What is the Atopic Dermatitis Clinical Trials Market Size?

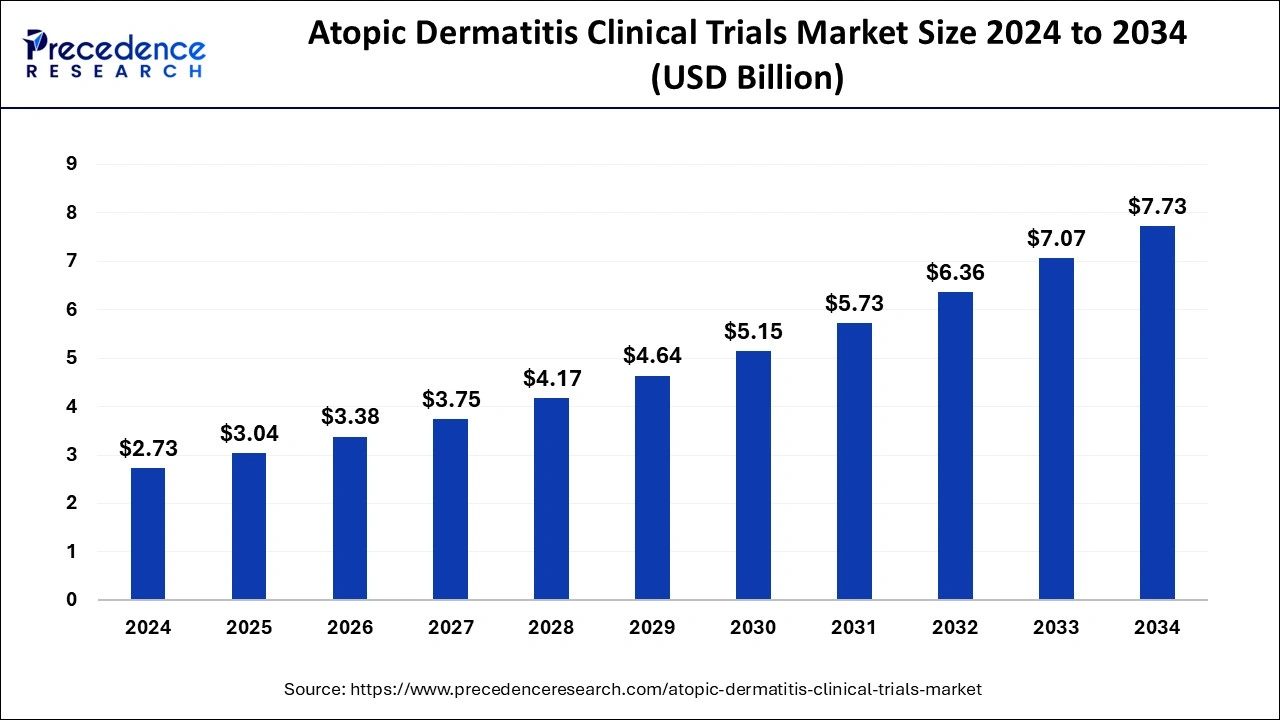

The global atopic dermatitis clinical trials market size is estimated at USD 3.04 billion in 2025 and is predicted to increase from USD 3.38 billion in 2026 to approximately USD 7.73 billion by 2034, expanding at a CAGR of 10.97% from 2025 to 2034.

Market Highlights

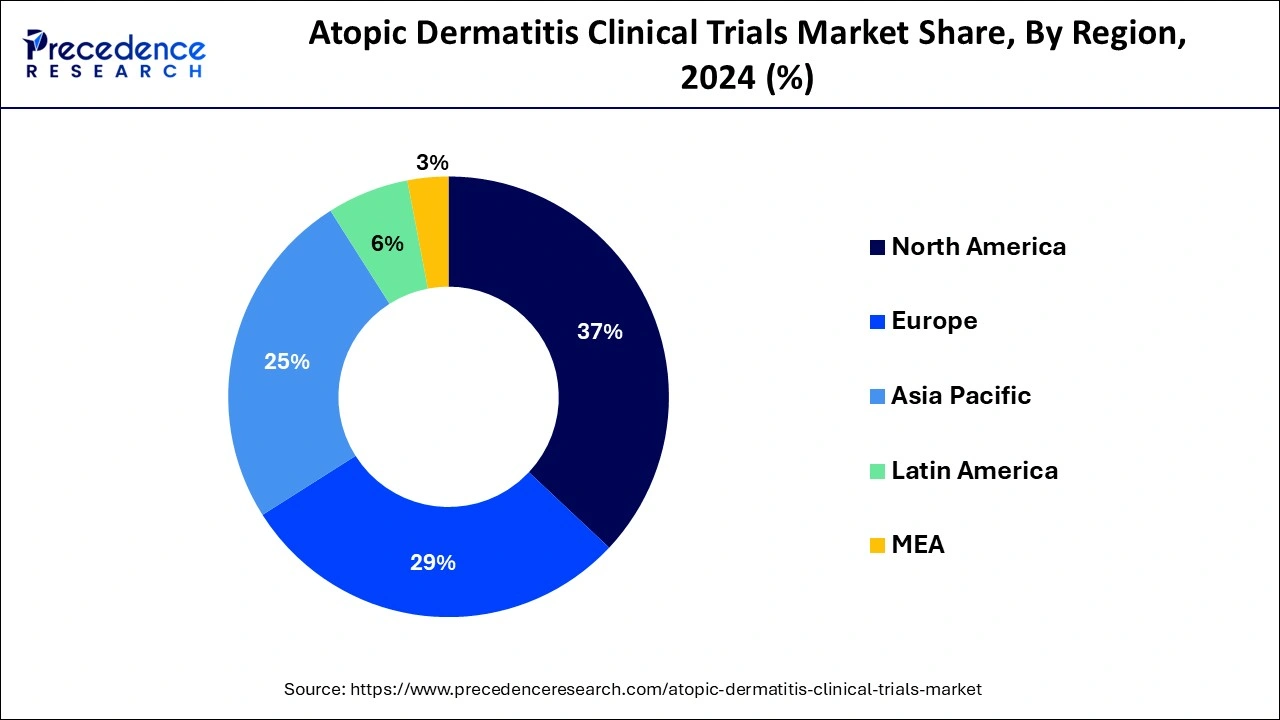

- North America has contributed more than 37% of market share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By molecule type, the large molecules segment has held the largest market share of 54% in 2024.

- By molecule type, the small molecules segment is anticipated to grow at a remarkable CAGR of 12.5% between 2025 and 2034.

- By study design, the interventional trials segment has generated over 72% of market share in 2024.

- By study design, the observational trials segment is expected to expand at the fastest CAGR over the projected period.

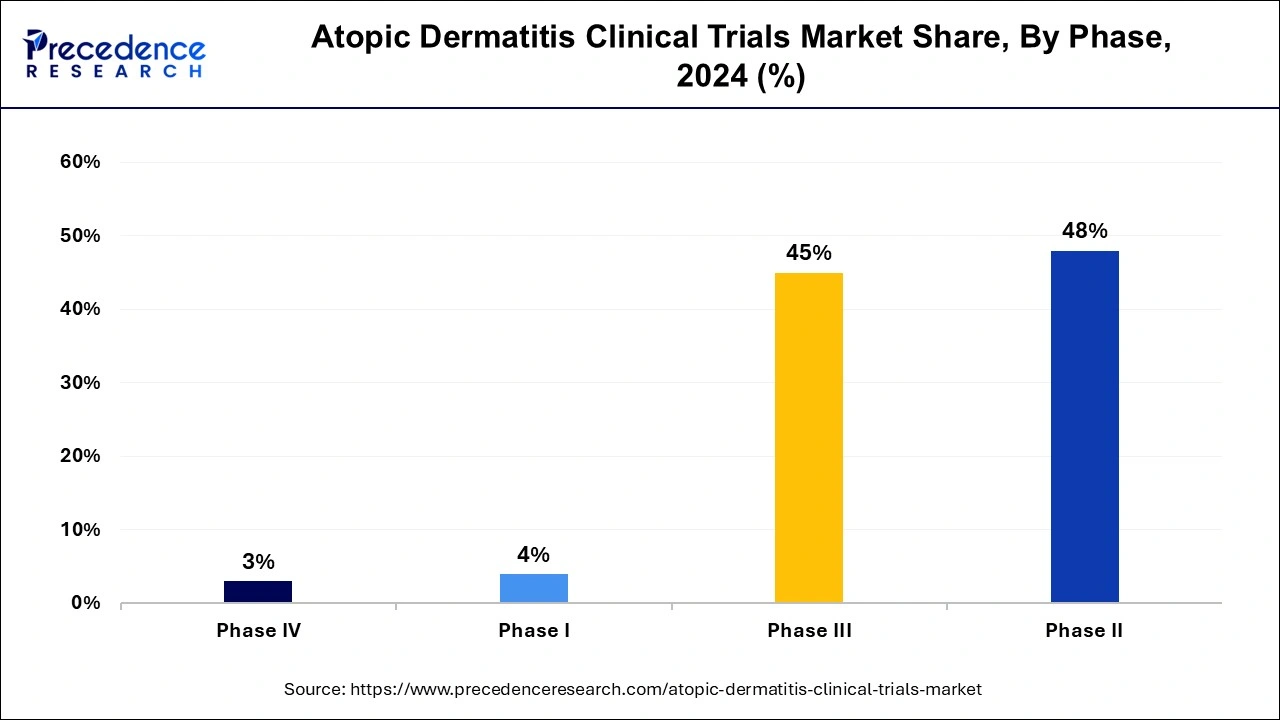

- By phase, the phase II segment has accounted more than over 48% of market share in 2024.

- By phase, the phase III segment is expected to expand at the fastest CAGR over the projected period.

Market Size and Forecast

- Market Size in 2025: USD 3.04 Billion

- Market Size in 2026: USD 3.38 Billion

- Forecasted Market Size by 2034: USD 7.73 Billion

- CAGR (2025-2034): 10.97%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

Atopic dermatitis clinical trials are studies conducted to test new treatments or therapies for the skin condition known as atopic dermatitis, also called eczema. These trials involve volunteers who have been diagnosed with atopic dermatitis and are willing to participate in the research process. The aim of these trials is to evaluate the safety and effectiveness of different medications, creams, or procedures in managing the symptoms of atopic dermatitis, such as itching, redness, and inflammation. Participants may be asked to try experimental drugs, follow specific skincare routines, or undergo medical tests to assess their response to treatment. By participating in these trials, patients not only contribute to advancing medical knowledge about atopic dermatitis but also may gain access to potentially beneficial treatments that are not yet available to the general public.

Atopic Dermatitis Clinical Trials Market Data and Statistics

- The International Eczema Council's Global Burden of Disease (GBD) 2022 report revealed that approximately 223 million individuals worldwide were affected by atopic dermatitis in 2022, with about 43 million falling into the age group of 1-4 years old.

- In June 2023, Sanofi unveiled promising topline Phase 2b data for amlitelimab in the treatment of atopic dermatitis. These findings underscore amlitelimab's potential as an innovative candidate, being a first-in-class and potentially best-in-class investigational anti-OX40-ligand monoclonal antibody for addressing atopic dermatitis.

Atopic Dermatitis Clinical Trials MarketGrowth Factors

- Despite the availability of various treatment options, there remains a significant unmet need for effective therapies for atopic dermatitis. A substantial portion of patients do not achieve adequate symptom control with current treatments, driving the demand for novel therapies while promoting the growth of the atopic dermatitis clinical trials market.

- Advances in biotechnology, including the development of biologics and targeted therapies, have opened up new avenues for the treatment of atopic dermatitis. These innovations have led to the exploration of novel mechanisms of action and the development of more precise and effective treatments.

- Governments and regulatory agencies worldwide are increasingly recognizing the burden of atopic dermatitis and are taking measures to support research and development in this area. Funding initiatives, regulatory incentives, and expedited approval pathways are driving growth in clinical trial activity.

- Patient advocacy groups and increased public awareness of atopic dermatitis are driving demand for better treatments. Patients and caregivers are actively seeking out clinical trial opportunities, leading to increased participation in research studies.

- Atopic dermatitis imposes a significant economic burden on healthcare systems and societies worldwide. The direct and indirect costs associated with the condition, including healthcare expenses, lost productivity, and decreased quality of life, provide a strong incentive for investment in research and development of new therapies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.04 Billion |

| Market Size in 2026 | USD 3.38 Billion |

| Market Size by 2034 | USD 7.73 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.97% |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Molecule Type, Study Design, Phase, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Demand for novel and effective treatments

The demand for novel and effective treatments drives the market demand for atopic dermatitis clinical trials as patients and healthcare providers seek better solutions to manage this skin condition. With existing treatments often providing only partial relief or causing unwanted side effects, there's a strong push for the development of new therapies. Clinical trials offer the opportunity to test these potential treatments in real-world settings, allowing researchers to assess their safety and effectiveness in diverse patient populations. Thereby, the rising demand for novel and effective treatments offers a significant driver for the atopic dermatitis clinical trials market.

As demand for better treatments increases, pharmaceutical companies and research institutions are motivated to invest in clinical trials to bring innovative therapies to market. These trials not only offer hope for patients seeking relief from the symptoms of atopic dermatitis but also represent a significant market opportunity for companies developing new drugs or therapies. By participating in these trials, patients can access cutting-edge treatments while contributing to the advancement of medical science and the improvement of care for future generations.

Restraint

Challenges in recruiting and retaining participants

Challenges in recruiting and retaining participants pose significant restraints on the market demand for atopic dermatitis clinical trials. Difficulty in finding suitable participants who meet the specific criteria set for the trials can delay the research process and prolong the time it takes to bring new treatments to market. Moreover, once participants are recruited, retaining them throughout the duration of the trial can be challenging due to factors such as inconvenience, discomfort from treatments, or other personal reasons. These recruitment and retention challenges hinder the progress of clinical trials, limiting the number of studies that can be conducted and potentially delaying the availability of new treatments for atopic dermatitis.

Additionally, the slow pace of recruitment can increase the overall costs of conducting trials, as resources are expended on advertising, screening, and enrolling participants. Addressing these challenges through innovative recruitment strategies, improved patient education, and enhanced support throughout the trial process is crucial for accelerating the development of effective therapies for atopic dermatitis.

Opportunity

Expansion of emerging markets for clinical trials

The expansion of emerging markets for clinical trials presents significant opportunities in the atopic dermatitis clinical trials market. As these markets grow and become more accessible, there is a broader pool of potential participants for research studies on atopic dermatitis. Emerging markets often have diverse populations with varying genetic backgrounds and environmental exposures, providing researchers with valuable insights into the disease's underlying mechanisms and treatment responses.

Moreover, conducting clinical trials in emerging markets can offer several advantages, including lower costs, streamlined regulatory processes, and faster patient recruitment. These factors enable researchers to conduct studies more efficiently and cost-effectively, accelerating the development of new therapies for atopic dermatitis. Additionally, expanding into emerging markets allows pharmaceutical companies and research institutions to tap into previously untapped patient populations, increasing the diversity and representativeness of clinical trial data and ultimately improving the generalizability of study findings.

Segments Insights

Molecule Type Insights

The large molecules segment held the highest market share of 54% in 2024. In the atopic dermatitis clinical trials market, the large molecules segment comprises biologic drugs and monoclonal antibodies designed to target specific immune pathways involved in the disease. This segment is witnessing a growing trend due to increasing research in biotechnology and immunotherapy for atopic dermatitis. Large molecules offer targeted and potent treatment options with potentially fewer side effects compared to traditional small molecule drugs. As a result, there's a rising interest in developing and testing large molecule therapies in clinical trials for atopic dermatitis.

The small molecules segment is anticipated to witness rapid growth at a significant CAGR during the projected period. In the atopic dermatitis clinical trials market, the small molecules segment refers to chemical compounds with low molecular weight that can effectively target specific biological pathways involved in the disease. Small molecules are often administered orally or topically and have shown promise in treating atopic dermatitis by modulating inflammatory responses or immune system dysfunction. Current trends in clinical trials indicate a growing interest in developing small molecule therapeutics due to their potential for targeted therapy and the convenience of administration.

Study Design Insights

The interventional trials segment held a 72% market share in 2024. Interventional trials in atopic dermatitis clinical trials involve testing new treatments or therapies to assess their efficacy and safety. These trials typically compare the effects of the experimental treatment against a control group receiving standard care or a placebo. In recent trends, there is a growing emphasis on innovative interventions such as biologics, targeted therapies, and novel drug delivery systems. Additionally, there is an increasing focus on personalized medicine approaches and the inclusion of pediatric populations in interventional trials for atopic dermatitis.

The observational trials segment is anticipated to witness rapid growth over the projected period. Observational trials in the atopic dermatitis clinical trials market involve monitoring patients' outcomes without intervening in their treatment. These trials observe natural disease progression, treatment patterns, and real-world effectiveness of therapies. A notable trend is the increasing use of observational trials alongside interventional studies to provide comprehensive insights into atopic dermatitis management. These trials offer valuable data on long-term treatment outcomes, patient-reported outcomes, and real-world adherence to therapy, enhancing our understanding of the disease and improving patient care strategies.

Phase Insights

The phase II segment has held a 48% market share in 2024. Phase II clinical trials in the atopic dermatitis market involve testing the safety and effectiveness of potential treatments in a larger group of patients with the condition. These trials typically aim to determine the optimal dosage and evaluate the treatment's preliminary efficacy. Recent trends in Phase II trials include an emphasis on exploring novel mechanisms of action, such as biologics and targeted therapies, as well as evaluating combination therapies and assessing long-term safety and efficacy outcomes.

The phase III segment is anticipated to witness rapid growth over the projected period. Phase III clinical trials are large-scale studies conducted to evaluate the safety and efficacy of potential treatments for atopic dermatitis in a diverse patient population. These trials typically involve hundreds to thousands of participants and are designed to confirm the findings from earlier phases while also assessing long-term effects and comparing the treatment to standard care or placebo. Trends in Phase III trials for atopic dermatitis include increased focus on biologics, targeted therapies, and patient-reported outcomes to demonstrate clinical benefits effectively.

Regional Insights

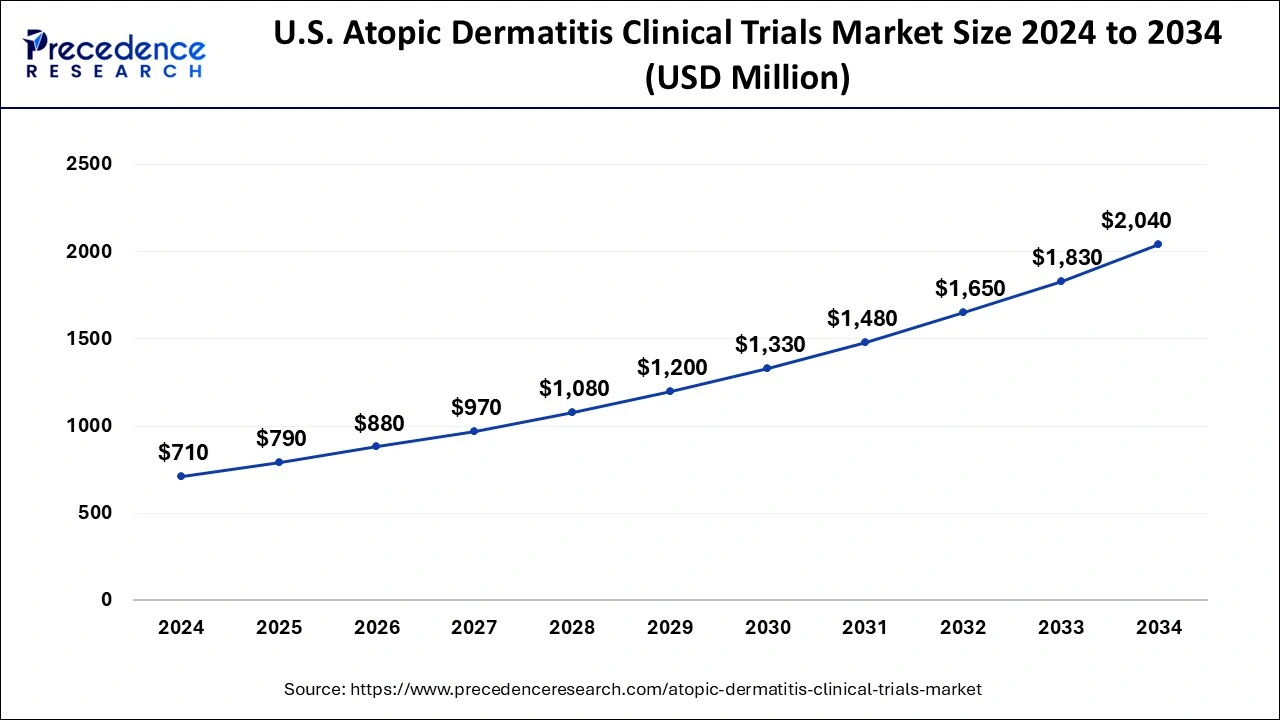

U.S.Atopic Dermatitis Clinical Trials Market Size and Growth 2025 to 2034

The U.S. atopic dermatitis clinical trials market size is estimated at USD 790 million in 2025 and is projected to surpass around USD 1,830 million by 2034 at a CAGR of 11.20% from 2025 to 2034.

North America held a share of 37% in 2024 due to several factors. Firstly, the region has a high prevalence of atopic dermatitis, driving demand for innovative treatments. Secondly, North America boasts advanced healthcare infrastructure and a robust research ecosystem, facilitating the development and commercialization of new therapies. Additionally, strong regulatory frameworks and supportive reimbursement policies encourage investment in clinical trials and market expansion. Lastly, increased awareness among patients and healthcare providers further fuels market growth in North America. Overall, these factors contribute to the region's dominant position in the atopic dermatitis clinical trials market.

Asia-Pacific is experiencing rapid growth in the atopic dermatitis clinical trials market due to several factors. First, the region's large and diverse population provides a vast pool of potential participants for research studies. Second, there's increasing recognition of atopic dermatitis as a significant health concern, driving demand for new treatments. Third, improvements in healthcare infrastructure and regulatory frameworks have made it easier to conduct clinical trials in the region. These factors combined contribute to the burgeoning growth of atopic dermatitis clinical trials in the Asia-Pacific region.

Meanwhile, Europe is experiencing notable growth in the atopic dermatitis clinical trials market due to several factors. The region boasts a large patient population with atopic dermatitis, driving demand for innovative treatments. Additionally, Europe offers a favorable regulatory environment, streamlined approval processes, and access to advanced healthcare infrastructure, making it an attractive destination for conducting clinical trials. Furthermore, collaborations between industry and academia, along with increased investment in research and development, are fueling the expansion of the atopic dermatitis clinical trials market in Europe.

Atopic Dermatitis Clinical Trials Market Companies

- Pfizer Inc.

- Sanofi SA

- Regeneron Pharmaceuticals, Inc.

- AbbVie Inc.

- Novartis International AG

- Eli Lilly and Company

- GlaxoSmithKline plc

- Johnson & Johnson

- Leo Pharma A/S

- Dermira, Inc. (acquired by Eli Lilly and Company)

- Galderma S.A.

- AnaptysBio, Inc.

- Dermavant Sciences, Inc.

- LEO Pharma A/S

- Amgen Inc.

Recent Developments

- In October 2023, LEO Pharma disclosed the favorable outcome of the DELTA 3 trial. This Phase 3 extension trial assessed delgocitinib cream, an investigational topical pan-Janus kinase (JAK) inhibitor, for potential treatment in adults with moderate to severe chronic hand eczema (CHE). This positive result bolstered the company's pipeline value and is expected to facilitate the commercialization of the product.

- In May 2023, Dermavant Sciences, Inc. unveiled encouraging results from ADORING 1, Phase 3 studies investigating the efficacy and safety of topical VTAMA (tapinarof) cream 1% in adults and pediatric subjects as young as 2 years old with moderate to severe atopic dermatitis. These findings provided the company with a route to commercial success, expansion in the market, competitive differentiation, and increased investor support.

Segments Covered in the Report

By Molecule Type

- Small Molecules

- Large Molecules

By Study Design

- Interventional

- Observational

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content