Automotive Parts Packaging MarketSize and Forecast 2025 to 2034

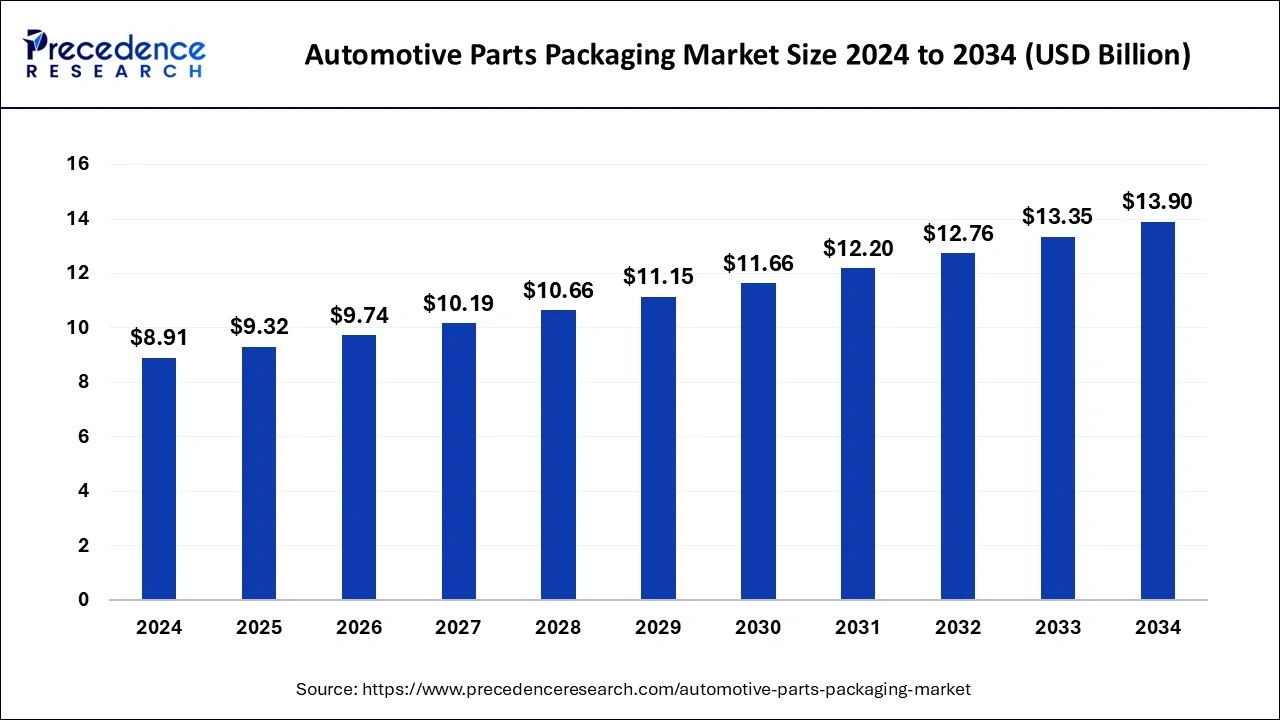

The global automotive parts packaging market size accounted for USD 8.91 billion in 2024 and is expected to exceed around USD 13.90 billion by 2034, growing at a CAGR of 4.55% from 2025 to 2034. The automotive parts packaging market is growing as automotive packaging materials provide better protection for products from special assemblies, shock-absorbing materials, and poor sealing. Durability and reusability reduce the risk of damage during shipping.

Automotive Parts Packaging Market Key Takeaways

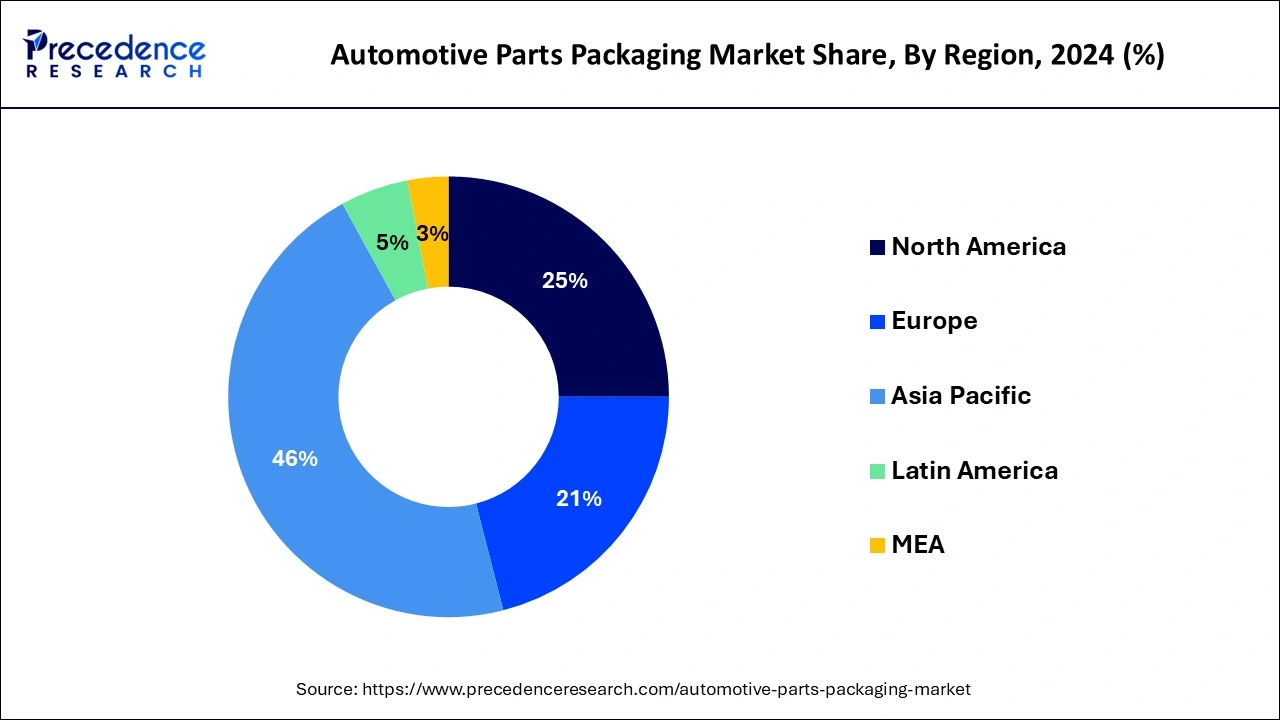

- Asia Pacific led the global market with the highest market share of 45.14% in 2024.

- By region, China has the most significant and fastest-growing automotive industries.

- By product, as per volume, protective packaging will probably represent the most significant market, while bulk cases and containers will hold the largest market share globally.

- By packaging, the market share of disposable packaging will be the largest.

- By component, the lighting segment will lead the market for packaging automobile parts.

Impact of Artificial Intelligence (AI) on the Automotive Parts Packaging Market

AI can help improve packaging design for any solution by analyzing product size, shipping method, and environmental factors. AI tools can help create unique, eco-friendly packaging that reduces material consumption while maintaining energy efficiency and safety. In the automotive packaging sector, the integration of AI and automation technologies plays a key role in increasing efficiency and reducing costs. Automating packaging processes increases accuracy and handling speed, reduces human error, and increases productivity. Using this technology, companies can not only increase the safety and reliability of packaging but also ensure that solutions comply with regulations and business needs. AI systems can continuously monitor inventory, track usage patterns, and predict when products need to be replenished. This ensures consistent product quality, reduces holding costs, and reduces the likelihood of production delays, thus supporting the growth of the automotive parts packaging market.

Asia Pacific Automotive Parts Packaging Market Size and Growth 2025 to 2034

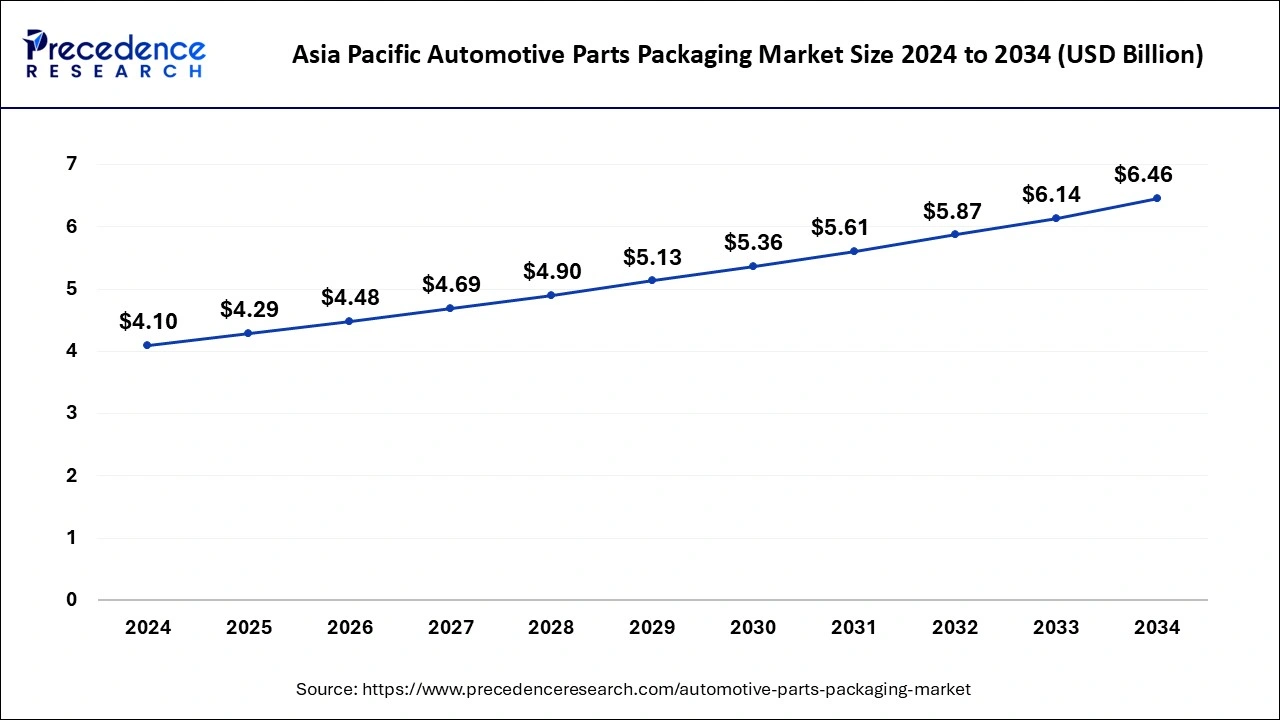

The Asia Pacific automotive parts packaging market sizewas evaluated at USD 4.10 billion in 2024 and is projected to be worth around USD 6.46 billion by 2034, growing at a CAGR of 4.65% from 2025 to 2034.

Asia Pacific dominated the automotive parts packaging market in 2024, the region is expected to hold the largest share of the market during the forecast period. In comparison to other nations, China has the most prominent and fastest-growing automotive industries. Although many established packaging providers in the Asia Pacific region already offer packaging solutions at affordable prices, global packaging industry leaders have the chance to enter the China automotive industry and take advantage of the enormous opportunity created with advanced packaging solutions.

Packaging companies in the Asia-Pacific area invest substantially less in R&D than their competitors in North America and Europe. Therefore, rather than creating product-specific innovative packaging solutions, the competition in China's packaging business is concentrated on conventional packaging products. Additionally, advances in material science have produced a wide range of affordable biodegradable plastics that may be used in making disposable packaging for car parts. Due to its many advantages over reusable packaging, the automotive sector is moving towards embracing the use of disposable packaging. As a result, the market for packaging automotive parts globally has seen some attractive opportunities.

Market Overview

The global automotive parts packaging market revolves around the innovation, production and distribution of packaging solutions, especially developed for packaging automotive parts. Packaging for automotive, aftermarket, spare, or service parts is called automotive parts packaging. This can include packaging for the aftermarket, engines, or industrial uses, such as custom crates, wood packing, corrugated materials, pallets, bubble wrap, and more.

The automobile packaging sector is changing due to sustainable advances in packaging like recyclable packaging materials, biodegradable packaging materials, sustainable logistics, reusable packaging, and optimized packaging. Automobile manufacturers are concentrating on package optimization to utilize fewer calories while preserving their products during transportation. This strategy lessens waste production and the industry's environmental impact.

Automotive Parts Packaging Market Growth Factors

- Packaging is ideal for assembly lines due to its compact size, modular design, and compatibility with RFID/barcode systems, which enables the growth of the automotive parts packaging market.

- Automotive parts must reach their destination without damage; otherwise, the damage that will occur can disrupt production and negatively affect profitability, leading to the growth of the automotive parts packaging market.

- Automotive packaging is essential for the transportation of the basic components of a vehicle, which enables the growth of the automotive parts packaging market.

- Automotive packaging serves two purposes. Protecting products and promoting goods to consumers, enables the growth of the automotive parts packaging market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 9.32 Billion |

| Market Size by 2034 | USD 13.90 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.55% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Packaging, and Component |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing urbanization

The need for automotive production is increasing due to rising urbanization, particularly in developing nations. To meet consumer and industrial demand, the automotive industry has boosted its production in recent years. Packaging for aftermarket parts is more in order due to the automotive industry. After the original equipment manufacturer (OEM) sells the car to the consumer, the automotive aftermarket, the secondary parts market of the automotive market deals with the production, distribution, retailing, and installation of all the equipment/parts, chemicals, and accessories for vehicles.

As the automotive industry across the world concentrates on creating packaging options for automotive parts, the increase is observed to show a significant effect on the packaging market. Packaging for automotive parts allows the safe storage of vital functions, and parts must be packaged effectively to prevent damage. By the end of 2022, India had produced 1,557,238 units in total of passenger cars, three-wheelers, two-wheelers, and quadricycles.

Restraint

Strict government regulations

Government regulation of the automobile industry has a direct impact on the appearance, construction, inclusion of safety features, and overall performance of each vehicle. Government regulation thus has a significant effect on the auto industry by raising production costs and restricting how cars are sold and promoted. Automakers may be punished with harsh fines if they violate automotive regulations intended to benefit consumers and safeguard the environment. Such stringent government policies directly impact on the sales of automotive parts and further act as restraints for the market's expansion.

Opportunity

Rising direct consumer sales through e-commerce platforms

Compared to conventional, over-the-phone ordering and buying components online have now become more convenient options because of the ease of e-commerce and modern shop management systems. Because local garages frequently hold the negative image of being unclear in their pricing and procedures, in addition to their product descriptions, consumers enjoy the information and price clarity available online. The range of aftermarket car parts includes everything from fenders or headlights to replacement windscreens. Each product must be protected with unique packaging to prevent damage while shipping. The best product packaging solution can be made using various materials and methods, depending on the application and destination.

Some examples include plastic corrugated divisions lined with foam, heat-sealed bubble pouches, and films to prevent scratching, marring, and abrasion. Thus, the market for manufacturing automobile components is expanding as there is an increase in demand for direct sales through e-commerce platforms. The expansion of e-commerce platform across the globe along with the rising focus of the automotive industry on their presence on online platforms is expected to offer plethora of opportunities for the global automotive parts packaging market.

Product Insights

According to volume, protective packaging will probably represent the most significant market, while bulk cases and containers will hold the largest market share globally. Due to the substantial amount of delicate electrical parts that are needed in automobiles, protective packaging is used significantly. Protective packaging causes significant waste because it is only used once before being discarded. Additionally, a substantial amount of non-biodegradable garbage is created globally due to the cheaper cost of protective packaging from non-biodegradable plastics than from biodegradable materials. Due to their wide range of applications, light weight, high strength, and biodegradable nature, corrugated packaging products are in high demand. On the other hand, several political and regulatory restrictions impact the trade of pulp used to make corrugated packaging products. These variables have affected the packaging market for automobile parts on a global scale.

Packaging Insights

The market share of disposable packaging will be the largest. When a vehicle part is used for its intended function, these goods are typically considered single-use packaging options that should be recycled or discarded. The lifecycle of the production and packaging process needs to include a regular material disposal procedure. Returnable packaging options have been developed for reuse in systems of manufacture and distribution. With this kind of packaging, there is no longer any need to buy disposable packaging that must be discarded in a landfill or recycled.

Component Insights

The lighting segment will lead the market for packaging automobile parts. Novel technologies for lighting are being developed by automobile manufacturers, focusing on popular lighting fixtures like headlights. They are creating allies to take the lead against competitors in the market. An essential element in making an environment that is secure for nighttime driving is the use of headlights.

Automotive Parts Packaging MarketCompanies

- Knauf Industries

- DS Smith plc

- Mondi plc

- Primex Plastics Corporation (ICC Industries Inc.)

- Nefab AB

- Schoeller Allibert Services B.V.

- Signode India Ltd.

- Sealed Air Corporation

- Smurfit Kappa Group plc

- Sunbelt Paper & Packaging Inc.

- Sonoco Products Company

- WestRock Company

Recent Developments

- In August 2023, Genuine Parts Company announced an acquisition of its European Automotive business. With a combination of organic growth and numerous store openings, the business has expanded over the past few years, bringing annual turnover to around €100 million ($110 million).

- In December 2024, Arkema completed the acquisition of the flexible packaging lamination adhesives business of Dow's, a global leader in adhesives for the flexible packaging sector. This acquisition will allow the Group to expand its portfolio of revolutionary innovations and become a major player in this attractive sector.

- In October 2024, Mondi, a global leader in sustainable packaging and paper products, announced that it has signed an agreement to acquire the corrugated board converting and rigid board businesses of Schumacher Packaging in Germany, Benelux, and the UK. The acquisition will expand Mondi's corrugated board business in Western Europe and add fiber products focused on e-commerce and fast-moving consumer goods, improving the immediate customer experience.

- In July 2024, Saica Group and Schumacher Packaging received approval for Poland. This includes all operations in Poland, all management, all employees, two state-of-the-art corrugated board mills in Bydgoszcz and WrocÅ‚aw, two paper mills (one fully completed) in GrudziÄ…dz and Myszków, and three service center.

Segment Covered in the Report:

By Product

- Crates

- Pallets

- Bags and Pouches

- Bulk Containers and Cases

- Folding Carton

- Trays

- Corrugated Products

- Protective Packaging

By Packaging

- Reusable

- Disposable

By Component

- Cooling System

- Battery

- Underbody Components

- Automotive Filter

- Engine Components

- Lighting Components

- Electrical Components

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting