What is the Automotive Suspension Market Size?

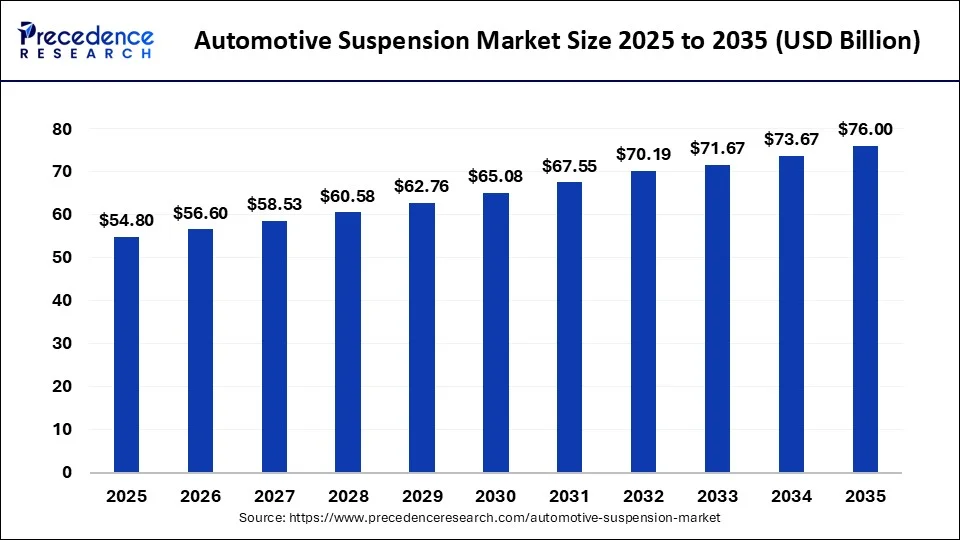

The global automotive suspension market size is calculated at USD 54.80 billion in 2025 and is predicted to increase from USD 56.60 billion in 2026 to approximately USD 76.00 billion by 2035, expanding at a CAGR of 2.51% from 2026 to 2035.

Automotive Suspension Market Key Takeaways

- Asia-Pacific segment dominated the global automotive suspension market in 2025.

- Europe is expected to expand at a solid CAGR during the forecast period.

- By system type, the semi-active suspension segment accounted for the largest market share in 2025.

- By system type, the active suspension segment is projected to grow at a notable CAGR during the forecast period.

- By vehicle type, the passenger vehicle segment generated the largest share of the market in 2025.

- By vehicle type, the light commercial vehicle segment is expected to witness significant growth in the forecast period.

Market Overview

The mechanism of two adjoining parts or gears in a vehicle or locomotive, regardless of proportions and size, is known as automotive suspension. The automotive suspension systems come in a variety of shapes and sizes, including tire air and springs. It is a shock absorption process that includes the relative motion of both wheels and shock absorbers between the locative and the surface on which the machine is functioning. The main objective of an automotive suspension is to minimize discomfort and exertion in the face of adversity.

The passengers will be more comfortable, the cargo will be less damaged, and driver tiredness will be reduced on lengthy trips if the rise is of high quality. The suspension is in charge of ride quality and automobile handling control since vehicles with firm suspension may have better body control and quicker reactions. As a result of these aforementioned factors, the demand for enhanced driving comfort has increased, favorably impacting the global automotive suspension market's growth during the forecast period. As the suspension system connects the wheel to the vehicle chassis and is one of the most important sections of a vehicle, demand for it is directly tied to new vehicle production.

Impact of adoption of AI in the manufacturing industry

AI is becoming a lifesaver for the automotive suspension market. The need for predictive maintenance to improve the overall quality, safety, and efficiency of automotive suspension is significantly encouraging the adoption of AI in manufacturing sectors. The rising demand for advanced vehicles requires cutting-edge technologies to support productivity and maintain quality and safety standards, which is becoming easier thanks to AI integration. AI algorithms provide real-time monitoring, operation optimization, and quick decision-making abilities. For the development of luxury and advanced vehicle models, AI technology is becoming essential in automotive suspension systems.

Automotive Suspension Market Growth Factors

- The automotive business is growing as a result of rising urbanization, technological improvements, and changing consumer preferences.

- Significant expenditures are being made to update existing vehicle suspension systems in order to improve ride quality and road-holding capabilities.

- In the near future, greater customer affordability combined with increased competitiveness would raise two-wheeler output, resulting in the automotive suspension market growth.

- The rising demand for lightweight suspension systems and the development of innovative suspension systems are playing for the growth of the automotive suspension market.

- The growing population, rising disposable incomes, and shifting consumer dynamics are resulting in a massive demand for two-wheelers. In order to increase their bottom line, many prominent two-wheeler companies are using targeted product launch strategies. The rising development of affordable and more efficient tow-wheelers is further driving the automotive suspension market.

- The global automotive suspension market is predicted to develop because of some factors, such as technological developments in vehicle components, increased vehicle production, and increased demand for luxury passenger vehicles.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 54.80 Billion |

| Market Size in 2026 | USD 56.60 Billion |

| Market Size by 2035 | USD 76.00 Billion |

| Growth Rate from 2026 to 2035 | 2.51% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | System Type, Vehicle Type, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Demand for luxury passenger vehicles

Passenger vehicles are widely productive vehicle types. The demand for advanced, safer, more secure, and superiorly experienced passenger vehicles has demonstrated the market. The rising demand for ride quality and handling is contributing to the market expansion. Additionally, the ability of luxury vehicle manufacturers to provide modern suspension systems is fueling the market growth. The demand for luxury passenger vehicles, including S-class and E-class, is playing a crucial role in the market.

Restraint

Issues such as improved global vehicle regulations, high maintenance costs, and modern suspension systems are expected to slow the automotive suspension market's growth. Additionally, the lack of standardization and high prices of independent suspension systems may function as a major hurdle to the market's expansion. Consumers often prefer original equipment manufacturer (OEM) components because of their high quality and lengthy service life. However, the original equipment manufacturer (OEM)-supplied vehicle suspension parts and components are more expensive than aftermarket-supplied parts and components.

Opportunity

Technology developments

The adoption of cutting-edge technologies like 3D printing, active and semi-active suspension systems, air suspension systems, electronic stability control systems, and advanced sensor systems is playing a favorable role in the automotive suspension industry. Additionally, the rising adoption of predictive and adaptive suspension systems is emerging in the market. The growing adoption of automobiles due to rising population and urbanization is continually seeking better safety and quality standards. The ongoing innovation of cutting-edge technologies is supporting the market in witnessing growth opportunities. The development of sensor technologies to provide real-time monitoring and adjustments of suspension systems is expected to be a game changer for the market in the forecast period.

Segment Insights

System Type Insights

Based on the system type, the active suspension segment accounted largest revenue share in 2024. A control device that receives input from sensors control the vertical movement of the wheels in active suspension systems. During the projected period, the active suspension is predicted to be the market leader in suspension systems. With the help of the onboard system, it can control the vertical movement of the wheel in relation to the vehicle.

On the other hand, the semi active suspension segment is estimated to be the most opportunistic segment during the forecast period. The semi active suspensions vary the strength of the shock absorber based on dynamic driving conditions, whereas inactive suspension actuators raise and lower the vehicle independently at each wheel. The onboard computer system aids in the operation of semi active and active suspensions by sensing vehicle movement via sensors throughout the vehicle.

Vehicle type insights

By vehicle, the passenger vehicle segment dominated the global automotive suspension market due to the large production value of the passenger cars. The vast demands for passenger cars are required to comply with safety and comfort standards. Passenger cars are widely produced and sold worldwide. The rising innovation and development of customized suspension systems are fueling the segment's growth.

On the other hand, the light commercial vehicle segment is expected to witness spectacular growth in the forecast period due to rising demands for commercial vehicles, including trucks, vans, and pickups. The demand for high payload capacity is the major factor driving segment growth.

Region Insights

What Makes Asia Pacific the Dominant Region in the Automotive Suspension Market?

Countries like China, India, and Japan are leading the regional market. India and China are dominating the market due to their rich and well-established automotive manufacturing industries and government initiatives and investments in the expansion of the industry. The rising population has surged for luxury vehicles in Asia. The adoption of cutting-edge technologies is playing a favorable role in market expansion in India, China, and Japan.

- In March 2024, Nidec Corporation announced the development of a new air suspension motor for automobiles by Nidec Motor (Dalian) Limited, a corporation that the company owns in China.

Asia Pacific dominated the automotive suspension market with the largest share in 2024. This is mainly due to the presence of major automotive manufacturing hubs, rapid growth in vehicle production, and increasing consumer demand for advanced and comfortable suspension systems. Additionally, rising investments in electric vehicles, growing urbanization, and expanding automotive infrastructure in countries like China, India, and Japan are further strengthening the region's market leadership.

What Makes Europe the Fastest-Growing Region in the Market?

Germany stands out in the European automotive suspension market due to its well-established automotive sectors. Presently, leading car manufacturing companies like the Volkswagen Group and BMW are also contributing to the country's market expansion. The superior focus of the competitive landscape in Germany is to develop high safety standards, ride quality, and innovative technologies, which are the major highlights of the market.

- In April 2024, Porsche, a German luxury automaker, collaborated with ClearMotion to validate the U.S. startup's active suspension technology and road-reading software and signed a licensing agreement for its technology with ClearMotion

Europe is the fastest-growing region in the market due to increasing adoption of advanced suspension technologies, rising demand for electric and luxury vehicles, and stringent safety and emission regulations. Additionally, strong automotive R&D, government incentives for vehicle innovation, and growing consumer preference for enhanced ride comfort and performance are driving market growth across the region.

What Potentiates the Market in North America?

North America is witnessing significant growth in the market. This growth is due to the region's strong demand for light trucks, SUVs, and premium vehicles. The region has a strong presence of major OEMs and component suppliers. Countries like the U.S. and Canada lead the regional market, driven by ongoing advancements in automotive technologies. The market is also witnessing a steady shift toward electronically controlled systems. There is also a high consumer preference for performance and comfort, which fuels innovation even more. Increasing investments in research & development for autonomous vehicle suspension technologies also drive the market.

U.S. Automotive Suspension Market Analysis

The market in the U.S. is growing due to the rapid expansion of advanced driver assistance systems (ADAS), autonomous vehicles, and electric vehicles, which require enhanced suspension systems for safety, stability, and ride comfort. Investments in innovation by global automakers, such as Hyundai Motor Group's $26 billion U.S. investment in automotive, steel, and robotics, are driving the development of advanced suspension technologies, including adaptive, air, and electronic systems. Additionally, the rising focus on vehicle performance, passenger comfort, and safety standards is further boosting demand for sophisticated suspension solutions in the U.S. market.

What Opportunities Exist in Latin America?

Latin America offers significant opportunities in the automotive suspension market due to growing vehicle production, increasing consumer demand for enhanced safety and comfort features, and rising adoption of advanced suspension technologies. Countries such as Brazil and Mexico are key players in the regional market, driven by growing passenger vehicle production and increasing investments in automotive manufacturing. The region is also witnessing an increased demand for durable and cost-effective suspension systems. Government support for domestic manufacturing of automotive components also continues to support regional market growth.

Brazil Automotive Suspension Market Trends

The market in Brazil is growing due to increasing investments in electric vehicles (EVs), advanced automotive technologies, and decarbonization initiatives by both the government and global automakers like Toyota, Volkswagen, and Stellantis. Incentives promoting EV innovation and production are driving demand for advanced suspension systems that support heavier battery packs while maintaining ride comfort and vehicle stability. Additionally, export-oriented policies and R&D investments are encouraging automakers to adopt sophisticated suspension solutions to meet global safety and performance standards, further boosting market growth.

How is the Opportunistic Rise of the Middle East & Africa in the Automotive Suspension Market?

The Middle East & Africa (MEA) is witnessing an opportunistic rise in the market, supported by rising vehicle imports and infrastructure projects. Gulf Cooperation Council (GCC) countries are witnessing a high demand for premium SUVs that are equipped with advanced suspension technologies. Africa also presents various growth opportunities, though affordability constraints are present. There is a high demand for aftermarket and replacement services. Vehicle sales are seen to be gradually increasing due to rapid urbanization activities and improved financing options, contributing to the regional market growth.

Saudi Arabia Automotive Suspension Market Analysis

The market in Saudi Arabia is expanding due to increasing vehicle sales, infrastructure development, and rising demand for advanced and luxury vehicles that require improved ride comfort and handling. Government initiatives to diversify the economy under Vision 2030, along with investments in electric vehicles (EVs) and smart mobility, are driving the adoption of modern suspension technologies, including adaptive and electronic systems. Additionally, harsh road conditions in parts of the country create demand for robust and durable suspension solutions, further boosting market growth.

Value Chain Analysis

- Raw Material Sourcing (Steel, Plastics, Electronics): This stage is about procuring raw materials going into high-quality suspension systems, such as specialized steel for springs and shock absorbers, plastics for bushings, and electronics for adaptive damping systems, at the most competitive cost.

Key Players: Tata Steel, Nippon Steel - Component Manufacturing (Engines, Transmissions, etc.): This refers to manufacturing specialized suspension components such as springs, dampers, control arms, and anti-roll bars with the utmost precision and efficiency.

Key Players: DuPont, Trinity Auto Engineering Pvt Ltd - Vehicle Assembly and Integration: This involves installing and integrating the various suspension components into the greater vehicle chassis to ensure correct fit, alignment, and function.

Key Players: Toyota Motor Corp, Volkswagen AG - Test and Quality Control: Concentrating on ensuring that the assembled systems are tested for performance and durability and in line with all safety parameters and regulations for quality standards.

Key Players: TRIGO, - Distribution to Dealers and OEMs: This involves storage means, shipping, and the delivery of finished suspension systems to car dealerships and other OEMs.

Key Players: ZF and Tenneco

Key Companies & Market Share Insights

To build a firm presence in the automotive suspension market, the key market players are employing several methods such as increasing production capacity, diversifying sales and distribution networks, product differentiation and new product development, and strategic partnerships and collaborations.

Automotive Suspension Market Companies

- Tenneco Inc.

- Continental AG

- ZF Friedrichschafen AG

- Schaeffler AG

- Sogefi SpA

- Magneti Marelli SpA

- KYB Corporation

- ThyssenKrupp AG

- Mondo Corporation

- BENTELER International AG

Recent Developments

- In April 2025, Tenneco's Monroe Ride Solutions business, a premier global supplier of innovative electronic and passive suspension systems and components, introduced a leading-edge semi-active suspension technology that enables automotive OEMs to achieve exceptionally refined, controlled, and secure driving experiences in their latest models. The new technology, Monroe Intelligent Suspension CVSA2, is suitable for all driving styles and a wide range of vehicle segments, including McPherson strut-equipped SUVs, off-road vehicles, and luxury cars.

(Source: tenneco.com ) - In March 2025, Benteler International AG highlighted innovation in both product and process design related to suspension. The company is focusing on electric vehicle (EV) component manufacturing, including a substantial investment in a new plant in Grand Rapids, Michigan, to produce battery trays for EVs. Benteler is also showcasing new products and solutions at the Detroit Auto Show. These initiatives reflect Benteler's commitment to advancing its capabilities in the automotive sector and adapting to the evolving needs of the industry.

(Source: benteler.com ) - In August 2024, Mr. Veejay Nakra, President—Automotive Division, Mahindra & Mahindra Ltd, talked about the launch of the Thar Roxx SUV: "With the launching of Thar ROXX, the company is not just improving the SUV experience but also setting sights on creating the Thar brand as the No. 1 SUV by volume within the next 3-5 years."

- In April 2024, Ingo Albers, Porsche's vice president for drive systems, said in a statement that the launch of Vehicle-motion: "The Vehicle-motion is the next novel fortunate to provide a superior experience for drivers and passengers."

Recent Developments

- In August 2024, Mahindra introduced its Thar Roxx SUV with WATT's link suspension, modern shock absorbers, and a hydraulic rebound stopper. The Thar Roxx promises to provide a smooth ride and a premium experience.

- In April 2024, Tesla launched its Track Mode V3, which now integrates motor controls, suspension controls, powertrain cooling, and Tesla's Vehicle Dynamics Controller (VDC) under a single, unified system. This model has a custom-tuned suspension, Track Mode V3, and ludicrous acceleration.

- In September 2023, the C round of financing of 300 million yuan was completed by KH Automotive Technologies, which is projected to be used for a range of capital expenditures, including a plant and equipment in the new production capacity and supporting working capital support.

- In September 2025, UPG UK & Ireland introduces EXO Automotive's OP range of braking, steering, and suspension parts, expanding its Car and light commercial vehicle product offerings.

- (Source:autotrade.ie)

- In June 2025, Setco Automotive Limited introduces Load Cushion and Torque Rod Bush, expanding its suspension product portfolio for medium and heavy commercial vehicles.

(Source:autocarpro.in )

Segments Covered in the Report

By System Type

- Passive Suspension

- Semi Active Suspension

- Active Suspension

By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy commercial vehicles (HCV)

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Latin America

- MEA

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting