What is the Aircraft Computers Market Size?

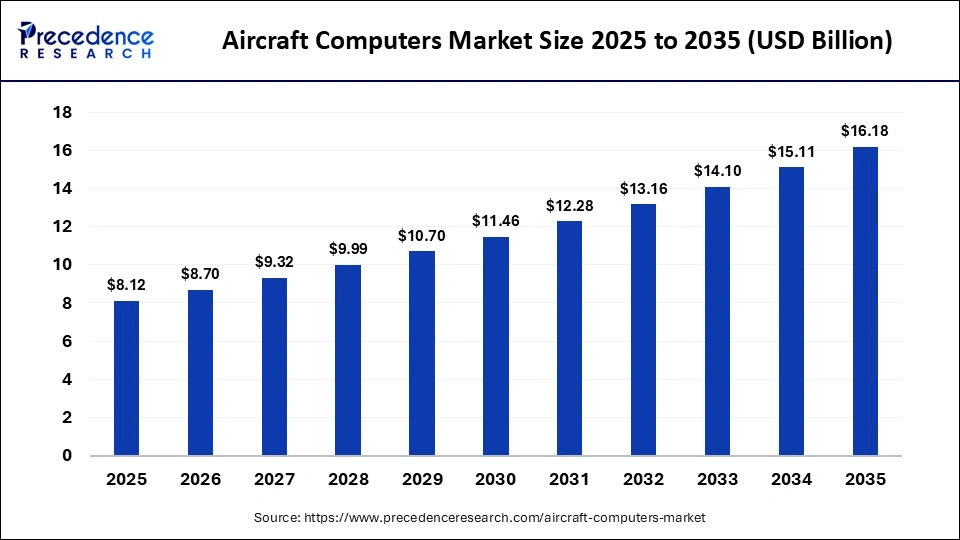

The global aircraft computers market size accounted for USD 8.12 billion in 2025 and is predicted to increase from USD 8.70 billion in 2026 to approximately USD 16.18 billion by 2035, expanding at a CAGR of 7.14% from 2026 to 2035. The market is experiencing a significant growth rate due to the growing technological advancements in the avionics sector and major shift towards increasing focus on enhanced safety features.

Market Highlights

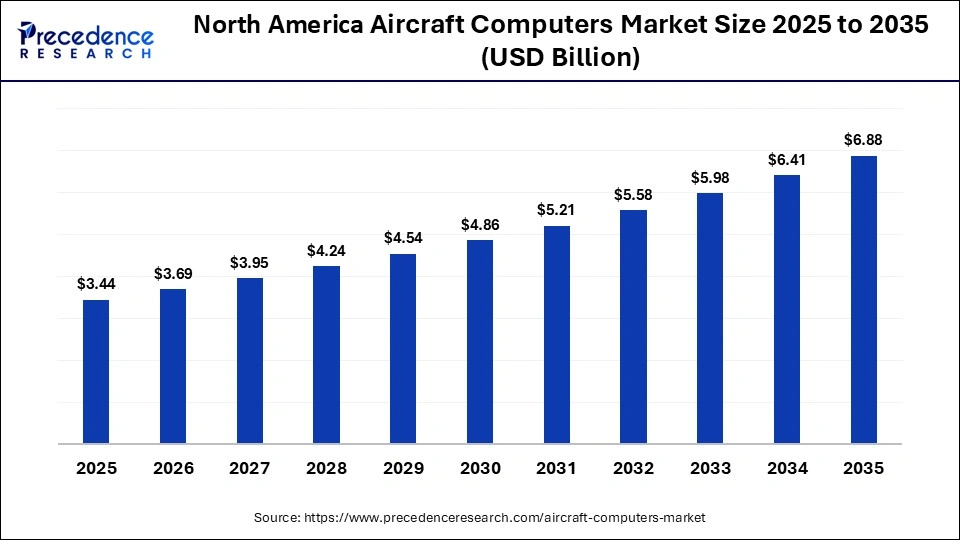

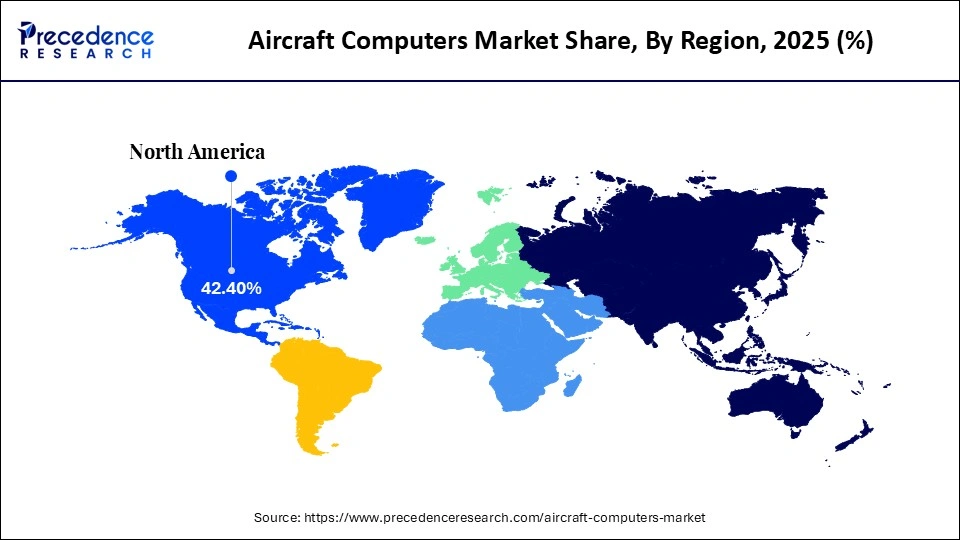

- North America accounted for the largest market share of 42.4% in 2025.

- Asia Pacific is expected to grow at a strong CAGR of 6.5% from 2026 to 2035.

- By type, the flight control computers segment held the major market share of 38.6% in 2025.

- By type, the mission computers segment is growing at a CAGR of 5.5% from 2026 to 2035.

- By platform, the commercial aircraft segment contributed the largest market share of 46.8% in 2025.

- By platform, the UAV segment is projected to grow at the fastest CAGR of 5.8% from 2026 to 2035.

- By function, the navigation & flight control segment held the largest market share of 42.3% in 2025.

- By function, the electronic warfare segment is expanding at a CAGR of 5.6% from 2026 to 2035.

- By end-use, the hardware segment captured the biggest market share of 67.5% in 2025.

- By end-use, the software segment is projected to grow at the fastest CAGR of 6.5% from 2026 to 2035.

Understanding the Aircraft Computers Market: Onboard Processing, Redundancy Architectures, and Certification Requirements

The aircraft computers market comprises onboard computing systems that manage, control, and optimize aircraft operations, including flight control, navigation, engine performance monitoring, mission management, and onboard data handling. These avionics-grade computers operate in safety-critical environments and are designed to meet strict requirements for reliability, redundancy, cybersecurity, and real-time performance. They form the core processing layer that integrates data from sensors, avionics subsystems, and communication networks to support precise decision-making during all phases of flight.

Aircraft computers are widely used in commercial aviation, military aircraft, and unmanned aerial platforms and act as the brain of the aircraft. In commercial aircraft, they support flight management systems, avionics integration, predictive maintenance, and fuel optimization to improve operational efficiency and compliance with aviation safety regulations. In military and defense platforms, these systems enable mission-critical functions such as sensor fusion, electronic warfare management, situational awareness, and secure communications. Unmanned aerial systems rely heavily on advanced onboard computing for autonomous navigation, obstacle avoidance, payload control, and real-time data transmission.

Market adoption is being driven by rapid technology upgrades within the aviation sector, including increased use of automation, software defined avionics, and modular open systems architectures. The growing integration of autonomous and semi-autonomous capabilities is significantly increasing computing requirements, as aircraft must process larger volumes of sensor data with minimal latency. Global defense modernization programs and rising investment in next-generation aircraft platforms are accelerating demand for high-performance, ruggedized computing solutions that can operate under extreme environmental conditions while maintaining regulatory compliance and long-term operational reliability.

AI-Driven Evolution of Aircraft Computing: From Deterministic Processing to Context-Aware Intelligence

The aircraft computers market has long been at the forefront of technological transformation, but the integration of Artificial Intelligence has elevated onboard computing to a new level of operational sophistication. AI is now being embedded directly within avionics-grade computers to support real-time decision-making, adaptive control, and predictive intelligence across flight operations. These capabilities extend beyond aircraft alone, connecting airline operations centers, airports, and air traffic management systems into data-driven ecosystems that improve efficiency, safety, and passenger experience.

Within aircraft computers, AI-powered algorithms are increasingly used for real-time route optimization by continuously analyzing weather patterns, air traffic congestion, turbulence data, and fuel burn models. By processing large volumes of sensor and external data onboard, these systems help pilots and flight management computers dynamically adjust flight paths to minimize fuel consumption, reduce delays, and maintain safety margins. Regulatory acceptance of such decision-support functions is progressing under certification frameworks overseen by authorities such as the Federal Aviation Administration and the European Union Aviation Safety Agency, which require deterministic behavior, explainability, and redundancy in AI-enabled avionics.

Aircraft Computers Market Outlook

- Industry growth overview: The aircraft computers market is significantly expanding due to the combination of factors like the fleet modernization initiative, the surge in UAV manufacturing, and growing spending on defense. The increasing use of UAVs for logistics and surveillance and retrofitting older aircraft is another driving factor of the market's growth.

- Major Investors: The market is consolidated due to the leading players like Honeywell International Inc., Raytheon Technologies, GE aerospace and Thales Group, which are major aerospace and defense corporations and avionics manufacturers. They are highly investing in R&D for innovative products. Honeywell International is a leading provider for a range of aircraft computer systems like flight management, navigation, and engine control systems.

- Startup Ecosystem: The aircraft computers market is witnessing startup growth while focusing on several areas like autonomous systems, flight management, electric propulsion controls, and communication. Startups like Zero Error systems, Klok systems, Beacon AI, Xwing, and Pyka are some of the emerging startups in the aircraft computer markets due to their innovative avionics products and solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.12 Billion |

| Market Size in 2026 | USD 8.70 Billion |

| Market Size by 2035 | USD 16.18 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.14% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Platform, Function, End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Type Insights

Why Do Flight Control Computers Lead the Aircraft Computers Market in 2025?

The flight control computers segment held the largest market share of 38.6% in 2025, reflecting the safety-critical role these systems play in modern aircraft operations. Flight control computers are the core of fly-by-wire architectures, where digital signals replace mechanical linkages to control aircraft surfaces. Continuously processing inputs from pilot controls, sensors, and inertial systems allows these computers to ensure precise control, stability augmentation, and envelope protection under all flight conditions, making them indispensable for both commercial and military aircraft.

The mission computers segment is projected to grow at the fastest CAGR of 5.5% during the forecast period, driven by their expanding role as centralized processing hubs for safety-critical and mission-critical aircraft functions. Mission computers consolidate navigation, flight management, sensor fusion, tactical data processing, and human-machine interface functions into a single, high-performance computing architecture. This centralization reduces system complexity, improves data coherence across subsystems, and enhances pilot situational awareness and decision-making, particularly in high-workload and contested operating environments.

Platform Insights

Why Were Commercial Platforms Popular in the Aircraft Computers Market During 2025?

The commercial aircraft segment held the largest market share of 46.8% in 2025, driven by the scale, frequency, and standardization of commercial aviation programs worldwide. Commercial aircraft platforms benefit from mature, modular avionics and computing architectures that prioritize cost efficiency, high production volumes, and rapid certification compared with bespoke or highly customized systems used in niche applications. Commercial aircraft systems are designed for repeatability and fleet-wide deployment, enabling faster development cycles and smoother integration of incremental technology upgrades. This approach allows manufacturers and airlines to introduce new aircraft variants, retrofit existing fleets, and adopt updated avionics or computing capabilities without extensive redesign or prolonged downtime.

The UAVs segment is projected to grow at the fastest CAGR of 5.8% during the forecasted period between 2026 and 2035 because of growing avionics technology solutions and the expanding range of applications across multiple industries, supported by increasingly favorable regulatory environments. Advancements in battery technology are enabling drones to perform complex, longer-duration missions with minimal human intervention while integrating multiple sensors and onboard intelligence. Expanded regulatory frameworks from authorities such as the Federal Aviation Administration and the European Union Aviation Safety Agency are enabling beyond-visual-line-of-sight operations and wider commercial deployment.

Function Insights

Why Did Navigation & Flight Control Systems Dominate in the Aircraft Computers Market in 2025?

The navigation & flight control segment held the largest market share of 42.3% in 2025. The segment is dominating due to its unmatched offerings like automated flight path systems, accurate flight positioning, and enhanced pilot awareness in complex environments. This is possible by fly-by-wire tech, GPS and IRS integration, and databases to manage flight operations for complex maneuvers.

The electronic warfare segment is projected to grow at the fastest CAGR of 5.6% during the foreseeable period. The segment is expanding as it provides advanced systems for electronic attacks such as jamming and spoofing, along with intelligence gathering, detection systems, and electronic protection to counter adversary threats and ensure aircraft survivability. Increasing integration of electronic warfare functions into centralized mission computers is enabling real-time sensor fusion, faster threat classification, and adaptive countermeasure deployment during contested operations.

End-Use Insights

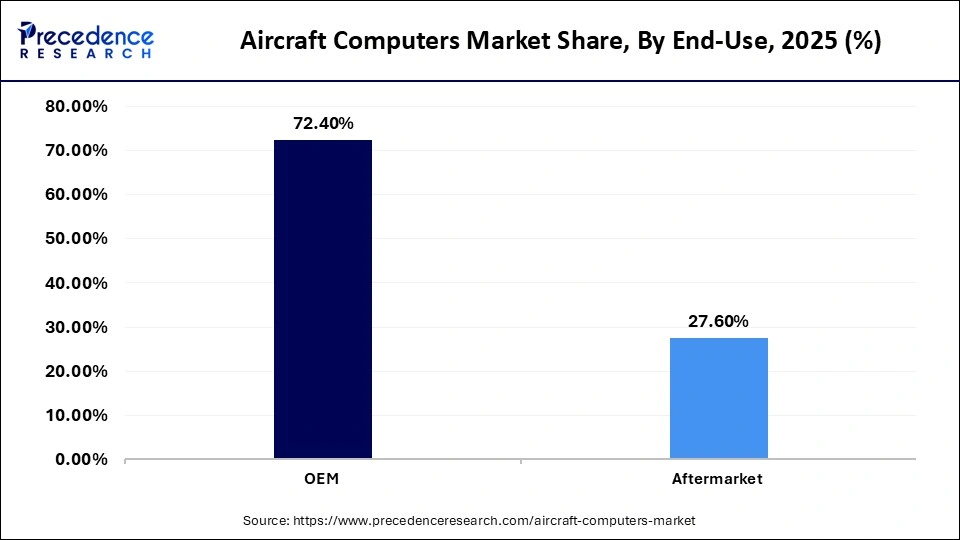

Why Does the OEM Segment Dominate the Aircraft Computers Market in 2025?

The OEM segment held the largest market share of 72.4% in 2025 because aircraft computers are predominantly integrated at the original manufacturing stage, where safety-critical avionics must be designed, certified, and installed as part of the aircraft's baseline configuration. Aircraft computers such as flight control computers, mission computers, and flight management systems are deeply embedded into the aircraft architecture and must meet stringent airworthiness, redundancy, and certification requirements before entry into service. As a result, airlines and defense operators rely heavily on OEM-installed systems rather than aftermarket alternatives, since retrofitting or replacing core onboard computers post-delivery involves high costs, extensive re-certification, and operational downtime.

The aftermarket segment is projected to grow at the fastest CAGR of 5.8% during the foreseeable period, due to rising demand for avionics upgrades, lifecycle extension of aging aircraft fleets, and increasing emphasis on cost-efficient modernization rather than full aircraft replacement. Airlines and defense operators are increasingly retrofitting existing platforms with upgraded flight control computers, mission computers, and data processing systems to meet evolving safety, performance, and regulatory requirements without incurring the high capital costs of new aircraft procurement. This trend is particularly strong in mature fleets where airframes remain structurally viable but onboard computing systems require modernization to support enhanced automation, connectivity, and cybersecurity.

Regional Insights

How Big is the North America Aircraft Computers Market Size?

The North America aircraft computers market size is estimated at USD 3.44 billion in 2025 and is projected to reach approximately USD 6.88 billion by 2035, with a 7.18% CAGR from 2026 to 2035.

What Factors Made North America a Dominant Region in the Aircraft Computers Market?

North America held the largest market share of 42.4% in 2025, driven by its deep-rooted aviation ecosystem, early adoption of advanced avionics technologies, and sustained government and industry investment in air traffic growth and safety. The region leads in the development and large-scale deployment of aircraft computers supporting flight control, navigation, communication, and integrated avionics architectures, underpinned by a strong concentration of aircraft OEMs, avionics suppliers, and certified manufacturing facilities. Regulatory oversight and certification rigor enforced by bodies such as the Federal Aviation Administration have established some of the world's highest airworthiness and avionics performance standards, which in turn shape global design benchmarks for aircraft computers. North America serves as a major production hub and also a reference market for safety-critical computing systems used across commercial, military, and unmanned platforms.

Emerging aviation concepts such as electric vertical takeoff and landing aircraft and urban air mobility are reinforcing regional demand for next-generation aircraft computers. These platforms introduce new technical challenges related to distributed propulsion control, energy management, autonomous flight functions, and high-bandwidth communication, all of which require highly adaptable, software-intensive computing architectures. Continued investment in advanced air mobility programs, electric aircraft development, and digital airspace management is expanding the scope and complexity of aircraft computer integration, further strengthening North America's leadership position in both current and next-generation aviation computing technologies.

What is the Size of the U.S. Aircraft Computers Market?

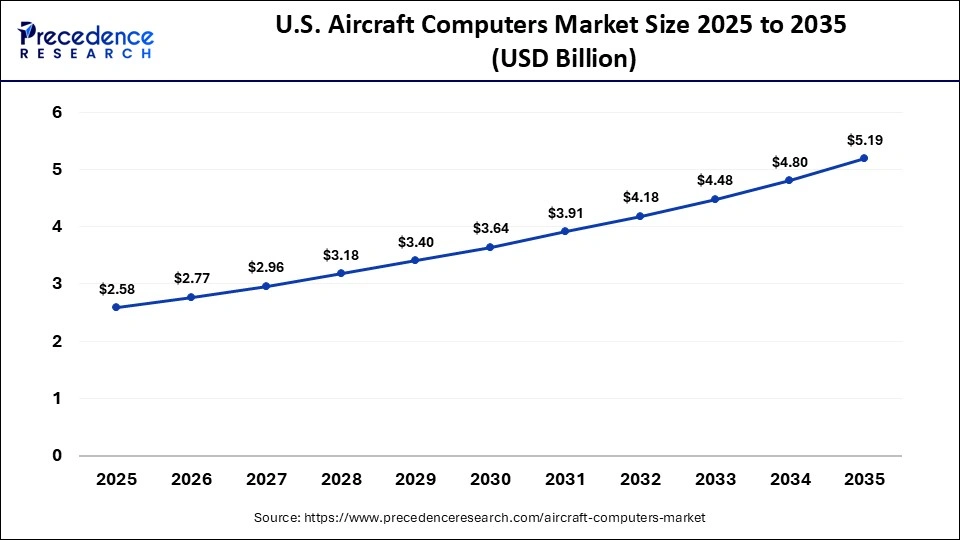

The U.S. aircraft computers market size is calculated at USD 2.58 billion in 2025 and is expected to reach nearly USD 5.19 billion in 2035, accelerating at a strong CAGR of 7.24% between 2026 and 2035.

U.S. Aircraft Computers Market Trends

The U.S. aircraft computers market is witnessing accelerated integration of AI-enabled capabilities directly into avionics-grade computing systems, where algorithms support real-time decision assistance, adaptive flight control, predictive maintenance, and sensor fusion. These capabilities are being embedded within certified flight computers to improve navigation accuracy, optimize flight paths, and enhance situational awareness while maintaining deterministic behavior required for safety-critical systems. Regulatory oversight by the Federal Aviation Administration is shaping how AI is deployed, with emphasis on explainability, redundancy, and verifiable performance to ensure compliance with airworthiness and software assurance standards.

Sustainability objectives are increasingly influencing aircraft computer architectures in the U.S. Aviation stakeholders are deploying advanced computing to support fuel efficiency improvements through optimized flight profiles, real-time performance monitoring, and energy management functions that reduce fuel burn and COâ‚‚ emissions. Aircraft computers are also being adapted to control and manage electric and hybrid-electric propulsion systems, where precise power distribution, thermal management, and battery monitoring are critical. These developments align with national environmental targets and industry efforts to reduce aviation's carbon footprint, positioning aircraft computers as a central enabler of greener, more efficient, and regulation-compliant next-generation aircraft platforms.

Why Is Asia Pacific Set to See Rapid Growth in the Aircraft Computers Market During the Period Between 2026 and 2035?

Asia Pacific is projected to grow at the fastest CAGR of 6.5% during the foreseeable period, driven by the rapid expansion of regional avionics manufacturing and increasing adoption of advanced aircraft computing systems. The region hosts fast-scaling aerospace and avionics ecosystems across China, Japan, South Korea, and India, where aircraft programs increasingly rely on digitally integrated, highly customized computing architectures. Investments in avionics R&D, software-defined systems, and manufacturing process optimization are strengthening regional capability to design and produce flight control computers, mission computers, and cockpit systems suited for both commercial and defense platforms.

Growth is further reinforced by the rising deployment of advanced cockpit computing technologies aimed at reducing pilot workload and improving operational safety. Aircraft operators and manufacturers in the region are adopting computing systems that support automation, decision-support functions, and real-time performance optimization, allowing pilots to focus on critical flight management tasks rather than manual system control. This trend is supported by strong government involvement through aerospace development policies, funding programs, and national aviation roadmaps that prioritize domestic aircraft capability, defense modernization, and next-generation aviation technologies.

China Aircraft Computers Market Trends

The country is expanding due to large-scale defense modernization efforts led by China, aimed at establishing globally competitive technological benchmarks in aviation and avionics. A key policy driver is the Made in China 2025 plan launched in 2015, which prioritizes domestic capability development in high-end manufacturing sectors, including avionics systems, aircraft computers, flight control technologies, and integrated mission electronics. Through coordinated state funding, industrial policy support, and supply-chain localization, the initiative is accelerating the development of indigenous avionics platforms for both military and civil aircraft programs.

One of the most significant manifestations of this strategy is China's commercial aircraft push led by Commercial Aircraft Corporation of China, with programs designed to compete directly with narrow-body platforms such as the Airbus A320 and Boeing 737 families. These aircraft programs are driving demand for domestically developed flight control computers, avionics integration systems, and cockpit computing architectures, as China seeks to reduce reliance on imported technologies while scaling certification-ready aircraft systems for large-volume commercial deployment.

Why Is Europe Seeing Significant Growth in the Aircraft Computers Market?

The Europe market for aircraft computers is experiencing strong growth, supported by the presence of major original equipment manufacturers such as Airbus, sustained government backing for defense modernization, and rising demand for fuel-efficient and increasingly autonomous aircraft systems. European aircraft programs are integrating advanced flight control computers, mission computers, and avionics processors to support fly-by-wire architectures, automation, and next-generation navigation and communication requirements. The growing integration of AI, machine learning, and IoT-enabled avionics is enhancing air traffic management compatibility, predictive maintenance, and real-time performance monitoring, reinforcing demand for higher-performance and software intensive aircraft computing platforms across both civil and defense aviation.

Other growth drivers include the expanding role of electronic warfare and mission computing in military aviation, which requires advanced onboard processing for sensor fusion, threat detection, and secure communications. At the same time, demand for advances in in-flight entertainment and connectivity systems in commercial aircraft is increasing computing requirements within cabin and network management architectures. Sustainability policy is also shaping market direction through initiatives such as the EU Green Deal, implemented under the European Commission, which targets COâ‚‚ emissions reduction through more fuel-efficient aircraft systems. These policies are accelerating adoption of aircraft computers that enable optimized flight profiles, energy management, and integration with low-emission propulsion and efficiency-enhancing avionics technologies.

Germany Aircraft Computer Market Trends

Germany is a significant contributor to the Europe aircraft computers market, supported by stringent national avionics safety standards and robust compliance requirements governing certification, testing, and operational reliability. Oversight by authorities such as the Luftfahrt-Bundesamt reinforces strict airworthiness and software assurance expectations, which drive demand for high-reliability flight control computers, mission computers, and avionics processors. Germany's strong aerospace ecosystem, anchored by established OEMs, tier suppliers, and avionics specialists, is further supported by government incentives and advanced manufacturing infrastructure, enabling sustained development and integration of safety-critical aircraft computing systems.

Why is the Middle East and Africa substantially Growing in the Aircraft Computers Market?

The Middle East and Africa's growth is highlighted by the Middle East's position as the sixth-largest aviation region globally, supported by 270 million one-way seats in 2024. Expanding airline operations, particularly by carriers such as Air Arabia and flydubai, are increasing aircraft utilization rates across short- and medium-haul routes. Higher utilization intensifies operational demands on flight control computers, avionics processors, and onboard data systems, driving demand for aircraft computers that improve reliability, fuel efficiency, and real-time performance monitoring in high-cycle operating environments.

The region is witnessing a growing shift toward comprehensive Maintenance, Repair, and Overhaul services, particularly for avionics retrofits and system upgrades. Airlines and operators are increasingly modernizing existing fleets with updated aircraft computers to meet evolving navigation, communication, and safety requirements without full fleet replacement. This expansion of MRO capability across the Middle East and Africa is supporting increased adoption of aftermarket aircraft computer solutions, especially for legacy aircraft platforms operating in demanding climatic and operational conditions.

UAE Aircraft Computer Market Trends

The UAE is largely seeing promising trends like the significant shift for digital cockpit solutions backed by modernization initiatives and government mandates for increased safety standards. Emerging opportunities are evolving around augmented reality and AI to enhance situational awareness of pilots and operational efficiency. Also, recent technological breakthroughs like head-up displays and multifunctional flight management systems customized for regional and business aircraft are further supporting the market's growth.

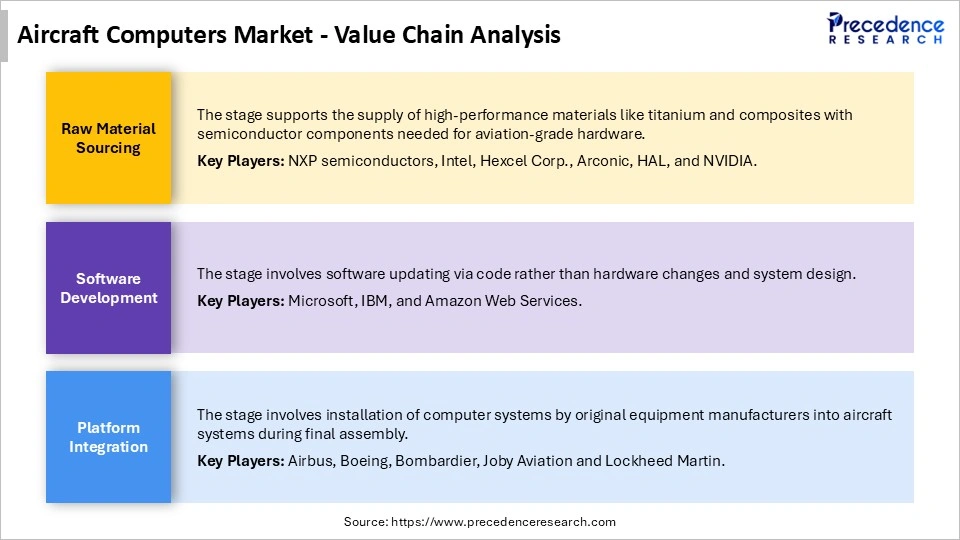

Aircraft Computers Market Value Chain Analysis

Top Companies in Aircraft Computers Market & their Offerings

- BAE Systems

- Honeywell Aerospace/Honeywell International Inc.

- Collins Aerospace (Raytheon Technologies)

- Thales Group

- Safran SA

- Curtiss-Wright Corporation

- General Dynamics Mission Systems

- GE Aviation

- Bombardier Inc.

- Kontron S&T AG

- Esterline Technologies

- Saab AB

- Cobham plc

- Rockwell Collins

- Garmin Ltd.

Recent Developments

- In March 2025, Pilatus Aircraft announced the launch of the 2025 version of the PC-12 turboprop single, the PC-12 Pro with a Garmin G3000 prime avionics suite.(Source: https://www.ainonline.com)

- In August 2024, a leading marketer, BAE systems have upgraded flight control computers for F-15EX and F/A-18E/F fighters to improve aircraft performance, capabilities, and readiness with safety.(Source: https://www.baesystems.com)

Segments Covered in the Report

By Type

- Flight Control Computers

- Mission Computers

- Utility Control Computers

- Display Computers

- Other Types

By Platform

- Commercial Aircraft

- UAVs

- Military Aircraft

- Helicopter

By Function

- Navigation & Flight Control

- Electronic Warfare

- Surveillance & Reconnaissance

- Engine Control & Monitoring

- Communication & Data Management

By End-Use

- OEM

- Aftermarket

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting