What is the Pultruded Fiberglass Market Size?

The global pultruded fiberglass market is witnessing strong growth as industries adopt lightweight and corrosion-resistant composites for construction, transportation, and industrial applications.The market growth if driven by rising demand for lightweight, high-strength, and corrosion-resistant materials across diverse industries. Advancements in pultrusion manufacturing technologies, coupled with increasing investments in wind energy and other renewable energy initiatives, also contribute to market expansion.

Pultruded Fiberglass Market Key Takeaways

- Asia Pacific dominated the pultruded fiberglass market with the largest market share of 40% in 2024.

- North America is anticipated to grow at the fastest CAGR from 2025 to 2034.

- By resin type, the polyester resin segment captured the biggest market share of 40% in 2024.

- By resin type, the vinyl ester resin segment is expected to witness the fastest CAGR during the foreseeable period.

- By fiber type, the e-glass segment contributed the highest market share of 70% share in 2024.

- By fiber type, the hybrid fibers segment is expected to grow at a significant CAGR over the forecast period.

- By end-use industry, the construction & infrastructure segment held the maximum market share of 35% share in 2024.

- By end-use industry, the automotive & transportation segment is expected to expand at the highest CAGR from 2025 to 2034.

- By application, the structural components segment held the major market share of 50% in 2024.

- By application, the electrical components segment is expected to experience the fastest CAGR during the foreseeable period.

- By form, the profiles segment generated the major market share of 45% in 2024.

- By form, the tubes segment is expected to grow at the fastest CAGR in the upcoming period.

Why are Industries Turning to Pultruded Fiberglass?

The increasing demand for lightweight, corrosion-resistant, and durable materials spans several industries, including construction, transportation, wind energy, electrical, and consumer goods, resulting in a growing need for pultruded fiberglass. Pultruded fiberglass is produced through a continuous process where fibers, typically glass, are pulled through a resin bath and then through a heated die, creating a rigid, high-strength composite material. This method enables the creation of complex shapes, making it suitable for various applications in the construction, automotive, and aerospace industries.

Key Technological Shifts in the Pultruded Fiberglass Market

Artificial intelligence (AI) is transforming the market by enhancing manufacturing efficiency through automation and predictive maintenance, improving quality control with AI-driven inspections, and accelerating product development through simulations. AI systems can perform precise and quick inspections of fiberglass products for defects, thereby boosting product quality and reducing waste and recalls compared to manual inspections. AI also enables the rapid simulation of new fiber textures and compositions, allowing for data-driven innovation and the faster development of customized, high-performance fiberglass solutions.

Pultruded FiberglassMarket Outlook

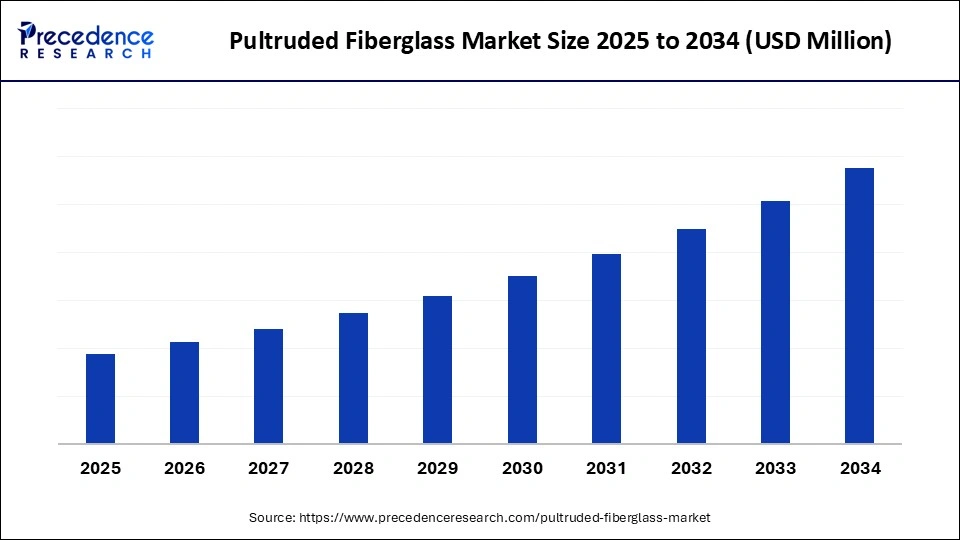

- Market Growth Overview: Between 2025 and 2034, the pultruded fiberglass market is poised for robust expansion, driven by increasing adoption in infrastructure, renewable energy, and transportation sectors. Growth is significantly reinforced by a global shift toward lightweight, durable, and corrosion-resistant materials, particularly in Asia Pacific and North America.

- Sustainability Trends: Sustainability trend is increasingly influencing the market, with growing demand for environmentally friendly resins and the development of more energy-efficient pultrusion processes. Manufacturers are investing in research into recyclable composites and bio-based resin alternatives to address tightening environmental regulations and customer preferences.

- Global Expansion: Leading pultrusion manufacturers are expanding their geographical footprint to serve key growth markets and leverage regional infrastructure development. For example, several European and North American firms are establishing or expanding production facilities in Southeast Asia to be closer to emerging automotive and construction customers.

- Major Investors: Private equity and strategic investors are actively showing interest in the pultruded fiberglass, attracted by its strong application potential, high strength-to-weight ratio, and alignment with sustainable construction and energy trends. Funds have recently been allocated to companies specializing in composite manufacturing and advanced material solutions.

- Startup Ecosystem: The pultruded fiberglass startup ecosystem is evolving, particularly in areas like smart composites and automated production techniques. Emerging firms are attracting venture capital by developing scalable solutions, like integrated sensor-enabled pultrusions for structural health monitoring and advanced composite materials with enhanced fire resistance.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Resin Type, Fiber Type, End-Use Industry, Application, Form, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Lightweight and Durable Materials

The primary factor driving the growth of the pultruded fiberglass market is the growing demand for lightweight and durable materials, particularly in the automotive, aerospace, and construction sectors. This demand is driven by the need for improved fuel efficiency, reduced emissions, and more durable infrastructure. Global construction and infrastructure projects, including roads, bridges, and energy facilities, are increasing the need for durable and cost-effective fiberglass composites such as pultruded rebar and gratings, which help reduce maintenance and safety risks.

Restraint

Lack of Established and Efficient Recycling Processes

The main restraint in the pultruded fiberglass market is the lack of established and efficient recycling processes for fiberglass composites. This issue is exacerbated by increasing environmental regulations and the growing volume of end-of-life products, such as wind turbine blades and auto parts. While high initial capital requirements and raw material price volatility are also significant challenges, the recyclability issue poses a substantial long-term challenge to sustainable growth in the industry, creating substantial waste disposal difficulties.

Opportunity

Development of Compact and Accessible Pultrusion Technology

A key opportunity in this market lies in the development of compact and accessible pultrusion technology, driven by the growing demand for lightweight composites in sectors such as renewable energy, transportation, and construction. The introduction of compact pultrusion machines minimizes the need for dedicated production facilities, thereby enhancing manufacturing efficiency and facilitating rapid installation. These novel and compact machines increase accessibility for composite manufacturers, enabling more flexible and faster production capabilities.

Segment Insights

Resin Type Insights

What Made Polyester Resin the Leading Segment in the Pultruded Fiberglass Market?

The polyester resin segment led the market while holding a 40% share in 2024. This dominance is attributed to its affordability, versatility, and ease of customization, which allows it to be tailored for various sectors such as construction, automotive, and marine. The pultrusion process with polyester resins is straightforward, and the resins' lower viscosity facilitates their use with a good balance of mechanical strength and electrochemical properties. Advanced isophthalic polyester resins offer excellent water resistance, making them suitable for corrosive and marine environments and expanding their application range.

The vinyl ester resin segment is expected to expand at the fastest CAGR in the coming years. The growth of the segment is driven by its superior corrosion resistance, high mechanical strength, and excellent fatigue and impact resistance, making it ideal for demanding environments such as offshore structures, pipelines, and wind energy applications. Vinyl esters can withstand repeated flexing, impact, and stress, which is vital for components in industries such as wind energy and transportation, reducing crack formation and failure, and making them a preferred choice in many applications.

Fiber Type Insights

How Does the E-Glass Segment Dominate the Market in 2024?

The e-glass segment dominated the pultruded fiberglass market, accounting for a 70% share in 2024. This is primarily due to its exceptional balance of mechanical strength, corrosion resistance, electrical insulation, and cost-effectiveness, making it suitable for widespread applications in construction, automotive, wind energy, and electronics, which drive market growth. E-Glass offers a high strength-to-weight ratio, resistance to acids and chemicals, good electrical insulation, and excellent dimensional stability at high temperatures, allowing the creation of customized composites for specific applications.

The hybrid fibers segment is expected to grow at the fastest rate during the forecast period. Combining different fibers, such as glass and carbon, provides tailored, enhanced properties, including increased strength and stiffness, often at a lower cost than a single high-performance fiber. This makes hybrid fibers ideal for applications in construction, automotive, and infrastructure sectors. Growth in these industries, such as bridges, fuels the demand for high-performance composite materials, with hybrid fibers enhancing manufacturing processes.

End-Use Industry Insights

Why Did the Construction & Infrastructure Segment Lead the Pultruded Fiberglass Market?

The construction & infrastructure segment led the market with a 35% share in 2024. This is because fiberglass's high strength, corrosion resistance, durability, and lightweight nature make it ideal for use in building materials such as structural components, insulation, and roofing. As governments and industries focus on energy-efficient buildings and sustainable construction practices, the demand for durable and long-lasting materials, such as fiberglass, rises, particularly for insulation and structural reinforcement in infrastructure projects.

The automotive & transportation segment is expected to grow at the fastest CAGR in the upcoming period. This growth is primarily driven by the industry's high demand for lightweight materials that enhance fuel efficiency and reduce emissions. Pultruded fiberglass offers a superior strength-to-weight ratio compared to traditional materials, such as steel, making it suitable for vehicle parts like body panels and bumpers. Stricter government fuel efficiency regulations, rising consumer preference for electric vehicles, and a broader shift toward sustainable, high-performance vehicle design further drive the demand for pultruded fiberglass.

Application Insights

What Made Structural Components the Dominant Segment in the Market in 2024?

The structural components segment dominated the pultruded fiberglass market with a 50% share in 2024. This is mainly due to fiberglass's lightweight nature, corrosion resistance, and strength, which make it ideal for construction and transportation. The need for energy-efficient, sustainable materials in construction, combined with the drive to reduce weight for improved fuel efficiency, especially in electric vehicles, is a key factor. Increased use of fiberglass composites in electric vehicle components to meet stricter fuel economy and emissions standards is also boosting market growth.

The electrical components segment is likely to expand at the highest CAGR over the projection period, owing to fiberglass's excellent electrical insulation, non-conductivity, corrosion resistance, and high strength-to-weight ratio. These properties make it perfect for demanding applications such as renewable energy infrastructure, 5G telecommunications, and electrical distribution systems. The shift toward sustainable and energy-efficient electrical solutions encourages the use of fiberglass, supporting long-term environmental goals.

Form Insights

Why Did the Profiles Segment Dominate the Pultruded Fiberglass Market in 2024?

The profiles segment dominated the market while capturing a 45% share in 2024. This is because the profile form leverages fiberglass's key strengths, including high tensile strength, corrosion resistance, and dimensional stability, making it ideal for long, load-bearing applications in the construction, infrastructure, and automotive sectors. The linear shape of profiles enables the efficient utilization of fiberglass's properties, resulting in strong yet lightweight components suitable for structural applications.

The tubes segment is among the fastest-growing segments in the market, due to increasing demand for high-performance, lightweight, and corrosion-resistant materials across various industries. Pultruded fiberglass tubes outperform traditional materials such as steel, aluminum, and timber in many applications, helping manufacturers meet specific design requirements. Their low thermal conductivity also enhances energy efficiency in construction by serving as thermal breaks and reducing lifecycle costs for infrastructure owners.

Regional Insights

How Did Asia Pacific Dominate the Pultruded Fiberglass Market in 2024?

Asia Pacific dominated the global pultruded fiberglass market by capturing a 40% share in 2024. The region's dominance is attributed to rapid industrialization, extensive infrastructure investments in countries like China and India, and a growing focus on renewable energy projects, such as wind power, which rely heavily on fiberglass composites. Countries such as South Korea, Taiwan, and Japan extensively use fiberglass for electronics applications, particularly in PCB manufacturing and electrical insulation. The expansion of the automobile industry, along with an emphasis on lightweight and durable components, has further boosted demand in this sector.

India Pultruded Fiberglass Market Trends

India plays a major role in the global market, primarily due to its extensive infrastructure development projects, rapid growth in renewable energy, and increasing demand for lightweight, durable, and corrosion-resistant materials in the automotive and construction sectors. With both domestic and international companies expanding their manufacturing capacities, India is transitioning from a reliance on imports to establishing itself as a significant production hub.

China Pultruded Fiberglass Market Trends

China is also a key player in this market. The country is recognized as the largest producer and consumer, capitalizing on low production costs, a vast manufacturing base, and extensive government incentives. The market is driven by rapid industrialization, significant infrastructure development, and an escalating demand for durable, lightweight materials in key sectors, including wind energy, construction, and electronics. This environment is prompting Chinese manufacturers to pursue technological innovation and adopt more environmentally friendly practices.

Why is North America Considered the Fastest-Growing Region in the Pultruded Fiberglass Market?

North America is expected to experience the fastest growth in this market in the coming years. This growth is primarily driven by a high demand for lightweight, durable, and sustainable materials in the construction, automotive, and renewable energy sectors. These industries favor fiberglass due to its unique properties and are supported by government initiatives and technological advancements. Stringent fuel efficiency and emissions regulations, such as the U.S. Corporate Average Fuel Economy standards, are encouraging automakers to incorporate lightweight materials. The growing preference for sustainable and energy-efficient materials in the region aligns with its environmental goals and directly benefits fiberglass products.

Country-level Investments & Funding Trends for Pultruded Fiberglass Market

- China: The country is investing heavily in large-scale, zero-carbon manufacturing facilities (e.g., China Jushi's 5.658-billion-yuan investment).

- India: India is experiencing significant government and private investment (e.g., Saint-Gobain's Rs 8,000 crore investment) in infrastructure, renewable energy, and acquisitions (such as Twiga Fiberglass Ltd.).

- U.S.: Focused on domestic manufacturing expansion and composite recycling initiatives. Owens Corning sold its global glass reinforcements business for $755 million.

- Finland: Exel Composites is planning a rights offering of up to EUR 23 million and has secured EUR 52.4 million in financing. Investing in R&D.

- Saudi Arabia: Growing market ($118.7 million in 2024) boosted by Vision 2030 projects and investments like Saudi Aramco's Fibre Glass Rebar Facility.

Pultruded Fiberglass Regulatory Landscape: Global Regulations

| Country/Region | Regulatory Body / Standards | Key Regulations & Focus Areas |

| U.S. | ASTM, IBC, OSHA, EPA | ASTM D7705 (Alkali Resistance), IBC (Fire Retardancy), OSHA PELs (Worker Safety), EPA (VOC Emissions) |

| EU | CEN, ECHA, EU Directives | EN 13706 (Structural Profiles), REACH (Chemical Additives), Waste Directives (End-of-Life) |

| China | SAC, MEE | GB Standards (Product Quality), MEE Regulations (Pollution Control) |

| Canada | CSA Group, Federal/Provincial Regulators | CSA S807 (Concrete Reinforcement), Building Codes (FRP Applications), Workplace Safety |

| Australia | Standards Australia, State Regulators | AS 5100.9 (Bridge Structures), Building Codes (Fire, Structural Safety) |

Top Vendors in Pultruded Fiberglass Market & Their Offerings

- Strongwell Corporation: As a world-leading pultruder, it produces a vast range of high-performance FRP composites, including structural shapes, grating (EXTREN, DURADEK), and fabricated assemblies.

- Creative Composites Group: Recognized as North America's largest structural composite manufacturer, it provides custom-engineered FRP solutions, including profiles, grating, and specialty parts, for the infrastructure, industrial, and marine sectors.

- Exel Composites: A Finnish global technology company and major pultrusion manufacturer, known for its standard and custom composite profiles, tubes, and sustainable solutions for diverse industries.

- Jushi Group: A world-leading fiberglass material producer from China that supplies critical rovings and reinforcing fabrics to pultruders globally for manufacturing various FRP products.

- Jiangsu Jiuding New Material Co., Ltd.: This Chinese company manufactures fiberglass raw materials and produces a wide range of finished pultruded FRP products, including profiles and gratings, for international markets.

Pultruded Fiberglass Market Companies

- Owens Corning

- PPG Industries

- Fenzi Group

- Advanced Glassfiber Yans

- Menzolit GmbH

- U.S. Composites

- Ashland Global Holdings

- Zhongtai International

- Pultrall Inc.

- Bharat Fiber Glass Limited

- JNC Corporation

- Saertex GmbH & Co. KG

- China National Glass Industrial Group Corporation (CGIC)

- DUNA-USA, Inc.

- Sireg Geotech Srl

Recent Developments

- In February 2025, Exel Composites' joint venture Kineco Exel Composites India (KECI) received a €10 million purchase order for pultruded carbon fiber planks to supply a major wind turbine manufacturer in South Asia. The planks will start manufacturing in Q1 2025, with deliveries extending into 2026 from KECI's new factory in India, ensuring a minimum annual commitment from the customer.(Source: https://investors.exelcomposites.com)

- In September 2024, Exel Composites announced a purchasing agreement with INEOS for over 100 metric tons of the ENVIREZ bio-based resin system, aiming to phase out hydrocarbon-derived resins. The ENVIREZ resin contains 23% bio-based glycol, reducing manufacturing emissions by 21%, equating to a decrease of 79,000 kilograms of CO2. (Source: https://exelcomposites.com)

Segments Covered in the Report

By Resin Type

- Polyester Resin

- Vinyl Ester Resin

- Epoxy Resin

- Phenolic Resin

- Others

By Fiber Type

- E-Glass

- S-Glass

- Hybrid Fibers

- Other Glass Fibers

By End-Use Industry

- Construction & Infrastructure

- Automotive & Transportation

- Aerospace & Defense

- Energy & Power

- Marine

- Electrical & Electronics

By Application

- Structural Components

- Electrical Components

- Thermal Insulation Components

- Corrosion Resistant Components

- Fire Retardant Components

- Other Applications

By Form

- Sheets

- Rods

- Bars

- Profiles

- Tubes

- Custom Shapes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting