Clean Label Mold Inhibitors Market Size and Forecast 2054 to 2034

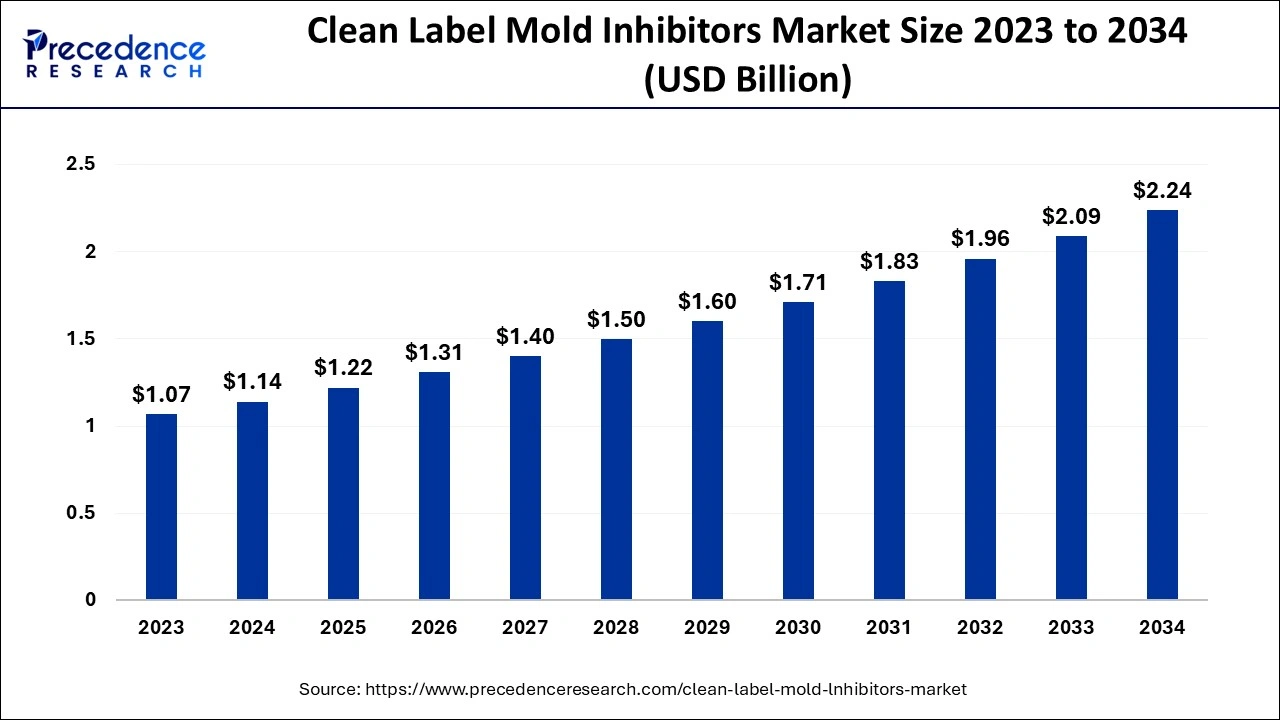

The global clean label mold inhibitors market size was estimated at USD 1.14 billion in 2024 and is predicted to increase from USD 1.22 billion in 2025 to approximately USD 2.24 billion by 2034, expanding at a CAGR of 6.99% from 2025 to 2034. The rising need to meet consumer demands for natural and sustainable ingredients while also prolonging shelf life and enhancing product safety is fueling the growth of the clean label mold inhibitors market

Clean Label Mold Inhibitors Market Key Takeaways

- In terms of revenue, the global clean label mold inhibitors market was valued at USD 1.14 billion in 2024.

- It is projected to reach USD 2.24billion by 2034.

- The market is expected to grow at a CAGR of 6.99% from 2025 to 2034

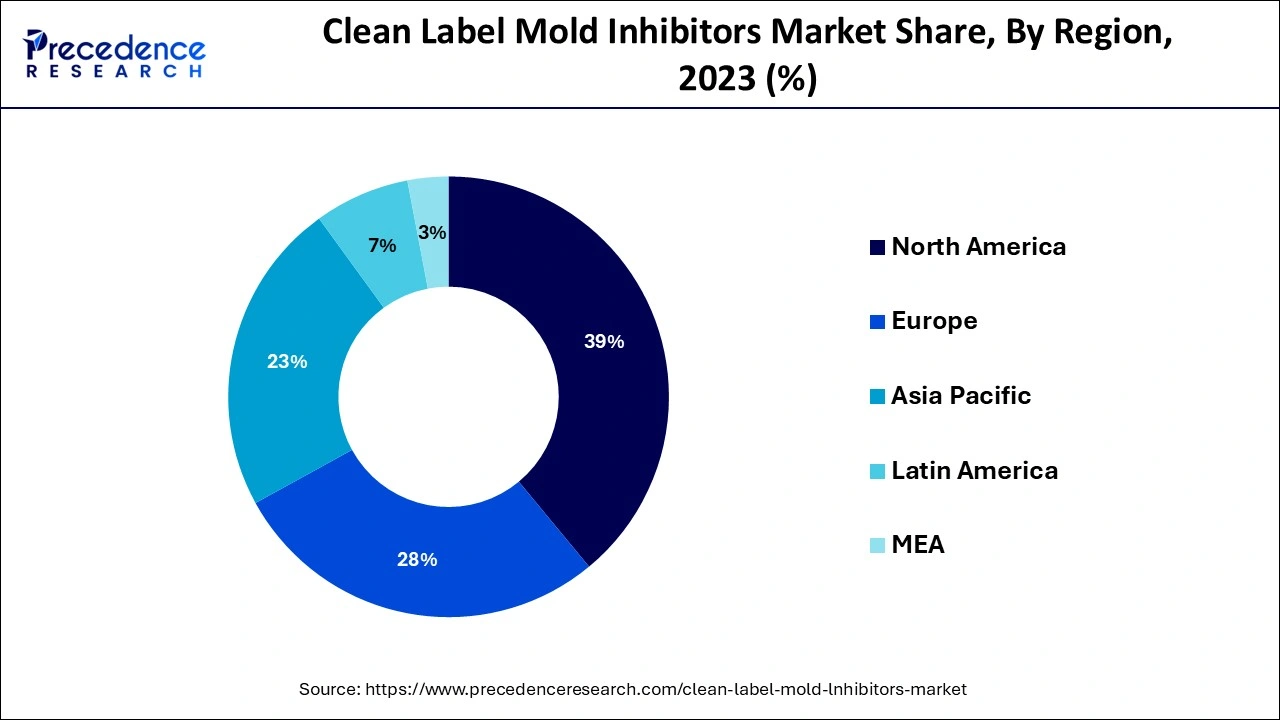

- North America dominated the global market with the largest market share of 39% in 2024.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

- By ingredient, the starch segment contributed the highest market share of 23% in 2024.

- By ingredient, the fermented flour segment is projected to grow at a notable CAGR during the forecast period.

- By end-use, the pharmaceuticals segment captured the biggest market share of 33% in 2024.

- By end-use, the animal feed segment is projected to expand at a solid CAGR from 2025 to 2034.

How is Artificial Intelligence (AI) changing the Clean Label Mold Inhibitors Market?

Companies in the clean label mold inhibitors market are adopting technologies such as artificial intelligence (AI) and machine learning (ML) in their manufacturing processes. The resultant framework of data-driven decision-making helps industry players to analyze data, sort out the drawbacks, and increase operational efficiency. Additionally, AI-integrated marketing campaigns are made more personalized by utilizing buying patterns and preferences, which increases brand commitment. Predictive analytics within manufacturing plants and premises help track the downtime of the machine and increase the lifespan of the equipment, thus cutting down the costs involved.

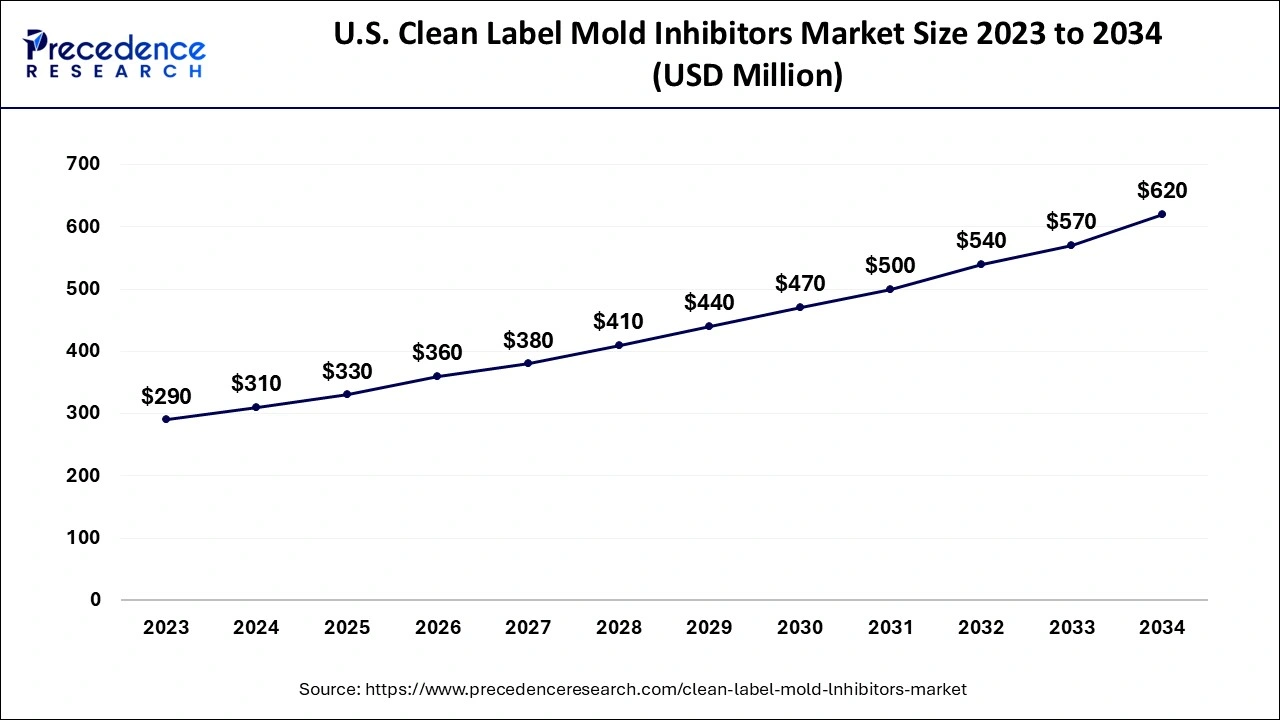

U.S. Clean Label Mold Inhibitors Market Size and Growth 2025 to 2034

The U.S. clean label mold inhibitors market size was evaluated at USD 310 million in 2024 and is projected to be worth around USD 620 million by 2034, growing at a CAGR of 7.18% from 2025 to 2034.

North America dominated the clean label mold inhibitors market in 2024. The dominance of this region can be attributed to the stringent regulations of food safety and the strong presence of major companies in this region. The key players in the market include BASF SE, Dow Chemical Company, Archer Daniels Midland Company, DuPont, and Eastman Chemical Company. Along with that, the FDA and USDA ensure food companies, restaurants, and retail stores take their own actions to respond to consumer demand for clean-label products.

Asia Pacific is projected to host the fastest-growing clean label mold inhibitors market in the coming years. The growth of this region is witnessed due to the adoption of clean-label products in companies to fulfil consumer demand. This clean-label trend goes beyond food and beverages to personal care and household products.

Market Overview

Clean-label mold inhibitors are natural preservatives that control mold growth and promote a longer shelf life of food. The clean label mold inhibitors market is a crucial part of the development of new products in the bakery industry. Fast-moving bakers are replacing chemical preservatives such as calcium propionate and sorbates with natural mold inhibitors.

There are two main categories of clean label mold inhibitors based on their functions: first is pH reduction in dough or batter, and the other is disruption of mold cellular membranes and processes. Category one is the pH reduction, which includes vinegar, prune/plum juice concentrate, raisin juice concentrate, culture whey products, and cultured flour. The second category includes cinnamon, cloves, and natamycin. The versatile application makes clean label mold inhibitor more popular with its seamless integration into bakery products such as packaged bread buns and rolls, packed sliced bread, enriched bread, and many more.

Clean Label Mold Inhibitors Market Growth Factors

- Improve product performance: Natural food preservatives such as antioxidants and antimicrobials extend shelf life and enhance product quality and safety.

- Competitive distinction: Following clean label regulation makes the brand stand out from the rest of the market competitors. The rising consumer demand for clean-label products also increases the products' fortification with natural solutions, gaining an edge in the competition.

- Sustainability: Several natural food production solutions are obtained from renewable sources, which is attributed to more sustainable supply chains. The benefits of offering safe and high-quality products along with supporting ecological well-being resonate strongly with current eco-aware consumers.

- Regulatory compliance: The regulatory standards and requirements of clean-label mold inhibitors make it easier for consumers to navigate preventing foodborne illness and ensure public health.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.24 Billion |

| Market Size in 2024 | USD 1.14 Billion |

| Market Size in 2025 | USD 1.22 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.99% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Ingredient, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Market Dynamics

Driver

Transparency with Ingredients

The growing consumer demand for transparent and natural ingredients is driving the clean label mold inhibitors market. Utilization of clean-label mold inhibitors meets consumer demand without compromising the food quality. Conscious consumers choose to incorporate food and beverages with minimal ingredients that are natural, recognizable, and perceived as better for them. Increased transparency provides an opportunity for value-added benefits.

For instance, if the producer is able to grow better grains with greater nutrient density using sustainable and safe practices, this reflects on consumers with a willingness to pay a significant value for transparency. The hand-in-hand action with growers, suppliers, and customers ensures that the entire supply chain operates in harmony.

- A survey conducted by the researchers of the Food Industry Association states that 76% of more than three-quarters of the surveyed grocery shoppers desire transparency about ingredients and how food is made.

Restraint

Manufacturing complexities

Manufacturers in the clean label mold inhibitors market struggle with switching to natural, clean-label products and maintaining profits. Incorporation of clean labels has similar challenges as the traditional way of doing things in the food industry such as issues with price volatility, refrigeration and storage costs, shorter shelf lives, new equipment needed, and sourcing. Moreover, along with the reformulation product, the flavour and consistency should be as the original recipe with the new ingredients.

However, to deal with this problem, food manufacturers have raised their standards to maintain the competition. Food manufacturers are fulfilling consumers' demands by removing artificial ingredients and chemical modifiers from their applications and replacing them with clean and natural alternatives.

Opportunity

Transforming how consumers perceive and purchase food products

The emerging trend of clean label mold inhibitors market in the food industry is revolutionizing with increasing awareness of the health and environmental impacts of artificial additives, preservatives, and overly processed ingredients. According to the survey, 75% of global consumers are willing to pay extra for products that promise clean labels, such as free from artificial colors, flavors, and preservatives. Additionally, this has proven to be beneficial for environmental sustainability. By integrating clean labels, the companies are reducing the environmental footprint and aligning with the growing consumer demand for sustainability.

Ingredient insights

The starch segment contributed the highest share of the clean label mold inhibitors market in 2024. The dominance of this segment is observed due to the excellent built-in property of starch to absorb moisture. As mold needs moisture to grow and start, it does a perfect job of absorbing the moisture present, which restrains the growth of mold. For food packaging purposes, starch-citrate films are used, which are extremely efficient in inhibiting microbial growth in cake and bread compared to commercial food wrappers. The potential application of this starch-citrate film as an antimicrobial and eco-friendly bio-based food packaging application is expected to replace petrochemical-based food packaging materials.

The fermented flour segment is projected to grow at a notable rate in the clean label mold inhibitors market during the forecast period. The growth of this segment is noticed due to its utilization in a wide variety of products such as bread, baked goods, processed meat, and many more. The application of fermented flour as a preservative is observed in bakery products, animal feed, calcium supplements, and many more. It is powdered and processed with advanced technology, ensuring a high-quality final product. The fermented flours offer excellent results when used in poultry, veterinary, fish, piggery, and other livestock feed.

End-use Insights

The pharmaceuticals segment dominated the clean label mold inhibitors market in 2024. The dominance of this segment is noticed due to the particular attention from the FDA in ensuring mold growth isolation in environmental monitoring and product testing in the pharmaceutical industry. The companies are anticipating these FDA concerns, especially concerning the regulatory inspections and institute remediation when mold is found in their products and manufacturing facilities to protect patient safety.

The animal feed segment is projected to expand at a solid CAGR in the clean label mold inhibitors market over the studied period. The growth of this segment is driven by the produced qualitative feed free from mold. The moisture in the air gets trapped on the surface area of feed which promotes the growth of mold. The development of mold destroys the important nutrients in the feed and has adverse effects on the performance of the animal.

Clean Label Mold Inhibitors Market Companies

- Kemin Industries Inc.

- Corbion

- Ara Partners

- BioVeritas

- Ribus, Inc.

- Lesaffre Corporation

- Puratos Group

- Kerry Group plc

- Cargill

- Tate & Lyle PLC

- J&K Ingredients

Latest Announcements by Industry Leaders

- In October 2024, Courtney Schwartz, marketing director of Kemin Food Technologies, commented, “The Kemin Shield V solution is a unique mold inhibitor that combines the preservation properties of buffered vinegar with a botanical extract that is a source of sorbic acid; she further adds, “This blend works to slow down the development of mold, ensuring product freshness over time.”

Recent Developments

- In July 2024, BDF Natural Ingredients, a Biotech company specializing in innovative and technological additives for the Food and Nutrition & Cosmetics industries, launched a revolutionary natural mold inhibitor derived from fermented wheat flour, specifically tailored for bakery products.

- In April 2024, MILLBIO, a highly innovative, clean-label, all-natural solution, now offers X-Tra Guard gluten-free rowan berry extract, a potassium sorbate alternative for mold inhibition. The ingredient adds shelf life to a product without sacrificing flavor or texture, according to the company.

Segments Covered in the Report

By Ingredient

- Stretch

- Vinegar

- Fermented Flour

- Whey

- Others

By End-use

- Food and Beverages

- Animal Feed

- Pharmaceuticals

- Personal Care and Cosmetics

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting