What is the Cardiac Troponin Market Size?

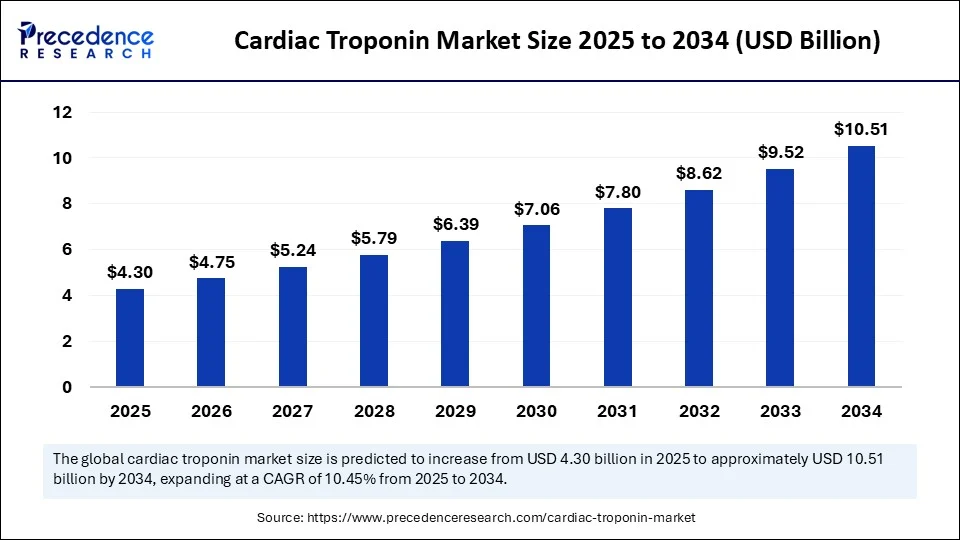

The global cardiac troponin market size is calculated at USD 4.30 billion in 2025 and is predicted to increase from USD 4.75 billion in 2026 to approximately USD 11.44 billion by 2035, expanding at a CAGR of 10.28% from 2026 to 2035.

Cardiac Troponin MarketKey Takeaways

- In terms of revenue, the global cardiac troponin market was valued at USD 4.30 billion in 2025.

- It is projected to reach USD 11.44 billion by 2035.

- The market is expected to grow at a CAGR of 10.28% from 2026 to 2035.

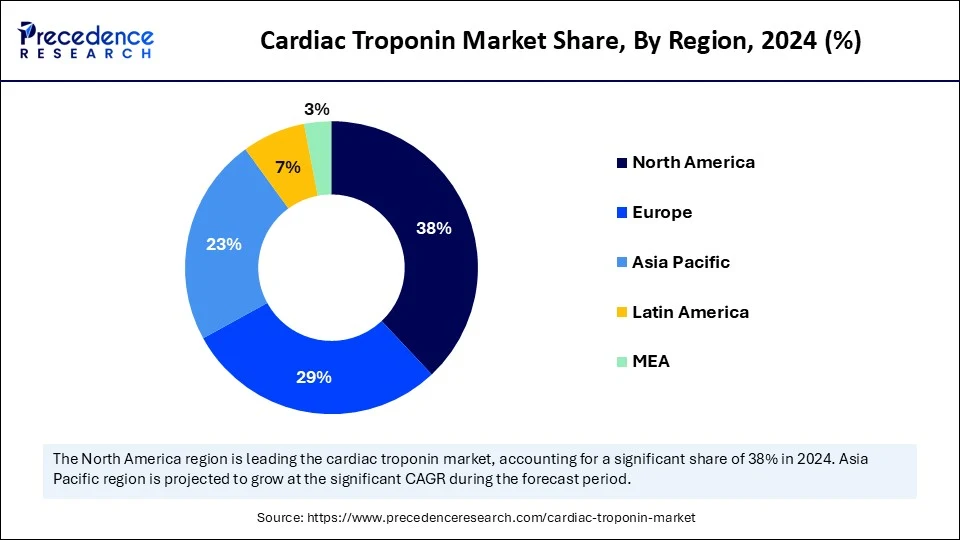

- North America dominated the global cardiac troponin market with the largest market share of 38% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR between 2026 and 2035.

- By type, the troponin I (cTnI) segment held the biggest market share of 56% in 2025.

- By type, the troponin T (cTnT) segment is anticipated to grow at a remarkable CAGR between 2026 and 2035.

- By test type, the laboratory-based testing segment captured the highest market share of 62% in 2025.

- By test type, the point-of-care testing (POCT) segment is expected to expand at a notable CAGR over the projected period.

- By sample type, the serum segment contributed the largest market share of 45% in 2025.

- By sample type, the other segment is expected to expand at a significant CAGR over the projected period.

- By technology, the chemiluminescence immunoassay (CLIA) segment generated the major market share of 41% in 2025.

- By technology, the other (biosensors, electrochemical) segment is expected to expand at a notable CAGR over the projected period.

- By end use, the hospitals & clinics segment held a remarkable market share of 49% in 2025.

- By end use, the homecare settings segment is expected to expand to a notable CAGR over the projected period.

- By application, the myocardial infarction diagnosis segment accounted for significant market share of 58% in 2025.

- By application, the ACS risk stratification segment is expected to expand at a notable CAGR over the projected period.

Market Overview

The cardiac troponin market refers to the global landscape of diagnostic solutions used for detecting cardiac troponin proteins (cTnI and cTnT) in blood, which are highly specific and sensitive biomarkers for myocardial infarction (MI) and acute coronary syndromes (ACS). Troponins are structural proteins released into the bloodstream when heart muscles are damaged, and their rapid and accurate detection is vital for early diagnosis and timely treatment. The market includes instruments, reagents, and assays used in point-of-care and laboratory settings across hospitals, clinics, and diagnostic laboratories.

How is AI Revolutionizing the Cardiac Troponin Market?

Artificial intelligence is disrupting the cardiac troponin market by enhancing speed, accuracy, and availability of the test. AI optimizes troponin test results accurately, reducing errors and enhancing decision-making. A rapid troponin test, combined with machine learning algorithms, can identify the risks of a heart attack more quickly and accurately.

- In February 2025, Researchers at UCLA constructed an AI-enabled chemiluminescencesensor that produces troponin I results equivalent to lab results in 25 min, improving the timeliness of emergency care and furthering early intervention strategies. (Source: https://www.ee.ucla.edu)

What are the Major Growth Factors of the Cardiac Troponin Market?

- Rising Cases of Cardiovascular Disease: The rising incidence of heart attacks and other cardiac-related disorders around the globe is increasing the demand for reliable biomarkers such as troponins so that early diagnosis and effective clinical response can occur.

- Availability of High-Sensitivity Tests: The emergence of high-sensitivity troponin assays enables the detection of damaged heart tissue sooner. In turn, it improves the diagnostic accuracy and clinical treatment approach for patients. Ultimately, the understanding that high-sensitivity assays improve patient outcomes is leading to the global acceptance and use by clinicians in emergency and acute care settings.

- Expansion of Emergency Services: As emergency departments and cardiac care units expand around the world, there is a growing need for rapid, reliable biomarkers, such as cardiac troponins, to inform timely clinical decision-making and treatment.

- Aging Population Worldwide: With an increasing population of elderly people, the propensity for cardiac events increases, leading to the utilization of cardiac biomarkers both as a routine and acute standard for diagnosis and ongoing well-being.

- Increased Use of Point-of-Care Testing: The growing use of portable diagnostic equipment in ambulatory or even home care settings, such as troponin testing, is enhancing access to these cardiac biomarkers for a larger population, particularly those residing in under-resourced or more remote areas.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 11.44 Billion |

| Market Size in 2025 | USD 4.3 Billion |

| Market Size in 2026 | USD 4.75 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.28% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Test Type, Sample Type, Technology, End Use, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Rapid Diagnostics

One of the major factors driving the growth of the cardiac troponin market is the rising demand for rapid, high-sensitivity troponin (hs-cTn) testing. Recent reports have demonstrated that U.S. entities have shown hs-cTn assays to have not only improved analytical specificity for myocardial injury indications, but also to improve patient outcomes and processing efficiencies in the emergency care continuum. Laboratory guidelines recommend hs-cTn test results be communicated to physicians in less than sixty minutes from the receipt of the sample, and some point-of-care devices can deliver results in less than twenty minutes.

(Source:https://www.sciencedirect.com)

The clinical practice framework of health systems across North America has now incorporated rapid troponin-based clinical pathways that safely rule out myocardial infarction in 1-2 hours, relieving some congestion in emergency rooms and increasing patient flow. Diagnostic protocols sanctioned by the government, as well as Laboratory Standards, have only solidified the utility and impact of fast and reliable troponin assays, creating a large demand for the global supply chain and infrastructure supporting and testing.

Restraint

Regulatory Hurdles

A significant factor limiting the growth of the cardiac troponin market is the strict regulatory requirements imposed by Europe's In Vitro Diagnostic Medical Device Regulation (IVDR), which has heightened approval barriers and hindered the availability of new or laboratory-developed troponin assays. The IVDR imposes stringent performance validation, clinical evidence, and post-market surveillance requirements, necessitating confirmation of follow-up activities in relation to the requirements under the previous IVDD scheme.

Many former in-house tests, including laboratory-developed tests, must now either be fully compliant or must be reclassified, while the notifying bodies under the member state's capacity are constrained. These regulatory cultures limit the speed-to-market of new high-sensitivity and point-of-care troponin assays, especially in Europe and nearby markets, and curtail overall accessibility for clinicians as demand rapidly increases.

Opportunity

Will Point-of-Care Troponin Testing Change the Future of the Market?

One of the greatest opportunities in the cardiac troponin market is the rapid adoption of point-of-care (POC) technologies, particularly in emergency settings or for remote care. In November 2024, the U.S. FDA approved Abbott's i-STAT TnI-Nx assay for use in ER settings, providing troponin I results, allowing much faster diagnosis of myocardial infarction. POC testing is beneficial for hospitals that lack adequate testing solutions. POCT allows rapid troponin testing at the patient's bedside, reducing turnaround times and improving patient management.(Source: https://clinicaltrials.gov)

Furthermore, the World Health Organization (WHO) has prioritized the expansion of decentralized diagnostic testing tools as part of its Global Health Emergency preparedness plan. Cardiovascular diseases are still the leading cause of mortality globally, which makes fast and portable troponin diagnostics a strong opportunity to hasten clinical decisions and increase access to care for patients in need.

Segment Insights

Type Insights

The troponin I (cTnI) segment dominated the market with the largest share in 2025. The dominance of the segment stems from its ability to provide the highest cardiac specificity and sensitivity for diagnosing myocardial infarction. Additionally, troponin is widely accepted by clinicians and regulatory agencies as a valuable biomarker for cardiac muscle injury, particularly in acute care and emergency settings. cTnI document reliability and clinical verification for laboratory-based platforms.

The troponin T (cTnT) segment is expected to grow at the fastest rate in the coming years, primarily due to its increased use in high-sensitivity assays and its widespread application in risk stratification, as well as in the management of chronic cardiac conditions. Its greatest potential lies in identifying more subtle cardiac events, such as other troponin types, as well as in following invasive procedures and/or monitoring the progression of heart failure. Given the increased demand for accurately tracking the cardiac state of patients, either longitudinally or as part of an acute case, cTnT product types will continue to grow in both institutional and outpatient settings. cTnT's eventual usage limitations and refinements will drive the application of troponin to new detection innovations, particularly when integrated into more advanced technology platforms and/or as point-of-care devices.

Test Type Insights

The laboratory-based testing segment led the market with the largest share in 2025, as it is generally considered more accurate and sensitive. This test finds widespread applications in hospitals and clinics. Laboratory tests are especially important in diagnosing acute myocardial infarction and are typically performed in emergency departments, regardless of whether the troponin test is sent to an outside laboratory. The rising demand for more advanced testing technologies, such as chemiluminescence immunoassays (CLIA), further supports segmental growth.

The point-of-care testing (POCT) segment is expected to grow at the fastest CAGR in the upcoming period, as healthcare systems increasingly favor more rapid diagnostics in emergency rooms, ambulances, and rural areas. POCT allows for the identification of any elevated cardiac troponin, thereby reducing the risk of heart attacks. POCT helps enhance decision-making, improving patient outcomes. Additionally, the increasing development of sophisticated POCT devices contributes to segmental growth.

Sample Type Insights

The serum segment led the market in 2025, as it is the predominant sample type for cardiac troponin testing due to both organizational and clinical laboratory acceptance, as well as its compatibility with standard diagnostic procedures. In addition, serum provides a clean matrix that enables accurate and sensitive detection of troponin levels based on techniques such as chemiluminescence immunoassays (CLIA). Serum samples are routinely used in many hospitals and emergency department settings, as they provide reproducible results for diagnosing myocardial infarction. The clear infrastructure associated with serum processing at clinical laboratories has led to its continued adoption in routine, acute, and emergency cardiac care settings.

The others (e.g. fingerstick samples) segment is likely to grow at a significant CAGR during the projection period. This is mainly due to the increasing development of point-of-care testing and decentralized diagnostic tests that utilize non-serum samples. These samples facilitate rapid, minimally invasive testing, which could be particularly advantageous in emergency transport (e.g., in an ambulance), in rural clinics, and in home care environments. In addition to their obvious ease of use, the push for rapid clinical decision-making and better reach into lower-resource environments has led to the widespread adoption of non-serum-based cardiac troponin testing.

Technology Insights

The chemiluminescence immunoassay (CLIA) segment held the largest share of the market in 2025. CLIA is the most widely used platform in cardiac troponin assessment because it is extremely sensitive, specific, and capable of generating fast and reliable results. CLIA is used extensively in hospital laboratories, enabling high-throughput testing in emergency or routine cardiac assessments. The strong performance of CLIA in the detection of low troponin concentrations is especially critical for the early diagnosis of myocardial infarctions. Moreover, compatibility with automated processing and sophisticated analyzers further enhances the clinical utility of CLIA and strengthens its position as the gold standard among troponin testing technologies.

The others segment is expected to grow at a significant CAGR during the forecast period. This is mainly due to the increasing demand for biosensors and electrochemical assays in cardiac troponin diagnostics. Emerging technologies enable point-of-care or wearable applications, allowing for the real-time monitoring of cardiac biomarkers in outpatient or non-traditional laboratory settings. With a growing emphasis on personalized and preventive healthcare, there is an increasing interest in these advanced platforms, given their ability to provide instantaneous results with minimal sample requirements.

End Use InsightsÂ

The hospitals & clinics segment dominated the cardiac troponin market in 2025, offering the benefits of centralized facilities to diagnose and manage acute cardiovascular conditions (such as myocardial infarction). These settings are outfitted with advanced laboratory infrastructure and staff, which are necessary to handle high-sensitivity assays. Because the rapid diagnosis of heart-related conditions is of paramount clinical importance, hospitals and clinics will continue to be the primary end-users of troponin diagnostics.

The homecare settings segment is expected to experience the fastest growth, given the global trend of remote monitoring and decentralized diagnostics. With an aging population contributing to the demand for post-discharge care, there is an increasing need for portable, easy-to-use cardiac testing devices that can be brought into patients' homes instead of being performed in a hospital or clinical setting. Technological advancements are significantly improving the quality of point-of-care and wearable troponin monitoring products, enabling patients and healthcare staff to easily monitor their heart health at home. This change supports the early detection of problems, reduces ER visits, and improves longer-term outcomes, making home-based testing an emerging area within cardiac care.

Application Insights

The myocardial infarction diagnosis segment has remained the leading application segment in the cardiac troponin testing because troponin is the gold standard biomarker for heart muscle injury. Troponin elevation during a heart attack is significant, and obtaining troponin measurements is critical for confirming or ruling out MI in emergency departments or acute-care settings. Hospitals, emergency departments, and other urgent care facilities routinely perform troponin assays on patients to inform important treatment decisions. The reliability, rapid turnaround time, and clinical diagnostic evidence provided by troponin in the identification of MI ensure the consistent application of troponin remains.

The acute coronary syndrome (ACS) risk stratification segment is expected to expand at the fastest rate because of a shift in focus to early intervention and individualized care in modern medicine. High-sensitivity troponin assays allow clinicians to evaluate patients at variable degrees of cardiovascular risk, even those that may not yet fully qualify a patient as having undergone a myocardial infarction. As preventive cardiology comes to the forefront, concurrent with evolving guidelines that consider troponin-based risk models, this application is likely to increase and be incorporated into outpatient paradigms and preventive cardiology initiatives.

Regional Insights

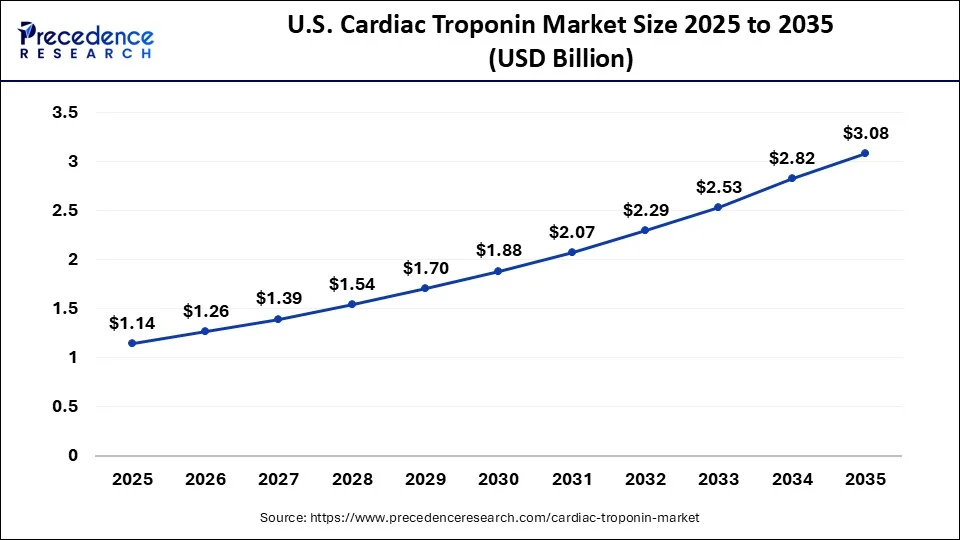

The U.S. cardiac troponin market size was exhibited at USD 1.14 billion in 2025 and is projected to be worth around USD 3.08 billion by 2035, growing at a CAGR of 10.45% from 2026 to 2035.

What Made North America the Dominant Region in the Cardiac Troponin Market?

North America dominated the market by capturing the largest share in 2024. This is mainly due to heightened awareness of cardiovascular health and increased adoption of sophisticated diagnostic tools in emergency care systems. There is a high utilization of high-sensitivity troponin assays, which are not widely adopted in other regions. The region has environments conducive to rapid and reliable evaluation of a burgeoning elderly population with escalating heart disease. There is also a plethora of stakeholders in the medical diagnostics sphere, including pharmaceutical and device companies that have ongoing clinical studies, which help drive innovation, increase the number of companies investing in the cardiac troponin market, and continue to make North America the global leader in cardiac troponin testing.

The U.S. is at the apex of North America's cardiac troponin market. This is mainly due to the high incidence of acute coronary syndrome and heart failure, and the timeliness of troponin testing is critical when diagnosing these medical conditions. As per the CDC, heart disease continues to be the leading cause of death in the U.S.

Asia Pacific is the fastest-growing region in the cardiac troponin market because of its increasing burden of cardiovascular disease, improved access to healthcare, and growing awareness of early cardiac diagnostics. Both governments and private providers are beginning to invest in healthcare infrastructure, while the latter are also leveraging advanced diagnostics for clinical use. Additionally, the threat of further disease and the increasing affordability of new point-of-care testing and innovation are leading to the erosion of outdated market behaviors in specialty diagnostic markets on a macro level, in both rural clinics and urban hospitals.

India is emerging as a prominent player in the Asia Pacific cardiac troponin market, driven by its large population size and increasing prevalence of heart disease. Based on figures released by the Indian Council of Medical Research (ICMR), cardiovascular disease is now the leading cause of death in both rural and urban areas. The Indian government aims to strengthen primary and emergency care and is also seeking to expand access to cardiac diagnostics through public-private partnerships. The rising demand for decentralized diagnostics further supports market growth.

The European market is estimated to have a significant growth rate during the forecast period. This growth is characterized by heterogeneous growth patterns across its countries. Germany stands at the forefront of this region due to its strong healthcare system and proactive approach towards disease management. We can see that there is a growing emphasis on the early diagnosis of heart-related conditions in the region. The implementation of supportive healthcare policies which are aimed at improving cardiac care is also expected to drive the European market forward. Additionally, innovations in diagnostic technologies are also being increasingly integrated into clinical practice.

Latin America is expected to witness substantial growth throughout the forecasted years. This growth is driven by rising cardiovascular disease incidence, advancements in biomarker assays, and increasing adoption of rapid diagnostic technologies across hospitals and clinics in the region. The region is also supported by rising healthcare investments, improved diagnostic infrastructure, and strong government health initiatives that help to promote the adoption of cardiac marker diagnostics. Technological advancements such as point-of-care testing devices are also making cardiac diagnostics faster and more accessible in the region.

The Middle East and Africa is expected to pick up pace in the upcoming years. The key factors that are contributing to this region's market growth include the shifting focus of operating entities and government agencies on launching advanced testing facilities and introduction of new products. Collaborations are underway, focusing on co-developing new assays and technologies. These partnerships help companies accelerate their product launches and strengthen distribution networks. Hospitals also benefit from access to cutting-edge diagnostic tools through these partnerships. This collaborative approach is fostering innovation and adoption of advanced testing solutions.

Value Chain Analysis

- Raw material sourcing

Sourcing raw materials for this market involves the procurement of high purity recombinant proteins, buffer regeants, antibodies and surface chemistries. Suppliers are seen shifting towards advanced recombinant protein platforms in order to improve batch consistency as there is a high demand for high sensitivity troponin tests all across emergency care. Rising costs for raw materials and strict regulatory bodies further push the market.

Key Players: Merck, Abcam, Bio Rad - Manufacturing and Processing

This manufacturing process involves preparing reageants, fitting them into cartridges and then building analyzer systems that are able to read results. Production facilities must maintain strict sterile conditions and follow international safety standards. Many companies produce both, central lab assays as well as point of care kits. The rise of automation software is improving the consistency of this stage.

Key Players: Roche, Abbott, Siemens - Distribution and Logistics

The next stage is distribution, which involves the shipping of kits, tests, analyzers and consumables to hospitals, diagnostics labs, point of care sites and emergency care centers. Because these troponin kits are temperature sensitive, companies usually rely on cold chain logistics and validated supply partners. MNCs also often use direct distribution processes for major hospitals.

Key Players: Cardinal Health, Fisher Healthcare, Medline Industries

Cardiac Troponin Market Companies

- Abbott Laboratories: Known for high-sensitivity troponin assays, Abbott Laboratories offers a comprehensive portfolio of cardiac markers, including troponin tests, which are crucial for diagnosing acute myocardial infarction and other cardiac conditions.

- Siemens Healthineers: Siemens Healthineers provides rapid, reliable testing solutions that integrate into their diagnostic ecosystem, making them a preferred choice for hospitals and laboratories.

- Roche Diagnostics: Roche Diagnostics offers a broad portfolio of cardiac markers, including troponin tests, which are essential for the early detection and prevention of heart failure and other cardiac conditions.

Other Major Key Players

- Beckman Coulter (Danaher Corporation)

- bioMérieux SA

- Ortho Clinical Diagnostics (QuidelOrtho)

- Becton, Dickinson and Company (BD)

- Radiometer Medical (Danaher)

- Bio-Rad Laboratories

- LSI Medience Corporation

- Tosoh Corporation

- Randox Laboratories

- Thermo Fisher Scientific

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Singulex, Inc.

- HyTest Ltd

- Response Biomedical Corp.

- Getein Biotech Inc.

- LifeSign LLC

- Creative Diagnostics

Recent Developments

- In September 2025, Roche's sixth-generation Troponin T test offered a new level of accuracy critical for diagnosing heart attacks. The test helps clinicians quickly identify heart attack and rule out non-cardiac causes, ensuring patients receive the care they need at the earliest opportunity. Results showed that the Elecsys Troponin Gen 6 test was able to identify acute myocardial infarction (AMI), or heart attack, and identify those not having an AMI, with a high level of precision. This supports the efficient triage of patients arriving at the emergency department, ensuring healthcare resources can be focused where they are needed most.

(Source:taiwannews.com ) - In November 2025, QuidelOrtho Corporation recently received 510(k) clearance from the U.S. Food and Drug Administration for its VITROS Troponin I Assay, the company. The news comes as the stock trades at $26.99, significantly below its 52-week high of $49.45, with shares down over 8% in the past week. According to InvestingPro analysis, the company appears undervalued based on its Fair Value assessment.

(Source:investing.com) - In March 2024, Polymedco received FDA clearance for the PATHFAST hs-cTnI-II test as the first high-sensitivity cardiac troponin I assay that has been approved for point-of-care use in the US. The test provides accurate results within 17 minutes to help with rapid heart attack diagnosis.

(Source:prnewswire.com) - In October 2023, HyTest launched a new recombinant human cardiac troponin complex that combines cTnI and TnC, that can have improved accuracy on the calibrators and controls. This advancement offers the opportunity to better reproduce troponin forms seen in clinical patient samples with myocardial infarction.

(Source:hytest.fi) - In October 2023, Mindray expanded its cardiac biomarker offering with the launch of hs-cTnI and NT-proBNP assays developed with HyTest. The aim of the new assays is to facilitate earlier identification, diagnosis, and monitoring of cardiovascular disease - with the application throughout global healthcare settings.

(Source:dicardiology.com)

Segments Covered in the Report

By Type

- Troponin I (cTnI)

- Troponin T (cTnT)

- Troponin C (cTnC)

- Others (e.g., high-sensitivity multi-marker combinations)

By Test Type

- Laboratory-Based Testing

- Point-of-Care Testing (POCT)

- Others

By Sample Type

- Whole Blood

- Plasma

- Serum

- Others (e.g., fingerstick samples)

By Technology

- Chemiluminescence Immunoassay (CLIA)

- Immunofluorescence Assay (IFA)

- Enzyme-Linked Immunosorbent Assay (ELISA)

- Radioimmunoassay (RIA)

- Others (e.g., biosensors, electrochemical assays)

By End Use

- Hospitals & Clinics

- Diagnostic Laboratories

- Ambulatory Surgical Centers (ASCs)

- Homecare Settings

- Others (e.g., academic & research institutions)

By Application

- Myocardial Infarction Diagnosis

- Congestive Heart Failure Monitoring

- Acute Coronary Syndrome (ACS) Risk Stratification

- Others (e.g., perioperative risk assessment, myocarditis)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting