What is the Cloud EDA Market Size?

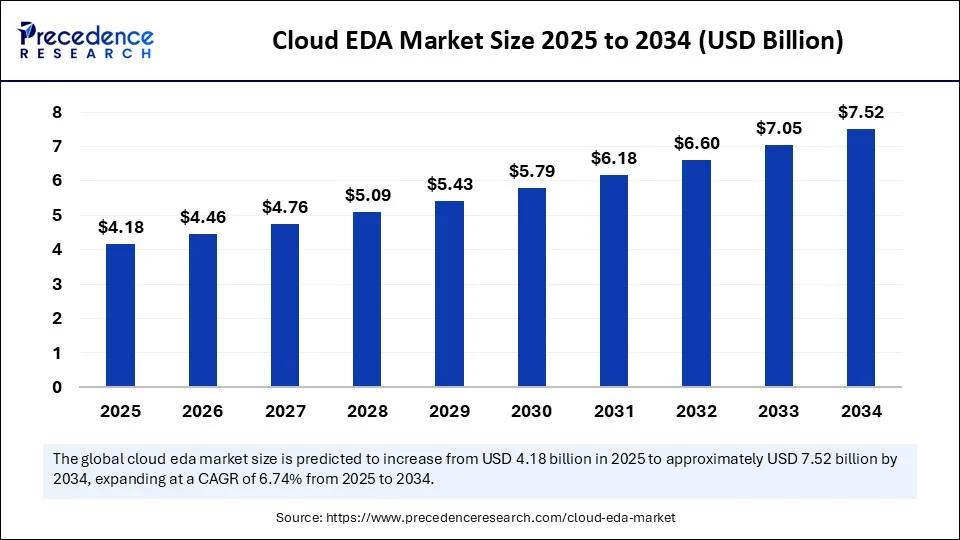

The global cloud EDA market size is valued at USD 4.18 billion in 2025 and is predicted to increase from USD 4.46 billion in 2026 to approximately USD 7.52 billion by 2034, expanding at a CAGR of 6.74% from 2025 to 2034. The market is growing due to the increasing demand for scalable, collaborative, and cost-effective platforms among design teams and the growing need to reduce IT burden.

Cloud EDA Market Key Takeaways

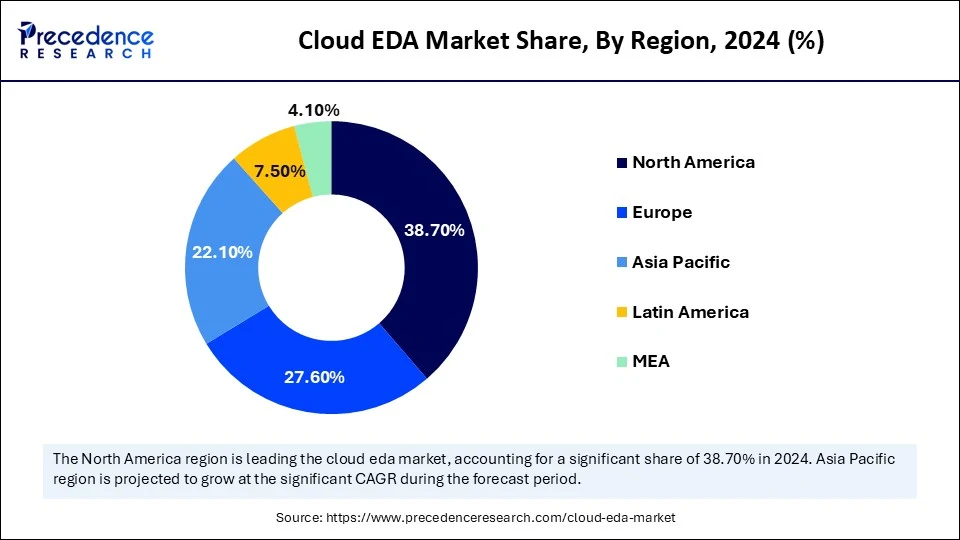

- North America dominated the cloud EDA market with the largest share of 38.7% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the coming years.

- By deployment type, the public cloud segment held the biggest market share of 48.6% in 2024.

- By deployment type, the hybrid cloud segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the simulation & verification segment captured the highest market share of 29.1% in 2024.

- By application, the IP management segment is expected to grow at the fastest CAGR during the forecast period.

- By end use industry, the consumer electronics segment contributed the major market share of 33.4% in 2024.

- By end use industry, the automotive segment is expected to grow at the fastest CAGR during the projection period.

- By component, the software tools segment held the largest share of 63.8% in 2024.

- By component, the services segment is expected to grow at the fastest CAGR during the forecast period.

- By access mode, the web-based segment accounted for the significant market share of 45% in 2024

- By access mode, the API-based integration segment is observed to grow at the fastest CAGR during the forecast period.

- By enterprise size, the large enterprise segment generated the major market share of 72.5% in 2024.

- By enterprise size, the small & medium enterprises (SMEs) segment is expected to grow at the fastest rate between 2025 and 2034.

Market Overview

Cloud EDA (Electronic Design Automation) market refers to the deployment of EDA tools and workflows in a cloud computing environment. EDA software enables the design, simulation, verification, and validation of electronic systems such as integrated circuits (ICs), printed circuit boards (PCBs), and system-on-chip (SoC). Cloud-based EDA solutions offer scalable, on-demand compute resources and storage infrastructure, enabling collaborative development, faster design iterations, and cost-efficient deployment without the need for heavy on-premises infrastructure. These tools are crucial in industries like semiconductors, automotive, aerospace, IoT, and consumer electronics.

How is artificial intelligence transforming the cloud EDA market?

Artificial Intelligence is revolutionizing the cloud EDA (electronic design automation) landscape. By automating crucial processes such as logic synthesis, verification, floor planning, and error detection, AI algorithms significantly reduce both human error and development time. AI in cloud environments enables continuous learning across projects, enhances real-time collaboration, and leverages massive datasets for design optimization. For complex chips, this results in a shorter time to market, enabling faster iteration cycles and increased design accuracy. Furthermore, predictive modeling and adaptive workflows are made possible by AI-driven analytics in cloud EDA tools, which enhances the intelligence and scalability of design processes. AI algorithms also optimize design cycles, leading to quicker product launches.

Cloud EDA Market Outlook

- Industry Growth Overview: The market is set for rapid expansion from 2025 to 2034, fueled by the increasing complexity of semiconductor designs and shorter time-to-market demands. High-growth areas include AI/ML-driven design automation, verification, and simulation processes that require scalable cloud resources.

- Adoption of Cloud Solutions: There is a strong focus on improving operational efficiency in design workflows and data center operations, with a growing emphasis on cloud solutions that leverage energy-efficient data centers and adhere to green software principles. This approach aims to reduce computational power needs, cut energy consumption, and minimize environmental impact, helping businesses achieve both cost savings and sustainability goals while optimizing performance.

- Global Expansion:The market is expanding globally as semiconductor companies increasingly adopt cloud-based solutions for designing complex chips and managing massive datasets, enabling faster innovation and greater collaboration across distributed teams. Emerging regions like Asia-Pacific, Latin America, and Eastern Europe present significant opportunities, driven by growing electronics manufacturing, infrastructure development, and increased adoption of cloud technologies in sectors like automotive, 5G, and consumer electronics.

- Major Investors:Major investors in the market include leading technology firms such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, which contribute by providing robust cloud infrastructure and services that support EDA tools for chip design, simulation, and verification. Additionally, EDA software providers like Synopsys, Cadence Design Systems, and Mentor Graphics (now part of Siemens) are investing in cloud-based solutions, enabling enhanced collaboration, scalability, and computational power for complex semiconductor design and development processes.

- Startup Ecosystem:The startup ecosystem is maturing, with innovation centered on open-source tools, AI-driven analysis, and automation software. Emerging companies attract substantial VC funding by providing specialized solutions that tackle data security and IP protection issues in cloud environments.

Cloud EDA MarketGrowth Factors

- Complex chip designs: The demand for advanced ICs in AI, 5G, and automotive applications requires powerful cloud-based EDA tools.

- Scalability: Cloud platforms provide flexible, on-demand computing power without incurring heavy infrastructure costs.

- AI integration: AI enhances automation, accuracy, and speed in design processes when paired with cloud EDA.

- Remote collaboration: Cloud EDA enables global teams to work together in real-time, fostering collaborative workflows.

- Cost efficiency: Pay-as-you-go models reduce capital expenditures (CapEx) and accelerate time-to-market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 7.52 Billion |

| Market Size in 2026 | USD 4.46 Billion |

| Market Size in 2025 | USD 4.18 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.74% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment Type, End Use Industry, Access Mode, Application, Component, Enterprise Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Adoption of Cloud Infrastructure

Many semiconductor companies are transitioning from traditional on-premise setups to cloud-based environments for better scalability, flexibility, and cost control. Could EDA eliminate the need for high upfront investments in hardware, while allowing startups and mid-sized design houses to scale instantly, as they cannot afford expensive in-house computer clusters. With cloud adoption accelerating across industries, cloud EDA is emerging as the must-have solution to enable agile development.

Rising Complexity in Chip Design

Modern chips, particularly those constructed on 5nm or 3nm nodes, require simulation and verification on a never-before-seen scale and involve billions of transistors. Due to this complexity, real-time collaboration, massive processing power, and AI-based optimization are required; these features are best supported in a cloud environment. Real-time error detection, quicker design iterations, and parallel processing are all made possible by cloud EDA platforms. The ability to effectively handle chip complexity becomes a competitive advantage as Moore's Law slows.

Restraints

Data Security and IP Protection Concerns

One of the biggest challenges in cloud EDA adoption is the fear of losing control over sensitive design data and intellectual property. Semiconductor designs involve highly confidential blueprints that, if compromised, could lead to significant financial and competitive losses. Companies are hesitant to fully trust third-party cloud providers with this information. Although cloud platforms offer encryption and security protocols, the perception of vulnerability still acts as a barrier. Regulatory compliance and IP governance further complicate cloud transitions for many global players.

Limited Internet Infrastructure in Some Regions

The lack of availability of high-speed internet access in some regions restrains the growth of the cloud EDA market. Cloud-based EDA tools cannot operate effectively without dependable, fast internet access. There are still problems with connectivity, latency, and bandwidth in many parts of the world, particularly in developing nations. Large data transfers and real-time collaboration are hindered, which is detrimental to high-performance design processes. To prevent workflow disruptions caused by erratic internet connections, businesses in these areas may favor on-premises solutions.

Opportunities

Rising Demand from Fabless Semiconductor Companies

Fabless firms rely heavily on fast, agile design tools to stay competitive without owning fabrication facilities. Cloud EDA is suitable for these firms, offering high performance without the need for capital-intensive infrastructure. With the number of fabless companies increasing globally, cloud EDA providers have a growing customer base eager for pay-as-you-go and collaboration-friendly platforms. Tailored solutions for these firms could open long-term revenue streams.

Remote Work and Global Collaboration Trends

Work models have undergone permanent changes since the pandemic shifted toward remote and hybrid engineering teams. Cloud EDA platforms facilitate cross-border project sharing, version control, and real-time collaboration. Serving clients worldwide who now favor decentralized design teams becomes possible as a result. The need for cloud-native collaboration-enabled EDA tools will only increase as businesses strive to preserve flexibility and productivity.

Segment Insight

Deployment Type Insights

Why did the public cloud segment dominate the cloud EDA market in 2024?

The public cloud segment dominated the market with the largest share in 2024. The dominance of public cloud stems from its scalability, reduced initial costs, and worldwide accessibility, all of which meet the expanding demands of electronics and semiconductor companies. For faster chip design cycles, real-time collaboration between design teams across regions is made possible by public cloud infrastructure. Furthermore, the dominance of this segment is further supported by the specialized EDA tool integrations offered by top cloud providers, such as AWS, Microsoft Azure, and Google Cloud.

The hybrid cloud segment is expected to grow at the fastest rate during the projection period, as companies seek a balance between security, control, and flexibility. Semiconductor firms are increasingly opting for hybrid environments to keep sensitive data on-premises while leveraging public cloud power for complex simulations and peak workload mobility, making it ideal for organizations transitioning from legacy on-premises systems to cloud-native environments.

Application Insights

How does the simulation & verification segment dominate the cloud EDA market in 2024?

The simulation & verification segment dominated the market with a significant share in 2024 since cloud infrastructure easily supplies the high-performance computing power needed for these crucial phases of the IC and SoC design flow. Given the growing complexity of semiconductor designs, cloud-based simulation enables rapid iterations and a shorter time to market. Cloud environments' scalability and flexibility significantly reduce the time and expense required to validate designs.

The IP management segment is likely to grow at a rapid pace in the coming years, as companies emphasize reusability, collaboration, and version control across globally distributed design teams. The cloud enables centralized storage, real-time updates, and integration of IP blocks into new designs, boosting design productivity and reducing errors. With the surge in complex chipsets requiring diverse IP cores, cloud-based IP management platforms are becoming essential.

End Use Industry Insights

Why did the consumer electronics segment dominate the cloud EDA market in 2024?

The consumer electronics segment dominated the market while capturing a significant share in 2024. This is due to the increased demand for wearables, tablets, smartphones, and other cutting-edge, small, and power-efficient gadgets. These products need intricate integrated circuits (ICs) with quick design cycles, which cloud-based EDA tools effectively support. Cloud infrastructures' speed and scalability enable them to meet strict product launch deadlines in the cutthroat consumer electronics industry.

The automotive segment is expected to experience the fastest growth in the market over the forecast period due to the increasing integration of chips in EVs, ADAS, and autonomous vehicles. Designing automotive-grade chips involves rigorous simulation, safety verification, and compliance, which cloud-based platforms can handle efficiently and quickly. As vehicle electrification and connectivity rise, so does the reliance on cloud-driven chip design tools.

Component Insights

What made software tools the dominant segment in the cloud EDA market?

Th software tools segment dominated the market with the largest share in 2024, as they form the backbone of the EDA workflow, encompassing functions like layout design, synthesis, verification, and testing. In the cloud environment, these tools can be accessed on demand, offering flexibility and faster processing. Their continuous evolution to support AI and ML-driven chip designs also reinforces their dominant role in the market.

The services segment is expected to grow at the highest CAGR in the coming years, as businesses look for assistance with workflow optimization, cloud platform migration, and cybersecurity compliance. Consulting, system integration, maintenance, and training are among the services offered. These are essential for semiconductor companies implementing new cloud-based design environments. As the use of cloud-native EDA grows, so does the demand for professional advice.

Access Mode Insights

Why did the web-based segment dominate the cloud EDA market in 2024?

The web-based access segment dominated the market in 2024 due to the fact that it allows users to run EDA tools in their browsers without requiring complicated installations. With web-based access mode, design teams can collaborate easily and access design environments instantly from any device. Web-based portals are convenient for international teams working on the same projects because they also enable centralized updates

The API-based integration segment is expected to expand at the fastest CAGR over the projection period, as enterprises demand greater customization and automation in their design workflows. APIs allow integration of EDA tools into broader CI/CD pipelines, automating repetitive tasks and facilitating efficient data exchange. This mode supports more agile development and enables better alignment with enterprise IT ecosystems.

Enterprise Size Insights

How Does the large enterprises segment dominate the cloud EDA market in 2024?

The large enterprises segment dominated the market with the majority of market share in 2024. This is because they have larger budgets to spend on cutting-edge cloud-based EDA tools, more complex designs, and strong R&D capabilities. These businesses frequently have international design teams and need scalable infrastructure, which the cloud provides. Their inclination towards enterprise-grade, security-compliant cloud solutions accelerates their adoption rates even further.

The small & medium enterprises segment is expected to grow at a rapid pace in the upcoming years, are they are increasingly adopting cloud EDA tools to gain access to high-performance design solutions without heavy capital investment. The pay-as-you-go model, ease of deployment, and elimination of hardware maintenance make cloud EDA particularly appealing to startups and smaller design houses. As the ecosystem supports innovation from smaller players, their adoption rate continues to climb.

Regional Insights

U.S. Cloud EDA Market Size and Growth 2025 to 2034

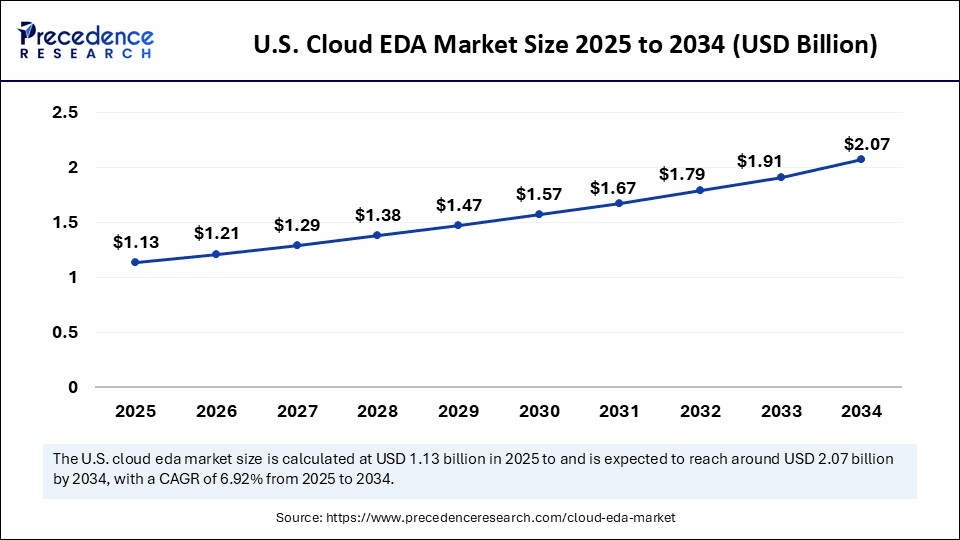

The U.S. cloud EDA market size is exhibited at USD 1.13 billion in 2025 and is projected to be worth around USD 2.07 billion by 2034, growing at a CAGR of 6.92% from 2025 to 2034.

What made North America the dominant region in the cloud EDA market in 2024?

North America registered dominance in the cloud EDA market by holding the largest share in 2024. This is mainly due to significant R&D investments, a strong presence of top semiconductor and EDA software companies, and a stable cloud infrastructure. Cloud-based EDA tools are widely used in the region due to its sophisticated technological ecosystem, early adoption of cloud computing, and growing demand for high-performance integrated circuits. Additionally, partnerships between chip design companies and cloud service providers support the growth of the market in the region.

U.S. Cloud EDA Market Trends

The U.S. is the market leader and innovation hub for the Cloud EDA market, largely due to its established technology ecosystem and significant investments in advancing AI and machine learning integration into EDA tools. Prominent players like Synopsys, Cadence Design Systems, and ANSYS are based in the U.S., with additional support from government initiatives like the U.S. CHIPS Act, which bolsters the sector's growth by promoting domestic semiconductor manufacturing and technological innovation.

Asia Pacific is expected to experience the fastest growth in the coming years due to the expansion of semiconductor manufacturing facilities. There are more design startups, and the demand for consumer electronics is on the rise. Cloud-based EDA platforms are gaining popularity due to the region's emphasis on digitization and government initiatives aimed at enhancing chip design skills. New design companies in the area are rapidly adopting cloud EDA due to its affordability and scalability.

India Cloud EDA Market Trends

India is considered an emerging player in the cloud EDA market in Asia Pacific due to its growing semiconductor design and engineering services sector, which benefits from a highly skilled workforce and a strong IT services ecosystem. The country's growing focus on digital transformation, coupled with government initiatives such as Make in India, supports the adoption of cloud-based EDA tools for chip design, verification, and simulation. Additionally, India's expanding role as a hub for R&D and offshoring for global semiconductor companies further fuels its growth in the cloud EDA space.

How is the Opportunistic Rise of Europe in the Cloud EDA Market?

Europe is experiencing an opportunistic rise in the market. The region hosts some of the major semiconductor companies and emphasizes high-reliability, low-power applications, especially in the automotive and industrial sectors. The market is driven by demand for faster turnaround times and complex chip designs, which require the computing power and collaborative capabilities provided by cloud platforms. European companies are increasingly adopting hybrid cloud models to balance data security with scalability, with both major players and startups using platforms from tech giants such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud.

Germany Cloud EDA Market Trends

Germany is a key player in the European market, focusing on engineering excellence and hosting a dominant automotive industry. The growing demand for advanced semiconductor integration in connected and autonomous vehicles is driving the need for sophisticated, high-performance EDA tools. German companies are leading in adopting hybrid cloud solutions to securely and efficiently handle large data volumes. The market benefits from strong collaboration between industrial players and research institutes, such as the Fraunhofer Institute for Innovation in Cloud-Based Semiconductor Design.

What Opportunities Exist in Latin America for the Cloud EDA Market?

Latin America offers immense opportunities in the market. This is mainly due to the rising adoption of cloud-based EDA solutions, mainly driven by the growing semiconductor industry and a push for digital transformation in academic and research institutions. Countries like Brazil and Mexico are leading, increasing investments in R&D and becoming more aware of the cost-effectiveness and scalability that cloud platforms provide, especially for startups and smaller design firms looking to compete without large capital costs on on-premises infrastructure.

Brazil Cloud EDA Market Trends

Brazil is a key market in Latin America, supported by a well-established technology sector and a government eager to promote innovation. Academic institutions and research centers are the main early users of cloud EDA tools for educational purposes and initial design projects. The market is slowly attracting private investment as local semiconductor firms and tech startups see the advantages of using cloud platforms to speed up design cycles and cut operational costs.

What Potentiates the Growth of the Middle East and Africa Cloud EDA Market?

The growth of the market in the Middle East and Africa is driven by increasing investments in smart city infrastructure, telecommunications, and electronic manufacturing across the region. Government initiatives, such as the UAE's Vision 2021 and Saudi Arabia's Vision 2030, are encouraging technological innovation and the adoption of cloud-based solutions, boosting demand for advanced semiconductor design tools. Additionally, the region's growing focus on AI, IoT, and automotive electronics further accelerates the need for efficient, scalable cloud EDA platforms to support chip design and development.

Saudi Arabia Cloud EDA Market Trends

Saudi Arabia is a prominent player in the MEA region for Cloud EDA, driven by its focus on technological advancement and economic diversification under initiatives like Vision 2030. The government's substantial investments in establishing research centers and technology parks, such as the King Abdulaziz City for Science and Technology (KACST), are creating an ecosystem ripe for the adoption of cloud EDA solutions to support innovation in semiconductor design and advanced technologies.

Value Chain Analysis

Research & Development (R&D):

This stage involves developing cutting-edge cloud EDA tools powered by AI, machine learning, and automation to enhance design accuracy and speed.

- Key Players: Synopsys, Cadence Design Systems, and Mentor Graphics (Siemens)

EDA Software Development:

This stage involves developing specialized cloud-based EDA software that enables designers to perform simulation, verification, and design optimization tasks remotely and efficiently.

- Key Players: Synopsys, Cadence, and ANSYS

Implementation & Integration:

This stage involves helping customers integrate cloud EDA platforms into their current workflows and infrastructures.

- Key Players: Tata Consultancy Services (TCS) and Wipro

Support and Maintenance:

This stage focuses on providing ongoing support and maintenance for cloud EDA systems, ensuring continuous optimization, software updates, and troubleshooting to maximize performance and reliability.

- Key Players: Accenture and Capgemini

Top Companies in the Cloud EDA Market

- Synopsys Inc.: Synopsys is a major player in the cloud EDA market, offering a suite of cloud-based tools for IC design, verification, and simulation, enabling scalable and efficient semiconductor design processes.

- Cadence Design Systems Inc.: Cadence provides a comprehensive portfolio of cloud EDA solutions, including design and verification software that integrates AI and machine learning to accelerate chip design and improve accuracy.

- Siemens EDA (formerly Mentor Graphics): Siemens EDA delivers cloud-based electronic design automation tools, offering simulation, verification, and PCB design solutions that enable collaboration and optimization across distributed teams.

- Ansys Inc.:Ansys contributes to the cloud EDA market by offering cloud-enabled simulation software for electronic systems design, focusing on power integrity, electromagnetic analysis, and thermal simulation.

- Aldec Inc.: Aldec provides cloud-based FPGA design solutions with simulation, verification, and prototyping tools that help accelerate the development of complex electronic systems.

- Keysight Technologies: Keysight offers cloud-based solutions for signal integrity, RF design, and electronics testing, helping to simulate and validate electronic components for high-performance applications in communications and aerospace.

- Altium LLC:Altium offers cloud-based PCB design software that enables real-time collaboration and data sharing among teams, streamlining the electronic design process and enhancing workflow efficiency.

Other Key Players

- Zuken Inc.

- Dassault Systèmes

- Xilinx Inc. (AMD)

- Arm Ltd.

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- Efabless Corporation

- Achronix Semiconductor Corporation

- OpenFive

- Empyrean Technology

- Huada Empyrean Software Co.

- Metrics Design Automation

Recent Developments

- On June 24, 2025, Siemens Digital Industries Software unveiled its new Siemens EDA AI System at the 2025 Design Automation Conference, introducing generative and agentic AI across its EDA suite (including Aprisa AI, Calibre Vision AI, Solido platform) to boost productivity and support hybrid on prem/cloud deployment models. (Source: https://semiwiki.com)

- On November 18, 2024, Keysight Technologies released the Keysight EDA 2025 software suite, integrating AI-enhanced workflows for simulation, verification, and AI-optimized design control to accelerate time-to-insight and enhance engineer productivity.(Source: https://www.keysight.com)

Segments Covered in the Report

By Deployment Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Application

- Design & Synthesis

- Simulation & Verification

- IP Management

- RTL Analysis

- Layout & Routing

- Testing & Debugging

- Others

By End Use Industry

- Consumer Electronics

- Automotive

- Industrial Automation

- Aerospace & Defense

- Telecommunications

- Healthcare Devices

- IoT & Edge Devices

- Others

By Component

- Software Tools

- Front-end Tools

- Back-end Tools

- Services

- Design Services

- Support & Maintenance

- Consulting & Integration

By Access Mode

- Web-based (Browser Access)

- API-based Integration

- Virtual Desktop Interface (VDI)

- Others

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting