What is Circulating Biomarkers Market Size?

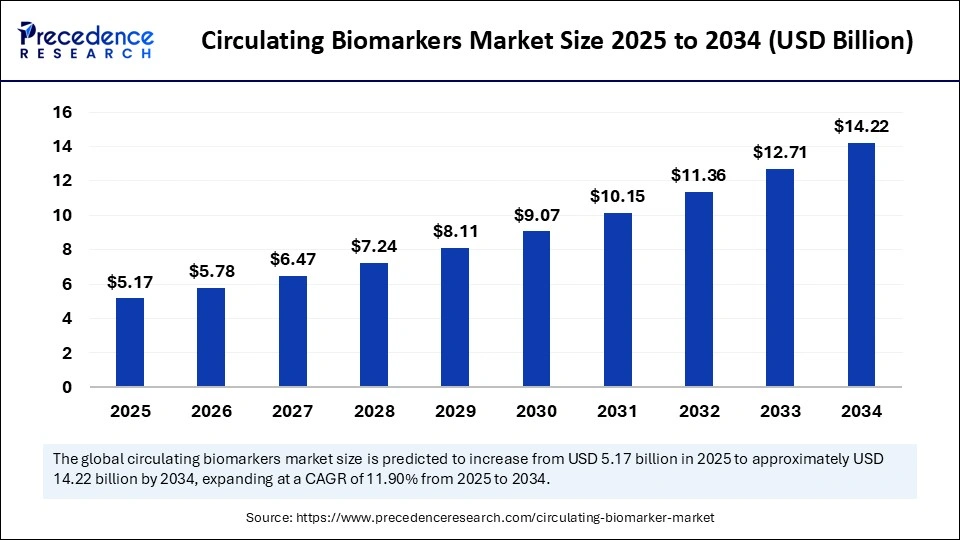

The global circulating biomarkers market size is calculated at USD 5.17 billion in 2025 and is predicted to increase from USD 5.78 billion in 2026 to approximately USD 14.22 billion by 2034, expanding at a CAGR of 11.90% from 2025 to 2034. The global circulating biomarkers market is experiencing robust growth, driven by the increasing prevalence of chronic disease diagnostics, growing demand for personalized medicine, a surge in regulatory approvals, increasing need for early & non-invasive detection methods, and rising investments in healthcare infrastructure. This report covers market trends, production volumes, technological developments, and competitive dynamics across North America, Europe, and APAC between 2025 and 2030."

Market Highlights

- North America held the largest share in the circulating biomarkers market in 2024.

- Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- By types, the circulating DNA segment accounted for the dominating share in 2024.

- By types, the circulating tumor cells segment is expected to witness significant growth during the forecast period in the circulating biomarkers market.

- By application, the hospital segment held the major market share in 2024.

- By application, the medical research center segment is projected to grow at a CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 5.17 Billion

- Market Size in 2026: USD 5.78 Billion

- Forecasted Market Size by 2034: USD 14.22 Billion

- CAGR (2025-2034): 11.90%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What Are Circulating Biomarkers?

The growing demand for early disease diagnosis, favorable regulatory frameworks, and the increasing incidence of chronic diseases worldwide are anticipated to boost the growth of the circulating biomarkers market during the forecast period. Circulating biomarkers refer to biological molecules commonly found in bodily fluids, primarily blood, urine, or saliva, that can provide valuable information to assess health and disease states. These biomarkers include Circulating tumor DNA (ctDNA), Circulating tumor cells (CTCs), Cell-free RNA (cfRNA), Extracellular vesicles (EVs), circulating proteins, and other metabolites. They offer a minimally invasive way for the early diagnosis, monitoring, and treatment of diseases for a wide range of chronic conditions, particularly cancer, as they enable non-invasive assessments and real-time monitoring of disease progression and therapy efficacy.

Circulating biomarkers market Outlook

- Industry Growth Overview: Between 2025 and 2030, the industry is expected to see accelerated growth, owing to the increasing prevalence of cancer and a range of chronic conditions, rising efforts for the development of advanced technologies for biomarker detection, rising research funding, and the increasing integration of artificial intelligence in data analysis.

- Global Expansion:Leading players are expanding their geographical presence. For instance, in April 2024, Câ‚‚N Diagnostics expands into Japan through Mediford Corporation's partnership with Precivity Blood Testing foralzheimer's disease and the brain research market. The agreement greatly increases access to Câ‚‚N Biopharma Clinical Research Services, which offers highly sensitive mass spectrometry-based identification, quantification, and monitoring of proteins, protein fragments (peptides), and other biomolecules implicated in human neurological diseases and overall brain health. (Source:https://c2n.com/news-releases)

- Major Investors:Several Private equity and strategic investors are actively participating in the market to strengthen its market presence. For instance, OncoHost has secured a USD 2.8 million grant from the EIC Transition Program, an initiative under the EU's broader Horizon Europe funding program, to develop a biomarker capable of predicting cancer patient responses to immunotherapy. Known as NeutroFlow, Israeli biotech OncoHost is leading the biomarker's development alongside consortium partners including Heidelberg University Hospital and the European Institute of Oncology (EIO). (Source: https://www.oncohost.com)

Key Technological Shifts in the Circulating Biomarkers Market

In the rapidly evolving technological landscape, Artificial intelligence emerges as a game-changer and holds potential for growth and innovation in the circulating biomarkers market by optimizing prognosis prediction, enabling more accurate diagnostics, optimizing personalized treatment strategies, and accelerating the analysis of complex data. AI algorithms can effectively analyze high-throughput data from sources such as next-generation sequencing and mass spectrometry to pinpoint novel biomarker signatures for chronic diseases. Artificial intelligence (AI) is increasingly utilized in biomarker analysis to process complex data and provide actionable clinical insights. AI-powered liquid biopsies can detect minimal residual disease (MRD) by analyzing ctDNA; the earlier detection allows for more timely changes in therapies.

- In December 2024, PanGIA Biotech, a pioneer in liquid biopsy technology, announced its first international partnership, collaborating with Canary Oncoceutics. This collaboration introduces the PanGIA Prostate Assay, the world's first AI-integrated urine-based liquid biopsy for prostate cancer detection, marking its commercial debut in India. (Source: https://www.businesswire.com)

Major trends in the circulating biomarkers market

- In September 2024, Researchers from DZNE in Göttingen, together with US experts from Boston University and the Indiana University School of Medicine, reported the potential of using microRNAs in blood to detect Alzheimer's disease and its preliminary stages. Their assessment is based on data from around 800 adults participating in a long-term study on Alzheimer's. Although the method used is not yet ready for clinical routine, these findings could pave the way for better early diagnosis

- In September 2025, Myriad Genetics, Inc. announced that The Lancet Oncology published a study highlighting the performance of Myriad's molecular residual disease (MRD) test, Precise MRD, in patients with oligometastatic clear-cell renal cell carcinoma (ccRCC). One of the goals of this study was to determine whether patients with oligometastatic ccRCC could benefit from incorporating ultrasensitive MRD testing into their care. The study also demonstrated that circulating tumor DNA (ctDNA) levels were associated with patients' response to metastasis-directed radiation therapy (MDT). (Source: https://investor.myriad.com)

- In January 2025, Lucence announced a decision by the Molecular Diagnostic Services (MolDX) Program allowing for Medicare coverage of its LiquidHALLMARK ctDNA/ctRNA liquid biopsy test. This decision marks a critical step toward making advanced, minimally invasive diagnostic solutions more accessible, enabling personalized cancer care for more U.S. patients. The MolDX Program, administered by Palmetto GBA, rigorously evaluates molecular tests for clinical utility, analytical validity, and medical necessity. The MolDX coverage decision signifies that LiquidHALLMARK ctDNA/ctRNA liquid biopsy testing meets standards for Medicare coverage and will promote broader access to this important tool.

- In November 2024, DELFI Diagnostics, Inc., a developer of accessible blood-based tests that deliver a new way to enhance cancer detection, selected Lahey Hospital & Medical Center (LHMC), part of Massachusetts-based Beth Israel Lahey Health (BILH), to utilize its FirstLook Lung cancer screening test to help improve screening rates in the greater Boston area. Lung cancer is the leading cause of cancer death both domestically and globally. Lahey will incorporate DELFI's blood-based lung cancer screening test in the primary care setting for patients eligible for lung cancer screening. Studies show lung cancer screening can reduce lung cancer death rates by 20% or more. (Source:https://www.prnewswire.com)

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.17 Billion |

| Market Size in 2026 | USD 5.78 Billion |

| Market Size by 2034 | USD 14.22 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.90% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Types Insights

Which Segment Is Dominating the Market by Types in the Circulating Biomarkers Market?

The circulating DNA segment dominated the global circulating biomarkers market in 2024. The growth of the segment is driven by the surge in liquid biopsies, the growing demand for precision medicine, and the increasing prevalence of cancer. Circulating tumor DNA (ctDNA) is widely adopted as a clinical biomarker. ctDNA is used for molecular characterization of solid tumors and has been introduced into clinical practice for conditions such as non-small cell lung cancer (NSCLC) and colorectal cancer (CRC).

On the other hand, the circulating tumor cells segment is expected to witness remarkable growth during the forecast period. Circulating tumor cells (CTCs) are a promising tool in cancer diagnosis. Moreover, the ongoing advancements in chip technology and increasing demand for noninvasive procedures are anticipated to propel the segment's growth over the forecast period.

Application Insights

What Causes the Hospital Segment to Dominate the Circulating Biomarkers Market?

The hospital segment held a dominant presence in the circulating biomarkers market in 2024. Hospitals extensively use these biomarkers for early detection, diagnosis, and monitoring of chronic diseases. The demand for circulating biomarkers is spurred by the liquid biopsies and the increasing importance of precision medicine and drug development. The wide adoption of liquid biopsy technologies is expanding the applications for circulating biomarkers for cancer detection and monitoring in hospitals.

On the other hand, the medical research center segment is expected to grow at a notable rate. Medical research centers are increasingly focusing on identifying and validating these biomarkers for various health conditions such as cancer, neurological, infectious, and autoimmune diseases. Moreover, medical research centers are collaborating with commercial entities to translate discoveries into commercial tests and therapies.

Regional Insights

What Made North America Dominate the Circulating Biomarkers Market in 2024?

In 2024, North America held a dominant presence in the market. This region holds a strong position in circulating biomarkers, with the presence of thriving innovation companies, high healthcare spending, a surge in regulatory approvals, growing demand for detection methods, rising advancements in liquid biopsy and high-throughput technologies, significant R&D investment, and favorable government policies. The increasing prevalence of cancer, autoimmune diseases, infectious diseases, and neurodegenerative diseases like Alzheimer's Disease, Parkinson's Disease, and others, is expected to accelerate the market's revenue during the forecast period. Moreover, the greater R&D spending by major players and the rising government funding for innovative therapies are likely to boost the expansion of the circulating biomarkers market in the region. Several researchers are increasingly focused on developing miniaturized devices that can rapidly and accurately detect and analyze circulating biomarkers.

How is the United States Contributing to North American Dominance in the Circulating Biomarkers Space?

The United States is a major contributor to the growth of the circulating biomarkers market. The presence of modern research institutions and hospitals in the country. The country has a well-established healthcare infrastructure, increasing investment in advanced therapies, rising cases of cancer, growing demand for personalized medicine, rapid advancements in omics technologies, high per capita healthcare expenditure, expanding applications of circulating biomarkers, and increasing regulatory approvals. Several companies are engaging in partnerships and securing regulatory approvals to bolster their regional position.

In May 2024, Mercy BioAnalytics, Inc., a leader in extracellular vesicle-based liquid biopsy for early cancer detection, received Breakthrough Device Designation from the FDA for its Mercy Halo Ovarian Cancer Screening Test, intended for use in asymptomatic, postmenopausal women. On the other hand, the Asia Pacific region is expected to experience the fastest growth during the forecast period. The market in the Asia Pacific is expanding steadily, driven by developing healthcare infrastructure, increasing need for non-invasive detection methods, surging R&D investments, increasing burden of cancer, and growing focus on personalized medicine.

Several key players in the market are strategically adopting initiatives such as mergers & acquisitions to strengthen their market presence. The market is witnessing rapid advancements in exosome technologies are anticipated to propel the growth of the circulating biomarkers market in the region. Such factors are paving the way for circulating biomarkers for more effective diagnostics and targeted treatments in the region.

Country-Level Investments & Trends in the Circulating Biomarkers Market:

In October 2025, the Trump administration has upped the budget for the National Cancer Institute's (NCI's) “Childhood Cancer Data Initiative” from $50 million to $100 million. The program launched under President Donald Trump's first term and is designed to collect, generate, and analyze childhood cancer data. The budget boost is supposed to help advance the development of better diagnostics, treatments, and prevention strategies. (Source:https://www.fiercebiotech.com)

In September 2025, Myriad Genetics, a leader in molecular diagnostic testing and precision medicine, and SOPHiA GENETICS, an AI technology company transforming precision medicine, announced a strategic collaboration to develop and provide pharmaceutical companies with an innovative global liquid biopsy companion diagnostic (CDx) test. This partnership will leverage Myriad's advanced laboratory capabilities in the U.S. to support global testing for clinical trials and SOPHiA GENETICS' broad, decentralized network of more than 800 connected institutions in more than 70 countries for global test deployment. (Source:

https://investor.myriad.com)

- In June 2025, Oxford Cancer Biomarkers Ltd (OCB), a leader in molecular precision cancer diagnostic tests, announced a new partnership with Mira Precision Health Inc to advance OCB's proprietary ToxNav test in the USA. (Source: https://www.prnewswire.com)

Major Breakthroughs in the circulating biomarkers market

Date Breakthrough

- In July 2024 Guardant Health, Inc., a leading precision oncology company, announced that the U.S. Food and Drug Administration (FDA) has approved the company's Shield blood test for colorectal cancer (CRC) screening in adults aged 45 and older who are at average risk for the disease. (Source:https://investors.guardanthealth.com)

- In May 2025,The U.S. Food and Drug Administration cleared for marketing the first in vitro diagnostic device that tests blood to aid in diagnosing Alzheimer's disease. The Lumipulse G pTau217/ß-Amyloid 1-42 Plasma Ratio is for the early detection of amyloid plaques associated with Alzheimer's disease in adult patients, aged 55 years and older, exhibiting signs and symptoms of the disease. (Source: https://www.fda.gov)

- In May 2024 Mercy BioAnalytics, Inc., a pioneer in extracellular vesicle-based liquid biopsy for the early detection of cancer, has been granted Breakthrough Device Designation from the U.S. Food and Drug Administration (FDA) for the use of its Mercy Halo Ovarian Cancer Screening Test in asymptomatic, postmenopausal women. The Breakthrough Devices program is intended to help give patients more timely access to innovative tests like Mercy Halo that provide more effective diagnoses for life-threatening diseases. (Source: https://mercybio.com)

- In October 2024 Exact Sciences Corp., a provider of cancer screening and diagnostic tests, announced the U.S. Food and Drug Administration (FDA) approved the Cologuard Plus test, the company's next-generation multitarget stool DNA test. The Cologuard Plus test is now approved for adults ages 45 and older who are at average risk for colorectal cancer (CRC). The Cologuard Plus test showed 95% cancer sensitivity and 43% sensitivity for advanced precancerous lesions with 94% specificity, based on findings from the pivotal BLUE-C study.

Top Key Players in the Circulating Biomarkers Market & Their Offerings:

- Abbott Laboratories: Abbott Laboratories is a global leader in diagnostics and molecular testing, offering advanced platforms for oncology, infectious disease, and genetic screening. The company's innovations in liquid biopsy and molecular diagnostics provide precise, minimally invasive testing solutions. Abbott's continuous investment in automation and data integration strengthens its position in personalized medicine and early disease detection.

- Becton, Dickinson and Company: Becton, Dickinson and Company (BD) specializes in molecular diagnostics and laboratory automation, delivering reliable systems for sample preparation, amplification, and analysis. Its BD MAX and BD COR platforms are widely used in clinical laboratories for high-throughput testing. BD's focus on diagnostic accuracy and workflow efficiency supports its leadership in healthcare innovation.

- GE Healthcare: GE Healthcare integrates advanced imaging and molecular diagnostics technologies to improve disease detection and monitoring. Its AI-enhanced platforms support precision diagnostics and personalized treatment planning. GE continues to expand its molecular diagnostics capabilities through partnerships and R&D in oncology and genomic testing.

- Epigenomics AG: Epigenomics AG is a molecular diagnostics company focused on developing blood-based epigenetic tests for cancer detection. Its Epi proColon test is one of the first FDA-approved liquid biopsy assays for colorectal cancer screening. The company leverages DNA methylation biomarkers to create non-invasive diagnostics that enable early disease detection.

- Agilent Technologies:Agilent Technologies provides analytical instruments and molecular diagnostic solutions used in genomics, proteomics, and clinical research. Its technologies support biomarker discovery, precision oncology, and genetic testing. Agilent's focus on high-sensitivity molecular analysis makes it a key enabler of advanced diagnostic research.

- Biocept: Biocept specializes in liquid biopsy diagnostics for cancer detection and monitoring. Its Target Selector platform enables the capture and analysis of circulating tumor cells (CTCs) and cell-free DNA from blood samples, offering insights into tumor evolution and treatment response.

- Affymetrix: Affymetrix, now part of Thermo Fisher Scientific, is known for its microarray and genomic profiling technologies used in biomarker discovery and molecular diagnostics. Its tools play a critical role in understanding genetic variation and disease pathways.

- Fluxion Biosciences: Fluxion Biosciences develops cutting-edge microfluidic systems for liquid biopsy, cell analysis, and single-cell genomics. Its IsoFlux and BioFlux systems enable high-sensitivity detection of rare cells and molecular biomarkers, supporting cancer research and precision diagnostics.

Recent Developments:

- In January 2025, Guardant Health, Inc., a leading precision oncology company, announced that Palmetto GBA, a Medicare administrative contractor that administers the Molecular Diagnostics Services program (MolDX), granted coverage for the Guardant Reveal test to monitor for disease recurrence in patients with colorectal cancer (CRC) following curative intent therapy. Guardant Reveal, which runs on Guardant's Smart Liquid Biopsy platform, is a blood test that uses epigenomic (methylation) analysis to detect circulating tumor DNA (ctDNA), a marker of minimal residual disease (MRD), to predict cancer recurrence, helping to guide clinical decisions after surgery or chemotherapy. (Source:https://investors.guardanthealth.com)

- In October 2024, GeneCentric Therapeutics, a company making precision medicine more precise through RNA-based diagnostics, announced the launch of its EXpressCTSM liquid biopsy platform that allows the value of tissue RNA expression and epigenomics to be realized in liquid biopsy. EXpressCT expands the application of the company's pipeline of RNA-based gene expression signatures and diagnostic tests to cell-free DNA (cfDNA) liquid biopsy samples, including blood and urine. (Source: https://www.businesswire.com)

Segments Covered in the Report

By Types

- Circulating DNA

- Circulating Tumor Cells

- Others

By Application

- Hospital

- Medical Research Center

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting