What is the Chemical Indicators Market Size?

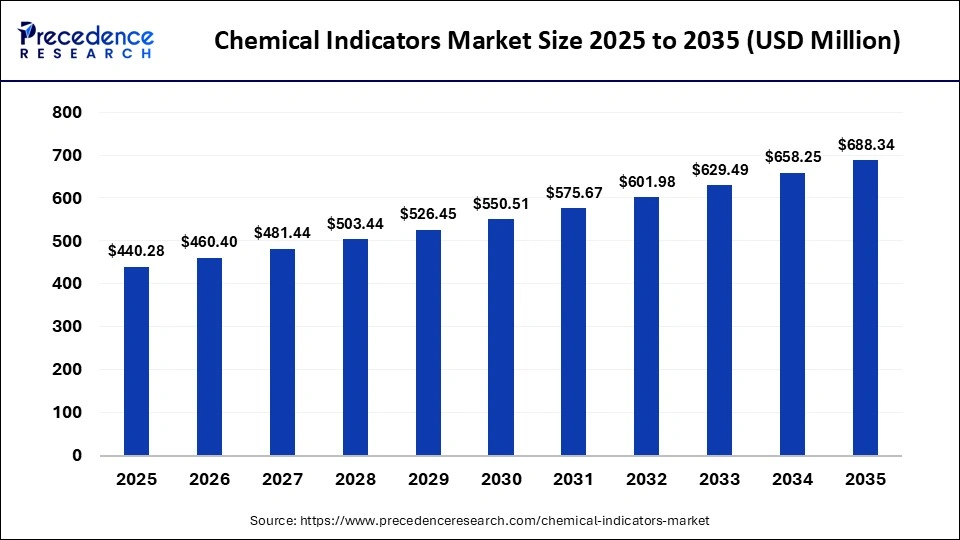

The global chemical indicators market size was calculated at USD 440.28 million in 2025 and is predicted to increase from USD 460.40 million in 2026 to approximately USD 688.34 million by 2035, expanding at a CAGR of 4.57% from 2026 to 2035. This market is growing due to rising demand for reliable sterilization and infection control solutions across healthcare, pharmaceutical, and laboratory settings.

Market Highlights

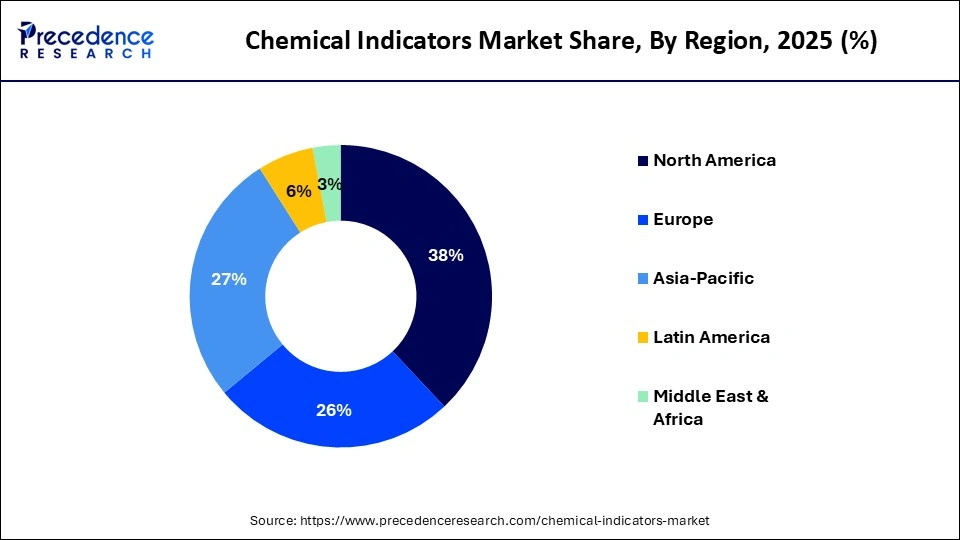

- North America dominated the market with approximately 38% share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By indicator type, the pH & acid-base indicators segment held the biggest market share of approximately 31% in 2025.

- By indicator type, the chromatographic chemical indicators segment is expected to expand at the fastest CAGR between 2026 and 2035.

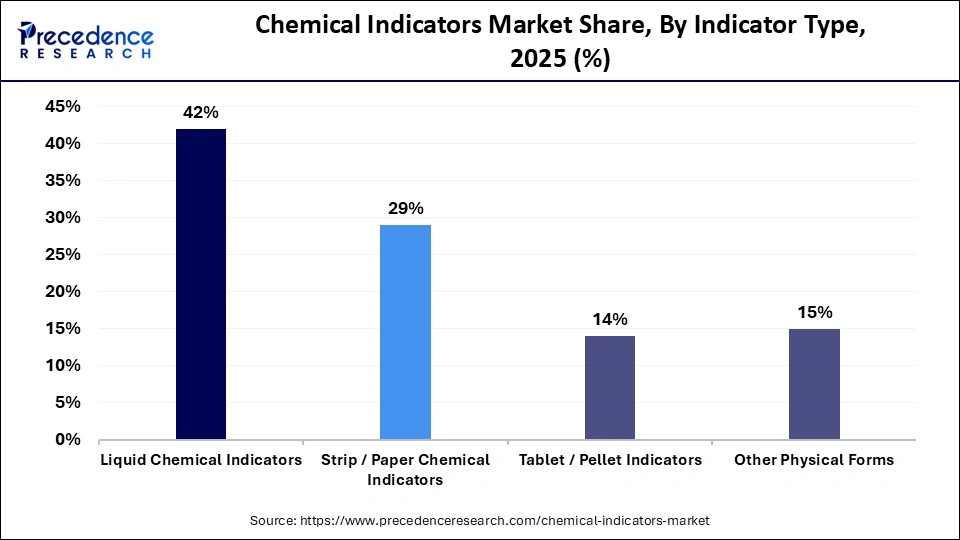

- By form, the liquid chemical indicators segment contributed the highest market share of approximately 42% in 2025.

- By form, the strip/paper chemical indicators segment is expected to grow at a strong CAGR between 2026 and 2035.

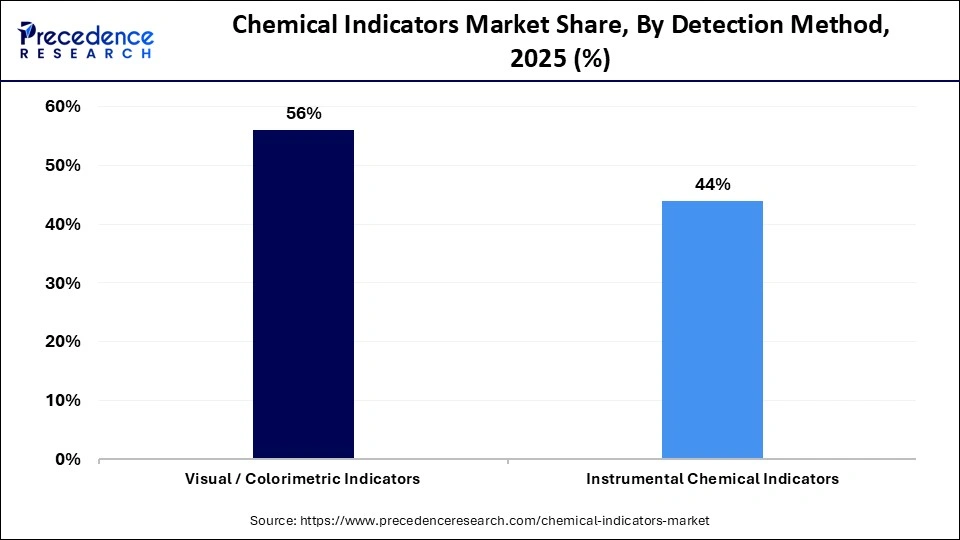

- By detection method, the visual/colorimetric indicators segment held a major market share of approximately 56% in 2025.

- By detection method, the instrumental chemical indicators segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By application, the sterilization & healthcare monitoring segment generated the biggest market share of approximately 28% in 2025.

- By application, the environmental & water quality testing segment is expected to expand at the fastest CAGR between 2026 and 2035.

What are Chemical Indicators?

Chemical indicators includes reagents, dyes, indicator strips, chromatographic indicators, and chemical sensor indicators used to visually or instrumentally detect the presence, concentration, or change of specific chemical species, pH levels, temperature thresholds, oxidizers/reducers, and reaction endpoints across industries such as healthcare, pharmaceuticals, food & beverages, environmental monitoring, water treatment, and industrial processing. Chemical indicators are used in sterilization verification, analytical testing, quality control, process monitoring, and safety compliance.

The chemical indicators market is experiencing steady growth, driven by the increasing focus of laboratories, healthcare facilities, and pharmaceutical companies on infection control and effective sterilization. Chemical indicators provide rapid visual confirmation of critical parameters such as time, temperature, and exposure to sterilizing agents, making them essential for monitoring and verifying sterilization processes. The global demand for reliable chemical indicators is rising due to heightened awareness of hospital-acquired infections, stricter regulatory requirements, and the expanding pharmaceutical and medical device manufacturing sectors.

Market Trends

- Growing focus on infection control and prevention is increasing the routine use of chemical indicators in healthcare facilities.

- Rising adoption of advanced multi-parameter and integrator indicators for more precise sterilization validation.

- Increased demand from pharmaceutical and biotechnology manufacturing due to stringent regulatory compliance.

- Preference for single-use, disposable indicators to minimize contamination risks and human error.

- Technological improvements lead to faster, clearer, and more user-friendly indicator designs.

- Expansion of hospitals, clinics, and diagnostic laboratories in developing regions is driving volume demand.

- Greater emphasis on quality assurance and audit readiness across healthcare and life sciences industries.

Future Growth Outlook

- Expanding healthcare infrastructure and rising surgical procedures in emerging economies are expected to boost the need for chemical indicators.

- Growing pharmaceutical and medical device manufacturing increases the need for validated sterilization monitoring solutions.

- Development of advanced, multi-parameter, and high-accuracy chemical indicators offers scope for product differentiation.

- Increasing adoption of automated and smart sterilization systems opens opportunities for compatible indicator solutions.

- Stricter global regulations on infection control and sterilization compliance support long-term market growth.

How is AI Influencing the Chemical Indicators Market?

Artificial intelligence is gradually reshaping the chemical indicators market by enhancing sterilization monitoring precision, reliability, and effectiveness. By analyzing sterilization data, identifying trends, and flagging deviations in real time, AI-powered systems can lower the possibility of human error and incomplete sterilization cycles. AI assists medical facilities and pharmaceutical companies in streamlining sterilization procedures, guaranteeing regulatory compliance, and keeping records through audit trails when combined with chemical indicators and digital tracking technology. The adoption of AI-enabled sterilization monitoring solutions is anticipated to open new growth opportunities for the chemical indicators market as smart hospitals and automated labs continue to grow.

What Government Initiatives are Supporting the Growth of the Chemical Indicators Market?

Governments across key regions are implementing strict sterilization and infection control regulations, which directly boost the adoption of chemical indicators. The U.S. organizations like the FDA and CDC encourage hospitals and pharmaceutical companies to use chemical indicators to ensure compliance with their guidelines for sterilization monitoring in healthcare facilities. Reliable chemical indicators are in greater demand in India due to programs like the National Health Mission and hospital accreditation initiatives that prioritize safe sterilization practices. Furthermore, by making these goods widely available and reasonably priced, regulatory support for regional production and quality standards reinforces market expansion.

How does investing in chemical indicators deliver a strong ROI?

Investing in chemical indicators delivers a strong return on investment (ROI) by helping organizations prevent costly sterilization failures and infection-related risks. These indicators provide quick, reliable verification of sterilization conditions, reducing the likelihood of hospital-acquired infections, product recalls, regulatory penalties, and reprocessing costs. Their low upfront cost, ease of use, and minimal training requirements make them highly cost-effective compared to the potential financial and reputational losses from non-compliance. In addition, chemical indicators improve operational efficiency and workflow consistency, enabling healthcare facilities and manufacturers to maintain compliance while optimizing time, resources, and overall quality outcomes.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 440.28 Million |

| Market Size in 2026 | USD 460.40 Million |

| Market Size by 2035 | USD 688.34 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.57% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Indicator Type, Form, Detection Method, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Indicator Type Insights

What made pH & acid-base indicators the dominant segment in the market?

The pH & acid-base indicators segment dominated the chemical indicators market with a major share of 31% in 2025. This is because of their widespread use in pharmaceuticals, healthcare labs, and educational settings. These indicators are easy to use, reasonably priced, and incredibly dependable for tracking acidity and alkalinity in chemical reactions, sterilization procedures, and quality control applications. They are even more dominant because they are simple to understand and work well with standard testing methods.

The chromatographic chemical indicators segment is expected to grow at the fastest CAGR in the coming years, driven by the growing need for multi-parameter analysis and increased precision. These indicators are appropriate for sophisticated laboratory and pharmaceutical applications because they provide improved accuracy and detailed separation capabilities. Chromatographic indicators are becoming more widely used as a result of increased focus on regulatory compliance and quality assurance.

Form Insights

Why did the liquid chemical indicators segment dominate the chemical indicators market?

The liquid chemical indicators segment dominated the market with 42% market share in 2025, thanks to their uniform reaction properties and highly sensitive nature. In labs and medical environments where accurate measurement and prompt action are essential, liquid indicators are frequently utilized. Their strong market position is further reinforced by their compatibility with automated and high-throughput testing systems.

The strip/paper chemical indicators segment is expected to grow at the fastest CAGR in the coming years due to their affordability, portability, and ease of use. These indicators are becoming increasingly popular for quick on-site testing on water quality assessment, environmental monitoring, and healthcare. Strong growth is being driven by the growing demand for field-based and point-of-care testing solutions.

Detection Method Insights

Why did the visual/colorimetric indicators segment dominate the chemical indicators market?

The visual/colorimetric indicators segment dominated the market with the largest share of 56% in 2025. This is because they don't require specialized equipment and offer quick, readable results. They are perfect for routine laboratory testing, healthcare applications, and sterilization monitoring because of their dependability and simplicity to reduce operating expenses, and little training is another factor that supports broad adoption. Additionally, these indicators comply with regulatory standards from organizations like ISO, FDA, and CDC, ensuring quality and safety assurance. Their proven reliability and long-standing performance further reinforce their dominance in the market.

The instrumental chemical indicators segment is expected to grow at the fastest CAGR during the projection period, driven by growing automation and digitalization in medical facilities and labs. Higher accuracy of data logging and traceability is provided by these indicators, which support strict audit and regulatory requirements. Rapid growth is being driven by an increasing number of smart labs and AI-integrated monitoring systems.

Application Insights

What made sterilization & healthcare monitoring the leading segment in the chemical indicators market?

The sterilization & healthcare monitoring segment led the market with a 28% share in 2025 due to the critical need for infection control in hospitals, clinics, and laboratories. In hospitals, clinics, and surgical centers, chemical indicators are crucial for verifying sterilization procedures. The rising incidence of hospital-acquired infections and the growing adoption of advanced sterilization technologies have further fueled demand in this segment. Additionally, healthcare facilities prioritize reliable and rapid monitoring solutions, making sterilization & healthcare monitoring the largest and most dominant application area for chemical indicators.

The environmental & water quality testing segment is expected to grow at the fastest CAGR in the coming years due to increasing concerns over water contamination and environmental pollution. Chemical indicators are frequently used to keep an eye on pollution levels, chemical contamination, and water safety. Chemical indicators provide rapid, reliable, and cost-effective detection of sterilants, chemicals, and pollutants, which is crucial for maintaining safe water supplies and minimizing environmental hazards. Additionally, rising awareness about public health and environmental sustainability is driving the adoption of these indicators in water treatment plants, laboratories, and environmental testing facilities.

Regional Insights

How Big is the North America Chemical Indicators Market Size?

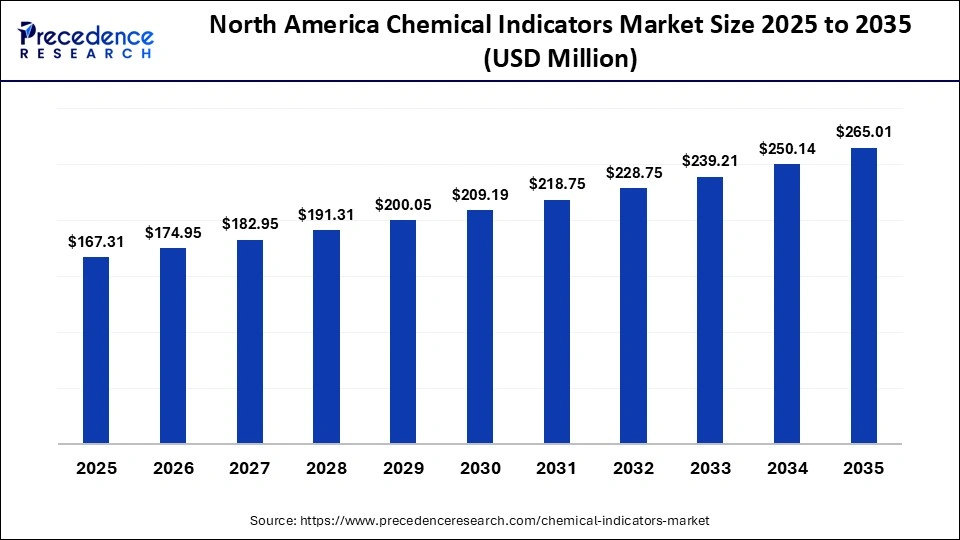

The North America chemical indicators market size is estimated at USD 167.31 million in 2025 and is projected to reach approximately USD 265.01 million by 2035, with a 4.71% CAGR from 2026 to 2035.

What made North America the dominant region in the chemical indicators market?

North America dominated the chemical indicators market with a major revenue share of 38% in 2025 because of its sophisticated healthcare system and robust biotechnology and pharmaceutical industries. Significant R&D investments, strict regulatory frameworks, and widespread adoption of sterilization standards all contribute to regional dominance. The region's leadership in the market is also strengthened by the extensive use of chemical indicators in laboratories and healthcare settings.

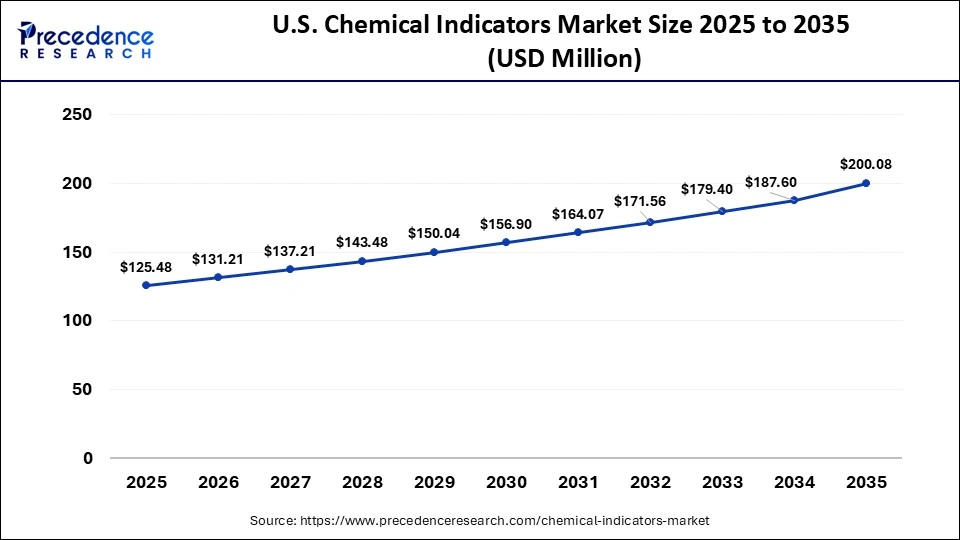

What is the Size of the U.S. Chemical Indicators Market?

The U.S. chemical indicators market size is calculated at USD 125.48 million in 2025 and is expected to reach nearly USD 200.08 million in 2035, accelerating at a strong CAGR of 4.78% between 2026 and 2035.

U.S. Chemical Indicators Market Trends

The market in the U.S. is driven by strict safety and sterilization regulations in the pharmaceutical and healthcare sectors. Chemical indicators are becoming increasingly necessary to guarantee process reliability due to the widespread use of advanced sterilization techniques like steam, ethylene oxide, and hydrogen peroxide. To ensure compliance and reduce contamination risks, leading hospitals and pharmaceutical companies favor single-use chemical indicators. The presence of a large number of industry participants and steady R&D investments supports the market expansion in the U.S.

What makes Asia Pacific the fastest-growing region in the chemical indicators market?

Asia Pacific is expected to grow at the fastest CAGR in the coming years, due to rapid industrialization and growing healthcare infrastructure. The demand for chemical indicators is rising due to increased investments in pharmaceuticals, environmental monitoring, and water quality testing. Regional market growth is also accelerated by rising awareness of infection control and regulatory advancements in emerging economies.

India Chemical Indicators Market Trends

India's chemical indicators market is witnessing rapid growth because of the growth of the pharmaceutical and healthcare industries. The growing number of hospitals and diagnostic facilities, along with growing awareness of sterilization safety are driving up demand. Chemical indicators are more widely available in urban and semi-urban areas thanks to affordable solutions and localized manufacturing options. Market adoption in India is being further supported by government initiatives to upgrade healthcare infrastructure as well as partnerships between domestic and foreign businesses.

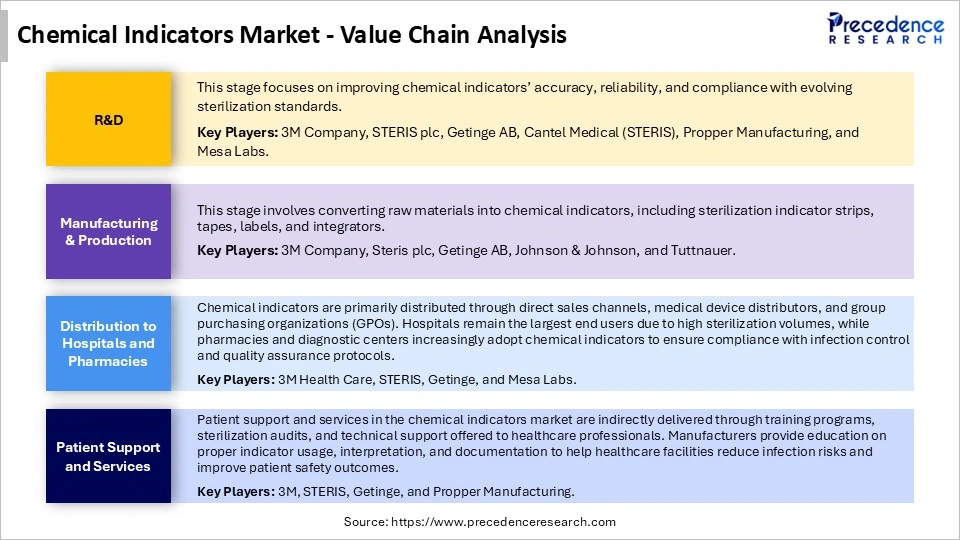

Chemical Indicators Market Value Chain Analysis

Who are the Major Players in the Global Chemical Indicators Market?

The major players in the chemical indicators market include 3M Company, STERIS Plc, Getinge, Mesa Laboratories, Inc, Solventum, ASP, Terragene S.A., Thermo Fisher Scientific, Inc, Crosstex International, Inc., Propper Manufacturing Co., Inc., gke GmbH, Tempil (LA-CO Industries, Inc.), NiGK Corporation, Riken Chemical Co., Ltd, ETIGAM B.V., and Tuttnauer.

Recent Developments

- In August 2025, Advanced Sterilization Products (ASP) announced the launch of its BIOTRACE Instant Read Steam System. This new system is noted for providing the fastest FDA-cleared steam biological indicator readout in the U.S. market, delivering results in seven seconds, a significant reduction from typical industry wait times of 20 minutes or more. (Source: https://finance.yahoo.com)

- In June 2025, Solventum announced the launch of its Attest Super Rapid VH2O2 Clear Challenge Pack. This solution is the first FDA-cleared preassembled test pack for routine monitoring across multiple sterilizer brands and models, integrating both a biological and chemical indicator.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Indicator Type

- pH & Acid-Base Indicators

- Oxidation/Redox Indicators

- Chromatographic Chemical Indicators

- Temperature/Thermochromic Indicators

- Sterilization Chemical Indicators

- Other Chemical Indicator

By Form

- Liquid Chemical Indicators

- Strip/Paper Chemical Indicators

- Tablet/Pellet Indicators

- Other Physical Forms

By Detection Method

- Visual/Colorimetric Indicators

- Instrumental Chemical Indicators

By Application

- Sterilization & Healthcare Monitoring

- Sterilizer indicator strips

- Hospital process checks

- Environmental & Water Quality Testing

- Food & Beverage Quality Control

- Industrial & Manufacturing Process Monitoring

- Pharmaceutical & Analytical Testing

- Other Applications

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting