Agricultural Packaging Market Size and Forecast 2025 to 2034

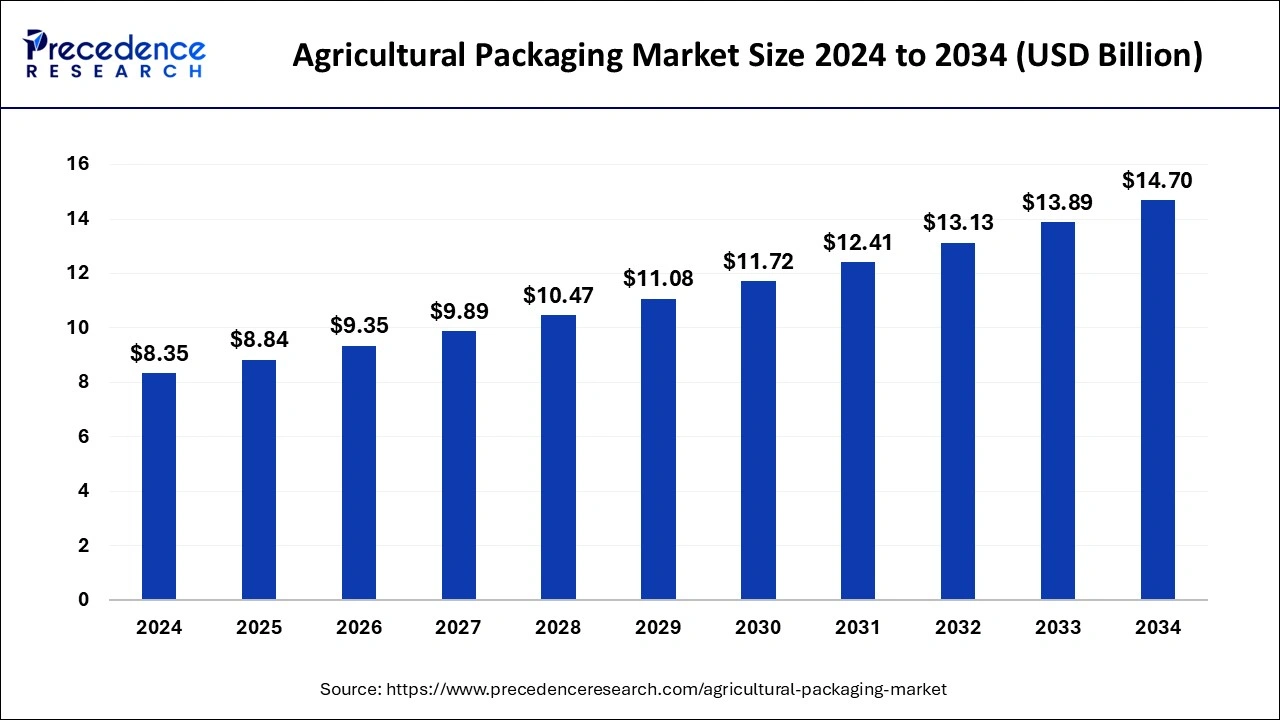

The global agricultural packaging market size was worth around USD 8.35 billion in 2024 and is anticipated to reach around USD 14.7 billion by 2034, growing at a CAGR of 5.82% from 2025 to 2034.

Agricultural Packaging Market Key Takeaways

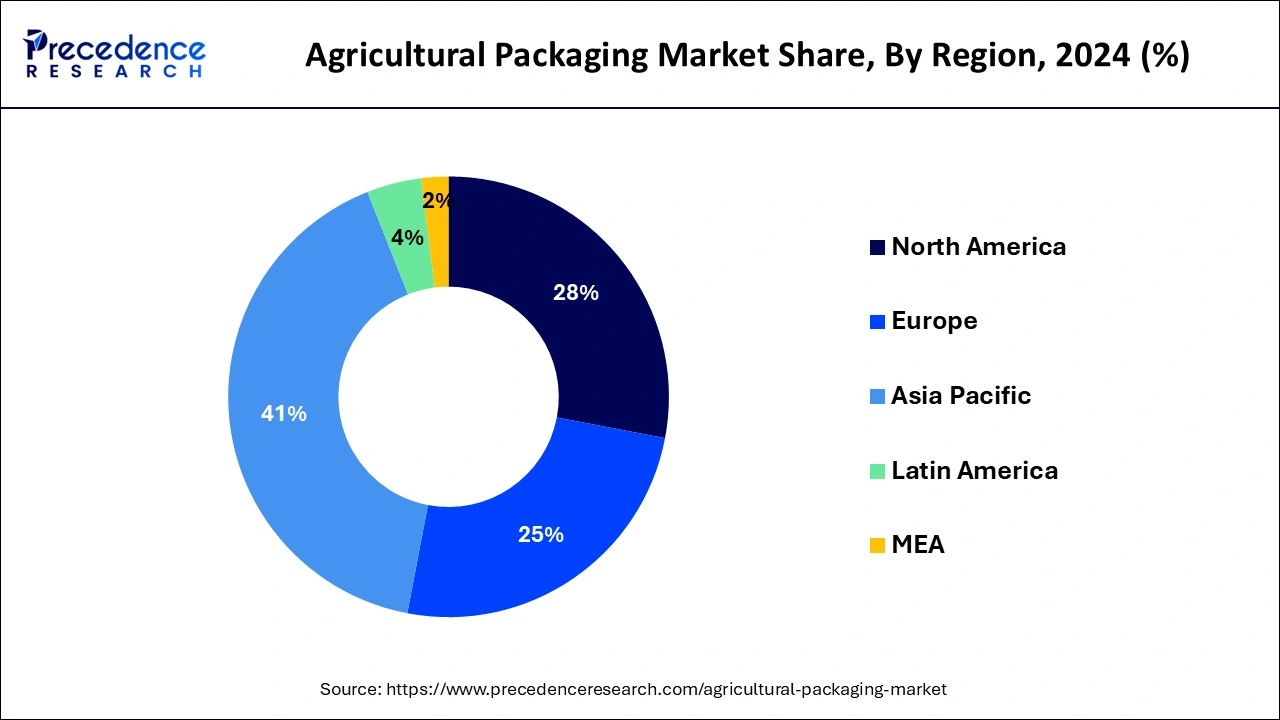

- Asia Pacific is predicted to register the highest market share from 2025 to 2034.

- North America is expected to hold a maximum market share from 2025 to 2034.

- By Product, the pouches & bags segment is expected to lead the market between 2025 and 2034.

- By product, the bottles & cans segment is expected to expand at the fastest rate in the coming years.

- By Material, the plastic segment is projected to dominate the market from 2025 to 2034.

- By material, the paper and paperboard segment is projected to grow rapidly during the forecast period.

- By Application, the fertilizer segment is expected to lead the market between 2025 and 2034.

Asia Pacific Agricultural Packaging Market Size and Growth 2025 to 2034

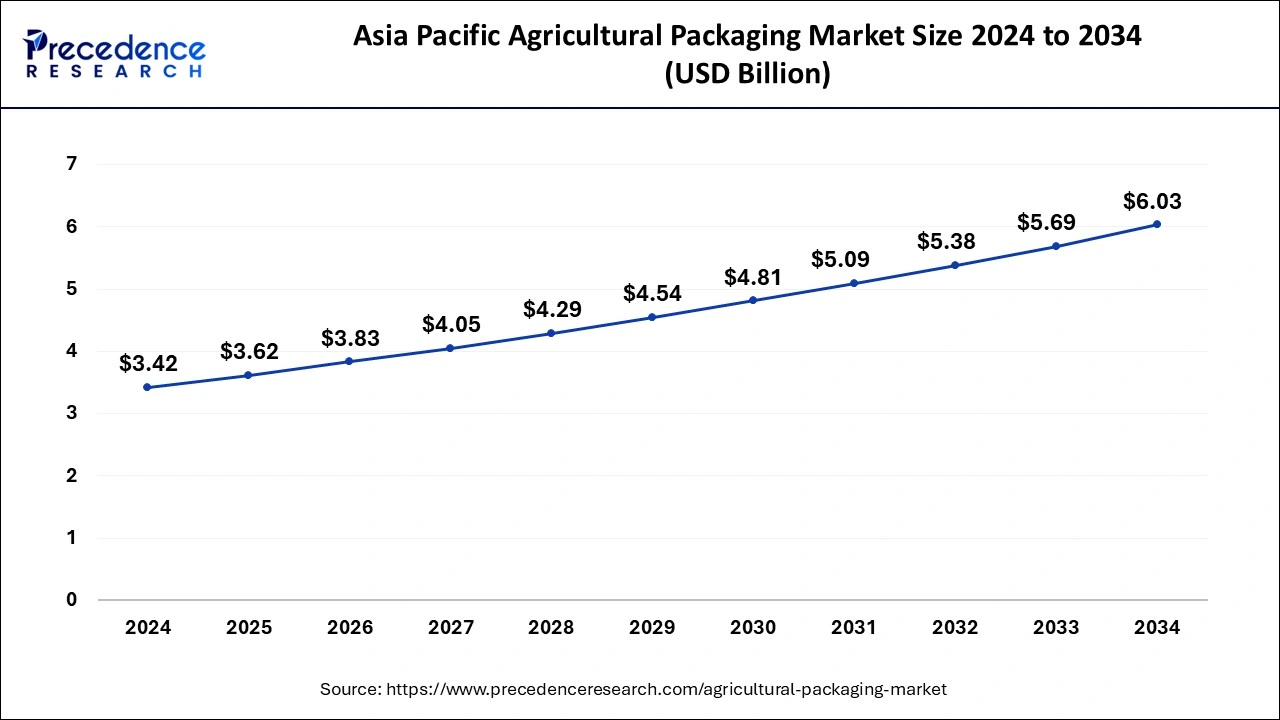

The Asia Pacific agricultural packaging market size was exhibited at USD 3.42 billion in 2024 and is projected to be worth around USD 6.03 billion by 2034, growing at a CAGR of 5.95% from 2025 to 2034.

Asia Pacific dominated the market with the largest share in 2024 owing to the rapid expansion of the agriculture sector. The region is home to some of the world's largest agriculture producers, including China and India. They have a diverse range of agricultural products, including grains, fruits, vegetables, meat, and dairy products. The increasing population and rising middle-class consumer base in countries like China and India are driving the demand for efficient packaging solutions to ensure the quality and safety of agricultural products.

For instance, according to WorldData.info, India's population climbed from 450.55 million in 1960 to 1.43 billion in 2023. This is an increase of 216.5% in 63 years. The year 1974 saw the highest growth in India, at 2.36% and 2023 will have the smallest growth, at 0.61%. Furthermore, the rising exports of agricultural products to both regional and global market is also driving the market growth over the forecast period. Packaging plays a crucial role in preserving the quality of these products during transportation.

As the demand for Asian agricultural products continues to grow, there is a corresponding need for reliable and effective packaging solutions that meet international quality standards. For instance, as per the statistics from DGCI&S, India's exports of agricultural goods increased by 19.92% in 2021-2022 to reach USD 50 billion. The growth rate is noteworthy since it exceeds the increase of 17.66% at USD 41.87 billion recorded in 2020-21. Thus, the aforementioned statistics support the penetration rate of the agricultural packaging market in the region during the projected period.

North America is expected to hold a substantial market share over the forecast periodowing to the advanced infrastructure and stringent quality standards. The region has a robust infrastructure that supports the agriculture industry, including efficient transportation networks, modern storage facilities, andadvanced packagingtechnologies. This infrastructure facilitates the movement of agricultural products from farms to markets, driving demand for reliable and efficient packaging solutions. In addition, the agriculture industry in the region is known for its high-quality standards and stringent regulations. This emphasis on quality extends to packaging, as it plays a crucial role in preserving the freshness, safety, and overall integrity of agricultural products. Packaging solutions in areas often need to meet strict requirements related to product protection, labeling, and traceability. Furthermore, North America is home to several major players in the agriculture packaging market. Companies like Amcor Limited, Sonoco Products Company, and Berry Global Inc. have a significant presence and offer a wide range of packaging solutions tailored to the specific needs of the region's agriculture industry. These companies often invest in research and development to develop innovative packaging solutions.

- For instance, in November 2022, Amcor, a pioneer in creating and manufacturing ethical packaging solutions, disclosed a USD 3 million investment in PulPac, A Swedish business that offers innovative manufacturing technology for inexpensive, high-performance fibre-based packaging. Amcor is one of several strategic investors in an inter-industry partnership that aims to accelerate the adoption of PulPac's technology on a worldwide scale.

Europe is expected to capture a significant position in the agriculture packaging market. They have a strong emphasis on sustainability and eco-friendly packaging solutions. The region has implemented strict regulations and policies regarding packaging waste and recycling. There is a growing demand for recyclable andbiodegradable packaging materials to reduce environmental impact. Packaging companies in Europe are actively investing in sustainable packaging innovations, such as compostable packaging, bio-based plastics, and eco-friendly printing technologies.

- In March 2023, one of the most significant manufacturers and co-packers of tomato products in Europe, Casalasco Societa Agricola, is the first company in the continent to introduce food items in aseptic carton packs from SIG, which are built of even more environmentally friendly Signature Nature Full Barrier. A mass balancing mechanism linked the few polymers used n this packaging material to verified forest-based renewable sources, significantly lowering the carbon footprint of the carton pack. Therefore, these types of product launches by the key players will drive regional market growth.

Market Overview

Agriculture packaging refers to the specialized packaging solutions designed and used specifically for agricultural products. It involves the development and manufacturing of packaging materials and containers that protect and preserve the quality of various agricultural goods throughout the supply chain, from production to distribution and retail. The primary purpose of agriculture packaging is to ensure the safe transportation and storage of agricultural products, preventing physical damage, contamination, spoilage, and loss of quality.

It helps in maintaining the freshness, nutritional value, and overall integrity of products, ultimately extending their shelf life. Agricultural packaging is utilized for a wide range of agricultural commodities, including but not limited to grains, fruits, vegetables, meat, poultry, seafood and dairy products. The packaging materials and formats may vary depending on the specific requirements of the product, transportation mode, and storage conditions. Different types of packaging options are available for agriculture products such as bags, pouches, containers, crates, boxes and bottles. These packaging solutions are typically made from materials like plastics, paper, glass, metal, or a combination of these, chosen based on factors such as product compatibility, protection needs, cost-effectiveness, and sustainability considerations. In recent years, there has been a growing emphasis on sustainable agriculture packaging solutions. This includes the development and utilization of eco-friendly and recyclable materials, as well as the adoption of packaging practices that minimize waste generation and environmental impact.

- According to the Fertiliser Association of Inda, the output of fertilizers increased by 0.5% over 2020-21 to 18.58 million MT (N+P2O5) in 2021-22. Phosphate (P2O5) production decreased by 0.5% to 4.71 million MT in 2021-2022 while nitrogen output climbed marginally by 0.9% to 13.87 million MT.

- As per USDA, in 2022, US agricultural exports to China totaled USD 36.4 billion, breaking the previous year's record. China was the top export destination for the second year in a row.

Agricultural Packaging Market Growth Factors

- Urbanization and Population Growth: Rapid urbanization and the rising population worldwide are major factors boosting the need for food products and significantly boosting the demand for agricultural packaging.

- Awareness of Food Safety: Increased consumer awareness of food safety and quality is one of the key factors driving the growth of the agricultural packaging market. Consumers are becoming more conscious about health and hygiene, thus boosting the need for quality packaging.

- Demand for Smart Packaging: With the growing technological advancements, the demand for smart packaging solutions to maintain the freshness of food items is increasing.

- Expansion of E-commerce: With the expansion of e-commerce businesses, online grocery shopping has increased, leading to increased demand for advanced packaging solutions.

- Government Regulations: Stringent government regulations regarding food safety encourage manufacturers to invest in high-quality packaging solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.84 Billion |

| Market Size by 2034 | USD 14.7 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.82% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Material, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing global population and food demand

The increasing global population and the subsequent increase in food demand drive the need for efficient and sustainable agriculture packaging solutions. Packaging plays a critical role in preserving the quality, safety, and shelf life of agricultural products, ensuring they reach consumers in optimal conditions. For instance, according to United Nations data, the population of the globe has increased by more than three times since the middle of the 20th century.

In mid-November 2022, there were 8.0 billion people on the planet, up from 2.5 billion in 1950, 1 billion since 2010, and 2 billion since 1998. The population of the world is projected to rise by about 2 billion people over the next 30 years, from the present 8 billion to 9.7 billion in 2050, with a potential peak of roughly 10.4 billion in the middle of the 2080s. Similarly, the demand for food is expected to rise anywhere between 59% to 98% by 2050. Therefore, the growth in the global population coupled with the rise in the demand for food will drive the agricultural packaging market over the forecast period.

Demand for high-quality packaging

The increasing consumer demand for high-quality packaging solutions is driving the growth of the market. With the growing awareness of food safety and hygiene, there is a high demand for high-quality packaging solutions in the food and beverage sector to maintain food safety and quality and reduce contamination risks. Manufacturers are focusing on developing high-quality packaging solutions to maintain the shelf life and freshness of food products. The demand for durable and resistant packaging has been on the rise. Innovations in smart packaging, like modified atmosphere packaging and tamper-evident and resistant packaging solutions, boost consumer expertise.

Restraints

Environmental concerns and plastic waste

The use of plastic packaging in agriculture has faced increasing scrutiny due to its environmental impact. Plastic waste and pollution have raised concerns, leading to demand for reduced plastic usage and increased adoption of sustainable packaging alternatives. This presents a challenge for the agricultural packaging industry to develop and implement more eco-friendly solutions.

Opportunities

Technological advancements and innovation

The agriculture packaging industry is driven by technological advancements and innovations. New materials, packaging formats, and technologies are continuously being developed to meet the evolving needs of the industry. This includes advancements in barrier properties, smart packaging, intelligent labeling, and active packaging solutions that enhance product freshness, traceability, and consumer experience. In March 2021, Amcor China and JD Farm partnered to develop the next generation of packaging for a more successful and engaging customer experience. Consumers may learn more about the quality, safety, and provenance of JD Farm goods through the jointly developed NFC-enabled packaging that makes use of market-leading technology. Thus, these kinds of innovations in the market provide an attractive opportunity for market growth over the forecast period.

Sustainability trends and regulatory supports

In recent years, there has been a growing emphasis on sustainable agriculture packaging solutions. This includes the development and utilization of eco-friendly and recyclable materials, as well as the adoption of packaging solutions that minimize waste generation and environmental impact. The growing sustainability concerns are driving the demand for sustainable packaging. Stringent environmental regulations have encouraged manufacturers to innovate and develop sustainable packaging using biodegradable, recyclable, and reusable packaging materials. Moreover, the ban on single-use plastic packaging contributes to market expansion.

- In September 2024, Pakka, a leading manufacturer of compostable packaging solutions, launched its novel range of flexible compostable packaging aimed to satisfy the growing demand for sustainable packaging solutions in the food & beverage industry. The company introduced M1, M3, and NM1, three groundbreaking paper-based compostable structured food packaging solutions.

Product Insights

The pouches & bags segment accounted for the largest share of the agricultural packaging market in 2024 due to their lightweight, cost-effectiveness, and versatility. Pouches & bags play a vital role in agriculture packaging by providing protective, convenient, and customizable packaging solutions for a wide range of agricultural products. They are adaptable to various product sizes and packaging requirements, ensuring the safety of agricultural goods throughout the supply chain.

The bottles & cans segment is expected to expand at the fastest rate in the coming years due to the increasing demand for liquid fertilizers and pesticides. Bottles are easy to handle and convenient for transportation. High-density polyethylene bottles are in high demand due to their superior properties, such as excellent durability and resistance to hazardous chemicals. Bottle packaging reduces product contamination by preventing air, moisture, or light contact. The demand for transparent bottles is rising in agriculture, boosting segment growth.

Material Insights

The plastic segment held the largest market share in 2024. This is mainly due to its increased adoption in packaging agricultural products because of its lightweight, durability, and cost-effectiveness. Moreover, its resistance to moisture, dust, and pest properties makes it a preferred choice in the packaging industry. Plastics are easy to mold in any shape and size. Manufacturers prioritize using plastics, as their light weight helps reduce transportation costs. Additionally, material science advancements led to bioplastics' development, contributing to segmental growth.

On the other hand, the paper and paperboard segment is expected to grow at the highest CAGR over the forecast period. The growth of the segment is attributable to its eco-friendly and recyclable nature. Growing sustainability trends are encouraging the adoption of paper and cardboard packaging solutions. Paper and paperboard are cheaper than plastic. Additionally, the design, printing, and labeling capabilities make paper and paperboard materials popular to enhance branding. Kraft paper and paper bags are the common packaging solutions that are in high demand. Additionally, paper packaging is mostly used for animal feed packaging. Environmental regulations further encourage the adoption of paper-based packaging solutions, which contribute to segmental growth.

Application Insights

The fertilizer segment dominated the agricultural packaging market with the largest share in 2024. This is mainly due to the increased adoption of fertilizers to improve crop and soil health. Fertilizers are sensitive to moisture, heat, and air. Packaging materials used for fertilizers need to provide adequate protection against these elements to maintain product quality and efficacy. Packaging should prevent moisture ingress, minimize exposure to light and oxygen, and offer barrier properties to prevent nutrient loss or degradation.

Agricultural Packaging Market Companies

- Mondi Group

- Proampac LLC

- Pactiv LLC

- NNZ Group

- Sonoco Products Company

- BAG Corporation

- Greif Inc.

- Flexpack FIBC

- Amcor plc

- Anderson Packaging Inc.

- LC Packaging International BVs

- Western Packaging

Recent Development

- In April 2023,packaging manufacturer Mondi collaborated with Swiss converter ATS-Tanner to create a paper band to hold products or bundles, reducing unnecessary plastic. ATS-Tanner uses Mondi's kraft paper Advantage MF SpringPack and converts it into a band by adding a functional barrier on each side of the paper. The paper is sealed using ultrasound which eradicates the need for adhesive, ensuring that products are secured with minimum packaging, reducing waste and delivering cost-efficiency. ATS-Tanner markets the coated bands under the brand name TruePaper.

- In May 2022,Agri-Flex, a Canadian supplier of agricultural supplies, has been acquired by Zeus, an international packaging solutions company with Irish ownership. The next step in the company's USD 36.88 million investment plan is represented by this acquisition. Zeus will now rank among the world's leading suppliers of agricultural crop packaging goods.

- In June 2024, Mondi Group, a global leader in sustainable packaging solutions, launched the latest addition to its popular portfolio of sustainable pre-made plastic bags, FlexiBag Reinforced - a range of innovative mono-PE-based, recyclable packaging solutions with improved mechanical properties.

- In August 2024, Valmatic collaborated with Ital-Agro and introduce Valpeck, a single-dose paper packaging system designed for Ital-Agro's Blackjack Bio bioactivator and the agricultural sector.

Segments Covered in the Report

By Product

- Pouches & Bags

- Drums

- Bottles & Cans

- Others

By Material

- Plastic

- Metal

- Paper and Paperboard

- Composite Materials

- Others

By Application

- Fertilizers

- Pesticides

- Seeds

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting