What is Building Information Modelling (BIM) Software Market Size?

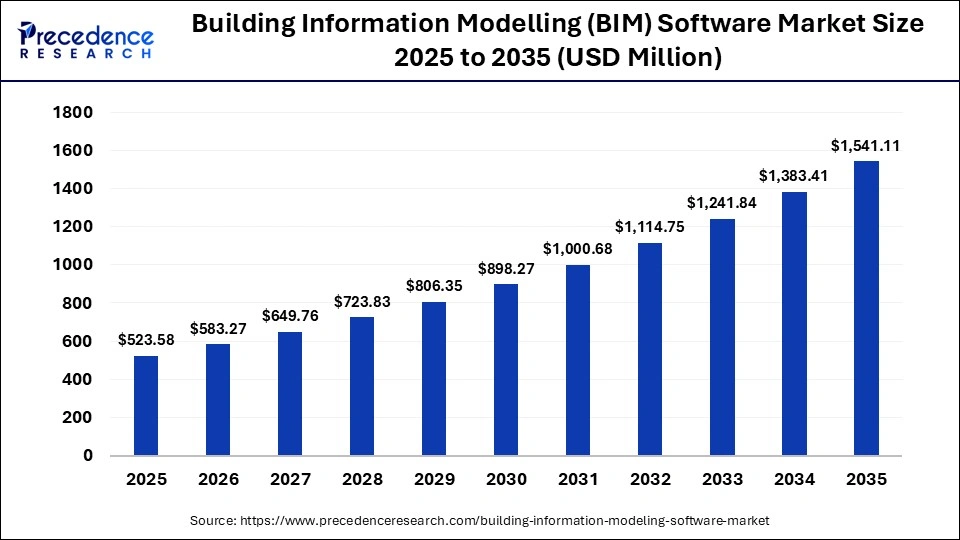

The global building information modelling (BIM) software market size was calculated at USD 523.58 million in 2025 and is predicted to increase from USD 583.27 million in 2026 to approximately USD 1541.11 million by 2035, expanding at a CAGR of 11.40% from 2026 to 2035. The building information modelling (BIM) software market is experiencing unprecedented growth, driven by rapid infrastructure development and the rising integration of Artificial Intelligence (AI) and machine learning (ML).

Market Highlights

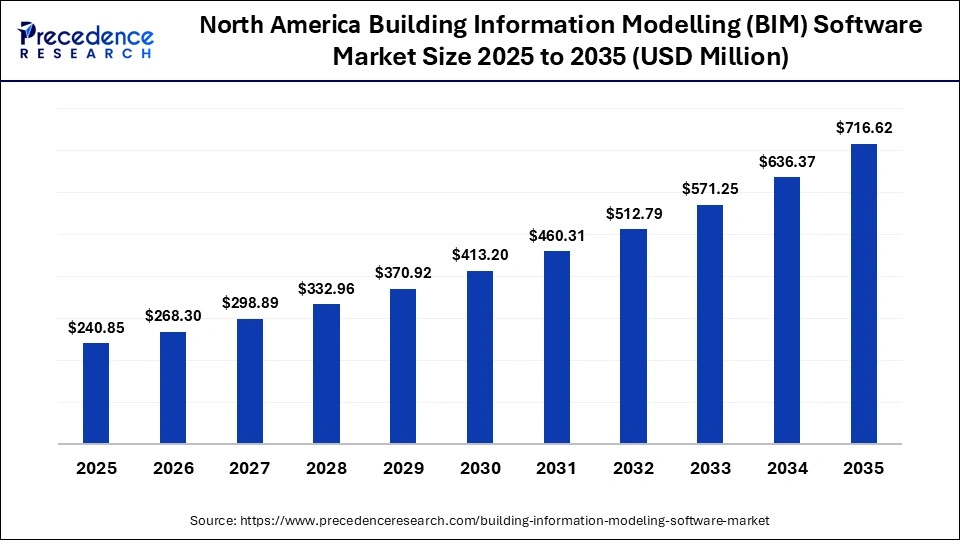

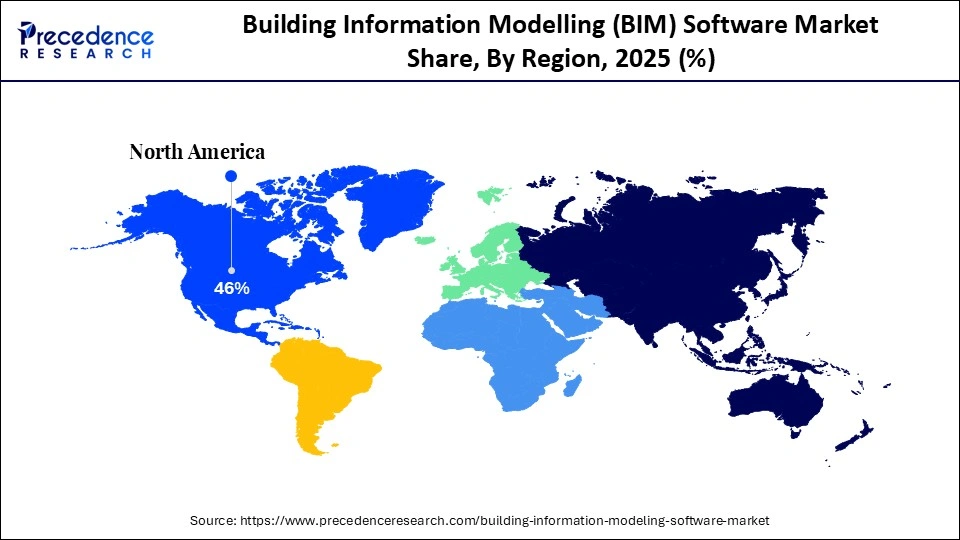

- North America dominated the market with the largest share of approximately 46% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR of 12% in the building information modelling (BIM) software market.

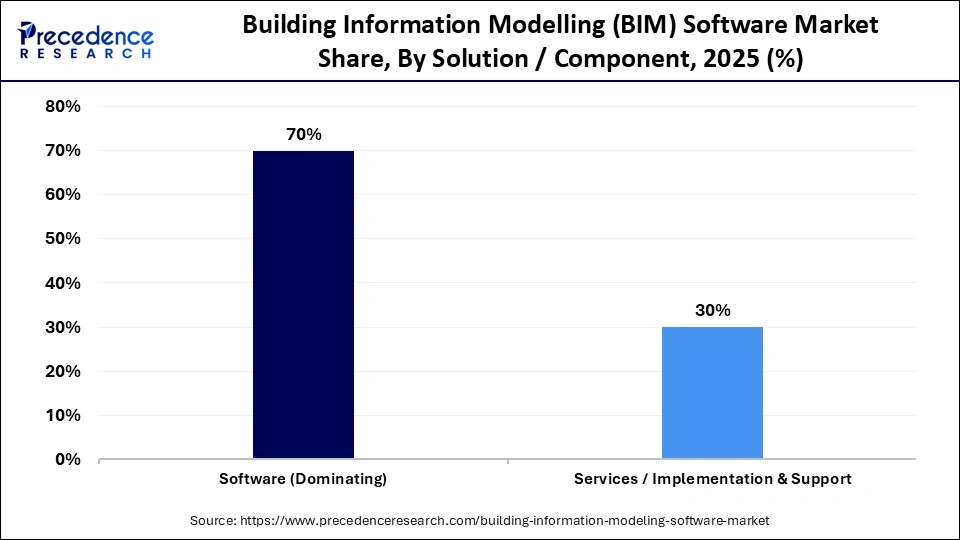

- By component, the software segment held the largest market share of approximately 70% in 2025.

- By component, the services segment is expected to grow at a remarkable CAGR of 10.7% between 2026 and 2035.

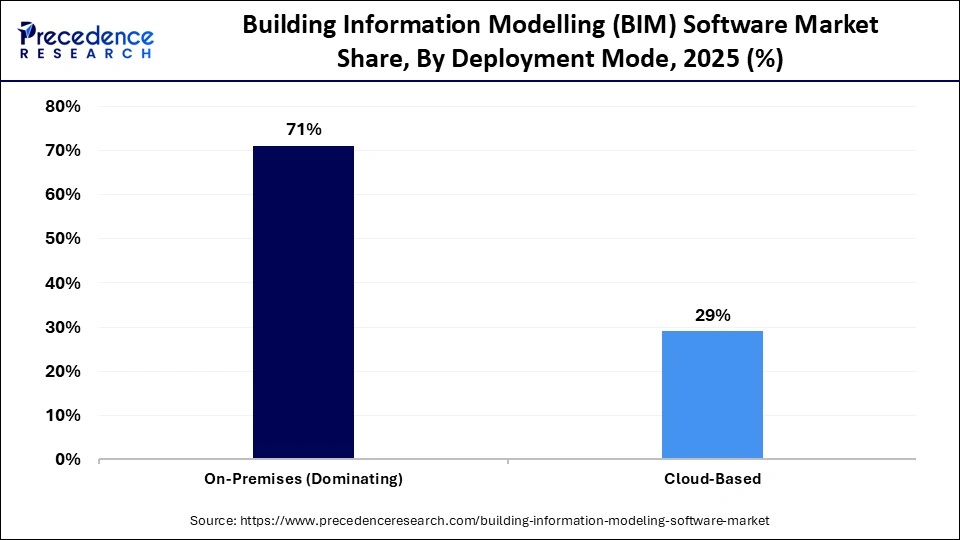

- By deployment mode, the on-premises segment held the largest market share of approximately 71% in 2025.

- By deployment mode, the cloud-based segment is expected to grow at the fastest CAGR of 11% from 2026 to 2035.

- By type, the 3D BIM segment held the largest market share of approximately 50% in 2025

- By type, the 7D BIM segment is expected to expand at a remarkable growth rate of 10.4% between 2026 and 2035.

- By end-user, the architects/AEC offices segment held the largest share of approximately 42% in the building information modelling (BIM) software market during 2025.

- By end-user, the contractors segment is set to grow at the highest CAGR of 10.6% between 2026 and 2035.

Market Overview

The building information modelling (BIM) software market comprises digital platforms that enable creation, management, and collaboration on detailed building data throughout a project's lifecycle. Building information modeling (BIM) is the comprehensive process of creating and managing information for a built asset. BIM solutions improve design accuracy, project coordination, cost planning & operational workflows across architecture, engineering, construction, and facility management domains.

How are AI-driven innovations reshaping the market?

In the evolution of digital construction, the integration of Artificial Intelligence is significantly accelerating the growth of the building information modelling (BIM) software market. The integration of AI into building information modeling (BIM) is significantly revolutionizing the way projects are planned, designed, and executed. AI is paving the way for new possibilities for design optimization, process automation, and intelligent building management.

AI can enable more efficient and faster responses to project changes and construction challenges during the construction phase. AI integration in building information modelling (BIM) involves the application of deep learning, machine learning, and predictive analytics to optimize design processes, automate tasks, and simulate real-world building behaviors. AI-powered systems can continuously learn and adapt to project-specific requirements. This combination of AI and BIM assists companies and public agencies in adapting to evolving conditions while predicting any potential delays. Actionable insights are provided for making more informed decisions.

- In January 2026, OFA Group, focused on advancing digital transformation in the architecture, engineering, and construction (AEC) sector, announced the official commercial deployment of QikBIM, its in-house developed, AI-powered platform for automated Building Information Modeling (BIM) production.

What are the emerging trends in the market?

- The BIM adoption has significantly increased, influenced by government sustainability mandates and the rise in the number of large-scale projects with complex data needs, such as civil infrastructure and data centers.

- The increasing trend of sustainability integration is expected to drive growth in the building information modelling (BIM) software market in the coming years. Energy modeling tools are efficient for automatically calculating carbon footprints during design phases.

- The increasing shift towards cloud-based platforms, which allows for real-time collaboration across global teams, is anticipated to accelerate the growth of the market during the forecast period.

- The integration of digital construction technologies that enhance visualization, simulation, and real-time collaboration is expected to contribute to the overall growth of the building information modelling (BIM) software market.

- The rapid urbanization and growing demand from renovation and retrofitting projects are anticipated to fuel the expansion of the market in the coming years.

- The rising demand for sustainable building practices and rising investment in smart cities are expected to create significant growth opportunities for the market during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 523.58 Million |

| Market Size in 2026 | USD 583.27 Million |

| Market Size by 2035 | USD 1541.11 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.40% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Component, Type , Deployment, Enterprise Size, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Component Insights

What causes the software segment to dominate the market?

The software segment held the largest building information modelling (BIM) software market share of approximately 70% in 2025. Software solutions provide 3D, 4D, and 5D Building Information Modeling (BIM) capabilities, and are significantly transforming the Architecture, Engineering, and Construction (AEC) industry. BIM software serves as the critical platform for design, simulation, and clash detection, which enhances productivity throughout the building lifecycle. Software providers are increasingly integrating AI to enable smarter project decision-making, automate repetitive tasks, and improve model intelligence.

The services segment is expected to grow at a remarkable CAGR of 10.7% between 2026 and 2035. The segment's fastest growth is driven by the increasing complexity of construction projects, which necessitates expert consultancy and management services. Several organizations lack in-house BIM expertise, particularly among small to mid-sized companies, which heightened the need for consulting, integration, and training support to ensure smooth adoption and alignment with project goals. Moreover, the rising outsourcing trends of BIM modeling, coordination, and documentation to specialized firms drive the segment's growth during the forecast period.

Deployment Mode Insights

Which deployment mode segment dominated the market in 2025?

The on-premises segment is dominating the building information modelling (BIM) software market by holding a majority of approximately 71% market share. The growth of the segment is primarily driven by the growing need for robust data security & privacy, stringent regulatory compliance, and the increasing need to take complete control over sensitive project information, especially in large and complex infrastructure projects. This deployment model is particularly favored by defense contractors, large construction companies, and government agencies that handle confidential construction data. On-premises deployment mode permit for greater customization, seamless integration with legacy systems, and reliable performance in environments with limited internet connectivity.

The cloud-based segment is the fastest-growing in the building information modelling (BIM) software market with a CAGR of 11% between 2026 and 2035, owing to the increasing adoption of cloud-based platforms for real-time collaboration across global teams. The market is experiencing a massive shift towards cloud-based solutions and software-as-a-service (SaaS) models, as it offers enhanced scalability, seamless integration with technologies like IoT and AI, and the ability to overcome initial cost barriers for smaller firms. The cloud-based subscription models are becoming accessible to small and medium-sized enterprises (SMEs) as it eliminates the need for expensive on-premise infrastructure.

Type Insights

What causes the 3D BIM segment to dominate the market?

The 3D BIM segment held the largest market share of approximately 50% in 2025. 3D BIM modeling provides digital representations of intelligent virtual models that incorporate detailed information about each component of a building lifecycle. This data-driven design approach is gaining immense popularity among architects, engineers, and construction contractors owing to its accuracy, precision, and efficiency. This model has the ability to detect clashes and potential conflicts in a virtual environment that substantially minimizes costly on-site modifications and rework. The governments across various countries are increasingly mandating 3D BIM modelling for public projects to ensure both transparency and efficiency.

The 7D BIM segment is the fastest-growing in the building information modelling (BIM) software market at a remarkable growth rate of 10.4% between 2026 and 2035. 7D BIM is all about related to the facility management by building managers and owners in a single place within the building information model. 7D BIM seamlessly integrates facility management information, such as operation and maintenance manuals, warranty information, technical details, and asset management data. It provides various benefits, such as better asset and facility management from the initial design stage to demolition, streamlines the maintenance process for contractors and subcontractors, and facilitates easy repairs and replacement of parts anytime during the building lifecycle.

End-user Insights

What has led the architects/AEC offices segment to dominate the market?

The architects/AEC offices segment is dominating the building information modelling (BIM) software market with the largest share of approximately 42%. Architects/AEC offices are the core end-users of building information modelling (BIM) software. The growth of the segment is supported by the rising need for advanced 3D visualization, simulation, and collaboration tools to improve efficiency, reduce errors, and align with the project goals. With the rising government mandates and standards, the adoption of BIM has increased, as the industry is shifting towards standardized digital workflows.

The contractors segment is a significant and rapidly growing segment in the building information modelling (BIM) software market with a CAGR of 10.6% between 2026 and 2035. BIM allows contractors to visualize a facility before its actual construction, which enables them to input critical information before building begins and identify opportunities for off-site prefabrication.

Regional Insights

How Big is the North America Building Information Modelling (BIM) Software Market Size?

The North America building information modelling (BIM) software market size is estimated at USD 240.85 million in 2025 and is projected to reach approximately USD 716.62 million by 2035, with a 11.52% CAGR from 2026 to 2035.

North America's Building Information Modelling (BIM) Software Market Analysis

North America dominated the industrial burners market, holding the largest market share of approximately 46% in 2025. The digital transformation of the construction industry in the North America region represents a massive shift in the approach to designing, constructing, and managing buildings. With the increasing complexity of infrastructure projects and the rising emphasis on sustainability, efficiency, and construction quality, the integration of Artificial Intelligence (AI) into the BIM environment is gaining immense popularity in the region.

What is the Size of the U.S. Building Information Modelling (BIM) Software Market?

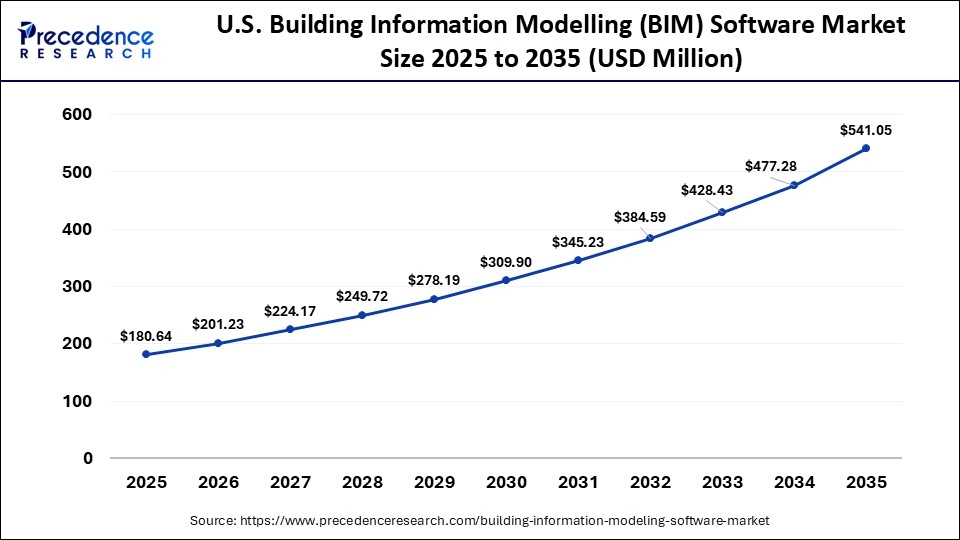

The U.S. building information modelling (BIM) software market size is calculated at USD 180.64 million in 2025 and is expected to reach nearly USD 541.05 million in 2035, accelerating at a strong CAGR of 11.59% between 2026 to 2035.

U.S. Building Information Modelling (Bim) Software Market Analysis

The U.S. is transforming the market. The United States is a major contributor to the market in the North American region. The country is home to the leading market players such as Autodesk, Inc., Bentley Systems, Trimble Inc., Oracle Corporation, Procore Technologies, Inc., Bluebeam, and others. The country's leadership position in the region is attributed to the early adoption of advanced technologies like AI, cloud-based platforms, and digital twins, rising investment in construction activities, stringent government mandates, and rising adoption of sustainable & energy-efficient building practices.

Asia Pacific Building Information Modelling (BIM) Software Market Analysis

The Asia Pacific region is the fastest-growing region in the market and is expected to expand at the fastest CAGR of 12%. The rising investment in smart city projects, driven by rapid urbanization and infrastructure modernization, spurs the demand for building information modelling (BIM) software. The growth of the Asia Pacific region is mainly driven by the rising digital transformation in the Architecture, Engineering, and Construction (AEC) sectors, rising innovation in cloud-based and 3D modeling technologies, and rapid technological advancements like IoT and AI integration. The government's stringent mandates, particularly in countries like Singapore, China, and South Korea, are compelling to adopt BIM for large-scale public projects to ensure accuracy, transparency, and reduce delays.

China's building information modelling (BIM) software market analysis

India's market holds a notable revenue share in the market. The country is experiencing significant infrastructure investment in large-scale commercial, residential, and public infrastructure projects, which necessitate advanced, collaborative, and data-driven project management tools. The growth of the country is also largely driven by rapid urbanization, rapid transition toward sustainable construction practices, increasing cloud-based collaboration platforms adoption, stringent government mandates for infrastructure projects, and the rising integration of AI/Machine Learning for predictive analysis. Several Chinese companies are increasingly integrating building information modelling (BIM) with AI, IoT, and cloud computing to enhance construction workflows, improve data accuracy, and increase efficiency.

Who are the Major Players in the Global Building Information Modelling (BIM) Software Market?

The major players in the building information modelling (BIM) software market include Autodesk, Inc., Nemetschek SE, Bentley Systems, Incorporated, Trimble Inc. , Dassault Systèmes SE, Hexagon AB, AVEVA Group plc, ACCA Software S.p.A., Asite Solutions Ltd., Oracle Corporation, Graphisoft (part of Nemetschek), RIB Software AG, Procore Technologies, Inc., Siemens AG, and Bluebeam (by Nemetschek)

Recent Developments

- In May 2025, Procore Technologies Inc., a leading technology partner for every stage of construction, announced enhancements to its building information modeling (BIM) capabilities through the acquisitions of Novorender and FlyPaper. These acquisitions aim to support owners and contractors in improving coordination and integrating BIM data across the Procore platform.(Source: https://www.engineering.com)

- In March 2024, Trimble announced the introduction of 2024 versions of its Tekla software for constructible Building Information Modeling (BIM), structural engineering, and steel fabrication management. Boasting an enhanced user experience, let users collaborate with ease through enhanced communication for more integrated, connected workflows between all construction project stakeholders. (Source: https://www.prnewswire.com)

Segment covered in the report

By Component

- Software

- Services

By Deployment Mode

- On-Premises

- Cloud-Based

By Type

- 3D BIM

- 4D BIM

- 5D BIM

- 6D BIM

- 7D BIM

By End-User

- Architects / AEC Offices

- Contractors

- Facility Managers / Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting