What is the Aluminum Smelting Market Size?

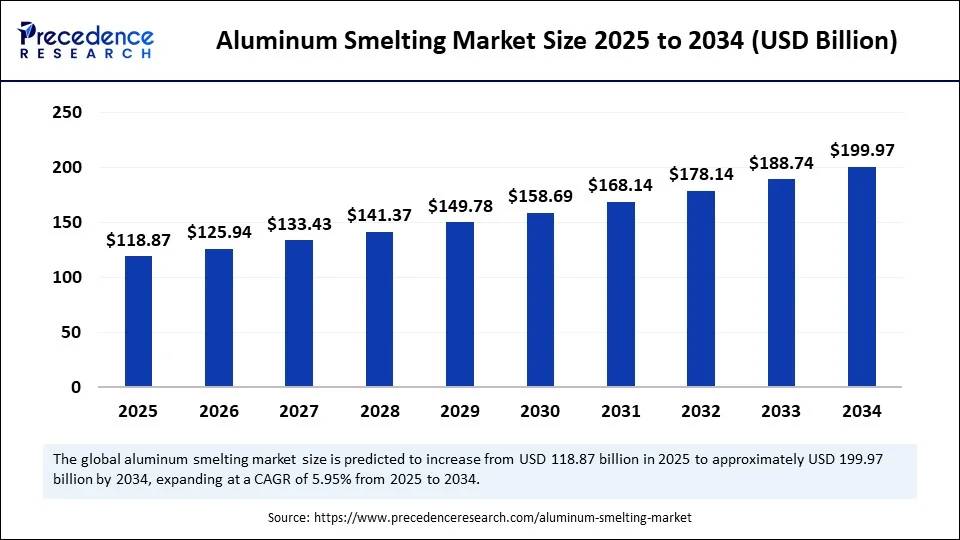

The global aluminum smelting market size was calculated at USD 112.19 billion in 2024 and is predicted to increase from USD 118.87 billion in 2025 to approximately USD 199.97 billion by 2034, expanding at a CAGR of 5.95% from 2025 to 2034. The rapid industrialization, combined with rising technological advancements in smelting processes and increasing demand for lightweight materials across various industries, is expected to drive the growth of the global aluminum smelting market over the forecast period. Additionally, the market is rapidly expanding in various developing and developed regions, particularly the Asia Pacific, fuelled by supportive government policies and increasing investment in aluminum smelting projects.

Market Highlights

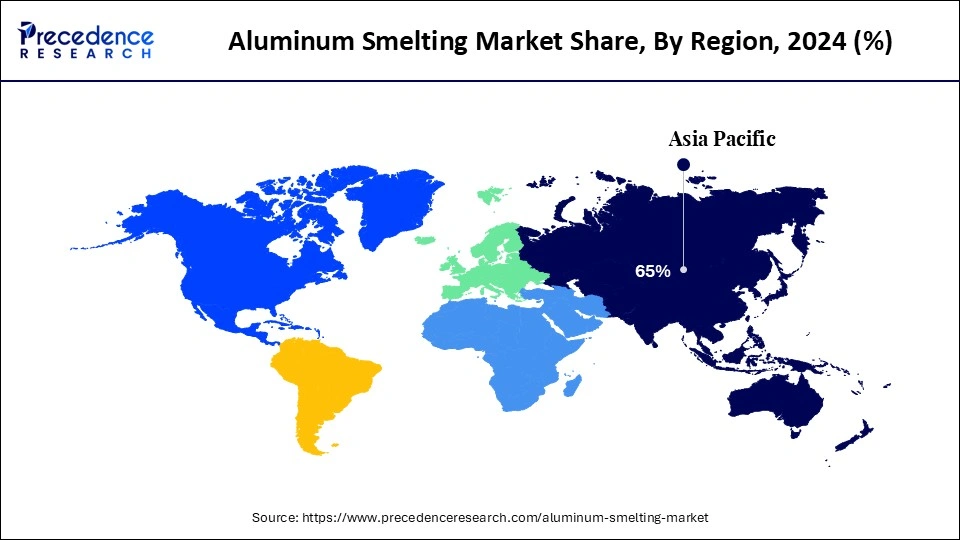

- Asia Pacific dominated the aluminum smelting market with the largest market share of 65% in 2024.

- North America is anticipated to grow at the fastest CAGR during the forecast period.

- By process, the Hall–Héroult prebrake segment accounted for the significant market share of 70% in 2024.

- By process, the inert anode technology segment is expected to witness a remarkable growth during the forecast period.

- By power source, the coal-based smelters segment held the biggest market share of 45% in 2024.

- By power source, the hydroelectric-powered smelters segment is expected to account for considerable growth over the forecast period.

- By product form, the ingots segment captured the highest market share of 40% in 2024.

- By product form, the billets segment is projected to grow at a CAGR between 2025 and 2034.

- By application, the automotive & transportation segment generated the major market share of 35% in 2024.

- By application, the electrical & electronics segment is expected to grow significantly during the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 112.19 Billion

- Market Size in 2025: USD 118.87 Billion

- Forecasted Market Size by 2034: USD 199.97 Billion

- CAGR (2025-2034): 5.95%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Market Overview

The aluminum smelting market covers the production of primary aluminum from alumina through electrolytic reduction. The process is dominated by the Hall–Héroult method, which continues to underpin global output. At the same time, newer technologies such as inert anode and carbothermic reduction are being developed to enhance efficiency and reduce carbon emissions. Power sourcing remains a critical factor, with coal, hydro, and gas-based smelters leading production, though renewable integration is accelerating in response to sustainability pressures. The market produces ingots, billets, slabs, and alloys that feed into applications across automotive, construction, packaging, electronics, and aerospace.

How Can Artificial Intelligence Improve the Aluminum Smelting Market?

In today's rapidly evolving technological landscape, Artificial intelligence emerges as a game-changer and holds potential for significant market growth and innovation in the coming years. AI integration is quickly transforming the aluminum smelting market by optimizing energy-intensive processes, streamlining production lines, enhancing operational efficiency, and lowering environmental impact. In aluminum manufacturing, the integration of Artificial Intelligence (AI) has become pivotal in driving efficiency, quality, and innovation. The adoption of this advanced technology collectively transforms traditional manufacturing processes into more data-driven and intelligent operations. The aluminum smelting process traditionally consumed vast amounts of energy. Still, with the implementation of AI-driven process control, it has significantly reduced energy consumption by 17 percent while enhancing output quality. As aluminum smelting is an energy-intensive industry, even minor efficiency improvements can yield substantial cost savings and sustainability benefits. Leveraging the power of advanced AI algorithms assists in effectively continuously monitoring and adjusting various process parameters to maintain optimal conditions.

What are the Latest Trends in the Aluminum Smelting Market?

- The rising demand for lightweight, high-strength, and versatile materials in the aerospace, automotive, and construction sectors is anticipated to accelerate the growth of the aluminum smelting market during the forecast period.

- The increased global industrialization and rapid urbanization, particularly in developing countries, are expected to propel the expansion of the aluminum smelting market in the coming years.

- The rising environmental concerns are encouraging the adoption of greener smelting methods, and government policies are increasingly promoting low-carbon technologies and recycling processes, bolstering the market's growth during the forecast period.

- The increasing focus on aluminum recycling, along with the surge in public and private investments in the aluminum melting projects, is expected to contribute to the overall growth of the market.

- The rising efforts of key players to focus on developing next-gen smart smelting technology in production represent a major advancement in the aluminum industry. This technology integrates autonomous systems and utilizes Industry 4.0 principles to enhance productivity, improve energy efficiency, and significantly reduce greenhouse gas emissions in the production of aluminum.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 112.19 Billion |

| Market Size in 2025 | USD 118.87 Billion |

| Market Size by 2034 | USD 199.97 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.95% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Process, Power Source, Product Form, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for Lighter Vehicles and Aircraft

The growing demand for lighter vehicles and aircraft to improve fuel efficiency and reduce emissions is expected to boost the growth of the aluminum smelting market during the forecast period. Aluminum's low density, corrosion resistance, ease of recycling, and high strength make it an ideal material for applications in vehicle manufacturing and aircraft production. Aluminum is considered a preferred material for various components such as wings, fuselages, and various automotive parts like engine blocks, wheels, and body panels. Lighter vehicles require significantly less energy to accelerate, which has led to improvements in fuel economy. By consuming less fuel, aircraft and vehicles reduce their greenhouse gas emissions to contribute substantially to better environmental protection and improving air quality. The market growth is further boosted by the increasing demand for electric vehicle (EVs), which uses lightweight materials to enhance energy efficiency and range. Therefore, aluminum's light weight, high strength, and recyclability assist in boosting sustainability, improving fuel efficiency, and reducing the overall weight of vehicles and aircraft.

Restraint

High Energy Consumption and Electricity Costs

The high energy consumption and electricity costs are anticipated to hamper the market's growth. The aluminum smelting process is highly energy-intensive, which increases the need for significant amounts of electricity. Fluctuations in the prices of electricity directly impact operational costs as they create a financial burden on producers. In addition, the high upfront capital investment in new technologies can be a barrier to entry, particularly for small and medium-sized companies with limited financial resources. Transitioning from conventional smelting processes to more advanced techniques requires substantial capital investment. Such factors are likely to limit the expansion of the global aluminum smelting market.

Opportunity

How Is the Surging Investment in Infrastructure Projects Impacting the Market's Growth?

The rapid infrastructure developments are projected to offer lucrative growth opportunities to the aluminum smelting market during the forecast period. Aluminum is most widely used in the construction of buildings, bridges, and other infrastructure, owing to its lightweight nature, high strength, and aesthetic appeal. Aluminum finds usage in windows, roofing, doors, cladding, HVAC systems, and electrical wiring. Aluminum provides resistance to corrosion and can withstand harsh environmental conditions, making it a well-suited material for both residential and commercial construction. Moreover, the rising investment of governments and the private sectors in building and construction significantly drives the expansion of the aluminum smelting market during the forecast period.

In December 2024, Adani Group announced $5 billion investment plan in aluminum, steel, and copper, aiming to boost India's infrastructure and reduce energy costs. This significant move into aluminium, steel, and copper production aims to leverage synergies with Adani's existing infrastructure, energy, and logistics operations. This investment is expected to boost India's infrastructure capacity, reduce energy production costs, and make the group more competitive against other market players like Vedanta and Hindalco.(Source: https://www.angelone.in)

Segmental Insights

Process Insights

Which Segment Dominates the Market by Process in the Aluminum Smelting Industry?

The hall–héroult process segment registered its dominance over the global aluminum smelting market in 2024. The hall–héroult process is the most widely used for producing high-purity aluminum by electrolytically reducing aluminum oxide dissolved in a molten cryolite bath at nearly 940–980°C, using massive amounts of electricity to separate aluminum from oxygen. The Hall-Héroult process's cost-effectiveness and efficiency make it the industry standard for the majority of global aluminum production. The market is witnessing various innovations to improve the energy efficiency of this process, with several smelters increasingly incorporating renewable energy sources to reduce overall environmental impact. On the other hand, the inert anode technology segment is expected to witness remarkable growth during the forecast period. The segment includes ceramic-based inert anodes and metal/alloy-based inert anodes. The inert anode technology is significantly transforming the aluminum smelting process by eliminating CO2 emissions and perfluorocarbon (PFC) emissions associated with the conventional process, leading to carbon-neutral or carbon-negative aluminum production, which also reduces costs and production time. Inert anodes replace carbon anodes by producing only pure oxygen instead of carbon dioxide.

Product Form Insights

What Has Led the Ingots Segment to Dominate the Aluminum Smelting Market?

The ingots segment registered its dominance over the global aluminum smelting market in 2024. Aluminum ingots are widely utilized in automotive (especially EVs), construction, aerospace, and packaging industries. Moreover, rapid urbanization and a surge in construction projects, especially in developing countries, are anticipated to fuel the demand for aluminum in buildings. Thus, it bolsters the segment's growth in the coming years. On the other hand, the billets segment is expected to witness remarkable growth during the forecast period. Aluminum billets are a crucial segment, providing raw materials for various aluminum products such as castings, extrusions, rolled products, and others. The growth of the segment is attributed to the increasing demand from the automotive and aerospace industry, rising construction activities and infrastructure development, and technological advancements in aluminum production.

- In September 2024, Vedanta Aluminium, India's largest aluminium producer and the country's top billet manufacturer, announced the launch of its new 5-inch aluminium billets at ALUMEX India 2025. The 5-inch billets have been developed to serve the growing demand for precision-engineered aluminium in critical applications across various sectors. The 5-inch aluminum billets are ideally suited for producing small to medium profiles and extruding seamless tubes for automotive, aerospace, and HVAC industries.(Source: https://www.indiawhispers.com)

Power Source Insights

How Will the Coal-Based Smelters Segment Dominate the Aluminum Smelting Market in 2024?

The coal-based smelters segment held the majority of the market share in 2024. The segment includes captive coal power plants and grid-based coal power. Coal is a readily available, abundant, and inexpensive energy source, which has made it a popular choice for powering smelters in countries like India and China. Coal-based aluminum smelters primarily use coal-fired power plants to generate electricity for the electrolytic reduction of alumina into aluminum, resulting in higher emissions and increased dependency on coal as an energy source in key aluminum-producing countries such as China, India, and others.

- In August 2025, National Aluminium Company (Nalco) plans to invest ₹30,000 crore in setting up a new aluminium smelter and an associated coal-based power plant over the next five years. The state-run aluminium producer will allocate about ₹18,000 crore for establishing the proposed smelter in Odisha. The chairman and managing director stated that Nalco is also looking to acquire new bauxite and coal mines to strengthen raw material security.(Source: https://energy.economictimes.indiatimes.com)

On the other hand, the hydroelectric-powered smelters segment is projected to grow at a CAGR between 2025 and 2034. The segment includes run-of-river hydropower and reservoir hydropower. The growth of the segment is driven by the rising demand for hydrogen as a clean fuel alternative, the increasing need to decarbonize efforts in the aluminium industry, and supportive government policies. Hydroelectric-powered aluminum smelters offer a low-carbon footprint by leveraging a renewable energy source for the energy-intensive electrolysis process. Hydroelectric-powered smelters prioritize significantly reducing their environmental impact, making them well-suited for companies seeking greener aluminum production. Hydrogen offers a promising pathway to lower reliance on fossil fuels, contributing to reducing greenhouse gas emissions. Electricity has a substantially high operating cost, and locating smelters near low-cost hydropower reduces expenses.

Application Insights

What Causes the Automotive & Transportation Segment to Dominate the Aluminum Smelting Market?

The automotive & transportation segment held a dominant presence in the aluminum smelting market in 2024, owing to the growing demand for lightweight vehicles. The automotive industry is a major consumer of aluminum, especially for the production of lightweight vehicles. Lightweight aluminum plays an indispensable role in electric vehicles (EVs) and aircraft, improving fuel efficiency, enhancing performance, and reducing the overall weight of automobiles and aircraft. As governments worldwide are implementing stringent fuel economy regulations has compelled automakers to increasingly seeking aluminum to improve fuel efficiency and reduce greenhouse gas emissions. Automotive manufacturers widely adopted aluminum in body panels, vehicle frames, engine components, and others.

On the other hand, the electrical & electronics segment is expected to grow at a notable rate. The growth of the segment is attributed to the increasing use of aluminum in smartphones, laptops, tablets, refrigerators, washing machines, and other consumer electronics. Aluminum has excellent electrical conductivity, lightweight, and corrosion resistance properties that make it vital for applications such as electronic components, power lines, and various appliances.

Regional Insights

Asia Pacific Aluminum Smelting Market Size and Growth 2025 to 2034

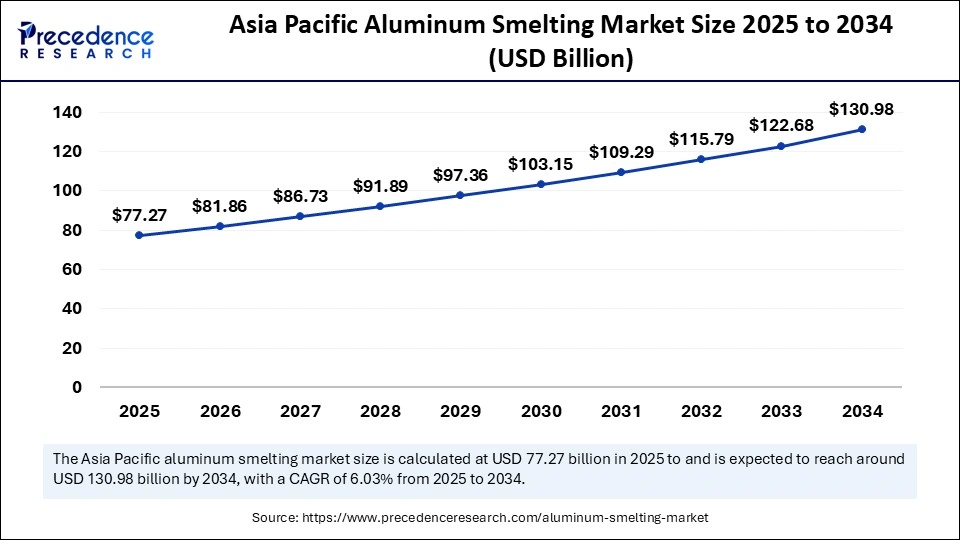

The Asia Pacific aluminum smelting market size was evaluated at USD 72.92 billion in 2024 and is projected to be worth around USD 130.98 billion by 2034, growing at a CAGR of 6.03% from 2025 to 2034.

Asia Pacific Is Dominating the Market With the Majority of the Market Share

Asia Pacific dominated the aluminum smelting market, capturing the largest market share of 65% in 2024.The Asia Pacific region has a well-established automotive, construction, packaging, and electronics industry, a significant consumer of aluminum products. Aluminum smelting provides essential raw material for these industries owing to its unique properties, such as a high strength-to-weight ratio, good conductivity, and corrosion resistance. The Asia Pacific is the major contributor to the growth of the global aluminum smelting market, with countries such as India and China leading in aluminum production.

China leads the market in aluminum smelter production, accounting for nearly 60% of the world's smelter capacity. Almost 25% of annually produced aluminum is utilized by the construction industry, 23% is allocated to vehicle frames, wires, wheels, and other components within the transportation sector. Aluminum foil, cans, and packaging constitute a significant end-use category, accounting for 17% of consumption. The rapid urbanization and industrialization, particularly in emerging nations, are fueling infrastructure development, which is further increasing the demand for aluminum and subsequently driving the growth of the aluminum smelting market in the region. The region's sustainability-led initiative and commitment to reducing carbon emissions are likely to fuel the deployment of low-carbon technologies and recycling processes in the area. The area is experiencing the push toward fuel efficiency, which has led automotive manufacturers to increasingly adopt aluminum in vehicle frames, engine components, car bodiesand other parts to reduce vehicle weight.

- Additionally, the rising investment in aluminum smelting projects and increasing mergers or collaborations among key players to expand production capacity, diversify product offerings, and expand geographically are anticipated to drive the growth of the aluminum smelting market in the region.

Furthermore, technological advancements in the smelting process play a crucial role as a primary driver for market growth in the region. The Hall-Héroult process is the most extensively used method for producing aluminum, significantly increasing production efficiency and reducing overall costs. The rising research and development efforts are increasingly focused on improving the efficiency of this process, including the utilization of renewable energy sources to substantially lower carbon emissions.

- In June 2025, Vedanta Aluminium, a mining company, initiated one of the largest private sector investments in the history of Odisha, a mega project valued at Rs 1.28 lakh crore. Vedanta will establish a 3 million tonnes per annum (MTPA) aluminium smelter along with a massive 4,900 MW captive power plant in Dhenkanal district. The project is expected to reshape the industry drastically and is expected to create 30,000 direct and indirect jobs within the state. The announcement marks a major leap in Vedanta's expansion in Odisha, where the company already operates smelters, refineries, and bauxite mining operations.(Source: https://www.constructionweekonline.in)

On the other hand, North America is expected to grow at the fastest rate in the market during the forecast period. The most rapid growth of the region is mainly fuelled by the increasing shift towards electric vehicles (EVs), increasing adoption of greener smelting methods, government incentives promoting clean energy sources, the presence of robust recycling facilities, technological advancements in aluminum production, and surging investments in infrastructure development and construction activities. North American countries are committed to reducing their carbon footprint and transitioning towards a sustainable, low-carbon future. Moreover, the rapid technological improvements are substantially enhancing the efficiency, sustainability, performance, and cost-effectiveness of aluminum smelting.

