What is Combination Antibody Therapy Market Size?

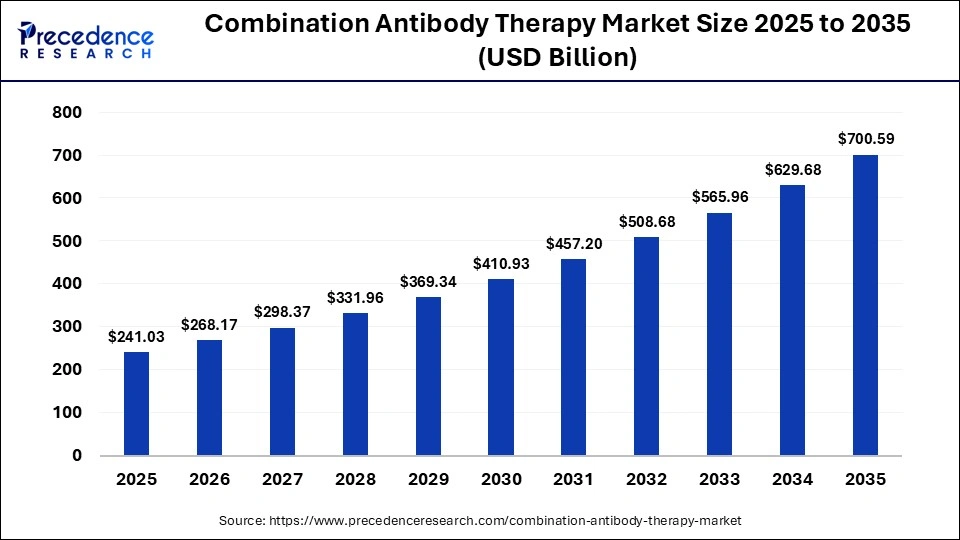

The global combination antibody therapy market size was calculated at USD 241.03 billion in 2025 and is predicted to increase from USD 268.17 billion in 2026 to approximately USD 700.59 billion by 2035, expanding at a CAGR of 11.26% from 2026 to 2035.The market is growing because of the rising prevalence of cancer and autoimmune diseases. Doctors are using treatments that target multiple disease pathways simultaneously. These therapies can work better, reduce drug resistance, and support personalized treatment. Ongoing research and supportive regulations are also helping the market expand.

Market Highlights

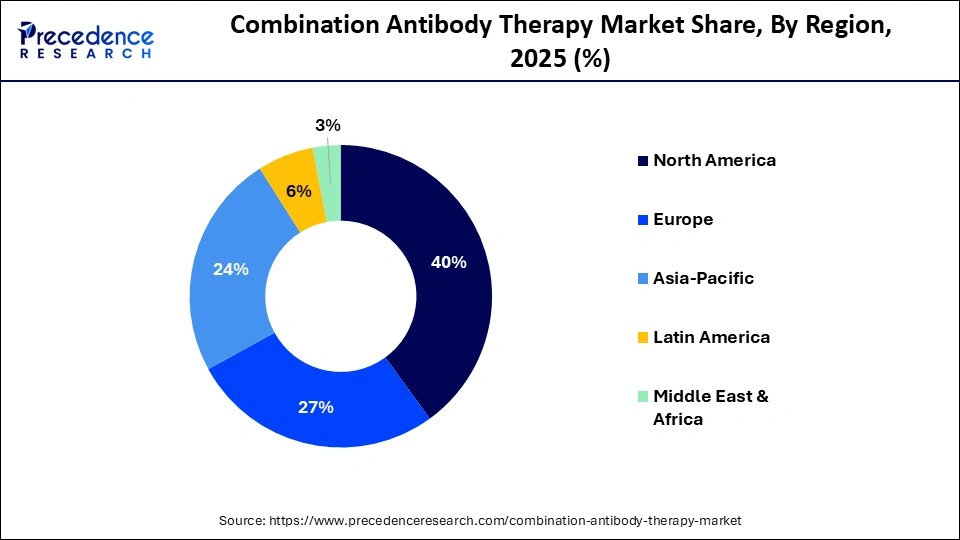

- North America led the combination antibody therapy market with a share of approximately 40% in the global market in 2025.

- Asia-Pacific is expected to expand at the highest CAGR of approximately 11.5% in the market between 2026 and 2035.

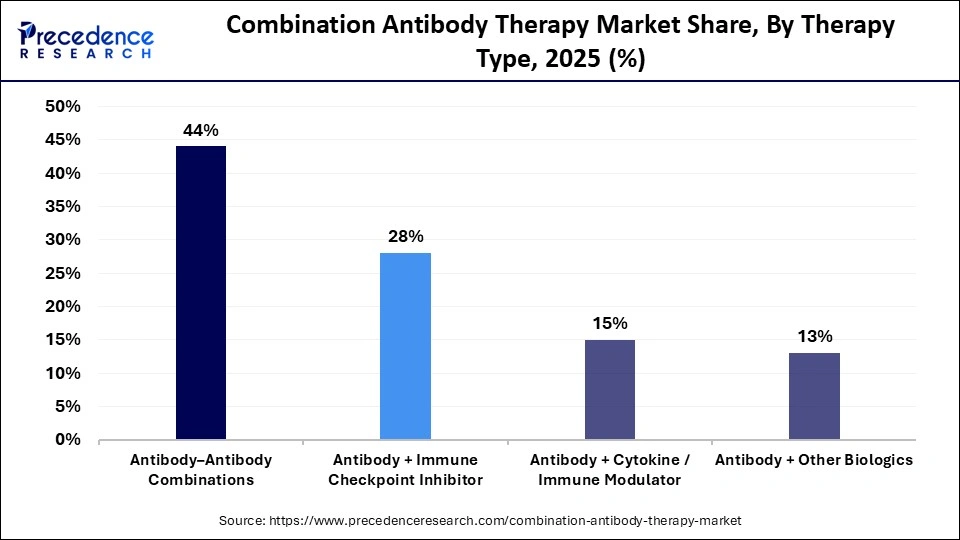

- By therapy type, the antibody–antibody combinations segment held a dominant revenue share of approximately 44% in the market in 2025.

- By therapy type, the antibody + immune checkpoint inhibitor segment is expected to grow at the highest CAGR between 2026 and 2035.

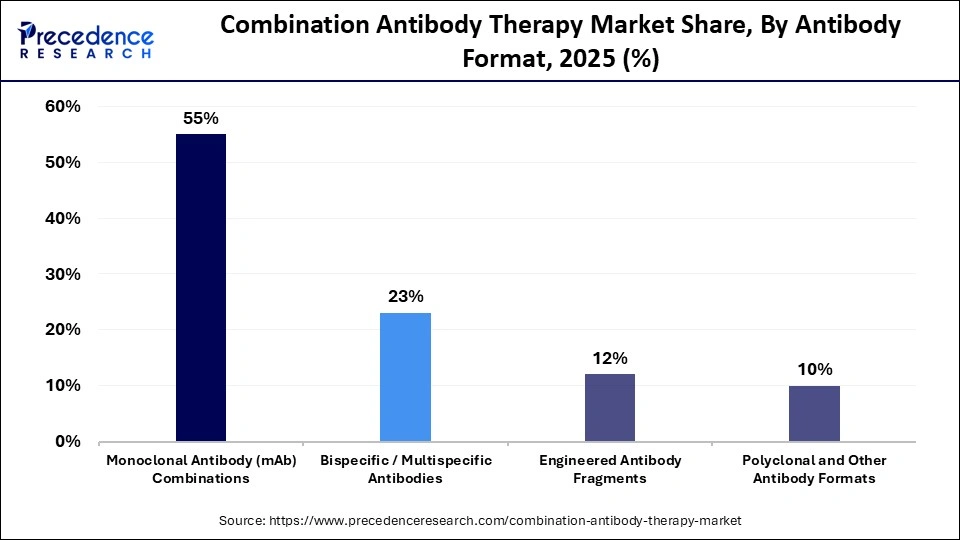

- By antibody format, the monoclonal antibody (mAb) combinations segment led the market with a share of approximately 55% in 2025.

- By antibody format, the bispecific/multispecific antibodies segment is expected to expand at the highest CAGR from 2026 to 2035.

- By target mechanism, the immune checkpoint targets segment held a dominant combination antibody therapy market share of approximately 32% in 2025.

- By target mechanism, the tumor-associated antigens (TAAs) segment is expected to grow with the fastest CAGR between 2026 and 2035.

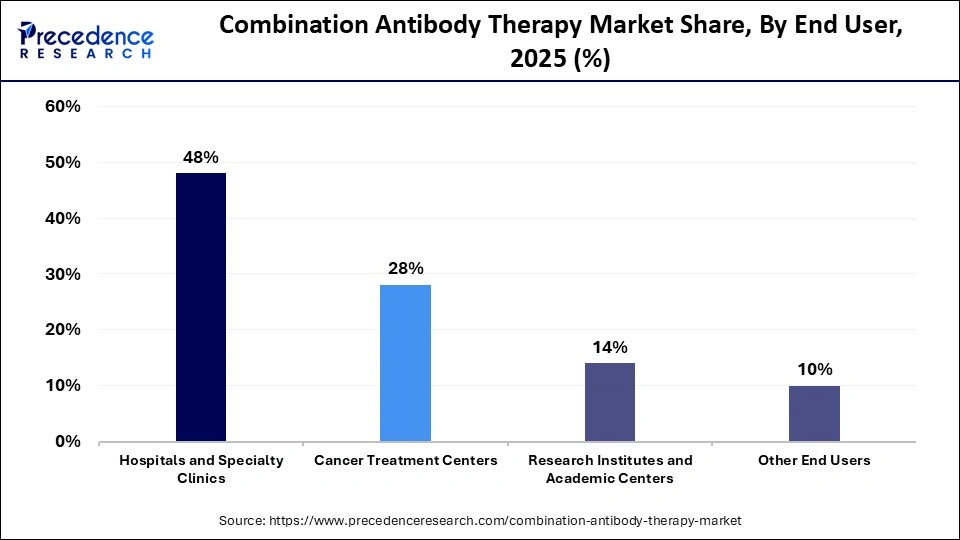

- By end user, the hospitals and specialty clinics segment held a dominant revenue share of approximately 48% in the market in 2025.

- By end user, the cancer treatment centers segment is expected to expand rapidly over the studied period.

Why is the Combination Antibody Therapy Market Gaining Strategic Importance?

The market is gaining strategic importance because it offers better results for complex diseases, especially cancer and immune disorders. By using two or more antibodies together, these treatments can target different disease pathways simultaneously, improving patient response. Growing success in clinical studies, rising focus on precision medicine, and strong investment in advanced biologic research are encouraging companies to develop and adopt these therapies.

Primary Trends Influencing the Combination Antibody Therapy Market

- Shift Towards Multi-target Antibody Platforms: Companie s are increasingly investing in bispecific and multispecific antibodies that can address multiple disease mechanisms in a single treatment. These platforms offer stronger clinical outcomes and improved patient response compared to single-target therapies. As a result, pharmaceutical firms are prioritizing multi-target pipelines to strengthen competitive positioning and accelerate product differentiation.

- Strong Commercial Focus on Oncology Combinations: Cancer treatment remains the largest commercial opportunity for combination antibody therapies. Drug makers are launching dual-antibody regimens that deliver higher response rates and better survival outcomes. The success of checkpoint inhibitor combinations is encouraging companies to expand similar strategies across different tumor types, driving revenue growth and portfolio expansion.

- Convergence with Advanced Therapeutic Platforms: Biopharma companies are integrating antibodies with technologies such as antibody-drug conjugates, targeted small molecules, and cell therapies. This approach enhances treatment precision and effectiveness, particularly in hard-to-treat cancers. Strategic investments in these hybrid treatment models are helping companies build more versatile and high-value therapeutic pipelines.

- Expansion of Biomarker-driven Therapy Strategies: Combination antibody therapies are increasingly aligned with precision medicine approaches. Companies are using biomarkers to identify patient subgroups that respond best to specific combinations. This targeted strategy improves treatment success, supports premium pricing, and strengthens market adoption across oncology and immune-related conditions.

- Increase in Global Manufacturing Investments and Partnerships; Pharmaceutical companies are expanding biologics production capacity and forming strategic collaborations to accelerate combination therapy development. Partnerships between large drug makers and biotech firms are helping share risks, access new technologies, and speed up commercialization. This trend is strengthening supply chains and expanding global market reach.

How is AI Reshaping the Combination Antibody Therapy Market?

Artificial intelligence integration is reshaping combination antibody therapy in 2026 by making discovery and development far more precise and efficient. Advanced models now predict antibody-antigen interactions, enabling smarter design of multispecific therapy candidates. AI tools help identify optimal combinations, analyze massive biological data, and reduce reliance on slow lab experiments. Major pharmaceutical companies are also acquiring AI firms and datasets to improve trial designs and biomarkers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 241.03 Billion |

| Market Size in 2026 | USD 268.17 Billion |

| Market Size by 2035 | USD 700.59 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.26% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Therapy Type,Antibody Format,Target Mechanism,End User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Therapy Type Insights

Why was the Antibody–Antibody Combinations Segment Dominant?

The antibody-antibody combinations segment dominated the combination antibody therapy market with a share of approximately 44% in 2025 because it builds on well-established monoclonal antibody therapies with known safety and mechanisms, making development and regulation easier. Pairing two antibodies can block multiple disease pathways at once, improving effectiveness, and clinicians are more familiar with these regimens, boosting adoption, especially in cancer and autoimmune treatments.

The antibody + immune checkpoint inhibitor segment is expected to be the fastest-growing segment in the market during the forecast period because this pairing delivers stronger and longer-lasting cancer responses than single agents. Checkpoint inhibitors unleash the immune system, while the added antibody targets specific cancer markers, boosting attack efficiency and overcoming resistance seen with monotherapy. This synergy is driving high clinical adoption, guideline inclusion, and expanded use across multiple tumor types, making it a preferred strategy for new oncology regimens.

Antibody Format Insights

How the Monoclonal Antibody (mAb) Combinations Segment Dominated the Market?

The monoclonal antibody (mAb) combination segment held a major revenue share of approximately 55% in the combination antibody therapy market in 2025 because these therapies offer highly targeted action against specific disease pathways while reducing off-target toxicity. Their proven clinical success in oncology and autoimmune disorders, strong regulatory approvals, and extensive ongoing combination trials make them a preferred choice for physicians and developers. In addition, established manufacturing platforms and predictable safety profiles make monoclonal combinations more commercially viable than newer antibody formats.

The bispecific/multispecific antibodies segment is expected to grow at the fastest CAGR in the market due to their ability to target multiple antigens or pathway stimulators simultaneously, thereby improving treatment response and helping reduce resistance. Increasing clinical success in cancer treatment and continuous innovation in antibody design are further accelerating their adoption across advanced therapy programs.

Target Mechanism Insights

Which Target Mechanism Segment Dominated the Market?

The immune checkpoint targets segment contributed the biggest revenue share of approximately 32% in the combination antibody therapy market in 2025 because PD-1, PD-L1, and CTLA-4 inhibitors have demonstrated superior survival benefits when paired with chemotherapy, targeted therapies, and other immuno-oncology agents. Their ability to overcome tumor-induced immune suppression, expand indications across lung, melanoma, and renal cancers, and support biomarker-driven treatment strategies has accelerated clinical adoption and regulatory approvals worldwide.

The tumor-associated antigens (TAAs) segment is expected to grow with the highest CAGR during the studied years, due to the rising development of antibodies that specifically recognize cancer-linked surface markers, enabling more precise tumor targeting in combination regimens. Advances in antibody-drug conjugates, bispecific formats, and personalized treatment approaches are expanding clinical pipelines. Increasing success in treating resistant and high-burden cancers is also encouraging regulatory support and wider clinical adoption.

End User Insights

Which End User Segment Led the Market?

The hospitals and specialty clinics segment led the combination antibody therapy market with a share of approximately 48% in 2025 due to the need for advanced infusion infrastructure, multidisciplinary oncology teams, and continuous patient monitoring during complex biologic treatments. These settings manage adverse events, biomarker testing, and personalized dosing protocols efficiently. Strong reimbursement frameworks and access to clinical trials further reinforce their leading position in administering combination antibody therapies.

The cancer treatment centers segment is expected to witness the fastest growth in the market over the forecast period due to rising patient preferences for specialized oncology care, access to advanced immunotherapy protocols, and availability of precision diagnostic facilities. These centers focus exclusively on cancer management, enabling faster adoption of combination antibody regimens, participation in clinical trials, and delivery of personalized, protocol-driven treatment approaches.

Regional Insights

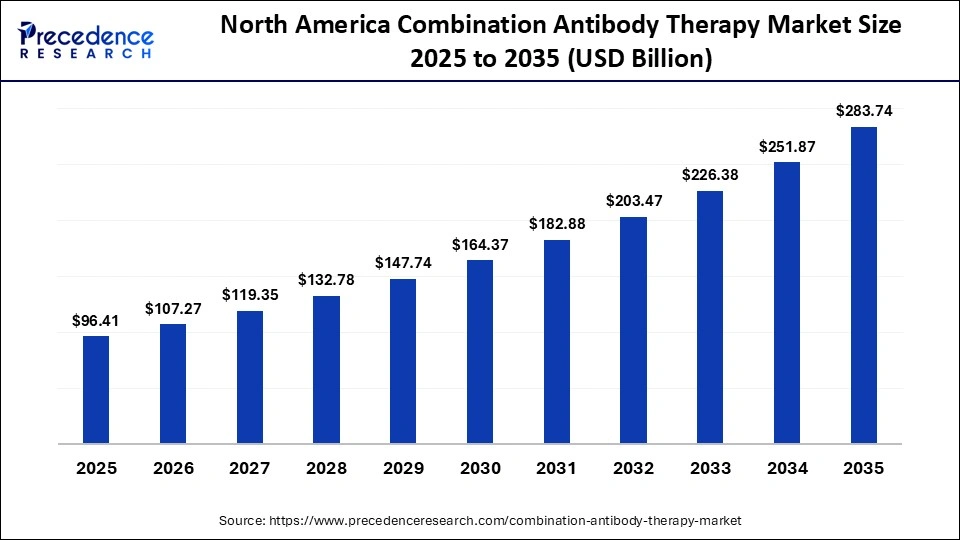

How Big is the North America Combination Antibody Therapy Market Size?

The North America combination antibody therapy market size is estimated at USD 96.41 billion in 2025 and is projected to reach approximately USD 283.74 billion by 2035, with a 11.40% CAGR from 2026 to 2035.

Why North America Dominated the Combination Antibody Therapy Market?

North America dominated the market with a share of approximately 40% due to its strong presence of leading biopharmaceutical companies, advanced clinical research infrastructure, and early adoption of innovative immunotherapies. The region benefits from favorable reimbursement frameworks, high oncology spending, and rapid regulatory approvals, enabling quicker commercialization of combination antibody treatments across multiple cancer indications.

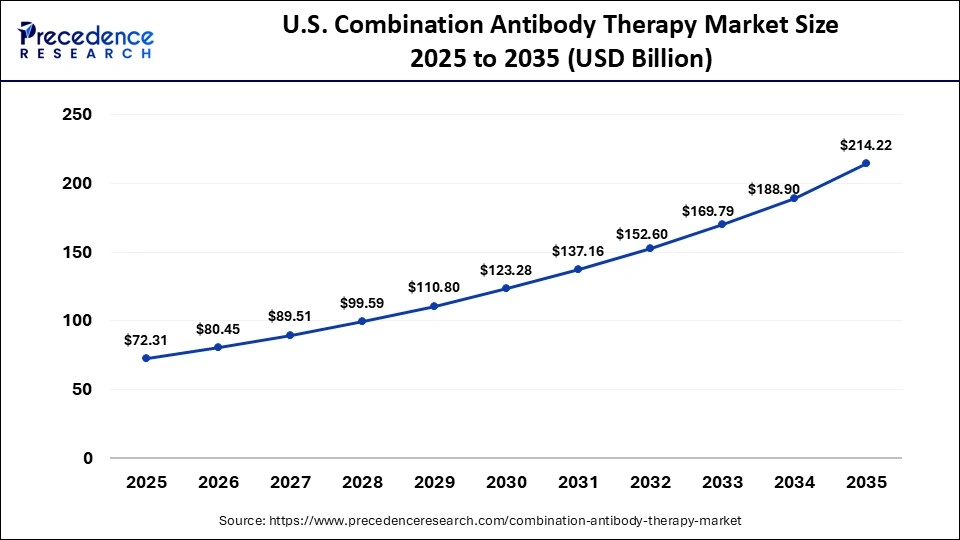

What is the Size of the U.S. Combination Antibody Therapy Market?

The U.S. combination antibody therapy market size is calculated at USD 72.31 billion in 2025 and is expected to reach nearly USD 214.22 billion in 2035, accelerating at a strong CAGR of 11.47% between 2026 to 2035.

U.S. Market Trends

The U.S. combination antibody therapy manufacturing trends are driven by large-scale domestic investments in bispecific and antibody-drug conjugate production, alongside the expansion of high-capacity biologics plants. Companies such as Amgen, Merck, AbbVie, and Fujifilm are building multi-billion-dollar facilities and biologics centers to localize supply chains, scale complex antibody therapies, and strengthen commercial and clinical manufacturing capabilities across the country.

How is Asia-Pacific Growing in the Combination Antibody Therapy Market?

Asia-Pacific is expected to host the fastest-growing market with a CAGR of approximately 11.5% in the coming years due to the rising cancer burden, expanding healthcare infrastructure, and increasing government funding for oncology innovation. Countries such as China, Japan, and South Korea are accelerating domestic biologics manufacturing and clinical trial activity. Improving reimbursement frameworks, growing adoption of advanced immunotherapies, and strategic collaborations between regional and global biopharmaceutical companies are further driving rapid market expansion.

China Market Trends

China is the dominant country in the Asia-Pacific market due to the rapid expansion of domestic biologics manufacturing, strong government incentives, and a large pipeline of bispecific and antibody-drug conjugate programs. Chinese firms are leading global clinical activity, forming high-value licensing deals with multinational companies, and scaling contract manufacturing capacity to support complex antibody combinations for both domestic use and international export.

Will Europe Grow in the Combination Antibody Therapy Market?

Europe offers substantial growth opportunities in the combination antibody therapy industry due to strong clinical leadership in bispecific antibodies and antibody-drug conjugates, particularly in Germany, the U.K., Switzerland, and France. Regional firms and research institutes are advancing multi-target immunotherapy programs, while EU funding and cross-border trials are accelerating development, manufacturing scale-up, and earlier access to complex combination antibody treatments.

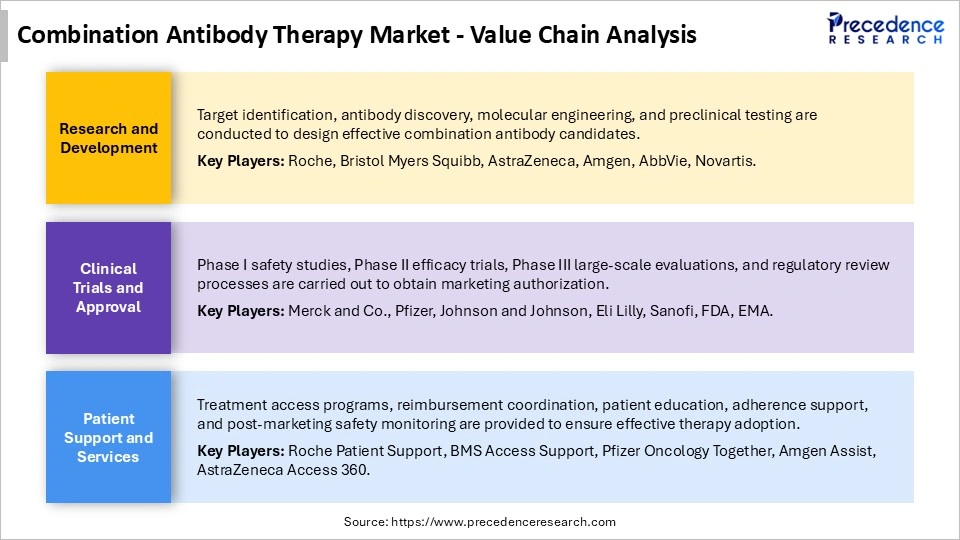

Combination Antibody Therapy Market Value Chain Analysis

Who are the Major Players in the Global Combination Antibody Therapy Market?

The major players in the combination antibody therapy market include Merck and Co., Inc., Bristol-Myers Squibb Company, Roche Holding AG, AstraZeneca PLC, Pfizer Inc., Novartis AG, Johnson and Johnson, Sanofi S.A. Regeneron Pharmaceuticals, Inc. Amgen Inc., Eli Lilly and Company, Gilead Sciences, Inc., Takeda Pharmaceutical Company Limited, AbbVie Inc., GlaxoSmithKline PLC, Biogen Inc., Seagen Inc., Xencor, Inc., MacroGenics, Inc., and Zai Lab Limited

Recent Developments in the Combination Antibody Therapy Market

- In January 2026, AbbVie signed an exclusive licensing agreement with RemeGen to develop RC148, a PD-1×VEGF bispecific antibody for advanced solid tumors. Early studies showed favorable activity when combined with antibody-drug conjugates, and the therapy is expected to be integrated into AbbVie's broader combination oncology programs. (Source: https://news.abbvie.com)

- In December 2025, the U.S. FDA approved a first-line regimen combining AstraZeneca and Daiichi Sankyo's antibody-drug conjugate Enhertu with Roche's HER2 antibody Perjeta for advanced breast cancer. Clinical studies showed significantly improved progression-free survival and high tumor response rates, reinforcing the role of antibody-based combination strategies. (Source: https://www.reuters.com)

- In June 2025, BioNTech and Bristol Myers Squibb announced a global co-development and commercialization partnership for BNT327, a PD-L1×VEGF-A bispecific antibody. The candidate is in late-stage trials for lung and breast cancers, with over 1,000 patients treated, aiming to create a new immunotherapy backbone for combination regimens. (Source: https://news.bms.com)

Segments Covered in the Report

By Therapy Type

- Antibody–Antibody Combinations

- Dual monoclonal antibody regimens

- Bispecific antibody combination therapies

- Co-administered antibody cocktails

- Antibody + Immune Checkpoint Inhibitor

- PD-1/PD-L1 combinations

- CTLA-4 combination regimens

- Antibody + Cytokine/Immune Modulator

- Interleukin-based combinations

- Interferon-based combinations

- Antibody + Other Biologics

- Antibody + fusion proteins

- Antibody + enzyme therapies

By Antibody Format

- Monoclonal Antibody (mAb) Combinations

- Humanized monoclonal antibodies

- Fully human monoclonal antibodies

- Bispecific/Multispecific Antibodies

- T-cell engagers

- Dual-target immune activators

- Engineered Antibody Fragments

- Fab and scFv-based combinations

- Polyclonal and Other Antibody Formats

By Target Mechanism

- Immune Checkpoint Targets

- PD-1/PD-L1

- CTLA-4

- Tumor-Associated Antigens (TAAs)

- Cytokine and Growth Factor Targets

- Cell Surface Receptors

- Other Molecular Targets

By End User

- Hospitals and Specialty Clinics

- Cancer Treatment Centers

- Research Institutes and Academic Centers

- Other End Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting