What is the Cold Spray Technology Market Size?

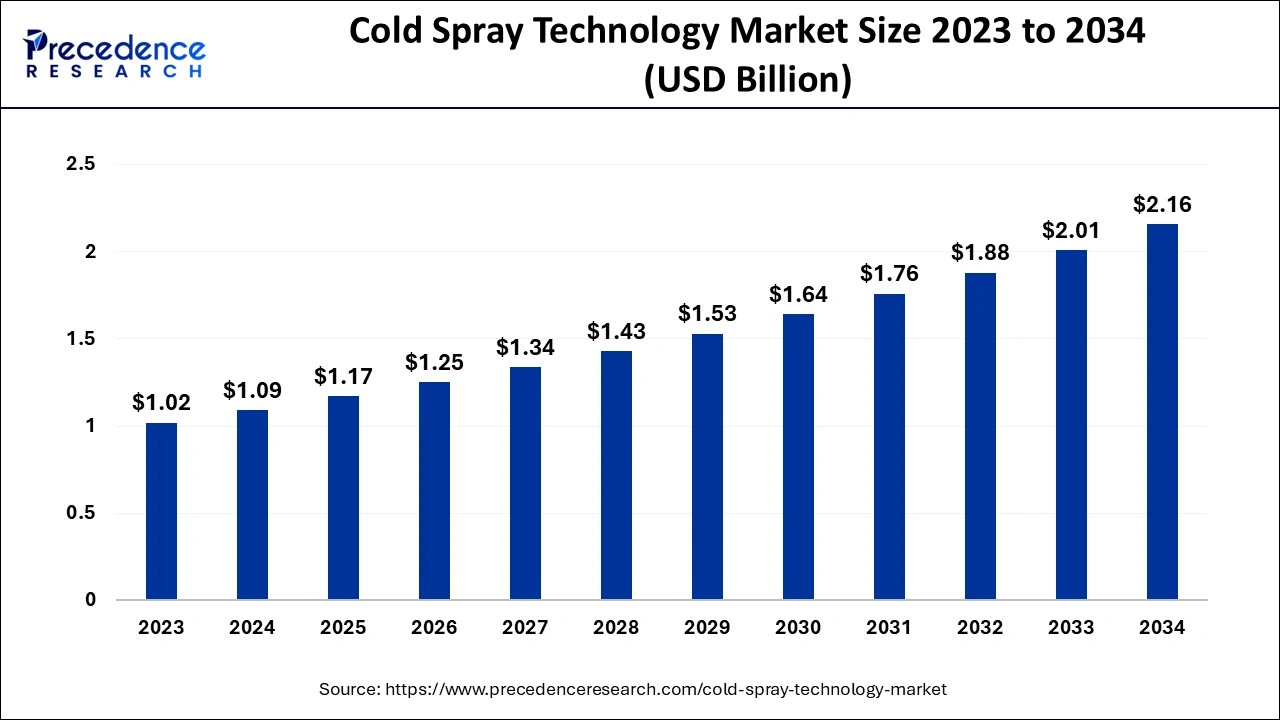

The global cold spray technology market size is accounted at USD 1.17 billion in 2025 and predicted to increase from USD 1.25 billion in 2026 to approximately USD 2.16 billion by 2034, expanding at a CAGR of 7.08% from 2025 to 2034. Increasing demand for cold spray technology from the aerospace industry is the key factor driving the cold spray technology market growth. Also, expanding the electrical industry in emerging economies coupled with materials innovation is expected to fuel market growth soon.

Cold Spray Technology Market Key Takeaways

- In terms of revenue, the global cold spray technology market was valued at USD 1.09 billion in 2024.

- It is projected to reach USD 2.16 billion by 2034.

- The market is expected to grow at a CAGR of 7.08% from 2025 to 2034.

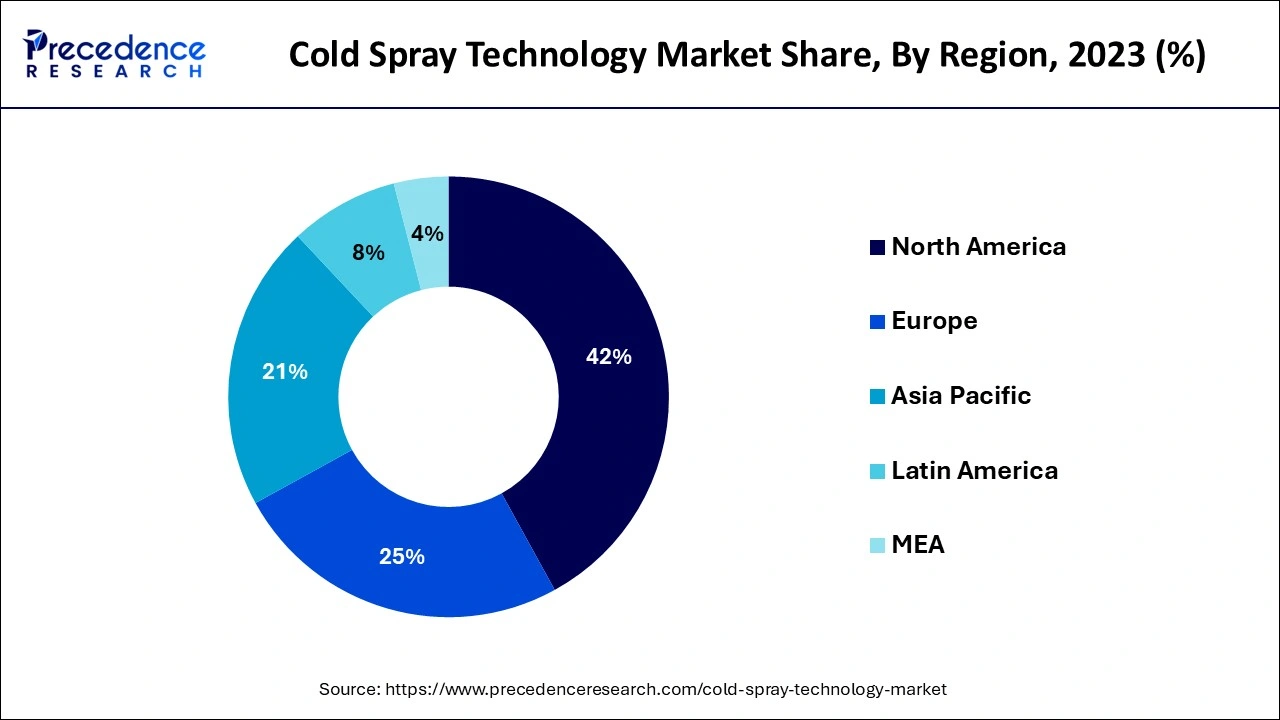

- North America dominated the global market with the largest market share of 42% in 2024.

- Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By material, the aluminum segment contributed the highest market share of 29% in 2024.

- By material, the titanium segment is expected to grow at the fastest CAGR over the forecast period.

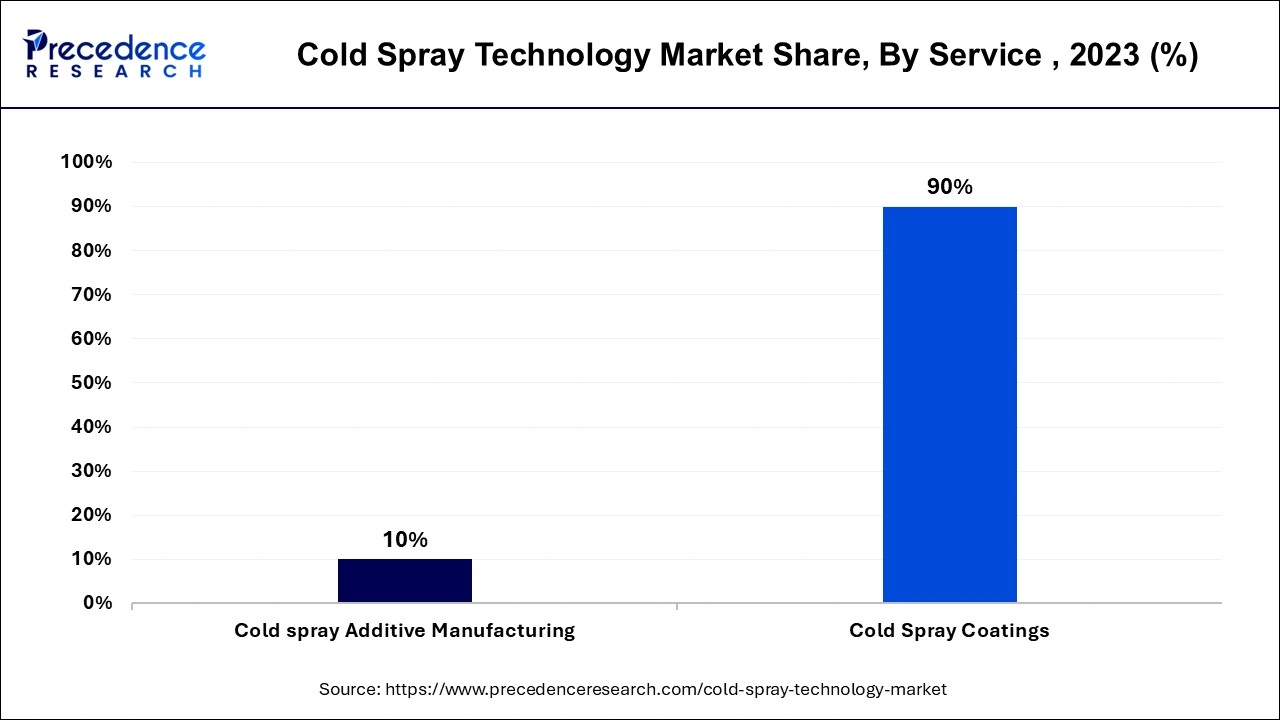

- By service, the cold spray coatings segment captured the biggest market share of 90% in 2024.

- By service, the cold spray additive manufacturing (CSAM) segment is anticipated to grow at the fastest CAGR from 2025 to 2034.

- By end use, in 2023, the aerospace segment generated the major market share of 27% 2024.

- By end use, the electrical and electronics segment is estimated to grow rapidly during the forecast period.

What is the role of AI in the Cold Spray Technology Market?

The implementation of AI technology has significantly transformed the dimensions of the cold spray technology market by offering better enhancements in terms of precision, scalability, and operations, helping improve the range of predictive analysis and enabling businesses to showcase their market trends. Furthermore, AI analytics tools can extract the required data from the vast data sets, which helps to employ data-based operations. As AI technologies progress, they directly help the market grow at a remarkable rate.

- In June 2024, Aibuild unveiled the launch of Aibuild 2.0. The new version of Aibuild's software platform introduces improved capabilities, and new branding strategies created to boost the advancement in the large-format Additive Manufacturing industrial technologies, such as cold spray, concrete, and paste extrusion.

What is Cold Spray Technology?

The cold spray technology market is the industry for innovative techniques of cold spray, which utilize compressed gas to propel metal particles onto the material at high speed. The coating is used to restore structural and corrosive elements which cannot be eliminated with welding. Cold spray coating technology is preferred over the thermal spray method as it reduces porosity, increases hardness, enhances adhesion strength, and retains feedstock powder properties.

What are the Growth Factors in the Cold Spray Technology Market?

- Increasing urbanization, along with the growth in the middle-class population, is expected to boost the cold spray technology market growth shortly.

- Ongoing shifts in the expenditure priorities of customers in emerging economies like India and China can propel market growth soon.

- Developments in hybrid manufacturing techniques that combine cold spray with subtractive or additive processes will likely propel the market growth further.

Cold Spray Technology Market Outlook

- Industry Growth Overview: Between 2025 and 2030, the cold spray technology industry is expected to scale dramatically as industries demand high-performance repair, coating, and additive manufacturing technologies. Demand is appearing in the aerospace, defense, and electronics industries in response to the demand for low-heat metal deposition and improved life of components, particularly in the Asia-Pacific and North America.

- Sustainability Trends: Cold spray is gaining momentum as a more environmentally friendly alternative to thermal spraying because there are low-level emissions, zero melting waste, and increased life of the equipment. Companies are investing in eco-efficient metal powders and energy-saving systems with increased restrictions on the environment in Europe and North America.

- Global Expansion: Key suppliers are scaling production and service operations in Southeast Asia, Eastern Europe, and the Middle East to support defense and manufacturing growth. Several suppliers are also scaling production, research and development capabilities, and application centers in proximity to aerospace clusters to increase regional adoption and reduce logistics costs.

- Major Investors: Strategic investors and private equity are beginning to participate in the cold spray space. The high technical barriers, increasing use cases in aircraft repair, and additive manufacturing contributions are all attracting investment. Interest generated by defense applications with healthy margins and the long-term trend in industrial digitization are also driving the investment.

- Startup Ecosystem: The technology is attracting new startups, launching portable cold spray systems, improved nozzles, and high-performance metal powders. Young companies working toward lightweight alloys, integration of robotics, and high-speed deposition are now attracting significant venture capital interest as the use of cold spray becomes part of next-generation manufacturing.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.16 Billion |

| Market Size in 2026 | USD 1.25 Billion |

| Market Size in 2025 | USD 1.17 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.08% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Service, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Market Dynamics

Driver

Better performance and durability

The cold spray technology market provides exceptional longevity and wear resistance properties, which makes it highly preferred for applications in industries like automotive and aerospace. The coating done by this technique can bear extreme conditions, such as abrasion, stress, and harsh climatic changes. In addition, this higher strength ensures that the material remains reliable and functional over a longer duration of time, even in challenging operational situations.

- In April 2024, Evonik added Ancamine 2844, an epoxy cure hardener created for plural component spray applications, to its curing agent portfolio. This innovative high-functional aliphatic amine hardener provides ultra-fast cure properties and fast property development in harsh low-temperature and high-humidity conditions, as well as marine and protective coating applications.

Restraint

Technical complexity of the system

The requirement for specialized knowledge and training, along with the technical complexities of the system, can be the major obstacle hindering the adoption of the cold spray technology market. The technical person must need extensive training to learn and understand the whole operation, which can be difficult in areas with limited access to technical resources.

Opportunity

Surge in the renewable energy sector

There is an increasing demand for renewable energy sources, which directly raises the requirement for reliable and robust materials that can bear the environmental stresses related to these applications. Furthermore, the cold spray technology market can enhance the longevity and overall performance of components, including solar panel supports and wind turbine blades, by offering better resistance to corrosion, wear, and environmental degradation.

- In March 2024, Linde, an industrial gas company, introduced its next-generation post-additive manufacturing cold spraying gas supply solution, LINSPRAY Connect, which will substantially improve the safety and reliability of the cold spraying process. The innovative supply solution was developed in partnership with German cold spraying technology leader Impact Innovations.

Material Insights

The aluminum segment dominated the cold spray technology market in 2024. The dominance of the segment can be attributed to the extensive features of this metal, such as great ductility, low density, better resistance to corrosion, and good electrical conductivity. This alloy coating can be used to repair industrial parts for cost-saving purposes. Additionally, the surface of aluminum powder gets rapidly oxidized, and hence, it is hard to make high-density deposits while mimicking the effect of the oxide layer.

- In September 2022, PSI atomization technology optimizes aluminum powder production for Additive Manufacturing. Through its HERMIGA atomizer range, PSI offers consumers ATEX-rated equipment to produce high-quality spherical aluminum powders.

The titanium segment is expected to grow at the fastest rate in the cold spray technology market over the forecast period. The growth of the segment can be linked to the titanium's good biocompatibility, high strength, and better corrosion resistance properties. Titanium is also widely used in chemical, medical, petroleum, sports equipment, and aviation sectors. The technique of cold sparring can create oxygen-sensitive compounds such as titanium without leading to chemical degradation of the powder.

Service Insights

The cold spray coatings segment accounted for the majority share of the cold spray technology market in 2024. The dominance of the segment is due to cold spray coatings preventing oxidation, chemical reactions, and residual stresses of the material. Also, the cold spraying coating technique is being increasingly adopted because of their capability to offer protective layers which enhances the longevity and maintenance of the existing materials.

The cold spray additive manufacturing (CSAM) segment is anticipated to grow at the fastest rate in the cold spray technology market over the projected period. The growth of the segment can be driven by increasing demand for sustainable solutions and developments in the latest technologies. However, the current developments in CSAM technology are highly focused on electric motors utilized in the automotive sector to decrease the emission of carbon dioxide from automobiles.

- In October 2024, Titomic Limited, based in Brisbane, Australia, declared the launch of its Augmented Reality (AR) software suite for the D523 portable cold spray Additive Manufacturing machine. This is said to be the first application of AR technology in cold spray AM. The D523 cold spray Additive Manufacturing machine is utilized in defense, manufacturing aerospace, and oil & gas industries.

End-Use Insights

The aerospace segment held the largest share of the global cold spray technology market. The dominance of the segment can be linked to the increasing application scope of this technology because of its advantages, such as protection from wear and corrosion, reduction in harmful gas emissions, and electrical resistance. Furthermore, a good impact on the market is expected to come from the surge in the civil aviation sector, especially in countries like China and India, due to their increasing disposable income.

The electrical & electronics segment is estimated to grow rapidly in the cold spray technology market during the forecast period. The dominance of the segment is due to the increasing use of spray technology in the many components like refrigeration units, electrical contacts, transformers, electric motors & electric generators, & semiconductors displays, and circuit boards, etc., which necessitate good electrical, oxidation, and corrosion resistance to function in harsh environments.

Regional Insights

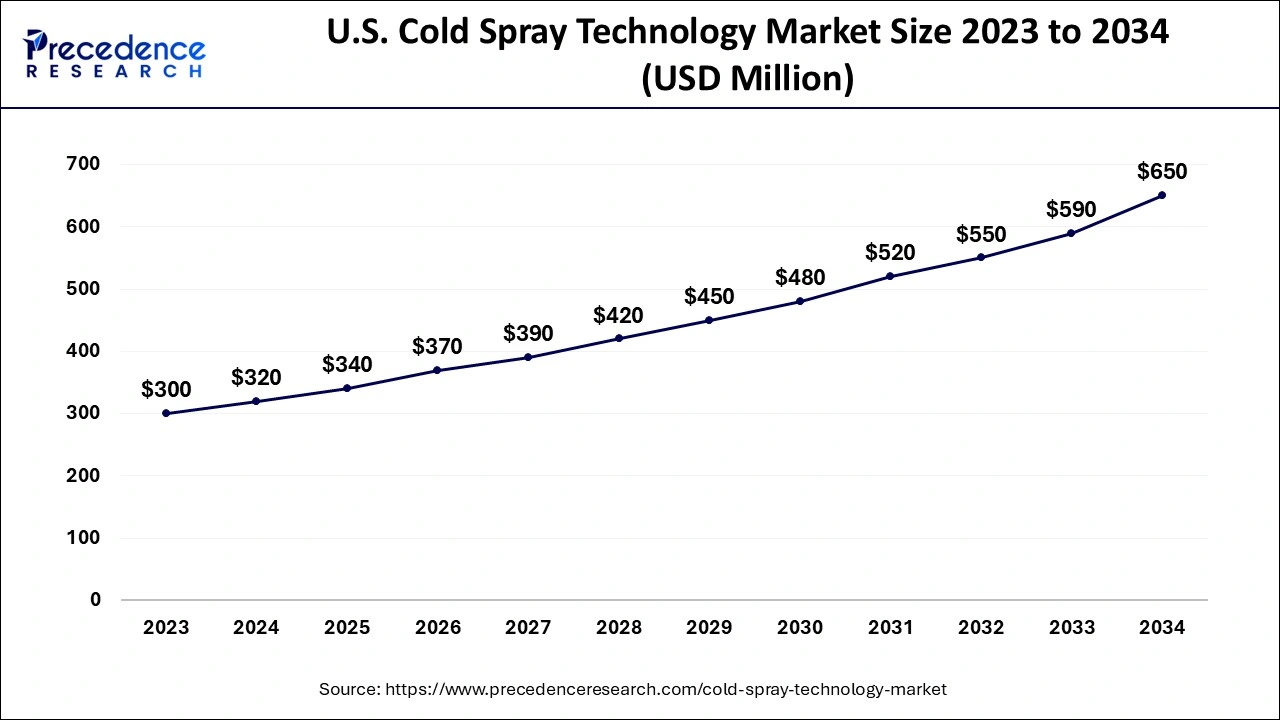

U.S. Cold Spray Technology Market Size and Growth 2025 to 2034

The U.S. cold spray technology market size is exhibited at USD 340 million in 2025 and is projected to be worth around USD 650 million by 2034, growing at a CAGR of7.34% from 2025 to 2034.

North America dominated the global cold spray technology market in 2024. The dominance of the segment can be attributed to the increasing demand for products produced using cold spray technology from the automotive and transportation industries in the region. The region is also experiencing substantial growth due to the abundance of commodities in its nation. Moreover, growing investments in R&D activities for designing autonomous cars in countries like the U.S. and Canada are expanding market growth in the region.

- In November 2022, Titomic announced the launch of its D623 medium-pressure Cold Spray Additive Manufacturing (CSAM) machine. With the abilities including the wear-resistant coatings and restoration of high-wear parts, among other updates.

North America: U.S. Cold Spray Technology Market Trends

The U.S. market is growing rapidly as industries adopt the process for high-performance coatings, repairs, and additive manufacturing applications. Rising demand from aerospace, defense, and automotive sectors is driving the use of cold spray for corrosion protection, part restoration, and lightweight component fabrication. Technological advancements in portable and high-pressure cold spray systems are expanding its use in field repairs and large-scale industrial operations. Additionally, increasing interest in cost-effective, low-heat metal deposition methods is further accelerating market adoption.

Asia Pacific will witness the fastest growth in the cold spray technology market during the forecast period. The growth of the region can be credited to the increasing demand for cold spray technology from the aerospace industry in developing countries such as India and China. Furthermore, in India, the adoption of cold spray technology is escalating, especially in the utility sector, because of its potential benefits. The region also has a flourishing automotive sector that will contribute to the market growth during the forecast period.

Why did Europe Experience Rapid Growth in the Cold Spray Technology Market?

Europe was projected to experience rapid growth due to the high demand in the aerospace, automotive, and industrial machinery industries. The region focused on lightweight metals and green manufacturing, supporting an increase in the adoption of cold spray technologies. Many European countries were investing in R&D of advanced materials and repair technologies.

There are opportunities in aviation maintenance, repairs to equipment used for the generation of renewable energy, and electric vehicles. Strict environmental rules in the European Union prompted industries to adopt cold spray because it was less wasteful and contributed to longer-term sustainability objectives.

Germany Cold Spray Technology Market Trends

Germany led the European cold spray technology market due to its engineering, automotive, and manufacturing industries. Companies in Germany were using cold spray technology to repair high-value metal parts and extend the life of machinery. Research centers were developing more energy-efficient systems and high-performance nozzle designs. Continuous action to incorporate Industry 4.0 and automation technologies has boosted the adoption of advanced repair technologies.

Why did Europe Experience Rapid Growth in the Cold Spray Technology Market?

Latin America experienced considerable growth potential, as Brazil, Mexico, and Chile all featured advanced solutions for repairing equipment for mining, oil, gas, and aviation operations. Cold spray reduced maintenance costs and increased the reliability of heavy machinery. Adoption rates were also supported by the region's movement toward advanced manufacturing. The region represented opportunities in aircraft repair facilities, restoration of worn mining tools, and coatings for energy equipment.

Brazil Cold Spray Technology Market Trends

Brazil was the leading economy in Latin America, due mainly to its large aerospace and mining sectors. Cold spray was used to repair aircraft engine components and restore worn mining tools. Universities and technical centers in Brazil worked to understand combinations of metals and powders to improve bonding capabilities and efficiency.

Why did Europe Experience Rapid Growth in the Cold Spray Technology Market?

The Middle East and Africa exhibited rapid growth potential due to the necessity of repair technologies for the oil, gas, and heavy machinery industries. Cold spray limits downtime and protects metallic components against corrosion in harsh environments. The region was investing in industrial modernization, refurbishment, and maintenance facilities for aerospace applications. The opportunities for cold spray were emerging in the repair of turbine components, coatings for pipelines, and enhanced maintenance for military equipment.

The UAE Cold Spray Technology Market Trends

The UAE was leading the market, with a fast-growing aviation sector and relatively advanced MRO (Maintenance, Repair, Overhaul) facilities. The cold spray technology was applied towards the repair of turbine components and extending the life of aircraft fleets. The UAE's government fostered modern technologies and fostered the development of industrial innovation clusters. This ultimately enticed more global manufacturers into establishing cold spray facilities here, stepping up cold spray as a major catalyst, specifically in this country.

Cold Spray Technology Market Companies

- ASB Industries (Hannecard Roller Coatings, Inc)

- Bodycote plc

- Flame Spray Technologies BV

- Plasma Giken Co., Ltd.

- VRC Metal Systems

- CenterLine (Windsor) Limited

- WWG Engineering Pte. Ltd.

- Praxair S.T. Technology, Inc.

- Impact Innovations GmbH

- Concurrent Technologies Corporation

- Effusiontech Pty Ltd (SPEE3D)

- Titomic Limited

Latest Announcements by Market Leaders

- In October 2024, Titomic Limited announced a new application for the quotation of 2,000,000 ordinary fully paid securities under the ASX code TTT. This move indicates the company's steps towards expanding its financial base and offering new opportunities for investment in the stock market.

- In July 2022, Impact Innovations' Cold Spray Additive Manufacturing technology (CSAM) demonstrated the powder bed fusion-based 3D printing processes due to equipment size limitations or protective atmosphere necessity, especially when depositing reactive materials such as Ti-6Al-4V.

Recent Developments

- In July 2024, VRC Metal Systems launched the Dragonfly Cold Spray System, an additive manufacturing solution tailored for in-field repairs in sectors such as aeronautical maintenance, maritime, repair and overhaul, and energy.

- In February 2023, Kennametal Inc. launched a brand-new, higher-performance turning grade with state-of-the-art coating technology, KCP25C with KENGold is the best choice for metal-cutting inserts with superior wear and higher metal removal rates in steel-turning applications.

- In June 2023, OC Oerlikon Management AG announced substantial advancement in thermal spray equipment. With the introduction of Metco IIoT, the first-ever Industry 4.0 platform for the thermal spray industry, and the integration of digitalization.

Segments Covered in the Report

By Material

- Nickel

- Copper

- Aluminum

- Titanium

- Magnesium

- Others

By Service

- Cold Spray Additive Manufacturing

- Cold Spray Coatings

By End-Use

- Aerospace

- Automotive

- Defense

- Electrical and Electronics

- Utility

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting