What is the Articaine Hydrochloride Market Size?

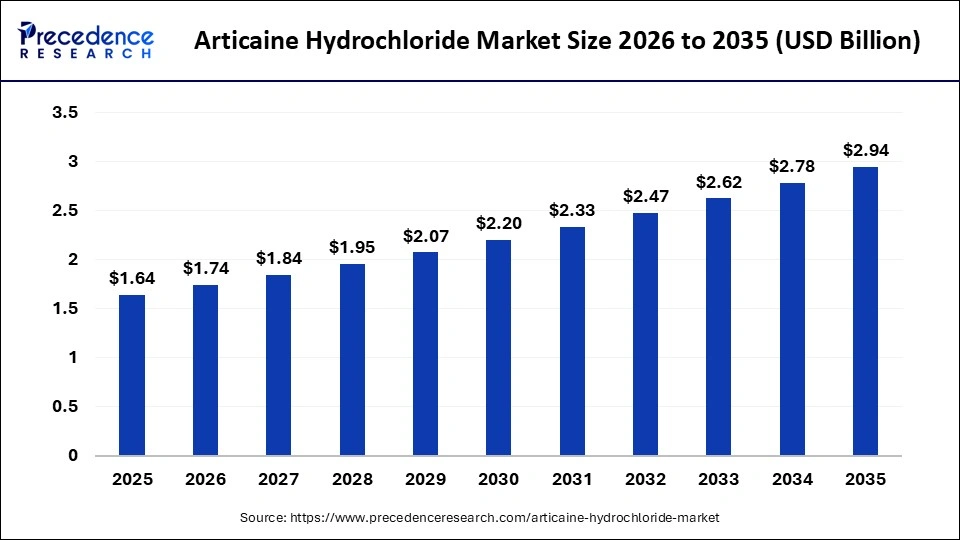

The global articaine hydrochloride market size accounted for USD 1.64 billion in 2025 and is predicted to increase from USD 1.74 billion in 2026 to approximately USD 2.94 billion by 2035, expanding at a CAGR of 6.02% from 2026 to 2035. The market is experiencing robust growth driven by the increasing prevalence of dental issues, growing awareness of preventive healthcare measures, the significance of articaine anesthesia in dental procedures, and government reimbursement for oral care/ procedures, which are assisting the markets global expansion.

Market Highlights

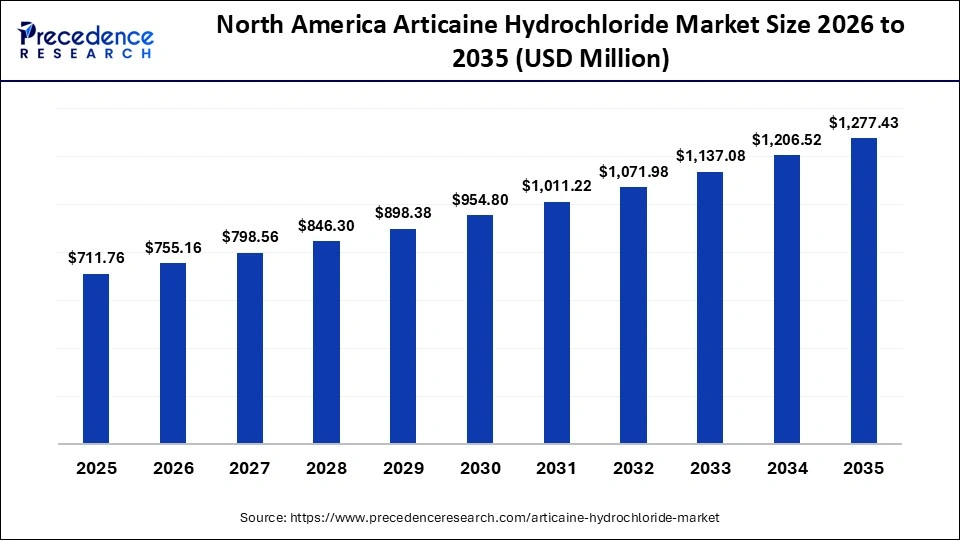

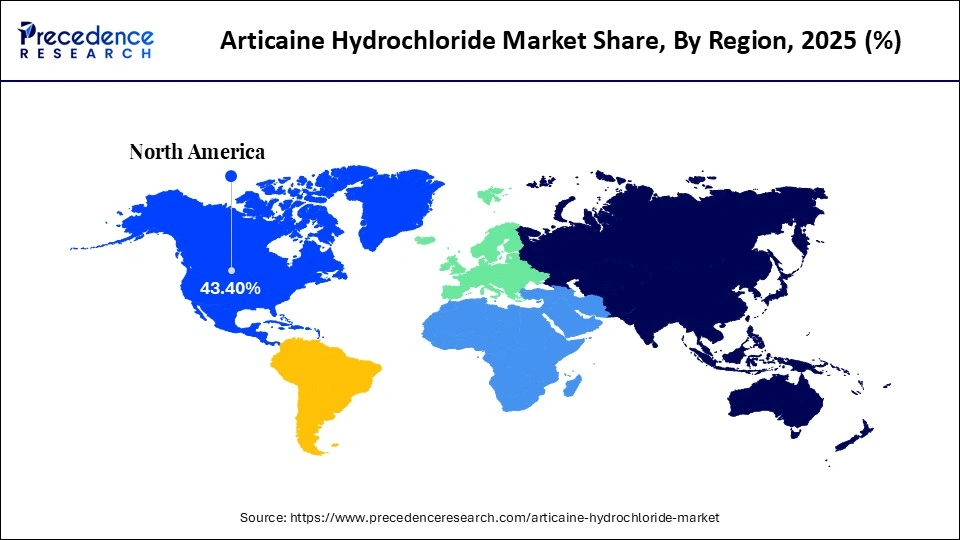

- North America accounted for the largest market share of 43.4% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of 7% from 2026 to 2035.

- By type, the articaine HCl 4% with epinephrine 1:100,000 segment held the largest market share of 56.3% in 2025.

- By type, the articaine HCl 4% without epinephrine segment is growing at a notable CAGR of 6.1% from 2026 to 2035.

- By formulation, the single-dose cartridges segment contributed the biggest market share of 51.4% in 2025.

- By formulation, the prefilled syringes segment is expanding at a CAGR of 6.0% from 2026 to 2035.

- By application, the dental local anesthesia segment generated the biggest market share of 50.4% in 2025.

- By application, the minor oral & maxillofacial surgical procedures segment is projected to grow at the fastest CAGR of 6.3% from 2026 to 2035.

- By end user, the dental clinics/chain dental practices segment captured the highest market share of 57.8% in 2025.

- By end user, the dental schools/academic institutions segment is expanding at a solid CAGR of 6.1% from 2026 to 2035.

- By distribution channel, the dental distributors/B2B dental wholesalers segment contributed the biggest market share of 56.5% during 2025.

- By distribution channel, the retail pharmacies & online pharmacies segment is growing at the fastest CAGR of 6.2% from 2026 to 2035.

Understanding the Articaine Hydrochloride Market: Usage Trends, Formulations, and Clinical Adoption

Articaine hydrochloride is an amide-type local anaesthetic widely used in dentistry for infiltration and nerve block anaesthesia due to its fast onset and good bone penetration. Its thiophene ring structure enhances lipid solubility, allowing superior diffusion through dense maxillary and mandibular bone compared with other agents such as lidocaine. The market covers the API, finished formulations such as cartridges, ampoules and prefilled syringes, and branded generics supplied to dental clinics, hospitals and retail or online distributors.

Demand is driven by the increasing volume of dental procedures, the growth of private dental practices and expanding access to dental care in emerging markets. Articaine is preferred in procedures such as restorative work, extractions, periodontal surgery and paediatric dentistry because it provides strong anaesthesia with reduced volumes. Formulation convenience, especially preloaded dental cartridges compatible with standard dental syringes, contributes significantly to user adoption and practice efficiency. Regulatory approvals across North America, Europe and Asia support wider clinical use, while ongoing product improvements, such as reduced preservative formulations and improved packaging, continue to shape market competitiveness and clinical preference.

AI-Driven Changes in the Articaine Market: Digital Dentistry Integration and Patient-Specific Treatment Mapping

The involvement of artificial intelligence with the articaine hydrochloride market is majorly transforming each stage of the pharmaceutical lifecycle from research and development to clinical application, along with better patient management. Major shifts include focusing on enhanced precision, efficiency, and personalized care.

Additionally, the integration of AI supports drug discovery and formulation design, clinical trial optimization by guiding site selection and study protocol design, improved drug delivery systems, and précised anesthesia with patient monitoring. Moreover, in the manufacturing process, AI is used for quality control and manufacturing efficiency. This helps ensure better product quality and lowers overall operational costs.

Articaine Hydrochloride Market Outlook

The articaine hydrochloride market is expanding due to the increasing focus on technological innovation for drug delivery systems and strategic global expansion by emerging economies, where dental diseases are increasing that results in the growing demand for pain management solutions. The markets growth largely depends on articaine hydrochlorides superior efficacy, rapid onset, and better bone absorption compared to other anesthetics in dentistry.

A sustainability trend in the articaine hydrochloride market includes better ways to improve pain management while performing surgeries related to dentistry and provide safety, comfort, and clinical efficiency by using technological advancements in the delivery method of anesthesia via computer-controlled devices and single-use cartridges. Researchers are also focusing on developing optimized dosages for different patient groups and enhancing formulations.

Major investors in the articaine hydrochloride market are particularly involved in large pharmaceutical companies, dental supply companies, along venture capital. Major key players include Septodont, Dentsply Sirona, Pierrel S.p.A., and Sanofi. These companies are heavily investing in R&D and production capacity, along with innovative product launches that can be useful for dental practices and drug-delivery formulations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.64 Billion |

| Market Size in 2026 | USD 1.74 Billion |

| Market Size by 2035 | USD 2.94 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.02% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Formulation, Application, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Articaine Hydrochloride Market Segmental Insights

Type Insights

Articaine HCl 4% with Epinephrine 1:100,000: The segment held the largest market share of 56.3% in 2025, due to its powerful offerings in dental practices, such as the unique chemical structure of articaine and the precise concentration of the vasoconstrictor epinephrine, which result in less bleeding and a clear surgical field. Also, several researchers have demonstrated the efficacy of articaine HCl 4% with epinephrine, resulting in successful anesthesia even in critical cases.

Articaine HCl 4% without Epinephrine: The segment is expected to witness the fastest CAGR of 6.1% over the foreseeable period, driven by the benefits of short dental procedures and its suitability for medically challenged patients who are unable to safely receive epinephrine. Also, its unique pharmacological profile makes it an effective and versatile option in several crucial situations.

Articaine HCl 4% with Epinephrine 1:200,000: The segment is notably growing due to its unmatched qualities like a highly effective dental local anesthetic, which offers superior tissue diffusion and efficacy than various other agents. According to recent studies, Articaine HCl 4% with Epinephrine 1:200,000 offers profound anesthesia even in critical cases where cardiovascular stimulation is controlled, bypassing overdose.

Formulation Insights

Single-Dose Cartridges (Dental Carpules): The segment held the largest market share of 51.4% in 2025, due to the increased safety, hygiene, and comfort this formulation offers during dental procedures. Single-dose cartridges further reduce the risk of cross-contamination and possible infections during dental procedures, as their large-scale use has been recognized for their safety.

Prefilled Syringes/Ready-to-Use Formats: The segment is expected to witness the fastest CAGR of 6.0% during the foreseeable period, due to the enhanced safety, like minimized risk of needlestick injuries and possible microbial contamination for patients. Each syringe has a premeasured dose of articaine hydrochloride that reduces dosing errors when filled manually.

Ampoules (Multi-Dose Vials): The segment is notably growing worldwide due to its economic and logistics benefits and cost-effective solutions. Multi-dose vials are engineered to be used multiple times safely while preventing microbial growth while performing dental procedures. Also, they require less space and storage, making them more economical than other vials.

Application Insights

Dental Local Anesthesia (Endodontics, Extractions, Restorations): The segment held the largest market share of 50.4% in 2025, as it offers unmatched tissue penetration, a faster response, and effective pain relief for various dental procedures. It has a unique molecular structure that allows it to diffuse more readily through soft and hard tissues, including dense cortical bone, making it highly useful even for critical procedures such as mandibular blocks.

Minor Oral & Maxillofacial Surgical Procedures: The segment is expected to witness the fastest CAGR of 6.3% over the foreseeable period, as articaine provides enhanced safety and comfort to patients by effectively reducing pain and anxiety associated with minor oral surgeries. Also, articaines offerings align well with todays surgical needs, fueling the segments global growth.

Other Medical/Local Anesthetic Uses: The segment is growing due to the minimized systemic toxicity risk, unique properties of these drugs, and high lipid solubility with rapid metabolism, as it is highly useful in dental procedures. Articaine has a low potential for allergic reactions and side effects, contributing to the segment growth.

End User Insights

Dental Clinics/Chain Dental Practices: The segment held the largest market share of 57.8% in 2025, as these facilities are the major locations where routine and specialized dental procedures are performed with local anesthesia. Dental clinics perform a vast number of outpatient procedures like routine fillings, root canals, implant placements, and tooth extractions, requiring a constant supply of anesthesia.

Dental Schools/Academic Institutions: The segment is expected to witness the fastest CAGR of 6.1% during the foreseeable period, as these places are frontiers in clinical research and education that support articaine superior efficiency and improved diffusion properties over conventional anesthetics such as lidocaine.

Hospitals/Outpatient Surgical Centers: The segment is notably growing as hospitals perform a high volume of surgical and dental procedures, meeting constant and significant patient needs while offering comfort and better outcomes. Also, an increasing trend to perform critical surgeries in outpatient facilities, backed by ongoing advancements in anesthesia and recovery protocols, is fueling the segments growth further.

Distribution Channel Insights

Dental Distributors/B2B Dental Wholesalers: The dental distributors/B2B dental wholesalers segment held the largest market share in 2025, due to the critical role played by dental distributors/B2B dental wholesalers to supply all the basic and specialized dentistry products while offering all the necessary equipment and devices reasonably price. Distributors invest in significant stock and manage the complex logistics process for a constant supply of articaine hydrochloride, fueling the segments growth further.

Retail Pharmacies & Online Pharmacies: The segment is expected to witness the fastest CAGR of 6.2% during the foreseeable period. The segment is growing due to the increasing volume of dental procedures, superior clinical properties, and the increasing consumer preference for comfort and accessibility in healthcare. Retail pharmacies and online pharmacies are the leading suppliers of articaine hydrochloride by recognizing its increasing demand in the market.

Hospital Pharmacies: The segment is notably growing as hospital pharmacies are preferring efficient supply of articaine hydrochloride to support advanced procedures, driving research and maintaining high safety rules while managing bulk purchasing on a ground level for consumers.

Articaine Hydrochloride Market Regional Insights

The North America articaine hydrochloride market size is estimated at USD 711.76 million in 2025 and is projected to reach approximately USD 1,277.43 million by 2035, with a 6.04% CAGR from 2026 to 2035.

Which Factors Made the North American Articaine Hydrochloride Market Dominant Globally?

North America held the largest market share, at 43.4%, in 2025. The region is dominating globally due to a couple of leading factors, like advanced healthcare infrastructure with government funding, high volume of dental operations and the increasing demand for modern anaesthetics. The region performs a large number of endodontic, oral surgery and periodontal procedures each year, which directly increases the use of fast-acting, reliable agents such as articaine hydrochloride.

The region boasts a highly developed healthcare system equipped with the necessary devices and equipment, along with a large network of clinics, which facilitate the adoption of articaine hydrochloride. Dental professionals in the United States and Canada frequently prefer articaine due to its strong bone penetration, reduced injection volumes and improved patient comfort during routine and complex procedures. In addition, the presence of leading pharmaceutical manufacturers, strong regulatory approval pathways and widespread continuing education programs for dental clinicians further reinforce North Americas leadership in the global articaine hydrochloride market.

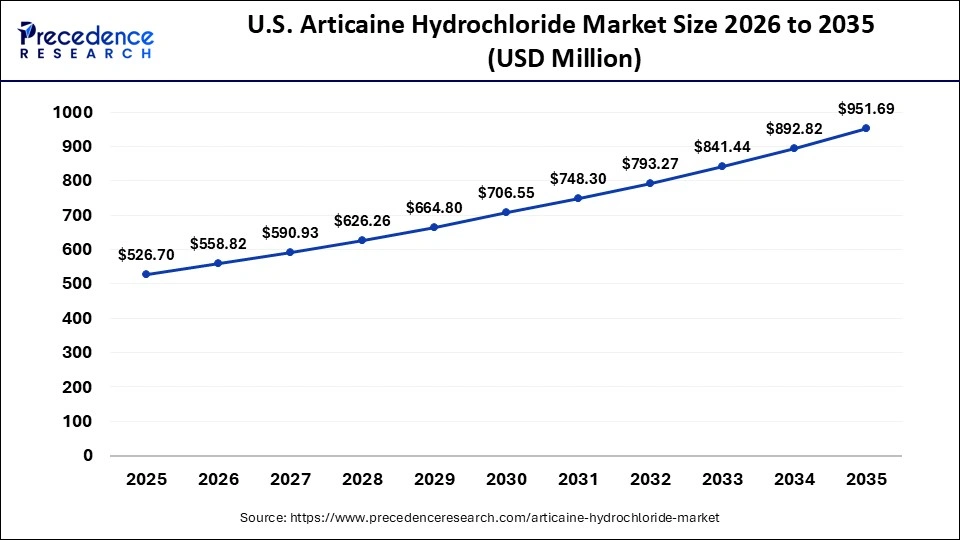

The U.S. articaine hydrochloride market size is calculated at USD 526.70 million in 2025 and is expected to reach nearly USD 951.69 million in 2035, accelerating at a strong CAGR of 6.09% between 2026 and 2035.

At the country level, the U.S. is a regional leader due to the combination of advanced healthcare and the growing demand for effective local anesthetics like articaine. A strong preference among a large pool of patients for rapid-onset, long-holding pain management during outpatient dental procedures is further fueling the regions growth. Also, factors such as reimbursement policies, maximum dental care coverage, and a strong dental clinic network facilitate the regions growth.

Asia Pacific is expected to witness the fastest CAGR of 7.0% during the foreseeable period of 2026 to 2035. The region is growing due to high-volume dental procedures each year, increasing awareness of oral health, expanding healthcare infrastructure, and growing disposable income. Government initiatives and educational campaigns have led to a greater focus on oral hygiene and health, as well as preventive dental procedures.

Additionally, the increasing adoption of modern dental technologies and anesthesia delivery systems, such as computer-controlled local anesthesia delivery devices, is further driving the frequent use of articaine hydrochloride. The region is home to a rapidly increasing geriatric population, prone to many health issues, including dental issues, which is fueling the markets growth.

China Articaine Hydrochloride Market Trends

The country is witnessing rapid growth of the market owing to increased dental tourism, increasing awareness of oral health, and the growing production of articaine hydrochloride in China. China is a frontrunner in adopting new technologies in its leading sectors, such as healthcare, which is helping train a large number of dental practitioners, leading to increased use of articaine hydrochloride. The expansion of private dental chains and specialised oral care centres is also increasing the volume of procedures that rely on fast-acting anaesthetics. In addition, Chinas strong domesticpharmaceutical manufacturing capacity allows for competitive pricing and wider distribution of articaine products across both urban and semi-urban regions.

The European articaine hydrochloride market is rapidly growing due to the widespread and early adoption of articaine as the preferred dental anaesthetic, driven by its superior clinical performance and the growing prevalence of dental procedures requiring reliable local anaesthesia. Europe was an early adopter of articaine, which was first used in 1976, and it has remained the most widely used anaesthetic for dental procedures in the region, with nearly 97% usage in Germany alone. This long history of clinical familiarity has strengthened dentist confidence and encouraged continuous use across restorative dentistry, oral surgery and paediatric treatments.

Strong regulatory support, a high density of dental practitioners and well established professional training systems contribute to sustained demand across European countries. The regions emphasis on minimally invasive dentistry and patient comfort further reinforces the preference for articaine due to its fast onset, strong bone penetration and predictable anaesthetic depth. As a result, Europe continues to be one of the most mature and clinically driven markets for articaine hydrochloride globally.

Germany Articaine Hydrochloride Market Trends

The Germany articaine hydrochloride market is expanding due to a couple of factors, like its superior efficacy, well-developed professional preference, favorable safety policies, and the growing prevalence of dental disorders with a highly advanced healthcare system in the country.

Germany boasts a well-established healthcare infrastructure, dental insurance coverage, and a growing focus on clinical training with technological integration in dental practices. A major portion of the German population suffering from dental problems is another key driver of the market in the region.

The Middle East and Africa articaine hydrochloride market is experiencing rapid growth, mainly due to the growing prevalence of dental disorders, ongoing improvement in healthcare infrastructure and the increasing awareness about preventive care of dental issues in the region. Rising cases of dental caries, periodontal disease and tooth decay are driving higher procedure volumes in both public and private dental clinics, which increases the use of fast acting anaesthetics such as articaine. Many countries are investing in modern dental centres, digital imaging systems and training programs that equip clinicians to perform a wider range of restorative and surgical procedures.

Public and private initiatives like the Healthy Saudi Smile 2025 campaign by Haleon are spreading more awareness about dental hygiene and preventive measures. National oral health programs in the UAE, Qatar and South Africa are also promoting regular checkups and early interventions, which leads to greater demand for local anaesthesia during routine and advanced treatments. The expansion of dental tourism in Gulf countries, combined with stronger pharmaceutical distribution networks, further strengthens market growth for articaine hydrochloride across the region.

UAE Articaine Hydrochloride Market Analysis

The region is expanding due to the UAE governments active involvement in building a robust healthcare infrastructure, which is facilitating a significant increase in the number of dental clinics and hospitals equipped with advanced technology. Dental professionals are increasingly aware of the benefits of articaine hydrochloride in dental procedures, driving market growth in the region.

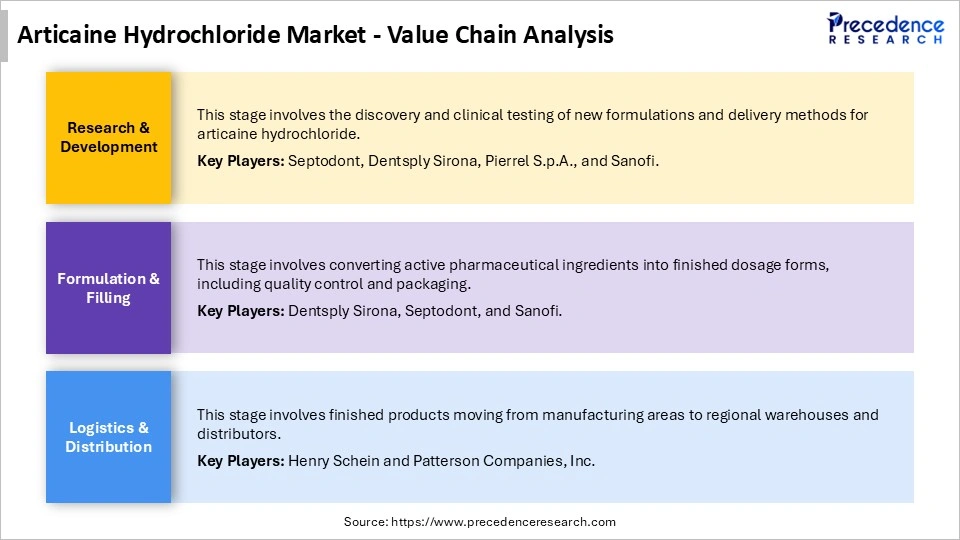

Articaine Hydrochloride Market Value Chain

Articaine Hydrochloride Market Companies

- Septodont

- Pierrel S.p.A

- Dentsply Sirona

- Sanofi

- 3M

- Merck / Sigma-Aldrich

- Anhui BBCA Pharmaceutical Co., Ltd.

- Manus Aktteva Biopharma LLP

- Nortec Quimica

- Fengchen Group/Jinan Chenghui

- Benco Dental/Patterson Dental

- Siegfried Holding AG

- Teva / GSK / Pfizer

- SUYOG LIFE SCIENCES

Recent Developments

- In December 2025, a leader in the local anesthetics in dentistry, Septodont, made a strategic move by investing in the U.S.-based Balanced Pharma, a pharmaceutical company aiming to improve patients safety with innovative launches and formulations in anesthetics.(Source: https://dimensionsofdentalhygiene.com)

- In October 2025, a well-known provider of innovative dental solutions, Premier Dental and Septodont Inc., announced their strategic distribution agreement to deliver advanced pain management in dental procedures with the BufferPro solution.

Articaine Hydrochloride MarketSegments Covered in the Report

By Type

- Articaine HCl 4% with Epinephrine 1:100,000

- Articaine HCl 4% with Epinephrine 1:200,000

- Articaine HCl 4% without Epinephrine

By Formulation

- Single-Dose Cartridges (Dental Carpules)

- Ampoules (Multi-Dose Vials)

- Prefilled Syringes/Ready-to-Use Formats

By Application

- Dental Local Anesthesia (Endodontics, Extractions, Restorations)

- Minor Oral & Maxillofacial Surgical Procedures

- Other Medical/Local Anesthetic Uses

By End User

- Dental Clinics/Chain Dental Practices

- Hospitals/Outpatient Surgical Centers

- Dental Schools/Academic Institutions

By Distribution Channel

- Dental Distributors/B2B Dental Wholesalers

- Hospital Pharmacies

- Retail Pharmacies & Online Pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting