What is the Clustering Software Market Size?

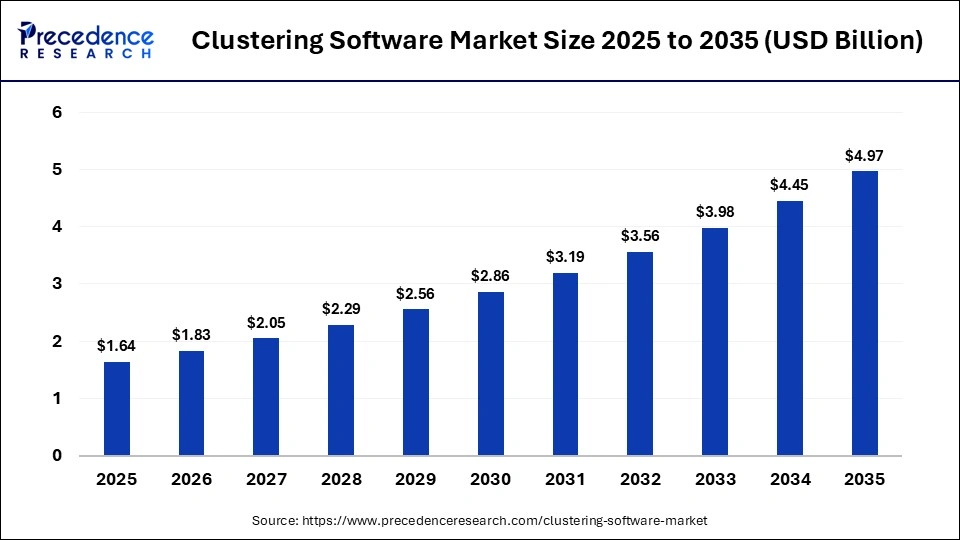

The global clustering software market size was calculated at USD 1.64 billion in 2025 and is predicted to increase from USD 1.83 billion in 2026 to approximately USD 4.97 billion by 2035, expanding at a CAGR of 11.73% from 2026 to 2035. This market is growing due to rising demand for scalable data processing and advanced analytics as organizations handle increasingly large and complex datasets across industries.

Market Highlights

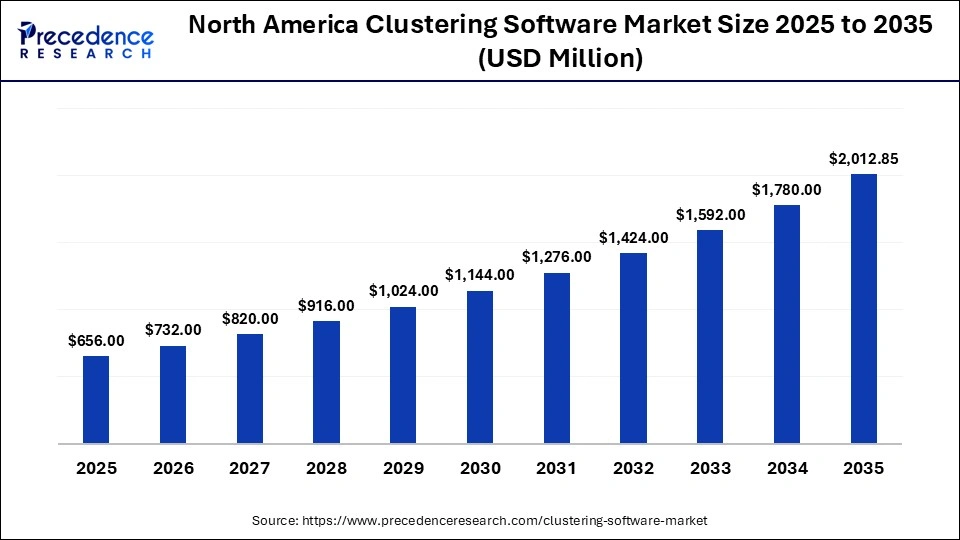

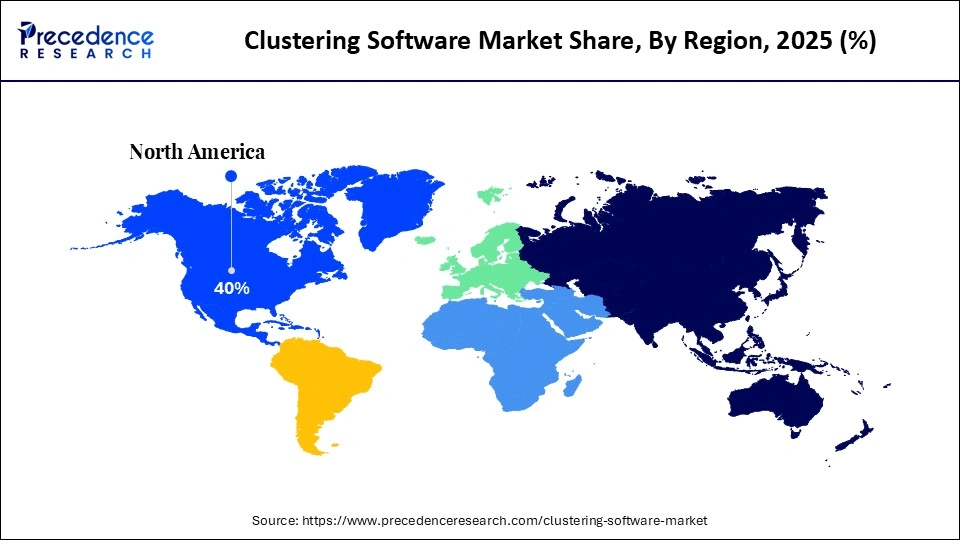

- North America dominated the clustering software market with the largest share of 40% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR of 10.8% between 2026 and 2035.

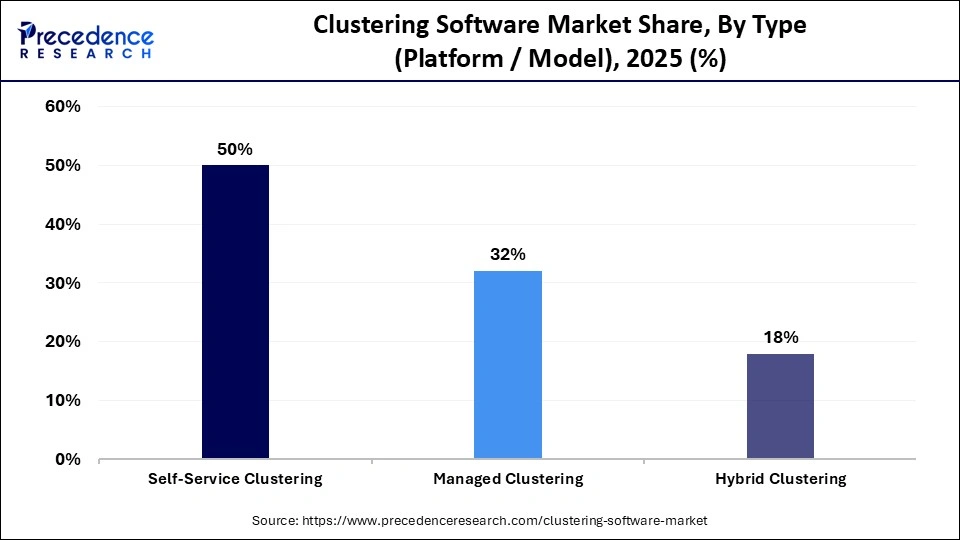

- By type, the self-service clustering segment held the biggest market share of approximately 50% in 2025.

- By type, the hybrid clustering segment is expected to expand at the fastest CAGR of 9.7% between 2026 and 2035.

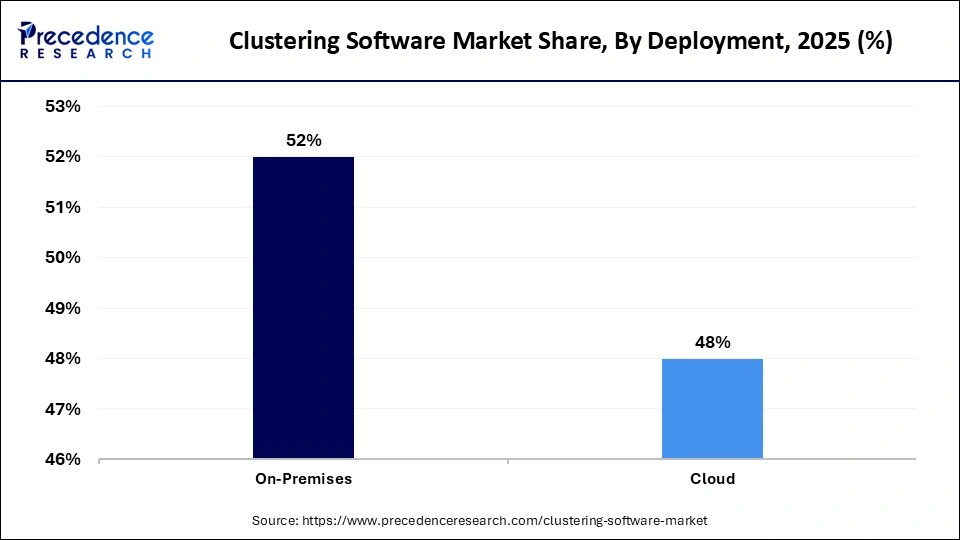

- By deployment, the on-premises segment contributed the highest market share of approximately 52% in 2025.

- By deployment, the cloud segment is expected to grow at a strong CAGR of 9.6% between 2026 and 2035.

- By enterprise size, the large enterprises segment held a major market share of approximately 64% in 2025.

- By enterprise size, the SMEs segment is expected to expand at the fastest CAGR of 9.1% from 2026 to 2035.

- By end use, the retail segment held a major market share of 25% in 2025.

- By end use, the healthcare & life sciences segment is expected to expand at the fastest CAGR of 9.4% between 2026 and 2035.

Why is the clustering software market gaining momentum?

The clustering software market witnessed steady growth as businesses increasingly relied on data-driven decision-making, requiring large volumes of structured and unstructured data to be efficiently organized, analyzed, and managed. Clustering software enables machines to group data based on similarity patterns, aiding analytics, customer segmentation, anomaly detection, and decision-making across industries. It supports large-scale data processing and leverages AI/ML to uncover hidden clusters in structured and unstructured data.

Rapid expansion of big data, cloud computing, and AI-enabled analytics across industries such as IT, healthcare, finance, and retail drove adoption. Additionally, the rising use of cloud architectures and real-time analytics increased demand for flexible, scalable clustering solutions, while applications in fraud detection, customer segmentation, IoT analytics, and network optimization further support market expansion.

How is AI Impacting the Clustering Software Market?

The market for clustering software is being greatly boosted by artificial intelligence, which makes it possible to group big and complicated datasets more quickly and accurately. AI-powered clustering algorithms eliminate the need for manual parameter tuning by automatically identifying hidden patterns, anomalies, and similarities in real time. In applications like fraud detection, network optimization, customer segmentations, and bioinformatics, machine learning based clustering enhances scalability and accuracy. Additionally, clustering tools can dynamically adjust to shifting data streams thanks to AI-powered automation, which makes them extremely useful for businesses handling big data and real-time analytics.

What are the Major Trends Influencing the Market?

- Integration with AI and machine learning for better predictive analytics and pattern recognition.

- Growing adoption of cloud native and hybrid clustering solutions for scalability and flexibility.

- Increasing demand for real-time data processing in finance, telecom, and e-commerce.

- Expansion across multiple industry verticals, including healthcare, retail, manufacturing, and cybersecurity.

- Development of automated and self-learning clustering models to reduce manual effort.

- Enhanced focus on data security, governance, and compliance in enterprise deployments

- Rising use in IoT and edge computing applications for distributed data clustering.

- Emphasis on user-friendly interfaces and visualization tools for faster insights.

Exploring the Future Potential of the Market

- AI-enabled clustering: Integration of AI allows enterprises to extract deeper insights and improve decision-making.

- Cloud and hybrid solutions: Scalable and flexible deployments help meet the needs of distributed and data-intensive environments.

- Industry-specific applications: Custom solutions for healthcare, finance, retail, and manufacturing enable specialized use cases.

- Real-time and edge analytics: Clustering software can process streaming data for IoT and smart infrastructure applications.

- Automated and self-learning models: Reduce manual effort while improving accuracy and efficiency in data analysis.

- Enhanced security and compliance: Strong data protection and regulatory adherence attract sensitive industries like healthcare and finance.

What are regulatory and data governance requirements influencing the market?

Regulatory and data governance requirements are influencing the clustering software market by driving demand for secure, compliant, and well-governed data environments. To guarantee data privacy, residency, and auditability, regulations like GDPR and HIPAA are pushing businesses to implement private cloud and hybrid clustering solutions on premises. As a result, vendors are incorporating features like encryption, access controls, and compliance monitoring. Choosing software with governance-ready capabilities is crucial.

How Are Government Initiatives Supporting the Growth of the Clustering Software Market?

Government initiatives promoting digital transformation, cloud adoption, and AI development are accelerating the demand for clustering software across public and private sectors. The demand for sophisticated data analytics and data organization tools is rising because of investments in smart cities, e-governance platforms, and national data infrastructure. Adoption of safe on-premises and hybrid clustering solutions is also being fueled by policies that prioritize data security, sovereignty, and regulatory compliance, especially in regulated industries.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.64 Billion |

| Market Size in 2026 | USD 1.83 Billion |

| Market Size by 2035 | USD 4.97 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.73% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Deployment, Enterprise Size, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

What made self-service clustering the dominant segment in the clustering software market?

The self-service clustering segment dominated the market with a 50% share in 2025. This is mainly due to its ease of use and capacity to enable data analysts and business users to carry out clustering without the need for extensive technical knowledge. It is the recommended option for extensive enterprise deployments due to its intuitive user interfaces, visualization tools, and integration with analytics platforms. It allows businesses to have less reliance on IT teams, which accelerates decision-making and insights.

The hybrid clustering segment is expected to grow at the fastest CAGR of 9.7% over the forecast period, as more businesses use both on-premises and cloud-based infrastructure. Businesses can maximize performance and reduce expenses with this method's flexibility, scalability, and improved handling of big, dispersed datasets. Additionally, the hybrid model facilitates business continuity by enabling data access in various environments.

Deployment Insights

Why did the on-premises segment dominate the clustering software market?

The on-premises segment dominated the market with a 52% share in 2025 because businesses want more control over data security and adherence to internal IT guidelines. On-premises solutions are frequently preferred by large organizations with vital data assets in order to preserve control and guarantee performance dependability. Additionally, it permits legacy system integration and customization to satisfy particular organizational requirements.

The cloud segment is expected to grow at the fastest CAGR of 9.6% in the upcoming period. The growth of the segment is driven by businesses shifting workloads to a cloud environment for scalability, lower infrastructure costs, and simple integration with contemporary AI and data analytics platforms. Faster deployment, remote accessibility, and seamless updates are further benefits of cloud solutions. Additionally, the growing adoption of cloud architecture across industries accelerated demand for cloud-based clustering solutions.

Enterprise Size Insights

How do large enterprises contribute the largest share of the clustering software market?

The large enterprises segment held the largest market share of 64% in 2025, as these enterprises heavily rely on clustering tools to manage massive data volumes and streamline complex business processes. Their larger budgets and dedicated IT teams enabled widespread deployment and integration of advanced clustering solutions. Additionally, they focused on strategic analytics initiatives that drive long-term business growth.

The SMEs segment is expected to expand at the fastest CAGR of 9.1% during the projection period. This is because small and medium-sized enterprises are increasingly adopting data-driven strategies to remain competitive. Affordable, cloud-based, and self-service clustering solutions enable SMEs to analyze large datasets, gain insights, and optimize operations without heavy IT infrastructure or specialized teams. Additionally, the rise of use cases such as customer segmentation, fraud detection, and operational analytics is driving broader adoption among SMEs seeking scalable, flexible, and cost-effective tools.

End Use Insights

Why did the retail segment dominate the clustering software market?

The retail segment dominated the market with a 27% share in 2025 because retailers rely heavily on data-driven insights to understand customer behavior, optimize inventory, and personalize marketing. Clustering tools enable efficient customer segmentation, demand forecasting, and targeted promotions, helping retailers improve sales and operational efficiency. Additionally, the large volumes of transactional and behavioral data generated in retail make these solutions essential for strategic decision-making, driving widespread adoption in the sector.

The healthcare & life sciences segment is expected to grow at a 9.4% CAGR in the coming years, driven by increasing adoption of clustering tools to analyze patient data, find new drugs, identify disease patterns, and increase operational efficiency. The adoption of clustering software in the healthcare industry is further accelerated by the growing digitization of research data and medical records.

Region Insights

How Big is the North America clustering software Market Size?

The North America clustering software market size is estimated at USD 656.00 million in 2025 and is projected to reach approximately USD 2,012.85 million by 2035, with a 11.86% CAGR from 2026 to 2035.

What made North America the dominant region in the clustering software market?

North America dominated the market while capturing the largest share of 40% in 2025. This is mainly due to the presence of top software vendors, early adoption of analytics technologies, and sophisticated IT infrastructure. Businesses in this region still make significant investments in cutting-edge data management systems. Additionally, strong demand for data-driven decision-making, real-time analytics, and digital transformation initiatives reinforced the region's leadership in the market.

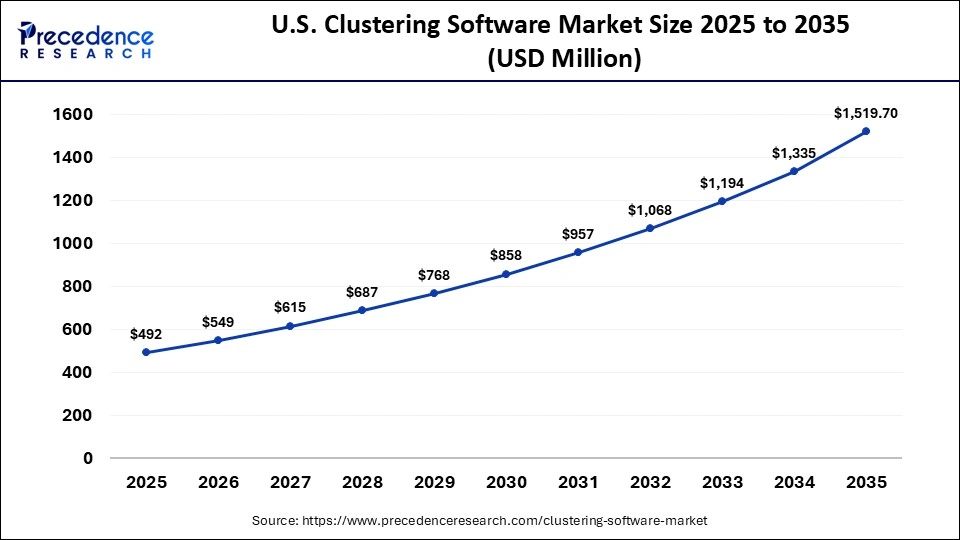

What is the Size of the U.S. clustering software Market?

The U.S. clustering softwaremarket size is calculated at USD 492.00 million in 2025 and is expected to reach nearly USD 1,519.70 million in 2035, accelerating at a strong CAGR of 11.94% between 2026 and 2035.

U.S. Clustering Software Market Analysis

The U.S. is a major contributor to the North American clustering software market, driven by the presence of a large number of international software vendors. Businesses in the U.S. are increasingly leveraging large volumes of structured and unstructured data to drive insights and improve decision-making. There is a rapid adoption of cloud computing, AI, and big data analytics, enabling organizations to implement scalable and flexible clustering solutions for applications like customer segmentation, fraud detection, and operational optimization. High investments in AI cloud adoption and government-backed digital projects all contribute to the U.S. market's rapid expansion.

What makes Asia Pacific the fastest-growing region in the clustering software market?Asia Pacific is expected to grow at the fastest CAGR of 10.8% in the market, driven by rapid digital transformation initiatives, increasing adoption of cloud computing, and rising demand for data analytics solutions across industries like manufacturing, retail, and healthcare. The region's expanding technology infrastructure, supportive government policies, and growing number of emerging startups are further accelerating the adoption of clustering software. Additionally, businesses in the region are increasingly leveraging data-driven insights to improve efficiency, competitiveness, and decision-making, driving market growth.

India Clustering Software Market Analysis

The market in India is growing rapidly, driven by the rise of startups shifting to data-driven decision-making, growing cloud adoption, and digital transformation initiatives. Clustering tools are being used more frequently in industries like IT, e-commerce, and healthcare to improve operational efficiency, real-time analytics, and customer insights. Affordable cloud solutions, expanding tech talent, and supportive government policies are all contributing to the nation's increased adoption.

Who are the Major Players in the Global Clustering Software Market?

The major players in the clustering software market include IBM Corporation, Oracle Corporation, Microsoft Corporation, SAP SE, VMware (Broadcom), Amazon Web Services (AWS), Google LLC, Red Hat (IBM), Hewlett Packard Enterprise (HPE), Fujitsu, NEC Corporation, Cisco Systems, Alteryx, Inc., Veritas (Carlyle Group), SUSE (Rancher), Stratus Technologies, HashiCorp, Mirantis, Huawei Technologies, Symantec (Broadcom), Axigen, and Evidian.

Recent Developments

- In January 2026, IBM announced the introduction of Sovereign Core. Sovereign Core is a software foundation designed to assist partners and governments in constructing and managing sovereign cloud environments. IBM introduced Sovereign Core to provide localized data control and security, allowing for the deployment of AI and sensitive workloads within specific regulatory jurisdictions(Source: https://www.ibm.com)

- In January 2026, the NVIDIA BlueField-4 SuperNIC and Inference Context Memory Storage platform were introduced to build an AI-native storage infrastructure. This technology enables agentic AI systems to scale by offloading and managing large context memories across rack-scale clusters.(Source: https://investor.nvidia.com)

- In November 2025, Penguin Solutions announced the release of its ICE ClusterWare 13.0 management software designed for production-scale AI and HPC infrastructure. This updated version includes new features such as patent-pending anomaly detection, auto-remediation for isolating underperforming nodes, and network-isolated multi-tenancy for secure partitioning of GPU clusters. (Source: https://ir.penguinsolutions.com)

Segments Covered in the Report

By Type (Platform / Model)

- Self-Service Clustering

- Managed Clustering

- Hybrid Clustering

By Deployment

- On-Premises

- Cloud

By Enterprise Size

- Large Enterprises

- SMEs (Small & Medium Enterprises)

By End-Use

- Retail

- BFSI

- IT & Telecom

- Healthcare & Life Sciences

- Manufacturing

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content