What is Circulating Tumor DNA (ctDNA) Market Size?

The global circulating tumor DNA (ctDNA) market size is calculated at USD 7.96 billion in 2025 and is predicted to increase from USD 9.14 billion in 2026 to approximately USD 27.67 billion by 2034, expanding at a CAGR of 14.85% from 2025 to 2034. Growth in precision oncology, demand for targeted therapies, and advancements in next-generation sequencing (NGS) technology are driving the growth of the circulating tumor DNA (ctDNA) market.

Market Highlights

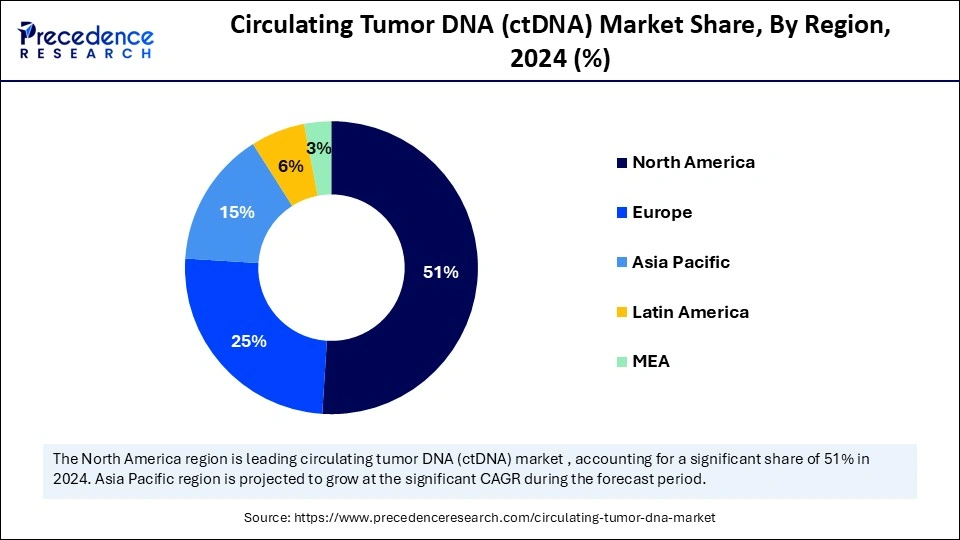

- North America dominated the circulating tumor DNA (ctDNA) market with a 51% share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By technology, the next-generation sequencing (NGS) segment contributed the largest market share of 48% in 2024.

- By technology, the PCR-based assays segment is expected to grow at a significant CAGR over the forecast period.

- By application, the cancer diagnosis and screening segment led the market while holding the largest share of 53% in 2024.

- By application, the minimal residual disease (MRD) monitoring segment is expected to grow at the fastest CAGR from 2025 to 2034.

- By sample test, the blood segment led the market while holding the largest share of 82% in 2024.

- By sample test, the urine segment is expected to grow at a significant CAGR between 2025 and 2034.

- By end-user, the clinical laboratories & diagnostic centers segment led the market while holding the largest share of 51% in 2024.

- By end-user, the biopharma companies segment is expected to grow at the highest CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 7.96 Billion

- Market Size in 2026: USD 9.14 Billion

- Forecasted Market Size by 2034: USD 27.67 Billion

- CAGR (2025-2034): 14.85%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is Circulating Tumor DNA (ctDNA)?

The circulating tumor DNA (ctDNA) market is experiencing rapid growth due to its role in revolutionizing cancer diagnosis and treatment. Circulating tumor DNA (ctDNA) refers to small fragments of DNA shed from tumor cells into the bloodstream. It serves as a non-invasive biomarker for detecting genetic alterations associated with cancer, enabling early diagnosis, monitoring treatment efficacy, and assessing minimal residual disease. ctDNA analysis is a pivotal component of liquid biopsy technologies.

The circulating tumor DNA (ctDNA) is crucial in applications of early cancer detection, treatment monitoring, and minimal residual disease (MRD) detection. The prevalence of lung cancer has increased across the globe, and the rapid utilization of leading technologies like next-generation sequencing (NGS). The increased use of liquid biopsies for cancer detection, treatment selection, and monitoring is fueling innovations in circulating tumor DNA.

In May 2025, a liquid biopsy using circulating tumor DNA (ctDNA) was shown to detect colorectal cancer recurrence significantly earlier than imaging, as presented at the American Association for Cancer Research (AACR) Annual Meeting 2025 in Chicago. This biopsy uses ctDNA signal appears up to 416 days before clinical detection. The result is the ongoing VICTORI study demonstrated personalized blood-based assays to transform post-surgical monitoring in patients with rectal colorectal cancer.

Market Overview

- Market Growth Overview: The circulating tumor DNA (ctDNA) market is likely to grow at a significant rate between 2025 and 2034 due to the increased cancer prevalence, rising demand for non-invasive diagnostics, and advancements in sequencing technologies. With the rising cancer incidence and mortality rates, the demand for personalized medicine is rising, supporting market growth.

- Global Expansion: The rising prevalence of cancer is driving demand for early detection, therapeutic monitoring, and personalized medicine, factors that are accelerating the adoption of circulating tumor DNA (ctDNA) technologies across key regions such as North America, Asia Pacific, and Europe. The broader adoption of liquid biopsy technologies across emerging healthcare systems, particularly in regions investing in advanced cancer diagnostics, contributes to the growth of the market. As awareness, infrastructure, and access to precision oncology grow globally, demand for non-invasive, real-time cancer monitoring through ctDNA analysis is expected to rise significantly.

- Major Investors: Major capital venture firms, such as large pharmaceutical companies and major technology industry players, are investing heavily in circulating tumor DNA (ctDNA). Pharmaceutical companies provide funding for the development of liquid biopsy diagnostics for various cancer-related applications, such as early detection, minimal residual disease (MRD) testing, and treatment monitoring. Companies like Exact Sciences Corporation, Bio-Rad Laboratories, Inc., Guardant Health, and Merarini Silicon Biosystems are major investors in circulating tumor DNA (ctDNA). Major market players like Illumina Inc., GRAIL Inc., and Guardant Health are investing significantly to expand ctDNA's global reach and accessibility.

Key Technological Shifts in the Circulating Tumor DNA (ctDNA) Industry

The circulating tumor DNA (ctDNA) is undergoing a significant technological shift due to increased advancements in sequencing technologies and rising demand for minimally invasive diagnostics. Innovations and the development of cutting-edge technologies, like Digital PCR (dPCR), are enhancing accuracy and sensitivity for early detection and monitoring of cancer treatment response. Researchers are focusing on the development of innovative liquid biopsy technologies enabling a non-invasive alternative to traditional tissue biopsies. Additionally, the integration of Artificial Intelligence and Machine Learning into ctDNA analysis improves data interpretation and enhances diagnostic accuracy.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.96 Billion |

| Market Size in 2026 | USD 9.14 Billion |

| Market Size by 2034 | USD 27.67 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.85% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Technology,Panel Size, Apllication,End-User Industry and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Technology Insights

Which Technology Lead the Circulating Tumor DNA (ctDNA) Market in 2024?

The next-generation sequencing (NGS) segment led the market, holding approximately 48% share in 2024. This is mainly due to its ability to analyze multiple genetic variations simultaneously. Next-generation sequencing is a sophisticated genomic tool that enables clinicians to detect minimal residual disease and monitor treatment response more effectively. The increased prevalence of cancer and advancements in genomic technologies are contributing to this growth. The growing demand for non-invasive diagnostics is enabling innovations and developments of cutting-edge technologies, including next-generation sequencing. Technological advancements like sequencing accuracy, scalability, and read length are driving the utilization of NGS in healthcare infrastructure.

The PCR-based assays segment is expected to grow at the fastest CAGR over the projection period, driven by their high sensitivity and accuracy. The PCR-based assays offer cost-effectiveness and FDA approvals for companion diagnostics targeting specific gene panels. The PCR-based assays enable access to specific segments. The ability of PCR-based assays to offer accurate and efficient detection of known methylation markers, for precise identification of cancer biomarkers, fuels innovations and adoption of this technology.

Application Insights

Why Did the Cancer Diagnosis and Screening Segment Dominate the Market in 2024?

The cancer diagnosis and screening segment dominated the circulating tumor DNA (ctDNA) market with about 53% share in 2024. This is mainly due to the critical role of ctDNA in early cancer detection and personalized treatment planning. Circulating tumor DNA (ctDNA) enables early detection of cancer, helps to timely interventions, and enhances patient outcomes. The ability of ctDNA to enhance the accuracy of screening tests for various cancer types, particularly in developing effective screening methods for ovarian and pancreatic cancer, makes it an ideal technology for early cancer detection and diagnostics. The ctDNA technique enabled tailored treatment plans for individual patients, reduced healthcare costs, and enhanced treatment efficacy.

The minimal residual disease (MRD) monitoring segment is likely to grow at the fastest CAGR over the forecast period. Minimal residual disease (MRD) monitoring leverages an ultra-sensitive ctDNA test for detecting trace amounts of cancer cells post-treatment. The ctDNA helps to expand clinical application beyond advanced disease and boosts personalized and dynamic treatment strategies for earlier-stage cancers. The liquid biopsy technologies, like ctDNA testing, provide minimally invasive alternatives to conventional tissue biopsies.

Sample Test Insights

What Made Blood the Dominant Segment in the Circulating Tumor DNA (ctDNA) Market?

The blood segment dominated the market, holding about an 82% share in 2024, due to its ability to transform cancer diagnostics from invasive tissue biopsies to non-invasive biopsies. Blood samples are a rich source of circulating tumor cells and DNA, making them ideal for ctDNA analysis. Blood samples provide a high concentration of CTCs in an author's bio specimen. The increased demand for non-invasive treatment solutions has boosted the preference for blood samples among both patients and healthcare providers. The ability to easily collect and process blood samples helps reduce turnaround time and increase the efficiency of results.

The urine segment is expected to grow at the highest CAGR between 2025 and 2034, driven by its ability to detect specific biomarkers are using certain research contexts. Urine samples, as a type of mixed liquid biopsy, are more convenient, accessible, and repeatable for a wide range of cancers. Urological cancers are the primary focus of urine samples for the detection of the disease. Urine samples are utilized for the detection of biomarkers, like urinary cell-free DNA or circulating tumor cell DNA.

End-User Insights

Which End-User Commands the Largest Share in the Market?

The clinical laboratories & diagnostic centers segment held about 51% share of the circulating tumor DNA (ctDNA) market in 2024, driven by their high testing capacity, validated clinical utility, and rapid adoption of advanced genomic technologies. The growing demand for non-invasive diagnostic tests, coupled with advancements in technologies such as next-generation sequencing (NGS), is fueling this segment's growth. These facilities are well-positioned to handle clinical validation and large-scale data generation, making them ideal for the development and implementation of ctDNA-based innovations.

The biopharma companies segment is expected to expand at the fastest CAGR in the upcoming period due to their increased reliance on genomic data for accelerating drug discovery, precision medicine initiatives, and development. The biopharma companies are investing heavily in significant R&D, which is crucial for clinical trials and strategic partnership activities. These companies are increasing their collaboration with research and university institutes to boost research and development capabilities. The heavy funding provided by the biopharma companies is fueling innovations in diagnostic technology to enhance the sensitivity and reliability of ctDNA detection methods.

Regional Insights

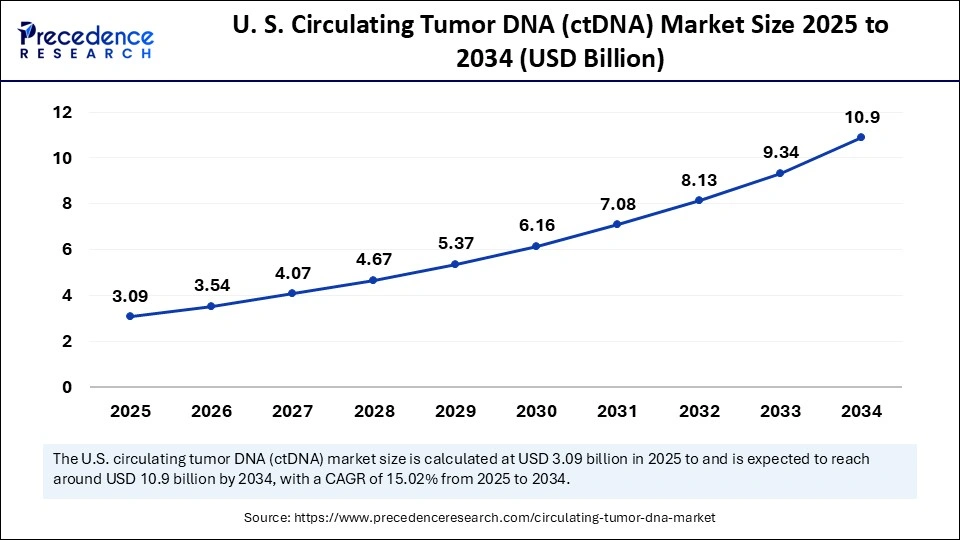

U.S. Circulating Tumor DNA (ctDNA) Market Size and Growth 2025 to 2034

The U.S. circulating tumor DNA (ctDNA) market size is exhibited at USD 3.09 billion in 2025 and is projected to be worth around USD 10.90 billion by 2034, growing at a CAGR of 15.02% from 2025 to 2034

What Made North America the Dominant Region in the Circulating Tumor DNA (ctDNA) Market?

North America dominated the circulating tumor DNA (ctDNA) market while capturing about 51% share in 2024. This is mainly due to its well-established healthcare infrastructure, high cancer prevalence, and growing demand for personalized therapies. Ongoing advancements aimed at improving detection sensitivity and specificity, through technologies like microfluidics and AI-enabled platforms, are enhancing market accessibility and clinical utility. Recent studies highlighting ctDNA's predictive value in treatment response, particularly in colorectal cancer where ctDNA positivity informs adjuvant therapy decisions, are fueling adoption. Additionally, pharmaceutical companies are investing heavily in R&D, particularly in molecular diagnostics, to integrate ctDNA testing into clinical workflows. Favorable reimbursement frameworks further support the broad clinical uptake of ctDNA assays across the region.

U.S. Circulating Tumor DNA (ctDNA) Market Trends

The U.S. is a major contributor to the market in North America due to its strong emphasis on early cancer detection and precision treatment monitoring. Significant investments in R&D have led to the development of multi-cancer early detection (MCED) tests, such as the one by Exact Sciences, which has shown promising results. Additionally, increasing investments in digital PCR (dPCR), next-generation sequencing (NGS), and companion diagnostics, supported by regulatory backing, are accelerating market growth. The U.S. remains at the forefront of technological innovation and adoption in ctDNA testing.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to expand at the fastest rate in the market, driven by improvements in healthcare infrastructure, rising cancer incidence rates, and supportive government initiatives. The region is witnessing increasing adoption of non-invasive liquid biopsy techniques, with technological advancements in ctDNA detection, such as those led by Gene Solutions in Singapore, playing a pivotal role. A growing focus on precision oncology and the rising emphasis on early cancer detection are accelerating innovation and boosting market adoption. Additionally, increased awareness among both patients and healthcare professionals is fueling rapid market expansion.

Japan: Strengthening Market Reach Through Multi-Cancer Early Detection

Japan is a key contributor to the Asia Pacific circulating tumor DNA (ctDNA) market, supported by its robust healthcare infrastructure and strong focus on multi-cancer early detection (MCED) research. The country is advancing in liquid biopsy capabilities, with ctDNA playing a critical role in early diagnosis strategies. The Japanese government's integration of precision diagnostics, such as liquid biopsies, into national cancer screening programs is significantly boosting innovation and market penetration. The presence of leading players like Sysmex Corp., Bio-Techne Corp., and ICON PLC further supports Japan's expanding role in the ctDNA space.

What Potentiates the Growth of the European Circulating Tumor DNA (ctDNA) Market?

Europe is expected to grow at a notable rate in the upcoming period, driven by its advanced healthcare infrastructure, strong government support, and the rising prevalence of cancer. The region is making significant strides in precision medicine, with advancements showcased at leading oncology congresses such as ESMO and ASCO. There is an increasing focus on developing novel assays for minimal residual disease (MRD) monitoring, which is accelerating market adoption. Furthermore, collaborative efforts between pharmaceutical companies and academic research institutions, along with faster regulatory pathways for innovative diagnostics and therapies, are contributing to the market's maturity and expansion across the region.

Strong Pharmaceutical Capabilities: To Boost the German Market

Germany leads the market in Europe, underpinned by its strong pharmaceutical and biotech ecosystem, substantial R&D investments, and supportive government initiatives. The country is a hub for oncology innovation, demonstrated by events such as the European Society for Medical Oncology (ESMO) held in Berlin, where emerging ctDNA technologies like NeoGenomics' RaDaR ST were presented for applications in therapy response and molecular residual disease (MRD) monitoring. Further, significant investments from leading players like Roche and NeoGenomics are enabling the advancement of ctDNA-based monitoring and drug development, reinforcing Germany's central role in the region's ctDNA landscape.

Circulating Tumor DNA (ctDNA) Market � Value Chain Analysis

- R&D

Ongoing R&D efforts are focused on advancing liquid biopsy technologies to improve cancer detection, monitoring, and treatment personalization. Circulating tumor DNA (ctDNA) analysis, a non-invasive method, is a core component of this approach, enabling the detection of tumor-derived genetic material in the bloodstream and other body fluids.

Key Player: Illumina, Inc., Thermo Fisher Scientific Inc., QIAGEN, Bio-Rad Laboratories, Inc.

- Clinical Trials and Regulatory Approvals

Clinical trials are essential to validate the clinical utility of ctDNA, particularly in evaluating treatment efficacy, identifying patient eligibility for targeted therapies, and monitoring minimal residual disease (MRD) to predict cancer recurrence. Regulatory approvals are increasingly supporting the integration of ctDNA into routine clinical workflows.

Key Players: Natera, Guardant Health, Illumina, Foundation Medicine.

- Patient Support and Service Infrastructure

Leading companies are prioritizing patient-centric services to improve the experience around ctDNA testing. These services include educational resources, emotional support, and logistical assistance, helping patients navigate their treatment journey. ctDNA-based liquid biopsies are gaining traction as a less invasive alternative for cancer detection and monitoring.

Key Players: Natera, Guardant Health, ArcherDX, Foundation Medicine.

Top Companies in the Circulating Tumor DNA (ctDNA) Market

|

Tier |

Companies |

Rationale / Roles |

Estimated Cumulative Share |

|

Tier I � Major Players |

Guardant Health; Roche Diagnostics; Illumina; Thermo Fisher Scientific; Natera |

These firms are repeatedly cited in multiple market reports as leading in technologies, assays, instruments, and test volume in ctDNA. They have strong R&D, commercial infrastructure, regulatory approvals, and often dominate the high-end, high-volume segment of ctDNA testing. |

~45% |

|

Tier II � Established Players |

QIAGEN; Foundation Medicine; Bio‑Rad Laboratories; Sysmex Corporation; GRAIL |

These companies have strong positions, particularly in sample prep, companion diagnostics, bioinformatics, and regional markets. They are major competitors to Tier I, though generally somewhat smaller or more specialized in capability or geographic reach. |

~30% |

|

Tier III � Emerging / Niche Players |

Biocept; Freenome; Personal Genome Diagnostics; Myriad Genetics; Invitae; others |

These are newer entrants or specialized firms focusing on particular niches (e.g. early detection, tissue‑of‑origin profiling, methylation assays, etc.), or firms with smaller geographic penetration or lower test volumes. Collectively they contribute meaningful revenue but are not yet as dominant. |

~20‑25% |

Recent Developments

- In September 2025, the International Association for the Study of Lung Cancer held its 2025 World Conference on Lung Cancer (WCLC). A novel study presented at this conference showed that monitoring circulating tumor DNA (ctDNA) could refine and personalize consolidation immunotherapy for patients with limited-stage small cell lung cancer (LS-SCLC).

- In April 2025, the VICTORI study was presented at the American Association for Cancer Research AACR) Annual Meeting 2025 demonstrated an ultrasensitive circulating tumor DNA (ctDNA)-based liquid biopsy assay. This Assay is designed to detect recurrence before signs for imaging and offering prognostic value within one month after surgery in patients with colorectal cancer (CRC). (Source:https://www.aacr.org)

Exclusive Analysis on the Circulating Tumor DNA (ctDNA) Market

The global circulating tumor DNA (ctDNA) market is poised at a pivotal inflection point, driven by a confluence of translational oncology breakthroughs, increasing adoption of minimally invasive diagnostics, and the paradigm shift toward precision medicine. As oncologic care accelerates its migration from generalized treatment to biomarker-driven therapeutics, ctDNA emerges as a cornerstone modality, offering unparalleled utility in early detection, molecular stratification, therapeutic monitoring, and residual disease assessment.

The market exhibits robust headroom for expansion, underpinned by advancing liquid biopsy platforms, surging oncologic burden globally, and the growing clinical acceptance of ctDNA as a surrogate endpoint in therapeutic trials. Significant investment flows from pharma, biotech, and academic collaborations are catalyzing the integration of ctDNA into clinical decision pathways, particularly in tumor-agnostic settings and longitudinal patient management. Technological convergence, especially with NGS, dPCR, and AI-assisted analytics, further amplifies sensitivity and specificity thresholds, reinforcing the commercial viability of ctDNA assays.

From an opportunity lens, emerging markets such as Asia Pacific present fertile ground due to rising healthcare infrastructure, government-led precision medicine programs, and growing awareness around early cancer detection. Meanwhile, the push for decentralized testing models and patient-centric care is spawning opportunities for scalable, point-of-care ctDNA solutions, marking a shift from centralized genomic hubs to distributed, real-time oncology diagnostics.

Despite regulatory complexities and reimbursement variability, the trajectory of the ctDNA market remains strongly positive, with sustained CAGR potential across clinical, companion diagnostic, and pharmaceutical R&D verticals. Stakeholders with capabilities in assay sensitivity, bioinformatics interpretation, and multiplex panel development are particularly well-positioned to capture asymmetric upside in this rapidly maturing ecosystem.

Segment Covered in the Report

By Technology

- Next-Generation Sequencing (NGS)

- PCR-based Assays

- Digital PCR (dPCR)

By Application

- Cancer Diagnosis and Screening

- Minimal Residual Disease (MRD) Monitoring

- Treatment Monitoring

By Sample Type

- Blood

- Urine

- Others (Cerebrospinal Fluid, etc.)

By End-User

- Clinical Laboratories & Diagnostic Centers

- Biopharma Companies

- Hospitals

- Research Institutions

By Region

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content