Whar is Fiberglass Market Size?

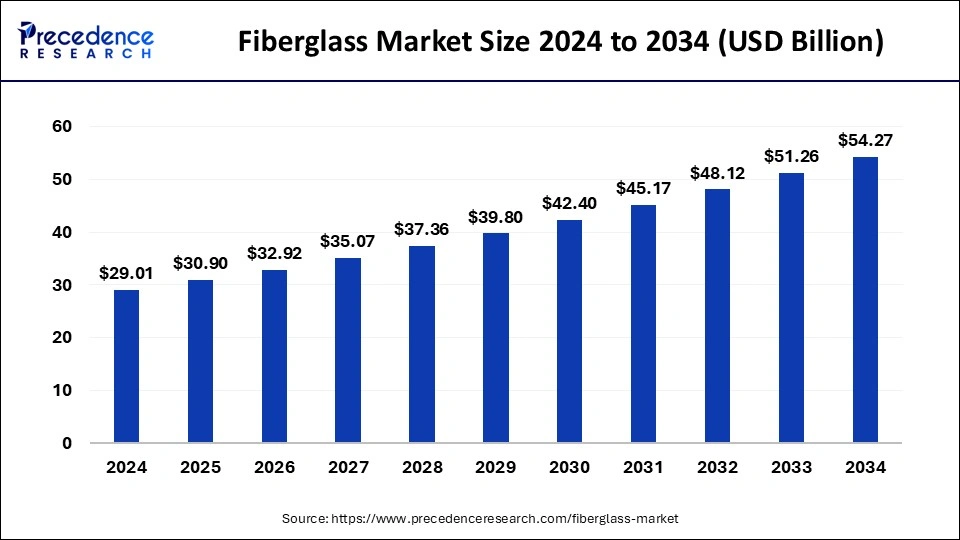

The global fiberglass market size is estimated at USD 30.90 billion in 2025 and is predicted to increase from USD 32.92 billion in 2026 to approximately USD 57.36 billion by 2035, expanding at a CAGR of 6.38% from 2026 to 2035. The growth of the market driven by the high resistance, durability, and other bled of properties that are used in the various manufacturing industries boosts the growth of the fiberglass market.

Market Highlights

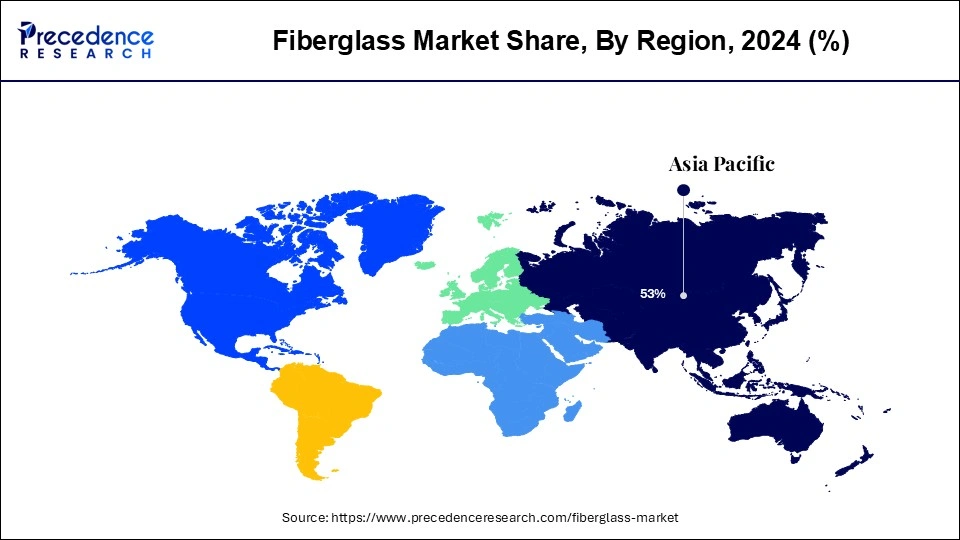

- Asia Pacific led the fiberglass market with the largest revenue share of 53% in 2025.

- North America is observed to grow at the fastest rate during the forecast period.

- By glass, the E-glass segment has contributed more than 66% of revenue share in 2025.

- By product, the glass wool segment has held a highest revenue share of 43% in 2025.

- By application, the composites segment dominated the market with the largest share in 2025.

- By end-user, the construction segment has generated the highest revenue share of 33% in 2025.

Fiberglass Market Overview: Glass Reinvention

Fiberglass is commonly made up of glass-reinforced plastic (GRP) or glass-fiber-reinforced plastic (GFRP). It is made of the extremely fine fibers of glass. Fiberglass has high tensile strength, durability, corrosion resistance, and moldability. Fiberglass is highly accepted by the manufacturing industries due to its unique number of properties. There are some of the properties such as stiff, durable, and strong, fire resistance, lightweight, great insulation properties, chemical resistance, corrosion resistance, insensitivity to temperature and humidity change, bending, wrapping, distortion, shrinking capabilities, and moisture resistance. The increasing demand from several industries such as construction, automotive, energy, etc. is driving the growth of the fiberglass market.

Artificial Intelligence: The Next Growth Catalyst in Fiberglass

Artificial intelligence is transforming the fiberglass industry by optimizing production, improving quality control, and accelerating product innovation to meet the high demand for lightweight, durable composites in sectors like automotive and aerospace. AI-driven systems and machine learning models analyze vast datasets to streamline manufacturing processes, reducing waste and energy consumption while enhancing the consistency of fiber and resin production.

Furthermore, AI-powered computer vision enables real-time defect detection, which drastically increases quality control standards and minimizes material flaws. Predictive maintenance algorithms are also being employed to forecast machinery failures, minimizing downtime and reducing operational costs for manufacturers.

Fiberglass Market Growth Factors

- The increasing demand for fiberglass from the various end-user industries such as construction, automotive, aerospace, automotive, wind energy, and others due to its lightweight and environment-friendly materials are driving the growth of the fiberglass market.

- The increasing focus on construction and infrastructural development across the world such as the construction of highways, roads, and development of building construction activities results in the increased demand for fiberglass that drives the growth of the market.

- The increasing demand for lightweight materials from the automotive industry enhances the speed and efficiency of the vehicle and makes it more sustainable which also contributes in the higher demand for fiberglass material.

- The extended demand and focus on renewable energy sources like wind energy is pushing wind turbine installation worldwide which results in a higher demand for fiberglass material due to its lightweight material, increased strength, and dimensional stability.

- The increasing investments in the development of fiberglass materials and the research and development activities for the expansion of the use of fiberglass materials accelerate the growth of the fiberglass market.

Market Outlook

- Market Growth Overview: The Fiberglass market is expected to grow significantly between 2025 and 2034, driven by the increasing adoption in wind turbine blades and EVs, automotive components, rising construction and infrastructure demand, and accelerating renewable energy.

- Sustainability Trends: Sustainability trends involve recycling and circular economy, bio-based and eco-friendly materials, and waste reduction and process optimization.

- Major Investors:Major investors in the market include Owens Corning, China Jushi Co., Ltd., Saint-Gobain S.A., Nippon Electric Glass Co., Ltd., and Johns Manville Corporation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 30.90 Billion |

| Market Size in 2026 | USD 32.92 Billion |

| Market Size by 2035 | USD 57.36 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.38% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Material Type, Product Type, Application, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand from the automotive industry

Fiberglass is a widely accepted material by various industries. In recent times, fiberglass has been highly accepted by the automotive industry. There are several benefits associated with the adoption of fiberglass in automobile manufacturing such as its lightweight nature. The rising environmental concern and the strict government policies for reducing emissions are resulting in the higher adoption of fiberglass in manufacturing due to it improves the speed, and fuel efficiency of the vehicle and is environmentally conscious.

Additionally, fiberglass are the corrosion resistance and is durable which makes it the perfect fit for automobile manufacturing. Fiberglass extends the lifespan of the vehicle due to its weather resistance and durability. With these factors, it has the designed flexibility and cost-effectiveness as compared to other materials that also contribute to the rising demand for fiberglass in the automotive industry and drive the growth of the fiberglass market.

Restraint

Supply chain disruptions

Events such as geopolitical tensions, natural disasters, or pandemics can disrupt the global supply chain, leading to delays and increased costs for raw materials and finished products. The availability of high-quality raw materials can be inconsistent, affecting the steady production of fiberglass. Any disruptions in the supply chain can lead to delays and increased costs.

Opportunity

Increasing demand from the end-use industry

Fiberglass plays an important role in the manufacturing and expansion of various industries such as construction, agriculture equipment, automotive, energy, and others. The rising demand for renewable sources of energy boosts the adoption of fiberglass in the manufacturing of wind turbines due to its lightweight and durable nature that drives the demand for the fiberglass. Fiberglass is more cost-effective in every aspect and industry as compared to other manufacturing materials which also boosts the growth of the market. Additionally, the supportive government regulation for sustainability, power consumption, and environment-related regulations that drive the demand for the fiberglass market in the future period.

Segment Insights

Material Type Insights

The e-glass segment dominated the fiberglass market in 2025. The growth of the segment is attributed to its cost-effectiveness and is widely used for general application. E-glass is also known as electrical glass, and it is the most common type of composition which is used in glass fiber. E-glass is more widely used in the fiber-reinforced polymer composite industry. E glass has properties like better resistance, cost-effectiveness, higher tensile strength, stiffness, and chemical, heat, and moisture resistance.

It is heavily used in the electrical industry due to its increased ability in electric insulation. The e-glass is mostly used in various industries such as aerospace and other industrial equipment components, general industrial components, and marine and other recreational equipment. Thus, the rising demand for the E glass is driving the demand for the E glass material segment.

Segments like ECR glass, H glass, and S glass are expected to increase their market growth during the forecast period. The growth of the segment is attributed due to its properties like corrosion, heat, and moisture resistance, higher insulation, and widely adopted by various industries such as aerospace, automotive, and other manufacturing equipment are driving the growth of the segment.

Product Type Insights

How did the Rovings segment expect to grow at the fastest CAGR in the fiberglass market during the forecast period?

The roving segment is driven by rapid infrastructure development in the Asia-Pacific region and innovations in single-end roving technology; the market is shifting toward high-performance, customized composites. Consequently, the roving segment is positioned as the primary catalyst for growth, bridging the gap between traditional material constraints and the demands of modern, sustainable engineering.

The glass wool segment held the largest share of the fiberglass market in 2025. The growth of the segment is attributed to the increasing demand from the construction and HVAC sectors is driving the development of the segment. Glass wool goes through several manufacturing processes. Glass wool has properties like lightweight and lower denser composition as compared to fiberglass. Glass wool expands in acoustic and thermal insulation. The increased demand from automotive, portable buildings and aerospace industries is due to theincreased demand for lightweight materials for cost efficiency and improved quality. Thus, these factors contribute to the increased demand for glass wool.

Application Insights

The composites segment dominated the fiberglass market in 2025. The growth of the segment is attributed to the rising demand from the marine, aerospace, automotive, and other manufacturing shipment equipment that drives the demand for fiberglass composites. Fiberglass composites are composed of glass fiber embedded in a resin matrix. The resin matrix works on the fiberglass to bind the fibers together and evenly distributes the strength throughout the material.

Tthe insulation segment is observed to grow at a notable rate in the fiberglass market during the forecast period. Fiberglass insulation is highly effective at reducing heat transfer, leading to significant energy savings in heating and cooling buildings. This aligns with the increasing global emphasis on energy efficiency. Fiberglass insulation is often made from recycled glass, making it an environmentally friendly option. Its use helps in reducing the carbon footprint of buildings by lowering energy consumption.

End-User Insights

The construction segment dominated the market with significant growth in 2025. Fiberglass is used in several applications in the construction industry such as in roof, facade, and surface coatings. Fiberglass plays an important role in the insulation materials such as insulation panels, roof plates, and roof panels which enables the building an increased lifespan due to its durable and resistant nature. It is used in the roof panel and wall cladding to increase the aesthetics of the building.

It is used in the protection of walls of concrete, wood, and steel due to its flexibility and durability over water and extreme temperatures. Fiberglass is effective in many of the applications in the construction industry in that it enhances aesthetics, strength, and durability and improves the life of the building. Thus, these factors are contributing to the higher demand for fiberglass in the construction industry.

Regional Insights

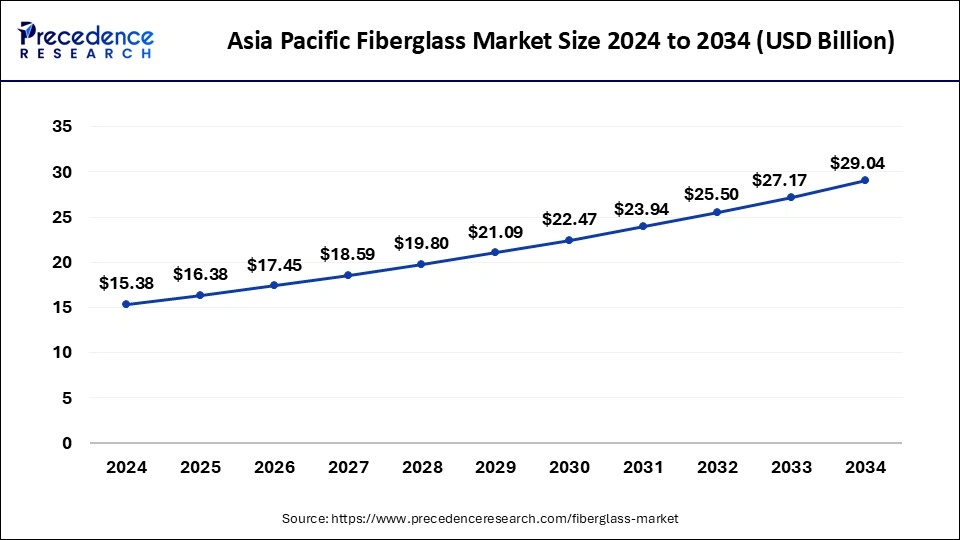

Asia Pacific Fiberglass Market Size and Growth 2026 to 2035

The Asia Pacific fiberglass market size is evaluated at USD 16.38 billion in 2025 and is projected to be worth around USD 30.77 billion by 2035, growing at a CAGR of 6.51% from 2026 to 2035

Asia Pacific Driven by Expanding Construction Industries

Asia Pacific led the fiberglass market with the largest share in 2025. The region is observed to sustain the position during the predicted timeframe. The dominance of the area in the market is expected to increase due to the rising demand from the construction and automotive industries along with the rising population and increasing economic development that contributes to the demand for fiberglass and other associated products. Additionally, favorable government policies towards sustainability are also influencing the growth of the market in the region. The rising investments in the research and development activities for the innovative product launch are boosting the growth of the fiberglass market.

China Fiberglass Market Trends

In the Asia Pacific, China led the market owing to the ongoing industrialization, government initiatives supporting domestic manufacturing, and infrastructure development. Also, initiatives such as "Made in China 2025" promote advancements in composite materials, further fuelling the market growth. China's emphasis on wind energy development has propelled the substantial demand for fiberglass in wind turbine blades.

Growth In Industrial Material Adoption Boosts North America

North America is observed to be the fastest growing marketplace during the forecast period. The growth of the market in the region is attributed to the increasing adoption of new materials for industrial use, the rising infrastructural development and construction activities are driving the demand for the fiberglass material for improving the life and durability of the building. The increasing investments in infrastructure development and the increasing automotive sector that uses fiberglass in automobile manufacturing enhance the growth of the fiberglass market in the region.

In North America, the U.S. dominated the market due to a surge in energy efficiency in buildings, coupled with the rising demand for lightweight materials. The rise of hybrid and electric vehicles, which necessitates lightweight materials to maximize battery range, boosts the demand for fiberglass in the automotive sector.

Expanding Wind Energy Projects Drives Europe

Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be attributed to the ongoing expansion of wind energy projects across major European countries such as Denmark, Spain, and the UK. Furthermore, advancements in fiberglass production technologies like enhanced resin systems and automated processes are improving overall material performance, impacting positive regional growth.

Rapid Urbanization Facilitates India

India is experiencing rapid urbanization, which is increasing the demand for fiberglass. The expanding infrastructure and construction industries are also increasing their use. Similarly, the development of wind turbine blades and the growing production of electric vehicles are also increasing their use.

Increasing Applications Stimulate U.S.

The demand for fiberglass in the U.S. is driven by its application in various industries. Therefore, the companies are heavily investing in their production, where their use is increasing due to their durability and thermal insulation. They are also being used in the aerospace sector.

Green Construction Propel UK

Due to a growth in green construction, the demand for fiberglass in the UK is increasing. The growing renewable energy sector is also increasing its use, which is encouraging its development. The companies are also focusing on enhancing their applications, which is supported by the investments.

Expanding Infrastructure Fuels MEA

MEA is expected to grow significantly in the fiberglass market during the forecast period, due to expanding infrastructure. Additionally, the expanding construction, oil & gas industries are also increasing their demand. The presence of abundant composites is also enhancing their manufacturing, driving their use in renewable energy projects, and promoting market growth.

The UAE Fiberglass Market Trends

The UAE market is experiencing notable growth driven by rapid expansion in construction, infrastructure, and real estate projects that leverage fiberglass for corrosion-resistant piping, architectural cladding, insulation, and structural components. Strong demand in water treatment, desalination, and utility sectors is boosting the use of fiberglass and glass fiber reinforced polymers (GFRP) because of their durability and suitability for harsh environments.

Fiberglass Market Value Chain Analysis

- Feedstock Procurement

Feedstock procurement of fiberglass includes high-purity silica sand, limestone, kaolin clay, and borates from the major suppliers and manufacturers.

Key players: Zillion Sawa Minerals, Saint-Gobain Vetrotex - Quality Testing and Certification

Quality testing and certification of fiberglass involves evaluation of tensile strength, insulation properties, and fire resistance.

Key players: Saint-Gobain Vetrotex, Owens Corning - Regulatory Compliance and Safety Monitoring

Regulatory compliance and safety monitoring of fiberglass involves adherence to the set standards of workplace safety, emission control, and chemical management.

Key players: Owens Corning, Johns Manville

Fiberglass Market Innovators: Key Players' Offering

- PPG Industries, Inc.: Continuous filament glass fiber products are provided by the company.

- Saint-Gobain Vetrotex: The company provided glass wool insulation, composite reinforcement, and technical textiles.

- Jushi Group Co., Ltd.: Glass fiber reinforcements, woven fabrics, and mats are provided by the company.

- POLSER: The company offers fiberglass-reinforced plastics and glass-reinforced plastic composite panels and sheets.

- Nippon Electric Glass Co. Ltd.: Glass fiber for composites is provided by the company.

Recent Development

- In April 2025, BICO Industries signed a contract with the Environmental Funds Administration (AFM) to finance the construction of a factory to produce non-woven fiberglass material by recycling fiberglass waste resulting from both its current activity (production of fiberglass mesh for reinforcing thermal systems) and by collecting it from the market.(Source: https://www.romania-insider.com)

- In March 2025, A Chinese fiberglass company expanded its reach in South Carolina, signing a fast turnaround, the largest Class A industrial lease in the state's central market for 2024. Jushi USA, a branch of China Jushi Co., signed a lease at the Pineview Trade Center in Columbia. Jushi USA specializes in the production and supply of fiberglass reinforcements and fabrics.(Source: https://www.costar.com)

- In March 2024, Edotco Bangladesh collaborated with Huawei Technologies of Bangladesh for the launch of a fiber-reinforced plastic (FRP) tower. It is an advanced eco-friendly telecommunication tower.

- In March 2024, Antenna Experts, a leading player in the assorted varieties of antennas, announced the launch of its ground-to-air antenna. The antenna is designed for aerospace requirements and solutions.

Segments Covered in the Report

By Material Type

- E Glass

- ECR Glass

- H Glass

- AR Glass

- S Glass

By Product Type

- Glass Wool

- Chopped Strand

- Yarn

- Rovings

- Fabrics

By Application

- Composites

- Insulation

- Liquid

By End-User

- Construction

- Automotive

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting