What is China Medical Devices Market Size?

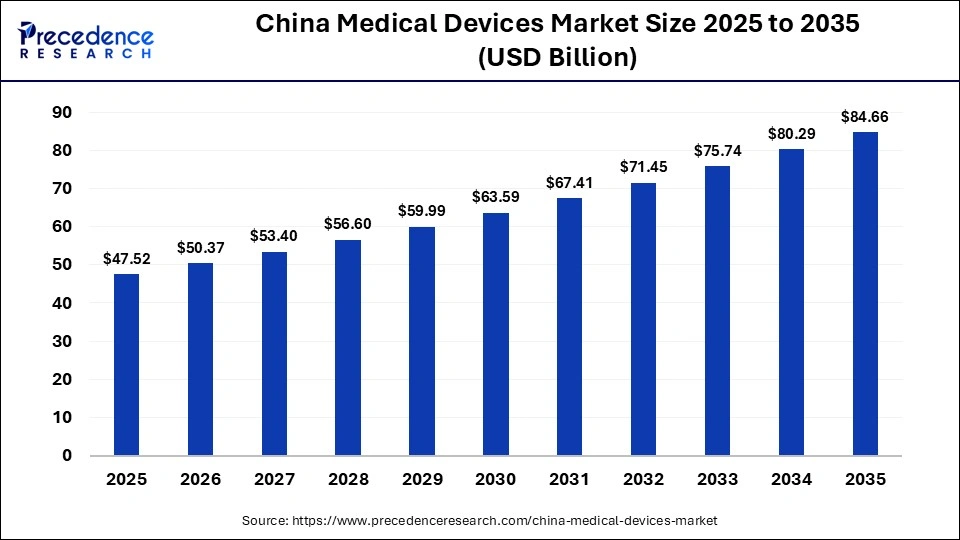

The china medical devices market size was calculated at USD 47.52 billion in 2025 and is predicted to increase from USD 50.37 billion in 2026 to approximately USD 84.66 billion by 2035, expanding at a CAGR of 5.94% from 2026 to 2035. The China medical devices market is rapidly expanding, driven by aging demographics, innovation, and increased healthcare spending.

Market Highlights

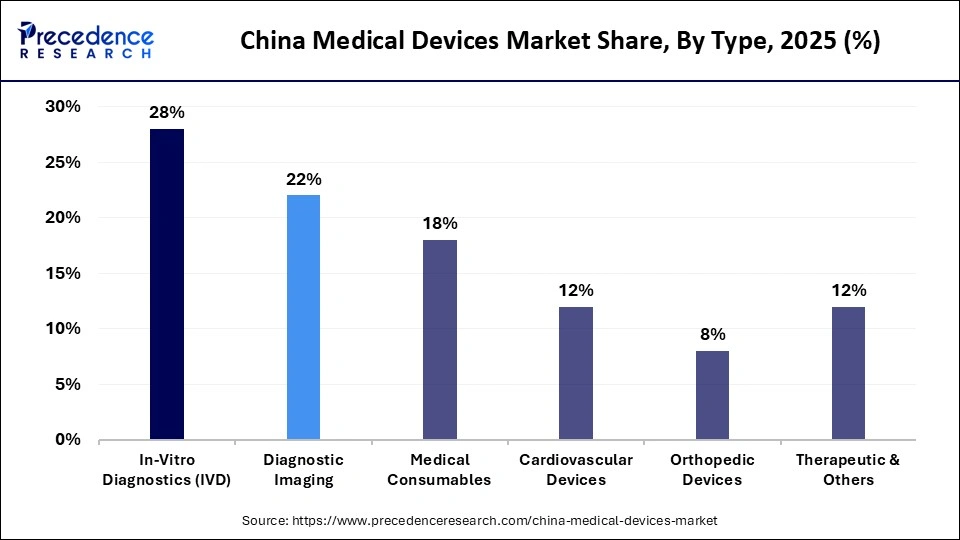

- By type, the in-vitro diagnostics segment led the market while holding the largest share of 28% in 2025.

- By type, the medical consumables segment is expected to grow at the fastest CAGR between 2026 and 2035.

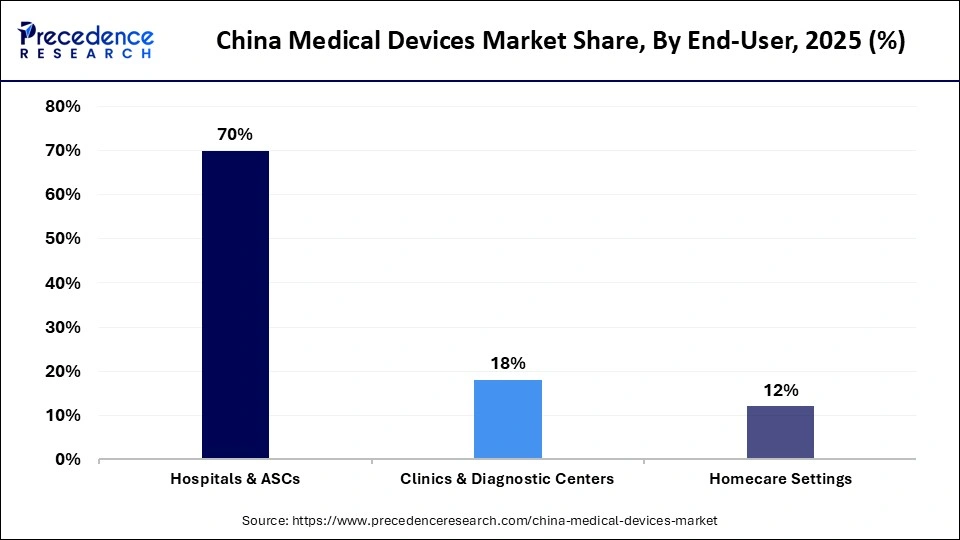

- By end-user, the hospitals & ASCs segment contributed the largest market share of 70% in 2025.

- By end-user, the clinics & diagnostic centers segment is expected to grow at a significant CAGR from 2026 to 2035.

Market Overview

The China medical devices market encompasses instruments, equipment, diagnostics, and related products used directly or indirectly in the diagnosis, treatment, monitoring, and prevention of disease, making it a foundational part of the country's healthcare system. China is also expanding its capabilities in adjacent biomanufacturing sectors such as viral vectors and plasmid DNA, which offer key advantages, including enabling efficient gene therapy, vaccine development, and advanced biologics production, supporting applications from regenerative medicine to cell and gene therapies with scalable, high-quality outputs. Ongoing technological innovation, growing R&D investment, rising healthcare demand from an aging population, supportive government policies promoting innovation and domestic manufacturing, and significant healthcare spending also drive the market.

Key Technological Shifts in the China Medical Devices Market

China's medical devices industry is undergoing rapid technological transformation, driven by national innovation policies, hospital infrastructure upgrades, and increasing clinical sophistication. Artificial intelligence is being widely integrated into diagnostic imaging, such as radiology and pathology, as well as clinical decision support systems and intelligent patient monitoring. Domestic manufacturers are increasingly specializing in algorithm-based image recognition, predictive analytics, and workflow automation, particularly across CT, MRI, ultrasound, and digital pathology platforms.

At the same time, the Internet of Medical Things (IoMT) is reshaping patient monitoring, chronic disease management, and hospital operations, with connected wearables, remote monitoring devices, and cloud-enabled hospital equipment becoming more commonplace. China is also accelerating its shift away from import dependence toward indigenous innovation in high-end medical equipment, including advanced imaging systems, surgical robots, and minimally invasive devices, while growing demand in interventional cardiology, orthopaedics, neurology, and oncology is fueling adoption of precision surgical tools, navigation systems, and additively manufactured customized implants.

Key Market Trends

- Import Substitution and Domestic Preference: Government-led procurement policies and centralized volume-based procurement (VBP) programs are accelerating the substitution of imported medical devices with high-quality domestic alternatives, particularly across mid-range and select segments of traditionally high-end products.

- Price Rationalization and Value-Based Purchasing: Ongoing pricing reforms are driving significant margin compression; however, this is being offset by rising procurement volumes. In response, manufacturers are shifting away from premium-led pricing strategies toward scale-driven profitability, lifecycle service models, and bundled solution offerings.

- Expansion Across Hospitals: Demand is increasingly extending beyond Tier III hospitals to county-level and community healthcare facilities, creating substantial growth opportunities for cost-effective, reliable, and easy-to-use medical devices tailored to lower-tier settings.

- Regulatory Maturation: China's regulatory framework is becoming more structured and aligned with international standards, raising market entry barriers while simultaneously improving product quality, strengthening clinical validation, and enhancing the credibility of domestically developed medical devices.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 47.52 Billion |

| Market Size in 2026 | USD 50.37 Billion |

| Market Size by 2035 | USD 84.66 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.94% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, End user |

Segment Insights

TypeInsights

Why Did the In-Vitro Diagnostics (IVD) Segment Dominate the China Medical Devices Market?

The in-vitro diagnostics segment dominated the China medical devices market by holding a share of 28% in 2025. This is mainly due to their central role in disease detection, monitoring, and treatment decision-making. The rising prevalence of chronic diseases, infectious conditions, and lifestyle-related disorders continues to drive sustained demand for diagnostic testing. The segment's dominance is also attributed to hospital expansion, public health screening programs, and growing awareness of early diagnosis. Domestic manufacturers have achieved significant scale in reagents, analyzers, and test kits, improving affordability and accessibility. Technological integration, particularly automation and digital reporting, has enhanced testing efficiency and throughput.

As diagnostics become embedded across the entire care pathway, IVD remains foundational to China's healthcare system. The policy-driven healthcare reforms have further strengthened the IVD segment by encouraging localized manufacturing and standardized testing. Centralized procurement has increased testing volumes, offsetting pricing pressure through scale advantages. Continuous innovation in molecular diagnostics, immunoassays, and point-of-care testing supports segment resilience. Hospitals increasingly rely on integrated diagnostic platforms to manage patient loads efficiently. Additionally, an aging population is boosting the demand for routine and preventive testing. Collectively, these factors ensure the IVD segment's sustained dominance in the market.

On the other hand, the medical consumables segment is expected to grow at the fastest CAGR during the forecast period, driven by high-volume applications, recurring demand, and expanded access to healthcare services. Essential products such as syringes, catheters, gloves, wound care materials, and other disposable items are critical across all levels of care. Rising hospitalization rates, surgical procedures, and outpatient visits are further accelerating growth, alongside an increased focus on infection control and single-use products. Domestic manufacturers benefit from strong production capabilities and cost competitiveness, making them well-positioned to meet demand. Overall, the consumables segment demonstrates steady, proportional growth in line with the expansion of healthcare utilization.

The expansion of county-level hospitals and primary healthcare facilities is a major driver of growth in the medical consumables segment. Centralized procurement policies favor suppliers capable of delivering large volumes while maintaining consistent quality standards. Advances in materials and technology have enhanced product safety, durability, and patient comfort, further boosting adoption. In addition, domestic manufacturers are leveraging cost advantages to supply both the local market and international exports, creating new growth opportunities. Stricter regulatory requirements are also driving improvements in quality, benefiting compliant manufacturers. These factors collectively position medical consumables as the fastest-growing segment in the market.

End-User Insights

What Made Hospitals & ASCs the Dominant Segment in the China Medical Devices Market?

In 2025, the hospitals & ASCs segment dominated the China medical devices market, accounting for the largest share of 70%. This dominance is driven by their central role in diagnosis, treatment, and surgical care. Tier-III hospitals, in particular, create strong demand for high-end imaging, diagnostic tools, and interventional equipment. The growing trend toward high-efficiency, high-throughput surgical models is also increasing the relevance of ASCs. These facilities require a wide range of medical devices, from capital-intensive equipment to consumables, supported by sustained government investment in hospital infrastructure. As a result, hospitals and ASCs remain the primary revenue generators in the China medical devices market.

On the other hand, the clinics & diagnostic centers segment is expected to grow at the fastest rate in the upcoming period, driven by rising demand for both specialized and high-throughput testing. The growing separation between diagnostic services and hospital facilities is creating opportunities for independent laboratories. Preventive healthcare initiatives, chronic disease monitoring, and population screening programs are further fueling expansion. These facilities prioritize automation, precision, and rapid turnaround times, with adoption accelerated by investments in advanced analyzers and digital systems. As the overall volume of testing increases, clinics and diagnostic centers are emerging as key growth drivers in China's medical devices market.

The scalable business models of diagnostic centers make them well-suited for centralized testing and standardized procedures. Demand for molecular, immunological, and point-of-care diagnostics is growing rapidly, driven by the need for efficient and accurate testing. Purchasing decisions in this segment are strongly influenced by cost-effectiveness and workflow optimization, while partnerships with hospitals and public health programs further boost utilization rates. Regulatory oversight is also enhancing the quality and credibility of independent laboratories. Collectively, these factors position clinics and diagnostic centers as the fastest-growing end-user segment in the market.

Country-Level Analysis

Yangtze River Delta

The area represents the most developed and innovative medical devices market in the East, supported by a robust healthcare infrastructure, high hospitalization density, and strong research and development capabilities. This area has a particularly high concentration of advanced medical technologies, including high-end imaging systems, in vitro diagnostics (IVD), digital health solutions, and AI-enabled devices, supporting market growth.

Greater Bay Area

The area serves as a key hub for technology-driven manufacturing, combining expertise in electronics, rapid design and prototyping, and strong private investment support. The region is highly competitive in areas such as smart medical devices, wearables, minimally invasive instruments, and AI-integrated healthcare platforms. Startups play a pivotal role in driving the speed of commercialization, accelerating innovation, and bringing new solutions to market faster than traditional players.

Beijing-Tianjin-Hebei

The area serves as the regulatory, policy, and clinical research hub of the medical devices industry. The region acts as a strategic base for regulatory preparation and national market access, supported by robust clinical trial infrastructure, government-backed innovation initiatives, and policy-driven procurement programs. Its concentration of regulatory expertise and research capabilities makes it a critical center for companies seeking compliance, validation, and entry into the broader China medical devices market.

Central China

Central China is emerging as a cost-effective hub for manufacturing and distribution in the medical devices sector, supported by improving healthcare infrastructure and favorable industrial regulations. Growth in the region is being driven by volume-based procurement initiatives, the expansion of county-level hospitals, and rising demand for mid-range and consumable medical equipment. This combination of factors positions central China as a strategic region for scaling production and reaching a broader population.

Western China

Western China is a rapidly growing market, with a primary focus on expanding access and developing basic medical infrastructure. Demand is concentrated in affordable diagnostics, patient monitoring devices, and essential medical equipment, while the market's prospects are being strengthened by increasing government investment and support. These dynamics make Western China an emerging opportunity for cost-effective medical device solutions and infrastructure development.

Value Chain Analysis

- R&D: Research & development focuses on translating clinical needs into safe, effective, and cost-optimized device designs, supported by rapid prototyping, clinician collaboration, and software-hardware integration.

- Clinical Trials and Regulatory Preparation: Clinical trials and regulatory preparation validate device safety, performance, and clinical relevance while ensuring compliance with evolving regulatory standards.

- Formulation and Final Dosage Preparation: Formulation and final dosage preparation involve optimizing material composition, device configuration, and functional performance to ensure consistency, stability, and usability. This stage translates validated designs into reproducible, market-ready products that meet quality, safety, and lifecycle requirements.

Who are the Major Players in the China Medical Devices?

The major players in the china medical devices areMindray (Shenzhen Mindray), United Imaging Healthcare, MicroPort Scientific, Lepu Medical, Yuwell (Yuyue Medical), Shandong Weigao Group, Shinva Medical, Edan Instruments, Sinocare , Biolight Medtech, Snibe Diagnostic, Blue Sail Medical, Autobio Diagnostics, Wandfu Biotech, and APT Medical

Recent Developments

- In November 2025, China's National Medical Products Administration (NMPA) issued an updated Good Manufacturing Practice (GMP) guideline for medical devices, replacing the previous 2014 framework with a more modern quality system. The new GMP, consisting of 15 chapters and 132 articles, will become effective on November 1, 2026, allowing manufacturers a one-year transition period to align their operations. It adds new sections on quality assurance, validation, verification, and contract manufacturing, highlighting stronger oversight of outsourced processes and lifecycle risk management. (Source: https://morulaa.com)

- In July 2025,Evonik has opened its largest medical device applications center in Shanghai, serving the Asian market. The facility focuses on R&D and processing of semi-finished components for bioresorbable medical devices, helping customers drive innovation in high-quality medical products. (Source:https://www.evonik.com)

Segments Covered in the Report

By Type

- In-Vitro Diagnostics (IVD)

- Diagnostic Imaging

- Medical Consumables

- Cardiovascular Devices

- Orthopedic Devices

- Therapeutic & Others

By End-User

- Hospitals & ASCs

- Clinics & Diagnostic Centers

- Homecare Settings

Get a Sample

Get a Sample

Table Of Content

Table Of Content