Bimekizumab (BIMZELX) Market Size and Forecast 2025 to 2034

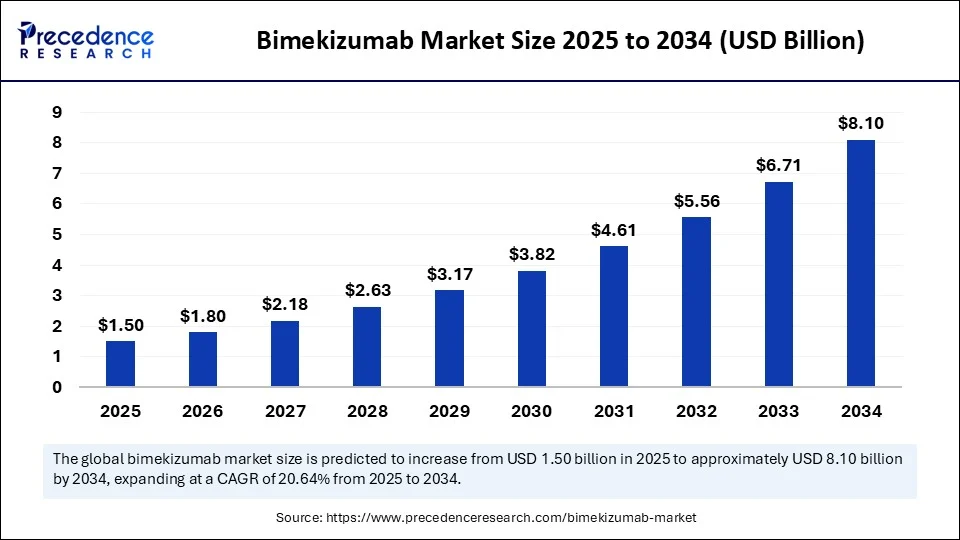

The global bimekizumab (BIMZELX) market size accounted for USD 1.24 billion in 2024 and is predicted to increase from USD 1.50 billion in 2025 to approximately USD 8.10 billion by 2034, expanding at a CAGR of 20.64% from 2025 to 2034. The growth of the market is driven by the rising approvals for bimekizumab across several countries are enhancing accessibility, making it a major contender in the immunology biologics space.

Bimekizumab (BIMZELX) Market Key Takeaways

- In terms of revenue, the global bimekizumab (BIMZELX) market was valued at USD 1.24 billion in 2024.

- It is projected to reach USD 8.10 billion by 2034.

- The market is expected to grow at a CAGR of 20.64% from 2025 to 2034.

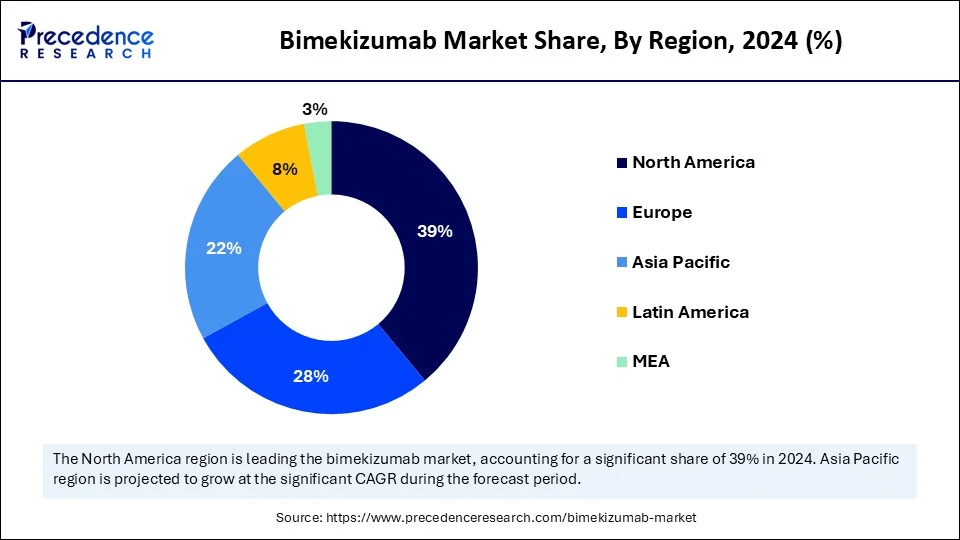

- North America dominated the market with the largest market share of 39% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By indication, the plaque psoriasis (PSO) segment captured the biggest market share in 2024.

- By indication, the hidradenitis suppurativa (HS) segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By formulation, the pre-filled syringe (160 mg / 1 mL) segment contributed the highest market share in 2024.

- By formulation, the pre-filled syringe or pen (320 mg / 2 mL) segment is expected to grow at the highest CAGR between 2025 and 2034.

- By distribution channel, the hospital pharmacies segment generated the major market share in 2024.

- By distribution channel, the online pharmacies segment is expected to grow at a significant CAGR between 2025 and 2034.

How is AI Reshaping the Bimekizumab (BIMZELX) Market?

Artificial intelligence (AI) plays a transformative role in accelerating the growth of the bimekizumab (BIMZELX) market. AI-driven patient screening tools are enhancing early diagnosis and enabling the matching of eligible patients to BIMZELX more efficiently. Predictive analytics are helping identify likely responders, optimizing treatment plans, and improving patient adherence. Moreover, AI is streamlining clinical trial design, reducing time-to-market for the label expansions. Pharmaceutical companies are utilizing AI-based sentiment analysis to refine their marketing strategies and enhance physician engagement. AI-powered supply chain systems are improving distribution in specialty pharmacies. Collectively, AI is not just aiding growth; it is reshaping the way immunological therapies like BIMZELX are delivered, accessed, and optimized.

U.S. Bimekizumab (BIMZELX) Market Size and Growth 2025 to 2034

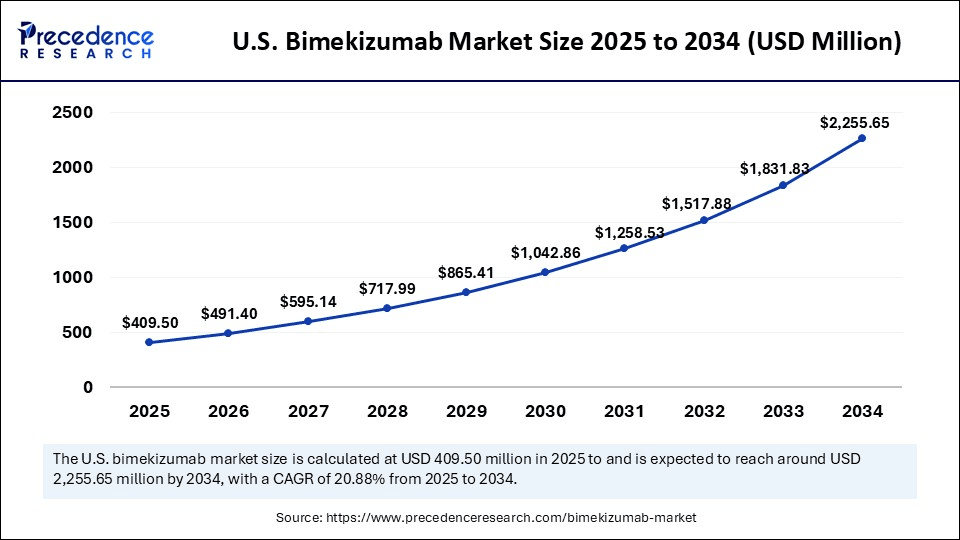

The U.S. bimekizumab (BIMZELX) market size was evaluated at USD 338.52 million in 2024 and is projected to be worth around USD 2,255.65 million by 2034, growing at a CAGR of 20.88% from 2025 to 2034.

What Made North America the Dominant Region in the Bimekizumab (BIMZELX) Market?

North America dominated the market while holding the largest share in 2024, fueled by high biologic adoption, strong reimbursement frameworks, and a well-established specialty care infrastructure. Dermatologists and rheumatologists are increasingly prescribing bimzelx due to its rapid skin clearance and dual-action mechanism. Payers are gradually incorporating BIMZELX into formularies as real-world data confirms its long-term value. Aggressive marketing and patient assistance programs by the manufacturer have also contributed to growing uptake. The presence of biologics-literate patients and well-established retail pharmacy chains further bolstered the growth of the market in the region.

The U.S. is a major contributor to the market, driving market growth due to a favorable regulatory environment and rapid prescriber adoption. The FDA's approval and post-market surveillance support have built strong clinical confidence. Patient preference for the self-injectable biologics model and increased awareness among patients about biologic therapies further support market growth.

Why is Asia Pacific Experiencing Rapid Growth in the Market?

Asia Pacific is expected to grow at the highest CAGR during the projection period, driven by rising autoimmune disease prevalence and growing availability of advanced treatment options. Healthcare ecosystems in countries like South Korea, Japan, India, and Australia are increasingly integrating biologics into standard care, favorable regulatory pathways, and rising biologic approvals are driving market growth. The region's expanding middle class and increasing specialist availability are catalyzing demand in dermatology and rheumatology. As the infrastructure for cold-chain and specialty care strengthens, the growth trajectory will steepen further.

China is emerging as a key player in the bimekizumab (BIMZELX) market in Asia Pacific due to its massive patient pool. Government policies under the Healthy China 2030 plan are promoting the adoption of innovative biologics. Although domestic competition is intensifying, BIMZELX stands out for its dual-targeting innovation and rapid efficacy. Market access is being enhanced through regional pilot programs and inclusion in provincial drug reimbursement lists. The rising prevalence of inflammatory diseases further supports market growth.

Market Overview

The bimekizumab (BIMZELX) market refers to the commercial ecosystem surrounding the IL17A/IL17F dual-inhibitor monoclonal antibody, bimekizumabbkzx, developed by UCB. This includes its performance across all approved indications: plaque psoriasis (PSO), psoriatic arthritis (PsA), ankylosing spondylitis (AS), non-radiographic axial spondylarthritis (nraxSpA), and hidradenitis suppurativa (HS), as well as its formulations, distribution channels, and regional performance as of 2025 and projected through 2034.

The market is witnessing strong momentum, particularly in dermatology and rheumatology segments. Bimzelx's dual inhibition mechanism has given it a competitive edge over IL-17A-only inhibitors. Uptake in certain regions has been robust, supported by favorable reimbursement frameworks. As emerging markets open to advanced biologics, bimzelx's global footprint is expanding. Competitive pressure from existing drugs, such as Cosentyx and Taltz, remains, but clinical superiority in rapid skin clearance and durability gives Bimzelx an edge. With multiple late-stage trials for new indications, such as hidradenitis suppurativa, the market outlook remains bullish.

Market Trends

- Rising preference for dual-cytokine inhibition therapies due to faster disease control

- Increased demand for treatments with rapid onset of action

- Growing focus on sustained disease management in therapeutic choices

- Enhanced patient and physician emphasis on treatment experience and outcomes

- Rising demand for personalized and combination therapies

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.10 Billion |

| Market Size in 2025 | USD 1.50 Billion |

| Market Size in 2024 | USD 1.24 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 20.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Indication, Formulation / Presentation, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Awareness of the Efficacy of Bimekizumab and the Rising Prevalence of Psoriasis

One of the major drivers of the bimekizumab (BIMZELX) market is the rising awareness of its dual inhibition of IL-17A and IL-17F, offering deeper and more sustained efficacy. This mechanism addresses inflammation more broadly than its predecessors, leading to faster patient response and higher clearance rates. Clinicians are increasingly choosing it for patients who have failed TNF inhibitors or single-pathway agents. Positive word-of-mouth and real-world data are boosting physician confidence. In psoriasis, rapid PASI 90 and PASI 100 scores give positioning. This clinical differentiation continues to fuel its market penetration across new geographies and specialties.

Patient advocacy and digital education campaigns are fueling awareness and demand. Strategic partnerships with dermatology clinics and rheumatology networks are helping penetrate the market. The rising prevalence of psoriasis and other inflammatory diseases further boosts the demand for effective therapeutics like bimekizumab. In addition, favorable reimbursement policies for therapeutics in countries like the U.S., Canada, and European countries drive market growth.

Restraint

Limited Awareness and High Therapy Costs

The bimekizumab (BIMZELX) market faces challenges such as limited awareness among general practitioners, particularly in developing countries, and high therapy costs. In some markets, payers are still cautious about reimbursing newer therapeutics without long-term, cost-effectiveness data. Logistics around cold-chain management also add distribution hurdles. Competitor brands with earlier approvals still hold prescriber loyalty. Furthermore, patients who switch due to inertia and fear of adverse effects can slow new adoption. The high costs associated with bimekizumab limit its accessibility and hamper the market growth.

Opportunity

Expanding Indications and Combination Therapies

The next wave of market growth lies in exploring the efficacy of bimekizumab beyond plaque psoriasis. Ongoing studies in conditions like hidradenitis suppurativa and axial spondylarthritis present sizable future opportunities. Additionally, pediatric trials and use in underserved populations open new access points. As biosimilar pressure on older biologics, bimekizumab can position itself as a next-generation innovation. Exploring the use of bimekizumab in combination therapies further opens up new avenues for growth.

Indication Insights

Why Did the Plaque Psoriasis (PSO) Segment Dominate the Market in 2024?

The plaque psoriasis (PSO) segment dominated the bimekizumab (BIMZELX) market with a major share in 2024. This is mainly due to its high prevalence and unmet needs in terms of rapid and complete skin clearance. Bimekizumab's dual inhibition of IL-17A and IL-17F has set a new benchmark in efficacy, with many patients achieving PASI 90 and 100 scores faster than with older biologics. Dermatologists are increasingly prioritizing BIMZELX for biologic naive as well as treatment-resistant patients. The safety profile and convenient dosing of bimekizumab (BIMZELX) add to its attractiveness in long-term psoriasis care. Patient satisfaction, driven by visible improvements in just weeks, fuels strong word-of-mouth advocacy. These clinical and patient-centered advantages continue to solidify its dominance in this segment.

The high level of disease burden and psychological impact of psoriasis boosts the demand for effective and fast-acting therapies. BIMZELX fills the gap, especially in moderate to severe cases where tropical therapies and older biologics have failed. Increased payer acceptance and broadening insurance coverage for psoriasis biologics are supporting segmental growth. Educational campaigns and dermatology society endorsements are accelerating prescriber confidence. As more patients transition to next-generation therapies, BIMZELX will remain the first-line therapy for PSO.

The hidradenitis suppurativa (HS) segment is expected to grow at the fastest rate in the market during the forecast period, driven by the disease's complex, painful nature and limited effective treatment options. The condition has long been underserved, with patients often cycling through antibiotics and surgeries with minimal relief. Bimekizumab's promising trial data in HS has gained significant popularity within the dermatology field. Early access programs and compassionate use initiatives are helping introduce the drug to critical patients ahead of full approvals. The high burden of disease, especially among young adults, makes HS a strategic area for therapeutic expansion. As patient awareness regarding HS grows, so does the demand for targeted, inflammation-modifying biologics like BIMZELX.

Formulation Insights

What Made Pre-Filled Syringe (160 mg / 1 mL) the Dominant Segment in the Bimekizumab (BIMZELX) Market in 2024?

The pre-filled syringe (160 mg / 1 mL) segment dominated the market in 2024. The growth of the segment stems from its convenience, precision, and patient familiarity. Its single-dose, ready-to-use format ensures ease of administration both in clinical settings and at home. This formulation aligns with established biological treatment routines, aiding quick adoption by prescribers. Patients appreciate the discreet, minimal-intervention injection style, which supports adherence. As the go-to starter dose, it anchors the current delivery strategy.

The popularity of the 160 mg syringe has increased due to its optimal balance between dose efficacy and tolerability. Pharmacokinetic studies confirm its suitability for initial induction and maintenance in psoriasis and other autoimmune conditions. Healthcare providers are well-versed in training patients to self-administer this dose, reducing the need for frequent clinical visits. Moreover, supply chains are already optimized to handle this unit format globally. Pre-filled syringes avoid contamination during syringe preparation and reduce administration errors, enhancing treatment efficacy.

The pre-filled syringe or pen (320 mg / 2 mL) segment is expected to grow at the fastest CAGR over the projection period, as it is designed to support deeper suppression of inflammation. The higher-dose option appeals to patients with extensive disease or suboptimal response to initial therapies. Its use is rising, especially in difficult-to-treat cases and in indications like hidradenitis suppurativa, where more aggressive dosing may be beneficial. The pre-filled pen offers even greater ease of administration with auto-injection technology, improving patient comfort and compliance. This format is particularly popular in U.S. and Europe, where self-administration is a popular trend. Pharmaceutical companies are heavily marketing this formulation as part of long-term management strategies. As clinical data continues to show durability and safety, it is becoming the formulation of choice for difficult and chronic presentations.

Distribution Channel Insights

How Does the Hospital Pharmacies Segment Dominate the Market in 2024?

The hospital pharmacies segment dominated the bimekizumab (BIMZELX) market in 2024 due to the easy availability of bimekizumab in these pharmacies. These pharmacies are central to patient onboarding and specialist-driven administration. Bimekizumab's positioning as an advanced therapy aligns well with hospital formularies and infusion protocols. Hospital pharmacists play a key role in guiding patients. Increased patient pool in hospital settings further bolstered the segmental growth. Hospital pharmacies provide the necessary infrastructure and guidance for patients initiating biologic therapies like bimekizumab. Hospitals also manage high-volume patients, making them strategic hubs for BIMZELX deployment. With built-in cold storage and access to multidisciplinary care, hospital pharmacies continue to lead distribution.

The online pharmacies segment is likely to expand at the fastest rate in the market during the forecast period, driven by rising patient preference for convenience and home-based care. Digital health platforms are increasingly integrating prescription biologics, supported by virtual consultations and e-prescriptions. Tech-savvy patients, especially in urban areas, appreciate the discreet and hassle-free ordering process. Online pharmacies also offer price comparisons, refill reminders, and delivery tracking, improving adherence. These pharmacies expand market reach, enabling patients from rural areas to receive bimekizumab at their door.

Bimekizumab (BIMZELX) Market Companies

- UCB

- AbbVie (Cosentyx)

- Novartis (Cosentyx)

- Eli Lilly (Taltz)

- Janssen (Tremfya)

- Pfizer

- Amgen

- Sanofi

- Janssen (Stelara for IL23)

- Regeneron

- Boehringer Ingelheim

- Bristol-Myers Squibb

- Sandoz

- Merck

- Biogen

- Horizon Therapeutics

- MorphoSys

- Incyte

- Arcutis Biotherapeutics

- Kyowa-Kirin

Recent Development

- In February 2025, UCB's dual IL 17A/IL 17F inhibitor, Bimzelx (bimekizumab), demonstrated strong early momentum following its launch in the U.S. psoriatic arthritis (PsA) market. A Spherix Global Insights survey conducted within three months of launch revealed that rheumatologists are embracing Bimzelx more rapidly and with greater enthusiasm than many other recently introduced biologics.

(Source: https://uk.finance.yahoo.com)

Segments Covered in the Report

By Indication

- Plaque Psoriasis (PSO)

- Psoriatic Arthritis (PsA)

- Ankylosing Spondylitis (AS)

- NonRadiographic Axial Spondyloarthritis (nraxSpA)

- Hidradenitis Suppurativa (HS)

By Formulation / Presentation

- Pre-filled Syringe (160 mg / 1 mL)

- pre-filled syringe or pen (320 mg / 2 mL)

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- online pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting