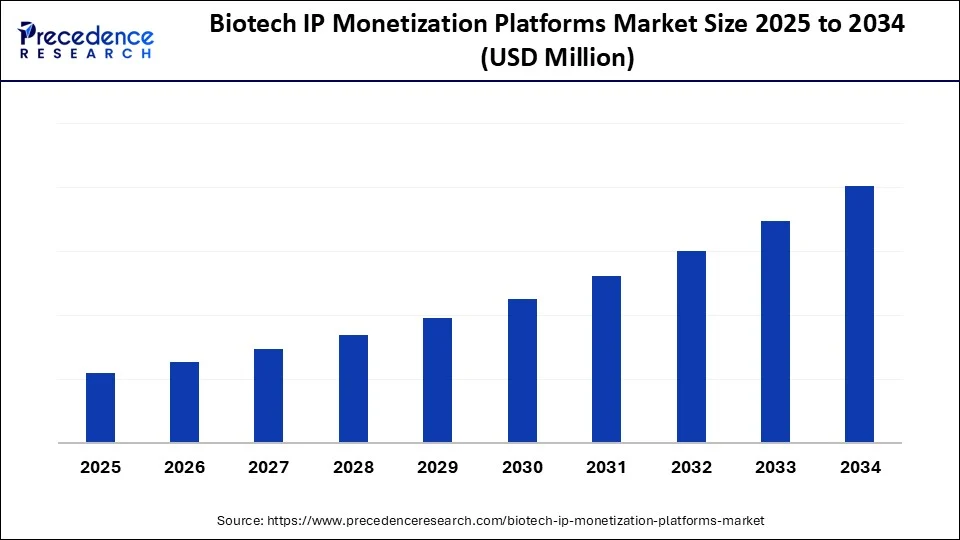

Biotech IP Monetization Platforms Market Size and Forecast 2025 to 2034

The biotech IP monetization platforms market is gaining traction as biotechnology companies increasingly leverage digital platforms to license, sell, and manage intellectual property. These solutions enable efficient IP valuation, revenue generation, and strategic partnerships across the biotech ecosystem. The growing awareness of importance of intellectual property protection in the biotech industry is driving the growth of the biotech IP monetization platforms market. Rising investments in research and development have increased demand for biotech IP monetization platforms.

Biotech IP Monetization Platforms Market Key Takeaways

- North America dominated the global biotech IP monetization platforms market with the largest share in 2024.

- Asia Pacific is expected to grow at a significant CAGR between 2025 to 2034.

- By type of monetization strategy, the licensing platforms (inbound & outbound licensing) segment led the market in 2024.

- By type of monetization strategy, the tokenization and blockchain-based IP monetization segment will grow at the fastest CAGR between 2025 and 2034.

- By type of IP asset handled, the patents segment contributed the largest market share of 60% in 2024.

- By type of IP asset handled, the genetic sequences/data sets segment will expand at a significant CAGR between 2025 and 2034.

- By platform model, the hybrid (marketplace + services) segment held a major market share in 2024.

- By platform model, the royalty investment platforms segment is expected to grow at the highest CAGR between 2025 and 2034.

- By application area, the drug discovery & development segment contributed the largest market share in 2024.

- By application area, the synthetic biology segment will expand at a significant CAGR between 2025 and 2034.

- By end-user, the biotech startups and SMEs segment generated the remarkable market share in 2024.

- By end-user, the IP holding firms (patent aggregators) segment is expected to grow at a CAGR between 2025 and 2034.

Market Overview

The biotech IP monetization platforms market refers to the ecosystem of companies, technologies, and intermediaries that specialize in unlocking financial value from intellectual property (IP) assets in the biotechnology sector. These platforms support licensing, asset-backed financing, patent pooling, royalty monetization, M&A scouting, and IP-based valuation strategies. They serve stakeholders, including biotech firms, research institutions, and IP investors, by identifying underutilized patents, enabling revenue generation from dormant IP, and facilitating transactions in innovation marketplaces.

This market has gained importance due to rising R&D costs, patent cliffs, and the need for non-dilutive capital among early-stage biotech companies. The growing research and development activities in areas such as biologics, personalized medicines, gene editing, and gene therapy, along with public and private sector investments in R&D, are driving the need for biotech IP monetization platforms to protect and commercialize companies' intellectual property.

- International organizations, such as the World Trade Organization (WTO) and WIPO, are collaborating to create standardized global licensing frameworks.

- The European Union has developed a novel legislation to facilitate cross-border licensing, particularly in creative and highly technological industries.

- The U.S. and China are working to harmonize their IP laws for more seamless licensing agreements between them. The China National Intellectual Property Administration (CNIPA) has developed novel reforms aimed at strengthening patent protection.

Biotech IP Monetization Platforms Market Growth Factors

- Advancements in Biotechnology: The ongoing advancements in biotechnology, like gene editing, gene therapy, biologics, and other biotech fields, are driving demand for IP monetization platforms.

- Patent Expiration: The increasing number of patent expirations of branded drugs is driving innovations in genetic and biosimilar manufacturing, thereby increasing demand for comprehensive biotech IP monetization platforms.

- Importance of Intellectual Property: The importance of intellectual property has increased in biotech companies as they recognize the value of their IP assets and the growing need to monetize their assets through licensing, collaborative arrangements, and partnerships.

- Government Initiatives: Governments worldwide are promoting innovations in the biotechnology sector, driving the adoption of IP monetization platforms.

- Importance of Data Analytics: Growing research and development activities have drawn significant focus to the importance of data analytics. The key role of data analytics in biotech IP monetization is to detect valuable IP assets, optimize monetization strategies, and track the latest market trends, are contributes to the growth.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Monetization Strategy, Type of IP Asset Handled, Platform Model, End-User, Application Area, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Digital Transformation and Technological Advancements

The rapid digitalization in biotech companies is enabling them to connect and collaborate with other partners, investors, and license more efficiently through the monetization of IP assets. Advanced data analytics tools are gaining traction in biotech companies for tracking trends, optimizing strategies, and identifying valuable IP assets. The AI integration and blockchain technologies are rapidly growing due to increased use of AI-based data analytics, enabling companies to make informed decisions regarding IP monetization. The growing adoption of blockchain technology for the secure and transparent management of IP rights enables biotech companies to protect and monetize their IP assets.

Restraint

Complex Regulations

Complex approaches are required to navigate multiple regulatory frameworks, including industry-specific regulations, data protection laws, and patent laws. These regulations create challenges for biotech companies. The regulatory framework and its jurisdictional variations challenge biotech companies to comply with multiple regulations in to countries. The constant evolution of regulations requires biotech companies to stay updated and adopt novel IP monetization strategies. The uncertainty and risk associated with regulatory complexity are hindering the adoption of IP monetization platforms by biotech companies.

Opportunity

Cross-Border IP Protection and Global Patent Harmonization

Biotech companies can safeguard their innovations across multiple jurisdictions through cross-border IP protections. The protection process and commercialization of innovations across various jurisdictions enable biotech companies to reduce the risk of IP infringement and increase the value of their IP assets. The global patent harmonization laws simplify the patent filing process, reduce complexity, and the cost burden for biotech companies. Stronger cross-border IP protections can also reduce barriers to international trade and increase investor confidence, thereby securing more funding and partnerships across biotech companies. The harmonization of IP regulations facilitates collaboration among biotech companies, academia, and industry partners across borders.

Type of Monetization Strategy Insights

What Made Licensing Platforms the Dominant Segment in the Biotech IP Monetization Platforms Market in 2024?

The licensing platforms segment dominated the market with the largest share in 2024, due to their widespread use in facilitating the IP monetization process through licensing agreements. Licensing platforms, including inbound & outbound licensing, provide services and tools to connect IP owners to licenses. These platforms establish the deal-making process and ensure the security and transparency of transactions. The licensing platforms are digital marketplaces that connect biotech companies with potential licensees. The ongoing trends like AI IP analytics, digital transformation, cross-industry collaborations, and subscription-based IP models are driving the segment.

The tokenization & blockchain-based IP monetization segment is expected to expand at the fastest rate during the projection period due to its high use for increasing accessibility and transparency. This platform enables secure, efficient, and transparent management and trade of IP assets. The tokenization & blockchain-based IP monetization increase liquidity by allowing fractional ownership, making it easier for creators to monetize their IP assets. The blockchain smart contracts enable automated royalty payments, providing fair compensation to creators for their work. The growing need for transparency in IP assets and streamlining royalty management is driving the adoption of tokenization & blockchain-based IP monetization platforms.

Regulated tokenization platforms, such as InvestaX and IX Swap, take responsibility for the initial sale of tokenized IP assets, where investors purchase tokens, known as a security token offering (STO), that represent the right to the asset.

Type of IP Asset Handled Insights

How Does the Patents Segment Dominate the Biotech IP Monetization Platforms Market in 2024?

The patents segment led the market in 2024. The dominance of the segment stems from the crucial role of patents in offering legal frameworks for the protection and commercialization of innovations. The patent IP asset handled offers efficient management of patent portfolios. This IP asset provides expert guidelines on patent valuation, strategy, and monetization. The patent IP assets handled are essential for biotech companies to navigate complex IP landscapes. The patent segment offers significant monetization strategies, including licensing, sales, litigation, and strategic partnerships.

The genetic sequences/data sets segment is expected to grow at the fastest CAGR over the forecast period, driven by the increasing demand for efficient and secure platforms for managing, protecting, and commercializing important genomic data. The growing innovations in genetic sequences are driving demand for IP monetization platforms for analyzing genomic data. The genomic data is important in drug discovery, development of personalized medicines, and diagnostics, making biotech companies surge for advanced platforms for its protection and monetization. The IP monetization platforms manage complex genomic data, like issues of privacy and regulatory requirements.

Platform Model Insights

Why Did the Hybrid Segment Dominate the Biotech IP Monetization Platforms Market in 2024?

The hybrid (marketplace + services) segment dominated the market while holding a major share in 2024. The hybrid model, which combines marketplaces and biotech IP with associated services, provides sophisticated solutions for IP property buyers and sellers. The hybrid model provides a comprehensive and efficient approach to managing and trading IP assets. The model provides IP access to international buyers, licensors, and sellers. The excellent flexibility of hybrid models enables biotech companies to select a more suitable approach according to their specific requirements.

The royalty investment platforms segment is likely to expand at the fastest rate in the upcoming period due to their crucial role in enabling the specialized monetization of their IP assets, especially future royalty streams. Future royalty streams can attract major investors based on predictive revenue. The royalty investment platforms are flexible, offer a non-dilute structure and investor base. The growing need for alternative financing instruments among biotech companies, coupled with the emergence of new funding sources, drives the adoption of royalty investment platforms. The platform enables biotech companies to manage their IP, access capital, and navigate acquisitions and mergers.

Application Area Insights

Which Application Area Leads the Biotech IP Monetization Platforms Market?

The drug discovery & development segment led the market in 2024 due to the increased demand for secure and efficient platforms for managing and trading IP assets in the drug discovery and development. The heavy investments by biotech companies in research & development are driving the adoption of IP monetization platforms. Drug discovery and development lead to a high volume of patents, as they are a major source of innovation in biotech companies. The demand for AI and blockchain-based IP monetization platforms is gaining traction in the drug discovery and development areas. Additionally, the increasing pharmaceutical and biopharmaceutical pipelines are driving demand for effective IP management and monetization.

The synthetic biology segment is expected to grow at the fastest CAGR over the forecast period. This is mainly due to the increasing applications of synthetic biology in industries such as agriculture, pharmaceuticals, and industrial biotechnology. Synthetic biology combines genetic engineering, bioinformatics, and systems biology principles for the creation of novel solutions in this industry. The biotech IP monetization platforms leverage synthetic biology to design and construct new biological parts, organisms, and systems. The rising demand for sustainable solutions has increased synthetic biology activities in healthcare, agriculture, and energy, driving the need for comprehensive IP monetization platforms. Technological advancements, such as gene editing and the integration of AI and ML, have boosted the adoption of IP monetization platforms in synthetic biology for managing, processing, and monetizing their assets effectively.

End-User Insights

What Made Biotech Startups & SMEs the Dominant Segment in the Biotech IP Monetization Platforms Market in 2024?

The biotech startups & SMEs segment dominated the market in 2024 due to the increased investments by these companies to generate more IP, driving the need for monetization platforms. Several biotech startups & SMEs have shifted toward IP-driven business models, driving the need for IP monetization platforms. The growing patent findings and demand for specialized IP management and services contribute to the segment's growth. The biotech startups & SMEs targeted niche areas in biotechnology, driving demand for highly valuable IP in specific and underserved areas. The robust, agile, and adaptable nature of biotech startups & SMEs enables them to respond quickly to ongoing changes and market trends, making IP monetization platforms essential for protecting and monetizing their strategies.

The IP holding firms (patent aggregators) segment is expected to grow at the highest CAGR during the forecast period due to their role in both facilitating and complicating the monetization process. Patent aggregators offer a flexible, streamlined process for identification, licensing, and acquisition. The IP holding firms enable biotech companies to find potential licenses and partners more easily. The specialized expertise of patent aggregators in IP licensing, valuation, and enforcement drives significant monetization opportunities. IP holding firms play a crucial role in navigating the complex web of patent ownership and licensing agreements.

Regional Insights

What Made North America the Dominant Region in the Biotech IP Monetization Platforms Market

North America dominated the biotech IP monetization platforms market by capturing the largest share in 2024. This is mainly due to the region's strong patent system, advanced research infrastructure, significant investments in research & development, and favorable business environment. North America has witnessed rapid expansion in research areas for personalized medicines, biologics, and genetic editing & testing. The increased innovations have driven demand for efficient IP management in companies. The strong existence of key market players in the biotech industry, like biotech startups, research institutions, and pharmaceutical companies, is further contributing to the increased demand for biotech IP monetization platforms in the region.

The U.S. is a major player in the regional market, contributing to market growth due to the presence of the U.S. Patent and Trademark Office (USPTO), robust access to funding, and strong intellectual property protection. The U.S. has a robust IP protection framework, which provides confidence to investors and companies when investing in biotech innovations. The well-established venture capital enables access to robust funding for the biotech industry. Additionally, the USPTO enables strong frameworks for patent protection.

- In April 2025, the USPTO (United States Patent and Trademark Office) launched the Patent Fraud Detection and Mitigation Working Group, focusing on monitoring suspicious filings, reviewing misrepresentations, addressing erroneous certifications, and imposing administrative sanctions.(Source: https://www.uspto.gov)

Asia Pacific Biotech IP Monetization Platforms Market Trends

Asia Pacific is emerging as the fastest-growing market. The growth of the market is driven by the rapid expansion of biopharmaceutical companies and the increasing demand for personalized medicines. There is rising utilization of AI and ML in drug discovery and development, which is driving the demand for sophisticated biotech IP monetization platforms. The increased investments in R&D and rising demand for innovative therapies further drive the growth of the market.

China is a major player in the regional market, contributing to growth due to the country's robust biopharmaceutical industry and high investments in research and development (R&D). Government initiatives, such as “Made in China 2025,” are further increasing investments in the biotech industry. The transformative biotech industry of China is increasingly adopting innovative technologies like IP monetization platforms, supporting market growth.

India is emerging as a significant market. The growing demand for advanced healthcare services, increasing investments in R&D, and government support contribute to market growth in the country. Favorable government policies for the biotech industry, including tax incentives, support for startups, and R&D funding, are contributing to its growth. Additionally, the “Make in India” initiatives are adding to the rising demand for IP monetization platforms in the Indian biotech industry.

- In August 2025, the Intellectual Property Conclave (IPIC) is scheduled to focus on key issues in IP domains, including technology transfer, IP commercialization, and global trends in IP monetization. (Source: https://legal.economictimes.indiatimes.com)

A Technology Transfer Office (TTO@BCIL) has been set up by Biotech Consortium Indian Limited to support the Department of Biotechnology initiatives. The TTO@BCIL leverages management of innovations and technology transfer, and undertakes to support innovators and technology developers worldwide. (Source: https://www.biotech.co.in)

European Biotech IP Monetization Platforms Market Trends

Europe is expected to witness a notable growth in the upcoming years, driven by its strong framework for IP protection, robust research infrastructure, strong investments in research & development, and favorable business environments. However, the geopolitical uncertainty in early 2025 has led to a 64% decline in European biotech financing compared to Q1 2024. There is now a growing focus on strategic partnerships and mergers and acquisitions (M&A), which is expected to help overcome economic barriers. The increasing number of patents in the biotech industry further contributes to market growth.

The importance of combating counterfeiting and enhancing IP rights enforcement is being highlighted through the EUIPO's 2025 IP Enforcement Summit, alongside discussions on the AI Act and Digital Service Act.(Source: https://insights.citeline.com)

Biotech IP Monetization Platforms Market Companies

- Royalty Pharma

- Ocean Tomo

- IPwe

- Aon IP Solutions

- SciFi VC

- Sagacious IP

- Innography (Clarivate)

- Ocean Tomo Bid-Ask™ Market

- LAVA IP

- IAM Market

- KEW Inc.

- Red Chalk Group

- NGB Corporation

- IPNav

- IPlicensing.net

- Allied Security Trust (AST)

- XOMA Corporation

- IPValue

- WIPO GREEN (for biotech sustainability IPs)

- LexisNexis PatentSight

Recent Developments

- In June 2025, Mudrex announced the listing of Bio Protocol (BIO) on their coins (Sport) trading platforms, where users can deposit BIO to start trading. The Bio Protocol is a decentralized platform that accelerates innovation in biotechnology by enabling global communities like scientists, patients, and investors to fund, develop, and govern tokenized scientific intellectual property (IP). (Source:https://mudrex.com)

- In March 2025, AstraZeneca and Alterogen Inc. entered into a license agreement for ALT-B4, a new hyaluronidase using Hybrozyme platform technology for subcutaneous formulations and commercialisation of multiple oncology assets.

(Source: https://www.outsourcedpharma.com) - In March 2025, Eagle Pharmaceutical, Inc. entered into a royalty purchase agreement with an entity that offered capital funds, which was managed by Blue Owl Capital Inc. The company will sell the royalty interest in annual net sales of BENDEKA in the U.S. for a purchase price of $69 million. (Source: https://investor.eagleus.com)

Segment Covered in the Report

By Type of Monetization Strategy

- Licensing Platforms (Inbound & Outbound Licensing)

- Royalty Monetization & Royalty Financing

- Patent Brokerage & Auctions

- Patent Pools & Cross-Licensing Hubs

- IP-Backed Debt & Securitization

- Technology Transfer Platforms

- M&A & Asset Divestiture Matchmaking

- Tokenization & Blockchain-Based IP Monetization

By Type of IP Asset Handled

- Patents

- Trade Secrets

- Know-How & Technical Dossiers

- Genetic Sequences/Data Sets

- Software/Algorithms (Bioinformatics/AI)

- Trademarks & Brands

- Copyrighted Research Tools

By Platform Model

- Marketplace Platforms (Online IP Exchanges)

- Advisory & Analytics Platforms

- Royalty Investment Platforms

- Hybrid (Marketplace + Services)

By End-User

- Biotech Startups & SMEs

- Large Biopharma Companies

- Universities & Research Institutions

- IP Holding Firms (Patent Aggregators)

- Venture Capital & Royalty Investment Funds

- Tech Transfer Offices (TTOs)

By Application Area

- Drug Discovery & Development

- Gene & Cell Therapy

- Diagnostics & Biomarkers

- Digital Health & Bioinformatics

- Biomanufacturing

- Agricultural Biotech

- Synthetic Biology

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content