What is the Air Compressor Condensate Separators Market Size?

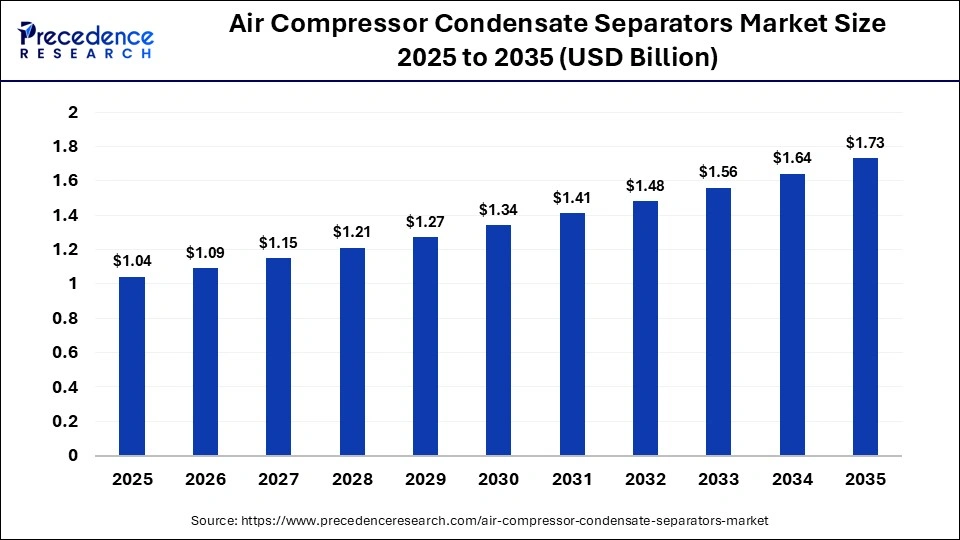

The global air compressor condensate separators market size was calculated at USD 1.04 billion in 2025 and is predicted to increase from USD 1.09 billion in 2026 to approximately USD 1.73 billion by 2035, expanding at a CAGR of 5.2% from 2026 to 2035.The market growth is attributed to stricter air-purity regulations, rising industrial automation, and increased adoption of energy-efficient compressed air systems across manufacturing sectors.

Market Highlights

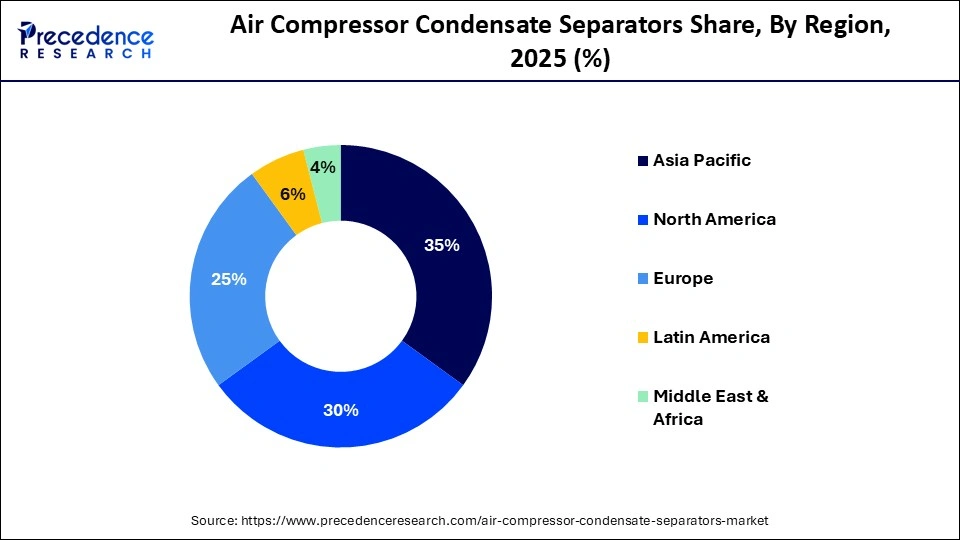

- Asia Pacific held a dominant revenue share of 35% in the market in 2025 and is expected to sustain its position in the upcoming period.

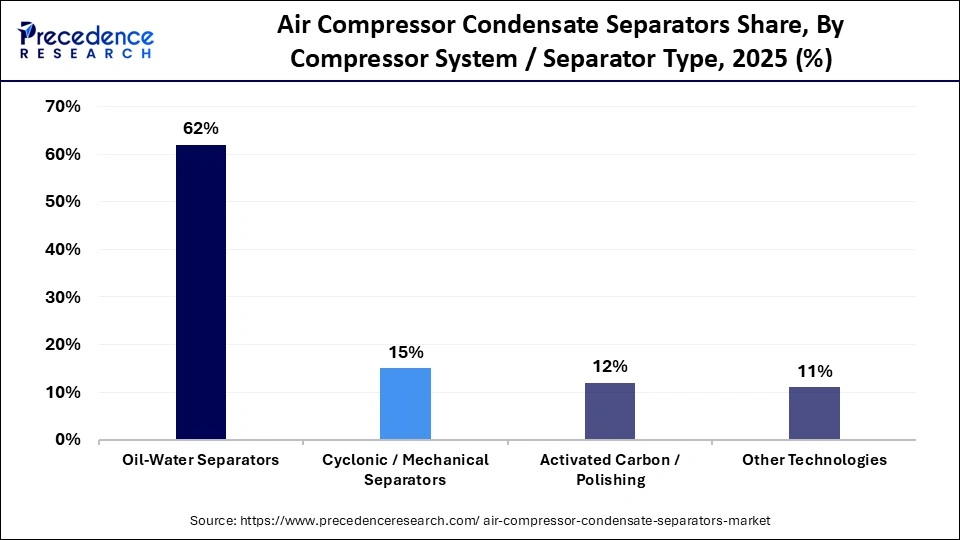

- By compressor system/separator type, the oil-water separators segment contributed the highest air compressor condensate separators market share of approximately 62% in 2025.

- By compressor system/separator type, the activated carbon/polishing segment is expected to grow at a strong CAGR of approximately 4.9% between 2026 and 2035.

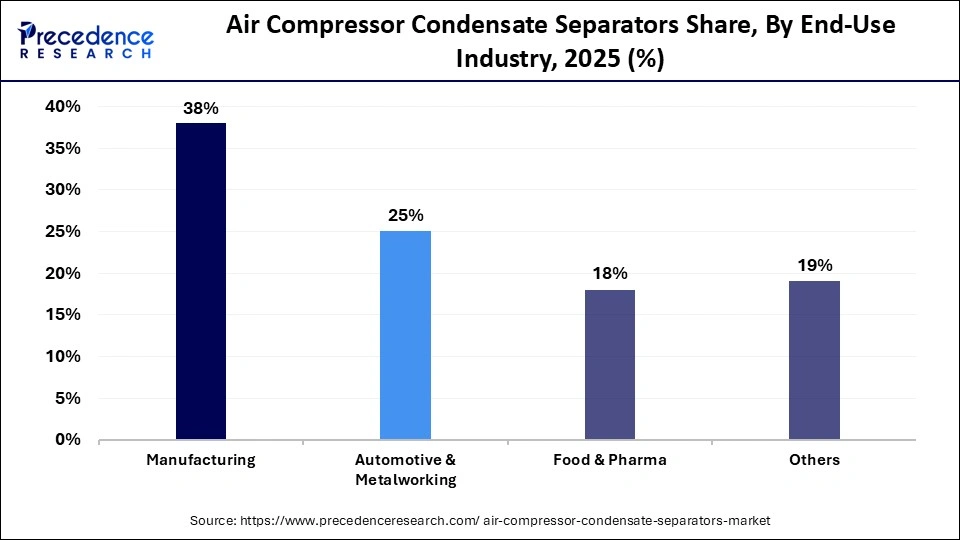

- By end-use industry, the manufacturing segment held a major market share of 38% in 2025.

- By end-use industry, the food & pharma segment is expected to expand at the fastest CAGR of approximately 5.1% from 2026 to 2035.

Market Overview

The air compressor condensate separators market is fuelled by the strict environmental discharge laws. Regulators such as the U.S. EPA limit oil in wastewater to no more than 40 ppm to prevent water contamination and avoid fines. The air compressor condensate separators involve systems that remove condensate water, oil, and solid contaminants from compressed air before discharge or reuse. Furthermore, the ISO 14001 certification encourages the use of condensate treatment systems in order to minimize the environmental impact.

Air Compressor Condensate Separators Market Growth Factors

- Rising Compressor Fleet Density: Expanding industrial compressor installations are fuelling higher condensate volumes, boosting separator demand at the plant level.

- Growing Emphasis on Zero-Loss Drainage: Increased focus on air efficiency is propelling the adoption of separators integrated with zero-loss condensate drains.

- Shift Toward High-Pressure Air Systems: Deployment of high-pressure compressors is boosting the need for advanced condensate handling to manage higher contaminant loads.

- Expansion of Continuous-Operation Facilities: 24/7 production environments are driving investments in reliable separators to prevent unplanned shutdowns.

Global Trade and Technology Landscape of the Air Compressor Condensate Separators Market

- China is the world's largest manufacturing base for air compressor condensate separators, accounting for an estimated 30 35% of global unit production between 2024 and 2026, supported by large-scale OEM manufacturing clusters and integrated compressed-air system assembly lines.

- According to Volza's Global Export Data, the world exported 42,847 oil separator shipments between Jun 2024 and May 2025 (TTM) through 6,708 verified exporters and 8,367 buyers, marking a 19% YoY change.

- The U.S. is a major exporter of oil, water, and related separator technologies, accounting for about 1,059 export shipments, reflecting strong industrial output and technology deployment.

- The U.S. leads in condensate separator technology filings, with multiple U.S. patent families, including, e.g., US20140301873A1/US9664185B2 on condensate separator devices for compressed air systems filed in the U.S. patent system through the period since 2012 2014.

Impact of AI on the Air Compressor Condensate Separators Market

Artificial intelligence (AI) is transforming operations and decision-making within industrial compressed air systems by optimizing condensate management processes. The manufacturers rely on AI-based predictive analytics to track the performance of compressors. Machine learning uses real-time sensor measurements to adjust the efficiency of the separators in real-time. This makes it in line with the environmental requirements of the U.S. EPA oil discharge limit of 40 ppm and ISO 8573 1 air purity requirements. Moreover, the AI accelerates the deployment of advanced coalescing and oil-water separation technologies by providing data-driven insights.

Atlas Corpo's SMARTLINK is an AI-driven cloud-based monitoring system that analyses data from over 250,000 machines and runs big data through AI models to generate prescriptive recommendations for customers. It can provide information on optimizing the performance of individual machines or compressor rooms.

Air Compressor Condensate Separators Market Trends

- Connected & IoT-Enabled Condensate Systems Accelerate Adoption:The use of condensate separators is increasingly influenced by smart compressed air systems that have real-time monitoring and predictive maintenance. Major OEMs are also integrating IoT sensors with separators to minimize unplanned downtimes to achieve energy management objectives. This trend reflects a broader shift toward fully connected manufacturing ecosystems that emphasize uptime, compliance, and data-driven decision-making.

- Sustainability & Energy Efficiency Become Core Procurement Drivers:Sustainability protocols and energy efficiency benchmarks are increasingly influencing condensate separator design and deployment. Compressed air systems account for a large share of plant electricity use, so energy consumption and heat recovery practices factor into equipment selection. Sustainability objectives are facilitated by the incorporation of intelligent drains, media with low-pressure drop, and systems that are in line with ISO 50001 energy management processes. Companies increasingly prefer equipment that can show a quantifiable increase in energy performance and resource utilization as companies improve their ESG reports.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.04 Billion |

| Market Size in 2026 | USD 1.09 Billion |

| Market Size by 2035 | USD 1.73 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.2% |

| Dominating Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Compressor System/Separator Type, End-Use Industry, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Compressor System/Separator Type Insights

Why Did the Oil-Water Separators Segment Dominate the Market?

The oil-water separators segment dominated the air compressor condensate separators market in 2025, accounting for approximately 62% market share. These units removed the bulk of the oil and hydrocarbons as condensate. This allows facilities to attain ultra-low discharged oil content that meets strict international standards.

Contemporary separators can remove oil down to 5 ppm, which is well below regulatory levels in numerous jurisdictions. In automotive, electronics, pharmaceutical, and food industries, operators prefer oil-water separators. They prevent environmental contamination and fines associated with improper discharge as stipulated by regional laws, boosting the segment's growth.

The activated carbon/polishing segment is expected to grow at the fastest CAGR of approximately 4.9% in the coming years, owing to the growing demands of ultra-clean condensates in specialized areas and developing standards.

Activated carbon filters eliminate the small traces of hydrocarbons and adsorbable organic compounds that cannot be captured by oil-water separators alone. Furthermore, the continued tightening of regulatory benchmarks for discharge and compressed air purity facilitates the demand for activated carbon/polishing air compressor condensate separators.

End-Use Industry Insights

How the Manufacturing Segment Dominated the Market?

The manufacturing segment held the largest revenue share of approximately 38% in the air compressor condensate separators market in 2025, due to the wide usage of compressed air systems across production facilities. The industry of manufacturing utilizes a large amount of compressed air for tools, automation, and material handling.

The automotive, electronics, and heavy fabrication industries are some of the sectors where air compressor condensate separators are being heavily used. ISO 85731 defines compressed air purity classes that limit oil content to ≤0.01 mg/m for the highest quality air and ≤0.1 mg/m for precision operations, making condensate separation essential. Additionally, increased automation improvements in Asia-Pacific, Europe, and North America are boosting long-term investment in high-performance condensate solutions.

The food & pharma segment is expected to grow at the fastest CAGR of approximately 5.1% in the coming years, owing to the need to use ultra-clean compressed air to ensure product safety and regulation. These industries frequently prefer ISO 8573-1 air purity grades with oil limits as low as 0.01 mg/m3 or limits even lower in case of high sensitivity, creating demand for condensate separators. Moreover, the expansion of food and drug manufacturing infrastructure in North America and the Asia-Pacific is likely to heighten demand for condensate treatment solutions.

Regional Insights

What is the Asia Pacific Air Compressor Condensate Separators Market Size?

The Asia Pacific Air Compressor Condensate Separators market size is expected to be worth USD 614.15 million by 2035, increasing from USD 364.00 million by 2025, growing at a CAGR of 5.37% from 2026 to 2035.

Which Factors Drive Asia-Pacific in the Air Compressor Condensate Separators Market?

Asia Pacific held a dominant revenue share of approximately 35% in the market in 2025 and is expected to sustain its position in the upcoming period with a CAGR of 6.0%, due to rapid industrialization and manufacturing expansion. China, India, Japan, and the countries of Southeast Asia are the ones that depend on compressed air systems to automate, handle materials, and produce with precision. Robotics, production lines, and CNC machines are supported using clean, dry compressed air.

Such systems rely on a strong condensate separation so as to prevent downtime and quality problems. The International Federation of Robotics forecasted that by 2023, approximately 70% of all installations of industrial robots in the world would be in Asia-Pacific. This increases the pressure on the high quality of the compressed air. Furthermore, the food processing and pharmaceutical industries in the Asia-Pacific are also emerging as dynamic growth segments for condensate management systems, driven by rising safety and hygiene expectations.

China Asia-Pacific Air Compressor Condensate Separators Market

China is leading the charge in the region, driven by rapid industrial modernization and intelligent manufacturing. Compressed air is used in factories to automate and robotize processes and bring precision in production. Condensate separators ensure that oil and water do not get into the air networks.

This eliminates the wear on actuators, valves, and other sensitive parts. Additionally, top OEMs like Atlas Copco, Kaeser-Kompressoren, Ingersoll Rand, BEKO Technologies, and Elgi Equipment increased their installations in China to cater to the rising industrial demands, facilitating the market in this region.

Will North America Grow in the Air Compressor Condensate Separators Market?

North America is expected to grow at a notable CAGR in the market during the forecast period, owing to the rigid environmental compliance policies and sophisticated industrial infrastructure, which require controlled condensate treatment.

Compressed air systems commonly used in industries typically produce condensate, which contains a lot of oil that, when released to the environment, may exceed U.S. EPA wastewater discharge limits, often set at 40 ppm oil content, leading to regulatory measures and fines. Additionally, manufacturers in these regions are increasingly installing high-efficiency oil-water separators at both point-of-use and centralized compressor rooms, further boosting the market growth in the coming years.

U.S. Accelerating Growth of the North American Region

U.S. leads the region, driven by growing laws and regulations regarding the use of certified condensate separators. CAGI-guided guidance and ISO-based compressed air quality models strengthen the best practices in condensate management as a part of the overall system efficiency. Moreover, stricter regulations and increased expectations on the quality of compressed air among various companies are expected to propel the market in this region.

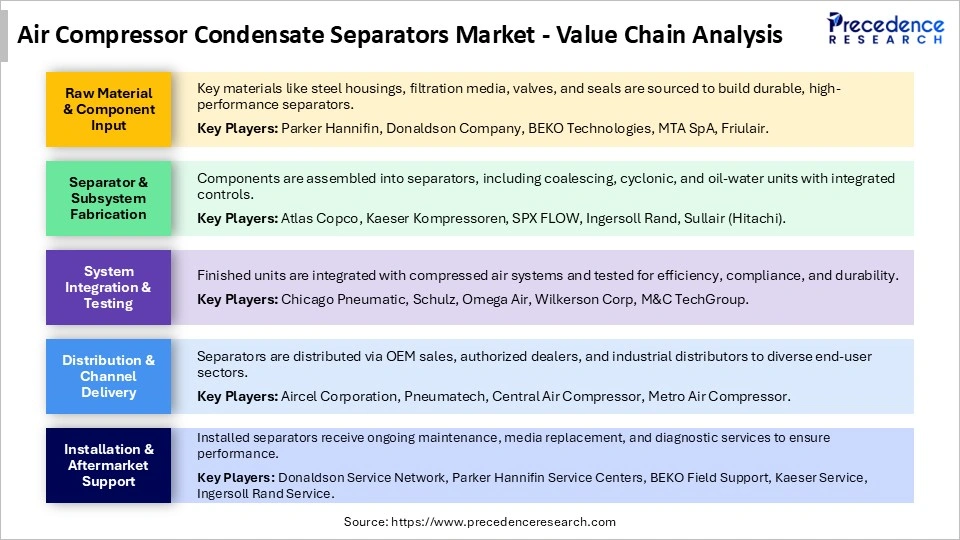

Air Compressor Condensate Separators Market Value Chain Analysis

Who are the Major Players in the Global Air Compressor Condensate Separators Market?

The major players in the air compressor condensate separators market include Atlas Copco, Kaeser Kompressoren, Parker Hannifin, SPX FLOW, Donaldson Company, Ingersoll Rand, Beko Technologies, Sullair (Hitachi), Alup Kompressoren, Emerson Electric, Pfeiffer Vacuum, Chicago Pneumatic, OMEGA AIR, Schulz, JORC Industrial

Recent Developments

- In January 2026, Ingersoll Rand (India) Ltd. announced the launch of its RSbn Nirvana Series Screw Air Compressors in India, featuring integrated VFD technology and high-efficiency IE5 permanent magnet motors across a 7 kW to 250 kW range to support energy-efficient industrial operations under variable load conditions.(Source: https://equipmenttimes.in)

- In January 2026, Atlas Copco revealed plans to launch the X-Air+ 750-20 portable air compressor in India, targeting water well drilling and mining applications with enhanced fuel efficiency, silent operation, improved mobility, and intelligent monitoring capabilities.(Source: https://www.engmag.in)

- In August 2025, Kaeser Compressors launched Aquamat i.CF, an oil-water separator, that introduces active process control for the first time. The system integrates the new Aquamat Control internal controller, enabling smarter operation, easier maintenance, and cleaner servicing.(Source: https://www.packagingnews.com)

Segments Covered in the Report

By Compressor System/Separator Type

- Oil-Water Separators

- Cyclonic/Mechanical Separators

- Activated Carbon/Polishing

- Other Technologies

By End-Use Industry

- Manufacturing

- Automotive & Metalworking

- Food & Pharma

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting