What is the Cobalt-Free Batteries Market Size?

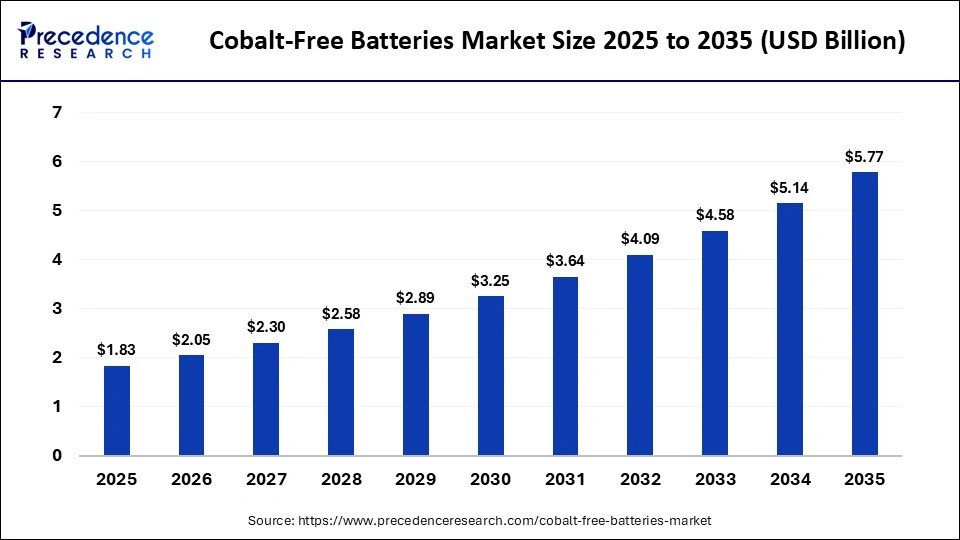

The global cobalt-free batteries market size was calculated at USD 1.83 billion in 2025 and is predicted to increase from USD 2.05 billion in 2026 to approximately USD 5.77 billion by 2035, expanding at a CAGR of 12.20% from 2026 to 2035.The cobalt-free batteries market is experiencing unprecedented growth, driven by the rising electrification of transportation and growing adoption of renewable energy storage.

Market Highlights

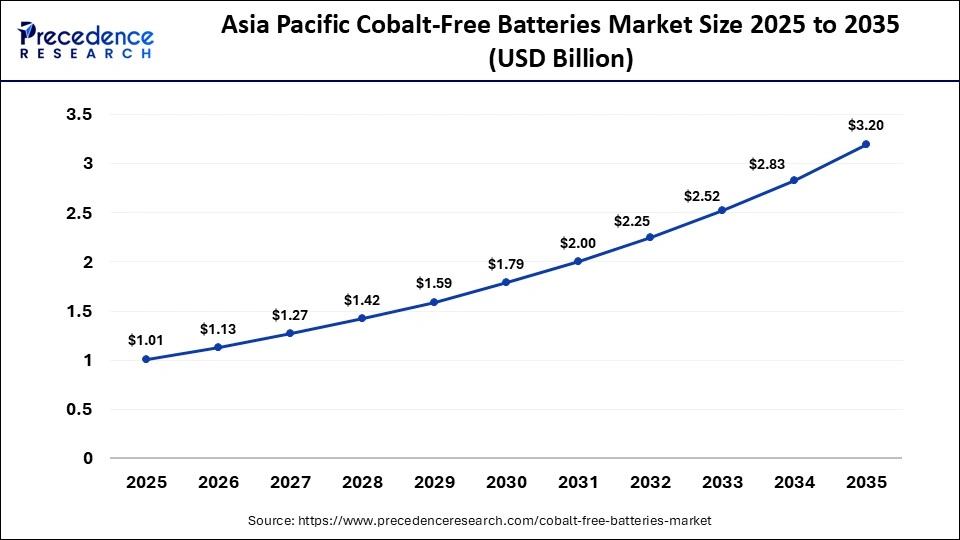

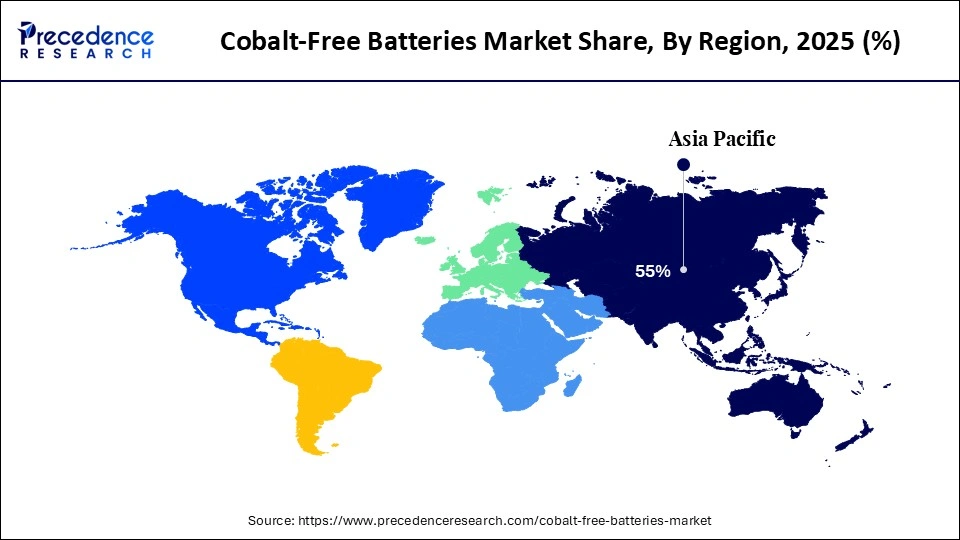

- Asia Pacific contributed with approximately 55% cobalt-free batteries market share and is expected to further grow at the fastest CAGR of 12.8% during the forecast period.

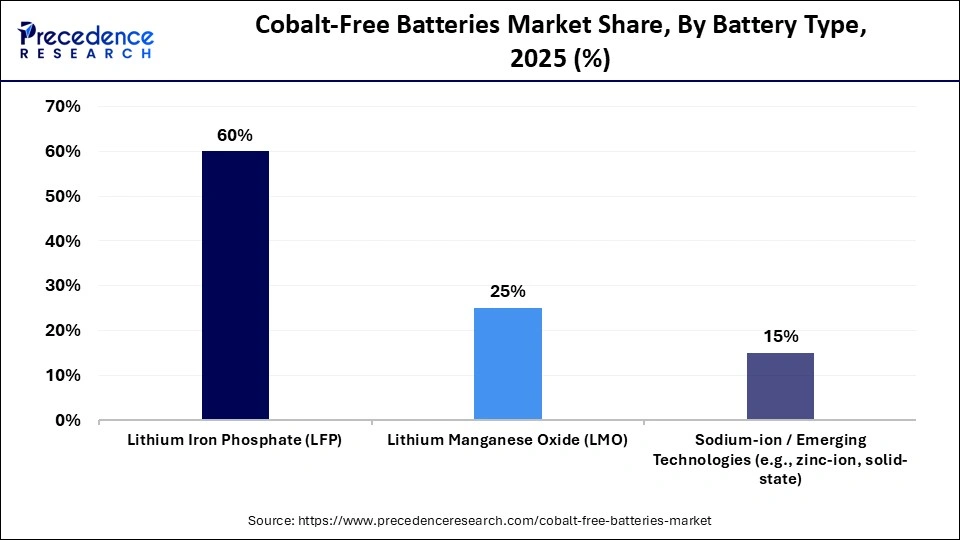

- By battery type, the lithium iron phosphate (LFP) segment held the largest market share, accounting for approximately 60% share in 2025.

- By battery type, the sodium-ion/emerging technologies segment is expected to grow at a remarkable CAGR of 10.6% from 2026 to 2035.

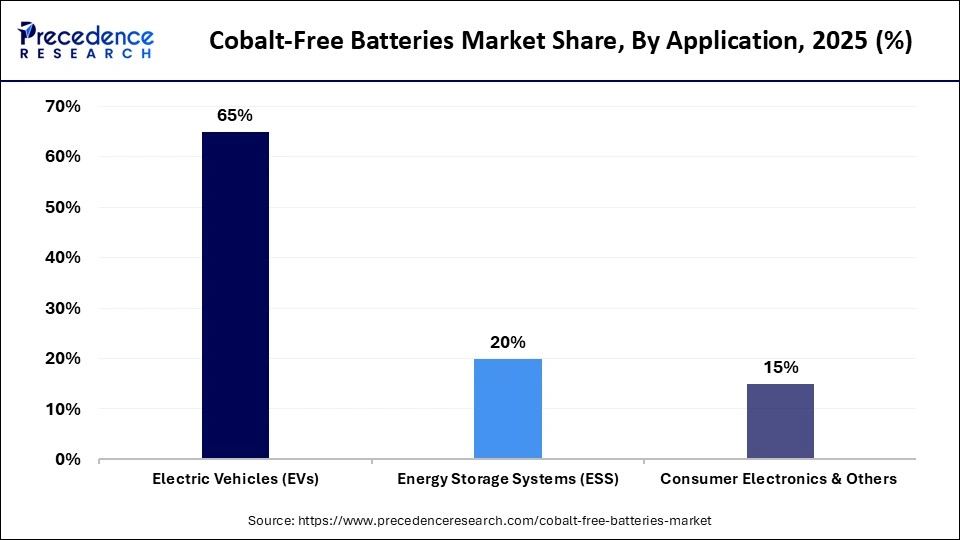

- By application, the electric vehicles (EVs) segment maintained a leading position in the market in 2025, accounting for an estimated 65% market share.

- By application, the energy storage systems (ESS) segment is expected to grow at a significant CAGR of 10.8% between 2026 and 2035.

- By sales/distribution channel, the direct sales segment registered its dominance over the global market with a market share of approximately 60% in 2025.

- By sales/distribution channel, the online retail segment is expected to grow at a remarkable 11.4% between 2026 and 2035.

- By end-user industry, the automotive (EV OEMs) segment held a major revenue share of about 65% in the cobalt-free batteries market in 2025.

- By end-user industry, the renewable energy & industrial use segment is set to grow at a notable CAGR of 11.1% from 2026 to 2035.

Market Overview

Cobalt-free batteries are energy storage technologies engineered to eliminate or significantly reduce cobalt in their chemistry, addressing cost, ethical, environmental, and supply-chain challenges associated with cobalt mining. These batteries, such as lithium iron phosphate and sodium-ion, offer improved safety, thermal stability, and cost advantages versus cobalt-based lithium-ion cells.

How are AI-driven innovations reshaping the cobalt-free batteries market?

In the rapidly evolving technological landscape, the integration of Artificial Intelligence (AI) represents a pivotal shift in how cobalt-free batteries are developed and utilize energy storage solutions, significantly accelerating the growth of the cobalt-free batteries market. AI assists in transforming battery design, enabling predictive maintenance, optimizing battery development, and streamlining the entire lifecycle of batteries. The AI impact on the cobalt-free batteries began gaining traction with the rise of electric vehicles and renewable energy storage. From discovering materials to predicting battery failures, AI streamlines the entire lifecycle of batteries. The AI transformation improves efficiency and addresses ongoing environmental concerns.

What are the emerging trends in the market?

- The rising transition to electric vehicles requires cheaper, safer, and more sustainable batteries, which is anticipated to accelerate the growth of the market during the forecast period. Lithium Iron Phosphate batteries offer a significant cost advantage and provide enhanced thermal stability.

- The stringent emission standards and favorable government incentive policy are expected to contribute to the overall growth of the cobalt-free batteries market.

- The rapid advancements in Lithium Iron Phosphate (LFP) and manganese-based chemistries are anticipated to fuel the expansion of the market in the coming years.

- The rising ethical concern is anticipated to boost the market's expansion in the coming years. The extraction and processing of cobalt pose significant ethical and environmental risks, which increases the need for cobalt-free batteries. By eliminating cobalt, these batteries offer a more reliable supply and improved safety.

- The rapid expansion of solar and wind energy requires stable and sustainable storage, which favors cobalt-free batteries for grid-scale applications, which is expected to bolster the growth of the market during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.83Billion |

| Market Size in 2026 | USD 2.05 Billion |

| Market Size by 2035 | USD 5.77Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 12.20% |

| Dominating Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Battery Type, Application, End-User Industry, Sales/Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Battery Type Insights

What causes the lithium iron phosphate (LFP) segment to dominate the cobalt-free batteries market?

The lithium iron phosphate (LFP) segment held the largest market share of approximately 60% in 2025. Lithium iron phosphate (LFP) batteries provide several benefits, such as superior thermal stability, enhanced safety, lower production costs, reduced risk of overheating, and longer cycle life. The growth of the segment is also driven by the rising need for cost-effective, ethically sourced materials and sustainable energy storage solutions for electric vehicles (EVs) and renewable energy. Several automakers like BYD, Tesla, and Volkswagen are widely adopting lithium iron phosphate (LFP) for their standard-range vehicles.

The sodium-ion/emerging technologies segment is expected to grow at a remarkable CAGR of 10.6% between 2026 and 2035, owing to the increasing demand for safer, cost-effective, and more sustainable energy storage solutions. The adoption of these batteries eliminates the ethical and high-cost risks associated with cobalt and lithium supply chains. These emerging technologies are rapidly gaining traction by offering enhanced performance for applications like grid storage and short-range electric vehicles (EVs). Sodium is 1,000 times more abundant and cheaper than lithium, which makes sodium-ion batteries (SIBs) more affordable. Zinc is also widely available and non-toxic, providing a stable supply chain.

Application Insights

What factors are contributing to the dominance of the electric vehicles (EVs) segment in the cobalt-free batteries market?

The electric vehicles (EVs) segment is dominating the market by holding a majority share of nearly 65% in 2025. The rising need for affordable and ethically sourced batteries has significantly increased the adoption of cobalt-free batteries in electric vehicles (EVs). Cobalt-free batteries are much cheaper and more readily available, which leads to lower electric vehicle (EV) prices for consumers and provides stable battery supplies. The use of cobalt-free batteries reduces the environmental and social impacts of cobalt mining and makes these batteries much safer and more environmentally friendly than cobalt-based ones. Cobalt-free batteries, particularly LFP, are 20–30% cheaper to produce compared to nickel-manganese-cobalt (NMC) batteries, making them ideal for mass-market electric vehicles.

On the other hand, the energy storage systems (ESS) segment is expected to grow at a significant CAGR of 10.8% between 2026 and 2035. Lithium iron phosphate (LFP) is widely used for stationary energy storage, where weight is less critical, and cost per cycle is paramount. Lithium iron phosphate (LFP) batteries provide exceptionally thermal stability and can withstand temperatures up to 270°C before entering thermal runaway, which significantly reduces the risks of fire or overheating.

Sales/Distribution Channel Insights

Which factors are responsible for the growth of the direct sales segment in the market?

The direct sales segment is dominating the cobalt-free batteries market, with a market share of approximately 60% in 2025. Direct sales are a significant distribution channel in the market. Direct sales bypassing intermediaries allow manufacturers to form direct partnerships with automotive OEMs to ensure a stable supply of cobalt-free batteries. Cobalt-free batteries, such as Lithium Iron Phosphate (LFP), often require tailored specifications for specific EV models, which increases the need for direct sales between manufacturers and automakers.

The online retail segment is the fastest-growing segment and is expected to grow at a remarkable 11.4% between 2026 and 2035. The growth of the segment is supported by the rising need for easy accessibility, discounted pricing, and the rapid expansion of consumer electronics. The online retail allows individual consumers and businesses to compare specifications, prices, and brands for specialized and eco-friendly battery options. In addition, rapid advancement in digital infrastructure and logistics has facilitated faster and more secure delivery of batteries.

End-user Industry Insights

What has led the automotive (EV OEMs) segment to dominate the market?

The automotive (EV OEMs) segment held the dominating share of about 65% in the cobalt-free batteries market. Cobalt-free LFP batteries allow automotive (EV OEMs) to produce more affordable and mass-market electric vehicles. As electric vehicle sales surge encourages automakers are encouraged to prioritize cobalt-free battery solutions to meet mass-market affordability targets. The EV adoption accelerated owing to the support of policy incentives and growing demand for sustainability.

The renewable energy & industrial use segment is set to grow at a remarkable CAGR of 11.1% from 2026 to 2035. Cobalt-free batteries, particularly lithium iron phosphate (LFP) offer superior thermal stability and significantly reduce the risks of overheating/fire in stationary, residential, and industrial grid-scale storage. Cobalt-free batteries are cheaper to produce than nickel-cobalt-manganese (NCM) alternatives, which makes them highly attractive for large-scale energy storage projects.

Regional Insights

What is the Asia Pacific Cobalt-Free Batteries Market Size?

The Asia Pacific cobalt-free batteries market size is expected to be worth USD 3.20 billion by 2035, increasing from USD 1.01 billion by 2025, growing at a CAGR of 12.22% from 2026 to 2035.

Asia Pacific Cobalt-Free Batteries Market Analysis

Asia Pacific dominated the market with approximately 55% market share and is expected to further grow at the fastest CAGR of 12.8% in 2026-2035. Countries like China, South Korea, and Japan are leading in developing and deploying cobalt-free technologies. The region is home to major market players, such as Contemporary Amperex Technology Co. Limited, BYD Company, LG Energy Solution, Samsung SDI, SK Innovation Co. Ltd, Murata Manufacturing Co. Ltd., and others. This leadership position is also attributed to the increasing adoption of electric vehicles (EVs) and energy storage systems (ESS), rising consumer demand for portable electronics, strong government support for local production, increasing focus on boosting sustainability, and the rising popularity of eco-friendly materials.

China's Cobalt-Free Batteries Market Analysis

China is a major contributor to the market. The country has the highest concentration of battery manufacturers, particularly lithium iron phosphate (LFP). The country is experiencing rapid growth in electric vehicles and energy storage systems owing to the increasing demand for safer, cost-effective, and more sustainable battery chemistries, such as lithium iron phosphate (LFP). Several automotive manufacturers in the country are widely adopting cobalt-free batteries, driven by the increasing shift toward greener mobility solutions and rising regulatory pressures associated with cobalt mining. Such a combination of factors is anticipated to boost the growth of the market in the Asia Pacific region.

North American Cobalt-Free Batteries Market Analysis

North America is witnessing notable growth in the market. The growth of the region is characterized by massive EV adoption, a significant rise in consumer electronics manufacturing, an increasing need to address ethical sourcing concerns associated with cobalt, and increasing investment in cost-effective battery technology. Moreover, the rising governmental subsidies and stringent environmental regulations support the transition to clean energy sources. Such factors are expected to accelerate the growth of the North American region during the forecast period.

The U.S. Cobalt-Free Batteries Market Analysis

The U.S. market is experiencing significant growth. The country is rapidly moving away from cobalt due to its ethical supply chain issues and high cost, with cobalt-free chemistries. The growth of the country is attributed to the rise in EV sales, stringent environmental standards, a shift towards secure and cost-effective energy storage solutions, increasing demand for sustainable cobalt-free alternatives, and supportive government policies subsidizing EV adoption. Several automotive OEMs in the country are increasingly adopting green manufacturing practices, mainly driven by the increasing need to reduce dependence on volatile cobalt prices, the increasing need to secure supply chains, and meet stringent environmental regulations.

- In January 2026, Argonne-backed research has unveiled that cobalt-free, manganese-rich batteries could deliver higher energy at a lower cost, just as U.S. automakers ramp up investment in LMR technology. The projections were encouraging: Cobalt-free LMR systems have the potential to achieve around 25 % greater energy density compared to leading lithium iron phosphate (LFP) cells, while maintaining equal or lower anticipated costs.

Cobalt-Free Batteries Market Value Chain Analysis

- Resource Extraction

Value chain shift prioritizes ethical, high-volume sourcing of lithium, iron, phosphate, and manganese, removing reliance on DRC cobalt. Key mining firms include Albemarle, SQM, Ganfeng Lithium, and major LFP raw material suppliers.

- Energy Storage Systems

Cell production focuses on LFP and Sodium-ion (Na-ion) chemistries, offering cost-effective, thermally stable energy storage for EVs and stationary grids. Leaders are CATL, BYD, SVOLT, Panasonic, and LG Energy Solution.

- Regulatory Compliance and Energy Trading

Stringent EU/US standards for sustainability and battery passports, including recyclability, drive adoption. Trading focuses on recycled materials, with players like Northvolt, Redwood Materials, and standard-setting bodies shaping compliance.

Who are the Major Players in the Global Cobalt-Free Batteries Market?

The major players in the cobalt-free batteries market include BYD Company Ltd, Contemporary Amperex Technology Co. Ltd (CATL), Tesla, Inc. , LG Energy Solution Panasonic Corporation, Samsung SDI Co., Ltd,. SVOLT Energy Technology Co., Ltd,. EVE Energy Co., Ltd,. A123 Systems LLC, Johnson Controls International plc, Saft Groupe S.A., Toshiba Corporation, Northvolt AB, Lithium Werks, Murata Manufacturing Co., Ltd.

Recent Developments

- In February 2026, Himadri Speciality Chemicals announced that it is accelerating its entry into the electric vehicle (EV) battery materials space, initiating advanced discussions with global EV manufacturers and battery makers to supply lithium iron phosphate (LFP) cathode materials. Through this move, the company aims to tap the fast-growing demand for cost-effective and safer battery chemistries while strengthening its presence in the global energy storage value chain.(Source:https://chemindigest.com)

- In April 2024, Our Next Energy Inc., a Michigan-based energy storage technology company, and L&F, a South Korean-based leader in cathode active materials, signed a Memorandum of Understanding (MOU) to collaborate on the validation, qualification, and production of a mid to long-term supply of lithium iron phosphate (LFP) cathode active materials (CAM). (Source:https://www.globenewswire.com)

Segments Covered in the Report

By Battery Type

- Lithium Iron Phosphate (LFP)

- Lithium Manganese Oxide (LMO)

- Sodium-ion / Emerging Technologies (e.g., zinc-ion, solid-state)

By Application

- Electric Vehicles (EVs)

- Energy Storage Systems (ESS)

- Consumer Electronics & Others

By End-User Industry

- Automotive (EV OEMs)

- Electronics

- Renewable Energy & Industrial Use

By Sales/Distribution Channel

- Direct Sales

- Online Retail

- Distributors / Resellers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting