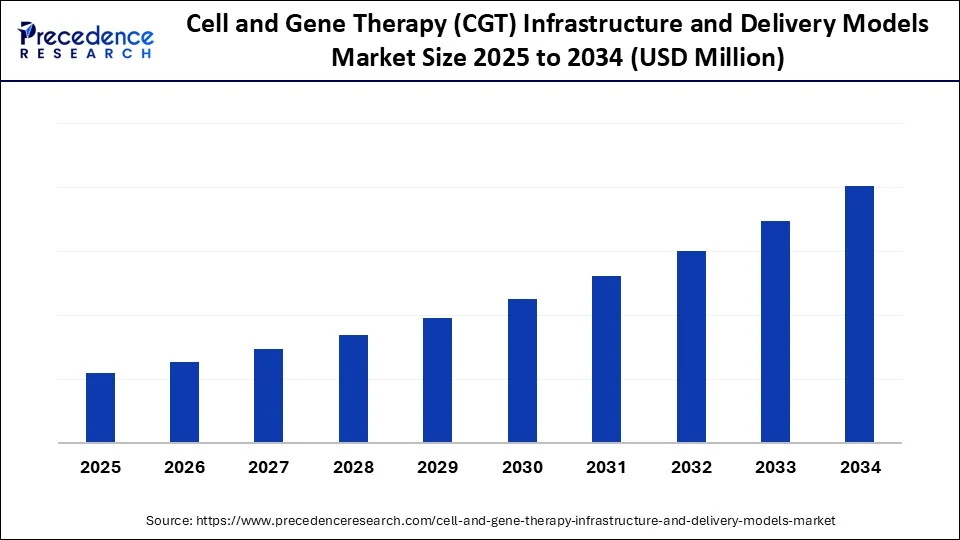

Cell and Gene Therapy (CGT) Infrastructure & Delivery Models Market Size and Forecast 2025 to 2034

The cell and gene therapy infrastructure and delivery models market is growing rapidly as the industry shifts toward scalable, decentralized manufacturing, advanced cold-chain logistics, and integrated clinical delivery to meet rising demand for personalized therapies. The cell and gene therapy (CGT) infrastructure & delivery models market continues to experience robust growth, driven by the increased clinical success rates of cell and gene therapies and increased healthcare expenditure.

Cell and Gene Therapy (CGT) Infrastructure & Delivery Models Market Key Takeaways

- North America led the cell and gene therapy (CGT) infrastructure and delivery models market with around 49% share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By therapy type, the gene-modified cell therapy (e.g., CAR-T) segment held the biggest market share of 42% in 2024.

- By component, the gene therapy segment is expected to grow at the fastest CAGR, under which the in-vivo gene therapy sub-segment is anticipated to grow rapidly between 2025 and 2034.

- By delivery mode, the centralized manufacturing & delivery segment captured the highest market share of 58% in 2024.

- By delivery mode, the decentralized/point-of-care manufacturing segment is expected to expand at a significant CAGR over the projected period.

- By infrastructure component, the manufacturing facilities segment contributed the largest market share of 36% in 2024.

- By infrastructure component, the supply chain orchestration platforms segment is expected to expand at the highest CAGR over the projection period.

- By end use, the biotech and pharmaceutical companies segment generated the major market share of 41% in 2024.

- By end use, the hospitals and transplant centers segment is expected to expand at a notable CAGR over the projected period.

- By application stage, the clinical (Phases I–III) segment accounted for the significant market share of 47% in 2024.

- By application stage, the commercial segment is expected to expand at a significant CAGR over the projected period.

- By service provider, the CDMOs segment held accounted for major market share of 52% in 2024.

- By service provider, the digital platform providers (TrakCel, Vineti, etc.) segment is expected to expand to a notable CAGR over the projected period.

How is AI Impacting the Cell and Gene Therapy (CGT) Infrastructure & Delivery Models Market?

Artificial intelligence (AI) significantly transforms the market for cell and gene therapy (CGT) infrastructure & delivery models by optimizing manufacturing processes, accelerating drug discovery, and optimizing clinical trials. AI analyzes vast amounts of data of genomic and proteomic to identify potential drug candidates and predict the efficacy of therapeutic candidates, optimizing clinical trials. AI models have advanced screening of patients and improved vector designs.

Several leading CGT manufacturing companies, such as Novartis and Thermo Fisher, have already implemented AI capabilities in practice through lab workflow automation and prediction models for clinical outcomes. The increasing knowledge and capacity to implement AI-directed platforms lead to a more reliable CGT delivery method that is more efficient, faster, scalable, and safer. Consequently, access to personalized medicine will become easier and quicker. In short, the convergence of CGT and AI infrastructures enables the faster, safer, and more scalable delivery of therapeutic agents.

Market Overview

The cell and gene therapy (CGT) infrastructure & delivery models market refers to the complete ecosystem of services, systems, facilities, and logistics required supporting the commercialization and delivery of cell and gene therapies (CGTs). It encompasses the physical, technological, and operational infrastructure required to collect, manufacture, store, transport, and administer CGTs to patients, as well as the evolving models (e.g., centralized vs. decentralized delivery) by which these therapies are made accessible across various care settings. The market is experiencing significant growth, driven by rising demand for personalized treatments, the expansion of the cell and gene therapy pipeline, and increasing investment in cell-based research.

Cell and Gene Therapy (CGT) Infrastructure & Delivery Models Market Growth Factors

- Increasing Gene Therapy Approvals: The rise in FDA and EMA approvals for gene and cell therapies is driving demand for robust infrastructure in manufacturing, distribution, and clinical delivery.

- Advancements in Vector Technologies: New efficiencies in viral (AAV, lentivirus) and non-viral vectors are providing improved efficiency, flexibility, scalability, and safety, requiring the development of new infrastructure for these platforms.

- Personalized Medicine: The continued shift toward patient-specific therapies, notably CAR-T, is driving the need for new, decentralized, and flexible delivery systems, as well as real-time logistics capabilities.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Therapy Type, Delivery Mode, Infrastructure Component, End-Use, Application Stage, Service Provider, Others, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is Government Funding Boosting the Growth of the Cell and Gene Therapy (CGT) Infrastructure & Delivery Models Market?

Rising government funding and regulatory support are major factors driving the growth of the market for cell and gene therapy (CGT) infrastructure & delivery models. Governments around the world are providing substantial funding to support research and clinical trials in cell and gene therapies. This enables researchers to explore innovative approaches, leading to optimized manufacturing processes of cell and gene therapies. Moreover, governments establish regulatory frameworks to fast-track approvals for these therapies, expanding access.

The United Kingdom's National Health Service (NHS) is supporting the expansion of Advanced Therapy Treatment Centers (ATTCs) to improve CGT delivery and grow real-world applications. Additionally, both the European Medicines Agency (EMA) and the U.S. FDA have streamlined pathways, such as the Regenerative Medicine Advanced Therapy (RMAT) designation, to achieve more rapid approvals and increased adoption. These institutional efforts are driving developments in both infrastructure and delivery.

Restraint

Regulatory Hurdles and High Costs

One of the major restraining factors of the cell and gene therapy (CGT) infrastructure & delivery models market is evolving regulations across regions. Obtaining regulatory approvals for cell and gene therapies is a time-consuming process, which can delay market entry. According to the U.S. FDA, as of 2024, approximately 3,000 investigational CGT products were being reviewed by the agency, but prolonged safety evaluations and governmental compliance hurdles delay many.

The European Medicines Agency (EMA) has also expressed concerns about regulatory fragmentation and the absence of consistent regulatory pathways, especially regarding decentralized manufacturing and hospital delivery models. At the time of writing, ICMR and CDSCO had also not completed CGT regulatory protocols, and approvals in India remain unclear. This unpredictability in regulatory oversight leads to delays in the timely deployment of therapies, increased costs, and a lack of investment in scalable infrastructure, ultimately preventing patients from accessing and benefiting from CGT therapies. Moreover, the high costs associated with CGT products hinder the market's growth.

Opportunity

Will Technological Advancement Change CGT Infrastructure and Delivery Models?

A significant opportunity for the cell and gene therapy (CGT) infrastructure & delivery models market lies in ongoing technological advancements. Currently, CGT manufacturing is tedious, complex, and time-consuming. The adoption of automation and closed systems can optimize the manufacturing of CGT products by reducing costs and improving efficiency. For example, in May 2025, Lonza made an exciting announcement about a new Design2Optimize platform to enhance the process development and manufacturing of small molecule APIs, while substantially reducing manufacturing time.

(Source: https://www.lonza.com)

Similarly, Thermo Fisher Scientific expanded its Gibco CTS platform of products with new digital tools to enable tech transfer and remote monitoring of CGT technologies, resulting in greater reproducibility, a lower chance of contamination, and reduced operational costs. As therapies progress through development toward commercialization, automation will become a more significant disruptor, enabling high throughput and consistency and bringing advanced therapies to the masses globally. Moreover, advancements in gene editing technologies and vector designs are improving the efficacy of CGT products.

Therapy Type Insights

Why Did the Gene-Modified Cell Therapy Segment Dominate the Market in 2024?

The gene-modified cell therapy, specifically CAR-T therapy, segment dominated the cell and gene therapy (CGT) infrastructure & delivery models market with the largest share of 42% in 2024. This is mainly due to its proven effectiveness in treating blood cancers and defined clinical protocols. Gene-modified cell therapy requires complex manufacturing methods that strictly follow therapeutic handling protocols and individualized, patient-specific delivery methods; thus, significant investment in centralized infrastructure has occurred. As large-scale biopharma companies and CDMOs continue to scale up specialized GMP facilities to support treatments that are required to comply with regulations and standardized processes, the segment continues to sustain dominance.

The gene therapy segment is expected to grow at the fastest CAGR during the forecast period, under which the in-vivo gene therapy sub-segment is leading the charge. This is mainly due to its ability to deliver genetic material directly into the patient (body) and not have to directly handle & manipulate the patient's cells (like ex-vivo delivery). The completion of in-vivo product approvals for hemophilia and some retinal disorders with innovations (in viral vectors) ensures business for the immediate future. However, it has different infrastructure needs that better facilitate decentralized and hospital-based delivery systems.

Delivery Model Insights

How Does the Centralized Manufacturing Delivery & Segment Dominate the Market in 2024?

The centralized manufacturing & delivery segment dominated the cell and gene therapy (CGT) infrastructure & delivery models market with share of 58% in 2024. This is because of its ability to provide consistency, quality assurance, and adherence to strict regulatory oversight. Centralized manufacturing also provides scale and minimizes variability, particularly for therapies like CAR-T, which require specific, controllable conditions. Centralized manufacturing also benefits from the commonality of training workers, facility phases, and part tracking.

The decentralized/point-of-care (PoC) manufacturing segment is expected to grow at the fastest CAGR over the projection period, as it reduces overall production costs of CGT products by reducing the need for transporting the product. The expanding pipeline of CGT products bolsters segmental growth. Moreover, the rising development of new facilities and growing focus on enhancing the manufacturing capabilities of existing facilities boost segmental growth.

Infrastructure Component Insights

What Made Manufacturing Facilities the Leading Segment in the Cell and Gene Therapy (CGT) Infrastructure & Delivery Models Market?

The manufacturing facilities segment held the largest revenue share of the market, under which the GMP-compliant manufacturing facilities sub-segment dominated the market with the share of 36% in 2024. This is mainly due to their ability to provide safety, sterility, and reproducibility of vetted processes. Regulatory requirements and the complexity of manufacturing cell and gene therapies further influenced segmental growth. Biopharma companies and CDMOs invest heavily in clean rooms, viral vector production suites, and automation to ensure compliance. The rising demand for CGT products that are GMP-compliant supports segmental growth.

The supply chain orchestration platforms segment is expected to expand at the highest CAGR in the upcoming period. The growth of the segment is attributed to the increasing need for tracking, traceability, and coordination of processes in order to adhere to CGT workflows. These platforms provide real-time inventory, scheduling, and chain-of-identity management, which is necessary for personalized therapies in general. Given the growing number of CGTs and the trend toward decentralization, there is a high demand for digital tools to enhance logistics and regulatory compliance and reduce errors, contributing to segmental growth.

End User Insights

Which End-User Dominate the Market in 2024?

The biotech & biopharma companies segment dominated the cell and gene therapy (CGT) infrastructure & delivery models market with the share of 41% in 2024 due to their increased investment in the development of CAGT products. They actively participate in clinical trials and eventually contribute to their commercialization. These companies consistently invest in expanding their manufacturing capabilities, logistics, and quality infrastructure, either themselves or by outsourcing to contract development and manufacturing organizations (CDMOs). Their relationships and partnerships with academic centers and other technology providers, in addition to their product development, will streamline the development-to-delivery pipelines and make them the dominant end-user in the CGT infrastructure space.

The hospitals & transplant centers segment is expected to grow at the fastest rate in the market, as they are focusing on expanding CGT delivery capabilities, especially for autologous and decentralized therapies. The rapid increase in in-hospital manufacturing units and high usage of cell and gene therapies further support segmental growth. Hospitals and transplant centers provide immediate access to patients, handling therapy actuality on site, and less logistics. All of these advantages are critical when the treatment is time-sensitive.

Application Insights

What Made Clinical (Phase I–III) the Most Popular Application?

The clinical (phase I–III) is segment dominated the cell and gene therapy (CGT) infrastructure & delivery models market with the share of 47% in 2024. This is mainly due to the increased number of clinical trials in cell and gene therapies. These stages involve significant treatment complexity, requiring high-quality systems, controlled manufacturing conditions, and validated logistics to ensure compliance with multiple regulations. Biopharma companies and CDMOs are primarily involved in clinical trials, validating and optimizing infrastructure for the clinical pipeline, which contains hundreds of actively progressing CGT candidates.

The commercial stage segment is expected to grow at the fastest rate in the coming years due to the increasing quantities of approved CGTs worldwide. Once therapies are approved and exit clinical trials, the infrastructure must shift to managing large-scale production, compliance, and delivery to patients. Commercial logistics, cold-chain capabilities, and post-marketing surveillance systems are rapidly expanding in this regard. Within the commercial stage, new blockbuster therapies are entering the marketplace, but systemic, integrated solutions will be required to support novel reimbursement, patient access, and long-term observation and monitoring of these commercial therapies.

Service Provider Insights

Which Service Provider Segment Dominate the Market in 2024?

The contract development and manufacturing organizations (CDMOs) segment led the market with the share of 52% in 2024. This is mainly due to the increased demand for outsourcing services from biopharmaceutical companies. CDMOs are the largest service providers, providing a range of services from process development to manufacturing and logistics. CDMOs specialize in providing services with CGT-specific facilities, regulatory approval, and the ability to scale up quickly, making them key partners for biopharma companies. Outsourcing CGT product manufacturing to CDMOs enables biopharma companies to focus on other core competencies.

The digital platform providers (TrakCel, Vineti, etc.) segment is likely to grow rapidly in the upcoming period. Digital platform providers offer developers digital tools to help schedule shipments, manage the chain of identity, and track shipments in real time, which are critical to delivering decentralized and patient-specific therapies. The pressure on CGT developers to reduce waste in logistics and minimize human error in the supply chain will increase the urgency and importance of digital solutions in CGT infrastructure planning.

Regional Insights

How Did North America Dominate the Market in 2024?

North America dominated the cell and gene therapy (CGT) infrastructure & delivery models market with the largest share of 49% in 2024. This is mainly due to regulatory support for cell and gene therapies. The increased government funding for research and development of cell-based therapies further bolstered market growth. The region also has a well-established infrastructure for cell and gene therapy manufacturing. Market players in the region are focusing on expanding their manufacturing capabilities, ensuring the long-term growth of the market. For example, recently, Thermo Fisher Scientific expanded its capacity to produce viral vectors, while Catalent launched new commercial-scale cell therapy facilities in NJ and Maryland.

The U.S. is a major contributor to the market in North America due to its well-established manufacturing infrastructure for CGT products. The U.S. is home to some of the leading biotech manufacturing companies. Companies like Novartis and Pfizer have invested heavily in CGT manufacturing, supporting market growth. For example, Pfizer ramped up production of CGT products in Sanford, North Carolina, in 2024 to meet global demand. Moreover, the U.S. FDA's regenerative medicine advanced therapy (RMAT) designation also encouraged increased approvals for advanced therapies and encouraged companies to scale up their infrastructure.

What Factors Contribute to Cell and Gene Therapy (CGT) Infrastructure & Delivery Models Market in Asia Pacific?

Asia Pacific is expected to experience the fastest growth during the forecast period, driven by the rapid expansion of biopharmaceutical companies and rising investment in biomanufacturing. Better regulatory reform and rising approvals for CGT products further support regional market growth. Some of the countries in Asia Pacific are improving their CGT capability to meet the growing demand for CGT products. There is a significant increase in the number of clinical trials, particularly in CAR-T therapies. Moreover, rising government investment in R&D in cell and gene therapies contributes to market growth.

India is emerging as a major player in the market. This is mainly due to the increasing healthcare expenditure and rising government initiatives to boost the production of cell and gene therapies. In April 2024, the President of India Smt. Droupadi Murmu launched India's first home-grown anti-Cancer CAR-T cell therapy and dedicated it to the Nation in the presence of the Governor of Maharashtra, Shri Ramesh Bais at the Indian Institute of Technology, (IIT) Bombay in Mumbai today.

(Source: https://www.pib.gov.in)

Cell and Gene Therapy (CGT) Infrastructure & Delivery Models Market Companies

- Catalent Cell & Gene Therapy

- Lonza

- WuXi Advanced Therapies

- Thermo Fisher Scientific

- Charles River Laboratories

- BioLife Solutions

- TrakCel

- Vineti

- Cryoport Systems

- Be The Match BioTherapies

- Longevity BioImaging

- Ori Biotech

- Miltenyi Biotec

- Akron Biotech

- BioSpherix

- Cellino

- QuickSTAT

- Lonza Bioscience

- Marken

- SHL Medical

Recent Developments

- In July 2025, New York State launched the Empire State Cellular Therapy Consortium (ESCTC), positioned to accelerate innovative approaches to cancer treatment. Specifically, the Consortium will provide supporting tools, resources, and commercialization pathways for new cell-based therapies being developed by stakeholders across New York State.

(Source: https://ritzherald.com) - In March 2025, Bharat Biotech announced that it would invest US$75 million to enter the cell and gene therapy market, establishing an advanced manufacturing facility to support its indigenous production capacity and collaborate on regenerative medicine on a global scale.

(Source: https://www.fiercepharma.com) - In April 2024, Thermo Fisher Scientific announced the launch of an animal-origin-free formulation to help ensure large-scale manufacturing of cell therapies is more consistent and safer while also responding to the industry's requirements for compliant and sustainable manufacturing solutions that can be applied across multiple jurisdictions.

(Source: https://www.businesswire.com) - In October 2023, OrganaBio announced the launch of its Cell Processing and Cryopreservation (CPC) Services, a new division within the company. CPC services have been specifically developed to provide decentralized clinical trial support, including timely sample processing and data capture, which are essential for accurately gauging the outcomes of clinical trials.

(Source: https://www.news-medical.net)

Segments Covered in the Report

By Therapy Type

- Cell Therapy

- Autologous Cell Therapy

- Allogeneic Cell Therapy

- Gene Therapy

- In-vivo Gene Therapy

- Ex-vivo Gene Therapy

- Gene-Modified Cell Therapy (e.g., CAR-T)

By Delivery Mode

- Centralized Manufacturing & Delivery

- Decentralized/Point-of-Care Manufacturing

- Hybrid Models

By Infrastructure Component

- Manufacturing Facilities

- GMP-compliant Manufacturing Facilities

- Modular/POD-based Units

- Cold Chain Logistics

- Cryogenic Storage & Shipment (LN2, Dry Shippers)

- 2–8°C Refrigerated Logistics

- Ambient Logistics (for in-vivo therapies)

- Supply Chain Orchestration Platforms

- Scheduling & Chain-of-Identity Software

- Real-Time Tracking & Inventory Systems

- Cryopreservation Solutions

- Controlled-Rate Freezers

- Cryobags & Cryovials

- Clinical Site Infrastructure

- Apheresis Centers

- Infusion Sites

- Cell Processing Labs (on-site)

- Data Management & IT Infrastructure

- EHR Integration

- GMP Software & QMS

- AI for Supply Chain Optimization

By End-Use

- Academic & Research Institutes

- Hospitals & Transplant Centers

- Commercial Treatment Centers (Private)

- Biotech/Biopharma Companies

By Application Stage

- Preclinical

- Clinical (Phase I–III)

- Commercial

By Service Provider

- CDMOs (for CGT-specific infrastructure)

- Specialty Logistics Providers

- Clinical Site Network Providers

- Digital Platform Providers (CGT workflow automation)

By Others

- Closed-loop Processing Systems

- Point-of-Care Manufacturing Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting