Automated Breast Ultrasound Systems Market Size and Forecast 2025 to 2034

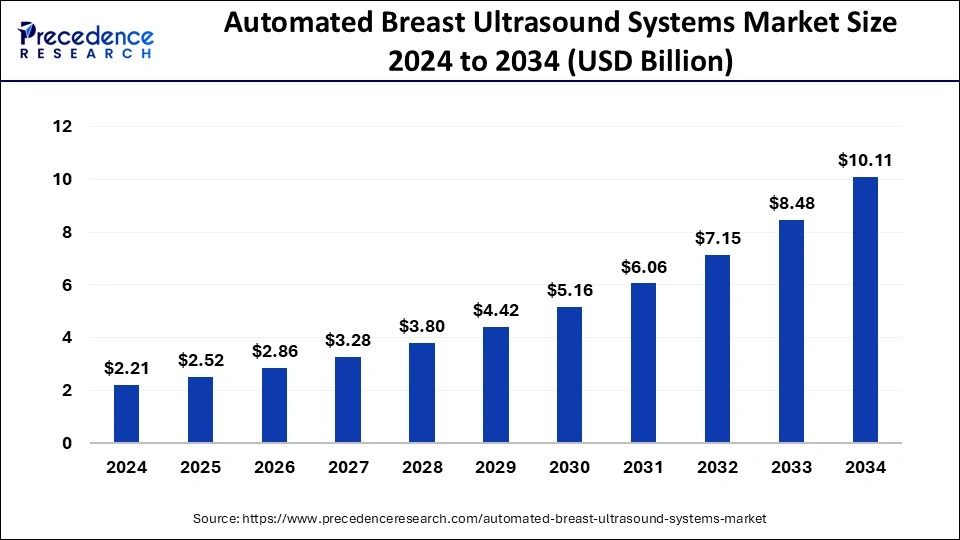

The global automated breast ultrasound systems market size accounted for USD 2.21 billion in 2024 and is predicted to increase from USD 2.52 billion in 2025 to approximately USD 10.11 billion by 2034, expanding at a CAGR of 16.70% from 2025 to 2034. Rising awareness of breast cancer screening, coupled with the need for more accurate and accessible diagnostic tools, further propels the adoption of ABUS in healthcare settings worldwide.

Automated Breast Ultrasound Systems MarketKey Takeaways

- The global automated breast ultrasound systems market was valued at USD 2.21 billion in 2024.

- It is projected to reach USD 10.11 billion by 2034.

- The automated breast ultrasound systems market is expected to grow at a CAGR of 16.70% from 2025 to 2034.

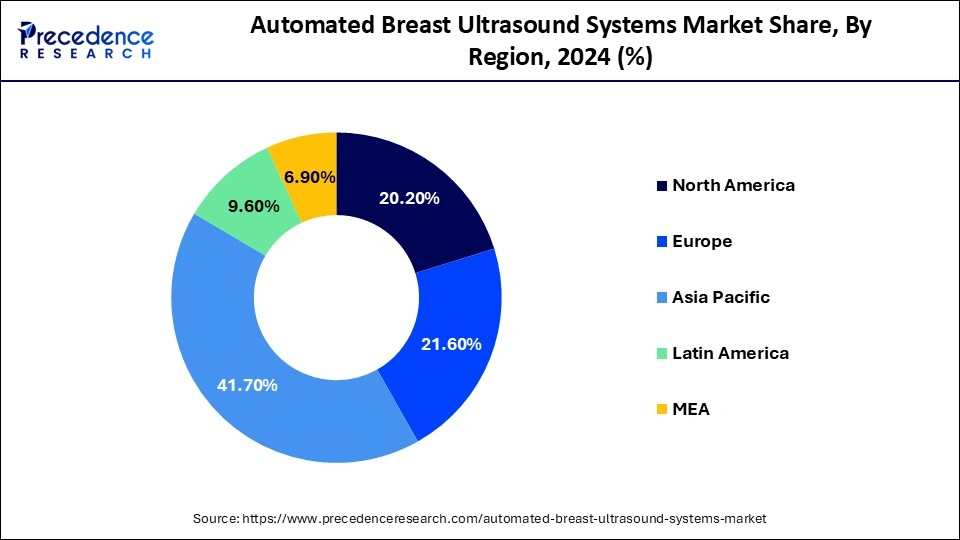

- North America dominated the automated breast ultrasound systems market with the largest share in 2024.

- Asia Pacific is observed to witness the fastest rate of growth during the forecast period.

- By product, the automated breast ultrasound scanner segment has contributed the largest market share in 2024.

- By product, the automated breast volume scanner combination therapy segment is observed to witness a notable rate of growth during the forecast period.

- By end user, the radiologists segment dominated the market in 2024.

- By end user, the surgeon segment is projected to witness rapid growth in the upcoming years.

Asia Pacific Automated Breast Ultrasound Systems Market Size and Growth 2025 to 2034

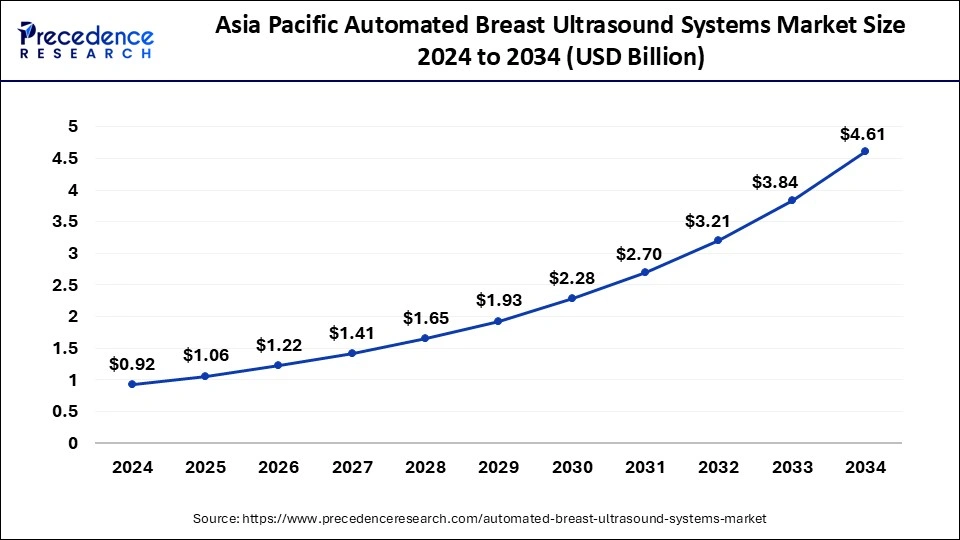

The Asia Pacific automated breast ultrasound systems market size was exhibited at USD 0.92 billion in 2024 and is projected to be worth around USD 4.61 billion by 2034, growing at a CAGR of 17.70% from 2025 to 2034.

Asia Pacific dominated the automated breast ultrasound systems market with the largest share in 2024. The region has historically dominated the market, driven by factors such as advanced healthcare infrastructure, early adoption of technological innovations, and robust research and development initiatives. The region boasts a high prevalence of breast cancer screening programs, favorable reimbursement policies, and strong collaborations between healthcare institutions and industry players. Consequently, North America has been at the forefront of ABUS adoption, with widespread usage among radiologists, oncologists, and breast surgeons.

North America is expected to witness fast growth in the automated breast ultrasound systems market during the forecast period of 2025-2034. The region is witnessing an emergence in ABUS utilization, driven by rapid economic growth, increasing healthcare spending, and rising awareness about breast cancer screening. Countries like China, Japan, South Korea, and India are leading the charge in ABUS adoption. These nations have significant populations, a growing burden of breast cancer cases, and improving healthcare infrastructure, making them ripe markets for ABUS technologies. Furthermore, initiatives to enhance breast cancer awareness and screening programs are gaining traction, fueling the demand for advanced diagnostic tools like ABUS.

Europe is observed to grow at a considerable growth rate in the upcoming period, fueled by an increasing focus on early breast cancer detection and heightened awareness of women's health issues. The region is seeing a higher adoption rate of automated breast ultrasound systems in hospitals and diagnostic centers, particularly for women with dense breast tissues where traditional mammography may be less effective. Innovations in technology, supportive regulatory conditions, and nationwide screening initiatives are all contributing to this growth. Additionally, the incorporation of ABUS with artificial intelligence and digital health technologies is improving diagnostic precision and optimizing workflows in healthcare facilities across countries like Germany, France, and the UK.

In Germany, the uptake of automated breast ultrasound systems is accelerating due to its advanced healthcare system and strong commitment to preventive medicine. Hospitals and outpatient clinics are adopting ABUS for its effectiveness in identifying early-stage breast cancer, especially in women with dense breast tissues. Government health initiatives and ongoing collaborations between medical institutions and technology manufacturers are further promoting the deployment and awareness of ABUS in standard clinical practices.

Market Overview

Automated breast ultrasound (ABUS) is an advanced imaging technique designed to enhance the detection of breast cancer, particularly in women with dense breast tissue where traditional mammography may be less effective. ABUS utilizes a transducer to generate high-frequency sound waves, which are then converted into detailed images of the breast tissue. Unlike handheld ultrasound, ABUS operates automatically, scanning the entire breast in a systematic and reproducible process that begins with the patient lying comfortably on a table as the breast is positioned within the ABUS system. The transducer moves across the breast, capturing multiple images from various angles. These images are then analyzed by specialized software to create a comprehensive three-dimensional representation of the breast.

The automated breast ultrasound systems market offers several advantages, including increased sensitivity in detecting small tumors, especially in dense breast tissue, where abnormalities may be obscured on mammograms. It also provides a non-invasive and radiation-free imaging option, making it safe for repeated use. While ABUS is not a replacement for mammography, it serves as a valuable adjunctive screening tool, particularly for women with dense breast tissue or those at higher risk of breast cancer. Its automation streamlines the imaging process, improving efficiency and standardization in breast cancer screening programs.

- In February 2024, Candelis introduced its advanced breast imaging workstation, enhancing its ImageGrid platform. The workstation now supports viewing and analysis of 3D breast ultrasound images from leading manufacturers like GE Healthcare, Siemens Healthineers, Hitachi, and iVu.

- In November 2023, GE Healthcare launched the MyBreastAI suite at RSNA 2023, the renowned radiology and medical imaging conference held in Chicago. This innovative product aims to streamline radiologists' workflows and facilitate earlier detection of breast cancer in patients.

Automated Breast Ultrasound Systems Market Growth Factors

- Within the automated breast ultrasound systems market, advanced software algorithms enhance image resolution, allowing for clearer visualization of breast tissue structures, including potential abnormalities such as tumors or cysts�Higher-resolution images aid radiologists in making more accurate diagnoses.

- Growth in automation technology streamlines the scanning process, reducing the need for manual adjustments and ensuring comprehensive coverage of the breast. Automated transducer movement and image capture enhance efficiency and consistency in image acquisition.

- The services of the automated breast ultrasound systems market incorporate sophisticated algorithms for the three-dimensional reconstruction of breast tissue. This enables radiologists to examine the breast from multiple angles, improving the detection of subtle abnormalities and providing a more comprehensive assessment.

- Integration of artificial intelligence (AI) algorithms further enhances the capabilities of the market. AI-powered image analysis can assist radiologists in identifying suspicious lesions by highlighting areas of concern, reducing interpretation time, and improving diagnostic accuracy.

Major Key Trends in Automated Breast Ultrasound Systems Market

- AI Integration: The integration of artificial intelligence within ABUS platforms is enhancing the accuracy of image interpretation, minimizing human error, and facilitating quicker, more uniform diagnostic decision-making.

- Expansion in Non-Hospital Settings: ABUS is being increasingly utilized in outpatient and imaging centers, which is making early breast cancer screening more accessible to a broader population beyond conventional hospital settings.

- Rising Focus on Dense Breast Screening: There is a growing need for ABUS as a supplemental screening tool for women with dense breast tissue, where standard mammograms may overlook early-stage tumors.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 16.70% |

| Market Size in 2025 | USD 2.52 Billion |

| Market Size by 2034 | USD 10.11 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Revolutionizing breast cancer screening

ABUS technology is transforming breast cancer screening by providing a radiation-free, non-invasive alternative to traditional mammography. With its ability to detect tumors in dense breast tissue, ABUS is revolutionizing early detection efforts, especially for high-risk individuals. Its automated scanning process ensures comprehensive coverage, enhancing efficiency and accuracy in diagnosis. As healthcare providers prioritize personalized medicine, services and products of the automated breast ultrasound systems market emerge as vital tools in improving patient outcomes through early detection and intervention.

- In January 2023, the International Agency for Research on Cancer (IARC) unveiled its latest digital resource, the Atlas of Breast Cancer Early Detection. This comprehensive atlas serves as a step-by-step guide to various procedures involved in early breast cancer detection, including clinical breast examination, diagnostic mammography, breast ultrasound, image-guided fine-needle aspiration cytology, and core biopsy of the breast.

Bridging the gaps in existing technologies

ABUS technology addresses the challenges of breast cancer diagnosis, particularly in populations with dense breast tissue where mammography may be less effective. By providing a detailed, three-dimensional view of the breast, ABUS enhances the detection of abnormalities, improving diagnostic accuracy and reducing the likelihood of false negatives. Its automation streamlines the imaging process, making it more accessible and less operator-dependent. The automated breast ultrasound systems market plays a crucial role in bridging the gap in breast cancer diagnosis, ensuring timely and accurate detection for improved patient outcomes.

- In November 2023, Boston Imaging, the U.S. headquarters of Samsung's digital radiography and ultrasound business, unveiled the V6 ultrasound system, offering comprehensive imaging capabilities in 2D, 3D, and color image quality tailored for Women's Health and Urology. Recently cleared by the U.S. FDA for commercial use, the V6 prioritizes affordability without compromising workflow or productivity requirements.

Restraints

Hurdles faced during the implementation of ABUS systems

Despite its potential benefits and the widespread adoption of ABUS, the automated breast ultrasound systems market faces several constraints. Firstly, the cost of ABUS technology remains a significant barrier, limiting accessibility, especially in resource-constrained healthcare settings. Additionally, the need for specialized training to operate and interpret ABUS results adds to the implementation challenges. Moreover, integrating ABUS into existing breast cancer screening programs requires infrastructural investments and workflow modifications, which may encounter resistance from healthcare institutions.

Furthermore, the limited evidence supporting ABUS as a standalone screening modality presents a challenge in gaining acceptance from regulatory bodies and insurance providers. Overcoming these restraints necessitates concerted efforts to reduce costs, expand training opportunities, streamline workflow integration, and generate robust clinical evidence to support the efficacy of ABUS in breast cancer detection. Only through addressing these challenges can ABUS realize its full potential in improving breast cancer screening and diagnosis outcomes.

Opportunities

Telemedicine Integration for Remote Consultations

The integration of ABUS with telemedicine platforms presents a significant opportunity to enhance the automated breast ultrasound systems market services, particularly in remote or underserved areas. By enabling remote consultations between patients and healthcare providers, ABUS can facilitate timely screenings and expert interpretations, reducing barriers to access and improving patient outcomes. This approach also offers the potential for more efficient use of healthcare resources and reduced patient wait times, as consultations can be conducted remotely without the need for in-person visits to specialized facilities.

- In October 2023, Lunit, a leading provider of AI-powered solutions for cancer diagnostics and therapeutics, announced a groundbreaking collaboration with Leeds Teaching Hospitals NHS Trust. Together, they embarked on the world's first prospective study of AI-powered breast reading in a symptomatic breast clinic environment. Leveraging Lunit INSIGHT MMG, an AI mammography analysis solution, the initiative aims to revolutionize breast cancer detection and streamline diagnosis processes.

Telemedicine-enabled education and training programs

Another opportunity for the automated breast ultrasound systems market lies in utilizing telemedicine platforms to provide education and training programs on ABUS technology for healthcare professionals. By offering remote training sessions, webinars, and virtual workshops, healthcare providers can enhance their skills in ABUS interpretation and usage, leading to improved diagnostic accuracy and patient care. Additionally, telemedicine-enabled educational initiatives can help address workforce shortages in certain regions by providing access to training opportunities for healthcare professionals who may not have access to traditional in-person training programs.

Product Insights

The automated breast ultrasound scanner (ABUS) segment dominated the automated breast ultrasound systems market in 2024. In recent times, two specific automated breast ultrasound technologies have emerged as particularly useful for the ABUS and the ABVS. ABUS offers comprehensive imaging of the entire breast, aiding in the detection of abnormalities, especially in dense breast tissue.

During the forecast period, the automated breast volume scanner (ABVS) segment is projected to grow substantially in the automated breast ultrasound systems market. On the other hand, ABVS provides high-resolution, three-dimensional images, enhancing diagnostic accuracy and efficiency. Both technologies offer significant advancements in breast cancer screening, providing clinicians with valuable tools to improve early detection rates and patient outcomes in a more accessible and operator-independent manner.

- In December 2023, Siemens Healthineers unveiled the eSie Measure AI-Powered Ultrasound System, boasting automated cardiac measurements to streamline echocardiography exams. This innovative system significantly reduces keystrokes by up to 44% and shortens routine exam times by five minutes.

End-user Insights

The radiologist segment dominated the automated breast ultrasound systems market in 2024. In recent times, two key end users who have found the ABUS particularly useful are radiologists and breast surgeons. Radiologists benefit from ABUS's ability to provide detailed, three-dimensional images of breast tissue, aiding in the accurate detection and characterization of abnormalities, especially in patients with dense breast tissue.

The surgeons segment is expected to show notable growth in the automated breast ultrasound systems market during the forecast period. For breast surgeons, ABUS offers enhanced pre-operative assessment, facilitating surgical planning and guiding interventions with greater precision. As ABUS continues to evolve, its utility for these specialists grows, contributing to improved patient care through more accurate diagnosis, treatment planning, and outcomes in breast cancer management.

Automated Breast Ultrasound Systems Market Companies

- ALPINION Medical Systems Co., Ltd.

- BK Medical Holding Company, Inc.

- Canon Medical Systems Corporation

- Delphinus Medical Technologies, Inc.

- Fukuda Denshi Co., Ltd.

- GE Healthcare

- Hitachi, Ltd.

- Hologic, Inc.

- Konica Minolta, Inc.

- Koninklijke Philips N.V.

- QT Imaging, Inc.

- Samsung Group

- Seno Medical Instruments, Inc.

- Siemens Healthineers AG

- SonoCine, Inc.

Recent Developments

- In July 2024, Delphinus Medical Technologies, Inc. implemented SoftVue breast ultrasound tomography at West Jefferson Medical Center in Louisiana. (Source - https://www.delphinusmt.com)

- In February 2023, iSono Health, a medical technology firm, established a distribution partnership with Abdul Latif Jameel Health to launch its 3D ultrasound portable breast imaging scanner in the Middle East & Africa. This collaboration will assist the company in expanding its geographic presence while enhancing its brand recognition. (Source - https://alj.com)

- In September 2023, Hologic Inc. teamed up with Bayer to create and provide contrast-enhanced mammography (CEM) solutions aimed at improving breast cancer detection across multiple countries. (Source - https://investors.hologic.com)

- In February 2024, Butterfly Network introduced the iQ3TM handheld ultrasound system, incorporating advanced image processing, artificial intelligence (AI) capabilities, and enhanced 3D imaging technology. This innovative device marks a significant milestone in ultrasound technology, offering healthcare professionals a portable and powerful tool for diagnostic imaging with improved accuracy and efficiency.

- In October 2023, Philips Healthcare unveiled a groundbreaking solution for breast ultrasound imaging, combining hardware and software into a cohesive package. Available on the company's Epiq and Affiniti ultrasound scanners, this innovative offering integrates Philips' PureWave eL18-4 ultra-broadband linear-array transducer with advanced �anatomical intelligence' automated software.

Segments Covered in the Report

By Product

- Automated Breast Ultrasound System

- Automated Breast Volume Scanner

- Automated Breast Ultrasound Device

- Automated Breast Imaging System

- Automated Breast Ultrasound Scanner

- Automated Breast Ultrasound Equipment

- Automated Breast Ultrasound Machine

- Automated Breast Ultrasound Technology

By End-user

- Radiologists

- Oncologists

- Breast Surgeons

- Gynecologists

- Breast Imaging Technologists

- Healthcare Providers

- Patients

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content