What is the Cloud Database Market Size?

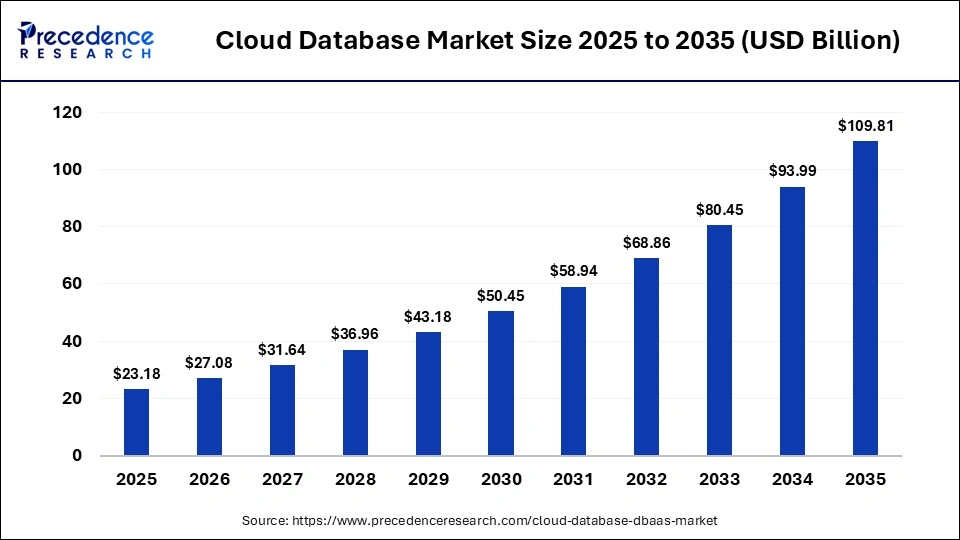

The global cloud database market size was calculated at USD 23.18 billion in 2025 and is predicted to increase from USD 27.08 billion in 2026 to approximately USD 109.81 billion by 2035, expanding at a CAGR of 16.83% from 2026 to 2035. This market is growing due to increasing demand for scalable, flexible, and cost-efficient data storage and management solutions across enterprises.

Market Highlights

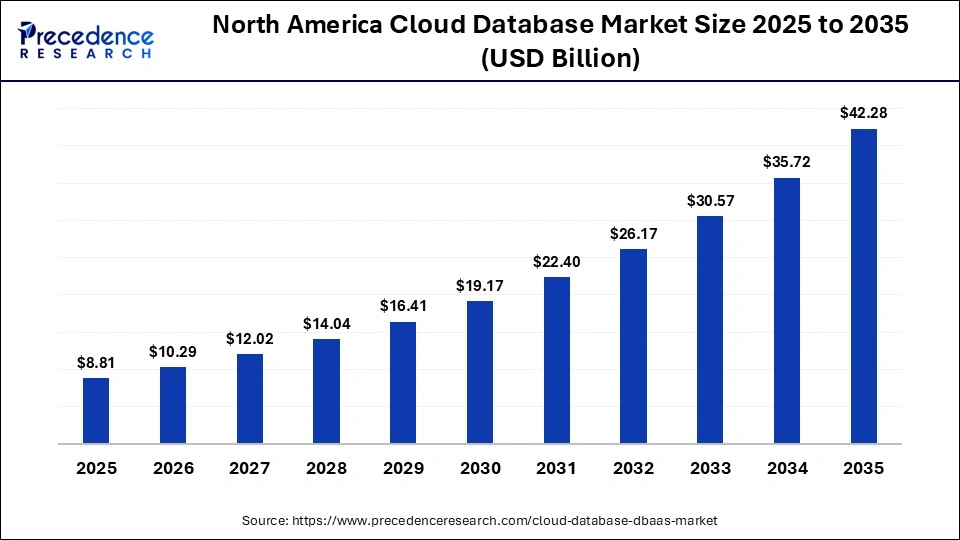

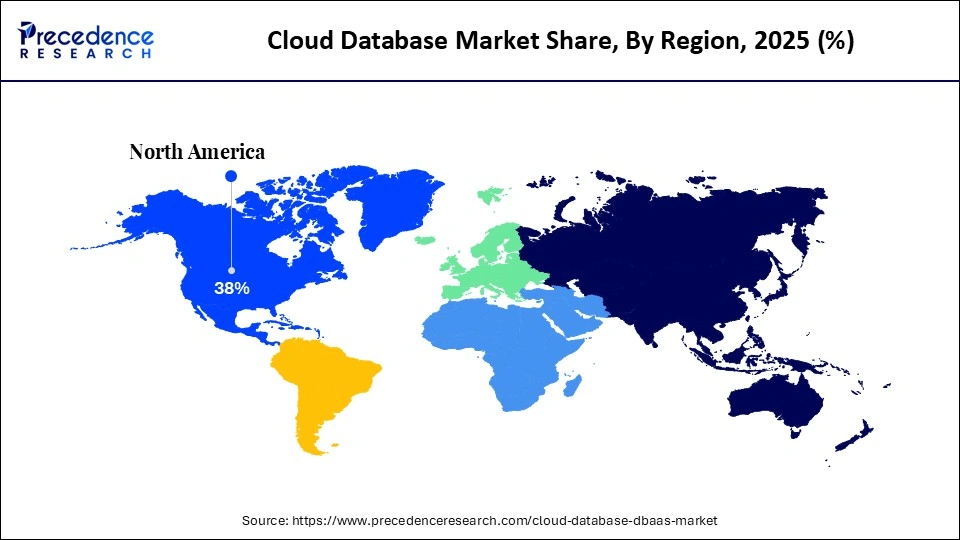

- North America dominated the global cloud database market with the largest market share of 38% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

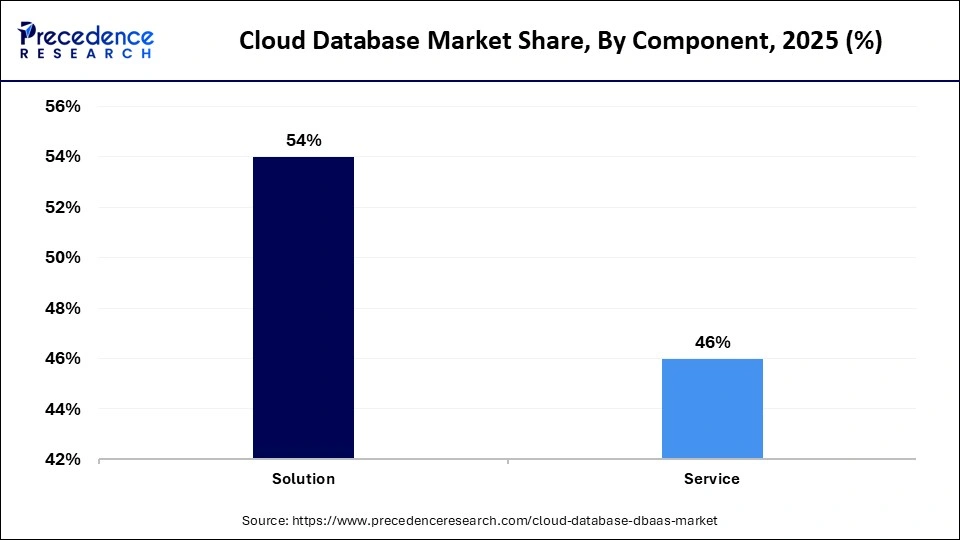

- By component, the solution segment held the biggest market share of 54% in 2025.

- By component, the service segment is expected to expand at the fastest CAGR between 2026 and 2035.

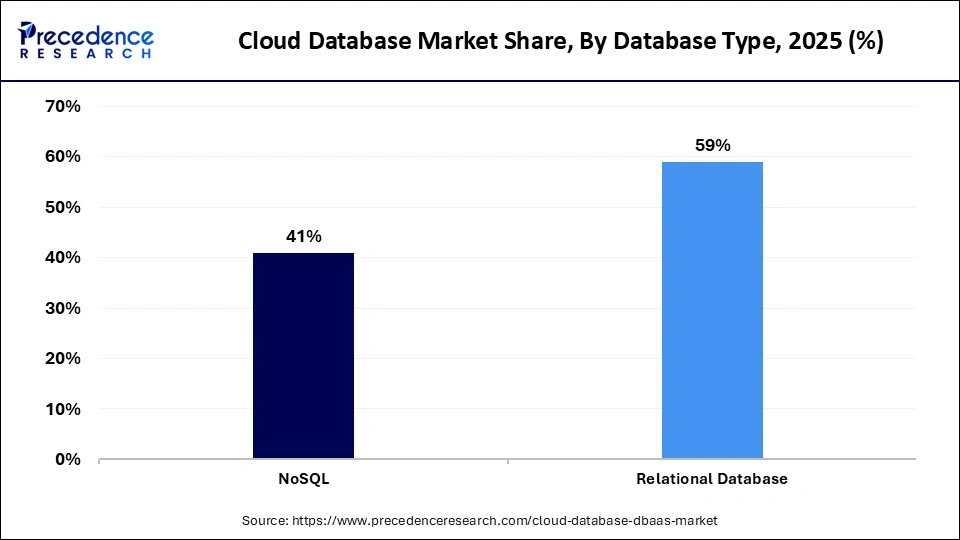

- By database type, the relational database segment contributed the highest market share of 59% in 2025.

- By database type, the NoSQL segment is expected to grow at a robust CAGR between 2026 and 2035.

- By deployment, the hybrid segment contributed the biggest market share of 48% in 2025.

- By deployment, the private segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By enterprise size, the large enterprises segment accounted for the biggest market share of 53% in 2025.

- By enterprise size, the small and medium-sized enterprises segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By end-use, the IT & telecommunications segment contributed the largest market share of 18% in 2025.

- By end-use, the automotive segment is expected to grow at the fastest CAGR between 2026 and 2035.

Why is the Cloud Database Market Gaining Momentum?

The cloud database market is growing rapidly as scalable, adaptable, and economic data management solutions are replacing on-premises infrastructure in organizations. Demand for relational and non-relational cloud databases is rising due to the growing use of cloud native apps, big data analytics, and AI-driven workloads because of their high availability, real-time access, and lower IT maintenance requirements. Cloud-based solutions are also becoming increasingly popular among businesses. As a result, they are crucial to contemporary digital ecosystems in a variety of sectors, including BFSI, retail, healthcare, and IT services.

What are the Major Trends Influencing the Market?

- Rapid adoption of cloud-native databases designed specifically for distributed and microservices-based architectures.

- Growing demand for multi-cloud and hybrid database deployments to avoid vendor lock-in and improve resilience.

- Rising use of AI- and ML-driven analytics directly within cloud databases for real-time insights.

- Strong shift toward NoSQL and NewSQL databases to handle unstructured data and high-velocity workloads.

- Increasing focus on database automation (DBaaS) to reduce operational complexity and management costs.

- Enhanced security and compliance features are being embedded to support regulated industries like BFSI and healthcare.

- Expansion of serverless cloud databases, enabling automatic scaling and pay-as-you-go pricing models.

- Integration with data lakes and data warehouses for unified analytics and data management.

- Growing adoption by SMEs due to lower upfront costs and flexible subscription models.

- Rising demand for high availability and disaster recovery solutions to support business continuity.

Unlocking the Future Potential of the Market

- Expansion of AI and machine learning workloads is expected to drive the demand for high-performance, cloud-native databases.

- Growing adoption among SMEs and startups due to low upfront costs and scalable pricing models is expected to contribute to the market.

- Rising needs for real-time analytics and decision-making, especially in e-commerce, fintech, and digital services.

- Increasing demand for multi-cloud and hybrid cloud strategies is creating opportunities for interoperable database platforms.

- Growth of serverless and fully managed database services (DBaaS) to reduce operational burden for enterprises.

- Rising data volumes from IoT and edge computing require scalable and resilient cloud database solutions.

- Untapped potential in emerging markets is driven by rapid digitalization and cloud adoption initiatives.

- Stricter data security and compliance requirements, encouraging advanced encryption, governance, and monitoring features.

How is Artificial Intelligence Influencing the Cloud Database Market?

Artificial intelligence (AI) is transforming the cloud database market by enabling intelligent data management, automated optimization, and real-time analytics. AI-driven features lower operating costs and the need for human intervention by enabling cloud databases to automatically adjust performance forecast workloads and maximize storage utilization. Additionally, cloud databases with AI-powered analytics enable businesses to quickly extract actionable insights supporting data-intensive applications in a variety of industries. The need for scalable AI-ready cloud databases is anticipated to grow dramatically as businesses use AI and machine learning models more frequently.

Key Markets Trends

- Automation and Smart Management: Cloud databases increasingly use automated tools for backup, scaling, and performance optimization, reducing manual workload and improving reliability.

- AI and Machine Learning Integration: AI helps optimize queries, predict workload needs, and detect anomalies, enhancing efficiency and decision-making.

- Advanced Database Types: Growth of NoSQL, NewSQL, and multi-model databases allows handling unstructured and real-time data more effectively.

- Integration with Analytics and BI: Cloud databases now seamlessly connect with analytics, AI, and business intelligence platforms for faster insights.

- Security and Compliance Enhancements: Advanced encryption, identity management, and regulatory compliance tools protect data while enabling global accessibility.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 23.18Billion |

| Market Size in 2026 | USD 27.08 Billion |

| Market Size by 2035 | USD 109.81Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 16.83% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Component, Database Type , Deployment, Enterprise Size, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

What Made Solution the Leading Segment in the Cloud Database Market?

The solution segment led the market with a major revenue share in 2025, as businesses mainly rely on software for analytics automation and database management. Scalability, smooth integration with current IT infrastructure, and cutting-edge features like disaster recovery and automated backups are all offered by cloud solutions. Businesses favor solutions that guarantee high performance and dependability while making data management and storage easier. Strong vendor support and ongoing database platform innovation are factors contributing to the segment's dominance.

The service segment is expected to grow at a rapid pace in the market during the forecast period. This is mainly due to the rising demand for managed services that handle security updates, maintenance, and operational management, allowing businesses to focus on their core competencies. Additionally, the rise of hybrid and multi-cloud deployments, AI-powered monitoring, and automation is further increasing reliance on cloud database services. Flexible pricing models, including pay-as-you-go options, have also made service-based solutions more attractive, contributing to segmental growth.

Database Insights

Why Did the Relational Database Segment Dominate the Cloud Database Market?

The relational database segment dominated the market while holding the largest share in 2025 due to its capacity to effectively manage structured data and support vital business applications like ERP, CRM, and finance. Large-scale businesses favor relational databases because of their strong data integrity, sophisticated query capabilities, and regulatory compliance. The dependability and maturity of relational database solutions for mission-critical operations are also valued by enterprises.

The NoSQL segment is growing rapidly in the market, driven by the growing demand for adaptable schema-less databases capable of managing semi-structured and unstructured data. For real-time analytics IoT applications and social media platforms that need scalability and fast processing, NoSQL solutions are essential. Cloud native NoSQL databases facilitate globally dispersed applications and lower latency. Growing use of big data, AI, and machine learning technologies is further boosting the need for agile data management, contributing to segmental growth.

Deployment Insights

What Made Hybrid the Dominant Segment in the Cloud Database Market?

The hybrid segment dominated the market in 2025, as businesses integrate both cloud and on-premises resources to maximize efficiency, security, and performance. Hybrid deployments enable businesses to maintain control over sensitive data. In industries that need high availability and regulatory compliance, this strategy is frequently chosen. The predominance of hybrid deployments is further reinforced by integration with current IT infrastructure and flexibility for workload migration.

The private cloud segment is expected to grow at the fastest CAGR in the upcoming period, driven by the growing emphasis of enterprises on regulatory compliance, customization, and data security. In addition to enabling advanced analytics and AI-driven database management, private clouds offer isolated environments for crucial workloads. Large businesses and SMEs looking for high-performance, secure, and controlled infrastructure are the main drivers of adoption. To provide flexible, scalable, and affordable options, vendors are offering private-public cloud solutions.

Enterprise Size Insights

Why Did the Large Enterprises Segment Dominate the Cloud Database Market?

The large enterprises segment dominated the market in 2025 due to their large IT budgets to implement all database solutions that facilitate international operations and corporate-wide digital projects. These businesses manage enormous amounts of transactional and analytical data, necessitating advanced security features, disaster recovery, and high reliability. Strong vendor relationships, specialized solutions, and round-the-clock assistance are advantageous for large businesses. Their dominance is also strengthened due to their high adoption of multiple clouds and long-term digital transformation tactics.

The small & medium-sized enterprises segment is growing rapidly as cloud databases facilitate quick scalability and reduce entry costs. To execute data-driven strategies without making significant upfront investments, SME are embracing DBaaS and cloud solutions. Easy deployment, low IT staffing needs, and flexible pay-as-you-go models are important growth factors. SME uses cloud databases to enhance decision-making skills, customer insights, and operational efficiency.

End-Use Insights

Why Did the IT & Telecommunications Segment Dominate the Cloud Database Market?

The IT & telecommunications segment dominated the market by capturing the largest share in 2025. This is because of the high adoption of digital services, real-time analytics, and cloud-based solutions in the industry. Cloud databases are heavily used by telecom operators for customer experience management, network monitoring, and billing, and by IT firms for software development and SaaS applications. Dominance of this segment is further reinforced by ongoing innovation, the need for global IT infrastructure, and scalability requirements.

The automotive segment is expected to grow rapidly in the coming years due to the increasing integration of connected vehicle technologies, telematics, and autonomous driving systems, all of which generate massive volumes of data requiring real-time processing and storage. Cloud databases enable automakers to manage, analyze, and share this data efficiently across manufacturing, R&D, and in-vehicle applications. Additionally, the rise of smart mobility solutions, electric vehicles, and predictive maintenance systems is driving demand for scalable, high-performance database solutions.

Region Insights

How Big is the North America Cloud Database Market Size?

The North America cloud database market size is estimated at USD 8.81 billion in 2025 and is projected to reach approximately USD 42.28 billion by 2035, with a 16.98% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Cloud Database Market?

North America dominated the cloud database market by holding the largest share in 2025. This is because of the presence of leading cloud service providers, high levels of digital adoption, and sophisticated IT infrastructure. To support international operations, businesses in the area place a high priority on scalability, data security, and high-performance database solutions. Demand is further increased by significant investments in AI analytics and digital transformation projects. North American businesses benefit from established cloud ecosystems, strong vendor support, and cutting-edge managed services, all of which contribute to the region's dominance.

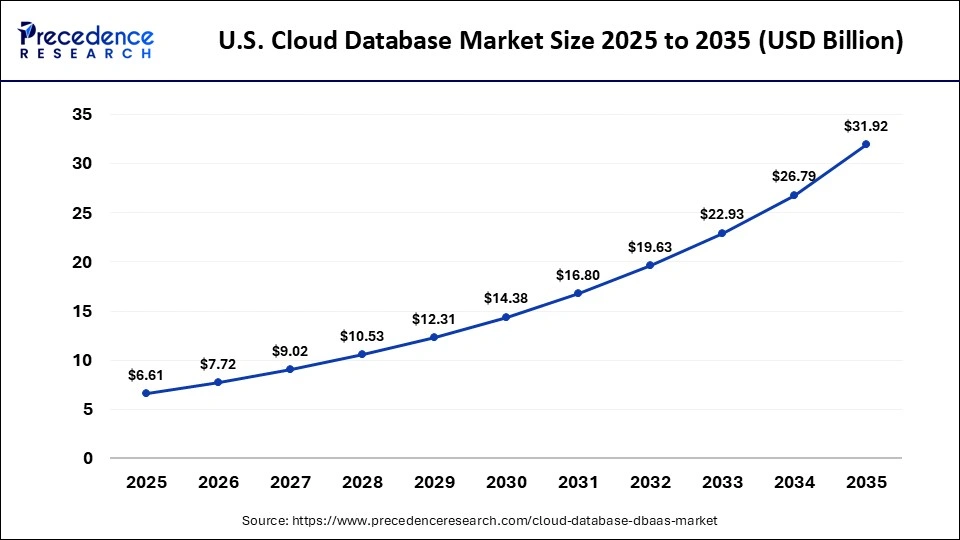

What is the Size of the U.S. Cloud Database Market?

The U.S. cloud database market size is calculated at USD 6.61 billion in 2025 and is expected to reach nearly USD 31.92 billion in 2035, accelerating at a strong CAGR of 17.05% between 2026 and 2035.

U.S. Cloud Database Market Trends

U.S. leads the market in North America, propelled by the extensive use of cloud solutions in the IT, telecom, financial, and healthcare industries. Businesses in the country concentrate on cloud-native databases and DBaaS to lower infrastructure costs, enable real-time analytics, and increase operational efficiency. Advanced cybersecurity frameworks, early adoption of hybrid and multi-cloud strategies, and regulatory compliance all support market expansion. Major cloud providers with state-of-the-art solutions are also based in the nation, giving it a significant competitive advantage.

What Makes Asia Pacific the Fastest-Growing Region in the Cloud Database Market?

Asia Pacific is the fastest-growing region in the market, driven by the growing IT and telecom industries, rising cloud adoption, and quick digitalization. To support initiatives related to smart cities, fintech, and e-commerce, Asian countries are investing in cloud infrastructure. Growth is being driven by expanding startup ecosystems, government incentives for digital transformation, and growing enterprise demand for affordable, scalable solutions. Supportive government initiatives, increased internet penetration, and growing smartphone and e-commerce usage are further fueling cloud adoption.

India Cloud Database Market Trends

India is a major contributor to the market within Asia Pacific, driven by the rapid adoption of cloud computing among businesses and startups. Organizations are leveraging DBaaS and cloud databases to support IoT services, AI-powered applications, and broader digital transformation initiatives. Market growth is further supported by the expansion of data centers, affordable cloud services, and government initiatives promoting cloud infrastructure. Additionally, the increasing adoption of hybrid and private cloud solutions by the country's telecom and IT sectors is fueling the demand for cloud database technologies.

Who are the Major Players in the Global Cloud Database Market?

The major players in the cloud database market include Google LLC, Nutanix, Oracle, IBM Corporation, SAP SE, Amazon Web Services, Inc., Alibaba Cloud, MongoDB, Inc., Microsoft, Teradata, Ninox, DataStax

Recent Developments

- In October 2025, Oracle and Google Cloud announced the expansion of Oracle Database@Google Cloud, introducing new AI-integrated database services and wider regional access. This expansion includes Oracle Autonomous Database on dedicated infrastructure and HeatWave MySQL, allowing enterprise workloads to run alongside Google Cloud's Vertex AI. The partnership aims to provide unified data management and integrated generative AI capabilities across both cloud platforms through simplified procurement. Read the full announcement at Oracle. (Source:https://www.oracle.com)

- In October 2025, MariaDB plc announced the launch of MariaDB Enterprise Platform 2026, a unified cloud database integrating transactional, analytical, and AI vector engines. Visit MariaDB for more information. (Source:https://mariadb.com)

Segments Covered in the Report

By Component

- Solution

- Database Management

- Storage

- Service

- Professional Services

- Managed Services

By Database Type

- NoSQL

- Relational Database

By Deployment

- Public

- Private

- Hybrid

By Enterprise Size

- Large Size Enterprises

- Small and Medium-Sized Enterprises (SMEs)

By End-use

- IT & Telecommunications

- BFSI

- Healthcare

- Government & Public Sector

- Manufacturing

- Automotive

- Retail & Consumer Goods

- Media & Entertainment

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content