The United States accounted for the majority of market revenue share in 2024, fuelled by supportive government incentives, increasing decarbonization efforts, rapid technological advancements, expansion of renewable energy infrastructure, and growing demand for lightweight materials in various industries such as transportation, construction & infrastructure, packaging, and electronics. The government is actively supporting the production of aluminum with numerous strategies, funding, policies, and decarbonisation goals. Several key players in the market, both private and public entities, are increasingly investing in aluminum smelting projects to meet growing demand from the automotive and aerospace sectors, transitioning to lighter-weight and better fuel efficiency.

- In May 2025, Oklahoma state officials announced a deal with a private company in the United Arab Emirates for the construction of a USD 4 billion aluminum manufacturing facility in northeast Oklahoma. The annual capacity of the smelter would be about 600,000 tons (544,000 metric tons) of primary aluminum, according to a memorandum of understanding signed by Stitt and the company's CEO. The project is expected to create about 1,000 direct jobs and 1,800 indirect jobs, commerce officials said. The facility would be constructed on more than 350 acres (140 hectares) at the Port of Inola, east of Tulsa.

(Source: https://www.usnews.com)

Aluminum Smelting Market Companies

- Nel Hydrogen

- ITM Power

- thyssenkrupp nucera

- Siemens Energy

- McPhy Energy

- Cummins (Hydrogenics)

- Plug Power

- Enapter

- AFC Energy

- Giner ELX (Giner Inc.)

- H2B2 Electrolysis Technologies

- Ohmium International

- Toshiba Energy Systems & Solutions (Toshiba ESS)

- Kawasaki Heavy Industries

- Mitsubishi Heavy Industries (MHI)

- Bloom Energy

- Sunfire

Recent Developments

- In February 2025, Rio Tinto and Hydro announced their plan to invest approximately USD 45 million over five years to develop carbon capture technologies for aluminium smelting. Rio Tinto and Hydro have signed a partnership agreement to explore carbon capture solutions for aluminium smelting. The collaboration focuses on identifying and assessing technologies to reduce CO2 emissions from the electrolysis process, which accounts for 75% of a smelter's direct emissions. The partnership aims to accelerate the aluminium industry's transition to net-zero emissions by 2050. Most of the work will take place at Rio Tinto's European facilities and Hydro's sites in Norway.(Source: https://esgnews.com)

- In February 2025, Coordinating Minister for the Economy Airlangga Hartarto met with Abdulnasser Ibrahim Saif Bin Kalban, CEO of Emirate Global Aluminium (EGA), discussing the continuation of cooperation in developing aluminium production through the development of a smelter that processes bauxite in Indonesia. EGA is the world's largest producer of premium aluminum in the world. Having aluminum smelters in Dubai and Abu Dhabi, it is the largest industrial company in the United Arab Emirates (UAE) outside the oil and gas sector.(Source: https://indonesiabusinesspost.com)

Segmentation Covered in the Report

By Process

- Hall–Héroult Process

- Prebake anode technology

- Söderberg anode technology

- Inert Anode Technology

- Ceramic-based inert anodes

- Metal/alloy-based inert anodes

- Carbothermic Reduction

- Direct reduction

- Plasma-assisted reduction

By Power Source

- Coal-Based Smelters

- Captive coal power plants

- Grid-based coal power

- Hydro-Powered Smelters

- Run-of-river hydropower

- Reservoir hydropower

- Gas-Based Smelters

- Natural gas plants

- LNG-based supply

- Renewable-Powered Smelters

- Solar-integrated smelters

- Wind-integrated smelters

- Hybrid renewable smelters

By Product Form

- Ingots

- Standard ingots

- High-purity ingots

- Billets

- Extrusion billets

- Forging billets

- Slabs

- Rolling slabs

- Casting slabs

- Foundry Alloys

- Sand casting alloys

- Die casting alloys

- Others

- Wire rods

- Plates & sheets

By Application

- Automotive & Transportation

- Building & Construction

- Electrical & Electronics

- Packaging

- Aerospace & Defense

- Machinery & Equipment

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting