Caps and Closures Market Size and Forecast 2025 to 2034

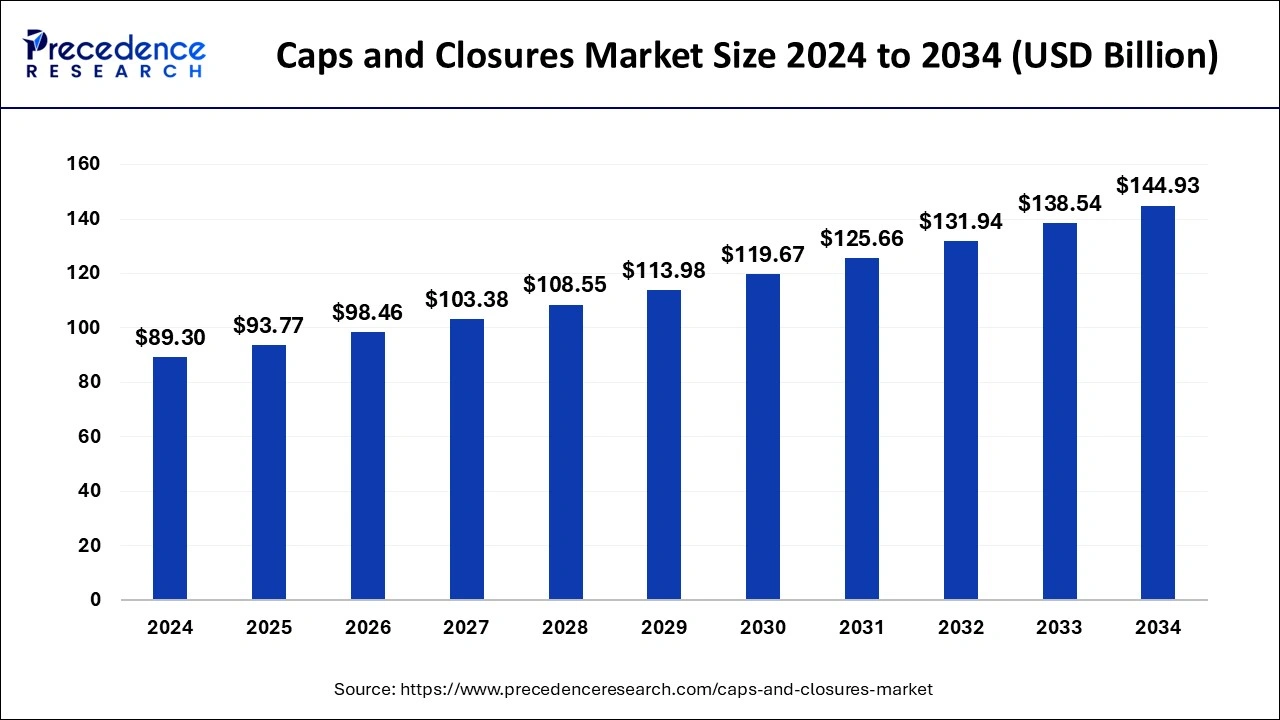

The global caps and closures market size is accounted at USD 93.77 billion in 2025 and predicted to increase from USD 98.46 billion in 2026 to approximately USD 144.93 billion by 2034, expanding at a CAGR of 4.96% from 2025 to 2034. The essential need for caps and closures in maintaining the ingredient safety, effectiveness, and quality in standard forms drives their demand in the growing caps and closures market.

Caps and Closures Market Key Takeaways

- In terms of revenue, the caps and closures market is valued at $93.77 billion in 2025.

- It is projected to reach $144.93 billion by 2034.

- The caps and closures market is expected to grow at a CAGR of 4.96% from 2025 to 2034.

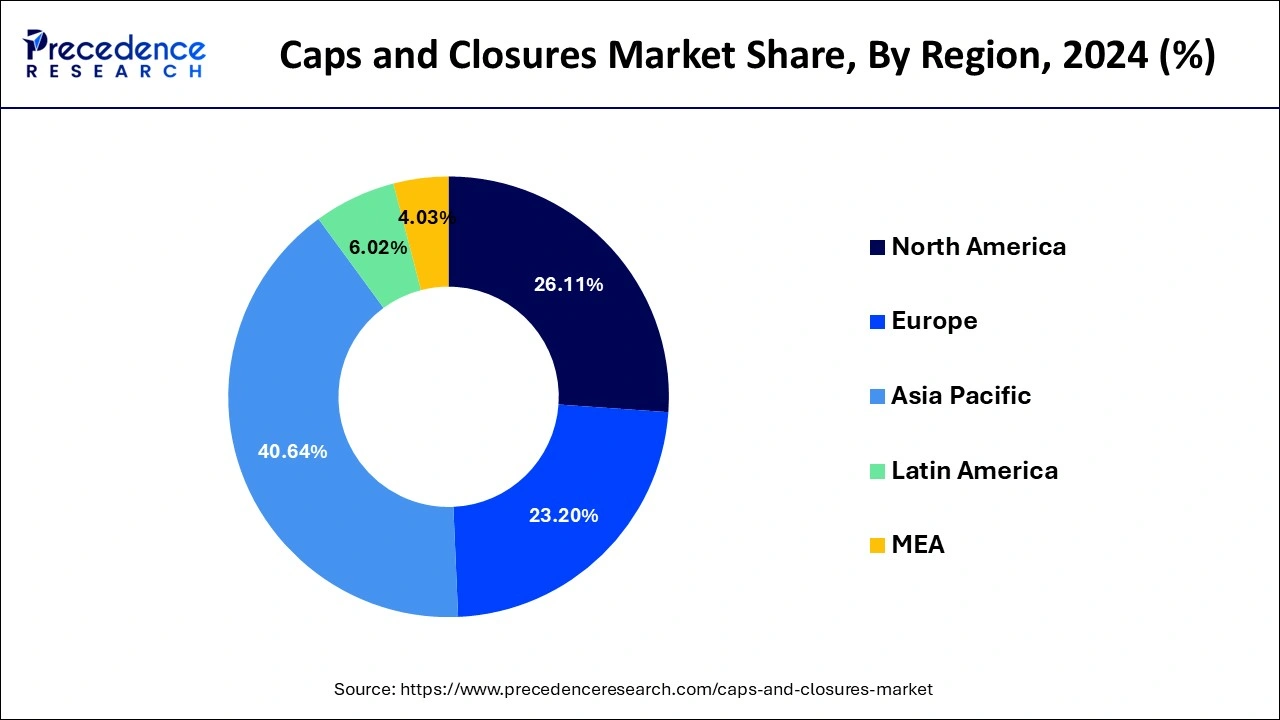

- Asia Pacific led the global market with the highest market share of 40.64% in 2024.

- By product type, the plastics crew closures segment has held the largest market share of 50.4% in 2024.

- By product type, the metal screw closures segment is expected to grow at a remarkable CAGR during the forecast period.

- By application, the food and beverage segment captured the biggest revenue share of 26.5% in 2024.

- By application, the pharmaceutical segment is expected to expand at the fastest CAGR over the projected period.

AI, a grip on the advancement opening tech possibilities

Artificial intelligence has the potential to calculate the ideal thickness and weight of caps to minimize the usage of materials without compromising performance. Moreover, vision AI systems are involved in sorting and categorizing defective caps for recycling which promotes circular manufacturing practices. The incorporation of scannable codes and Near Field Communication Technology (NFC) is allowing caps to undergo digital experiences such as personalized messages, loyalty rewards, and games. AI algorithms can analyze consumer interaction data to make the process more engaging and effective. AI is improving quality control, enabling personalization, driving sustainability, and enhancing efficiency. AI is contributing to transform the beverage packaging industry by introducing bottle caps to consumers.

Caps and Closures Market Growth Factors

The caps and closures serve the primary purpose of keeping the container closed and the contents contained for the designated shelf life. It also acts as a barrier against dirt, oxygen, moisture, as well as preventing the goods from being opened prematurely. In the packaging industry, the caps and closures are primarily used to protect items and extend their shelf life. The rubber, plastic, and metal are used in the caps and closures market to provide appropriate product packaging.

The caps and closures are in high demand due to the rise in demand for easy to open and sustainable packs, rapid urbanization, and demographic trends. These are commonly used in the food and beverage industry for alcoholic and non-alcoholic drinks. The caps and closures help to extend the shelf life of products, protect them from dirt and moisture, and keep the oxygen content of the packed product balanced. With the increasing demand for caps and closures, import and export have become more important.

The caps and closures market is primarily driven by the packaging industry. The major purpose of packaging is to give food and beverages a longer shelf life, as well as products that keep their texture, flavor, and test for a long period. The caps and closures aid in the process of extending product shelf life and brand promotion. Furthermore, the growing demand for packaging propels the global caps and closures market growth. The fast-moving consumer goods, cosmetics, toiletries, and pharmaceuticals contribute towards the growth of the caps and closures market. However, the price volatility of raw materials such as high-density polyethylene and polypropylene is a major constraint to the caps and closures market's expansion.

The caps and closures are popular because of their user-friendly design, great degree of customization, and durability. The caps and closures are expected to see a significant increase in demand throughout the projection period due to their accurate closing, binding properties, and widespread popularity among consumers.

The key market players are emphasizing circular packaging with the inclusion of post-consumer resin and other recyclable materials in caps and closures. The manufacturers of caps and closures are updating their recycling initiatives as a result of this, reaching sustainability goals and attracting environmental conscious customers to the caps and closures market.

Market Outlook

Industry growth overview

The caps and closures market tends to rise exponentially in the coming years with the increasing businesses and sustainable demand in pharmaceuticals, cosmetics and food and beverages sectors. The keen attention to tamper evidence, safety and convenience in packaging has bolstered the growth of this market.

Start-up ecosystem

The new start-ups' entry after addressing the concern area of packaging and the needs of customers has been both competition and a solution to the existing brands. The perspective of innovation is revolutionising the entire caps and closures future frame, registering partnerships and growth in the circular economy as the innovation works in the sustainable long-term policy.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 98.46 Billion |

| Market Size in 2025 | USD 93.77 Billion |

| Market Size in 2034 | USD 144.93 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.96% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Product Type Insights

Based on the product type, the plastics crew closures segment accounted largest revenue share 50.4% in 2024. The healthcare, food and beverage, personal care, and industrial products are all packaged using them. The different raw materials are used to make plastic caps and closures. The plastic caps and closures' cost effectiveness, compatibility, and light weight all contribute to the caps and closures market's growth.

The metal screw closures segment is estimated to be the most opportunistic segment during the forecast period. Metal screw caps and closures have threading inside that allows the container to be tightly sealed. For bottles of tonics, cough syrups, and tablets, the metal screw caps and closures are common. The moisture and infection are kept out of the medicines with these closures.

Application Insights

The food and beverage segment had the biggest revenue share 26.5% in 2024and it will continue to lead the market during the forecast period. The caps and closures market is expected to develop due to increased consumption of packaged food products, ready to eat meals, and on the go snacks. The non-alcoholic beverage consumption is expected to rise, which will help the segment to expand. The introduction of functional beverages that may be packaged in plastic, metal, or glass cans is expected to fuel the expansion of the segment.

The pharmaceutical is estimated to be the most opportunistic segment during the forecast period. The caps and closures are used in the pharmaceutical industry to seal cans and bottles of vitamins, medications, and vaccinations injections. Over the forecast period, the demand for caps and closures in this segment is predicted to increase due to the rising need for senior friendly as well as child resistant closures that reduce the occurrences of unintentional consumption of over-the-counter medicines by children and infants.

The strategic partnerships, mergers and acquisitions, new product introduction and development, and agreements are among the techniques used by major companies in the business to increase their market share and presence. The key market players are also expanding existing product offers to increase competitiveness. The majority of market share is concentrated among large and medium-sized regional firms, though. To gain core competency in international and domestic markets, the majority of manufacturers are investing in product and technological innovation.

Regional Insights

Asia Pacific Caps and Closures Market Size and Growth 2025 to 2034

The Asia Pacific caps and closures market size is evaluated at USD 38.36 billion in 2025 and is predicted to be worth around USD 61.04 billion by 2034, rising at a CAGR of 5.30% from 2025 to 2034.

The Asia-Pacific segment accounted for 40.64% of revenue share in 2024. The Asia-Pacific caps and closures market is likely to be driven by the presence of highly populous nations like India and China, as well as the rising food and beverage industry. Moreover, the surge in demand for cosmetics and toiletries is likely to drive up use of caps and closures.

The Indian market for caps and closures is steadily growing as industries increasingly rely on the provided sealing solutions for various packaging requirements. Increased demand from the food and beverage, pharmaceutical, and personal care sectors, along with expansion in the bottling and packaging industries, is enhancing this forecast. The features that indicate tampering and prevent leakage enhance usage. Additionally, creating cutting-edge and eco-friendly packaging options, along with enhancing product safety and quality, are additional elements that drive market expansion.

- In October 2024, Pepsico set Pep+ packaging agenda for the year 2025 which includes the design of 100% recyclable, reusable, compostable, biodegradable packaging. It also aims to invest for increasing recycling rates in key markets.

On the other hand, due to rising consumption of alcoholic and non-alcoholic beverages in nations such as the U.S. and Canada, the North America represented a major revenue share in 2024. The introduction of new types of beverages in the region is likely to boost the demand for the region's packaging products even further.

The caps and closures sector in the United States is undergoing notable changes influenced by shifting consumer tastes and technological progress in packaging options. The incorporation of nanotechnology into convenience food production has transformed essential processes, such as preservation techniques, packaging sealing approaches, and processing of final products. The growing consumer interest in specialty and craft drinks, including artisanal sodas, organic teas, and craft beers, has emerged as a crucial influence on the plastic caps and closures market. The healthcare and pharmaceutical industries keep fostering major advancements in the caps and closures market, especially in child-proof and senior-accessible pharmaceutical closure options. Producers are creating advanced closure systems that merge safety elements with user-friendliness, addressing both compliance demands and customer preferences.

- In August 2024, the United States planned to support the global adoption of caps and ban plastic production as a major policy shift.

Europe Caps and Closures Market Trends:

Europe's excellent contribution is characterised by merged rigorous industrial-based sustainability regulations that push innovation and increased demand for spirits, luxury cosmetics and wine. These premium end-use sectors are evolving and supporting the wide range of business of caps and closures. The spur of technological advancement empowers us to lead with compression molding and advanced injection to gain certification of consistency, materials economy and precision.

Latin America: Opening Doors for Innovative Winds to Ease Into the Caps and Closures Market

The region is dedicatedly focusing on sustainability, boosted by strict anti-plastic regulations and flowing consumer demand for seamless, eco-friendly solutions. The feather of smart technology has improved consumer engagement and product integrity. The region is adopting tethered caps that stay attached to the bottle after opening. In a mission to alleviate high-volume material use, the region is producing lightweight caps without compromising on quality.

Caps and Closures Market Companies

- Berry Plastics Corporation

- Silgan Holdings Inc.

- Amcor Limited

- Rexam PLC

- RPC Group PLC

- Crown Holdings Inc.

- BERICAP GmbH Co. & KG

- Guala Closures Group

- Reynolds Group Holdings Limited

- Aptar Group Inc.

Latest Announcements by Industry Leaders

- In May 2024, John Bissell, the Co-Founder and Co-CEO of Origin Materials said that the PCO 1881 neck finish is considered as the leading standard due to which 100% PET cap can make a remarkable difference by optimizing recycling circularity and product performance in the industrial market.

- In May 2024, John Bissell, the Co-CEO and Co-Founder of Origin Materials reported that best in-class manufacturing partners like IMD are dedicated to provide subsystems for their production line and Origin Materials will establish the world's first commercial scale PET cap and closure manufacturing system.

Recent Developments

- In March 2025, Corvaglia Group, a prominent worldwide producer of cutting-edge closure solutions, unveiled the SabreCap, its inaugural closure for aseptic carton packaging. By taking this step, the company broadens its substantial expertise in PET bottle closures to a different packaging segment, creating new benchmarks for consumers and bottling firms.

- In April 2025, Ekam Global, a company specializing in packaging sourcing and supply, has partnered with the sustainability start-up Blue Ocean Closures to introduce a groundbreaking fibre screw cap designed to decrease plastic consumption in packaging. This signifies the initial commercial application of Blue Ocean Closures' cellulose fibre cap, a novel substitute for conventional plastic screw caps.

- In September 2024, Berry Plastics Corporation launched a new tamper-evident pouring closure for sauces, dressings, and edible oils which are suitable according to consumer convenience and showcase functionality that enhance its recyclability and sustainability.

- In September 2024, Amcor Limited introduced its responsible packaging solutions in an interactive and engaging exhibition at Pack Expo International at Chicago with demonstrations of packaging equipment for liquid proteins and products to feature them daily.

Segments Covered in the Report

By Product Type

- Easy open Can Ends

- Metal Lug Closures

- Peel off Foils

- Metal Crowns

- Metal Screw Closures

- Corks

- Plastic Screw Closures

- Others

By Application

- Food & Beverage

- Healthcare

- Cosmetics & Toiletries

- Automotive

- Pharmaceutical

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting