What is the Blood-Based Non-Invasive Screening Market Size in 2026?

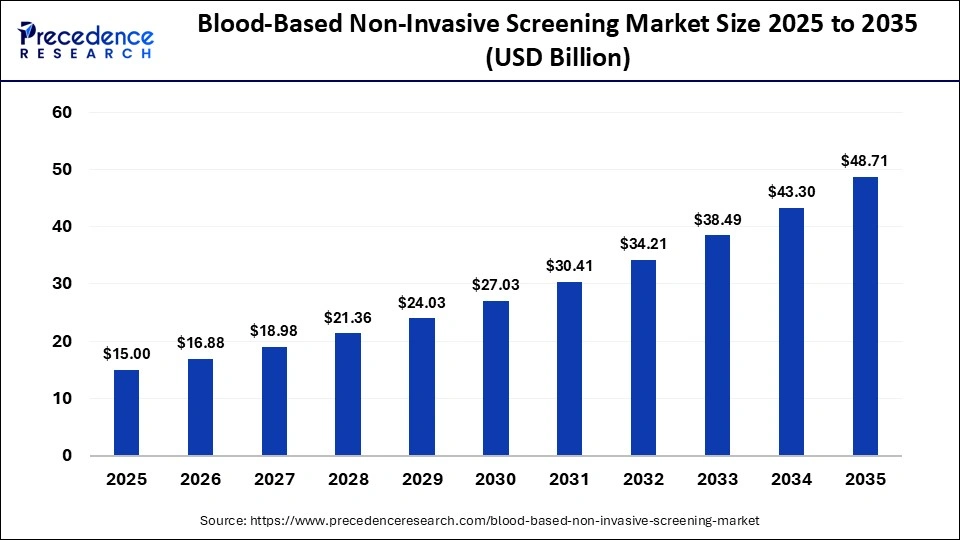

The global blood-based non-invasive screening market size was calculated at USD 15.00 billion in 2025 and is predicted to increase from USD 16.88 billion in 2026 to approximately USD 48.71 billion by 2035, expanding at a CAGR of 12.50% from 2026 to 2035.The market is expected to grow at a robust rate driven by increasing demand for early disease diagnosis, especially in oncology, prenatal screening, and management of chronic diseases.

Key Takeaways

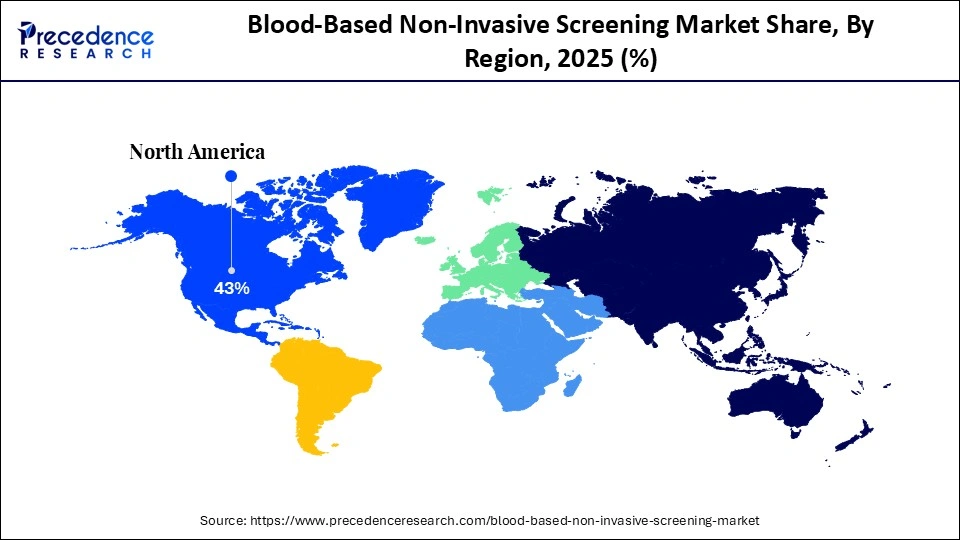

- North America dominated the global blood-based non-invasive screening market with a share of approximately 43% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

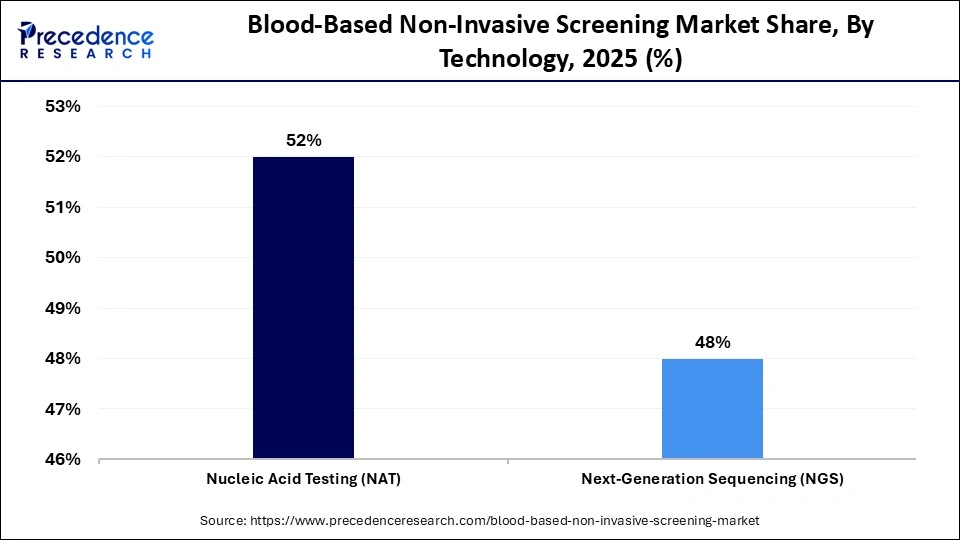

- By technology, the nucleic acid testing (NAT) segment held a dominant position in the market with a share of approximately 52% in 2025.

- By technology, the next-generation sequencing (NGS) segment is expected to grow at the fastest CAGR of approximately 14.5% in the market between 2026 and 2035.

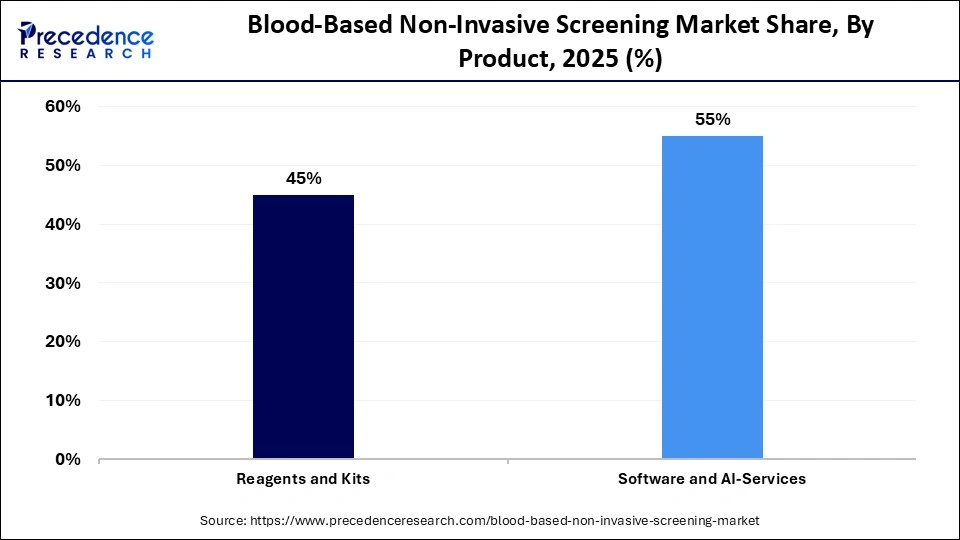

- By product, the reagents and kits segment led the global market with a share of approximately 55% in 2025.

- By product, the software and AI services segment is expected to grow with the highest CAGR in the blood-based non-invasive screening market during the studied years.

- By application, the infectious disease screening segment dominated the global market with a share of approximately 35% in 2025.

- By application, the oncology (liquid biopsy) segment is expected to expand rapidly in the market in the coming years.

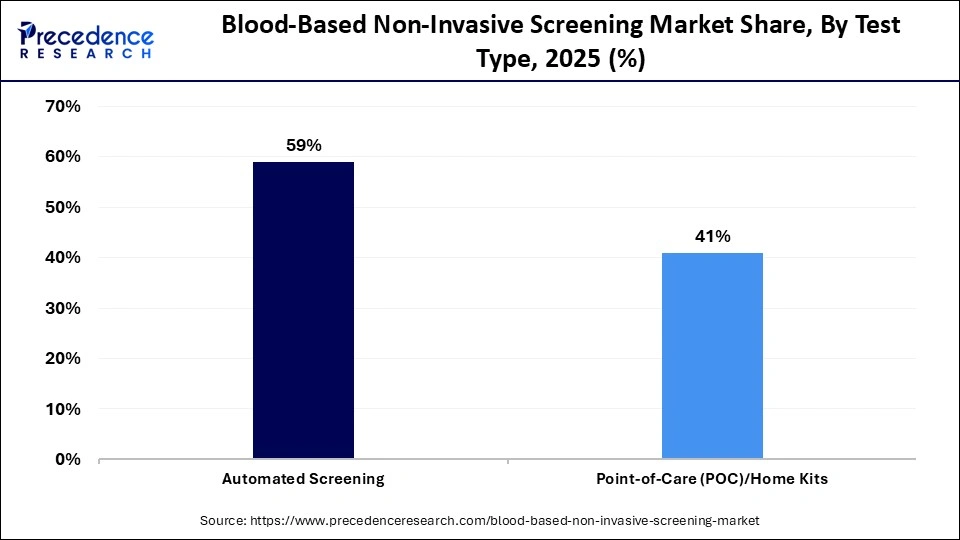

- By test type, the automated screening segment held the largest revenue share of approximately 59% in the market in 2025.

- By test type, the point-of-care (POC)/home kits segment is expected to expand rapidly in the market in the coming years.

- By end-user, the hospitals and blood banks segment held a major revenue share of approximately 46% in the market in 2025.

- By end-user, the specialized diagnostic labs segment is expected to expand rapidly in the market with a CAGR in the coming years.

What is Blood-Based Non-Invasive Screening?

The blood-based non-invasive screening market is a transformative sector of diagnostics that uses blood samples to detect diseases such as cancer, diabetes, and cardiovascular conditions without the need for tissue biopsies. The screening entails examining biomarkers, cell-free DNA, and proteins from a simple blood sample to identify a disease condition in its initial stages.

The market has been experiencing a robust increase due to the burgeoning healthcare sector, whereby healthcare providers and patients are shifting to personalized medicine and population screening programs. Next-generation sequencing (NGS) and high-sensitivity polymerase chain reaction (PCR) methods have enabled technological advancements to increase detection accuracy and shorten turnaround time.

What is the Role of AI in the Blood-Based Non-Invasive Screening Market?

Artificial intelligence (AI) is taking a revolutionary role in increasing the sensitivity and specificity of blood-based screening tests. Complex genomic and proteomic datasets are analyzed by using AI and machine learning (ML) algorithms to allow the detection of simple disease signatures earlier. Risk stratification, predictive analytics, and interpretation of multi-omics data to make personalized insights are also supported by ML models. With the enlarging datasets, platforms based on AI are likely to enhance the scalability of screening and decrease false positives, which will gain clinical trust and prompt use.

Blood-Based Non-Invasive Screening Market Trends

- Growth of Multi-Cancer Early Detection (MCED) Tests: Firms are now making single blood tests, which can identify several cancers at the same time. Such multi-analytes are predicted to transform the population of screening programs.

- Precision Medicine Connectedness: Screening is closely related to targeted therapy selection and monitoring of the treatment with blood-based screening. Diagnostic and therapeutic convergence is establishing the possibility of personalized treatment.

- Increase in Prenatal and Genetic Screening: The non-invasive prenatal testing (NIPT) is on the rise due to a growing maternal age and better reimbursement systems. The development of fetal DNA analysis is increasing the level of accuracy and the spectrum of conditions to be detected.

- Expanding Penetration in New Markets: Improvement of healthcare facilities and increased publicity in Asia-Pacific and Latin America are generating new avenues of growth. Localized manufacturing and strategic partnerships are likely to be used to enable cost-effective deployment in the areas.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 15.00 Billion |

| Market Size in 2026 | USD 7.33 Billion |

| Market Size by 2035 | USD 48.71 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 12.50% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Product, Application,By Test,End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Technology Insights

Which Technology Segment Dominated the Blood-Based Non-Invasive Screening Market?

The nucleic acid testing (NAT) segment dominated the market with a share of approximately 52% in 2025, driven by its sensitivity in detecting viral and genetic material in early stages of infection. NAT greatly shortens the period of diagnosis compared to traditional serological techniques. It is commonly used in blood banks and transfusion centers to guarantee the safety of blood. NAT has firmly established regulatory and proven clinical reliability that has strengthened its leading position. Multiplex testing and continuous advancements in automation are still exerting greater efficiency.

The next-generation sequencing (NGS) segment is expected to grow rapidly during the forecast period with a CAGR of 14.5%, driven by the ability of NGS for complete genomics mapping of minute quantities of blood. NGS enables simultaneous screening of various biomarkers, which can be used in early diagnosis and precision medicine programs. Advancements in sequencing chemistry, bioinformatics pipelines, and low cost have increased its accessibility. With the growing need to screen against multiple diseases and cancers, NGS has continued to be a foundational technology that has led to growth and development.

Product Insights

What made Reagents and Kits the Dominant Segment in the Market?

The reagents and kits segment held the largest revenue share of approximately 55% in the blood-based non-invasive screening market in 2025, because it is used in regular screening practices. These consumables are needed in the extraction of nucleic acids, amplification, and biomarker detection, which helps maintain a continuous revenue stream. The growing number of diagnostic tests being done all over the world enhances the need for standardized and high-quality kits. Validated reagent systems are important to laboratories and blood banks in terms of accuracy and compliance with regulations. Combined with the continuous innovation of its products and automation-ready kits, this segment strengthens its leadership in the market.

The software and AI services segment is expected to show the fastest growth over the forecast period, as sophisticated genomic datasets necessitate advanced analytics for meaningful interpretation. AI-driven solutions enhance biomarker detection, reduce false positives, and facilitate risk modeling. Cloud-based data management systems further bolster large-scale screening initiatives and enable remote collaborations. With the rise of personalized medicine, the demand for intelligent analytics solutions is poised to grow at an even more rapid rate.

Application Insights

Why Did the Infectious Disease Screening Segment Dominate the Market?

The infectious disease screening segment contributed the biggest revenue share of approximately 35% in the blood-based non-invasive screening market in 2025, due to the rising prevalence of infectious diseases, regular donor screening requirements, and evolving regulations globally. Pathogen screening, including HIV, hepatitis viruses, and the emergent infectious agents, is an essential practice in transfusion medicine. Constant demand is also stimulated by government-supported surveillance programs. This segment is stabilized by the existing testing regimes and reimbursement arrangements. Multiplex assays are always under development to provide thorough and valid detection.

The oncology (liquid biopsy) segment is expected to witness the fastest growth in the market over the forecast period, driven by constant and disciplined research on treatments for circulating tumor DNA (ctDNA) and other biomarkers of cancer without the need for tissue-based diagnostics. Ongoing research not only facilitates early-stage detection but also helps provide monitoring for real-time treatment. An increasing focus on early-stage detection and the rising prevalence of cancer augments the segment's growth.

Test Type Insights

How the Automated Screening Segment Dominated the Market?

The automated screening segment accounted for the highest revenue share of approximately 59% in the blood-based non-invasive screening market in 2025, since the method exhibits an extensive throughput capacity and efficiency. They reduce the level of human involvement and guarantee reproducible and accurate outcomes. Major labs and blood banks are heavily dependent on automated platforms to handle large volumes of samples. Data tracking and reporting accuracy are improved by integrating with laboratory information management systems (LIMS). This is strengthened by continuous innovation in automation technologies.

The point-of-care (POC)/home kits segment is expected to grow during the forecast period, with a certain CAGR, as blood sample collection expands beyond traditional clinical settings, improving accessibility and participation in screening programs. Technological advancements certify sample permanency and reliability of the biomarker preservation during transport. The shift toward decentralized healthcare models is expected to boost the adoption of home-based screening solutions further.

End-User Insights

Which End-User Segment Led the Market?

The hospitals and blood banks segment led the blood-based non-invasive screening market with a share of approximately 46% in 2025, since they can screen patients against a wide range of disorders and a huge patient population. These centres need high-quality, large-scale diagnostic systems to ensure the safety and clinical accuracy of transfusion. Laboratory infrastructure is centralized to facilitate automated and high-throughput functioning. Certain financing and systematic procurement systems guarantee long-term demand.

The specialized diagnostic labs segment is expected to grow during the forecast period in the market, due to their expertise in molecular testing and advanced genomic analysis. These laboratories operate high-complexity sequencing and biomarker assays. Strong collaborations with biotechnology firms and healthcare providers enhance service capabilities. As screening technologies become more sophisticated, specialized labs remain central to delivering accurate and scalable diagnostic solutions.

Regional Insights

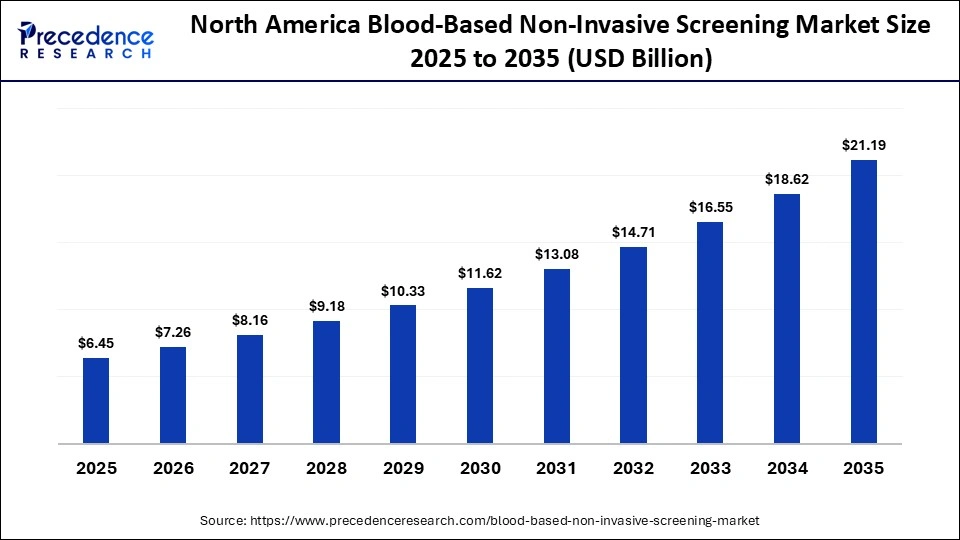

How Big is the North America Blood-Based Non-Invasive Screening Market Size?

The North America blood-based non-invasive screening market size is estimated at USD 6.45 billion in 2025 and is projected to reach approximately USD 21.19 billion by 2035, with a 12.63% CAGR from 2026 to 2035.

Why North America Dominated the Blood-Based Non-Invasive Screening Market?

North America held a major revenue share of approximately 43% in the market in 2025 because of its developed healthcare ecosystem and well-developed regulatory provisions. The regional demand is encouraged by high implementation of molecular diagnostics and early disease detection programs. The existence of prominent biotechnology companies and ongoing R&D investments promotes rapid innovations in diagnostics.

Government and private bodies offer favorable reimbursement policies, enabling patients to opt for clinical tests that have advanced screening capabilities. The high level of public education on the importance of preventive healthcare increases the level of test uptake. The area also enjoys a high level of rapid adoption of AI and digital health technologies.

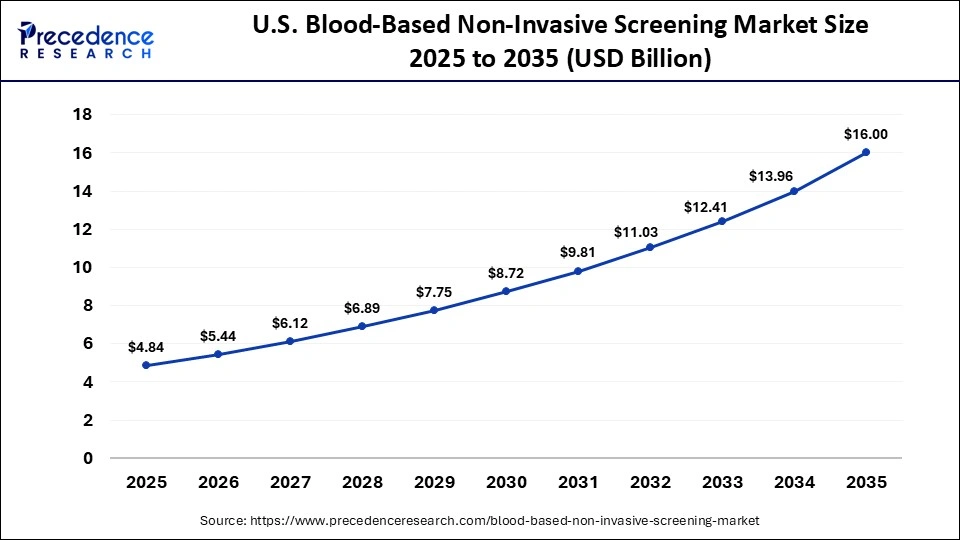

What is the Size of the U.S. Blood-Based Non-Invasive Screening Market?

The U.S. blood-based non-invasive screening market size is calculated at USD 484 billion in 2025 and is expected to reach nearly USD 16.00 billion in 2035, accelerating at a strong CAGR of 12.70% between 2026 and 2035.

Country-Level Analysis

The U.S. dominates the market at the country level because of massive screening schemes and substantial investment in initiatives on precision medicine. Canada is making its fair share through government-funded blood-safety and genetic-testing initiatives. Large amounts of healthcare spending facilitate early adoption of modern technologies.

Close cooperation between research organizations and biotech enterprises increases commercialization. Quality diagnosis is guaranteed by regulatory control. In general, North America has a developed but innovative market environment.

How is Asia-Pacific Growing in the Blood-Based Non-Invasive Screening Market?

Asia-Pacific is expected to witness the fastest growth during the predicted timeframe, due to a rising number of healthcare facilities and a rise in preventative diagnostics. The increasing prevalence of infectious diseases and cancer justifies the growth of the screening program. Government organizations are massively investing in upgrading their laboratory facilities.

The rising disposable incomes and access to healthcare services further potentiate the demand for blood-based non-invasive screening. There is growing use of modern molecular tests in both developed and emerging economies. The region is becoming a major growth driver for the global diagnostic firms.

Country-Level Analysis

China leads in the Asia-Pacific because of high healthcare reforms and investment in biotechnology. India is growing rapidly due to the development of local lab networks and the increase in diagnostic demand. Japan has been experiencing consistent adoption owing to the level of technology and an aging population.

South Korea and Southeast Asian countries are making more investments in genomic medicine programs. Screening programs are also enhancing government and population health outreach. All these situations make the Asia-Pacific the most vibrant market.

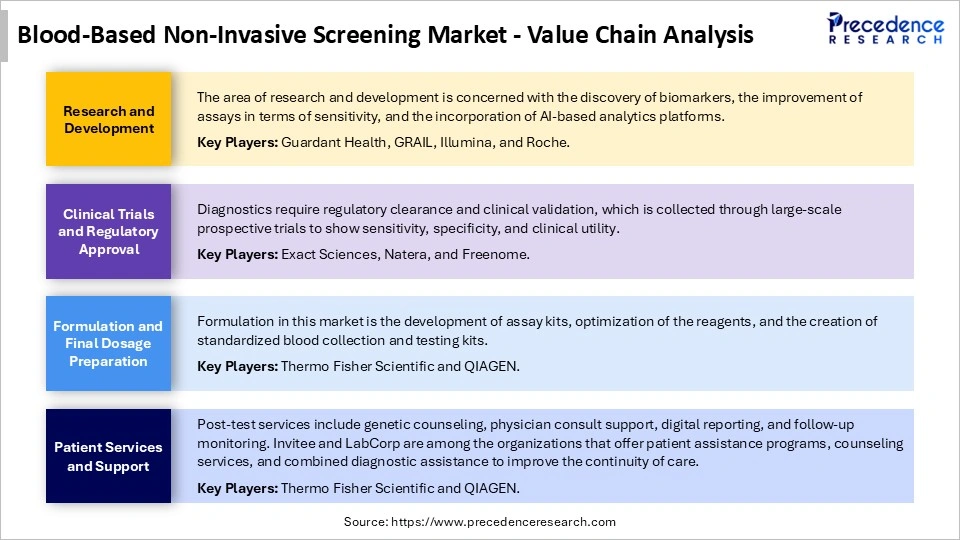

Blood-Based Non-Invasive Screening Market Value Chain Analysis

Blood-Based Non-Invasive Screening Market Companies

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd.

- Guardant Health, Inc.

- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- Grail

- Siemens Healthineers AG

- Bio-Rad Laboratories, Inc.

- Exact Sciences Corporation

- Grifols, S.A.

- Quest Diagnostics

- Labcorp

- QIAGEN

- Sysmex Corporation

- Natera, Inc.

Recent Developments

- In September 2025, Exact Sciences introduced an expanded version of its multi-cancer early detection (MCED) screening test, incorporating additional cancer signals and refined biomarker algorithms. The assay improved detection capabilities for cancers that are typically under-screened, while preserving strong specificity, enabling early cancer screening across clinical laboratories and primary care settings.

- In May 2025, Niloufer Hospital launched Amruth Swasth Bharath, an AI-based diagnostic tool, for non-invasive blood testing that delivers results in under a minute. The tool leverages advanced AI and deep learning algorithms through Remote Photoplethysmography (PPG) to generate real-time health assessments via camera-enabled devices. (Source: https://www.thehindu.com)

Segments Covered in the Report

By Technology

- Nucleic Acid Testing (NAT)

- Next-Generation Sequencing (NGS)

By Product

- Reagents and Kits

- Software and AI-Services

By Application

- Infectious Disease Screening

- Oncology (Liquid Biopsy)

By Test Type

- Automated Screening

- Point-of-Care (POC)/Home Kits

By End-User

- Hospitals and Blood Banks

- Specialized Diagnostic Labs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting