What is the Basalt Fiber Market Size?

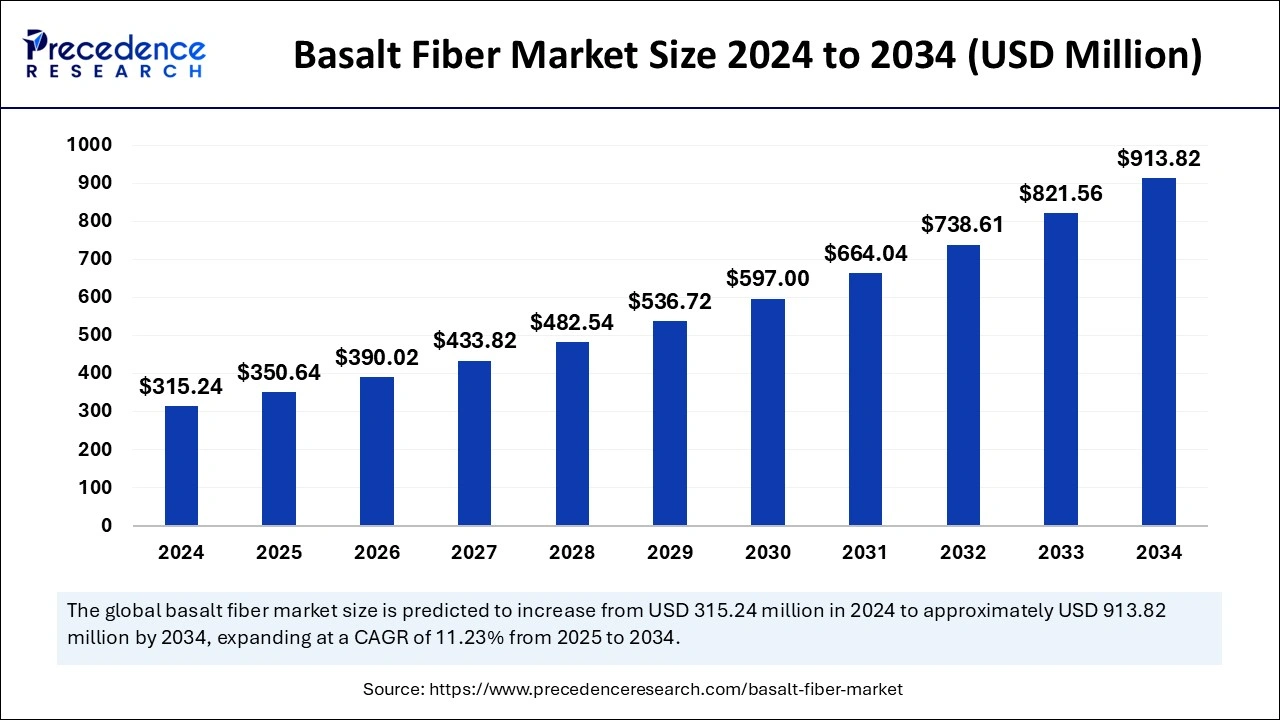

The global basalt fiber market size is valued at USD 350.64 million in 2025 and is predicted to increase from USD 390.02 million in 2026 to approximately USD 1,006.08 million by 2035, expanding at a CAGR of 11.12% from 2026 to 2035. Surging demand for basalt fiber from various end-use industries is the key factor driving the market growth. Also, increasing demand for sustainable materials coupled with technological advancements in the field can fuel market growth further.

Basalt Fiber Market Key Takeaways

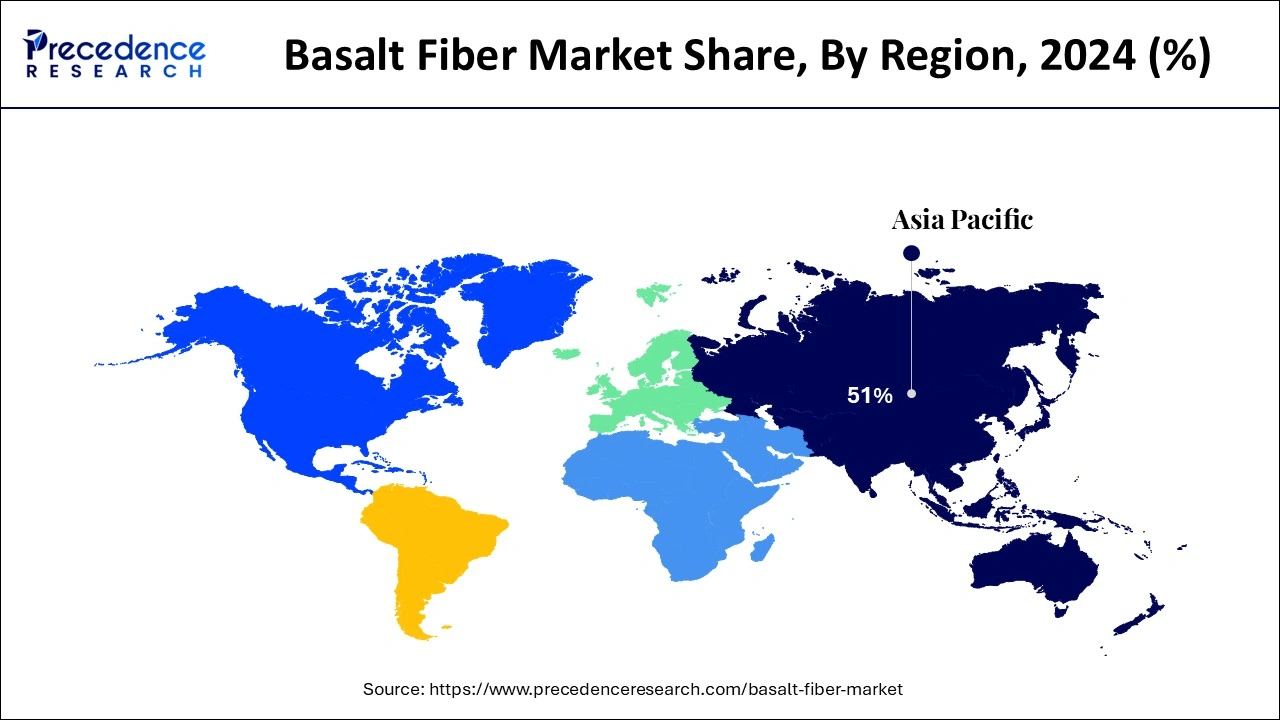

- Asia Pacific dominated the global basalt fiber market with the largest market share of 51% in 2025.

- North America is expected to grow at the fastest rate in the market over the studied period.

- The U.S. basalt fiber market is projected to grow at a notable CAGR of 9.83% over the forecast period.

- By usage, the composite segment contributed the highest market share of 59% in 2025.

- By usage, the noncomposite segment is expected to grow at the fastest rate over the forecast period.

- By end use, the building and construction segment has held a major market share of 35% in 2025.

- By end use, the automotive and transportation segment is anticipated to grow at the fastest rate during the projected period.

Impact of Artificial Intelligence (AI) on the Basalt Fiber Market

Artificial intelligence is playing a significant role in the basalt fiber market development by improving manufacturing efficiency and product quality. AI-powered technologies can be used to streamline the production process, ensure persistent product properties, and forecast maintenance needs. Furthermore, AI in production lines decreases labor costs and reduces human error, which can lead to great accuracy in fiber manufacturing.

Market Overview

Basalt fiber is made from very thin fibers of basalt. This fiber can be found in some important minerals like plagioclase, pyroxene, and olivine. Products made from basalt fiber serve as fire-resistant textiles in both the aerospace and automotive sectors, and they may also be employed as composites in manufacturing items such as camera tripods. It is also found in wide applications in pipe containers, reinforced nets, and plastic basalt products. It is the same as fiberglass and also has better mechanical and physical properties than fiberglass but is way more inexpensive than carbon fiber.

Basalt Fiber Market Growth Factors

- The expansion in the residential and municipal sectors is expected to boost basalt fiber market growth shortly.

- Increasing government initiatives over green infrastructure across the globe can propel market growth soon.

- Increasing research and development opportunities will likely contribute to the market expansion over the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 1,006.08 Million |

| Market Size by 2025 | USD 350.64 Million |

| Market Size in 2026 | USD 392.02 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.12% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Usage, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The rising usage of basalt fibers as a substitute

Basalt fibers possess good mechanical strength, heat and chemical resistance, insulation, and other qualities. The properties, including corrosion and lightweight resistance, enable the increased use of basalt fibres without requiring specialist equipment such as lifting, etc. In addition, the growing utilization of basalt fibers as a substitute for steel reinforcements is expected to impact the basalt fiber market positively.

- In January 2025, Michelman, a global developer of advanced materials, partnered with FibreCoat, a high-performance materials company based in Aachen, Germany, to support the launch of FibreCoat's aluminum-coated basalt fiber. This new fiber, AluCoat, was developed by FibreCoat to address the need for lightweight, conductive materials in applications such as electromagnetic interference (EMI).

- In July 2024, JOGANI Reinforcement introduced high tensile basalt fiber reinforcement in India for the Concrete and Infra sectors. These advanced fibers are designed specifically for high-grade concrete applications, promising to revolutionize the way modern construction addresses challenges like durability, tensile strength, and crack resistance.

Restraint

High production cost

The raw material necessary to manufacture the basalt fiber is igneous rocks but the process of transforming the rocks into fine fiber is as difficult as that of glass fiber. The manufacturing involves the preparation of melting of the stones and other raw materials, spinning of the fibers, and lastly, the application of its size. Moreover, all these processes increase production costs, which makes them more expensive than carbon fibers and glass fibers, hindering the basalt fiber market.

Opportunity

Ongoing material innovations and substitution

The diversity of basalt fiber is the major basalt fiber market trend boosting the market growth. The increasing product use as an effective substitute to steel and other fiber growth in manufacturing lightweight components for the demanding aerospace and automotive industries is creating opporutunties for the market in the near future. Furthermore, the increasing product innovations like the emergence of basalt fiber-reinforced plastic (BFRP).

- In January 2025, Michelman, a global developer of advanced materials, collaborated with FibreCoat, a high-performance materials company based in Aachen, Germany, to support the launch of FibreCoat's aluminum-coated basalt fiber. This new fiber, AluCoat, was developed by FibreCoat to address the need for lightweight, conductive materials in various applications.

Usage Insights

The composite segment dominated the basalt fiber market in 2025. The dominance of the segment can be attributed to the increasing use of basalt fiber in composite applications. In this application basalt fiber acts as a reinforcement material in the manufacturing of composite structures, providing durability, exceptional strength, and corrosion protection. Additionally, its extensive usage in composite production, especially in industries such as aerospace, construction, automotive, and marine underscores its importance in the segment.

- In March 2023, Anisoprint, a Skolkovo-based has introduced a new composite basalt fiber material for use with its 3D printers. The new material is said to have better properties than metal or plastic: 15 times stronger than plastic, 5 times lighter than steel, and 1.5 times stronger and lighter than aluminum. It is now available on the company's website together with the Anisoprint Composer 3D Printer.

The noncomposite segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be linked to the rising adoption of basalt fibers in non-composite applications, as these fibers find utility in different forms, including yarn, fabrics, and tapes, acting as a filtration, insulation, and reinforcement elements across industries such as insulation, textile, and filtration. Also, the dual functionality of basalt fiber over composite and non-composite settings boot the market.

End-Use Insights

The building and construction segment led the global basalt fiber market in 2025. The growth of the segment can be credited to the distinctive properties of the material, which makes it suitable for many applications. Basalt fiber's thermal resistance, high tensile strength, and corrosion resistance make it ideal for reinforcing concrete structures, thereby improving their durability. Furthermore, basalt fiber possesses good fire resistance properties, making it crucial for applications like partitions, fire-resistant doors, and cladding systems to improve the safety of the building.

- In August 2024, Mafic USA commenced operations at its new basalt fiber production facility in Shelby, North Carolina, which is also the first such facility in North America. The company expects to begin producing products for sale within the next few weeks.

The automotive and transportation segment is anticipated to grow at the fastest rate during the projected period. The growth of the segment can be driven by the increasing utilization of carbon fiber products in the aerospace and automotive sectors due to the weight reduction factor. Moreover, ongoing urbanization, the surge in consumer income along with the increasing demand for public and private transportation are impacting the segment's growth positively. Basalt fiber-reinforced composites are used in automotive production for components like interior trim, body panels, and chassis reinforcement.

Regional Insights

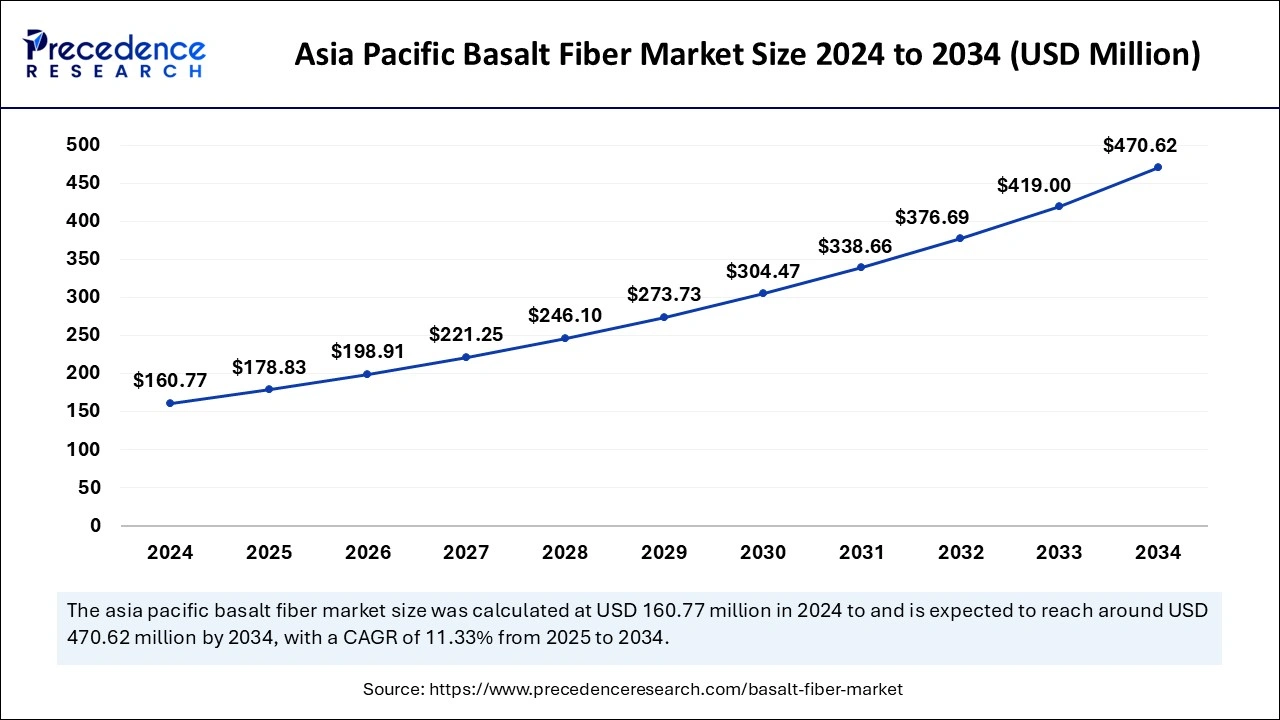

Asia Pacific Basalt Fiber Market Size and Growth 2026 to 2035

The Asia Pacific basalt fiber market size is exhibited at USD 178.83 million in 2025 and is projected to be worth around USD 516.03 million by 2035, growing at a CAGR of 11.18% from 2026 to 2035.

Asia Pacific dominated the global basalt fiber market in 2025. The dominance of the region can be attributed to the increasing use of basalt fiber across various industries such as wind energy, building and construction, electrical and electronics, and automotive. Furthermore, the industrial development in emerging economies such as China and India are propelling the market growth. The region's emphasis on environmental sustainability and renewable energy sources further boosts the demand for basalt fiber, particularly in applications associated with electrical insulation and wind energy.

North America is expected to grow at the fastest rate in the basalt fiber market over the studied period. The growth of the region can be credited to the strong presence of numerous electronic production bases in the region, particularly in the U.S., srging infrastructure investments in the region are fuelling demand for sustainable, next-generation construction materials such as basalt fiber. In North America, the U.S. led the market owing to the technological advancements in the field coupled with the lower production costs required for basalt fiber manufacturing.

- In March 2023, SGL Carbon introduced the new SIGRAFIL C T50-4.9/235 carbon fiber to expand its material portfolio. The fiber successfully addresses the high strength and high elongation requirements for pressure vessels and other applications.

Value Chain Analysis of the Basalt Fiber Market

- Raw Material Selection

The initial process deals with the sourcing and selection of high-quality basalt rock. The basalt should have a high silica content and low iron content for optimal fiber production.

Key Players: Basaltex, Mafic SA, Technobasalt - Manufacturing Process

This stage deals with various processes, such as basalt melting and extrusion through small nozzles. winding and sizing, then followed by rapid cooling and solidifying.

Key Players: KAMENNY Vek, Sudaglass, GBF Basalt Fiber - Quality Checks

This stage carries out various quality control measures in order to ensure the fibers meet specific standards for diameter, strength, and thermal resistance.

Key Players: Sika, Corning, Basaltex

Basalt Fiber Market Companies

- RMBAS

- BASTECH

- Deustche Basalt Faser GmbH

- Galen Ltd.

- INCOTELOGY GmbH

- ISOMATEX SA

- Kamenny Vek

- MAFIC

- Shanxi Basalt Fiber Technology Co., Ltd.

- Sudaglass Fiber Technology

- Technobasalt-Invest LLC

- Zhejiang GBF Basalt Fiber Co.

Recent Developments

- In May 2023, Avient Corporation expanded its production line for OnForce and Compl?t long fiber reinforced thermoplastic composites in Asia Pacific. This new line will help the company meet the increasing demand related to composite materials.

- In September 2023, Toray Industries, a leading Japanese manufacturer of advanced materials, announced plans to expand its carbon fiber production capacity by 20%. The expansion is in response to the growing demand for carbon fiber from the aerospace, automotive, and other industries.

- In October 2023, SGL Carbon, a leading German manufacturer of carbon fiber and graphite materials, announced plans to build a new carbon fiber plant in China. The plant is expected to be operational in 2026 and will produce high-performance carbon fiber for use in the aerospace, automotive, and other industries.

Segments Covered in the Report

By Usage

- Composite

- Non-Composite

By End-Use

- Building and Construction

- Automotive and Transportation

- Electrical and Electronics

- Marine

- Other End-Uses

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting