What is Autonomous Underwater Vehicle Market Size?

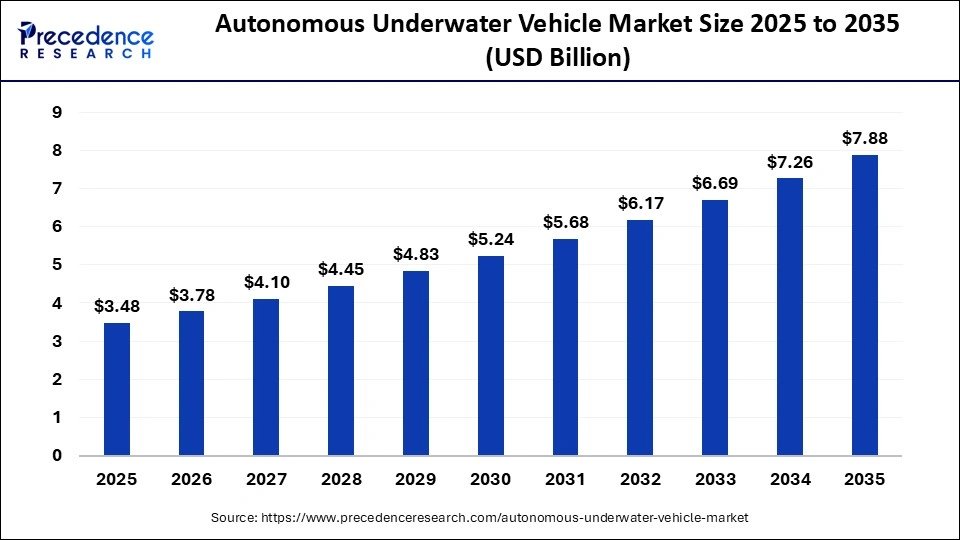

The global autonomous underwater vehicle market size is calculated at USD 3.48 billion in 2025 and is predicted to increase from USD 3.78 billion in 2026 to approximately USD 7.88 billion by 2035, expanding at a CAGR of 8.52% from 2026 to 2035. The market for autonomous underwater vehicles is driven by defense modernization, expanded offshore energy exploration, improved underwater mapping needs, and rising adoption of AI-enabled subsea inspection and environmental monitoring solutions.

Market Highlights

- North America led the autonomous underwater vehicle market with a dominant market share in 2025.

- The Asia Pacific is estimated to expand the fastest CAGR between 2026 and 2035.

- By type, the medium AUVs (up to 1,000 meters) segment contributed the largest share in 2025.

- By type, the large AUVs (more than 1,000 meters) segment is growing at the highest CAGR from 2026 to 2035.

- By technology, the navigation segment held a dominant market share in 2025.

- By technology, the collision avoidance segment is expanding at a notable CAGR between 2026 and 2035.

- By payload, the sensors segment held the biggest market share in 2025.

- By payload, the synthetic aperture sonars segment is growing at the fastest CAGR from 2026 to 2035.

- By application, the military and defence segment generated the biggest market share in 2025.

- By application, the oil and gas segment is expected to expand at the highest CAGR between 2026 and 2035.

- By shape, the torpedo segment contributed the largest market share in 2025.

- By shape, the multi-hull vehicle segment is poised to grow at the fastest CAGR from 2026 to 2035.

What Is Driving the Next Generation of Underwater Operations and Capacity Building?

AUVs (Autonomous Underwater Vehicles) are fully automated vehicles that can perform a wide range of deep-sea missions without direct human assistance. With onboard navigation, sensors, and propulsion systems, an AUV can operate autonomously in a very complex marine environment. The increasing demand for AUVs globally has resulted from a number of developments. First, the demand for enhanced maritime security has increased due to rising threats to shipping, and offshore energy exploration has also expanded.

Additionally, the expansion of environmental monitoring by governmental and non-governmental organizations (NGOs) has driven demand for AUVs. Recent developments in battery technology, more compact sonar systems, AI navigation technology, modular payloads, and higher precision during mission planning have dramatically reduced operating costs while transforming the AUV market by adding new types of payloads for defense modernization, pipeline inspections, and deep-sea research.

How AI Is Driving a Revolution in the Autonomous Underwater Vehicle Market?

Recent advancements in artificial intelligence (AI) are significantly impacting the use of Autonomous Underwater Vehicles (AAUVs), enabling better navigation and real-time decision-making, as well as higher-resolution, more precise mapping of the ocean floor. AUVs are now using machine learning algorithms to assist them in navigating less predictable, unpredictable underwater environments. AI will accelerate innovation and development across offshore energy, defense, and environmental monitoring sectors. For example, in November 2025, Beam launched Scout, an autonomous underwater vehicle (AUV) driven by artificial intelligence, which will combine AI, real-time 3D reconstructions, and precise navigation to enhance offshore inspections. With AI technology at the core of underwater robotics, there is a strong trend towards advancing AUVs towards a more autonomous, intelligent, and more efficiently maintained platform, thereby decreasing costs and personnel risk.

Autonomous Underwater Vehicle Market Outlook

AUV provides an alternative to crewed deep sea diving that is greater than the efficiency of crewed vessels, while also providing a level of safety for the operator (those diving) and their equipment.

Deployment is becoming more widely adopted for AUVs in the military, oil & gas, and in the scientific research community due to the current advancements in the design of AUVs with increased autonomy, modularity, and applications for thousands of kilometers.

As AUV technology develops and matures, there are currently rapid advancements in navigation, batteries or power systems, artificial intelligence-based control, and enhancements to communication. These advances are enabling AUVs to complete longer missions with significantly higher data fidelity while operating in challenging underwater environments.

With increased naval modernization and the concern of security for subsea infrastructure, governments are becoming more interested in the use of AUVs for surveillance purposes, mine plow countermeasure, and inspection of subsea infrastructure.

The continuing development of swarm-AUV architectures, energy-efficient designs, and underwater communication networks represents a future where autonomous ocean-monitoring and the continuous support for climate change science and conserving marine habitats.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.48 Billion |

| Market Size in 2026 | USD 3.78 Billion |

| Market Size by 2035 | USD 7.88 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.52% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Autonomous Underwater Vehicle MarketSegmental Insights

Type Insights

Medium AUVs (Up to 1,000 Meters): The medium AUVs (up to 1,000 meters) are dominating the autonomous underwater vehicle market in 2025, as they provide the ideal blend of operational cost-effectiveness, deep depth capability, and operational endurance to support naval missions and other operations such as scientific surveys and offshore inspections. Navigation systems are critical in this AUV segment because precise geolocation is required for proper autonomous operation in complex underwater environments.

Large AUVs (More Than 1,000 Meters): The rapidly growing segment is driven by deep offshore energy activities and long-range military operations, both of which are prompting AUV producers to develop models capable of operating at extreme depths. Additionally, the growing popularity and use of synthetic aperture sonars are leading to more rapid adoption of AUVs across many industries, as synthetic aperture sonars provide high-resolution seabed imagery, a need for many subsea mapping, pipeline inspection, and mine detection/avoidance operations.

Despite the rapid adoption of large AUVs by the commercial sector, there remains a critical need for shallow AUVs to support coastal monitoring, port security, and short-range scientific studies, given their relatively low operational complexity. The need for real-time command, data transfer, and remote supervision of underwater missions continues to be critical to shallow AUV operations, with the greatest need for bandwidth efficiency.

Technology Insights

Navigation: The segment is leading the autonomous underwater vehicle market due to their necessity for accurate underwater navigation and the accuracy of missions that occur on and in the ocean. In many sectors, including defense, offshore energy, and scientific exploration, there is an increasing number of opportunities for longer-term and more autonomous AUV missions. As AUV missions increase in duration and number, the demand for robust navigation supports at-sea navigation safety, effective data collection in complex seabed conditions, and safe and stable navigation throughout many situations.

Collision Avoidance: The rate of growth in the area of obstacle avoidance technology is increasing as AUVs are used on an increasing basis in environments that have dense cluttering (i.e., hazards) and various types of obstacles. Obstacles in these environments can be constant or may increase due to changing weather conditions. Real-time sonar perception systems, onboard processing, and autonomous decision-making are enabling AUVs to safely navigate through these types of environments and to reduce operational risk to personnel and to the equipment used to accomplish underwater missions.

Communication technologies will continue to be critical to the AUV industry by providing transfer of information, data communications, command/control functions, and operator oversight of AUVs while performing underwater missions. Communication technologies include acoustic/optical/hybrid technologies and provide varying levels of bandwidth for the various underwater conditions (i.e., depths). As the demand for AUV strategies to conduct more effective data exchange and more rapid response to questions continues, the importance of communications technology will continue to grow.

Payload Type Insights

Sensors: The segment dominated autonomous underwater vehicle market in 2025, because it provides environmental (e.g., CTDs, Magnetometers, Chemical Detectors), structural, and positional data to Defence, Offshore Energy, and Scientific Users. Multi-parameter sensors enable the ability to collect multiple parameters of data in a variety of conditions when operating in an underwater environment. Multi-parameter sensors' versatility, accuracy and compatibility with different AUV platforms make them essential for routine monitoring, Asset Inspection, and for many mission-critical decisions made by users.

Synthetic Aperture Sonar: The segment continues to grow due to its ability to produce ultra-high-resolution images of the ocean floor in very low-visibility or turbid-water environments. They have been adopted more frequently as tools to detect mines, inspect subsea infrastructure, create Deep Seabed maps (also referred to as Bathymetric Mapping), and conduct Archaeological Surveys (including shipwreck surveys). The increase in the use of Synthetic Aperture Sonars is related to the expansion of both Deep Water and Defence Modernization Programs, where users require very high image resolution and the ability to see over long distances and in complex underwater environments.

Echo Sounders: Although Echo Sounders provide critical information to support various marine research, coastal development (including the dredging of sea floors), hydrographic surveys and environmental monitoring and navigation planning by providing users with accurate bathymetric profiles, their most important use at present is as the foundation of the types of data to be obtained through Marine Research Initiatives.

Modern ocean research programs depend heavily on high-resolution depth measurements to map seafloor structures, monitor sediment movement and study habitat distribution in changing marine environments. Echo sounder data also forms the baseline for integrated ocean observation systems that combine acoustic readings with satellite imagery, autonomous underwater vehicles and water quality sensors to build comprehensive digital models of marine ecosystems.

Application Insights

Military and Defence: The military and defence sector is leading the autonomous underwater vehicle market, with increased use of AUVs across a range of operations, from intelligence gathering to mine countermeasures to underwater surveillance and anti-submarine warfare. They are also driving the growth of AUVs, particularly in the military and defence areas. Compared with conventional naval operations, AUVs have unique operational characteristics, including covert operations, extended-duration missions, and the ability to operate in very complex environments.

Oil and Gas: This sector, on the other hand, is seeing a rapid adoption of AUVs primarily for deep-water inspections of pipelines as well as monitoring subsea infrastructure, reservoir evaluations and geophysical surveys. Operators are now choosing to use AUVs for their unprecedented precision, reduced operational costs and ability to survey extensive areas without manned intervention, as exploration continues to move toward deeper and increasingly complex offshore zones.

Finally, governments and research institutes are placing an increased importance on protecting the marine environments, assessing biodiversity and tracking pollutants. AUVs allow for mission durations that enable continuous water-quality data collection, habitat mapping and detection of changes to ecosystems with a high degree of accuracy. Their growing role in a variety of areas including, but not limited to, coastal surveillance, studies of climate change and assessments of natural disasters is helping to support sustainable ocean management and to enhance worldwide programmes aimed at conserving our oceans, complying with regulations and maintaining ecosystems.

Shape Insights

Torpedo: This vehicle shape is leading the autonomous underwater vehicle market in 2025, which also provides long-range capability due to the hydrodynamic design. This design reduces drag, allowing the successful execution of deep-sea missions, defence surveillance, and offshore inspections. Furthermore, the broad compatibility with various types of payloads enhances the dominance of the torpedo-shaped AUV in commercial, military, and scientific applications.

Multi-Hull Vehicle: Multi-hulled AUVs have rapidly gained in popularity and are expected to be the highest growing segment during the forecast period, due to providing stability, buoyancy control, and the capability of wide-area sensor deployments. The increased exploration of the deep sea and the increasing need for high-endurance platforms has increased the interest of research institutions and offshore operators in acquiring multi-hulled AUV designs because of their enhanced range of operations and flexibility in fulfilling multiple mission tasks.

Streamlined Rectangular Style: Streamlined rectangular AUVs have become more widely used for getting high-manoeuvrability, modular payload integration, and the highest level of precise control in confined or structured underwater environments. Their design enhances the ability to hover, maximise the location of their sensors, and navigate through confined areas around ports, coastal installations, and subsea infrastructure. Streamlined rectangular designs are appealing for their versatility in inspection missions, environmental monitoring missions, and industrial survey missions, where the greater agility provided by more traditional torpedo-shaped AUVs may not be adequate.

Autonomous Underwater Vehicle Market Regional Insights

North America is the world's leader in the autonomous underwater vehicle market because it has received extensive government and military investment, it has many suppliers, and it has used AUVs extensively for civilian research use. The United States (U.S.) produces complete capabilities for all types of platforms (e.g., surface) and requires advanced autonomy software, along with a wide array of payloads that can be integrated on different types of platforms.

By having its navy purchase defence products, developing offshore commercial applications; and conducting various research through government agencies, the region's defence procurement activities, commercial marine applications, and national research agencies support technology maturation, the creation of standards, and the continued supply of operational contracts; as well as creating a positive feedback loop in which innovation results in manufacturing, and experience results in innovation.

The U.S. leads North America in AUV technology development through a long-established Navy and academic research, an active industrial base with a large-scale increase in small specialty AUV companies, and many oceanographic institutions that have used and supported fleets of AUVs. In June 2025, the U.S. Navy successfully launched and recovered an unmanned underwater vehicle (UUV) from a submerged submarine, beneath European waters, without a single diver in the water.

This combination facilitates rapid technology advances from research to operational use, continuous large-scale AUV use, and a strong supply base infrastructure for AUV components, AUV software stacks, and AUV mission support.

The Asia-Pacific is set to be the highest-growth region for the market for autonomous underwater vehicles due to the expansion of National Ocean Science Programs, the rapid industrialization of maritime industries, the awareness of coastal monitoring needs, and the growth of naval and commercial investments. Because of these factors, there is strong domestic demand, increased supply chain Activity, and expanded potential for exporting Regionally Developed Platforms and Autonomous Packages, due to the increased number of Shipbuilding Hubs, increasing amounts of Offshore Energy and Seabed Resource Activity, and the increasing amount of Robotically Designed Systems And Artificial Intelligence Research.

In September 2025, the Indian Navy signs a ₹66 crore deal with Odisha startup Coratia Technologies to induct its indigenously developed underwater remotely operated vehicles (UWROVs), marking the first large-scale deployment of Indian-built underwater robots in active naval operations.

China Autonomous Underwater Vehicle Market Trends

China is increasingly becoming a leader in the development of Ocean Science Technologies, including AUVs, through its fast Investment in Ocean Science, Establishment of Large Industial AUV Design Companies, And the Implementation of State Supported Programs to Accelerate Technology Deployment.The People's Liberation Army (PLA) showcased two classes of new unmanned underwater vehicle in a massive military parade in Beijing in September 2025.

Current R&D through Chinese Research Institutions, Chinese domestic manufacturers, and Chinese government funded research will result in a very expedited time frame to develop and bring to operational use a wide range of AUVs from small gliders to deepwater systems utilizing national research vessel funding.

In Europe, AUV use is on the rise primarily due to the industry's established offshore subsector with above average gross margins versus the offshore market. The majority of euro area AUV use utilization occurs in the North Sea where activity has created an early adopter culture. Given this early adopter culture, manufacturers have worked closely with European operators to provide support in the development of AUV specifications for launch as well as systems integration for unmanned workflows.

Recently the European Defence Agency (EDA) has launched a four-year research SPHYDA (Submarine Hull/Rudder/Propeller Hydrodynamics Interaction and Hydroacoustics) a 4.8 million project to reduce the noise produced by autonomous underwater vehicles, to boost naval stealth and limit the impact of human-made sound on marine life.

Germany Autonomous Underwater Vehicle Market Trends

Norway has the most established offshore subsector with respect to AUVs with nearly 80% of AUVs in Norway's offshore subsea services being operated under Norwegian law and regulations. Due to the relatively large subsea services ecosystem in Norway as well as the number of AUVs in Norway, Norway is the European leader in AUVs' use for seabed surveys, pipeline inspections and environmental monitoring. The majority of AUV operators and service providers in Norway are also vertically integrated in the AUV supply chain, covering AUV vehicle endurance, sensor technology, and machine learning.

Latin America has become a growing market for autonomous underwater vehicles with an increase in offshore oil exploration, as well as the need for coastal monitoring and studying marine biodiversity. The development of new subsea infrastructure and ports makes way for investment, which leads to new opportunities in this area. The extent of technology awareness is limited but developing, and there is an awareness of AUVs that supports the gradual growth of the market in Latin America.

Brazil Autonomous Underwater Vehicle Market Trends

Brazil is the leader in Latin America due primarily to the amount of oil and natural gas being explored on the country's continental shelf, as well as the depth at which oil and gas are being produced. As a result of these factors, the Brazilian government has made significant investments into national energy programs and, as a result, is driving the growth of the market for AUVs in the country.

Countries within the Middle East and Africa are showing steady growth in their use of AUVs due primarily to their growing offshore energy sector, their desire for maritime security, and their underwater inspection requirements. Seabed surveying, pipeline monitoring, and port security are new growth markets, but investments remain fairly selective, although they are on the rise due to increased energy diversification and an increase in coastal infrastructure development initiatives.

Saudi Arabia Autonomous Underwater Vehicle Market Trends

Saudi Arabia is leading the way in developing autonomous underwater vehicle for both offshore energy operations, and maritime security, as well as developing interests to increase the use of AUVs for underwater inspection, coastal monitoring, and utilizing advanced marine technology to increase the amount of autonomous underwater vehicles being used throughout the entire country using AUVs is also continuing to grow continuously within Saudi Arabia.

Autonomous Underwater Vehicle Market Value Chain

Concept development, Autonomy Algorithms, Validation of sensors & Prototype Trials created in cooperation between Universities, Naval Labs & Corporate R&D, which repeatedly iterate concepts prior to handing over to manufacturing. Key Players: Exail (ECA/iXblue heritage), Kongsberg, Thales, Ocean Infinity, Hydroid / HII

Production of hulls, batteries, INS, sonars, thrusters, and payload modules; specialized OEMs supply tested subsea components meeting depth, power, and comms specs. Key Players: iXblue, Teledyne Marine (Gavia/sonars), Sonardyne, NORBIT, Teledyne RD/Nortek (DVLs & sensors)

Design integration between the sub-systems, finalizing the Payload fit-out, uploading of software and conducting Factory Acceptance Testing. Mission-ready AUVs that meet the customer requirements are built by Integrators. Key Players: Kongsberg, Hydroid (HII), Exail, Teledyne (integration lines), Oceaneering.

Launch/Recovery of AUV from the Vessel, Execution of Mission Operations, Processing of Collected Data, Routine Service, Supporting Spare Parts and Compliance with Regulatory Requirements. Key Players: Ocean Infinity (Armada/motherships), Fugro,Oceaneering, Subsea7, Fugros survey services.

Autonomous Underwater Vehicle Market Companies

Develops advanced autonomous underwater vehicles (AUVs), marine robotics, and subsea mapping systems. The company is known for its HUGIN AUV series used in defense, oil and gas, and oceanography.

Provides a wide portfolio of subsea technologies including AUVs, ROVs, sensors, and acoustic positioning systems. Teledyne supports scientific, commercial, and defense applications globally.

Specializes in unmanned marine systems and autonomous platforms for monitoring, surveillance, and environmental sensing. The company focuses on energy-efficient, long-endurance designs.

Develops advanced autonomous underwater systems for defense, including long-endurance unmanned undersea vehicles. The company integrates mission systems, sensors, and naval technology.

A global leader in marine survey and geotechnical services, deploying AUVs and robotic systems for seabed mapping and offshore operations. Fugro emphasizes remote and autonomous marine data acquisition.

Provides AUVs, sonar systems, and naval underwater technologies for surveillance and mine warfare. The company supports multiple international naval modernization programs.

Designs and manufactures underwater robotics platforms, including bio-inspired unmanned systems for defense and scientific research. The company focuses on innovative propulsion and sensing technologies.

A pioneer in AUV and ROV development, offering custom subsea vehicles for scientific, commercial, and exploration missions. Known for deep-water and long-range capability.

Develops underwater robotic systems and subsea technologies for inspection, exploration, and industrial operations. The company focuses on modular robotics and custom engineering solutions.

Provides autonomous marine and subsea systems, including underwater drones for naval defense and surveillance. BAE integrates advanced sensing, mission management, and stealth technology.

Recent Developments

- In October 2025, Helsing acquires Blue Ocean, a specialist in autonomous underwater vehicles (AUVs), merging its hardware-manufacturing and AUV expertise with Helsing's AI system to speed up mass-production of autonomous platforms for maritime defence.

- In November 2025, Anduril Industries is awarded a contract by Defense Innovation Unit (DIU) to develop new undersea-warfare capabilities, advancing its portfolio of autonomous underwater vehicles for long-range, persistent undersea missions.

- In November 2025, Skana Robotics plans to launch its new amphibious platform Alligator by early 2026, adding to its autonomous surface (ASV) and underwater (AUV) vehicles, thus expanding its maritime-autonomy offerings to support logistics, sensors and personnel transfer between land and water.

Exclusive Insights

The autonomous underwater vehicle market is expected to experience growth through the increased demand for defense spending, offshore energy inspections, and mapping for scientific reasons. Recent investments made by states and private companies have supported this growth. The growth of the AUV Market will be dependent upon how well companies are able to develop onboard autonomous capabilities, even more so when combined with AI and other technologies, as well as the development of advanced and longer-lasting batteries.

This will allow for companies to expand their product offerings to include services for the surveillance of Subsea infrastructure, conducting renewable energy site surveys, and providing asset inspections as a service. Companies that are able to provide products that integrate with other systems will benefit from the largest shares of future AUV market growth.

Autonomous Underwater Vehicle Market Segments Covered in the Report

By Type

- Shallow AUVs (Up to 100 Meters)

- Medium AUVs (Up to 1,000 Meters)

- Large AUVs (More Than 1,000 Meters)

By Technology

- Collision Avoidance

- Communication

- Navigation

- Propulsion, and Imaging

By Payload Type

- Cameras

- Sensors

- Synthetic Aperture Sonars

- Echo Sounders

- Acoustic Doppler Current Profilers

- Others

By Application:

- Military and Defence

- Oil and Gas

- Environmental Protection and Monitoring

- Oceanography

- Archaeology and Exploration

- Search and Salvage Operations

By Shape

- Torpedo

- Laminar Flow Body

- Streamlined Rectangular Style

- Multi-Hull Vehicle

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting