia Pacific dominated the market, holding the largest market share in 2025. The region has a large agricultural base requiring nutrient replenishment, owing to high-intensity cultivation. Countries like China and India are leading the market, owing to their extensive agricultural bases, rising adoption of advanced farming techniques, and high food demand. The rising government-sponsored educational programs and attractive subsidies are driving awareness among farmers and increasing the adoption of agricultural micronutrients in the region.

Additionally, the increasing adoption of advanced agricultural technologies such as precision spraying, fertigation, and others allows for precise, targeted application of micronutrients that ensure optimal plant health and productivity. Such a combination of factors is anticipated to bolster the growth of the market in the region.

India Agricultural Micronutrients Market Analysis

India holds a substantial share of the market. The country is home to the leading market players such as Coromandel International Limited, Aries Agro Limited, Indian Farmers Fertiliser Cooperative Limited (IFFCO), Deepak Fertilisers and Petrochemicals Corporation Ltd., Rashtriya Chemicals and Fertilizers Ltd. (RCF), Anand Agro Care, Amruth Organic Fertilizers, Zuari Agro Chemicals Limited, Nagarjuna Fertilizers and Chemicals Limited, and others. The country's rapid growth is also largely driven by the growing population, massive agricultural land, increasing demand for nutrient-rich crops, widespread soil nutrient deficiencies, and increasing adoption of chelated micronutrients. Moreover, the supportive government policies and regulations promoting the usage of specialized fertilizer are expected to bolster the market's growth in the country.

According to the Department of Agriculture & Farmers Welfare, Agriculture plays a vital role in India's economy. As per land use statistics for 2022-23, the reported area of the country is 306650 thousand hectares, of which around 59% is agricultural land, 140705 thousand hectares is the reported net sown area, and 219357 thousand hectares is the gross cropped area with a cropping intensity of 155.9%. Net area sown comprises of 42.8% of the total geographical area.

According to the data published by the IBEF in November 2025, India's agricultural output has expanded significantly in the past decade, recording 40% growth and achieving surplus capacity for exports. In FY25, the sector grew by 5.4% year-on-year, supported by record production and higher trade volumes. Agricultural exports touched an all-time high of Rs. 4,40,000 crore (US$ 51.86 billion) in FY25, up from Rs. 3,95,793 crore (US$ 48.15 billion) in FY24. Agriculture and allied activities together contributed 17.8% to India's GDP in 2023-24, reaffirming the sector's importance to the national economy.

North America Agricultural Micronutrients Market Analysis

North America is expected to grow at the fastest CAGR in the market during the forecast period. The U.S. and Canada have the large-scale production of corn, soybeans, and cereals necessitate supplementation to improve productivity. The growth of the region is mainly driven by the rising soil nutrient deficiencies rising shift towards sustainable farming, the growing need for nutrient-rich & high-yield crops, increasing focus to enhance crop yield and quality, and the rising adoption of precision agriculture & technologies. The supportive government initiatives, such as providing subsidies, soil testing, and launching training programs, are addressing nutrient imbalances and enhancing food security.

The U.S. Agricultural Micronutrients Market Analysis

The U.S. market held a notable revenue share. The growth of the country is also largely driven by a surge in the adoption of high-value crops, an increasing shift toward sustainable agriculture, rising soil degradation and nutrient deficiencies, an increasing focus on increasing crop productivity, growing demand for chelated formulations, and favourable government initiatives encouraging soil testing and offering training programs for advanced agricultural practices. Additionally, the rapid technological advancements in precision agriculture and soil testing are assisting in identifying specific deficiencies and optimizing the application of agricultural micronutrients in the country. These collective factors are anticipated to drive the country's growth during the forecast period.

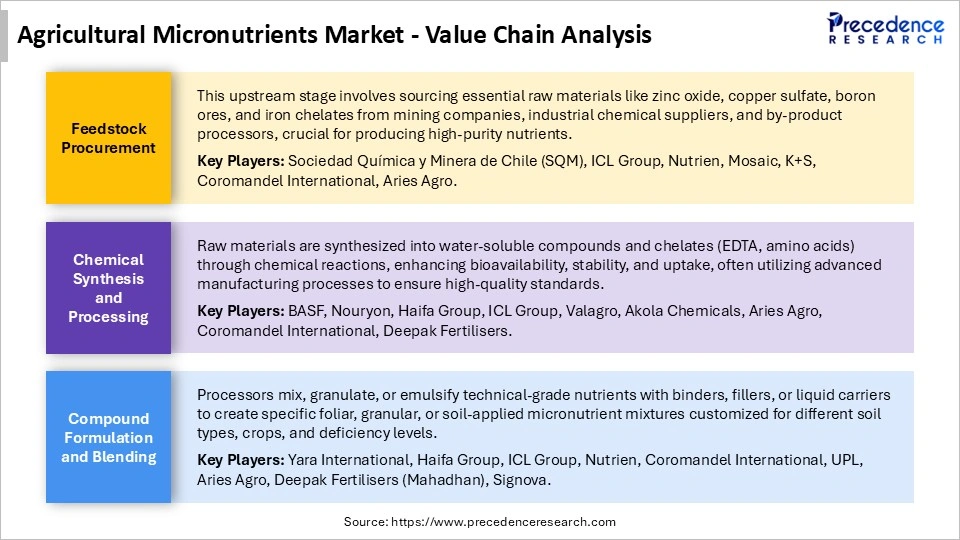

Agricultural Micronutrients Market Value Chain Analysis

Agricultural MicronutrientsMarket Companies

- BASF

- Yara International ASA

- Coromandel International Limited

- Nouryon

- Syngenta AG

- Zuari Agro Chemicals Ltd.

- Aries Agro Limited

- The Mosaic Company

- Haifa Group

- Nutrien Ltd.

- Coromandel International Ltd.

- ICL Group Ltd.

- Nufarm Limited

- Compass Minerals International, Inc.

Recent Developments

- In May 2025, Syngenta acquired Intrinsyx Bio, a California-based start-up specializing in the development of nutrient use efficiency products. This strategic move aligns with Syngenta's goal to reinforce its position as a global leader in the biologicals business, enhancing farmers' toolbox with additional assets to manage their crops effectively and sustainably.

(Source: https://www.syngentabiologicals.com) - In June 2025, Lucent Bio, a Canadian developer of sustainable agricultural inputs, announced the launch of Soileos Boron + Zinc, a new fertilizer aimed at improving micronutrient delivery while reducing environmental impact. Built on the company's patented cellulose delivery matrix, the product releases nutrients through microbial mineralization, making boron and zinc available in sync with crop demand.(Source: https://igrownews.com)

Segment covered in the report:

By Product

- Zinc

- Boron

- Manganese

- Molybdenum

- Iron

- Other

By Mode of Application

- Soil

- Foliar

- Fertigation

By Form

- Chelated

- Non-Chelated

By Crop Type

- Cereals

- Pulses & Oilseeds

- Fruits & Vegetables

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting