What is Business Information Market Size?

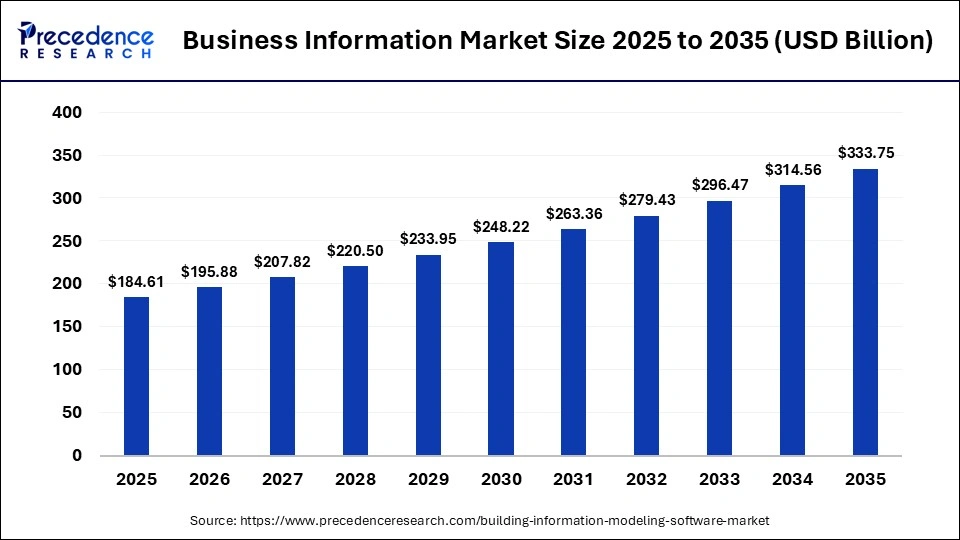

The global business information market size was calculated at USD 184.61 billion in 2025 and is predicted to increase from USD 195.88 billion in 2026 to approximately USD 333.75 billion by 2035, expanding at a CAGR of 6.10% from 2026 to 2035. The market is driven by growing demand for data-driven decision-making and increasing complexity of global business environments.

Market Highlights

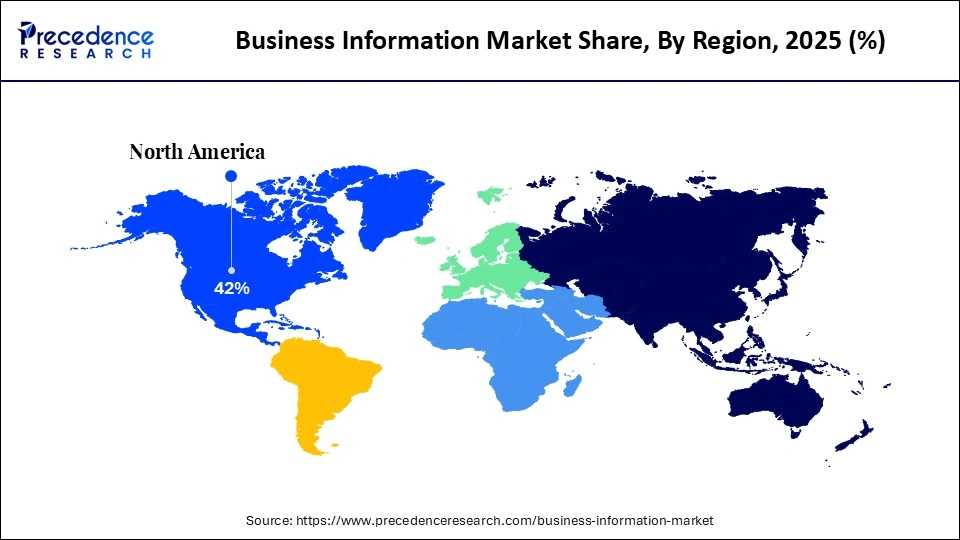

- North America dominated the global market with a share of approximately 42% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR of 6.5% in the market during the forecast period.

- By component/type, the software/information tools segment held a dominant position in the business information market with a share of approximately 60% in 2025.

- By component/type, the services/consulting tools segment is expected to grow at the fastest CAGR of 5.6% in the market between 2026 and 2035.

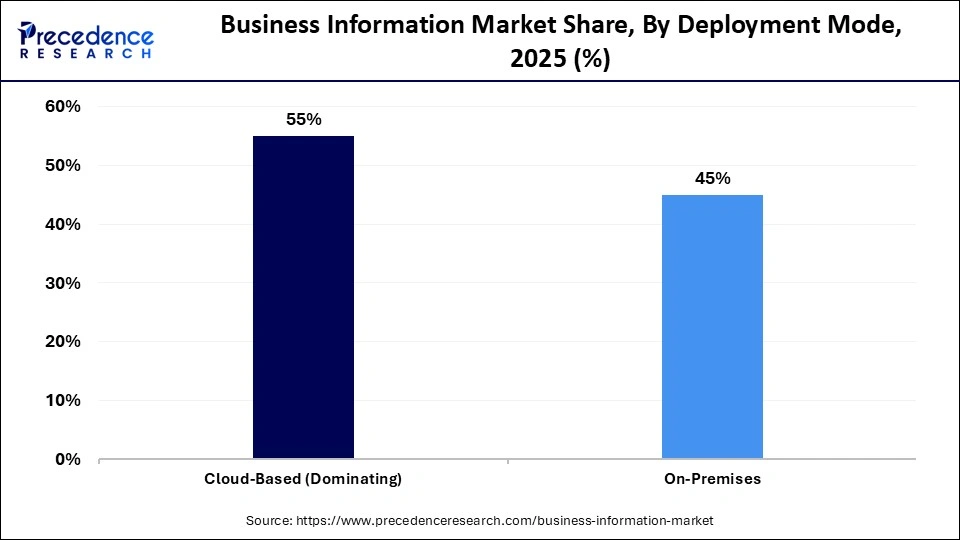

- By deployment mode, the cloud-based segment held the largest revenue share of approximately 55% in the market in 2025, and is expected to expand rapidly with a CAGR of 5.1% during the forecast period.

- By application/information type, the data analytics/data & financial information segment held a major revenue share of approximately 40% in the market in 2025.

- By application/information type, the risk management analytics/due diligence segment is expected to grow at the fastest CAGR of 5.4% in the market between 2026 and 2035

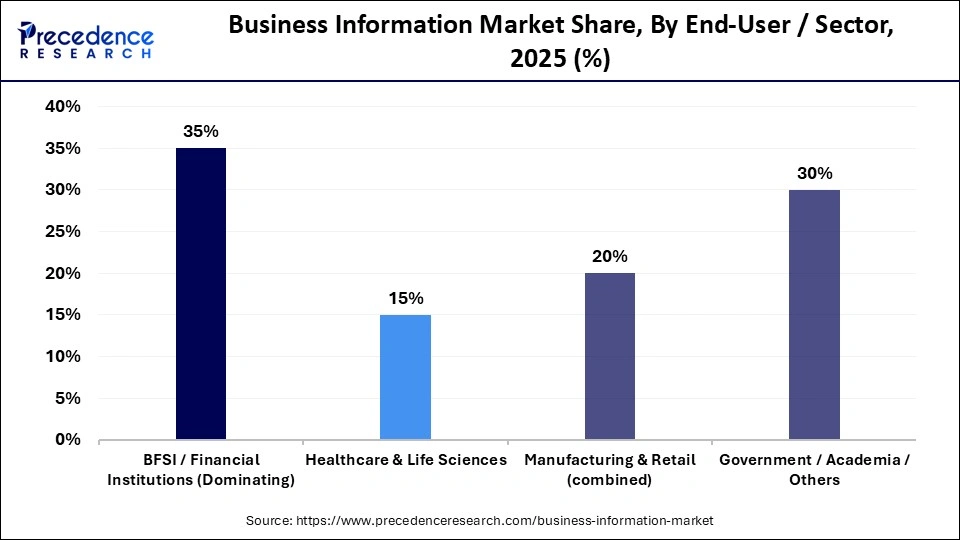

- By end-user/sector, the BFSI/financial institutions segment contributed the biggest revenue share of approximately 35% in the market in 2025.

- By end-user/sector, the healthcare & life sciences segment is expected to grow at the fastest CAGR of 5.3% in the market between 2026 and 2035.

Data-Driven Decisions: The New Age of Business Intelligence

The business information market is changing, away from fixed sets of data to dynamic, insights-driven platforms supporting strategic decision-making. Companies are turning to real-time analytics to deal with market uncertainties, regulatory changes, and market competition. The combination of structured and unstructured data sources is increasing the extent and applicability of business insights. Cloud-based and subscription-based models are enhancing access by enterprise of all magnitudes. It is also true that as data is becoming a strategic asset, the need to find trusted, actionable business information keeps increasing.

Technological Advancements in the Business Information Market

The development of artificial intelligence (AI) and machine learning (ML) is changing the business information platform, making it possible to predict and automatically derive insights. Data mining of news reports and social media is becoming more efficient with the help of natural language processing. AI tools help companies work more efficiently and save money, providing helpful insights and data analysis. Cloud computing is improving the scalability and complexity of deployment on the part of the end users. Sophisticated data visualization applications are rendering complicated data simpler to non-technical decision-makers. Also, API-based activities are facilitating the integration of the enterprise software ecosystem.

Business Information Market Trends

- Increasing business intelligence requirements in real-time prediction.

- Increasing use of cloud-based and subscription-based information platforms.

- Use of alternative data sources, including social media and web analytics.

- High emphasis on adherence, data management, and information accuracy.

- Business growth in terms of information application in emerging economies and SMEs.

- Process data related to competitors, consumer behavior, market demand, and industry trends, facilitating market research.

- Provides insights into the financial background and operational history of suppliers and partners to improve supply chain management.

- Growing need for maintaining financial, operational, and public record data, enhancing audit trails, and historical tracking.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 184.61 Billion |

| Market Size in 2026 | USD 195.88 Billion |

| Market Size by 2035 | USD 333.75 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.10% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Component, DeploymentMode, Application,End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Component/Type Insights

Which Component/Type Segment Dominated the Business Information Market?

The software/information tools segment dominated the market by holding a share of approximately 60% in 2025, due to the growing development of user-friendly software and information as businesses turn to online platforms to access real-time data, analytics, and decision support. They combine financial, economic, industry, and company-wide data in centralized dashboards that enhance strategic planning. Automation, AI-principled insights, and custom reports add value to large-scale users. Dominance is also encouraged by high switching costs and subscription-based models.

The services segment is expected to be the fastest-growing in the market with a CAGR of 5.6%, driven by professional help make sense of complicated data and draw actionable conclusions. There is an increasing demand for bespoke research, competitive intelligence, and regulatory advisory services. Software platforms are provided with consulting offerings, which fill the industry-specific and regional peculiarities. The development is particularly high among companies that do not have in-house analytical expertise.

Deployment Mode Insights

Why Did the Cloud-Based Segment Dominate the Business Information Market?

The cloud-based segment accounted for the highest revenue share of approximately 55% in the market in 2025 and is expected to witness the fastest growth in the market with a CAGR of 5.1% over the forecast period, driven by scalability, ease of accessibility, and reduced upfront costs. Cloud computing helps provide real-time information, is available worldwide, and can be easily integrated with business systems. Several types of subscription pricing models are suitable for adoption in both large and small organizations. Advanced analytics and AI-driven insights are also supported by cloud deployment.

Application/Information Type Insights

Which Application/Information Type Segment Led the Business Information Market?

The data analytics/data & financial information segment led the global market with a share of approximately 35% in 2025, because of concentration in financial services. Japan depends on financial information as a tool in corporate governance and planning. The adoption by emerging economies is slowly growing with maturing capital markets. Businesses use these applications to facilitate investment choices, mergers, and strategic plans. They are constantly updated, and predictive analytics increase the level of their criticality. This segment has good financial and enterprise system integration.

The risk management analytics/due diligence segment is expected to grow with the highest CAGR of 5.4% in the market during the studied years, because the regulatory environment is increasingly scrutinized, and geopolitical instability is increasing. Companies now need credit risk, compliance management, and third-party risk management tools. One of the major growth areas includes ESG and supply-chain risk analytics. Predictive risks are being improved by automation and AI.

End-User/Sector Insights

How the BFSI/Financial Institutions Segment Dominated the Business Information Market?

The BFSI/financial institutions segment registered its dominance over the global market with a share of approximately 35% in 2025. driven by financial data, credit analysis, and compliance with regulations. Banks, insurers, and investment companies require real-time information to be accurate when the risk is being assessed and the portfolio is being managed. Dominance is maintained by high data dependency and compliance intensity. The long-term contracts also build the market position.

The healthcare & life sciences segment is expected to show the fastest growth with a CAGR of 5.3% over the forecast period, due to the growing amounts of patient health data with the use of wearable devices and electronic health records. The shifting trend towards remote monitoring and personalized treatment promotes the use of business information. In addition, business information can also assist companies in developing novel healthcare products based on patients' trends and demands.

Regional Insights

How Big is the North America Business Information Market Size?

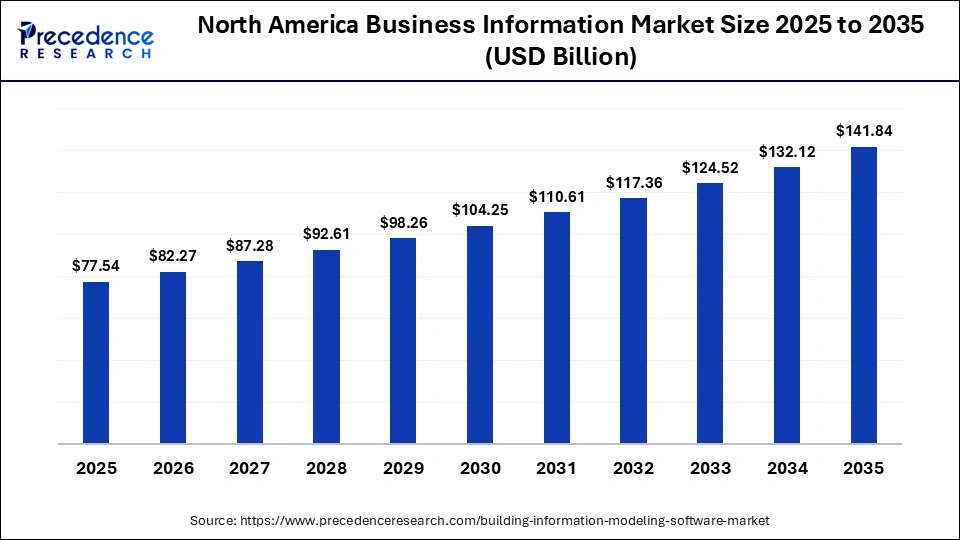

The North America business information market size is estimated at USD 77.54 billion in 2025 and is projected to reach approximately USD 141.84 billion by 2035, with a 6.23% CAGR from 2026 to 2035.

Why North America Dominated the Business Information Market?

North America dominated the market with the largest share of approximately 42% in 2025, due to advanced analytics, strong digital infrastructure, and high enterprise spending on data-driven decision-making. Organizations across BFSI, healthcare, and large enterprises increasingly rely on analytics platforms to enhance operational efficiency, compliance, and risk mitigation. The region benefits from a mature ecosystem of technology vendors, cloud service providers, and consulting firms. Continuous innovation and regulatory emphasis on data transparency further reinforce market growth.

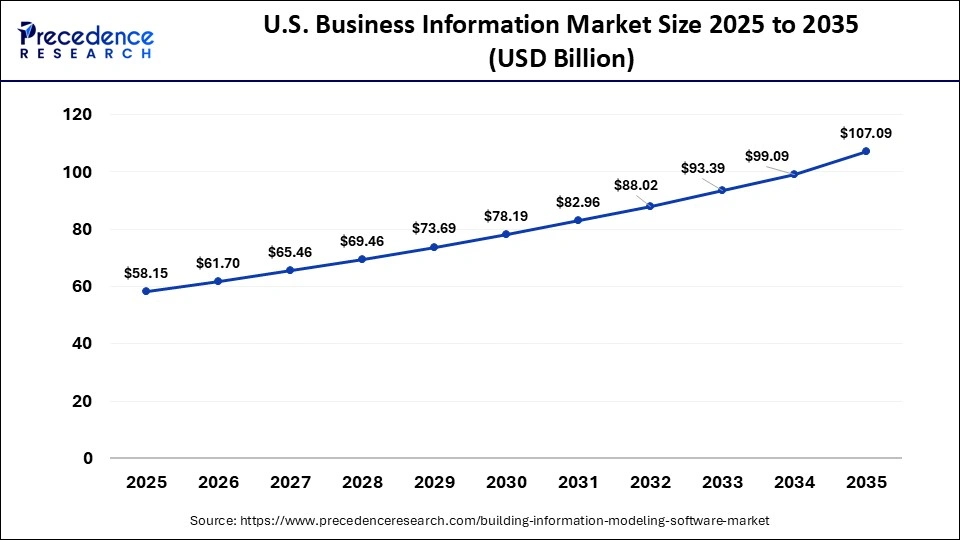

What is the Size of the U.S. Business Information Market?

The U.S. business information market size is calculated at USD 58.15 billion in 2025 and is expected to reach nearly USD 107.09 billion in 2035, accelerating at a strong CAGR of 6.30% between 2026 to 2035.

Country Level Analysis

U.S. holds a majority regional share, due to widespread cloud adoption, strong presence of global analytics providers, and high investments in AI-driven insights. Financial institutions and healthcare organizations in the U.S. are major contributors, leveraging analytics for fraud detection, patient outcomes, and financial forecasting. Canada follows with steady growth, supported by government-backed digital transformation initiatives and increasing analytics adoption among SMEs. Together, these countries sustain North America's leadership in both revenue and innovation.

SMEs account for almost 99.9% of all businesses in the U.S., with over 34.8 small businesses as of 2025. This represents 43.5% of the U.S. GDP. Of these, 99% of small businesses use at least one AI platform, while 91% of businesses using AI believe that it will contribute to future growth.

How is Asia Pacific the Fastest-Growing Region in the Business Information Market?

Asia-Pacific is expected to be the fastest-growing region in the market with a CAGR of 6.5%, fueled by rapid digitalization, expanding SME ecosystems, and rising cloud penetration. Enterprises are increasingly adopting analytics solutions to manage large data volumes generated by e-commerce, fintech, and healthcare expansion. Cost-effective cloud deployment models and growing awareness of data-driven strategies are accelerating adoption. Government-led smart city and digital economy initiatives further stimulate market demand.

Country Level Analysis

Country-wise, China and India dominate market growth, supported by massive data generation, strong fintech adoption, and increasing investments in analytics platforms. China's growth is driven by large-scale enterprise adoption and AI integration, while India benefits from a booming startup ecosystem and expanding BFSI and healthcare sectors. Japan and South Korea contribute through advanced enterprise analytics and strong technology infrastructure. Collectively, these markets position Asia-Pacific as a key future growth engine for the global analytics industry.

- As of February 2024, India is home to over 10,244 Fintech entities working in diverse sectors and segments, accounting for 3rd largest in the world. The Reserve Bank of India (RBI) floated a draft Framework for recognition of Self-Regulatory Organization (SRO) for the Fintech sector for stakeholder's consultation.

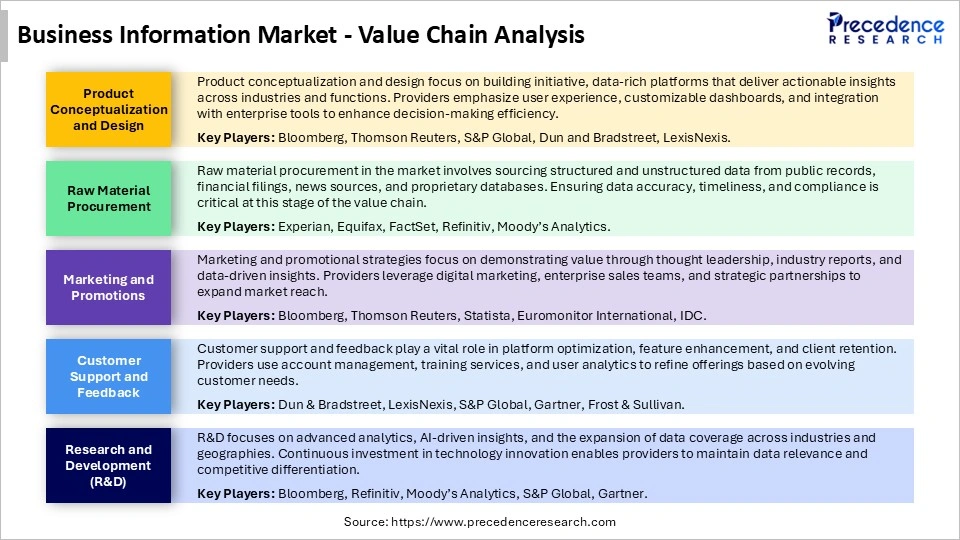

Business Information Market Value Chain Analysis

Who are the major players in the global business information market?

The major players in the business information market include Bloomberg L.P., S&P Global Inc., PwC (PricewaterhouseCoopers), Gartner, Inc., Dun & Bradstreet Holdings, Inc., Thomson Reuters Corporation, Statista, International Data Corporation (IDC), Microsoft Corporation, IBM Corporation, Oracle Corporation, SAP SE, Salesforce, Inc., Experian plc, and Moody's Corporation

Recent Developments in the Business Information Market

- In January 2026, the European Union is set to establish its first Legal Gateway Office in India to streamline and clarify authorized study and work pathways for Indian students and professionals across EU member states. The initiative aims to attract skilled talent by simplifying access to legal mobility routes, while final visa decisions will continue to follow individual national regulations.

(source: EU's Legal Gateway in India: Faster, easier routes for students, workers | Immigration News - Business Standard) - In January 2026, Novo Nordisk more than doubled its U.S. advertising spend on Wegovy and Ozempic in 2025, significantly outpacing rival Eli Lilly's promotional investment in competing obesity and diabetes drugs. The aggressive marketing push reflects Novo's efforts to strengthen market share and capitalize on renewed supply availability in one of the few countries that allows direct-to-consumer prescription drug advertising.

(source: Exclusive: Novo's Wegovy and Ozempic US advertising spend doubles rival Eli Lilly, data shows | Reuters)

Segments Covered in the Report

By Component/Type

- Software/Information Tools

- Services/Consulting

By Deployment Mode

- Cloud-based

- On-premises

By Application/Information Type

- Data Analytics/Data & Financial Information

- Market Intelligence

- Competitive Intelligence

- Risk Management Analytics/Due Diligence

- Others (Research Reports, Industry Data)

By End-User/Sector

- BFSI/Financial Institutions

- Healthcare & Life Sciences

- Manufacturing & Retail

- Government/Academia/Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting