What is the Capping Machine Market Size?

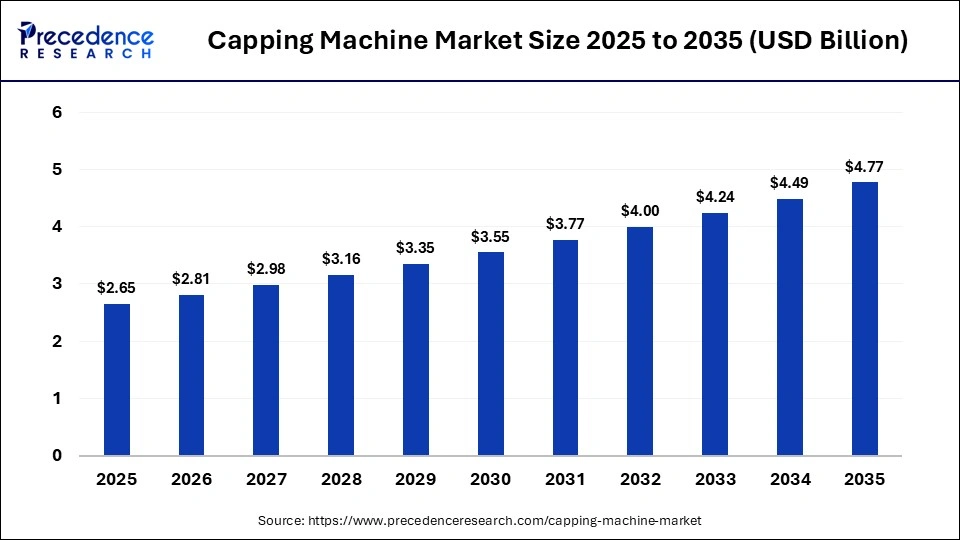

The global capping machine market size was estimated at USD 2.65 billion in 2025 and is predicted to increase from USD 2.81 billion in 2026 to approximately USD 4.77 billion by 2035, expanding at a CAGR of 6.04% from 2026 to 2035. The capping machine market is witnessing rapid growth, driven by the rising packaged product consumption and increasing focus on better quality & stringent compliance.

Market Highlights

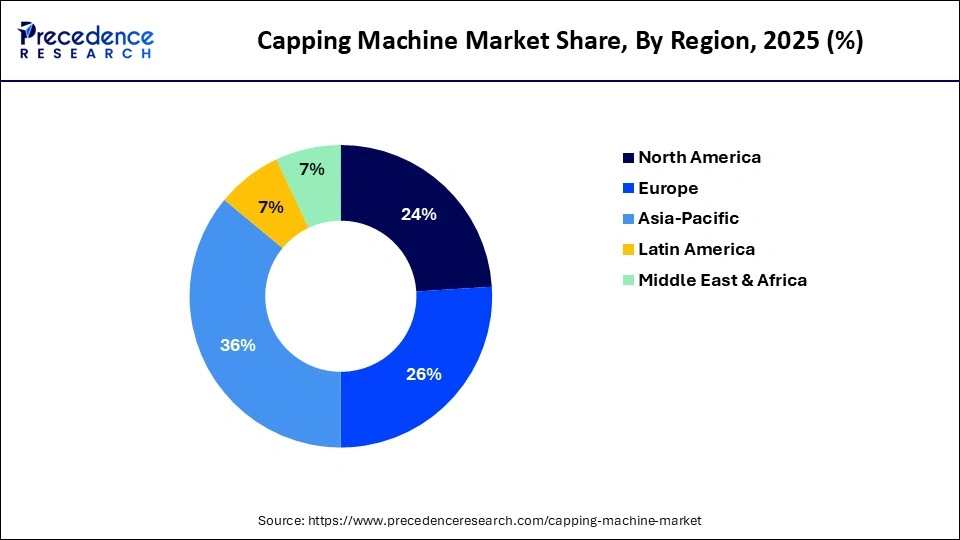

- Asia-Pacific dominated the market with a share of approximately 36% in 2025.

- North America is expected to expand at the fastest CAGR in the capping machine market between 2026 and 2035.

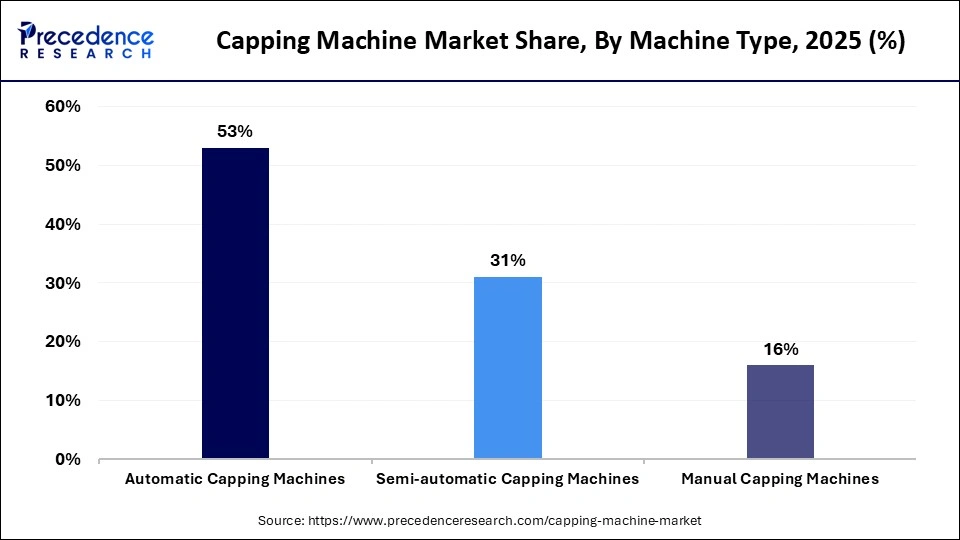

- By machine type, the automatic capping machines segment contributed approximately 53% revenue share in 2025, and is expected to grow at the fastest CAGR.

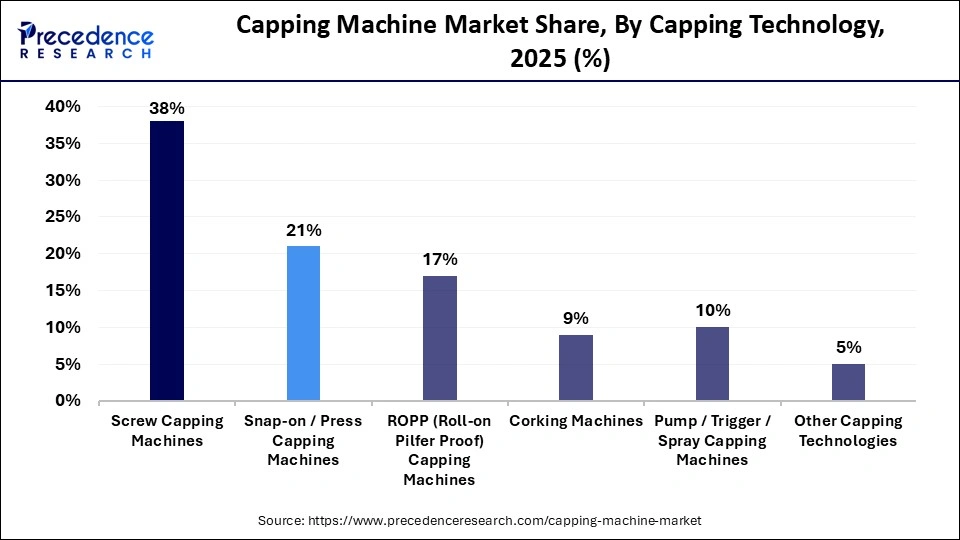

- By capping technology, the screw capping machines segment held the largest market share of approximately 38% in 2025.

- By capping technology, the pump/trigger/spray capping machines segment is expected to grow at the fastest CAGR between 2026 and 2035.

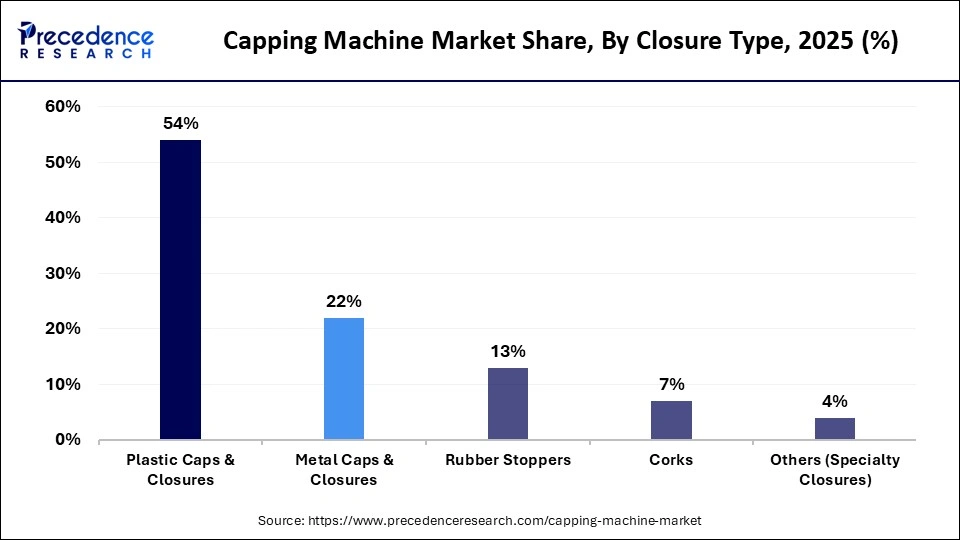

- By closure type, the plastic caps & closures segment held the largest market share of approximately 54% in 2025.

- By closure type, the rubber stoppers segment is expected to expand at a remarkable CAGR between 2026 and 2035.

- By container type, the bottles segment held the largest share of approximately 52% in the capping machine market in 2025.

- By container type, the vials & ampoules segment is set to grow at a remarkable CAGR between 2026 and 2035.

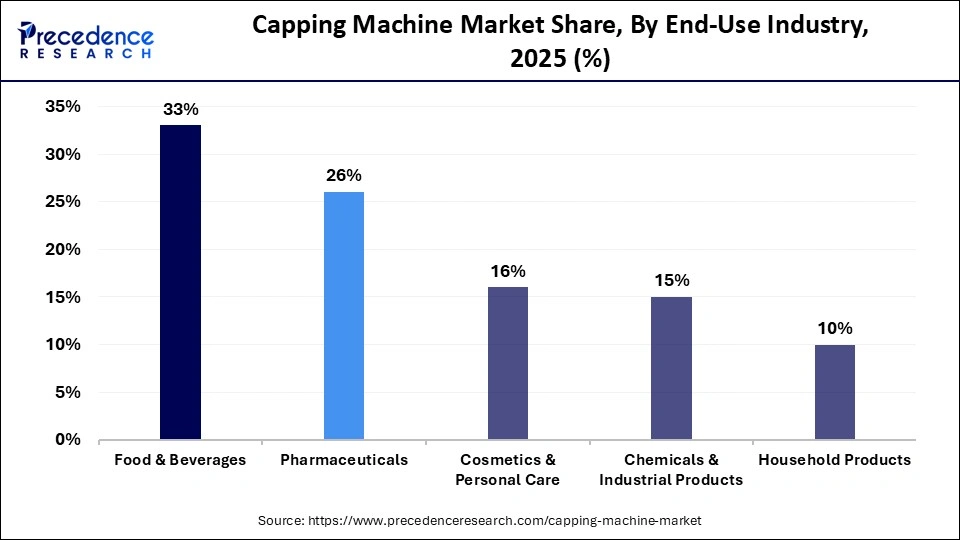

- By end-use industry, the food & beverages segment held the largest market share of approximately 33% in 2025.

- By end-use industry, the pharmaceuticals segment is expected to witness the fastest CAGR between 2026 and 2035.

What is the Capping Machine?

The capping machine market includes packaging equipment used to apply and secure caps, closures, lids, and plugs onto containers such as bottles, jars, vials, and tubes across food & beverages, pharmaceuticals, cosmetics, chemicals, and household products. These machines support multiple closure types (screw caps, snap caps, corks, pumps, droppers) and container formats, ranging from manual and semi-automatic systems to fully automated, high-speed integrated production lines.

How are AI-driven innovations reshaping the Capping Machine Market?

In the rapidly evolving technological landscape, the integration of artificial intelligence (AI) emerges as a game-changer, accelerating market growth. AI-driven innovations are significantly transforming capping machines by offering proactive and intelligent automation. AI and the Internet of Things technologies streamline operations and enhance efficiency. An AI-powered capping machine is most commonly used in the cosmetics, food, beverage, and pharmaceutical industries. It can automatically adjust settings for a wide range of bottle shapes, sizes, and cap types, allowing for faster changeovers and excellent flexibility in production lines.

AI-driven 360-degree vision inspection systems identify defects that are often invisible to the human eye, like incorrect torque, misaligned caps, and missing caps, with a 99.9% accuracy. Machine learning monitors capping machine health in real-time by analyzing sensor data for vibration, temperature, and torque to predict any anomalies or potential component failures and maintenance needs before a breakdown occurs. AI integration efficiently uses materials, significantly reducing wastage and optimizing resource consumption.

What are the Emerging Trends in the Capping Machine Market?

- The rising demand for packaged products from various industries such as food & beverages, pharmaceuticals, cosmetics & personal care, chemicals & industrial products, and household products, is bolstering the market's expansion in the coming years.

- The growing need for efficient, high-speed, and reliable capping machinery is anticipated to boost market growth. Capping machines offer high speed, consistent quality, efficient operation, and reduced labor costs, which are crucial for meeting high production targets.

- The rapid urbanization & industrialization, along with the rising disposable Income, particularly in developing and developed nations, are expected to boost the demand for packaged goods consumption.

- The growing consumer awareness of hygiene and stringent regulatory compliance potentiates the demand for secure and tamper-evident packaging.

- The increasing need for the development of specialized caps like child-resistant closures creates significant demand for specific capping machinery.

- The surge in online shopping increases the demand for reliable and high-capacity packaging with secure closures, accelerating market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.65Billion |

| Market Size in 2026 | USD 2.81 Billion |

| Market Size by 2035 | USD 4.77Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.04% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Machine Type, Capping Technology, Closure Type, Container Type, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Machine Type Insights

Which Machine Type Segment Dominated the Capping Machine Market?

The automatic capping machines segment dominated the market with a share of approximately 53% in 2025, and is expected to grow at the fastest CAGR. Robotics and AI-powered automatic capping machines can automatically adapt to different product shapes and sizes without extensive reprogramming. Automatic capping machines offer numerous advantages that enhance productivity. As the adoption of these machines takes over repetitive tasks which significantly reduces labor costs and allows human workers to focus more on strategic roles. Automated capping machines ensure uniformity in sealing, torque application, and caps positioning across production lines. These machines ensure every container is securely sealed, preventing leaks and product damage from external elements.

Capping Technology Insights

Why Did the Screw Capping Machines Segment Dominate the Capping Machine Market?

The screw capping machines segment held the largest market share of approximately 38% in 2025, due to the increasing demand for more packaged food, beverages, and cosmetics. There are mainly three types of screw capping machines: manual, semi-automatic, and automatic. Screw capping machines provide tamper-evident, secure, and consistent seals for different container types. Evolving consumer lifestyles have significantly increased the preference for ready-to-drink and conveniently packaged products.

On the other hand, the pump/trigger/spray capping machines segment is expected to grow at a remarkable CAGR between 2026 and 2035, owing to the growing demand for accurate and hygienic dispensing solutions in household cleaners, pharmaceuticals, cosmetics, personal care, and agrochemicals applications. They are primarily used in industries requiring precise, leak-proof, and consistent sealing for fluid products such as lotion pumps, sprayers, trigger sprays, and mist pumps. These mechanisms control the dispensing of liquid product, assisting consumers in avoiding spills or overuse.

Closure type Insights

How the Plastic Caps & Closures Segment Dominated the Capping Machine Market?

The plastic caps & closures segment contributed the biggest market share of approximately 54% in 2025, due to the surging consumer demand for safety, hygiene, and convenience in packaging. Some common examples of plastic caps and closures include tamper-evident (TE) and dispensing caps. Several leading brands are increasingly using sustainable materials, with a focus on eco-friendly plastics like polypropylene (PP) and high-density polyethylene (HDPE), addressing environmental concerns and rising regulatory pressures.

On the other hand, the rubber stoppers segment is expected to be the fastest-growing segment in the market, owing to its increasing use in pharmaceutical, biotech, food & beverages, and laboratories to prevent contamination, leaks, and spoilage, ensuring product integrity for medicines, chemicals, beverages, and samples. Rubber stoppers play an essential role in ensuring the safety, sterility, and integrity of injectable drug packaging, especially for vials, biologics, and syringes.

Container Type Insights

What Made Bottles the Dominant Segment in the Capping Machine Market?

The bottles segment held a major market share of approximately 52% in 2025, due to the increasing consumer demand for packaged bottled products from various industries, such as food & beverages, pharmaceuticals, cosmetics & personal care, household, and chemicals. PET bottles are increasingly favored for cost, lightweight, and convenience. Several key players are heavily investing in developing automated and adaptable machines that can handle both plastic and non-plastic materials, as well as meet specific capping requirements.

On the other hand, the vials & ampoules segment is expected to expand rapidly, because they are specialized containers widely used for vaccines and biologics, particularly in the pharmaceutical and biotechnology sectors. These containers ensure the stability and sterility of sensitive drugs. Automated capping ensures a secure and consistent hermetic seal, protecting contents from air, moisture, and microbes and reducing the risk of contamination or product recalls. In addition, the increasing prevalence of chronic diseases necessitating injectable medications is anticipated to drive the demand for vials and ampoules.

End-Use Industry Insights

Which End-Use Industry Segment Dominated the Capping Machine Market?

The food & beverages segment accounted for the highest market share of approximately 33% in 2025, primarily driven by increased consumption of packaged foods, including drinks, water, and juices, rising hygiene concerns, and rising disposable income. The rapid expansion of the e-commerce sector has created increased demand for packaged food & beverages products, accelerating the need for automated packaging and capping machinery.

On the other hand, the pharmaceuticals segment is expected to grow at the highest CAGR in the coming years, owing to the growing need to package vast quantities of drugs globally and growing investments in pharmaceuticals research and manufacturing. The segment's growth is mainly supported by the strict regulatory requirements from authorized bodies, such as the EMA and FDA, which mandate secure closures, tamper-evident, and child-resistant capping to ensure product integrity and patient safety.

Regional Insights

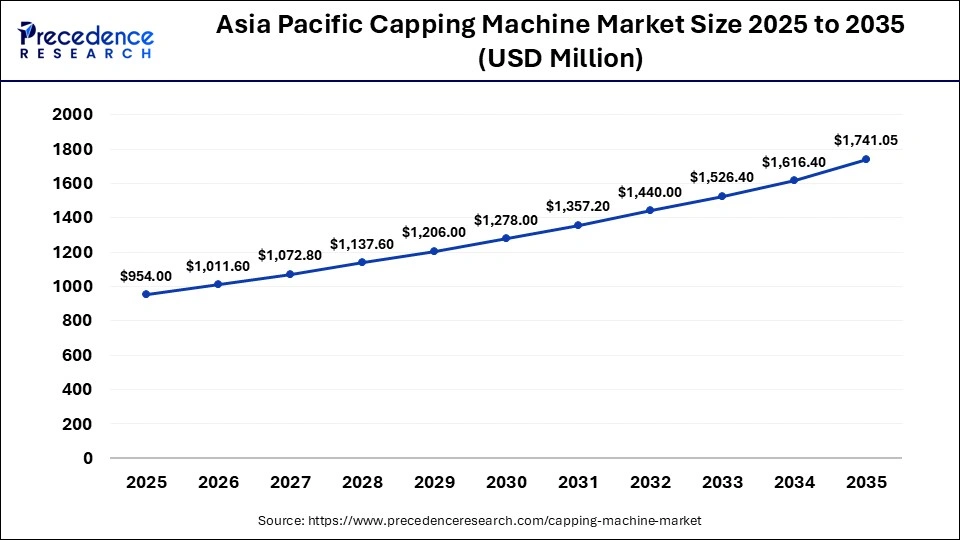

What is the Asia Pacific Capping Machine Market Size?

The Asia Pacific capping machine market size is expected to be worth USD 1,741.05 million by 2035, increasing from USD 954.00 million by 2025, growing at a CAGR of 6.20% from 2026 to 2035.

Which Factors Dominated the Capping Machine Market in Asia-Pacific?

Asia-Pacific dominated the market with a share of approximately 36% in 2025. The growth of the region is characterized by the rapid urbanization & industrialization, a surge in disposable income, increasing presence of key players, rapid expansion of the e-commerce sector, and a strong focus on hygiene & safety standards. The growing demand for packaged products across various industries significantly increases the need for capping machines for high-volume production, offering high speed, precision, and consistency in reducing, sealing, or eliminating manual errors.

China Capping Machine Market Analysis

China holds a major share in the Asia-Pacific as it is a major contributor to the market. The country is home to the leading market players, such as Shanghai Dahe Packing Machinery, Zhangjiagang King Machine, LIENM, Hualian Machinery, and Zhongya Packaging. Several leading manufacturers in the country are heavily investing in automated capping systems for high-speed and reliable sealing onto containers such as bottles, jars, vials, and tubes across food & beverages, pharmaceuticals, cosmetics, chemicals, and household products. The market growth is also driven by expanding manufacturing capabilities, rising consumer demand for packaged goods, strict regulatory compliance, and rising Innovations in machine precision.

How is North America Growing in the Capping Machine Market?

North America is expected to grow at the fastest CAGR in the market during the forecast period. The region's growth is driven by the rising push for automation to boost efficiency, safety, and productivity, the increasing expansion of the e-commerce sector, and favorable government frameworks for the modernization of the manufacturing industry. The burgeoning food & beverages, pharmaceuticals, and cosmetic sectors facilitate the need for robust packaging. In addition, rapid technological advancements like automation, smart features, and child-resistant closures are expected to accelerate the region's growth during the forecast period.

The United States Capping Machine Market Analysis

The country's growth is supported by the growing demand for reliable and secure packaging solutions, a surge in online shopping, high consumer spending on packaged products, and increasing investment in advanced & automated systems for high efficiency. As of mid-2025, approximately 61% of U.S. households, or 81 million homes, purchase groceries online. Moreover, the increasing emphasis on hygiene & safety standards, like stringent food safety laws, drives the need for automation to reduce contamination and ensure secure seals.

Who are the Major Players in the Global Capping Machine Market?

The major players in the capping machine market include Busch Machinery, Krones AG, APACKS, E-PAK Machinery Inc., Kinex Cappers, Technocap Group, Sidel Group, SACMI Group, KHS GmbH, Syntegon Technology, Crown Holdings, Inc., Closure Systems International (CSI)

Recent Developments in the Capping Machine Market

- In December 2025, AST partnered with Marchesini Group to combine the expertise, technologies, and global reach of two highly respected industry leaders in sterile fill-finish production. This enables both companies to have greater production capacity and an extended global network for technical assistance and support, while consolidating distribution networks and sales channels across North America, Europe, Asia, and other strategic regions.(Source:https://www.prnewswire.com)

- In December 2024, Origin Materials, a technology company with a mission to enable the world's transition to sustainable materials, announced the production of PET caps with new features as commercial qualification continues. The latest caps were produced at their partner's facility in Germany on Origin's CapFormer System, its proprietary system for manufacturing recyclable PET closures.(Source: https://www.businesswire.com)

Segments Covered in the Report

By Machine Type

- Automatic Capping Machines

- Semi-automatic Capping Machines

- Manual Capping Machines

By Capping Technology

- Screw Capping Machines

- Snap-on/Press Capping Machines

- ROPP (Roll-on Pilfer Proof) Capping Machines

- Corking Machines

- Pump/Trigger/Spray Capping Machines

- Other Capping Technologies

By Closure Type

- Plastic Caps & Closures

- Metal Caps & Closures

- Rubber Stoppers

- Corks

- Others (Specialty Closures)

By Container Type

- Bottles

- Jars

- Vials & Ampoules

- Tubes

- Other Containers

By End-Use Industry

- Food & Beverages

- Pharmaceuticals

- Cosmetics & Personal Care

- Chemicals & Industrial Products

- Household Products

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting