Artificial Intelligence and Analytics in Surgery Market Size and Forecast 2025 to 2034

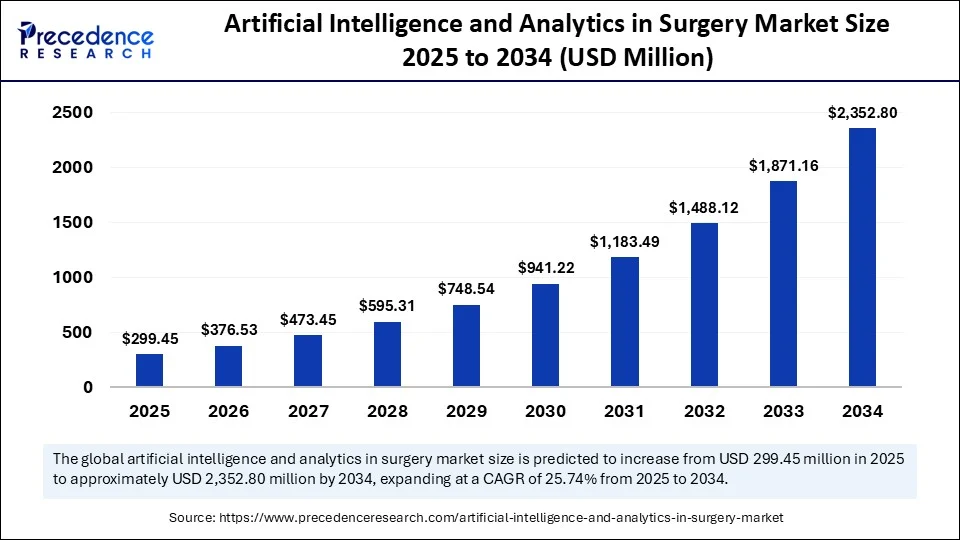

The global artificial intelligence and analytics in surgery market size accounted for USD 238.15 million in 2024 and is predicted to increase from USD 299.45 million in 2025 to approximately USD 2,352.8 million by 2034, expanding at a CAGR of 25.74% from 2025 to 2034. The market is expanding due to advancements in AI technology, its precise results in the healthcare sector, lack of skilled surgeons, and offerings of AI, like scalability, efficiency, accurate diagnosis, and precise data analysis of medical imaging, which reduces errors and burden on the existing healthcare infrastructure by streamlining workflows.

Artificial Intelligence and Analytics in Surgery MarketKey Takeaways

- In terms of revenue, the global artificial intelligence and analytics in surgery market was valued at USD 238.15 million in 2024.

- It is projected to reach USD 2,352.8 million by 2034.

- The market is expected to grow at a CAGR of 25.74% from 2025 to 2034.

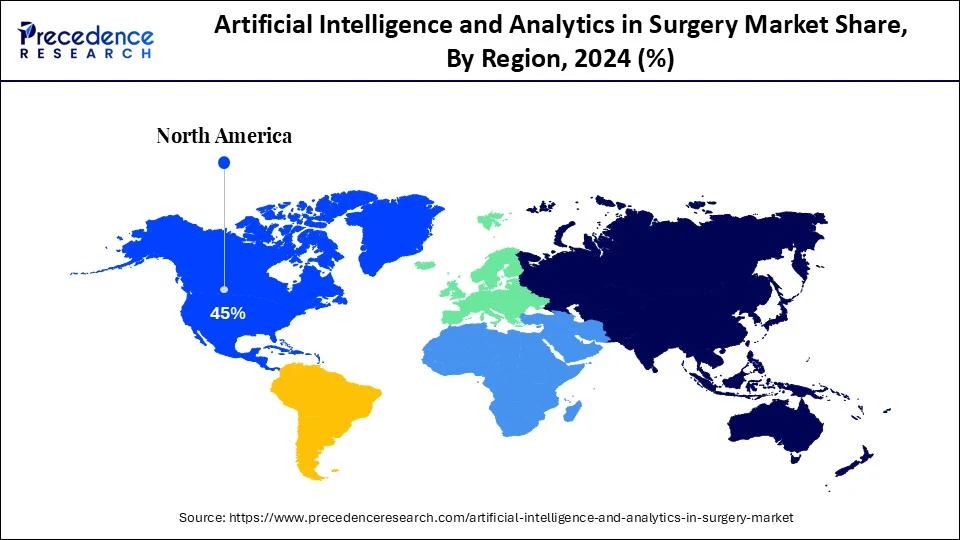

- North America dominated the global market with the largest market share of 45% in 2024.

- Asia Pacific is expected to witness the fastest CAGR during the foreseeable period.

- By application, the intraoperative guidance and navigation segment held the biggest market of 34% in 2024.

- By application, the surgical workflow and efficiency optimization segment is expected to witness the fastest CAGR during the foreseeable period.

- By technology, the computer vision and image recognition segment captured the highest market share of 38% in 2024.

- By technology, the predictive analytics platform segment is expected to witness the fastest CAGR during the forecast period.

- By surgical specialty, the general surgery segment contributed the major market share of 29% in 2024.

- By surgical specialty, the neurosurgery segment is expected to witness the fastest CAGR during the forecast period.

- By deployment mode, the cloud-based AI platforms segment held the largest market share of nearly 64% in 2024. And the same segment is expected to witness the fastestCAGR during the foreseeable period of 2025-2034.

- By end user, the hospital & surgical centers segment generated the major market share of 61% in 2024.

- By end user, the ambulatory surgical centers segment is expected to witness the fastest CAGR during the forecast period.

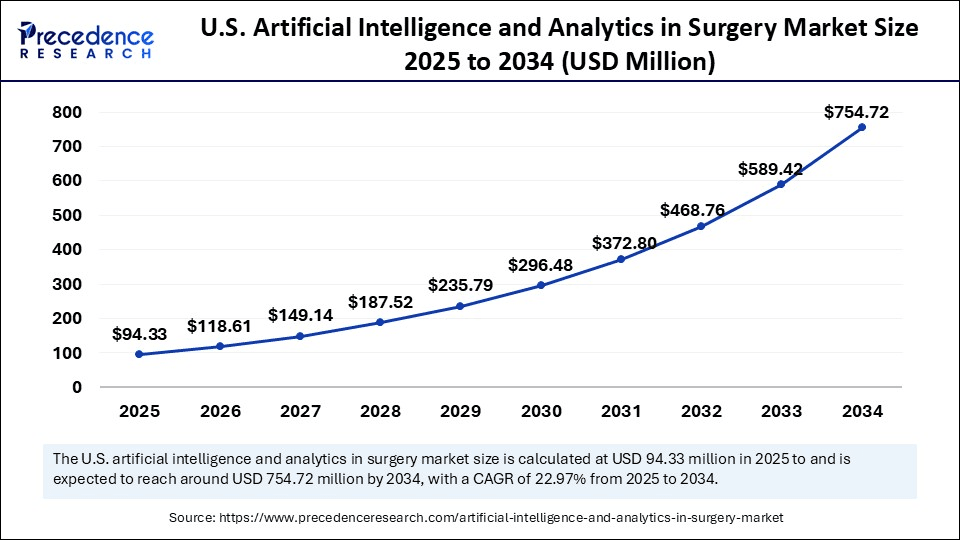

U.S. Artificial Intelligence and Analytics in Surgery Market Size and Growth 2025 to 2034

The U.S. artificial intelligence and analytics in surgery market size was exhibited at USD 75.02 million in 2024 and is projected to be worth around USD 754.72 million by 2034, growing at a CAGR of 25.97% from 2025 to 2034.

North America

How Is the Convergence of Technology and Healthcare Systems Supporting the Growth of the North American AI and Analytics in Surgery Market?

North America held the largest market share of approx. 45% in 2024. The region is dominating due to various reasons, including a highly developed healthcare infrastructure, along with widespread adoption of highly advanced and supportive technologies for medical systems, with substantial investment in research and development facilities. Such a dedicated ambience for the convergence of technology and surgery is fostering the innovation and integration of artificial intelligence with the surgical procedures in North America. In addition to this, the region has favorable government policies and various initiatives that facilitate the adoption of cutting-edge technologies for the healthcare sector, in turn, supporting market growth in the region.

On a country-level analysis, the U.S. artificial intelligence and analytics in surgery market is expected to grow at the fastest rate owing to the presence of leading tech giants collaborating with AI companies and startups to commercialize applications of artificial intelligence in every possible sector, including intricate surgeries in healthcare for the highest precision with a lifesaving agenda. U.S. further boasts with the highly skilled healthcare professionals and experts who are increasingly shifting their working pattern in assistance with AI to reduce errors, increase the level of surgical results, and improve the after-surgery recovery rate. Such elements collectively contribute to the region's growth on a large scale.

Asia Pacific

How Is AI-Powered Surgical Robot Reshaping the Asia Pacific Artificial Intelligence and Analytics in Surgery Market?

Asia Pacific is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The surgical landscape of the Asia Pacific is reshaping due to the integration of Artificial Intelligence into various domains of the healthcare sector, including the surgical area. Some of the key areas where integration of AI has taken place include AI-based diagnosis, customized treatment plan, remote surgery and telemedicine assistance, and AI-directed robotic systems for intricate surgeries. Leading countries like India and China have already deployed various surgical robots. China has surgical robots like KangDuo, Edge surgical system, and WEGO. These systems are highly sophisticated and offer précised surgical outcomes.

On the other hand, India has embraced AI by deploying LLM models into hospitals. For example, Apollo hospitals from India have deployed a clinical intelligence engine, CIE, which is operated by LLMs and uses extensive clinical data from the network of hospitals for faster delivery and highly informed patient responses.

Market Overview

The artificial intelligence and analytics in surgery market refers to the application of AI, machine learning (ML), and advanced data analytics in preoperative planning, intraoperative navigation, and postoperative evaluation to improve surgical outcomes, reduce errors, and optimize operating room efficiency. This includes computer vision, predictive analytics, robotic-assisted AI systems, real-time video analytics, and AI-powered decision support systems. Market growth is propelled by the global push toward precision surgery, the rise in minimally invasive procedures, digital OR integration, and the increasing availability of surgical data streams from imaging, sensors, and EMRs.

What are the Key Trends in the Artificial Intelligence and Analytics in Surgery Market?

- Surgical planning and execution with AI models: One of the significant trends that is being witnessed in the artificial intelligence and analytics in surgery market is, planning and execution of any surgery with the help of advanced data analytics, which enhances overall results. AI can generate accurate 3D models with optimized surgical plans through in detailed analysis of the patient's historical data and medical imaging, which offers detail insights to surgeons for a precise method of operations by improving accuracy.

- Innovations in Augmented Reality (AR):An innovation in augmented reality further helps in the decision-making process by evaluating complex medical data of patients and guiding surgeons with a highly effective approach. Robotic surgeries in an AR-powered environment offer immersive experiences for practices and education, along with real-time 3D guidance to increase procedural accuracy. AI is further rising as a tool for disease prediction and prescription rather than just a data interpretation tool. AI can forecast disease progression, offer customized treatment products and alternatives, and enable early disease prediction with complex conditions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2,352.8 Million |

| Market Size in 2025 | USD 299.45 Million |

| Market Size in 2024 | USD 238.15 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 25.74% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Technology, Surgical Specialty, Deployment Mode, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

What are the Artificial Intelligence and Analytics in Surgery Market Drivers?

Artificial intelligence and analytics in surgery market drivers are AI and analytics that enhance surgical outcomes by enabling personalized treatment plans, accurate preoperative simulations, and strategic planning to minimize failure risks. A significant driving factor includes the ability of artificial intelligence and analytics to improve overall results of surgery by analysing a huge amount of data, like medical imaging and patient health records, which will help to design personalize treatment plans for precise outcomes. Advanced algorithms offer an outline for preoperative simulations, assisting surgeons to visualize plans in prior with increased accuracy and guide them with possible surgery failure elements, making it full foolproof and strategic plan which reduces the chances of surgery failure to near zero. Such a conformity approach is driving the demand for artificial intelligence and analytics in surgery on a large scale.

What are the Artificial Intelligence and Analytics in Surgery Market Restraints?

Obstacles in the artificial intelligence and analytics in surgery market are interoperability issues and high adoption costs hinder the integration of AI and analytics in surgery, especially in systems with outdated infrastructure or limited budgets. A notable restraining factor for artificial intelligence and analytics in the surgery market includes challenges regarding interoperability or synergy issues between different systems. This problem arises where various IT systems are connected to operate as one unit, though they fail to communicate properly due to some and the other technical reas ons. This is mainly seen in the cases of integration of AI systems with existing infrastructures. Integration requires standard protocols for seamless communication and data exchange. Furthermore, high upfronts cost to adopt such technologies and keep them maintained are another challenge, as it cannot be affordable for every medical system, especially in underserved areas with budget constraints.

What Are the Opportunities in the Artificial Intelligence and Analytics in Surgery Market?

Growth opportunities in the artificial intelligence and analytics in surgery market are linked to robotic-assisted surgery is transforming modern healthcare with enhanced precision, flexibility, and autonomy, as seen in landmark procedures like the fully robotic living donor liver transplant performed in early 2025. A revolutionary concept of robots being employed for intricate surgeries is no longer just a theory in a textbook or science fiction. Robotic-assisted surgery is a reality, and many of the leading hospitals have adopted this cutting-edge technology along with robotic platforms that offer advanced autonomy, enhanced flexibility, and an instant feedback system. As per recent statistics, 14 million minimally invasive surgeries have taken place with the help of robotic systems, and more than 76,000 surgeons have been trained to perform robotic-assisted surgery with the ‘Da Vinci Surgical Systems.'

- For instance, in July 2025, surgeons in the VCU Health Hume-Lee Transplant Center performed a surgery of living donor liver transplant fully with robotic assistance in early 2025, and they were the first surgeons in the country to perform such an intricate operation successfully.

Application Insights

Why is Intraoperative & Navigation as an Application Dominating the Artificial Intelligence and Analytics in Surgery Market?

The intraoperative guidance and navigation segment held the largest market share of nearly 34% in 2024. The segment is dominating due to its potential to maximize precision level and enhance outcomes of surgery with fewer side effects. AI algorithms can analyze imaging data about previous operations and how the surgical procedure could be performed in real time. It helps surgeons navigate through anatomical complexities that may arise while performing surgery. This approach can shorten surgical time and mitigate potential life-threatening possibilities such as over bleeding, nerve damage, cell deformation, misplaced screws, and other complications that lead to surgery with greater accuracy.

The surgical workflow and efficiency optimization segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The segment is expanding due to AI–based systems that can optimize surgical scheduling, detect the possible time required for surgery, and further manage equipment with staff effectively. AI-based systems can send automated notifications to staff who offer equipment, which reduces delays in procedures and increases utilization of operating rooms with other resources.

Technology Insights

Why are Technologies like Computer Vision and Image Recognition Mostly Used in Artificial Intelligence and Analytics in the Surgery Market?

The computer vision and image recognition segment held the largest market share of nearly 38% in 2024. Computer vision technology is highly applicable in healthcare as it offers improved patient outcomes and safety with enhanced precision and helps streamline workflows. Algorithms of computer vision systems can analyze medical images like X-rays, computed tomography (CT) scans, magnetic resonance imaging that offer real-time insights and guidance while track surgical tools, leading to highly precise procedures with a non-invasive method or a less invasive surgical method, which is more in demand by patients and healthcare professionals as well.

The predictive analytics platform segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. Predictive analytics technology is highly efficient as it offers deep insights for enhancing surgical tasks, personalizing treatment plans, and identifying potential risks that would develop in patients after surgery, which will allow for time interventions. Also, predictive analytics is highly applicable in robotic-based surgeries and augmented reality systems for precise, clear visualization, navigation, and decision-making capabilities.

Surgical Specialty Insights

Why Did General Surgery Hold the Highest Market Share in 2024 for the Surgical Specialty?

The general surgery segment held the largest share of nearly 29% in the artificial intelligence and analytics in surgery market. The segment is dominating due to the huge scope of applications covered in general surgery, from minimally invasive methods to highly complex and intricate surgeries related to the heart, brain, and spine. AI can offer deep insights in such a case and optimize treatment plans with potential risks and their solutions by optimizing the pre-operative state. AI can also provide real-time guidance during the surgical process to boost the confidence and decisions of surgeons and help them identify anatomical landmarks for better hold.

How Will Artificial Intelligence Aid Neurosurgery With the Least Complications?

The neurosurgery segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The neurosurgery process has always been complex and highly sensitive due to the brain's intricacies and functionalities, with limited knowledge of the brain and its operating method in the healthcare sector. Thus, AI plays a crucial role here by offering insight into required tools and their usage to reduce errors and analyze a large volume of data generated for such intensive surgeries, which will aid in diagnosis, prognosis, with precise planning for surgery.

Deployment Mode Insights

Why Are Cloud-Based AI Platforms Gaining Traction in the Artificial Intelligence and Analytics in Surgery Market?

The cloud-based AI platforms segment held the largest market share of nearly 64% in 2024. And the same segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The segment is highly driven due to two main factors, include high scalability, accessibility offered by cloud-based AI platforms, and precise surgical analytics backed by AI models. Virtually unlimited storage is offered by cloud computing processes with remote access, helpful for analyzing huge datasets generated while performing surgeries. Also, surgeons can access the required data and tools from anywhere with the help of an internet connection, which further reduces the need for physical presence. This approach is highly revolutionary as it holds the potential to serve even in the underserved areas and reach many people from remote areas.

End User Insights

Why Are Hospital and Surgical Centers Increasingly Adopting AI and Analytics?

The hospital & surgical centers segment held the largest market share of nearly 61% in 2024. The segment is expanding due to AI offering preoperative planning, possible challenges, and its solutions, guidance while performing surgery, along with a postoperative care guide. Due to the increasing lack of skilled surgeons and growing demand for intricate surgeries, AI can bridge this gap by providing precise solutions with minimal effort and improved outcomes. It also addresses surgical workflow challenges and enables remote surgery when required.

The ambulatory surgical centers segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The segment is experiencing a huge growth rate due to its offerings, like cost-effective treatments, rapid procedures, focus on patients' outcomes, reducing medical waste, and improved efficiency while streamlining workflows.

Artificial Intelligence and Analytics in Surgery Market Companies

- Medtronic plc (Touch Surgery, AI-based analytics)

- Intuitive Surgical, Inc. (Da Vinci AI)

- Johnson & Johnson (Ethicon + C-SATS)

- Stryker Corporation (Mako Smart Robotics + OrthoLogIQ)

- Siemens Healthineers (AI-Rad Companion, Syngo Carbon)

- Zimmer Biomet (ZBEdge AI Ecosystem)

- Surgical Theater (VR & AI for neurosurgery)

- Activ Surgical (AI-powered surgical vision)

- Caresyntax (AI-Driven OR Analytics)

- Proximie (AI for tele-surgery & collaboration)

- Theator (AI surgical video analytics)

- Digital Surgery (Medtronic-acquired, AI surgical training)

- BrainLAB AG (AI-powered navigation and analytics)

- Augmedics (AR-assisted spine surgery)

- VirtaMed (AI simulation for surgical training)

- Globus Medical (Robotic AI surgical platforms)

- GE HealthCare (AI-enhanced imaging integration)

- Surgical Intelligence GmbH

- Robocath (AI-enhanced robotic catheterization)

- Hyperfine (portable MRI with AI surgical use cases)

Recent Developments

- In July 2025, a global research team from VCU used AI to enhance death prediction and risk factors associated with it for patients who were hospitalized for Cirrhosis. Their work has been registered in the journal Gastroenterology.

- In July 2025, the leading surgical intelligence company, Proprio, is planning to build the first foundational AI model for surgery by integrating multimodal data. The company joined forces with the AWS partner network.

Segments Covered in the Report

By Application

- Intraoperative Guidance & Navigation

- Real-time Video Analytics

- Augmented Reality Overlays

- AI-Based Instrument Tracking

- Surgical Workflow & Efficiency Optimization

- OR Scheduling & Staff Coordination

- Turnaround Time Analytics

- Postoperative Outcomes Monitoring

- Preoperative Planning & Risk Stratification

- Surgical Training & Simulation

- AI-based Skill Assessment

- Virtual Reality Training Modules

By Technology

- Computer Vision & Image Recognition

- Machine Learning & Deep Learning Models

- Natural Language Processing (NLP)

- Predictive Analytics Platforms

- Robotic Process Automation (RPA)

- Augmented Reality (AR) / Virtual Reality (VR)

- Edge AI & IoT Integration in Surgery

By Surgical Specialty

- General Surgery

- Orthopaedic & Spine Surgery

- Neurosurgery

- Cardiothoracic Surgery

- Gastrointestinal & Colorectal Surgery

- Urology

- ENT & Ophthalmology

By Deployment Mode

- Cloud-Based AI Platforms

- On-Premises Solutions

- Hybrid Systems

By End User

- Hospitals & Surgical Centers

- Ambulatory Surgical Centers (ASCs)

- Academic Research Institutes

- Surgical Training Facilities

- AI Health Tech Startups & Innovation Labs

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting