What is the Cell Transfection Market Size?

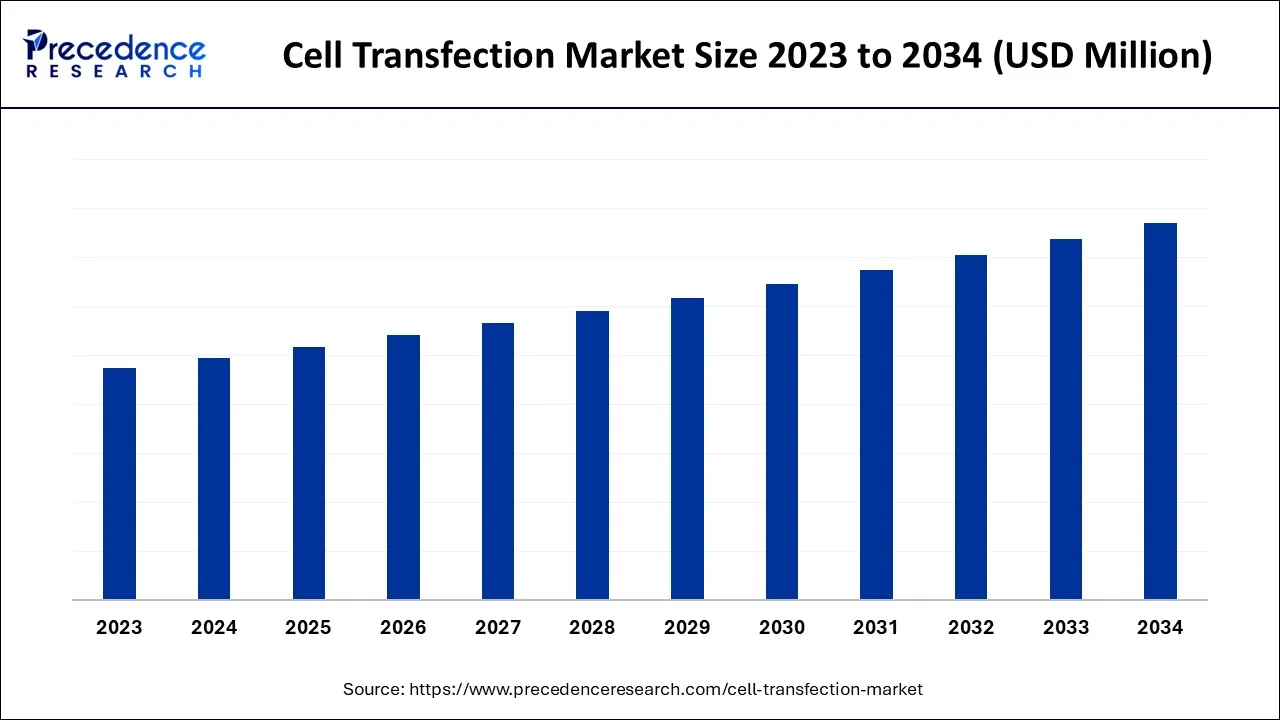

The global cell transfection market is surging, with an overall revenue growth expectation of hundreds of millions of dollars from 2026 to 2035. The cell transfection market is driven by the rising need for cell and gene therapies and the growth of biopharmaceutical research.

Cell Transfection Market Key Takeaways

- North America generated the largest market share in 2025.

- By Method, the electroporation segment had the biggest revenue share in 2025.

- By End User, the academic and research institutes segment dominated the global market in 2025.

What is a Cell Transfection?

Transfection, which is used in research to examine and control gene expression, is the introduction of RNA, DNA, or proteins into eukaryotic cells. The characterization of genetic functions, cell proliferation, protein synthesis, and development are therefore made easier with the use of transfection procedures, which operate as an analytical tool. Transfection assays help improve drug discovery techniques in addition to advancing cellular research. Lentiviral particles are used in similar ways, such as viral transfection or viral transduction, to introduce foreign material into eukaryotic cells. In contrast, horizontal gene transfer occurs during bacterial transformation, which involves the uptake of foreign genetic material by the bacterium.

Key AI Integration in the Cell Transfection Industry

AI-driven image analysis technology now automates the measurement of transfection efficiency, cell viability, along morphological changes in real-time, providing more accurate and even reliable results compared to inconsistent manual estimations. This automation now extends to quality control processes, guaranteeing consistency and compliance in manufacturing.

Cell Transfection Market Growth Factors

Gene therapy is a potential method for treating a variety of inherited and acquired disorders, which explains why there is an increasing need for it. Delivering genetic material to cells in order to repair or fix the damaged genes is involved. Effective and secure strategies for transferring genes to the target cells are essential for the success of gene therapy. The market for cell transfection is expanding as a result of the rising demand for gene therapy, which is an essential stage in the process of gene therapy.

The introduction of novel transfection techniques has resulted in the development of safer and more effective ways to deliver genes to cells. For instance, electroporation, a technique that introduces DNA into cells using electric pulses, has demonstrated encouraging outcomes in gene therapy and has grown in popularity among researchers. The use of viral vectors, lipid-based transfection agents, and CRISPR/Cas9 genome editing are other breakthroughs.

Cell Transfection Market Outlook

- Industry Growth Overview: The market is driven by growing R&D in cell/gene therapies, biopharma, and even personalized medicine. Key drivers include the expanding demand for efficient delivery in gene editing (such as CRISPR) and even cell-based therapies, ongoing innovation in reagents (lipids, polymers) together with methods (viral/non-viral), and the strong need from North America and fast-growing Asia-Pacific regions.

- Major Investors: They are mainly large pharmaceutical along biotechnology firms, specialized life science tool manufacturers, and investment companies that finance these companies and related research.

Market Scope

| Report Coverage | Details |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Method, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Advancements in genetic engineering technologies

The development of the cell transfection industry is being driven by improvements in genetic engineering technology. Cells' genetic composition may be altered via genetic engineering techniques for a variety of objectives, including gene therapy, the manufacturing of biopharmaceuticals, and genetic research. A crucial phase in the genetic engineering procedure that includes introducing foreign DNA into the cells is called cell transfection.

The area of genetic engineering has undergone a revolution due to the introduction of CRISPR-Cas9 gene editing technology. Scientists may alter particular genes inside a cell's DNA using the precise and effective gene-editing technique CRISPR-Cas9. The effectiveness of cell transfection methods is crucial to the success of CRISPR-Cas9 gene editing. The CRISPR-Cas9 system has been introduced into cells via a variety of transfection techniques, including electroporation, lipofection, and viral vectors.

The creation of RNA interference (RNAi) and synthetic biology are two more developments in genetic engineering technology. Small interfering RNAs (siRNAs) are a type of gene silencing known as RNA interference (RNAi), and it is used to silence particular genes. Gene therapy and drug discovery both benefit greatly from the use of RNAi. The creation of biological systems that do not occur naturally is known as synthetic biology. For the purpose of delivering synthetic DNA constructs into cells, cell transfection is crucial in synthetic biology.

Restraint

High cost

The price of cell transfection can be a considerable barrier to entry for certain academics or businesses, limiting its adoption in certain scientific applications. The creation and production of transfection reagents as well as the equipment necessary for transfection are the main causes of the high cost. Chemicals called transfection reagents make it easier for nucleic acids to enter cells. In order to assure the effectiveness and safety of these reagents, significant quality control testing is frequently necessary throughout the manufacturing process. Additionally, the cost of purchasing and maintaining the equipment necessary for transfection, such as electroporation devices or gene guns, can be high.

These variables make the price of cell transfection a considerable burden for academics or businesses with little funding. This may restrict its usage in some research applications, particularly in underdeveloped nations or in tiny labs with little resources. Additionally, the high cost may make it challenging for businesses looking to create novel therapeutics based on cell transfection to enter the market at competitive prices.

Opportunity

The use of cell transfection in drug discovery

In recent years, the use of cell transfection in drug development has grown in significance as scientists work to create novel, more potent therapies for a variety of ailments. In order to produce safe and effective treatments for patients, drug discovery often entails the discovery of novel drug targets and the creation of molecules that can modify those targets.

A crucial tool in this process is cell transfection, which enables researchers to insert foreign genetic material into cells and examine how that material affects numerous cellular functions. To learn more about the roles of particular proteins and how they interact with other molecules in the cell, for instance, researchers may introduce genes producing those proteins into the cells. Small interfering RNAs (siRNAs) may also be used to silence certain genes, and the impacts on cellular pathways are then investigated. Furthermore, cell transfection is frequently employed in high-throughput drug screening experiments, which examine a large number of substances for their potential to interact with certain biological targets. Researchers can make stable cell lines that express or mute certain targets of interest by inserting genes or siRNAs into cells. These cell lines can then be utilised in screening experiments to find drugs that affect the targets.

In general, the market for cell transfection is expected to increase significantly due to the usage of cell transfection in drug discovery. There will be greater demand for better cell transfection methods as drug development activities expand and advance.

Segment Insights

Method Insights

On the basis of the method, in the market for cell transfection market in 2023, the electroporation segment had the biggest revenue share. In terms of revenue share, the category is closely followed by the particle bombardment and liposomal transfection categories. The category is growing as a result of broad portfolios for a variety of electroporation solutions supplied by both established and developing competitors. In contrast, it is predicted that the liposomes category would expand at the quickest rate throughout the projection period. The market for liposome-based transfection is expected to grow in the upcoming years due to current research efforts in lipofection to increase the effectiveness of in vivo transfection.

End User Insights

On the basis of users, the market for cell transfection is anticipated to be dominated by the academic and research institutes sector. This is due to the fact that academic and research institutions are engaged in a variety of research projects, such as gene expression studies, protein manufacturing, and the creation of new drugs. In order to investigate gene function, regulation, and interaction, foreign genetic material must be introduced into cells. Cell transfection makes this possible. Major end users of the cell transfection industry include biotech and pharmaceutical firms. These businesses employ cell transfection for several purposes, including making recombinant proteins, creating cell-based drug screening tests, and researching disease causes. These businesses benefit from cell transfection since it helps them generate more effective and focused therapeutics by streamlining the drug discovery and development process.

Another prominent end user of the market for cell transfection is CROs. These businesses offer biotechnology and pharmaceutical firms, government agencies, academic institutions, and research institutes contract research services. Cell transfection is used by CROs for a variety of purposes, such as drug discovery, toxicity testing, and biosafety assessment.

Regional Insights

On the basis of region, in terms of revenue, North America held the largest market share in 2023. Throughout the projected period, it is predicted that the region will continue on this trajectory. This is due to the availability of reputable manufacturers and significant financing to support R&D on cancer therapies, precision medicine, and sophisticated cytological investigations. The region's additional market potential may boost the income of important market players in the U.S. market for cell transfection.

Rising healthcare spending in Asia Pacific is anticipated to offer a favourable environment for established multinational manufacturers wanting to build their cell transfection industry. This region also has a rising patient pool with consequent untapped market potential. Additionally, the government is actively involved in encouraging the use of cell and gene therapy, which supplements this.

Value Chain Analysis of the Cell Transfection Market

- R&D

Focused on enhancing the efficiency, safety, and even scalability of methods for delivering genetic material into cells. - Clinical Trials and Regulatory Approvals

It follows a rigorous along with multi-stage process governed by agencies such as the FDA (US) and EMA (EU) to ensure patient safety and even product efficacy. The process for these advanced therapies is usually more complex than for conventional drugs because of their unique biological nature.

Cell Transfection MarketCompanies

- Lonza: Lonza provides comprehensive solutions for the cell transfection market, thus, centered around its proprietary Nucleofector Technology for non-viral transfection, together with a variety of instruments, reagents, and even end-to-end manufacturing services for cell and gene therapies.

- QIAGEN:QIAGEN provides a comprehensive range of transfection reagents for introducing numerous nucleic acids (DNA, mRNA, siRNA, miRNA) into a broad array of cell lines, including sensitive primary cells.

Other Major Key Players

- Thermo Fisher Scientific, Inc.

- Promega Corporation

- F. Hoffmann-La Roche Ltd.

- Bio-Rad Laboratories Inc.

- Merck KGaA

- OriGene Technologies Inc.

- MaxCyte, Inc.

- POLYPLUS TRANSFECTION

Recent Development

- AGCBiologicsexpanded its gene therapy production capabilities and viral vector suspension technology at its commercial-grade site in Longmont, Colorado, in May 2022. The new capabilities are enhancing the website's adherent viral vector and cell treatment services and have been available since the third quarter of 2022. With so much attention being paid to the production of viral vectors, transfection technology which is essential to the process will be in more demand.

Segments Covered in the Report

By Method

- Electroporation

- Lipofection

- Calcium Phosphate

- Viral Transfection

- Others

By End User

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting