What is Fixed-Dose Combination Diabetes Drugs Market Size?

The global fixed-dose combination diabetes drugs market gain insights into market dynamics, competitive strategies and future projections for fixed-dose combination therapies designed to meet complex diabetes treatment needs. The growth of the market is driven by rising diabetes prevalence and growing demand for simplified, effective combination therapies.

Market Highlights

- By region, North America dominated the global market with the largest market share of 40% in 2024.

- By region, Asia Pacific is expected to experience the fastest growth during the forecasted years.

- By product type, the flash chromatography systems segment held the major market share of 65% in 2024.

- By product type, the consumables segment is expected to grow at the fastest rate over the forecast period.

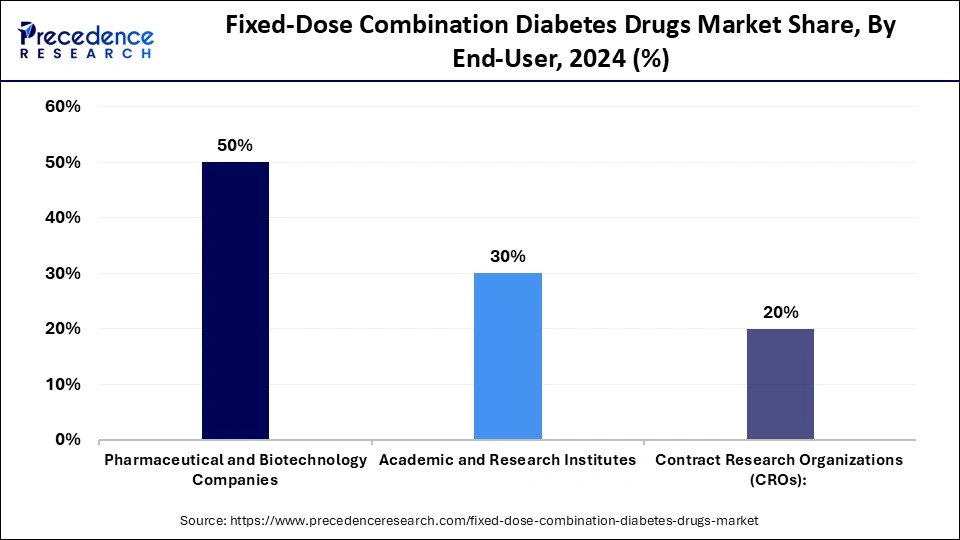

- By end-user, the pharmaceutical & biotechnology companies segment captured a 50% share of the market in 2024.

- By end-user, the academic & research institutes segment is expected to expand at the highest CAGR over the projection period.

- By application, the drug discovery & development segment led the market while holding a 60% share in 2024.

- By application, the natural products & fine chemicals segment is expected to grow at the fastest rate in the upcoming period.

What are Fixed-Dose Combination Diabetes Drugs?

Fixed-Dose Combination (FDC) diabetes drugs are pharmaceutical formulations that combine two or more antidiabetic agents in a single pill or tablet, administered at fixed doses. These combinations are designed to improve glycemic control by targeting multiple pathophysiological pathways of diabetes simultaneously, often with complementary mechanisms of action. The fixed-dose combination diabetes drugs market is a crucial and dynamic segment of the international pharmaceutical industry that deals with the management of Type 2 Diabetes Mellitus (T2DM).

Fixed-dose combinations consist of two or more antidiabetic agents administered in one dose or tablet form to produce a synergistic therapeutic effect, make treatment regimens easier, and increase adherence in the patient. As diabetes is one of the most widespread chronic illnesses globally, and millions of patients need to be treated with multi-drug therapy that keeps the glycemic levels within the normal range, the FDCs are another convenient and efficient solution.

The increased incidence of diabetes in the world, because of changes in lifestyles, obesity, and aging, has posed a big problem whose solution lies in more effective and patient-friendly therapies. Raising the preference of physicians towards FDCs due to better patient results and decreased likelihood of patients developing therapeutic non-adherence is a significant driving force. Moreover, the continuous innovation in the development of drugs and the creation of dual-action molecules is increasing the range of treatment opportunities. Market expansion is also supported in strategic partnerships between the pharmaceutical firms in co-formulations and patent extensions.

Fixed-Dose Combination Diabetes Drugs Market Outlook

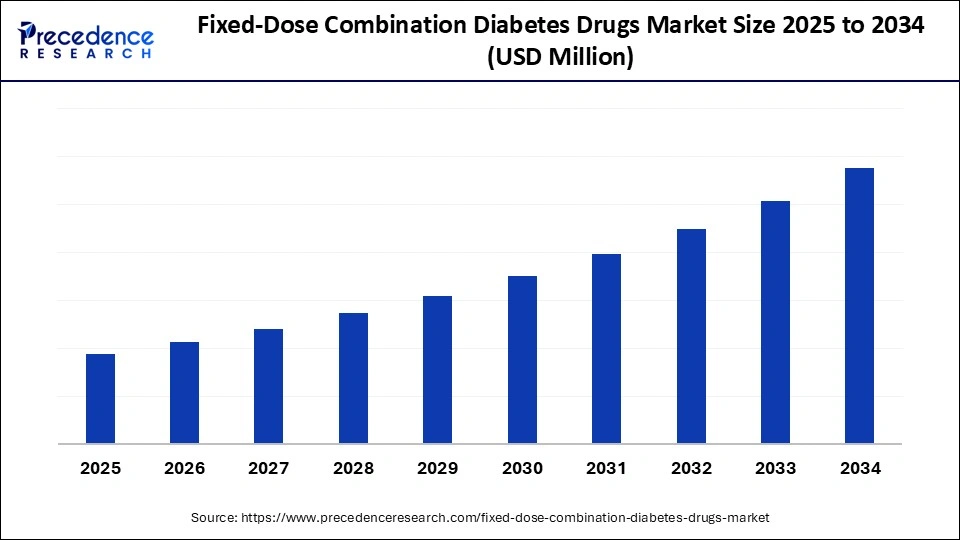

- Market Growth Overview: The market for fixed-dose combination diabetes drugs is projected to grow at a robust pace between 2025 and 2034, driven by the rising global prevalence of Type 2 diabetes, increased patient adherence due to simplified treatment regimens, and sustained innovation in dual- and triple-acting formulations. These combinations not only enhance glycemic control but also improve convenience for patients and providers alike, particularly in chronic management scenarios.

- Global Expansion: Market expansion is being accelerated by increasing disease burden in emerging markets, regulatory fast-tracking of co-formulated therapies, and greater availability of cost-effective generic FDCs. Pharmaceutical manufacturers are strengthening strategic alliances and regional licensing agreements across Asia-Pacific, Latin America, and select European markets to drive commercial uptake and improve access to advanced combination therapies.

- Major Investors:Key pharmaceutical players, such as Novo Nordisk, AstraZeneca, Merck & Co., Eli Lilly, and Sanofi, are investing heavily in FDC pipeline development, lifecycle management, and strategic patent collaborations. Their goal is to consolidate market leadership by addressing multifactorial needs in diabetes care through integrated, outcome-driven therapeutic portfolios.

- Startup Ecosystem: An emerging ecosystem of health-tech startups and biotech innovators is reshaping the competitive landscape by introducing novel drug delivery systems, personalized dosing algorithms, and AI-powered adherence tools. Supported by venture capital and digital health accelerators, these entrants are contributing to differentiated value propositions in the FDC diabetes space, particularly for niche and underserved patient populations.

What Factors are Fueling the Growth of the Fixed-Dose Combination Diabetes Drugs Market?

- Advancements in Drug Formulation: Ongoing innovation in pharmaceutical formulation technologies has enabled the development of more stable, synergistic fixed-dose combinations. These formulations enhance therapeutic efficacy, optimize safety profiles, and improve patient convenience, while also streamlining regulatory pathways and accelerating global product approvals.

- Improved Patient Adherence: By consolidating multiple medications into a single pill, fixed-dose combinations significantly reduce pill burden, simplifying treatment regimens and improving medication adherence. This is particularly critical for patients requiring multi-drug therapy, where improved adherence correlates with better long-term glycemic control and reduced complication risks.

- Rising Prevalence of Type 2 Diabetes: The global surge in Type 2 diabetes, driven by aging populations, sedentary lifestyles, and increasing obesity rates, is fueling demand for more convenient and effective treatment options. Fixed-dose combinations address this need by offering streamlined therapy that supports tighter glycemic control and better real-world treatment compliance.

Technological Shifts in the Fixed-Dose Combination Diabetes Drugs Market by AI

Artificial intelligence (AI) is emerging as a transformative force in the fixed-dose combination diabetes drugs market, driving innovation across drug discovery, formulation optimization, and patient management. AI-powered algorithms enable the analysis of vast datasets to identify optimal drug pairings, determine synergistic dosing strategies, predict efficacy, and minimize adverse effects, thereby accelerating the development timeline of next-generation FDC therapies.

Moreover, AI-integrated digital health platforms enhance disease management by tracking medication adherence, blood glucose fluctuations, and real-world treatment outcomes. These insights support dynamic therapy adjustments and enable a shift toward personalized, outcome-driven care. Collectively, the integration of AI bridges pharmaceutical innovation with patient-centric digital ecosystems, fostering greater therapeutic efficiency, improved outcomes, and sustained competitive differentiation in diabetes care.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End User, Apllication, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Diabetes Prevalence Worldwide

The rising prevalence of type 2 diabetes worldwide is a major factor that drives the growth of the market. The International Diabetes Federation opines that the world has been experiencing an unending epidemic of diabetic individuals because of sedentary lifestyles, obesity, unhealthy diets, and an aging population. Due to the increasing burden of disease, there is an immediate need to seek therapies that ensure patient adherence and effective glycemic control. The FDC drugs, which combine various antidiabetic agents into a single dose, provide an easy solution to the problem by addressing a range of pathophysiological processes with sophisticated treatment regimes.

Such combinations improve treatment outcomes, reduce the pill load, and enhance adherence, which is vital in the long-term management of diabetes. There is also a growing focus by governments and healthcare providers on the need to have convenient, cost-effective, and patient-friendly therapies to contain complications related to uncontrolled diabetes.

Restraint

High Cost of Testing

The expensive nature of diagnostic testing and clinical analysis is also one of the main limitations to the development of the Fixed-Dose combination drugs market. The formulation of FDCs involves extensive research on the product, numerous bioequivalence trials, and other regulatory approvals to ensure the product is safe, effective, and compatible with other active ingredients. Such processes involve advanced technologies in analysis and clinical trials, which may be too expensive to make FDC development affordable in low- and middle-income regions. The diagnostic procedures necessary to examine patient response to FDC therapy, such as metabolism profiling, pharmacokinetic tests, are often costly and thus hold back small and medium-sized pharmaceutical companies.

Opportunity

Regulatory Approvals and Reimbursement Support

Favorable reimbursement policies and regulatory approvals are opening up new opportunities in the market. Regulatory bodies worldwide are gradually simplifying processes to approve combination therapies that are safe, effective, and lead to better patient compliance. Speedier and more open-minded processes allow pharmaceutical firms to introduce innovative and new FDC formulations into the market in a shorter time, cutting costs and development timeframes. Meanwhile, the affordability and accessibility of FDC therapies are increasing due to supportive reimbursement schemes by government bodies and other private insurers. This financial and regulatory assistance helps build confidence in the manufacturers, which will make them invest in research and development of new combination therapies.

Segment Insights

Product Type Insights

Why Did the Flash Chromatography Systems Segment Lead the Market in 2024?

The flash chromatography systems segment led the fixed-dose combination diabetes drugs market, capturing approximately 65% share in 2024. This dominance is driven by the critical role these systems play in the purification and isolation of active pharmaceutical ingredients (APIs), ensuring high purity, consistency, and reproducibility in combination drug formulations. Compared to traditional separation techniques, flash chromatography offers superior processing speed, resolution, and scalability, from lab-scale optimization to large-scale commercial production.

This segment includes both automated and semi-automated systems. Automated systems are increasingly favored for high-throughput operations due to their reduced error rates and compliance with stringent regulatory standards, while semi-automated setups remain relevant in smaller-scale or customized settings where manual oversight is acceptable. Regulatory bodies globally are emphasizing standardized, high-quality production practices, further cementing flash chromatography's critical role in pharmaceutical manufacturing.

The consumables segment is expected to grow at a significant rate over the forecast period, driven by increasing demand for high-throughput and standardized purification processes in pharmaceutical manufacturing. Columns and solvents serve as the primary inputs for the efficient functioning of flash chromatography systems, while reagents are also critical for achieving optimal separation and purification. The quality of consumables directly impacts the separation accuracy, recovery rate, and consistency of active pharmaceutical ingredients (APIs), thereby influencing the overall efficacy and reliability of fixed-dose combination (FDC) formulations. The rising intensity of R&D in diabetes therapeutics, coupled with regulatory emphasis on reproducibility and quality assurance, is further accelerating the adoption of high-grade consumables.

Moreover, pharmaceutical manufacturers are increasingly allocating budget toward premium consumables to comply with stringent regulatory frameworks and maintain consistent product quality. The recurring nature of consumable usage—combined with the escalating production volumes, underpins the long-term revenue potential of this segment within the FDC diabetes drug manufacturing landscape.

End-User Insights

Why Did Pharmaceutical & Biotechnology Companies Hold the largest Market Share in 2024?

The pharmaceutical & biotechnology companies segment held about 50% share of the fixed-dose combination diabetes drugs market in 2024. These firms are leading in the development, production, and commercialization of FDC therapies and are able to utilize their high-level research power, mass manufacturing plants, and regulatory applications. Pharmaceutical companies and biotechnology companies are involved in mass production and global distribution, and innovative biologics and novel combination formulations.

Their management philosophy is informed by the sustained investments in R&D, strategic partnerships, and the creation of innovative drug delivery technologies to improve efficacy and patient compliance. With the increased demand for convenient, effective, and patient-friendly diabetes treatment around the world, pharmaceutical and biotechnology companies are likely to continue playing a central role in the market growth, enhancing innovation and ease of FDC diabetes medication.

The academic & research institutes segment is expected to grow at the fastest rate in the upcoming period. This is mainly due to their high involvement in preclinical research, formulation, and clinical research of fixed-dose combination therapies. These institutes are involved in innovation by investigating new drug combinations, dose proportions, pharmacokinetics, and safety profiles. Their work usually complements the development pipeline of pharmaceutical and biotechnology companies, providing them with scientific knowledge and preliminary validation. Moreover, the investment in diabetes research and cooperation with industry participants is allowing academic centers to extend their influence on the discovery of drugs and optimization of the formulations.

Application Insights

How Does the Drug Discovery & Development Segment Lead the Market?

The drug discovery & development segment led the fixed-dose combination diabetes drugs market in 2024, holding approximately 60% share. This segment plays a pivotal role in the identification, isolation, and purification of active pharmaceutical ingredients (APIs) that are foundational to combination therapies. It also includes the purification of small molecules with targeted pharmacological actions, as well as peptide purification, which is essential for ensuring the bioactivity and stability of peptides incorporated into multi-drug formulations.

The segment's leadership is further reinforced by increased investment in R&D, high-throughput screening technologies, and formulation optimization, all of which accelerate innovation and improve therapeutic efficacy. As global focus intensifies on enhancing patient compliance and clinical outcomes, the drug discovery and development segment is expected to retain its market dominance well into the forecast period.

The natural products & fine chemicals segment is expected to grow at the highest CAGR in the coming years. This category includes natural product isolation, which refers to the process of removing bioactive compounds of plants, microorganisms, and other natural resources, and specialty chemicals, which are employed in boosting formulation stability, solubility, and bioavailability in combination therapies. The rise in this segment has been facilitated by the rising trend in using natural compounds with established antidiabetic drugs to come up with new FDC formulations that have extra therapeutic effects, such as antioxidant or anti-inflammatory activity.

Moreover, the development of extraction technologies, analytical approaches, and purification technologies enabled natural products to be more available in terms of pharmaceutical uses. Due to the rising consumer demand for natural or vegetation-based therapies and ongoing academic-industrial research collaborations, the segment is poised for rapid growth.

Region Insights

Why Did North America Lead the Global Fixed-Dose Combination Diabetes Drugs Market?

North America led the global market with the highest market share of 40% in 2024. The region's dominance is driven by the high prevalence of Type 2 diabetes, widespread adoption of advanced healthcare technologies, and a robust pharmaceutical R&D ecosystem. FDC therapies have gained strong traction among both healthcare providers and patients due to their ability to simplify treatment regimens, enhance medication adherence, and reduce the risk of diabetes-related complications. Furthermore, favorable regulatory frameworks and comprehensive reimbursement policies in countries like the U.S. and Canada support the accelerated commercialization and uptake of novel combination therapies. As a result, North America remains a key hub for innovation and market expansion in diabetes pharmacotherapy.

U.S. Fixed-Dose Combination Diabetes Drugs Market Trends

The U.S. is a major contributor to the market due to its strong involvement in research and development of fixed-dose combination (FDC) diabetes therapies, with sustained investment in drug discovery, novel formulations, and advanced delivery systems aimed at optimizing therapeutic outcomes. The rising incidence of diabetes, largely driven by increasing rates of obesity, sedentary behavior, and an aging population, has created a substantial demand for effective, patient-friendly treatment options.

Pharmaceutical companies, in collaboration with leading academic institutions, are actively advancing innovation in combination therapies. These strategic partnerships foster the development of more efficacious, convenient formulations. Additionally, the presence of favorable reimbursement frameworks and insurance coverage supports broader patient access to FDC treatments, which in turn is accelerating market penetration and adoption across diverse patient populations.

Why is Asia Pacific Considered the Fastest-Growing Region in the Market?

Asia Pacific is expected to experience the fastest growth throughout the forecast period due to the increasing rates of Type 2 diabetes, driven by change in lifestyle and increased urbanization. Developing countries like India, China, and Southeast Asian countries are witnessing a boom in cases of diabetes. Therefore, there is a great demand to find effective and convenient means of treatment. FDC therapies have been particularly attractive in these markets because they simplify the complicated regimens of drug use, increase patient compliance, and reduce healthcare expenditures incurred in using more than one prescription. Moreover, the growing government efforts to enhance access to healthcare, awareness efforts on diabetes management, and the broadening of healthcare infrastructure are making the broader use of combination therapeutics easier.

China Fixed-Dose Combination Diabetes Drugs Market Trends

China is one of the largest contributors to the market in the Asia Pacific. The Chinese healthcare authorities are becoming more accommodating towards the growth and implementation of FDC therapies by providing favorable regulatory approvals, reimbursement schemes, and facilitation of clinical trials. Also, the growing interest in diabetes complications and the growing investment in healthcare facilities and chronic disease prevention and management models are increasing patient uptake. The huge number of patients, the government subsidies, and the increasing strength of manufacturing all combine to put China in a strategic position to drive the high growth.

Why is the European Market Experiencing Notable Growth?

The European fixed-dose combination diabetes drugs market is witnessing notable growth due to an increased diabetes prevalence rate, a positive regulatory environment, and the growing demand among patients for simplified treatment options. The governments and healthcare authorities are advocating cost-effective and efficient diabetes management measures, promoting the adoption of FDC therapies. Also, market innovation is encouraged by continuous research and development in new drug combinations, facilitated by partnerships between pharmaceutical companies and research firms. The adoption rates are further increased by investment in patient awareness and digital health care solutions.

Germany Fixed-Dose Combination Diabetes Drugs Market Trends

The market in Germany is expanding, driven by advanced healthcare facilities, a high awareness of diabetes management, and strong support for innovative therapy by government institutions. The rising rates of type 2 diabetes in Germany have driven the need to use combination therapies, which enhance adherence, reduce cases of complications, and improve patient outcomes. German pharmaceutical firms are investing in R&D to introduce new FDCs, supported by clinical trials and bioequivalence studies, to guarantee safety and efficacy. The adoption of FDC therapies is supported by government initiatives of managing chronic diseases, as well as reimbursement policies of statutory health insurance.

Fixed-Dose Combination Diabetes Drugs Market – Value Chain Analysis

- Research and Development (R&D): This phase is aimed at the identification and conjugation of active ingredients that will be compatible together to promote efficacy and patient compliance in one dosage form. The major stakeholders invested significantly in new formulations to remain competitive and meet regulatory requirements.

Key Players: Novo Nordisk, Roche, Sanofi, AstraZeneca

- Clinical Trials and Regulatory Approvals: FDA drug clinical trials are conducted to ensure safety and efficacy before a drug is granted regulatory approval for market introduction. This is done to ensure a quality standard and trust among health care providers and patients.

Key Players: Carmot Therapeutics, Provention Bio, Eccogene, Merck and Co.

- Formulation and Final Dosage Preparation: At this stage, the drugs are formulated into stable and patient-friendly doses to give uniform therapeutic effects. The choice of formulation is enhanced with sophisticated processes to maximize the bioavailability and patient convenience.

Key Players: Takeda Pharmaceutical, Johnson and Johnson, Pfizer Inc., Bristol Myers Splibb

Top Companies in the Fixed-Dose Combination Diabetes Drugs Market

Tier I – Major Players (~40–50% of Total Market Share)

These companies dominate the global fixed-dose combination diabetes drugs market, each holding a significant share and collectively accounting for roughly 40–50% of total market revenue.

- Novo Nordisk: A global leader in diabetes care, Novo Nordisk contributes to the market through innovative co-formulations that enhance glycemic control and patient adherence.

- Eli Lilly and Company: Eli Lilly leverages its extensive diabetes portfolio and R&D capabilities to develop effective and convenient fixed-dose combination therapies.

- Sanofi: Sanofi contributes by offering a broad range of combination diabetes drugs, focusing on improving treatment outcomes and expanding access worldwide.

- Boehringer Ingelheim: Boehringer Ingelheim supports the market with cutting-edge FDC formulations, emphasizing cardiorenal benefits alongside glycemic management.

- Merck & Co.: Merck supports the market through strategic collaborations and development of novel combination therapies targeting type 2 diabetes management.

Tier II – Mid-Level Contributors (~30–35% of Market Share)

These firms have a strong market presence with significant contributions but don't match the dominance of Tier I. Together, they make up approximately 30–35% of the market.

- AstraZeneca: AstraZeneca drives innovation in fixed-dose combinations by integrating novel mechanisms to improve glycemic control and cardiovascular outcomes.

- Johnson & Johnson: Johnson & Johnson contributes through its broad pharmaceutical expertise and development of patient-friendly combination therapies for diabetes management.

- Novartis: Novartis supports the market with research-backed co-formulations that focus on improving efficacy and simplifying treatment regimens.

- GlaxoSmithKline (GSK): GSK advances fixed-dose combination therapies by leveraging its strong R&D pipeline and global reach to enhance diabetes treatment accessibility.

- Pfizer: Pfizer supports the market with strategic partnerships and formulation innovations aimed at increasing adherence and therapeutic outcomes in diabetic patients.

Tier III – Niche and Regional Players (~15–20% of Market Share)

Smaller or regionally focused companies with more limited market reach, but collectively they account for 15–20% of the market.

- Bristol-Myers Squibb

- Takeda Pharmaceutical Company

- Alkem Laboratories

- Gilead Sciences

- Other local manufacturers and emerging companies

Recent Developments

- In March 2025, Empagliflozin was introduced in an Indian subsidiary of Glenmark Pharmaceuticals Ltd., as Glempa, and as Glempa-L (empagliflozin + linagliptin) and Glempa-M (empagliflozin + metformin) as FDCs. These launches are meant to offer convenient and effective treatment to Type 2 diabetes patients. (Source: https://www.pharmabiz.com)

- In October 2023,Glenmark Pharmaceuticals launched a triple-fixed-dose combination of Teneligliptin, Dapagliflozin, and Metformin as Zita, which expands the treatment opportunities in the management of complex diabetes. The introduction aims at enhancing adherence by patients with simplified multi-drug regimens. (Source: https://health.economictimes.indiatimes.com)

- In April 2023, Sanofi purchased Provision Bio, Inc. and added TZIELD (teplizumab-mzwv), a first-in-class treatment of Type 1 diabetes, to its primary asset base. This purchase will enhance the concentration of Sanofi on innovative, differentiated therapies in its General Medicines segment.

(Source: https://www.sanofi.com)

Exclusive Analysis on the Fixed-Dose Combination Diabetes Drugs Market

The fixed-dose combination diabetes drugs market is poised for accelerated expansion over the forthcoming decade, underpinned by multifactorial drivers that collectively underscore substantial growth potential. The escalating global prevalence of Type 2 diabetes, propelled by demographic shifts, urbanization, and lifestyle-related risk factors, establishes an unequivocal demand for innovative therapeutic modalities that optimize patient adherence and clinical outcomes.

Pharmaceutical stakeholders are increasingly capitalizing on FDC formulations' inherent value proposition, simplification of complex polypharmacy regimens, thereby enhancing patient compliance and mitigating therapeutic inertia. This paradigm shift towards integrated combination therapies is further catalyzed by advancements in formulation science, enabling synergistic pharmacodynamics and improved safety profiles.

From a commercial vantage, expanding regulatory endorsements and favorable reimbursement frameworks in key geographies are unlocking access pathways, particularly in emerging markets with burgeoning diabetic populations. Concurrently, the convergence of digital health technologies with AI-driven drug discovery platforms is propelling rapid innovation cycles, expediting pipeline maturation, and fostering personalized medicine approaches within the FDC domain.

Strategic imperatives for market incumbents encompass bolstering R&D investments, forging collaborative alliances to expedite co-formulation development, and navigating complex market access landscapes through value-based evidence generation. The ascendancy of generics post-patent expiry also presents lucrative avenues for cost-optimization strategies and volume-driven market penetration.

In sum, the market presents a compelling landscape characterized by robust demand dynamics, technological innovation, and evolving healthcare ecosystems, rendering it a fertile ground for sustained commercial success and transformational impact in global diabetes care.

Segments Covered in the Report

By Product Type

- Flash Chromatography Systems

- Automated Systems

- Semi-Automated Systems

- Consumables

- Columns

- Solvents & Reagents

By End-User

- Pharmaceutical & Biotechnology Companies

- Pharmaceutical Companies

- Biotechnology Companies

- Academic & Research Institutes

- Universities

- Private Research Labs

- Contract Research Organizations (CROs)

- CROs (General)

- Specialized CROs

By Application

- Drug Discovery & Development

- Small Molecule Purification

- Peptide Purification

- Natural Products & Fine Chemicals

- Natural Product Isolation

- Specialty Chemicals

- Analytical Research

- Organic Compound Analysis

- Biomolecule Analysis

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content