What is the Antimycotics Market Size?

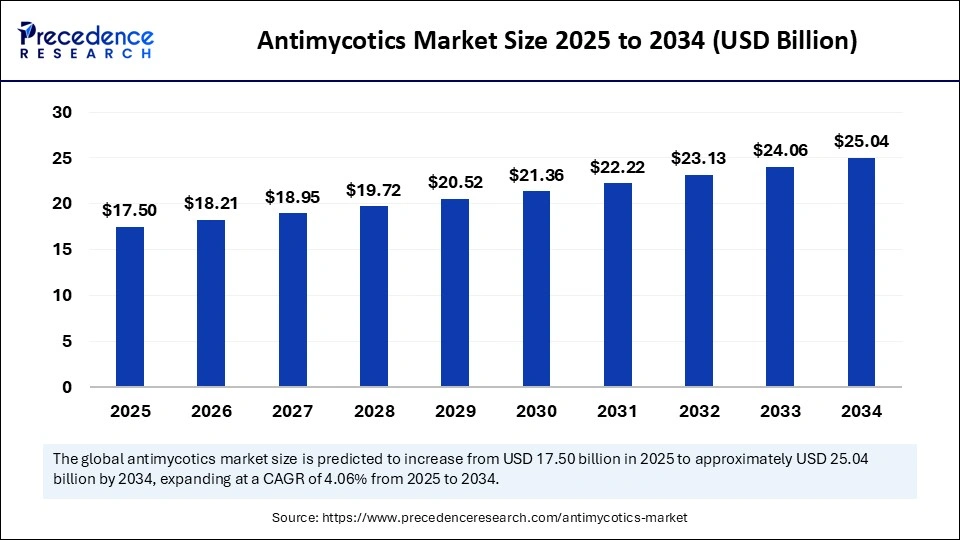

The global antimycotics market size accounted for USD 17.50 billion in 2025 and is predicted to increase from USD 18.21 billion in 2026 to approximately USD 25.04 billion by 2034, expanding at a CAGR of 4.06% from 2025 to 2034. This market is growing due to the rising prevalence of fungal infections worldwide and increasing demand for effective antifungal therapies.

Market Highlights

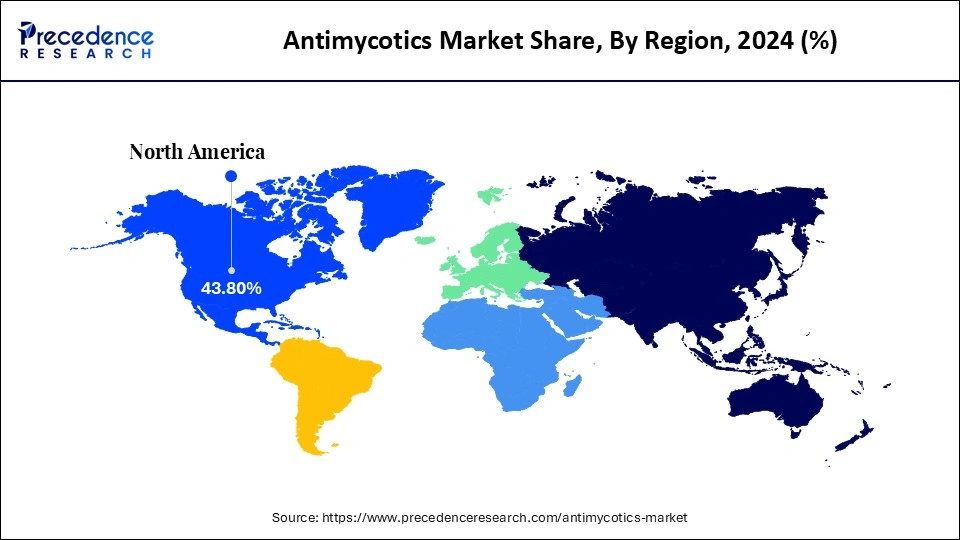

- North America dominated the market, holding the largest market share of 43.80% in 2024.

- Europe is expected to grow at a notable CAGR of 4.3% from 2025 to 2034.

- By drug class, the azoles segment held the largest share of the antimycotics market, accounting for 40.5% in 2024.

- By drug class, the polyenes segment is expected to grow at the fastest CAGR of 4.2% from 2025 to 2034

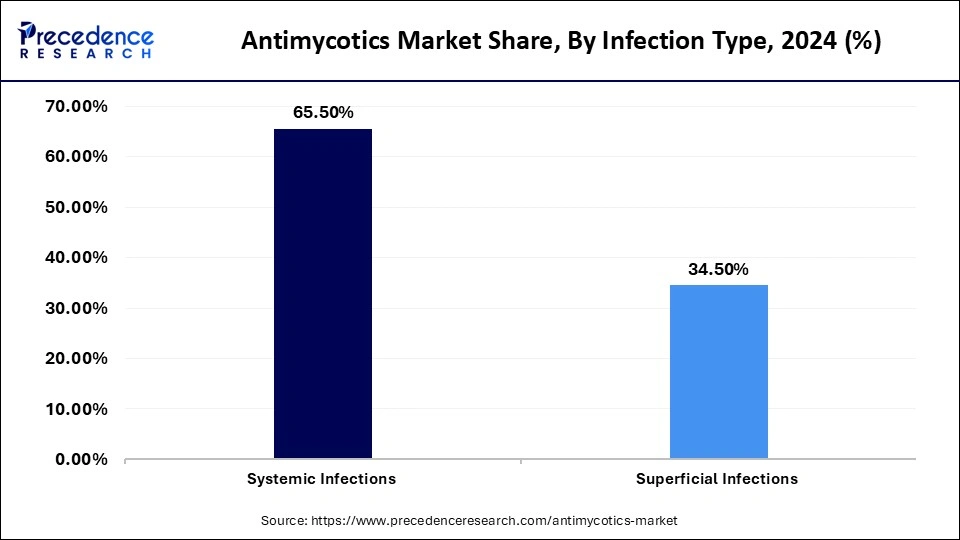

- By infection type, the systemic infections segment contributed the largest market share of 65.5% in 2024.

- By infection type, the superficial infections segment is expected to grow at the fastest rate of 4.4% from 2025 to 2034.

- By indication, the candidiasis segment contributed the biggest market share of 65.5% in 2024.

- By indication, the dermatophytosis segment is set to grow at the highest CAGR of 4.1% from 2025 to 2034.

- By route of administration, the oral segment generated the major market share of 55.5% in 2024.

- By route of administration, the injectable segment is expected to grow at the fastest CAGR of 4.2% from 2025 to 2034.

- By end user, the hospitals segment held the biggest market share of 45.5% in 2024.

- By end user, the specialty clinics segment is growing at a CAGR of 4.5% from 2025 to 2034.

What Is the Antimycotics Market?

The antimycotics market is expanding rapidly due to the growing demand for novel and enhanced treatments, as fungal infection rates rise from immunosuppression and hospital-acquired infections. The safety and effectiveness of treatments are being improved by technological developments such as new antifungal compounds, improved delivery methods, and quick diagnostic tools.

- In September 2025, Propedix launched Dryello (tolnaftate 1%), the first dry-stick over-the-counter antifungal for athlete's foot with a novel format that aims to enhance user convenience and adherence.

- In April 2025, the WHO released its first comprehensive pipeline review of antifungal agents, providing a strategic view of clinical and preclinical antifungal development and gaps in the sector.

Key Technological Shifts in the Antimycotics Market

- Rise of Topical Antimycotics: Introducing topical combinations and extended-release antifungal formulations to increase patient compliance and efficacy. Additionally, these innovations seek to improve patient convenience and decrease the frequency of dosing.

- Rapid Diagnostics Integration: Identification of fungal infections is facilitated by the use of molecular assays and point-of-care diagnostics, which allow for prompt treatment. Preventing severe or invasive infections is another benefit of early detection.

- Biological and Immunotherapy Approaches: Increasingly invasive or resistant fungal infections are being targeted by manipulatory drugs and monoclonal antibodies. These methods give patients who don't respond to traditional antifungal medications new choices.

AntimycoticsMarket Outlook

The antimycotics market is expected to grow steadily because more people are getting older, fungal infections are on the rise, and access to sophisticated antifungal treatments is growing. The industry is expanding due to increased R&D efforts in addressing drug resistance and novel formulations. Treatment adoption is increasing globally due to ongoing approvals and global awareness initiatives.

Businesses are concentrating on sustainable waste management, fewer toxic drugs, and greener production. The sustainability landscape is being shaped by initiatives to ensure affordable access and fight antifungal resistance in developing countries.

Alternative therapies and innovative antifungal solutions are being developed by new biotech companies. Innovation in this field is being revitalized by increased venture funding and partnerships with research institutes. Leading examples of next-generation antifungal innovations are startups like F2G and Zero Candida.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 17.50 Billion |

| Market Size in 2026 | USD 18.21 Billion |

| Market Size by 2034 | USD 25.04 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.06% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Class, Infection Type, Indication, Route of Administration, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Antimycotics MarketSegment Insights

Drug Class Insights

The azoles segment dominates the market with a 40.5% share in 2024 because it was driven by alternative therapies and innovative antifungal solutions developed by new biotech companies. Innovative in this field is being revitalized by increased venture funding and partnerships with research institutes. Leading examples of next-generation antifungal innovations are startups like F2G and Zero Candida.

The polyenes segment is expected to be the fastest-growing segment, with a CAGR of 4.2% in the market during the forecast period, motivated by their strong ability to combat resistant fungal strains. The market is expanding because of the increasing use of amphotericin B formulations to treat serious systemic infections. Recent developments in lipid-based polyene formulations have promoted wider clinical acceptance by enhancing patient safety and lowering toxicity.

Infection Type Insights

The systemic infections segment dominates the market with a 65.5% share in 2024, as the number of invasive fungal infections among transplant recipients and immunocompromised patients continues to rise. Strong antifungal medications have become more widely used as a result of the high morbidity and mortality rates linked to systemic mycoses.

On the other hand, the superficial infections segment is expected to be the fastest-growing segment with a 4.4% CAGR in the antimycotics market during the forecast period, fueled by the rising incidence of fungal infections of the skin, hair, and nails. Increased humidity, shifting lifestyles, and the growing use of over-the-counter topical antifungal medications are all contributing to the segment's expansion.

Indication Insights

The candidiasis segment dominates the market with a 65.5% share in 2024 because it is very common in both hospital and community settings. The prevalence of candida infections has increased due to an increase in intensive care unit admissions, catheter use, and antibiotic exposure. Additionally, the dominance of this market has been strengthened by ongoing advancements in azole-based medication.

The dermatophytosis segment is expected to be the fastest-growing segment in the market during the forecast period, driven by an increase in ringworm and athlete's foot cases worldwide. The need for topical antifungal treatments is being driven by rising skin hygiene awareness and the growth of dermatology clinics. Market expansion is also being accelerated by product launches targeting dermatophytes resistant to multiple drugs.

Route of Administration Insights

Oral segment dominates the market with a 55.5% share in 2024 due to its efficacy in treating systemic infections, patient compliance, and ease of use. The accessibility of treatment has been improved by the broad availability of oral antifungal formulations such as tablets and capsules. It is the recommended choice due to its consistent dosage and low need for medical supervision.

The injectable segment is expected to be the fastest-growing segment in the market during the forecast period, in response to the growing need for quick and focused antifungal treatment for serious infections. Because of its greater bioavailability, hospitals prefer intravenous administration for patients who are in critical condition.

End User Insights

The Hospitals segment dominates the market with a 45.5% share in 2024 because of the large number of patients receiving inpatient treatment for severe fungal infections. Hospitalization rates for post-operative and immunocompromised patients have risen, leading to increased demand for antifungal drugs. Hospitals are the primary locations where injectable and systemic antifungal drugs are administered.

The specialty clinics segment is expected to be the fastest-growing segment with a CAGR of 4.5% in the antimycotics market during the forecast period, motivated by the increase in consultations for infectious and dermatological conditions. These clinics appeal to urban populations because they provide prompt outpatient services and individualized antifungal therapies. The growing number of skin and nail care facilities in developing nations is speeding up.

Antimycotics MarketRegional Insights

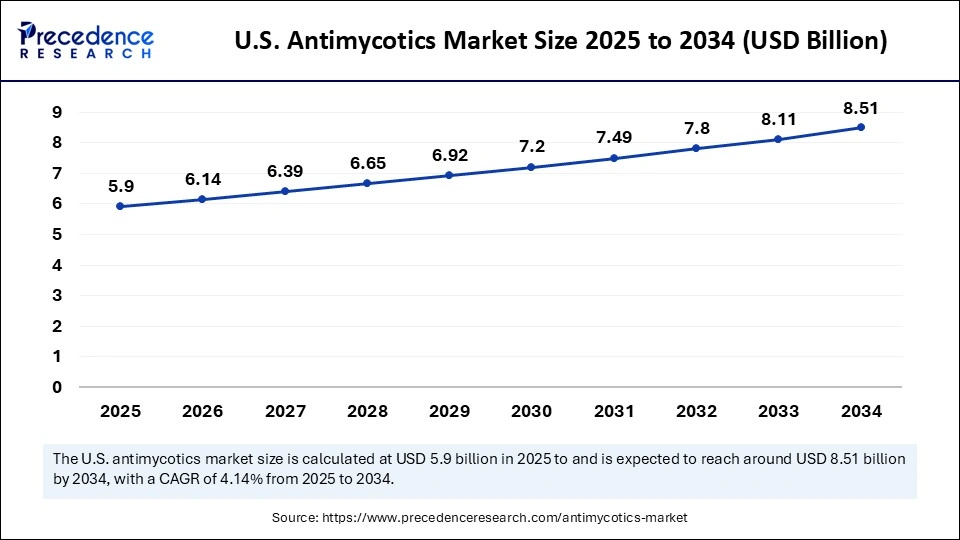

The U.S. antimycotics market size is exhibited at USD 5.90 billion in 2025 and is projected to be worth around USD 8.51 billion by 2034, growing at a CAGR of 4.14% from 2025 to 2034.

What Made North America Dominate the Antimycotics Market in 2024?

North America dominated the antimycotics market in 2024, supported by robust R&D activities, a high incidence of fungal infections in the elderly population, and sophisticated healthcare infrastructure. Favorable reimbursement practices and the presence of significant pharmaceutical companies have further strengthened regional dominance.

U.S. Antimycotics Market Trends

The U.S. antimycotics market continues to grow steadily, motivated by the rise in invasive fungal infections and the development of antifungal treatments. Several new antifungal treatments, such as combination therapies and innovative oral therapies, have been approved by the FDA to combat the growing incidence of fungal infections.

Europe is emerging as the fastest-growing regional market, driven by rising invasive fungal infection rates and public health campaigns. The market is growing due to increased government funding for antifungal drug research and regulatory approvals for novel treatments. Adoption of antifungals is further boosted by robust surveillance systems and an increase in hospitals acquiring infection control measures.

Europe is expected to be the fastest-growing region in the antimycotics market in 2024, with an expected CAGR of 4.3% due to the rising prevalence of fungal infections and increasing awareness of antifungal resistance. Hospitals and healthcare systems across Europe are expanding diagnostic capabilities and infection surveillance programs, leading to earlier detection and more targeted treatment of fungal diseases. The European Medicines Agency (EMA) has been encouraging faster approval pathways for critical infection-related drugs, which is supporting market entry for advanced antimycotic therapies.

In Germany, the antimycotics market shows consistent growth. Echinocandins are the fastest-growing drug class, while azoles continue to generate the most revenue. Strong healthcare infrastructure, growing awareness of fungal infections, and growing uptake of cutting-edge antifungal treatments have all contributed to Germany's continued dominance in the European antifungal market.

Asia Pacific showed notable growth in the antimycotics market in 2024, largely due to the region's expanding healthcare infrastructure, growing patient pool, and increasing awareness of fungal infections. The rising prevalence of conditions such as diabetes, cancer, and HIV, all of which heighten susceptibility to fungal infections, has significantly boosted the demand for antifungal treatments. Countries like India, China, and Japan are witnessing a surge in hospital-acquired fungal infections, prompting greater investment in advanced antimycotic therapies and improved diagnostic systems.

Government-led healthcare reforms and public health campaigns have also strengthened early detection and treatment of fungal diseases, particularly in rural and semi-urban areas. Additionally, the availability of low-cost generic drugs from domestic manufacturers has improved accessibility, driving higher treatment adoption rates across diverse income groups. Partnerships between regional pharmaceutical firms and international biotech companies are further expanding research capabilities and accelerating the introduction of novel antifungal drugs in the market.

In 2024, Japan emerged as the leading country in the Asia Pacific antimycotics market, due to its advanced healthcare infrastructure, strong pharmaceutical research base, and high diagnostic accuracy. Japan's well-established infection control systems and early adoption of innovative antifungal therapies have positioned it at the forefront of regional growth. The country's aging population and rising incidence of immunocompromised conditions, such as cancer and diabetes, continue to drive consistent demand for antimycotic drugs.

Additionally, Japan's robust regulatory framework and close collaboration between academia, hospitals, and the pharmaceutical industry foster continuous innovation in antifungal research. Domestic companies are actively developing novel formulations with improved efficacy and safety profiles, often in partnership with global biopharmaceutical leaders. Government initiatives promoting antimicrobial stewardship and resistance monitoring are also strengthening Japan's role in shaping evidence-based treatment protocols.

Antimycotics Market 2024 - Who is Leading and Who is Catching Up?

| Region | Market Status | Key Growth Drivers | Government/Public Health Support | Strategic Opportunities |

| North America | Dominating | Strong R&D ecosystem, high prevalence of Candida auris infections, and early adoption of advanced antifungal drugs | CDC's Antimicrobial Resistance Lab Network (ARLN) and NIH funding for fungal disease genomics | Expansion of antifungal resistance monitoring networks; AI-based infection diagnostics are being integrated in hospitals |

| Europe | Fastest Growing | High incidence of hospital-acquired infections, growing elderly population, and strong AMR surveillance | European Center for Disease Prevention and Control (ECDC) and Horizon Europe grants supporting antifungal R&D | Rapid adoption of long-acting echinocandins; the EU's focus on local drug manufacturing under the EU4Health policy |

| Asia Pacific | High Growth Potential | Increasing cases of superficial fungal infections, expansion of hospital infrastructure, and rising generic manufacturing | India's National AMR Action Plan, Japan's PMDA Innovation Program, and China's Healthy China 2030 initiative | Opportunities in developing topical antifungals and affordability-based pricing strategies; regional biotech collaborations are growing |

| Latin America | Notably Emerging | Urbanization, tropical climates, and limited access to fungal diagnostics create unmet demand. | Pan American Health Organization (PAHO) programs are improving fungal disease surveillance in Brazil, Argentina, and Chile. | Potential for expansion through public-private partnerships; growing e-pharmacy channel for OTC antifungal creams |

Antimycotics MarketValue Chain

The value chain begins with the sourcing of antifungal Active Pharmaceutical Ingredients (APIs), such as azoles, polyenes, echinocandins, and allylamines, along with excipients and solvents. Suppliers are typically pharmaceutical chemical manufacturers operating under strict Good Manufacturing Practices (GMP) to ensure purity and stability. API production is cost-intensive and heavily regulated due to complex synthesis and microbial fermentation processes. Upstream value is captured by API producers and raw material suppliers with strong formulation-grade quality and intellectual property (IP) control.

This is the core value-creation stage, where APIs are converted into oral, topical, or injectable antifungal formulations through blending, granulation, sterilization, and filling. Manufacturers focus on bioavailability, dosage stability, and extended-release profiles to enhance patient outcomes and differentiate products. Quality assurance, sterile processing, and regulatory compliance (FDA, EMA, WHO GMP) drive production complexity. Value capture lies in R&D innovation, branded drug portfolios, and generic manufacturing efficiency, often led by companies such as Pfizer, Merck, and Novartis.

Finished antimycotic products are distributed through pharmaceutical wholesalers, hospitals, clinics, and retail pharmacies under controlled supply chains. Cold-chain logistics may be required for certain formulations (e.g., IV echinocandins). Marketing, clinician education, and patient compliance programs add downstream value. Competitive differentiation arises from strong distribution networks, brand reputation, and partnerships with healthcare providers. The highest value capture downstream is achieved by companies combining robust therapeutic portfolios with a wide global distribution reach and regulatory credibility.

Antimycotics MarketCompanies

Pfizer is a global leader in the antimycotics market, offering a strong portfolio of antifungal medications, including Diflucan (fluconazole) and Vfend (voriconazole). The company’s research in azole and triazole antifungal classes has set benchmarks for treating invasive fungal infections. Pfizer continues to innovate through advanced formulations and global access initiatives, addressing rising cases of fungal resistance and hospital-acquired infections.

Merck is a key player in antifungal therapeutics, best known for its product Cancidas (caspofungin), one of the first echinocandin-class antifungals. The company focuses on developing advanced systemic antifungals for life-threatening fungal infections such as candidiasis and aspergillosis. Merck’s continued R&D and global distribution make it a cornerstone of hospital-based antifungal treatment.

Novartis offers broad-spectrum antifungal drugs through its Sandoz division, including formulations used to treat dermatological and systemic mycoses. Its focus on high-quality generics and biosimilars supports global access to affordable antifungal therapies. The company’s innovation in immunocompromised patient care further strengthens its presence in the antimycotics market.

Bayer develops a range of topical and systemic antifungal treatments, including Clotrimazole under the Canesten brand, a global leader in over-the-counter antifungal therapy. The company’s expertise in dermatology and women’s health supports its dominance in consumer antifungal products. Bayer continues to invest in formulation technologies that enhance patient comfort and treatment efficacy.

Johnson & Johnson provides antifungal solutions primarily through its Janssen Pharmaceuticals division. The company focuses on both topical and prescription antifungals targeting dermatophyte and yeast infections. Its continued research into combination antifungal therapies enhances treatment outcomes in resistant fungal infections.

Gilead Sciences is a leader in antifungal treatments for immunocompromised patients, with key products such as Ambisome (liposomal amphotericin B). Its lipid-based formulations improve drug delivery and reduce toxicity in severe fungal infections.

Sanofi offers antifungal and antimycotic medications as part of its global infectious disease portfolio. The company emphasizes broad-spectrum therapies and accessible pricing models in emerging markets.

AbbVie is expanding into antifungal therapeutics through its research in immunomodulation and infection control. Its focus on combination therapy development supports the management of opportunistic fungal infections.

Bristol-Myers Squibb contributes to the antimycotics space through its R&D in immunocompromised infection management. The company explores antifungal drug combinations to combat resistant pathogens.

GSK provides antifungal formulations targeting both dermatological and systemic infections. Its focus on accessible healthcare solutions supports antifungal treatment availability in global markets.

Astellas develops innovative antifungal agents such as Micamine (micafungin), widely used in hospitals to treat serious fungal infections. Its commitment to clinical research and formulation advancements positions it strongly in the echinocandin segment.

Eli Lilly contributes to antifungal research through legacy therapies and R&D partnerships. Its focus on drug discovery supports new antifungal classes for resistant infections.

Mylan manufactures generic antifungal drugs including fluconazole and itraconazole, ensuring cost-effective treatment options for fungal infections globally.

Teva produces a wide range of generic antifungal medications used in both topical and systemic applications. Its global manufacturing network enhances accessibility in developing markets.

Recent Developments

- In March 2025, Zydus Lifesciences received final approval from the U.S. Food and Drug Administration (USFDA) to manufacture and distribute Ketoconazole Shampoo 2%. This antifungal medication is used to treat dandruff, seborrheic dermatitis, and other fungal scalp infections. The approval positions Zydus to compete directly with the reference listed drug, Nizoral Shampoo 2%, in the U.S. market. (Source: https://zyduslife.com)

- In June 2024, Biocon received approval from the USFDA for its complex injectable antifungal medication, Micafungin. This drug is used to treat various fungal and yeast infections, including invasive candidiasis and esophageal candidiasis. The approval enhances Biocon's portfolio of vertically integrated, complex drug products.(Source: https://www.biocon.com)

Antimycotics MarketSegment Covered in Report

By Drug Class

- Azoles

- Echinocandins

- Polyenes

- Allylamines

- Others

By Infection Type

- Systemic Infections

- Superficial Infections

By Indication

- Candidiasis

- Dermatophytosin

- Aspergillosis

- Others

By Route of Administration

- Oral

- Topical

- Injectable

By End-User

- Hospitals

- Specialty Clinics

- Homecare

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting