What is the Cloud Foundation Market Size?

The global cloud foundation market size accounted for USD 24.47 billion in 2024 and is predicted to increase from USD 27.53 billion in 2025 to approximately USD 79.73 billion by 2034, expanding at a CAGR of 12.54% from 2025 to 2034. The market is driven by the increasing adoption of hybrid and multi-cloud strategies, demand for scalable IT infrastructure, and the need for streamlined cloud management and automation across enterprises.

Market Highlights

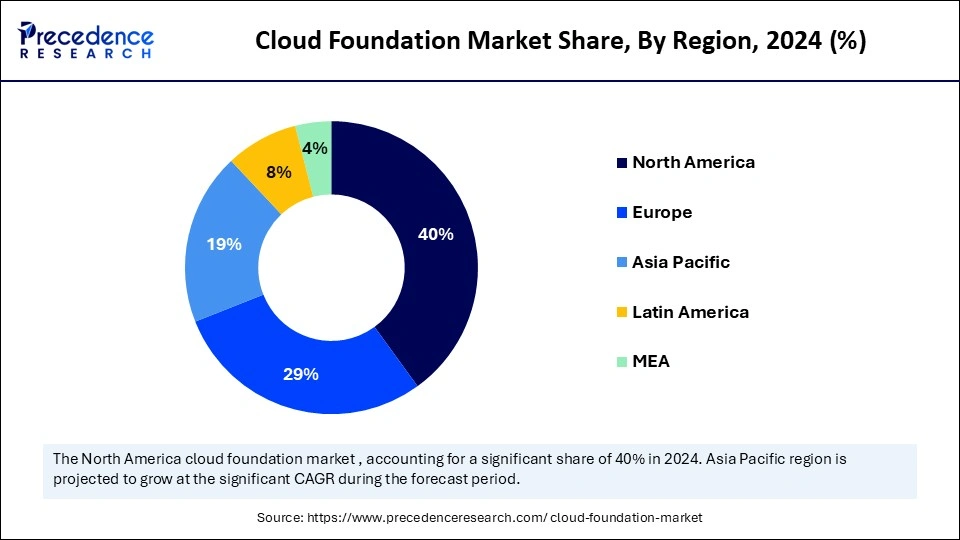

- North America dominated the global cloud foundation market with the largest share of 40% in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By component, the software segment led the market in 2024.

- By component, the services segment is anticipated to show considerable growth over the forecast period.

- By deployment mode, the public cloud segment captured the biggest market share of 50% in 2024.

- By deployment mode, the hybrid cloud segment is anticipated to show considerable growth over the forecast period.

- By service model, the infrastructure as a service (IaaS) segment contributed the highest market share of 40% share in 2024.

- By service model, the platform as a service (PaaS) segment is anticipated to show considerable growth over the forecast period.

- By end-user, the BFSI segment generated the major market share of 30 in 2024.

- By end-user, the healthcare and life sciences segment is anticipated to show considerable growth over the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 24.47 Billion

- Market Size in 2025: USD 27.53 Billion

- Forecasted Market Size by 2034: USD 79.73 Billion

- CAGR (2025-2034): 12.54%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The cloud foundation market is a set of software and infrastructure platforms that offer a standardized platform to deploy, administer, and secure cloud environments across the public, private, and hybrid clouds. Cloud foundations enable multi-cloud and hybrid implementations, streamlining the IT processes and improving the governance, compliance, and cost optimization. The rising use of cloud services, digital transformation processes, and the need to have a consistent and efficient use of the cloud also drive the market. The North American market is the leader due to its developed cloud infrastructure, high IT expenditure, and high presence of cloud service providers, whereas the Asia Pacific is the most advanced region in terms of digitalization, with the fastest-growing IT infrastructure and cloud adoption.

The market growth is also accelerated by the increased need to use hybrid and multi-cloud solutions to help organizations gain scalability, flexibility, and integration across the private, public, and on-premises environments. Business organizations are using cloud foundations more as a way of modernizing IT infrastructure, optimizing operations, lowering costs, and providing security and compliance. Favorable government policies, awareness of the advantages of the cloud, and investments in cloud infrastructure are increasing the pace of market expansion in the world.

How Is AI Integration Driving the Cloud Foundation Market?

The advent of artificial intelligence is rapidly transforming the cloud foundation market by improving cloud efficiency, automation, and decision-making. Cloud foundations can predict the loads, predict their imminent failures, deploy resources efficiently, and also automatically handle routine management-related activities by incorporating AI. This decreases downtimes, human error, and enhances the overall infrastructure performance, hence increasing the reliability and resilience of cloud environments.

Besides, AI can facilitate smart analytics and insight to assist enterprises in making decisions that are based on data to scale, enhance security, and reduce costs. AI-driven automation is also faster to deploy applications and coordinate them through cloud-native workloads and containerized applications. As the use of hybrids and multi-cloud strategies in organizations increases, the implementation of AI would ensure the sustainability of operations in different environments, reduce complexity, and encourage scalability.

What Factors Are Fueling the Rapid Expansion of the Cloud Foundation Market?

- Multi-Cloud Adoption and Hybrid: The demand is pointed towards the standardization of cloud foundation platforms to enable organizations to be flexible, scalable, and smoothly integrated between a private, a public, and an on-premises environment to facilitate deployment, administration, and orchestration consistency as well as operations and governance uniformity across the heterogeneous cloud infrastructures.

- Digital Transformation Plans: Modernization of IT infrastructure is supported with cloud foundation platforms, where it is possible to deploy applications faster, enhance better utilization of resources, and improve the workflow, which enhances the productivity of the organization and adoption of cloud-native technology in organizations worldwide.

- Cost Minimization and Operational Frugality: Cloud foundation platforms also automate deployments, monitoring, and maintenance services, and lower IT overheads and resource consumption. These platforms allow organizations to reduce the cost of operations, ensure high performance, reliability, and scalability of the cloud environments by allowing them to manage proactively, predictively, and efficiently in the allocation of resources.

- Technological Advancements: The AI, automation, analytics, and container orchestration implemented in cloud foundations improve the performance, monitoring, and decision-making. These technologies ease IT processes, facilitate the use of the cloud as a native workload, and help companies to create robust, agile, and scalable cloud infrastructures, driving the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 24.47 Billion |

| Market Size in 2025 | USD 27.53 Billion |

| Market Size by 2034 | USD 79.73 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Mode, Service Model, End User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Need for Cost Optimization and Operational Efficiency

Businesses are faced with a continuous challenge of lowering IT spending and still ensuring the availability of consistent and robust cloud infrastructures, and cost optimization has become a key factor in the cloud foundation market. Cloud foundation platforms allow companies to achieve the automation of regular activities, efficient distribution of resources, and efficient monitoring of the workload, which leads to a decrease in operational costs and better utilization of infrastructure. These platforms can also be used to balance the workloads dynamically, avoid resource bottlenecks, and save energy, which serves as a major cost-saving factor. This is also achieved by centralized governance, automation, and simplified management of hybrid and multi-cloud environments to enhance efficiency in their operations.

Improved Security and Regulatory Compliance Requirement

The increasing focus on data safety, privacy, and regulatory compliance is one of the major impetuses of the cloud foundation market. The businesses that are offloading valuable workloads and sensitive information to cloud providers are becoming more vulnerable to cyberattacks, data breaches, and regulatory breaches. Cloud foundation platform provides a potent platform that is implemented with a centralized security policy, encryption, access control, and round-the-clock inspection to safeguard and ensure that the cloud environment is secure and compliant.

A threat detection system can detect threats in real-time, and automated alerts and AI-based analytics add additional security and reliability in operations. It is projected that the need to have a secure, compliant, and resilient cloud infrastructure will remain to expand the market, and hence, regulatory compliance and security will be a key driving force towards the growth of cloud foundation platforms globally.

Restraints

Integration Complexity

One of the biggest restraints to the cloud foundation market is the problem of complexity in integrating the cloud foundation solutions with the already existing legacy systems and infrastructures. Many organizations have on-premises infrastructure that is in place and includes traditional applications and other IT structures, which may not necessarily be compatible with the new cloud architecture. Problems like data migration, compatibility of applications, network set up and continuity of operation during the migration are some of the challenges. Poor integration may result in downtime of the system, loss of data, security risks, and inefficiency to the enterprise, making it wary of adoption.

High Implementation Costs

High implementation cost, particularly to small and medium-sized businesses (SMBs), is highly limiting to the cloud foundation market. The adoption of cloud foundation platforms may be offered face-to-face with enormous initial expenses in the form of software rights, hardware upgrades, training, and integration. In addition, one can force the firms to engage professional services or turn to the assistance of consultants to perform the deployment, configuration, and further maintenance, which increases the costs.

Opportunity

Leveraging Automation in Cloud Foundations

Automation tools integration with cloud foundation platforms has great potential for growth in the market. Automation helps businesses to simplify processes and eliminate human interactions, and it also helps businesses to allocate resources efficiently, which leads to increased efficiency in their operations and accelerated ways of deploying applications. Automation of routine activities through provisioning, monitoring, scaling, and maintaining the system can help organizations greatly minimize the threat of human error, besides enhancing overall system reliability and performance.

The complex hybrid and multi-cloud environments can be easily managed through automation, and IT teams are able to enforce the same policies, governance, and compliance across diverse environments. The implementation of automated cloud foundation platforms speeds up the process of digitalization, also creates a great market opportunity in the global market, which is driven by efficiency and scalability, and resilience.

Segment Insights

Component Insights

Why did the software segment dominate the cloud foundation market in 2024?

The software segment dominated the market in 2024, with the virtualization and hypervisors sub-segment holding around 40% revenue share. Virtualization facilitates running more than one virtual server on the same physical server, so that the resources can be better utilized, reducing hardware costs and operational efficiency. These virtual environments are managed by hypervisors that can allow the enterprises to deploy, monitor, and scale workloads. Cloud foundation platforms combine hypervisor and virtualization technology to support a hybrid and multi-cloud environment, container-based applications, and automated orchestration.

The services segment is likely to expand quickly, particularly the managed cloud services sub-segment. Managed services providers will handle the deployment, monitoring, maintenance, and optimization of cloud foundation platforms that allow business organizations to concentrate on their core business operations without caring about the management of their infrastructure. Such services enhance efficiency in operations, compliance, and security, and they help to make the management of hybrid and multi-cloud environments less complex. This segment is also being driven by the rise in the use of cloud-native applications, containerized workloads, and digital transformation programs taken by enterprises.

Deployment Mode Insights

Why did the public cloud segment lead the cloud foundation market in 2024?

The public cloud segment held around 50% share in the market in 2024. With public cloud deployment, organizations subscribe to computing resources, storage, and services via the internet on a pay-as-you-use platform, eliminating the need for heavy investments in on-premises infrastructure. Cloud foundation platforms connected to public cloud environments enable enterprises to simplify the deployment, management, and orchestration of workloads, achieving scalability, reliability, and security. Also, the affordability, quick provisioning, and flexibility of the public clouds are appealing to organizations interested in operational flexibility.

The hybrid cloud segment is expected to grow substantially in the cloud foundation market. A hybrid cloud is a combination of the private and the public cloud, which provides better flexibility, scalability, and control of workloads to the organization. Cloud foundation platforms are used to support hybrid deployment to achieve a single management, governance, and security across different environments. Businesses are moving toward hybrid models that allow maintaining a balance between cost efficiency and privacy of data, regulatory standards, and performance criteria. The increase is also contributed to by the increased use of multi-cloud strategies, digital transformation efforts, and cloud-native applications.

Service Model Insights

Why did the infrastructure as a service segment lead the cloud foundation market in 2024?

The infrastructure as a service (IaaS) segment led the cloud foundation market while holding around 40% share in 2024. The IaaS offers virtualized computing capabilities to the enterprise in the form of servers, storage, and networking, allowing the organization to expand the IT infrastructure on demand without massive initial investment in costly hardware. Cloud foundation platforms unite the IaaS capabilities to ease deployment and management, as well as orchestration of cloud environments, which assure high availability, reliability, and security.

The platform as a service (PaaS) segment is expected to grow at a significant CAGR over the forecast period, owing to the increasing demand for fast application development and deployment. PaaS offers an all-encompassing cloud-based platform to developers, such as operating systems, middleware, and development tools, without having to worry about the underlying infrastructure. Cloud foundation platforms enable PaaS through a framework that is scalable and secure, and automatically deploys cloud-native applications and microservices effectively. Companies use PaaS to develop software faster, enhance teamwork, and combine the latest technologies (AI, analytics, and containerization).

End-User Insights

How did the BFSI segment hold over 30% share in the cloud foundation market in 2024?

The BFSI segment held around 30% share in the cloud foundation market in 2024. Financial institutions are adopting cloud foundation platforms as a tool for modernizing their IT infrastructure to attain the efficiency of their operations and customer experience. The platforms provide robust frameworks in the administration of the hybrid and multi-cloud, automate operations, and ensure that regulations are met. The field of BFSI will focus on security and data privacy, and cloud foundations offer additional control, real-time monitoring, and artificial intelligence to guarantee the safety of sensitive data without overutilizing resources.

The healthcare and life sciences segment is expected to grow substantially in the cloud foundation market, because of the growing digitization, the implementation of cloud-based healthcare solutions, and the demand for have secure and compliant IT infrastructure. The hospitals, pharmaceutical firms, and research facilities are using the basis of cloud computing to effectively handle electronic health records (EHRs), patient records, telemedicine services, and shared research portals. Moreover, the increased usage of precision medicine, remote monitoring, and AI-related diagnostics causes further pressure on the need to have reliable cloud environments.

Region Insights

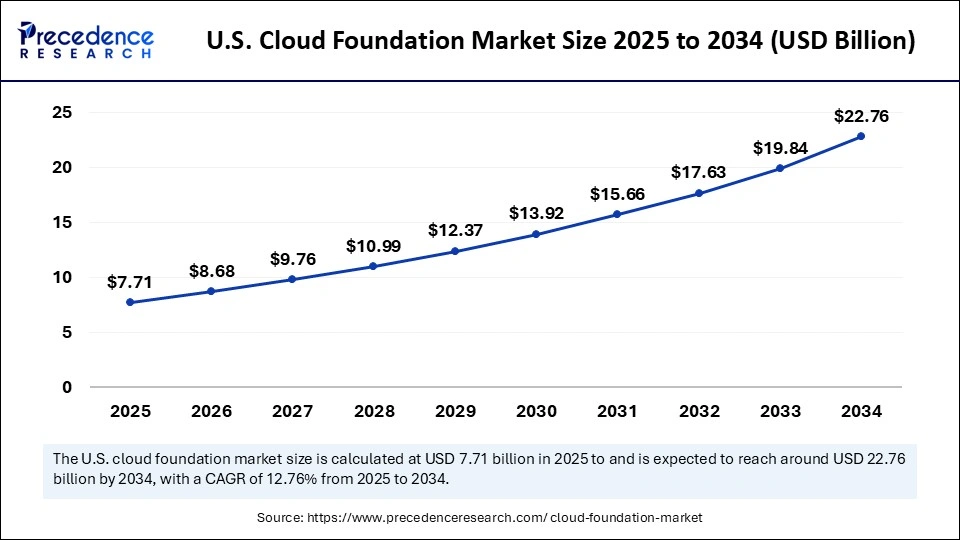

U.S. Cloud Foundation Market Size and Growth 2025 to 2034

The U.S. cloud foundation market size was evaluated at USD 6.85 billion in 2024 and is projected to be worth around USD 22.76 billion by 2034, growing at a CAGR of 12.76% from 2025 to 2034.

Why did North America dominate the global cloud foundation market in 2024?

North America led the global market with the highest cloud foundation market share of 40% in 2024. The region's dominance is based on its developed cloud infrastructure, early adoption of new technologies, and well-established IT environment. With cloud foundation platforms, enterprises across various industries continue to invest in these platforms to facilitate the simplification of IT operations, scalability, and increased operational efficiency. There is are great availability of major cloud service providers, technology vendors, and research-based organizations in the region that expedite cloud innovations and adoption. The North American market is characterized by robust regulatory systems, substantial IT spending, and a skilled workforce that can effectively manage complex cloud environments.

In North America, the U.S. has a strong penetration of enterprise clouds, the popularity of hybrid and multi-cloud approaches, and large investments in digital transformation programs are factors that make cloud foundation platforms in demand. The U.S. organizations are using the solutions to optimize costs, automate, use AI-API-based analytics, and operate securely and with compliance. Finance, healthcare, IT services, and government services are some of the sectors that are increasingly moving to using cloud foundations to implement cloud-native applications, containerized workloads, and enhance governance.

Why is Asia Pacific undergoing the fastest growth in the cloud foundation market?

The cloud foundation market in the Asia Pacific is growing the fastest, which is attributed to the rapid pace, rate of digitalization, growing use of cloud computing, and growth of the IT infrastructure in the region. Enterprise demand in such countries as India, Japan, South Korea, and Australia is soaring with scalable, flexible, and efficient cloud solutions. The companies are moving towards hybrid and multi-cloud development to increase operational efficiency, simplify IT management, and minimize costs. The growing popularity of the cloud advantages, along with the growing investment in data centers, network infrastructure, and digital technologies, only contributes to the popularity of cloud foundation solutions.

China is a major market in the region of the Asia Pacific region and hence a major growth driver. The focus of the country on smart cities projects, electronic government delivery, and the use of the enterprise cloud has dramatically increased the demand for cloud foundation platforms. There is also an enlargement of leading technology vendors and cloud service providers that provide solutions to support cloud-native applications, containerized workloads, automation, and AI integration. Also, the government assistance, expenditure on high technology, and access to skilled IT specialists boost the market development.

Cloud Foundation Market Companies

- OpenText

- VMware

- AWS

- Microsoft

- Oracle

- SAP

- Azure

- Huawei

- meshcloud

- Cisco

- Dell Technologies

- DNX Solutions

- ZTE Corporation

- division consulting

- Akamai

- Calix

- Workday

Recent Developments

- In August 2025, VMware Cloud Foundation became an AI-native service by Broadcom when VMware Private AI Services became a standard part of the services. This upgrade offered an integrated solution of new, secure cloud infrastructures on the private side.

- In May 2025, Salesforce purchased Informatica, a cloud data management firm, for 8 billion. The acquisition strengthened Salesforce in terms of AI potential, as Informatica offered its data management solutions.

- In March 2025, Google bought Wiz, one of the leading cloud security platforms, for 32 billion dollars. The acquisition was meant to enhance the security services provided by Google Cloud and combine the technology of Wiz.

Segments Coverd in the Report

By Component

- Software

- Virtualization and Hypervisors

- Container Orchestration and Management

- Networking and SDN Solutions

- Storage and Data Management

- Automation and Monitoring Tools

- Security and Compliance Tools

- Services

- Consulting and Implementation Services

- Managed Cloud Services

- Training and Support

By Deployment Mode

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Service Model

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

By End User Industry

- BFSI

- Healthcare and Life Sciences

- Retail and E-Commerce

- IT and Telecom

- Government and Defense

- Manufacturing

- Energy and Utilities

- Media and Entertainment

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting