What is the AI-Driven Industrial Robotics Market Size?

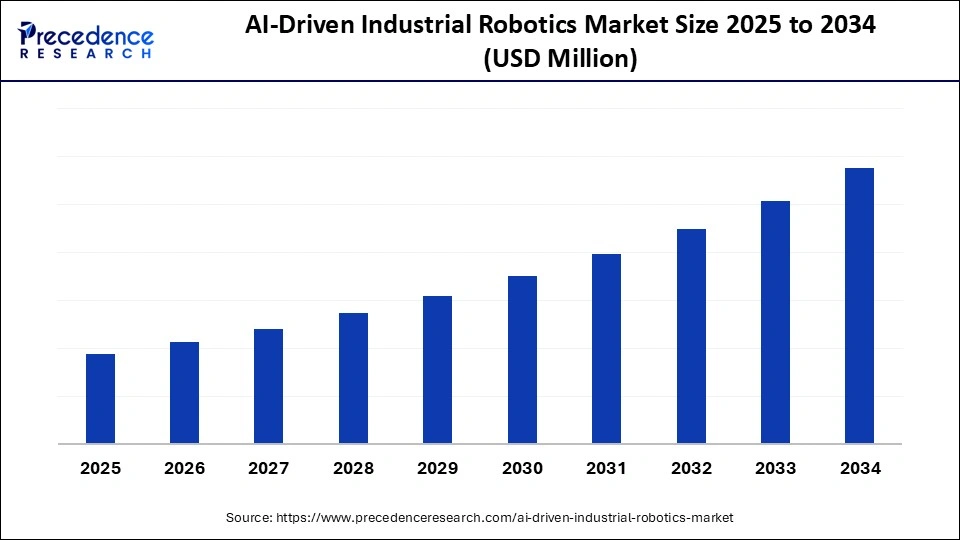

The global AI-driven industrial robotics market size is calculated at USD 8.98 billion in 2025 and is predicted to increase from USD 8.98 billion in 2026 to approximately USD 49.11 billion by 2034, expanding at a CAGR of 20.77% from 2025 to 2034. The market growth is driven by the increasing need for automation in various industrial processes, the evolution of AI technologies, and strategic partnerships between leading players to develop AI-powered robotics and its commercialization.

AI-Driven Industrial Robotics Market Key Takeaways

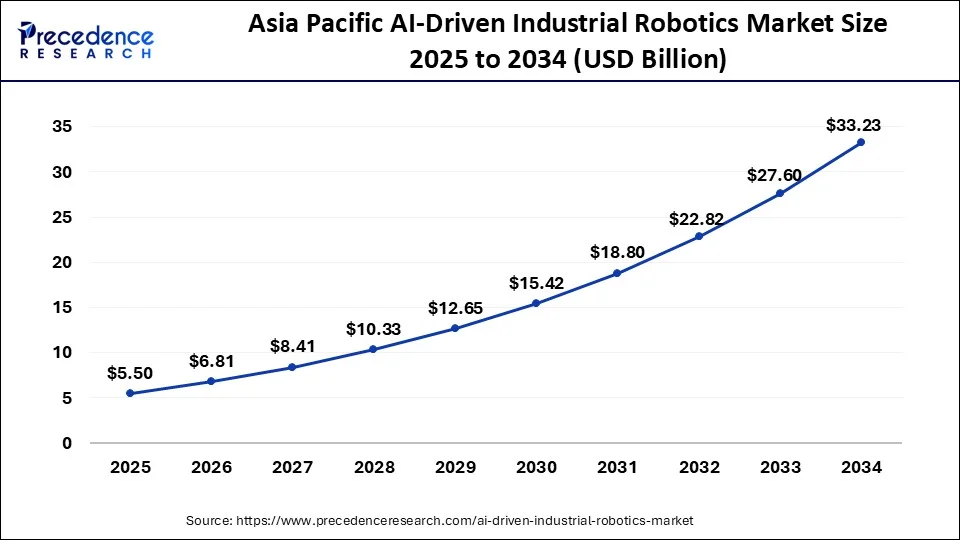

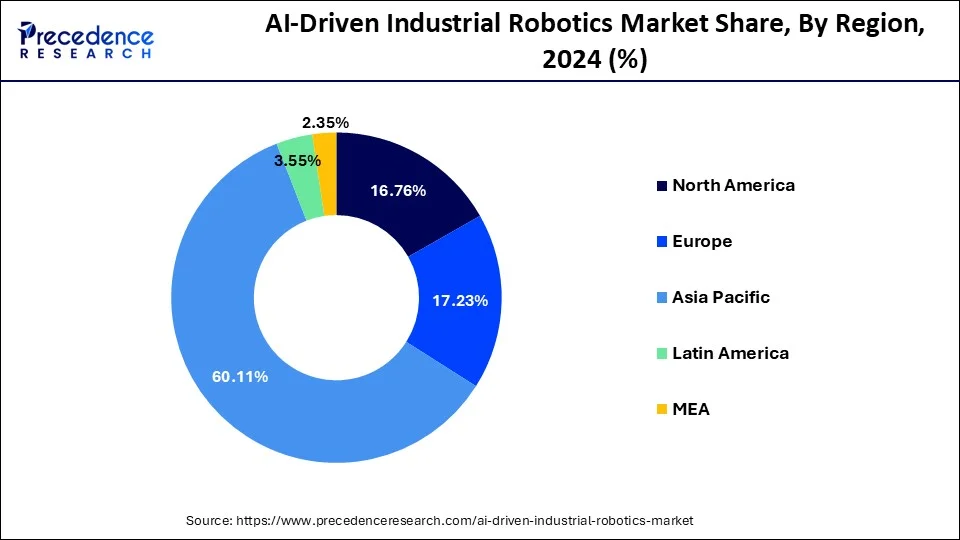

- Asia Pacific held the largest market share of around 60.11% in 2024.

- North America is expected to experience the fastest growth in the market during the forecast period of 2025 to 2034.

- By robot type, the articulated robots segment led the market with a 53% share in 2024.

- By robot type, the collaborative robots (Cobots) segment is expected to grow at the fastest CAGR during the foreseeable period.

- By technology, the machine learning & deep learning segment held around 32% share of the market in 2024.

- By technology, the computer vision & imaging segment is expected to expand at the fastest CAGR over the projection period.

- By application, the assembly & material handling segment held the largest market share of nearly 32% in 2024.

- By application, the quality inspection & vision systems segment is expected to grow at the fastest rate during the foreseeable period.

- By end user, the automotive segment held the largest market share of nearly 29% in 2024.

- By end user, the electronics & electrical segment is expected to witness the fastest CAGR during the foreseeable period.

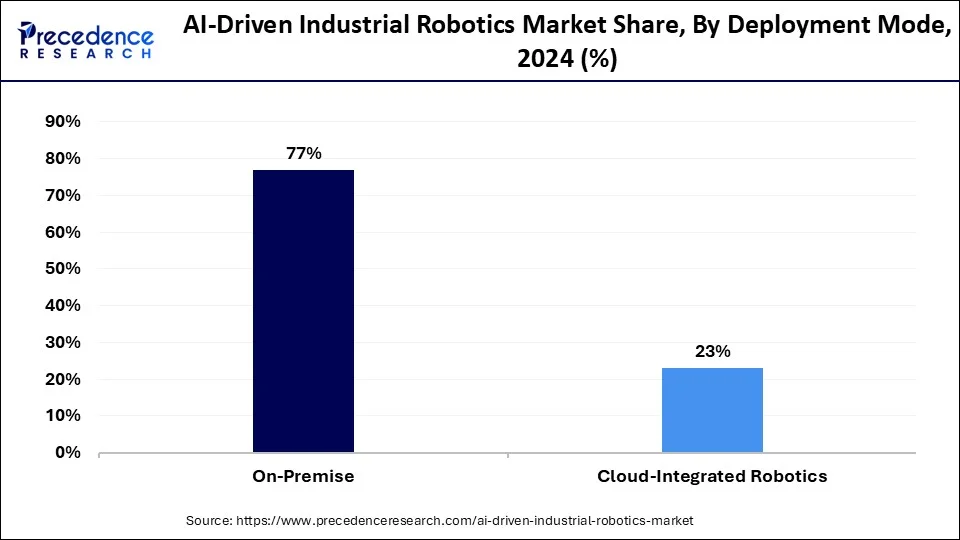

- By deployment mode, the on-premises segment dominated the largest market with a 77% share in 2024.

- By deployment mode, the cloud-integrated robotics segment is expected to expand at the highest CAGR during the forecast period.

Whatis AI-Driven Industrial Robotics?

AI-Driven Industrial Robotics refers to the integration of artificial intelligence (AI) technologies with industrial robots to enhance their autonomy, adaptability, and efficiency in manufacturing and production environments. The AI-driven industrial robotics market refers to the sector focused on industrial robots integrated with artificial intelligence (AI) to enable autonomous decision-making, adaptive control, and predictive maintenance across manufacturing operations. These robots leverage machine learning, computer vision, sensor fusion, natural language processing, and real-time data analytics to enhance operational efficiency, precision, and safety.

They are deployed in applications including assembly, material handling, welding, quality inspection, packaging, logistics, and painting. AI capabilities allow robots to adapt to dynamic production environments, optimize workflows, and reduce downtime. The market is experiencing significant growth, driven by Industry 4.0 adoption, labour cost reduction, rising demand for automation in manufacturing, and advancements in AI and robotics technology globally.

AI-Driven Industrial Robotics Market Outlook

- Market Growth Overview: The market is poised for rapid growth between 2025 and 2034, driven by increasing demand for automation, operational efficiency, and precision across various manufacturing sectors. The rising adoption of Industry 4.0 frameworks and smart factories is further accelerating the integration of AI-powered robots for tasks such as assembly, quality inspection, predictive maintenance, and human-robot collaboration. Additionally, escalating labor costs and the need for improved workplace safety are driving manufacturers to invest in intelligent automation solutions.

- Global Expansion: There is a potential for market expansion in emerging economies where industrial automation is rapidly being adopted to enhance productivity and reduce labor costs. Additionally, expanding into diverse geographic regions allows companies to tap into varying industry demands, regulatory environments, and technological infrastructures, driving broader market penetration and revenue growth. China holds significant potential due to its rich heritage of technological adoption and significant investments, along with initiatives like” Made in China 2025.”

- Major Investors: Leading players, including NVIDIA, Alphabet, Amazon, and Microsoft, are heavily investing in developing technologies that support AI-powered robotics. Nvidia is at the forefront with initiatives like GROOT, focused on embodied AI. While Intel is also actively working by investing in startups like Field AI through its venture capital arm, Intel Capital.

- Startup Ecosystem: Startups like GreyOrange from India and NEURA Robotics from Germany are leading players in the emerging global AI-driven industrial robotics market. They are pioneers in AI-based warehouse automation, utilizing intelligent robotic systems for tasks such as picking and sorting, as well as handling objects in unstructured environments.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 49.11 Billion |

| Market Size in 2026 | USD 10.98 Billion |

| Market Size in 2025 | USD 8.98 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 20.77% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Robot Type, Technology / AI Integration, Application, End User / Industry Vertical, Deployment Mode, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Restraint

Integration Issues

Despite several benefits and explosive applications across various sectors, the adoption of AI-driven industrial robotics is limited due to several factors, including integration issues resulting from its complex and resource-intensive nature, which create compatibility problems. Many manufacturers are heavily dependent on legacy systems, which are not designed to integrate with modern AI and robotic systems. Additionally, performance is largely dependent on clean data, and many organizations have suffered from fragile and incomplete data, creating a significant barrier to their seamless adoption.

Opportunity

Robot-as-a Service

The AI-driven industrial robotics market holds potential to offer services based on robotics technology with AI support. This model presents significant opportunities for SMEs to play a crucial role in the market and offer cost-effective solutions across various sectors, without requiring substantial upfront costs. Additionally, human-robot collaboration presents a significant opportunity for the AI-driven industrial robotics market. By interacting with their environment, robots can learn over time to navigate through challenging tasks and move beyond traditional automation methods. Advanced AI with digital processing is enabling the development of highly sophisticated humanoid robots that can perform industrial tasks as well.

Segment Insights

Robot Type Insights

What Made Articulated Robots the Dominant Segment in the Market in 2024?

The articulated robots segment dominated the AI-driven industrial robots market while holding the largest market share of nearly 53% in 2024. This is mainly due to their versatile capabilities, including the ability to perform complex tasks like humans through various rotary joints, as well as their widespread use in industries such as electronics, automotive, and pharmaceuticals. The integration of AI enhances real-time adjustments and automation in complex processes. This makes articulated robots a highly preferred choice in assembly, welding and, equipment handling.

The collaborative robots segment is expected to grow at the fastest CAGR during the foreseeable period. The segment growth is attributed to the capabilities of cobots to handle complex tasks similar to humans for various businesses. They offer cost-effective solutions that replace human labor, are highly flexible, and provide a high return on investment, which was previously unavailable.

AI-Driven Industrial Robotics Market By Robot Type, 2021-2024 (USD Million)

| By Robot Type | 2021 | 2022 | 2023 | 2024 |

| Articulated Robots | 1,718.14 | 2,260.89 | 2,985.38 | 3,881.16 |

| SCARA Robots | 531.10 | 696.56 | 915.83 | 1,185.06 |

| Delta Robots | 202.96 | 265.71 | 348.66 | 450.13 |

| Cartesian/Gantry Robots | 264.81 | 344.42 | 449.16 | 576.28 |

| Collaborative Robots (Cobots) | 352.46 | 480.35 | 656.66 | 882.54 |

| Others | 151.82 | 205.80 | 280.08 | 375.06 |

Technology Insights

How Does the Machine Learning & Deep Learning Segment Dominate the Market in 2024?

The machine learning & deep learning segment dominated the AI-driven industrial robotics market with about 32% share in 2024. This is mainly due to its ability to enable robots to learn from data, recognize patterns, and make autonomous decisions, significantly enhancing operational efficiency and adaptability. Machine learning & deep learning support tasks that are inherently complex with greater efficiency and precision. These technologies enable advanced applications, including predictive maintenance, real-time quality control, and dynamic path planning, making them indispensable for modern industrial automation across various sectors.

The computer vision & imaging segment is expected to expand at the fastest CAGR during the foreseeable period. The growth of the segment is attributed to the fact that vision-guided robots can operate with human-like perception, enabling a new level of automation with precision. Robots have already moved beyond traditional settings, thanks to AI-based systems, which give them the ability to navigate through dynamic and unpredictable surroundings. This technology enhances robotic precision and efficiency, reducing errors and downtime, which is crucial for industries that demand stringent quality standards and complex assembly processes.

AI-Driven Industrial Robotics Market By Technology, 2021-2024 (USD Million)

| By Technology | 2021 | 2022 | 2023 | 2024 |

| Machine Learning & Deep Learning | 947.50 | 1,288.58 | 1,759.47 | 2,364.36 |

| Computer Vision & Imaging | 1,248.68 | 1,632.90 | 2,137.24 | 2,750.24 |

| Natural Language Processing (NLP) | 109.16 | 140.02 | 180.75 | 230.08 |

| Predictive Analytics & Maintenance | 341.59 | 444.12 | 581.65 | 750.65 |

| Sensor Fusion & IoT Connectivity | 451.20 | 592.26 | 778.69 | 1,007.53 |

| Other Technologies | 123.15 | 155.86 | 197.96 | 247.37 |

Application Insights

Why Did the Assembly & Material Handling Segment Lead the AI-Driven Industrial Robotics Market?

The assembly & material handling segment led the market with the largest share of nearly 32% in 2024. The reason behind the segment's dominance includes the increasing need for automation solutions that can perform repetitive, high-volume tasks. AI vision systems can easily detect material flaws related to their dimensions and alignment, resulting in highly efficient real-time operation. Additionally, AI can operate 24/7, unlike humans, which leads to cost-effective working in industrial areas.

The quality inspection & vision systems segment is expected to grow at the fastest rate during the projection period. The segment's growth is attributed to the ability of AI to address fundamental issues with accuracy, leading to better quality inspections in a fraction of the time and at a higher speed. Early detection of defects in the production process further mitigates diversions such as scrap prices and material waste rates, while ensuring a high-quality product as well.

AI-Driven Industrial Robotics Market By Application, 2021-2024 (USD Million)

| By Application | 2021 | 2022 | 2023 | 2024 |

| Assembly & Material Packaging | 1,082.15 | 1,408.56 | 1,841.06 | 2,369.91 |

| Welding & Machining | 552.26 | 702.00 | 895.97 | 1,126.14 |

| Packaging & Palletizing | 350.24 | 460.73 | 608.11 | 789.82 |

| Quality Inspection & Vision Systems | 500.27 | 682.38 | 932.93 | 1,254.43 |

| Logistics & Warehousing | 507.80 | 704.74 | 976.50 | 1,327.25 |

| Painting & Coating | 152.96 | 197.68 | 255.11 | 322.84 |

| Other Applications | 75.63 | 97.63 | 126.09 | 159.84 |

End User Insights

Why Did the Automotive Segment Hold the Largest Market Share in 2024?

The automotive segment held approximately 29% share of the AI-driven industrial robotics market in 2024. This is primarily due to increased production volumes, manufacturing processes utilizing intricate technologies, and a focus on precision and quality in the automotive sector. Automotive companies are increasingly investing in AI-based technologies by recognizing their potential and utility for tasks like assembly, welding, QC, and material handling, making it an ideal choice for the automotive sector.

The electronics & electrical segment is expected to expand at the highest CAGR during the forecast period. This is primarily due to the sector's heightened need for precision, speed, and automation in manufacturing processes such as component assembly, testing, and quality control. A rapid shift toward automation, coupled with labor shortages and a lack of skilled professionals, is a leading reason behind the segment's growth.

AI-Driven Industrial Robotics Market By End User, 2021-2024 (USD Million)

| By End User | 2021 | 2022 | 2023 | 2024 |

| Automotive | 1,007.10 | 1,297.44 | 1,677.59 | 2,134.89 |

| Electronics & Electrical | 787.98 | 1,073.66 | 1,462.59 | 1,957.04 |

| Metal & Machinery | 489.98 | 637.05 | 830.44 | 1,065.27 |

| Food & Beverage | 318.11 | 427.74 | 577.70 | 769.11 |

| Pharamceuticals & Healthcare | 195.05 | 266.89 | 366.20 | 493.95 |

| Consumer Goods | 191.73 | 250.75 | 329.63 | 426.82 |

| Other End Users | 231.35 | 300.18 | 391.62 | 503.14 |

Deployment Mode Insights

Why Did the On-Premises Segment Dominate the AI-Driven Industrial Robotics Market?

The on-premises segment held the largest market share of nearly 77% in 2024 because it offers organizations greater control over data security, customization, and integration with existing manufacturing systems. On-premises deployment offers superior data security and privacy, ensuring compliance in sectors such as manufacturing and healthcare, which involve the transmission of sensitive data. On-site infrastructure provides instant data processing, which is ideal for rapid analysis and quick responses to mitigate ongoing challenges at working platforms.

The cloud-integrated robotics segment is expected to grow at the fastest CAGR during the foreseeable period. The segment's growth is attributed to its high computational power, intelligent data sharing, and increased scalability and flexibility through cloud deployment for AI-driven robotics. Robots can upload whole data to the cloud for training sophisticated models like ML and then download newly approved algorithms with accuracy.

AI-Driven Industrial Robotics Market By Deployment Mode, 2021-2024 (USD Million)

| By Deployment Mode | 2021 | 2022 | 2023 | 2024 |

| On-Premise | 2,561.69 | 3,345.46 | 4,383.76 | 5,654.09 |

| Cloud-Integrated Robotics | 659.61 | 908.27 | 1,252.01 | 1,696.14 |

Regional Insights

What is the Asia Pacific AI-Driven Industrial Robotics Market size?

The Asia Pacific AI-driven industrial robotics market size is evaluated at USD 5.50 billion in 2025 and is predicted to be worth USD 33.23 billion by 2034, at a CAGR of 22.13% between 2025 to 2034.

What Made Asia Pacific the Dominant Region in the AI-Driven Industrial Robotics Market?

Asia Pacific registered dominance in the market by capturing a 60.11% share in 2024. The region's market dominance is attributed to the substantial funding by governments of various Asian countries and initiatives like China's “Made in China.” Substantial investment in automation and manufacturing, a huge consumer base from the automotive and electronics sectors, along with high robot adoption, have further supported market growth in emerging economies like Japan and South Korea, which aim to mitigate labor costs.

The region's robust manufacturing base, rapid industrialization, and significant investments in automation technologies across key economies, such as China, Japan, and South Korea, ensure the long-term growth of the market. Additionally, government initiatives promoting Industry 4.0, coupled with a large skilled workforce and increasing demand for cost-efficient production, have accelerated the adoption of AI-powered robotics, driving substantial market growth in the region.

Country-Level Investments/Funding Trends for the AI-Driven Industrial Robotics Market

- China: China has substantially invested in the AI industry, with an investment fund of $8.2 billion, while the private sector has invested nearly $119.3 billion in AI development. China also installed approximately 300,000 robots in factories.

- India: The Indian government has invested nearly $11.1 billion through initiatives such as the National Program on Artificial Intelligence and the India AI Mission.

- U.S.: The U.S. government has invested nearly $470.9 billion in 2025 for its AI programs, supporting market growth through initiatives like the ARM Institute, which aims to establish technologies such as Generative AI and semiconductors.

What Factors Support the Growth of the AI-Driven Industrial Robotics Market in North America?

North America is expected to witness the fastest growth during the foreseeable period of 2025-2034. This is primarily due to a convergence of technological innovations, economic changes, and the increasing focus of leading players on developing innovative robots. There is a shortage of skilled labor, which translates into increasing labor costs, boosting the adoption of robots. Companies like Amazon have been heavily investing in AI-powered robots that can handle sorting, picking, and packing, which significantly reduces labor costs. Additionally, the presence of major market players supports the growth of the regional market.

Value Chain Analysis of the AI-Driven Industrial Robotics Market

Research & Development

This is the foundational stage where basic requirements for AI-powered robotics are studied to introduce the next generation of AI and robotics evolution, which includes AI algorithms and advanced sensory systems.

- Key players: Nvidia, Google DeepMind, and Boston Dynamics.

Component manufacturing and AI software development

This stage focuses on building physical hardware that supports scalable, AI-based software for intelligent robotics and operating systems.

- Key players: GreyOrange, LandingAI, ABB, Intel, and FANUC

End-Use

The stage involves the purchase and implementation of AI-driven industrial robotics by various sectors to automate their work processes for improved efficiency and enhanced productivity.

- Key players: BMW, Tesla, Amazon, Alibaba, and Foxconn.

AI-Driven Industrial Robotics Market Companies

Tier I – Major Players

These companies are the core drivers of the AI-driven industrial robotics market. They possess large-scale capabilities in AI, automation, and robotics integration, often leading in innovation, deployment scale, and global influence. Their extensive R&D pipelines, AI accelerator platforms, and embedded automation technologies allow them to dominate high-volume industrial applications.

- Fanuc Corporation

- ABB Ltd.

- Yaskawa Electric Corporation

- Siemens AG

- Mitsubishi Electric Corporation

Tier II – Mid-Level Contributors

These companies have strong, well-established positions in industrial automation and robotics, often specializing in segment-specific solutions. While they may not have the global dominance of Tier I players, they contribute significantly through vertical-specific expertise, integration of AI into legacy automation, and steady expansion into AI-capable systems.

- KUKA AG

- Rockwell Automation, Inc.

- Kawasaki Heavy Industries, Ltd.

- Denso Corporation

- Universal Robots (Teradyne Inc.)

Tier III – Niche and Regional Players

This tier comprises smaller, emerging, or regionally focused firms. These companies typically specialize in collaborative robotics (cobots), AI-enhanced control systems, vision-guided robotics, or embedded intelligence for specific industries like logistics, healthcare, or electronics. While their individual contributions are modest, they play a vital role in innovation and market diversity.

- Omron Adept Technologies, Inc.

- Kinova Robotics

- GreyOrange

- CloudMinds

- Neura Robotics

- Other regional OEMs and AI robotics startups

Recent Developments

- In September 2025, ABB Robotics introduced its revolutionary product, RobotStudio, with an AI assistant. It is an easy-to-use Generative AI interface that facilitates easier operations with high-level productivity.(Source: https://www.abb.com)

- In April 2025, Accenture and Schaeffler AG are collaborating to reinvent industrial automation through physical AI and Robotics. The companies are showcasing different work scenarios with the latest simulation and data technologies from NVIDIA and Microsoft.(Source: https://newsroom.accenture.com)

Segments Covered in the Report

By Robot Type

- Articulated Robots

- 4-axis

- 6-axis

- 7-axis

- SCARA Robots

- Delta Robots

- Cartesian / Gantry Robots

- Collaborative Robots (Cobots)

- Single-arm

- Dual-arm

- Others

By Technology / AI Integration

- Machine Learning & Deep Learning

- Supervised Learning

- Unsupervised Learning

- Computer Vision & Imaging

- 2D Vision

- 3D Vision

- Natural Language Processing (NLP)

- Predictive Analytics & Maintenance

- Sensor Fusion & IoT Connectivity

- Others

By Application

- Assembly & Material Handling

- Pick & Place

- Kitting

- Welding & Machining

- Arc Welding

- Laser Welding

- Packaging & Palletizing

- Quality Inspection & Vision Systems

- Surface Inspection

- Dimensional Measurement

- Logistics & Warehousing

- Automated Guided Vehicles (AGVs)

- Autonomous Mobile Robots (AMRs)

- Painting & Coating

- Others

By End User / Industry Vertical

- Automotive

- Electronics & Electrical

- Metal & Machinery

- Food & Beverage

- Pharmaceuticals & Healthcare

- Consumer Goods

- Logistics & Warehousing

- Others

By Deployment Mode

- On-Premises

- Cloud-Integrated Robotics

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting