What is the Body Control Module Market Size?

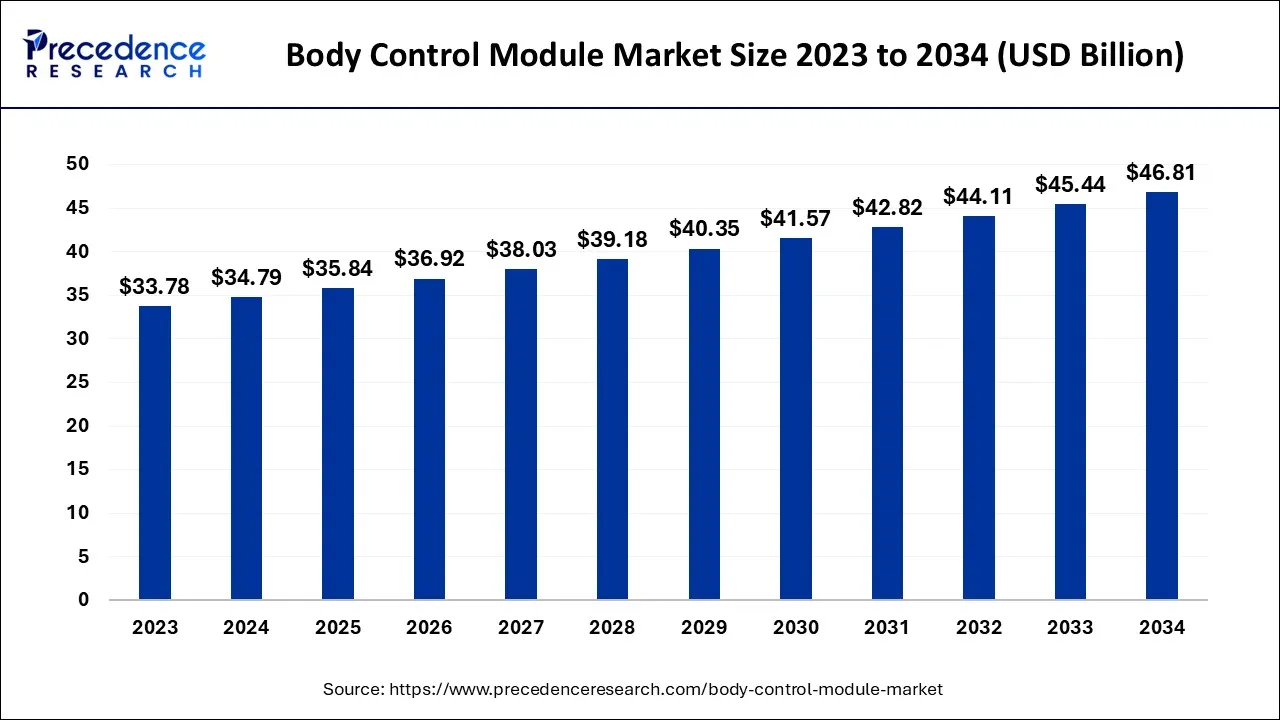

The global body control module market size is calculated at USD 35.84 billion in 2025 and is predicted to increase from USD 36.92 billion in 2026 to approximately USD 48.15 billion by 2035, expanding at a CAGR of 3% from 2026 to 2035.

Body Control Module Market Key Takeaways

- Asia Pacific dominates the market in 2025.

- By Functionality, the high-end segment dominates the market in 2025.

- By Communication Protocol, the CAN bus segment dominated the global market in 2025.

- By Component, the software segment dominated the global market in 2025.

- By Vehicle Type, the light duty segment dominated the market in 2025.

Body Control Module Market Growth Factors

The rapidly increasing demand for driving comfort and safety necessitates the development of cutting-edge vehicle electrical system architecture, influencing the growth of the body control module market. BCM is a comprehensive system that uses the vehicle bus to communicate and integrate the work of all electronic modules. The body control module's primary function is to control load drivers and coordinate the activation of auto electronics units.

In Addition, trending growth in the BCM market is owed to the rise in the adoption of advanced technologies in the automobile segment, the growing share of hybrid and electric vehicles, automated and electronic components, and software contents in vehicles boosting the market growth. Moreover, the key market players are working on different combinations of microcontrollers to make the body control module a perfect fit for any model. This trend is expected to drive the market in the forecast period.

The body control module is a unit or group of teams that controls three broad categories of features: interior and exterior lighting, security, and comfort. BCM is one of the most innovative automotive modules, and V2V and V2X connectivity are some of the critical drivers of innovation in the automotive industry regarding body electronics.

Another driver of such ongoing evolution in BCM is consumer demand for driving comfort and driver and passenger safety. Such market demands are heavily influencing the growth of the body control module.

A few keywords that define the future of the body control module market

- Centralized computing: The goal of centralized computing is to consolidate all body electronics functions onto a single platform. It not only makes the system less cluttered, but it also allows for a more compact and secure platform.

- Zonal gateways: The sensors and actuators are interconnected to the central BCM via a zonal gateway. This gateway function allows different nodes to process data sent over protocols such as LIN, CAN, and more. As a result, legacy ECUs can coexist with modern ECUs in a system.

Market Outlook

- Market Growth Overview: The body control module market is growing rapidly due to increasing vehicle electrification, the adoption of advanced driver-assistance systems (ADAS), and the rising demand for connected and smart vehicles. Innovations in automotive electronics, energy-efficient systems, and enhanced vehicle safety features are further driving market expansion.

- Global Expansion: Worldwide growth is fueled by the increasing integration of electronic control systems in vehicles, rising consumer preference for smart and automated features, and the expansion of electric and hybrid vehicles. Emerging regions such as Asia-Pacific, Latin America, and the Middle East & Africa present opportunities due to rising automotive production, growing adoption of connected vehicles, and supportive government policies promoting vehicle safety and electrification.

- Major Investors: Major investors include automotive OEMs, tier-1 electronic component suppliers, and private equity firms focusing on automotive technology. They contribute by funding R&D for innovative BCM solutions, advancing connected and electrified vehicle technologies, and establishing strategic partnerships to enhance production and global market penetration.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 35.84Billion |

| Market Size in 2026 | USD 36.92 Billion |

| Market Size by 2035 | USD 48.15Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Functionality, Component, MCU Bit Size, Vehicle Type, Communication Protocol, Distribution Channel, Vehicle Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Embedded body control module solutions

One of the significant trends defining automotive development is the growing role of embedded software. The small size of these systems drives the demand for complex embedded automotive solutions. By 2021, the embedded software development market will be worth $233 billion. Advanced fleet management video telematics and embedded electronics enable automakers to install new location navigators in vehicles, diagnose symptoms of potential malfunctions, and avoid premature mechanical part replacement.

Restrains

One of the factors impeding the growth of the body control module market is the increasing cost pressures OEMs face

Due to dynamic regulations imposed on various vehicle components, OEMs are under enormous cost pressure. Stringent emission standards, massive R&D investments, market competition, and evolving customer demands contributed to OEMs' high-cost forces. Because of the competitive market, they must bear the increase in vehicle costs and cannot pass these costs on to end users.

Significantly, because they must limit production costs to meet demand while also providing high-quality products, they are liable for any such product failures or recalls, which can impact the bottom line. These factors may hamper market growth during the forecast period.

Trends

One critical body control module market trend driving growth is the increasing demand for small and reliable BCMs

Primarily, the design of automotive BCMs has become increasingly complex in design. Despite using multiple BCMs to compensate for the increasing electronic content in vehicles, the demand for small BCMs is growing. Furthermore, with continuous market improvement and innovation, BCM manufacturers have begun producing small and dependable BCMs for automobiles. As a result, the trend of constant innovation and rising demand for small and reliable modules will positively impact the global body control module market during the forecast period.

The rise in demand for automotive components, followed by stringent safety regulations imposed by the government on the automotive industry, the increase in body electronic functions in modern vehicles, and the rise in demand for advanced safety, comfort, and convenience features in vehicles are some of the major factors driving the growth of the body control module market. Aside from that, an increase in module complexity may impact the market. Furthermore, the increased demand for advanced driver assistance features and the rise in demand for electric and hybrid vehicles worldwide create market opportunities.

Segment Insights

Functionality Insights

High-end BCM dominated the market in 2025

The high-end BCM dominates the market in 2025. The increased demand for concierge body function inside the vehicles and handling such a critical function is imposing OEMs to use high-end body control modules in vehicle models. BCM is installed with a higher configuration microcontroller. High BCM is used in exterior interior lightings, central locking systems, seat adjustments, and windshield wipers.

Communication Protocol Insights

CAN segment dominates the body control module market

The body control module market is divided into two segments: local interconnect network (LIN) bus and Controller Area Network (CAN) bus. The CAN bus has dominated the global market as the internet of things (IoT) and connected car technologies have grown, as have cloud computing technologies. Furthermore, the market can be divided into MCVs and HCVs, LCVs, and passenger cars based on application. During the forecast period, the passenger car segment is expected to grow at a faster rate due to increased demand for passenger cars in both developing and developed countries.

Component Insights

The growing use of embedded software boosting the market growth

One of the significant trends defining automotive development is the growing role of embedded software. The small size of these systems drives the demand for complex embedded automotive solutions. By 2023, the embedded software development market will be worth $233 billion. Advanced fleet management video telematics and embedded electronics enable automakers to install new location navigators in vehicles, diagnose symptoms of potential malfunctions, and avoid premature mechanical part replacement.

Embedded solutions and the Internet of Things (IoT) are also widely used in developing body control modules. Today, embedded software is used to create two types of BCM architectures: centralized and distributed. When compared to distributed architectures, which are built with a smaller number of modules and more communication interfaces, centralized architectures require fewer modules with high functionality. Although a distributed BCM architecture is more flexible, it cannot optimize an ECU with a centralized structure.

Vehicle Type Insights

Light-duty vehicles will dominate the market in 2025

Light-duty vehicles dominate the market in 2025. Light duty vehicles have fuel-efficient engines, and they contain low operating costs, making technology advancements that have transformed patient monitoring and treatment tools and the anesthetic record itself. Light-duty vehicles have a gross vehicle weight rating (GVWR) of less than 8,500 pounds.

Light-duty vehicle demand is expected to grow due to the lower volume of air pollutants they emit. Stringent regulations aimed at reducing vehicular emissions, on the other hand, are expected to encourage the adoption of light-duty electric trucks, thereby driving market growth over the forecast period.

Regional Insights

Asia Pacific region dominated the market in 2025

Asia Pacific dominates the body control module market. Asia Pacific countries such as India, China, South Korea, and others are among the top producers of automobiles. Over the forecast period, the Chinese automotive industry is expected to grow tenfold. The demand for body control modules is expected to rise in the coming years due to increased vehicle production and the incorporation of more electronic units.

India Body Control Module Market Analysis

The market in India is expanding due to the integration of advanced vehicle electronics, smart features, and safety mandates. The Ministry of Electronics and Information Technology (MeitY) launched and implemented national policies and programs to boost the development of the IT and electronics industry. Growing consumer demand for advanced safety features, energy-efficient electronics, and government initiatives supporting automotive technology and vehicle electrification are further driving market expansion.

Why is North America Considered the Fastest-Growing Region in the Body Control Module Market?

North America is expected to grow at the fastest rate in the market during the forecast period, owing to the rising demand for advanced safety features and the shift toward hybrid vehicles. There is high adoption of advanced driver-assistance systems (ADAS), connected vehicles, and electric/hybrid vehicles. Strong automotive R&D infrastructure, consumer demand for smart and automated vehicle features, and supportive regulations for vehicle safety and emissions are further accelerating market growth in the region.

U.S. Body Control Module Market Analysis

The U.S. market is driven by the rising adoption of software-defined vehicle features, improved connectivity, and enhanced user experience. In August 2024, Aptiv PLC, the leading company in the U.S., invested $45 million to expand its Chennai plant by integrating advanced safety and user experience. Additionally, the widespread adoption of connected and smart vehicles, advanced driver-assistance systems (ADAS), and increasing production of electric and hybrid vehicles are driving the market.

What are the Major Factors Contributing to the Body Control Module Market within Latin America?

In Latin America, the market is growing due to several factors. Firstly, regulatory standards and rising demand for emission control systems. Increasing vehicle production, rising demand for connected and smart vehicles, and growing adoption of advanced safety and convenience features are contributing to market growth. Expanding automotive manufacturing, supportive government policies for vehicle electrification, and rising consumer preference for energy-efficient and technologically advanced vehicles are further fueling market growth in the region.

What Opportunities Exist in the Middle East & Africa for the Body Control Module Market?

The Middle East and Africa (MEA) present significant opportunities in the market due to increasing automotive production, rising demand for connected and smart vehicles, and the adoption of advanced safety and convenience features. Government initiatives supporting vehicle electrification, growing investments in automotive technology, and expanding consumer awareness of energy-efficient and automated vehicle systems are further driving market growth and creating opportunities for BCM solution providers.

What Makes Europe a Notably Growing Region in the Market?

Europe is a notably growing region in the body control module market due to the widespread adoption of electric and hybrid vehicles, connected car technologies, and advanced driver-assistance systems (ADAS). Strong automotive R&D infrastructure, stringent vehicle safety and emission regulations, and increasing consumer demand for smart, energy-efficient, and technologically advanced vehicles are further driving market expansion across the region

Body Control Module Market Companies

- Continental AG

- Delphi Automotive PLC

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Denso Corporation

- HELLA

- Mouser Electronics

- Infineon Technologies AG

- Harman International

- Tata Elxsi

- Renesas Electronics Corporation

Recent Development

-

In January 2025, Marelli launched its Body Control Modules (BCM) solutions in India. These solutions manage power distribution and lighting.

(Source:https://www.marklines.com/en/news/320758 ) -

In May 2025, HIRAIN's Body Control Module helped Foton Piaggio's NP6 light truck meet European cybersecurity regulations and enter mass production. This milestone showcases HIRAIN's technical expertise in commercial vehicle control and marks the launch of its domain control products in Europe, supporting the company's global expansion strategy.

(Source: en.hirain.com ) - In 2021,Magma introduced cameras and electronic control units in luxury cars, which provide the benefits of 3D view.

- In 2019,Denso Corporation and Toyota motor corporation jointly established a joint Venture for R & D of next-gen vehicle semiconductors.

Segments Covered in the Report

By Functionality

- High End

- Low End

By Component

- Hardware

- Software

By MCU Bit Size

- 8-bit

- 16-bit

- 32-bit

By Vehicle Type

- Light-duty Vehicles

- heavy Vehicles

By Communication Protocol

- CAN

- LIN

- FlexRay

By Distribution Channel

- Relays

- Fuses

By Vehicle Type

- Passenger Cars

- Light commercial Vehicles

- Heavy commercial Vehicles

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting